10 Key Learnings from ‘One Up on Wall Street’ by Peter Lynch in the Indian Context

There are a few books I like to re-read every year at least once. ‘One up on Wall Street’ by Peter Lynch is one of them. It is written in such simple language that anyone can understand the key concepts of investing that the book talks about. At SOIC, one of our new year resolutions was to review some of the most celebrated investing books in the Indian context. This activity ends up benefiting you, and us at the same time. We have to think hard about where these concepts can be applied in the Indian markets with case studies. This book is written in such a way that my mother has almost read it twice, she’s a housewife who didn’t have knowledge/information about the markets. After reading Peter Lynch’s book she has been taking an active interest in our videos on youtube and she is my go-to sounding board whenever I want to simplify a complex concept or to talk about my thesis of investing in a stock. Before we start, if you are wondering who Peter Lynch is, he was the former fund manager at Fidelity (just like we have mutual fund managers in India) and he consistently outperformed the markets using simple methods and analogies. He generated a 29% CAGR return between 1977-1990 when he was managing the fund. The following graph shows his outperformance:

Let’s learn and apply the ‘10 Key Principles’ of Peter Lynch’s philosophy in the Indian context:

10 Key Learnings in the Indian Context:

1. The temporary phases of the market:

“At the Low Point, demoralised investors had to remind themselves that bear markets don’t last forever. Today it’s worth reminding ourselves that bull markets don’t last forever and that patience is required in both the direction.”- One Up On Wall Street

It is worth reminding ourselves that both Bull Markets and Bear Markets are in the nature of the market. It isn’t the market’s fault, the chief fault lies with us when we extrapolate the bull market (2003-2008) or the Bear Markets (2018 crash in midcaps) will continue forever. Just to give you an example, between 7th February 2020 to 3rd April 2020, Nifty 50 fell by almost 33% and many companies like Bajaj Finance corrected from Rs 5,000 to almost Rs 1,800. On the other hand, from 3rd April 2020 until today, i.e., 9th April 2020, Nifty has risen by almost 80%+ and Bajaj Finance has risen from Rs 1800 to Rs 4800+. It is important for the investor to realise that phases in the markets are temporary, what really counts is the longevity and the earnings of the underlying business. This reminds me of another Bull and Bear market that happened between 2013-2018 in the mid- and smallcap index. Many of the mid-caps listed on the exchanges doubled/tripled especially between 2015-2017. This led to excessive risk-taking, many small/micro-cap PMS Managers/investors were coming on TV to talk about poor quality businesses. As Warren Buffett says, “Only when the tide goes out, you discover who's been swimming naked.” This culminated when the bubble was pricked in 2018, with the collapse of IL&FS. Key learnings for investors were to stay rational, be objective, and focus on strong and clean businesses. Many of those strong and clean mid-caps survived and have continued growing irrespective of the index crashing in 2018 e.g., Alkyl Amines, Balkrishna Industries, Vinati Organics, etc. Between 1979 to 2017, Sensex went up by more than 250 times. If you missed 7% of the best months your returns would have been 0 and if you missed 1% of the best days your returns would have been 0.

Time, strong businesses, high ROCE’s, and tailwinds are much more important than the prevailing environment as bull and bear markets come and go. One has to just remind oneself that markets are like a pendulum that oscillates between greed and fear very rarely stops in the middle:

2. Advantages of Dumb Money:

“Rule number 1 in my book is: stop listening to professionals. Twenty years in this business convinces me that any normal person using the customary three percent of the brain can pick stocks just as well, if not better, than the average Wall Street expert.”-One Up On Wall Street

A retail investor has better sources, and guess what, most of these sources are all around us (only talking about filtering criteria). Think about using Parachute hair oil for the last 20 years? Think about the biscuits you eat (Gooday by Britannia, Sunfeast byITC) or the financial services you use e.g., CDSL is one of the depositories where all the shares are stored, insurance companies like HDFC Life, etc. We just have to observe the trends around us and the services/products that we and those around us are consuming. This is the edge of the retail investor.

Peter Lynch also clarifies that finding the company is only the first step. The next step is doing research, it will help you separate the bad businesses from the good ones.

3. Multibaggers give you time to build conviction:

Peter Lynch talks about how a commonly known consumer brand ‘L’Eggs’ made pantyhose/stockings became a bestseller in the 1970s. Peter Lynch recommended this to the portfolio manager at his firms and made a 6x return here. This is what he mentions about time given by the markets: “The Beauty of L’Eggs is that you didn’t have to know about it from the outset. You could have bought Hanes stock the first year, the second year, or even the third year after L’Eggs went nationwide and you’d have tripled your money at least.”

This is usually how the cycle of identifying the emerging businesses looks like:

1. The earnings explode and the ROCE expands.

2. There is skepticism and doubt about the business sustaining the numbers.

3. Earnings explode further.

4. Whatever doubt that was left gets taken care of and the business gets re-rated by the markets.

There have been countless such listed businesses Laurus Labs, Deepak Nitrite, P I industries; where initial skepticism after the earnings growth have been really strong. The key lesson I learnt in my own journey is that Markets in most cases will give you time to assess and validate your thesis. It's better not to chase the rising stock or a stagnant stock until the visibility of the next 3 years of earnings and ROCE direction isn’t clear.

4. Is this a good time to invest in the markets?

The most frequently asked question that I have received on mails or while talking to others- Is this a good time to invest? This is a question that I have been listening to for the last 4 years almost. Part of the reason why most people ask this is due to Analysis-Paralysis. The following is an example of a typical conversation between my learned uncle and I:

Uncle: Is this a good time to invest in the markets?

Me: It's always a good time if we are looking at fundamentally strong businesses and some of them are trading at reasonable valuations.

Uncle: What about Trump losing the elections? What about the lockdown? What if BJP loses Bengal? What if the Fed increases the interest rates? Is inflation coming back? Markets are too volatile these days. What will the RBI Governor do?

Me: (Slowly facepalms) We had the same conversation nearly 2 years ago, only the actors have changed :)

This is what Analysis-Paralysis looks like. This is what Peter Lynch has to say about marcos and economists:

“People try to predict the stock markets. That is a total waste of time, no one can predict the stock markets. They try to predict the interest rates, if anyone can predict the interest rates successfully 3 times in a row they will be a billionaire. No one can predict the interest rates successfully otherwise there will be lots of billionaires and no one can predict the economy.”

“I have always said if you spend 14minutes a year on economics, you have wasted 12 minutes.”

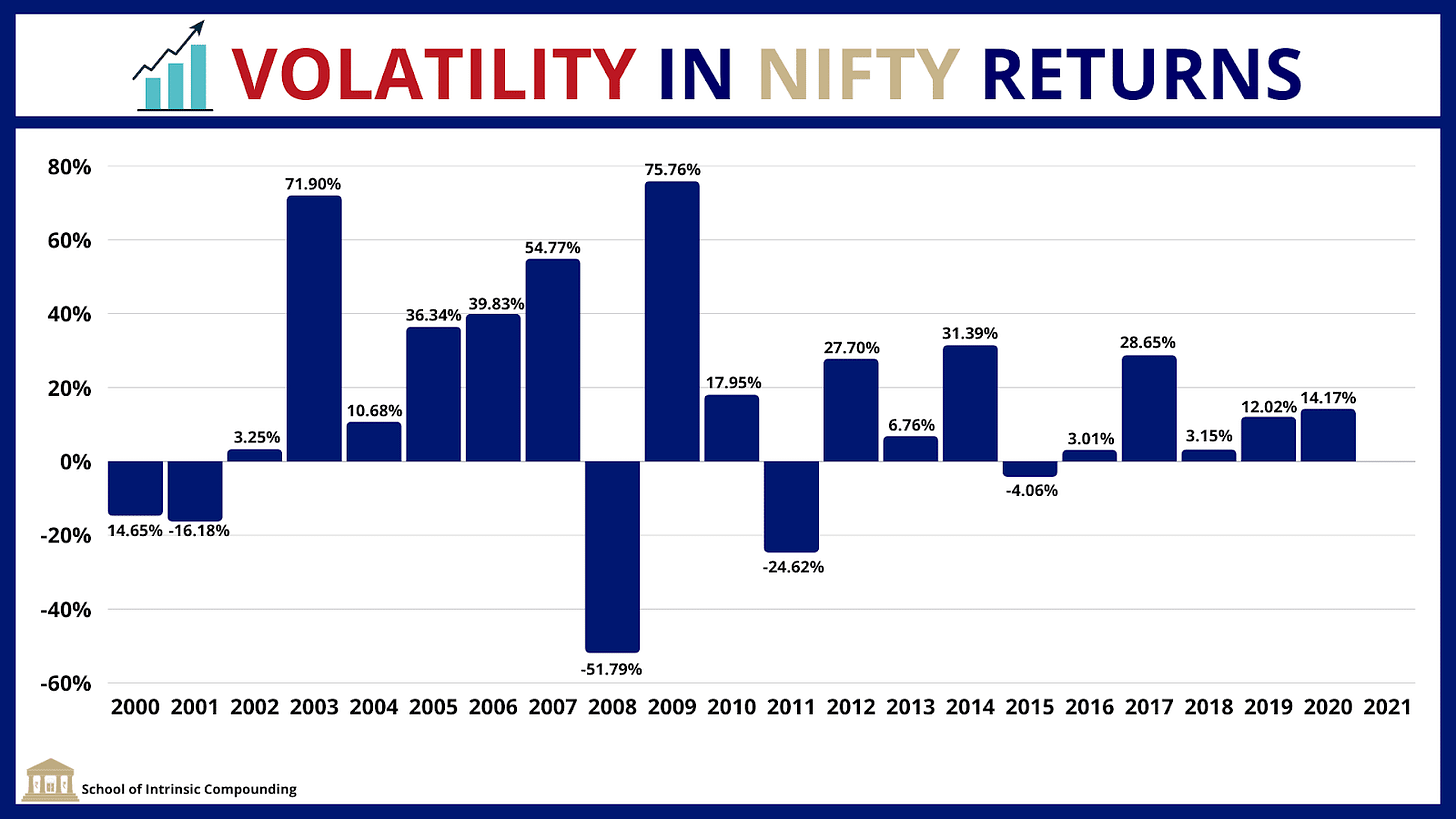

On an average, the Indian markets have gone up by 12%-14% over the long run. However, such is the nature of the beast (equity markets), returns are always going to be volatile. This uncertainty causes people to miss out on the rallies like we witnessed last year. The following displays the 'Returns of Nifty' over the long run, do notice the volatility in some years. The trend in general has been positive.

The key is to find a business bottoms up, and if you can’t- it is totally acceptable to invest in a good index fund or a good mutual fund over a long period of time.

5. Stalking the 10 bagger:

A person with an edge is always in a position to out-guess a person without an edge, who will after all be the last to learn of the important changes in a given industry. The edge could come from reading about an industry, or especially if you are working in the industry. Peter Lynch gives an example of how he missed investing in Dreyfus, the stock was a 100 bagger in nearly 10 years. This was due to the mutual fund investing boom in the USA in the 1980s. Peter Lynch working in the same industry could have made a lot of money just by identifying the trend. However, he missed the whole deal. This is perhaps the biggest learning from the book:

“Invest in things you know about”

This reminds me of a friend whose grandfather is from the chemical industry. Nearly 15 years ago he started investing in chemical businesses like Aarti Industries, Balaji Amines, Alkyl Amines, and Pidilite. Needless to say, they have done wonderfully well in the last decade purely because they invested in what they understood and held on to the investments stubbornly. Whenever I meet him it reminds me of why it is important to stick to what you know. Often the convection levels are higher and the holding period is longer when we invest in businesses we know inside-out.

6. Once I’ve established the size of the company relative to others in a particular industry, next I place it into one of the six general categories

The size of a company has a great deal to do with what you can expect out of a stock. Accordingly, Peter Lynch has classified these into 6 types. Lets use Indian examples to further explore these 6 types

A. Slow Growers: These are usually the large and aging companies that are expected to grow slightly faster than the economy. These companies started out as fast growers and eventually drifted to becoming slow growers. When an industry at large slows down most of the companies within the industry lose momentum as well:

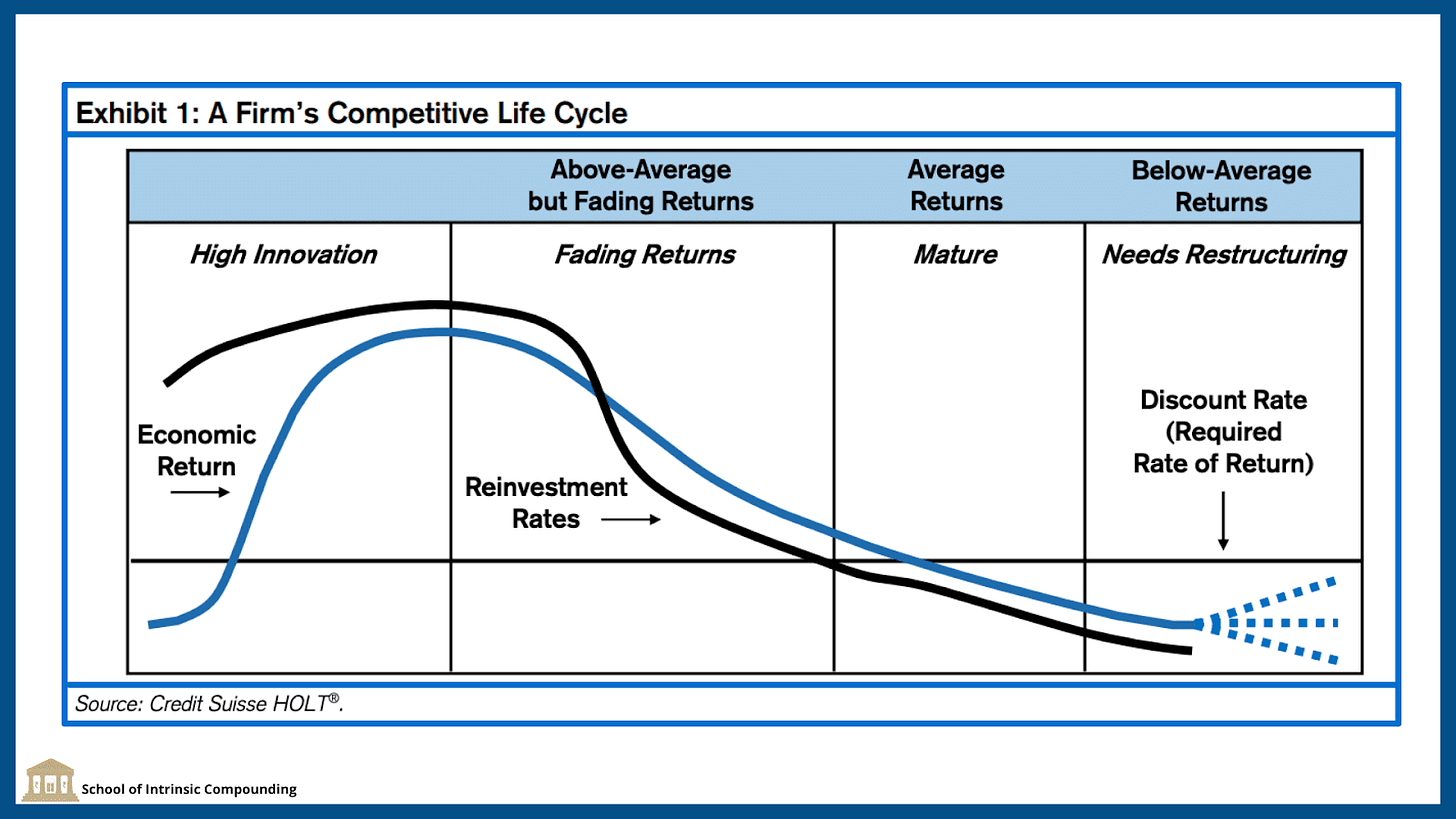

The graph above demonstrates how the returns on capital generally fall as the companies start aging.

I. Key criteria of identifying a slow grower:

i. The stock chart of a slow grower over a long period of time, say 4-5 years, is typically flat or is in a declining trend. Eg: Accelya Kale and Ambika Cotton. In both businesses the earnings growth/Profit Growth has been less than 5% in the last 5 years.

Let’s look at the 5 year stock chart for both businesses:

ii. Second key criterion for identifying a slow grower is that typically a slow grower pays a generous and regular dividend. Most of the businesses that pay generous dividends can’t typically imagine new ways to redeploy the earnings to expand the business. Coming back to Accelya Kale, the dividend yield for the business is at 3.6% and it is nearly paying out 70-80% of its earnings as dividends (last year was reduced due to pandemic).

B. Stalwarts: Stalwarts are typically the companies that grow their earnings at 10%-12% per annum. These are typically the Large and Giant caps that are a part of the index (Nifty 50 or Sensex). Examples in the Indian context include businesses like Hindustan Unilever, which is the largest listed FMCG business, it’s earnings have been growing at 10-12% in the last 5-7 years. Another example is Godrej consumer, which is also a large-cap company from the FMCG industry, earnings growth of Godrej consumer has been 10-11% in the last 5-7 years. These are good businesses, but one should temper their return expectations accordingly. Stalwarts won’t typically grow at more than 20%.

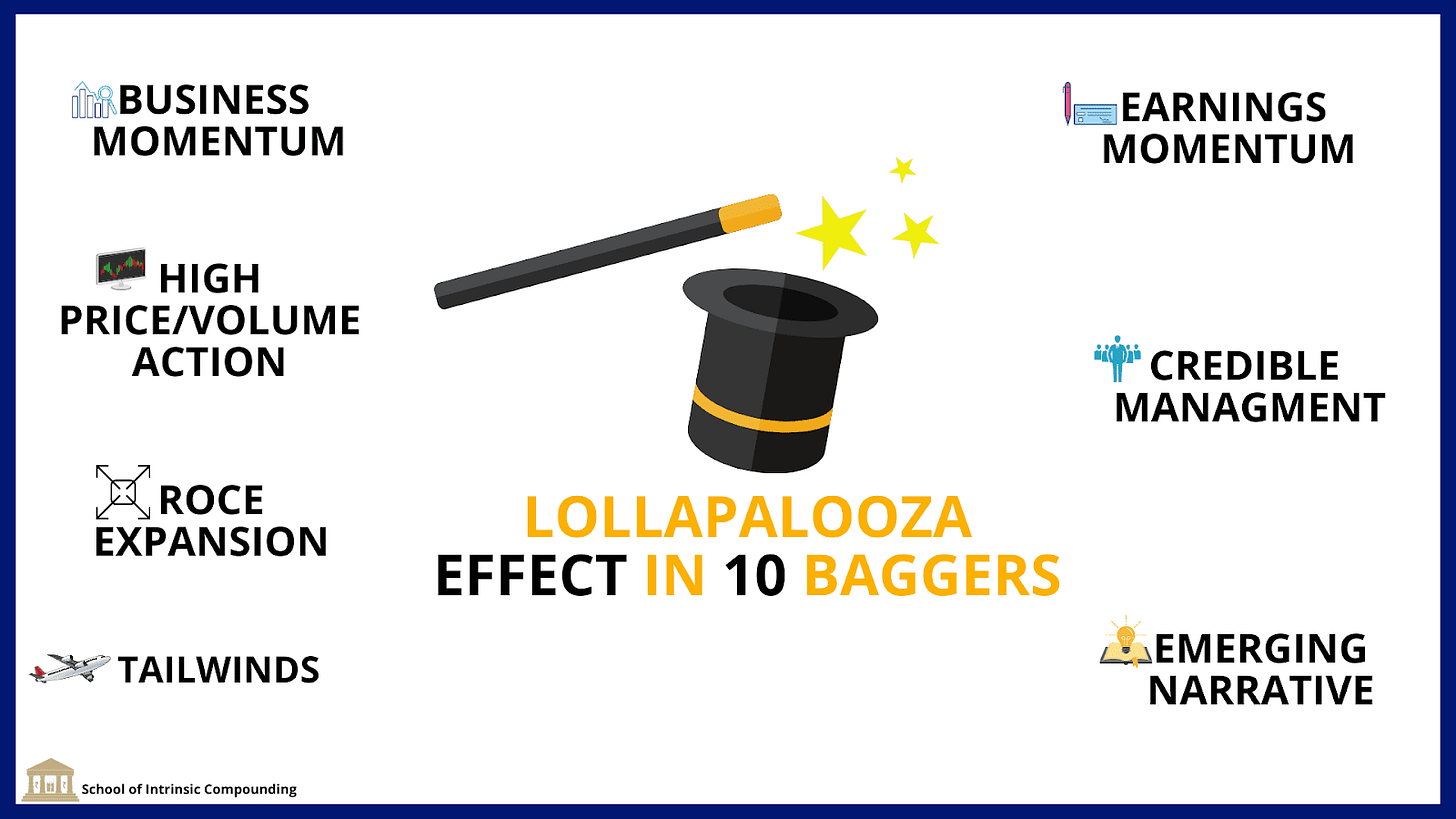

C. Fast growers: This is the land of businesses that can multiply by 40x to even 200x. These businesses outgrow the economy and the industry. Typically these companies grow at more than 20% annually. In my experience, the most powerful force of compounding and the Lollapalooza effect (multiple forces coming together) comes together in the fast growers. Here is what usually happens:

My approach purely focuses on finding businesses experiencing these phases of high growth and relatively lesser understood by investors for example, Sequent Scientific, Laurus Labs, Deepak Nitrite, PI Industries, APL Apollo, etc. Just check the growth of these businesses vs the average listed company. Stock price follows the earnings growth, and high earnings growth is only possible in fast-growing businesses.

D. Cyclicals: These are typically companies whose fundamentals are purely dependent on the commodity prices or capex in the end-user industry. In a growth industry, the business keeps expanding, but in a cyclical industry the business expands, contracts, then expands, and contracts again. You can easily lose more than 50% of your investment if you buy cyclicals in the wrong part/phase of the cycle. Cyclicals are where the stock picker is easily parted away with the money. Now, it becomes important for you to assess a business through the filter of sustainability. This is what I typically do before investing in a company, I call the cyclical bullshit filter:

1)How sustainable are the margins?

2)Is this business dependent on commodity prices?

3)What is the behaviour of the long term stock chart?

4)Is this business order book driven/capex driven?

5)Are the sales cyclical?

These are some of the filters I apply. Eg: one of the steel manufacturers gets eliminated in my filter, as I have no expertise in judging the steel cycle. Here is how the long term stock chart looks like:

E. Turnaround: Turnarounds are battered,depressed and bruised businesses, often drag themselves into the bankruptcy court. Mostly the base rates are against the investor who is investing in turnarounds. Turnarounds seldom turn, and the ones that do end up turning around very quickly. One prominent example that comes to mind is Symphony, which staged a turnaround after deworsifying initially and came back with a more focused approach-

It is extremely hard to spot turnarounds. We think our time is better spent looking at fast growers.

F. Asset Plays: Asset plays are found in companies that are sitting on something valuable we do not know about. In the Indian context, one of the most famous examples that comes to mind is NESCO, this is the company that owns the Bombay Exhibition Centre. Nesco has a 70 acre parcel of land in Goregaon, Mumbai. They have constructed 4 IT Parks and the Bombay exhibition centre moreover, a part of the land still remains vacant. The worth of the entire land is somewhere close to 4,000 crores, whenever the market cap is less than 4,000 crores, NESCO ends up becoming an asset play.

7. “You never find the perfect company, but if you can imagine it, then you will know how to recognize favourable attributes.”- Peter Lynch

Filtering the stocks is one of the key skills that you, the investor, must know in order to identify opportunities. Let’s look at different type of opportunities that exist in the markets:

First type of opportunities are found in companies that sound dull or even better, ridiculous: The perfect stock will be attached to the perfect company, and the perfect company, most of the time is engaged in perfectly simple business, and most of the time these perfectly simple businesses have a perfectly boring name. For example, businesses operating in Amines chemistry, both Balaji Amines and Alkyl Amines, are named after the chemistry they operate in. Another example in terms of boring names is Prince Pipes which operates in PVC, CPVC, UPVC pipes.

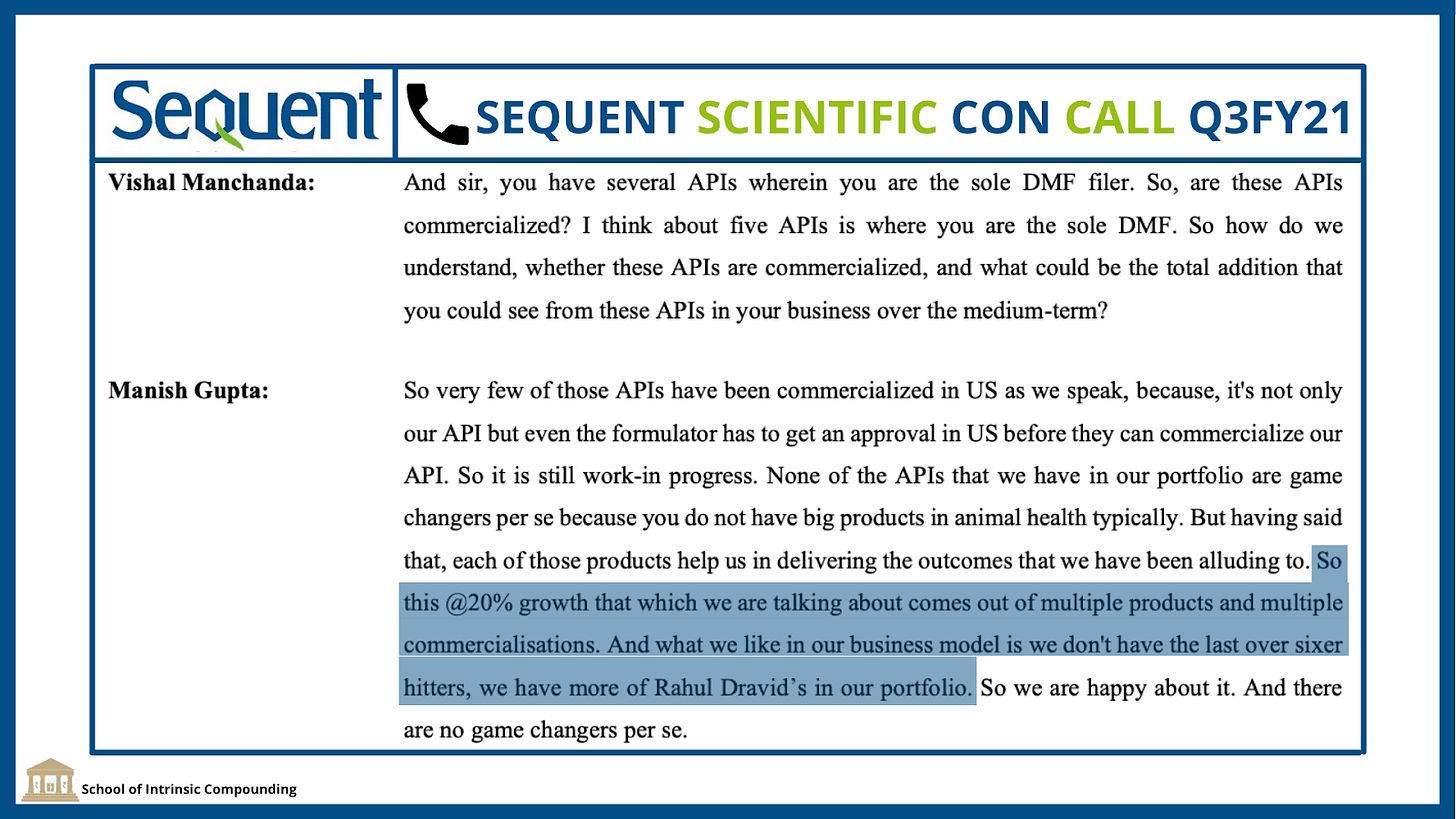

Second type of opportunities are found in companies that do something dull: A company that does something boring is another area where Peter Lynch looks for opportunities. In the Indian context, let's look at the concall of Sequent Scientific that operates in animal pharma. It's a dull, drab and boring industry-

Third type of opportunities are found in spin-offs: Demergers can create massive opportunities for investors. Here is what Peter Lynch writes:

“Large Parent companies do not want to spin off divisions and then see those spinoffs get into trouble,because that would bring embarrassing publicity that would reflect back on the parents. Therefore Spin offs have normally stronger balance sheets and are well placed to succeed as independent entities.”

Here is a list of some of the recently demerged businesses and their performance:

Fourth types are found in no growth industries: Many people choose to invest in high growth industries, but there are opportunities also to be found in no growth industries. Businesses in no/slow growth industries that can take market share away, can be really interesting in the long run. One of the Indian businesses that has done the same is Balkrishna Industries, in spite of operating in an industry which just grows at 1-2% CAGR, Balkrishna Industries has consistently been able to grow its volumes at 6-7% CAGR. Let’s look at the volume growth over the years:

Fifth type is found in niches: This one is perhaps the most interesting, as Peter lynch points out interesting opportunities do exist in niches:

“I always look for niches.The perfect company would have to have one.Warren Buffett started out by acquiring a textile mill in New Bedford, which he quickly realised was not a niche business. He did poorly in textiles but went on to make billions for his shareholders by investing in niches. He was one of the first to see value in newspapers and tv stations that dominated the major markets.”

Investing in niches is something that I constantly look for, as many of these businesses are ignored by the market. Let's look at some of the niche businesses in the Indian context:

Sixth type of opportunities exist in businesses whose products people have to keep buying: Warren Buffett effectively says that the best businesses to own are the ones where the product is made for a penny, sold for a dollar and the customer keeps on coming back.

Think of biscuits, maggi noodles, chronic medicines (customers have to keep consuming them), Amines (used in mankind API’s), Active Pharma Ingredients(used in making formulations), Hair oil etc. All of these businesses are examples of where the customer keeps on coming back and margins are usually high. Just to give you an example, Divis laboratories makes almost a mind boggling 70%+ gross margins.

8. What makes a company valuable, and why it will be more valuable tomorrow than it is today. There are many theories, but to me, it always comes down to earnings and assets. Especially earnings.

It's the earnings that count while looking at the performance of the stocks in the long run. The long terms profit growth (earnings line) and the stock returns often synchronise in the long term. Moreover, the market also looks for future earnings, this is one of the reasons why the stocks of fast growers get re-rated. For example, Navin Fluorine is expected to grow its earnings by 40%-50% in FY23 & FY24, this is one of the reasons why it has already been re-rated by the market to nearly 60 P/E multiple.

Let’s look at the long term earnings and stock chart of Pi Industries & Garware Technical Fibres:

Thus, while looking at stocks always look for the future earnings growth and where they will come from.

9. “Learn as much as possible about what the company is doing to bring about added prosperity, growth spurt, or whatever happy event is expected to occur. This is known as the ‘story’.”- One Up On Wall Street

Story of the company is all about getting to know the background of the management, product segments they operate in, and what makes the business special? What are the triggers for future earnings growth? Without answering these questions and making a simple thesis/theory, investing in stocks is like running through a dynamite factory with a burning match stick and blindfolds on.

Those who know why they bought the stock in the first place also know when to sell them, when the ‘story’ isn’t working out. I can’t stress the importance of getting to know the ‘story’ enough.

10. It’s only by sticking to a strategy through good years and bad you will maximize your long term gains:

Every investor has different risk taking capacity and different bandwidth to track the number of businesses they own. The point is not to rely on any fixed number of stocks but to investigate how good they are, on a case by case basis. There’s no use in diversifying into unknown companies just for the sake of diversity. I think it is important to focus on what the businesses are doing bottoms up and assess every opportunity that comes along while building a portfolio. It is even more important to put them in appropriate categories of whether the business you own are cyclical, fast growers or stalwarts. :)

I hope you enjoyed reading this article/blog, as much I did writing it. ‘One up on Wall Street,’ is one of the finest books I have ever come across, I can’t recommend it enough for anyone who is interested in investing.

What do you think?

Let us know the feedback in the comment section below. We would love to answer the comments. :)

I believe applying these books in the Indian context improves our understanding of the way the markets work.