Arman Financial: Conservatism in its roots

Before we start talking about Arman Financial Services, let's have a brief look at the story of Bandhan Bank. There is an interesting story shared in the book “Bandhan: The Making of A Bank”, where they share the Eureka Moment of Mr. Chandra Shekhar Ghosh.

It started when one day he was walking in the market and he saw a guy coming on Royal Enfield giving out Rs.500 to a bunch of women waiting there, and in return they were immediately paying him Rs.5 back. Later that evening the guy came to the same place and those women returned the principal amount. When Mr.Ghosh asked why they were paying 1% interest for the duration of half a day, which if seen annually would be an interest of 730%, they replied that it is just like offering tea to the moneylender. Plus the banks would not lend them as they don’t have proper documentation.

This incident was the eureka moment of Mr.Ghosh where he came up with the idea of setting up Bandhan.

The story above summarizes the foundation of any Microfinance business in India and why people are ready to pay high interest.

About the company

Arman Financial Services Ltd is an Non-Banking Financial Company (NBFC) mainly focusing on Microfinancing which represents around 80% of their portfolio, 15% is Micro, Small, and Medium Enterprises (MSME) Loans, and 5% is into 2 Wheeler loans as of FY21.

Jayendra B. Patel is the founder of the company who incorporated it in 1992. Now the business is mostly handled by his son Alok J. Patel. Mr. Alok has done his education from the U.S.A and holds a master’s degree in Accountancy & Finance. He is also a licensed Certified Public Accountant (CPA) and has worked as an independent auditor for KPMG for 4 years and also at John Deere Credit.

Currently they operate in 7 states with 239 branches and 3.74 lakh customers with Asset Under Management (AUM) of Rs.814 cr as of FY21.

Business Segments

Microfinance Institution (MFI) Segment

Microfinancing is providing micro-sized unsecured loans to the unbanked segment of our country’s population. The customers are from the lowest segment of the economy in terms of earning capacity, as portrayed in the image below.

One question that comes to mind instantly when you read an unsecured loan is that “what if the customer doesn’t pay or runs away?”. Well, fortunately that is not the case.

The best way to overcome this fear is through reading the book, “Banker to the Poor” which is about the story of Nobel prize winner Muhammad Yunus, founder of Grameen Bank. The book came to my notice when Prof. Sanjay Bakshi had recommended it to me. If you want to develop insights on MFI business this book is a must read.

The passage below shows that these people borrowed money for their living and if they don’t pay back they won't get the credit the next day and it would end up making their life miserable.

Arman Financial’s management has a similar mindset where they believe that, “agar chote bandhe ko finance diya jaye toh wo paise jaroor se time par vapas aatha hai” (If people who belong to lower segment of the economy are provided loans, then the money is always paid on time.)

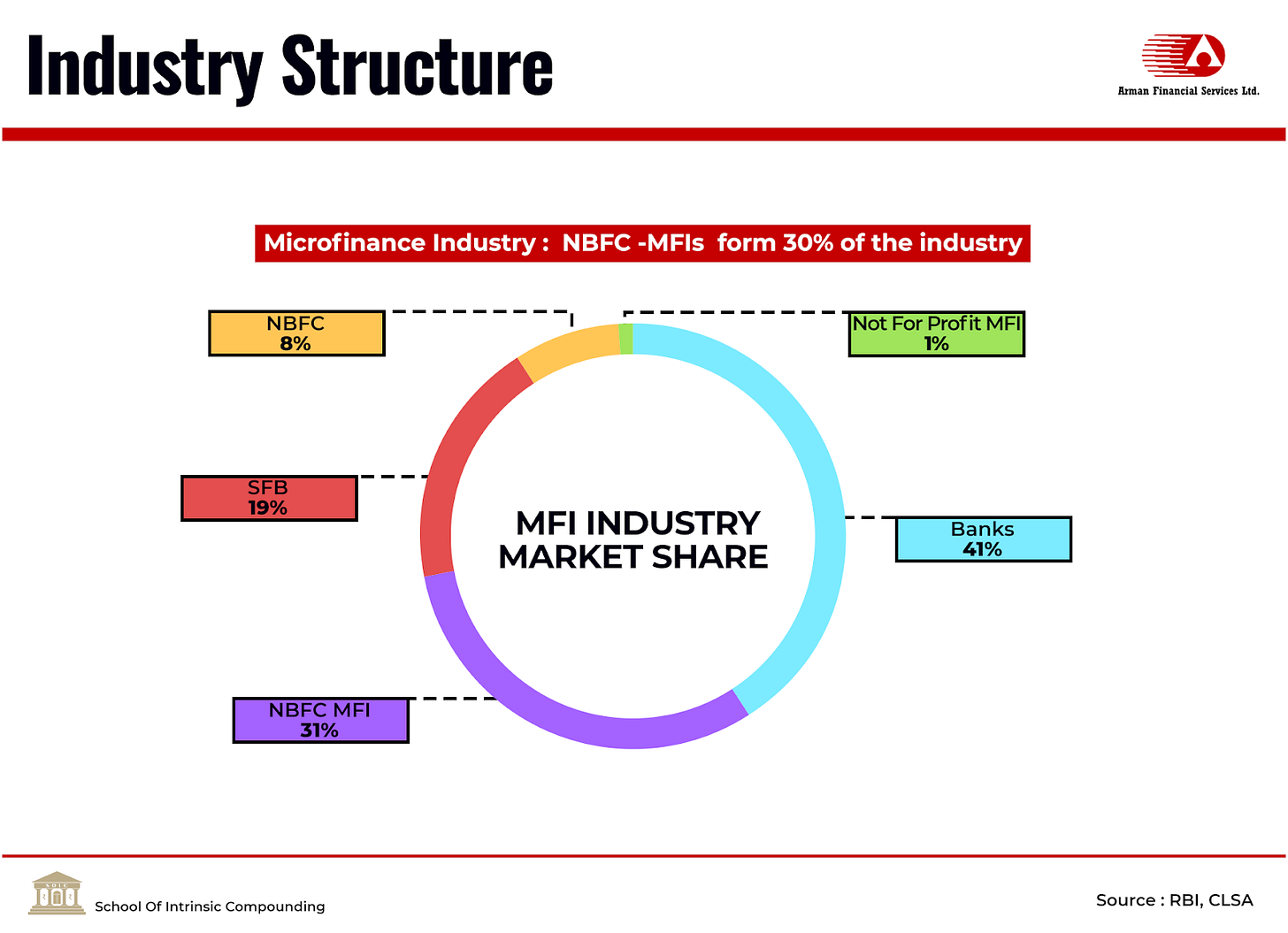

If you have read our analysis of Manappuram Finance, there we had written about MFI size opportunity being around 4 lakh crores as per research of CRISIL and MCRIL (Currently we are at 1 lakh crore).

Further we have also covered the two business models that are Joint Liability Group (JLG) and Self Help Group (SHG) which are used by MFIs, so to understand that you can refer to the blog.

Arman Financial follows the JLG model and operates their MFI business via their subsidiary, Namra Finance, where they have centre meetings - they take attendance of the members, and it happens every 14 days that is bi-weekly and they keep collecting money from 1st to 12th of every month. The customers are only women who indulge in income generating activities like Kirana stores, diary related activities (representing 40% of the loan book), etc. with the average ticket size of Rs.33,000-35,000. Arman Financial also does Loan Utilization Check (LUC) to verify whether the money taken as loan is being utilized for the said purpose or not. Here is a video to understand the process.

Management has most of their branches in rural areas which helps in avoiding competition, but they never enter a new district without other players testing out the market first.

They have 100% cashless disbursal (not collection) and fall under a centralized disbursal process, where the final approval is taken from the head office after all the checks. Even though this would lead to delay in disbursal compared to peers, such a process ensures quality of the loan book.

The MFI segment acts as a “turf testing tool” as the management calls it. This segment provides them information about the economic health of the area and helps in building a brand. Once they believe that the area is capable of higher ticket size loans they move few customers from MFI to MSME.

One characteristic of MFI business which we covered in our Manappuram analysis too is that it requires discipline from the side of customers. As it is difficult to manage the lowest customer segment as shown in the pyramid.

If customers behave in discipline, then they can be shifted to individual loans or even to MSME loans but only if customers need the loan amount. Management would do analysis of their business and understand why they would be needing more loans and not give it just because the person has completed 2-3 cycles. As of Q1FY21, 20% of their customers had experienced 3-4 cycles and 20-30% of their customers would be unique to them.

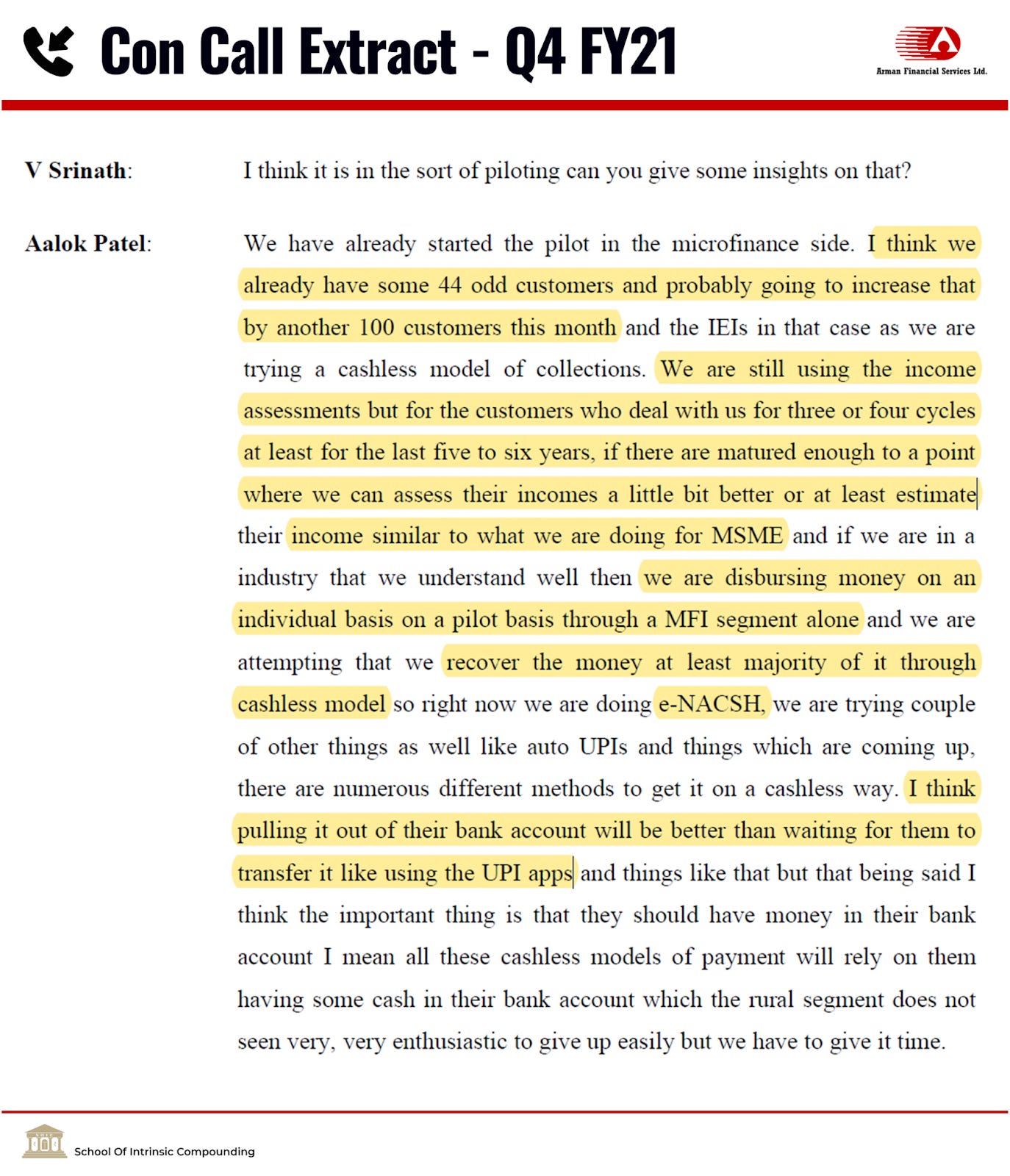

Further management also has plans to have individual loans under the MFI segment too. They already have one under MSME segment (which we will discuss later), but having the same could help the company retain more clients as the customer could shift to a different lender who is offering individual loans under the MFI segment and management does not want to lose a good-disciplined customer. Going forward that is in the next 3-5 years management believes that a large part of their loan book would be mitigating to individual loans. Like the one they are doing under the MSME segment.

Currently they cherry pick the best customers from the MFI segment and shift them to individual lending in the MSME segment. This is not an alarming thing because the quality of their loan book is quite good which can also be seen through the behaviour of their customers during COVID, where some customers didn’t take moratorium rather were paying two installments together.

Currently management is also planning to expand in three areas: Haryana, Madhya Pradesh, and Rajasthan. They have decided not to further expand in Maharashtra for next one year.

What can kill this business?

Similar to last time with the filter we used for Belstar (Muthoot Finance) and Asirvad (Manappuram Finance), let’s do it for Arman Financial.

Three characteristics that would kill an MFI business:

Large geographic concentration: Their MFI business operates in 7 states and has around 198 branches with 310,000+ customer base. This is the filter Arman fails. If we compare this with Manappuram they are one of the most diversified MFI with presence in 24 States with around 23 lakh customers.

Ultra-High-Ticket Size: Current average ticket size is around Rs.33,000-35,000 where average ticket size stands at Rs34,900. Therefore, one can conclude Arman’s ticket size is not ULTRA high. Bandhan has ticket size of around Rs.50,000-60,000.

Aggressive growth: Arman Financial’s AUM grew at 35% CAGR from Rs.176cr in FY17 to Rs.814cr in FY21 and they guided to hit Rs.1000cr mark in FY22. Looking at it on an absolute basis the growth looks aggressive but when comparing it with peers the growth rate doesn’t seem very aggressive. For example Manappuram grew their AUM at the rate of 35% CAGR from FY17 to FY21, SPANDANA grew their AUM CAGR of 77% during FY17-1HFY20, and CreditAccess Grameen: AUM CAGR of 51% over FY14-1HFY20.

Micro, Small, and Medium Enterprises (MSME) Loans Segment

If you can recall the pyramid image shown in earlier part of the article, MSME customers are generally from lower middle segment and these customers for Arman Financial are the ones which have survived a few cycles of MFI segment and after shift to MSME segment only after going through the underwriting filtering process which ensures the quality for larger ticket sized unsecured loan.

The loans under this segment are focused towards individual loans or small business working capital loans. They operate with 35 branches which are spread across Gujarat (23), Madhya Pradesh (8), and Maharashtra (4).

The purpose of starting this segment is to provide higher ticket size loans when compared with MFI to businesses or individuals who fall above the lowest customer segment. The ticket size is usually from Rs.50,000 to Rs.1,50,000/- (Average is Rs.70,000-75,000/-). Management describes this segment as Microfinance Plus because you take the best practices of MFI segment with greater underwriting process which was not allowed in MFI segment. Plus, this is their highest yield product with yield being as high as 35% and the average tenure of such loan is 24 months.

The customers for this segment are generally large Kirana stores, machine and tyre shops, small highway stores, etc. More than 80-90% of their portfolio is from rural areas and all these loans are unsecured as the model itself is operational heavy. Getting assets for secured lending would just bring in too many inefficiencies. Rather, they go the unsecured way with high quality MFI customers. 70% of their customers have outstanding loans with other institutions as well but management also has a 70% rejection rate in this segment with credit bureau checks of both the borrower and their spouse, which maintains asset quality.

The customer selection for their MSME segment is that the customer should have completed 3-5 cycles with them and have always made the payment even during the COVID times. Such criteria provide management the confidence to lend such customers higher ticket size loans. This is the reason that they have low NPAs which is in the range of 1-1.5% for such a business (removing the COVID period) but management guides that this to be around 2% in the long run.

But just because the customer has gone through various cycles doesn’t qualify them for higher ticket loan, they still have to undergo the underwriting process as per the standard of their MSME segment.

Arman Financial provides a doorstep collection facility which is appreciated by their customers because most of their branches are in rural areas where even bank branches are not present. Compared to banks they have a faster turnaround time, and they would have better asset quality because they get on the ground level to assess the cash flows of the customer. Furthermore, not many are doing unsecured loans under MSME segment and most of them follow Loan Against Property (LAP) which leads to higher cost and longer turnaround time.

Yields are very attractive in this business and currently business doesn’t have any competitive pressure to lower the rate but they are open to if required and focus on reducing operational cost.

Doorstep collection is the “secret sauce” of their MSME segment which helps in building relationships and indirectly maintains the asset quality (as it helps in maintaining discipline). Currently they consider Fullerton as their biggest competition as they follow a similar model.

But then comes the problem of logistics as doorstep collection makes the business operational heavy.

MSME vs MFI

The key differences between MFI and MSME segments are:

Ticket size: MFI has lower ticket size with average being around Rs.33-35,000/- plus the disbursement is done in a group-based model which includes only women. Whereas in MSME there is no such policy rather it is individual lending focused with average ticket size being Rs.70,000.

Customer segment: Customers in MFI belong to the lowest category of the pyramid whereas MSME customers are lower middle.

Yield: MFI yields around 24% and MSME around 30-35%.

Rejection Rate: MFI has rejection rate of 40-50% (during COVID it went up to 65%) and MSME has it at 70-75%

Retention Rate: We don’t have the exact figures for MSME retention rate but logically speaking MSME has very low repeat customers because once they are done with higher ticket size loans such customers hardly need that similar amount of loan again. But in MFI the loans are for their daily income generating activities, which leads to retention rate of around 55-60%, hence retention rates are relatively high.

Two-Wheeler Loans

Two-wheeler segment is not the most profitable segment which they have, plus the NPA they get here are relatively higher but still the management is interested in this business because it helps in operating leverage and in mitigating risk as during demonetization it was the only segment that was functioning. They have already burnt their hands in the used two-wheeler market earlier, so management has decided to stay away from it.

This segment is only present in Gujarat where their sales people sit at dealerships and as of now they have a reach of 55+ dealerships with AUM of Rs.45cr. Earlier they were only into the Urban side but now they have started Rural 2W loans too which have higher yields (Urban at 21-23% vs Rural at 26-28%). This is a secured loan segment where the Loan to Value is around 60-85% with average ticket size from Rs.30,000-50,000/-

Loan Against Property (Planned)

Management had planned to start a new segment that is Loan Against Property around 2018-2019 but didn’t execute the plan as they wanted to enter with a better understanding of the market but then in 2020 COVID hit, and all the plans have been delayed now. The ticket size would have been around Rs.2 lakh to Rs.5 lakhs and customer profile would be one step above MSME segment.

Conservative Management

The above quotes represent management’s long-term thinking and understanding towards the crisis. They have realized that crisis/scams are an inherent part of the NBFC sector, and one should expect it to happen every 5-6 years but still the company like Arman Financial would do good in the long run.

Now, let's look at the reasons behind the title, “Conservatism in its roots”.

Management is never the first mover in any district for their MFI segment and not in a hurry to enter any segment like they were planning for 2 years to enter the housing segment, but still did not as they believe they are yet to understand the market properly.

Further, whenever a crisis strikes, they are among the first companies to stop disbursement be it demonetization or COVID.

Due to their practice of choosing asset quality over growth, management has survived all the crises and performed better than industry in terms of collection efficiency. During the time of demonetization and the COVID pandemic the company was able to get 90-95% collection efficiency with industry being around 60-70%, which represents their asset quality and customer base.

Management has also being conversative and provided extra provisioning whenever they feel trouble where it is 2017 or 2021 they have also provided extra so as to create cushion for the business. The reason behind such nature is the history of Mr.Aalok Patel who has spent some time in the USA while he was completing his studies and has witnessed the 2008 financial crisis there.

It is very easy to lose patience in this lending business. There is no problem of growth as demand will always be there but asset quality if not maintained the business could get into trouble. Plus, management believes that sometimes there can be genuine issues and when dealing with people from the lower pyramid therefore, they must show sympathy (Management won’t hesitate to restructure a loan for such cases).

Management has completed the capex for 30 branches, but they have stopped the work on it because they want their team to focus on repayment rather than bringing in new business.

As mentioned at the start of this section, management has said that one should expect a crisis every 5-6 years in between saw issues which come up specific to the district are manageable; the problem only gets serious when it becomes an industry level issue.

Another way to judge the conservative nature of the management is through numbers, that is to see the difference in the GNPA and NNPA.

Net Non-Performing Asset formula is GNPA - provisioning = NNPA, which means higher the difference between both the numbers more the provisions management has made in their books.

Good banks/NBFCs generally maintain a 70% coverage ratio. Arman Financial made a total of Rs.36.67cr as provisions and GNPA were Rs.26.36cr which leads to 139% of provision coverage ratio.

Well, the care is not limited to customers only as at the end of the day employees are the assets of the company who also require help in times of crisis. They do not do layoffs during crises, rather they provide incentive to retain the talent. Even though they care about their employees they still can’t afford to pay them hefty salaries to retain talent and the maximum they can do is provide ESOPs. The reason being NBFCs advantage over Banks is that they can operate in a low-cost model even though borrowing cost would be high, operational cost can provide NBFCs advantage over banks. If NBFC start providing hefty salaries, then it would take away the low-cost advantage.

Few measures management takes to mitigate risk

Branch: To reduce the measure of a black swan event management does not allow a district to have more than 5% exposure and if a branch reaches a loan book of Rs.5cr they would split the branch.

Preference to old customers: They prefer providing new loans to their old customers who have maintained the discipline but we all know that this strategy doesn’t work for long and companies have to start getting new customers on board who bring in additional risk.

Avoid few businesses: Management avoids lending to some kinds of businesses like direct agriculture business or roadside restaurant during COVID as they believe there the risk to reward ratio is not suitable.

Top-up Loans

Evergreening/top-up loans are those loans which are given to existing customers to repay the initial loan they had taken. Such loans are dangerous because this will lead to customers falling into a vicious circle which would at the end affect the lender themselves. Management is totally against evergreening of loans. They believe that it disrupts the discipline one builds among their customers and it’s an easy way out to cover your losses.

RBI’s Consultative Paper

The current regulation for Net Interest Margin (NIM) , that is, how much the company charges on their product is 10% over the cost of borrowing. Arman Financial has their cost of borrowing at 12-13% which means the maximum they could charge on their MFI products would be 22-23%.

On SOIC channel we had mentioned about the structural changes the MFI industry is going to witness because of RBI’s consultative paper on new regulation norms.

The new regulation is going to bring in the following three major changes in the industry:

Removal of pricing cap: this could lead to increase in ROE (net income/shareholder equity) as they would be able to charge more on their products leading to increase in net income. Further this increased the size of the addressable market for the industry because earlier companies used to avoid riskier borrowers because due to cap on interest rates the risk to reward ratio was not attractive.

Change in upper limit: After the removal of cap now the limit for loans would be based on 50% of total household income, which means there is no individual borrower limit. Before this the cap was at Rs.1.25 lakhs.

Definition of household income: The requirement for a customer to avail MFI loan is that their household income should not exceed Rs 1.25 lakh (Rural) and Rs 2 lakh (Urban). This definition would now also apply to banks, earlier it was restricted to NBFCs.

Management believes that this paper is going to be a game changer for the MFI industry.

This white paper is exactly what the management wanted earlier, and analysts used to discuss about.

Please note this is a consultative paper, even though management is positive it will eventually be implemented but there is a risk involved here.

Cost/Liability Side

On the liability side the company looks fine as there is no asset liability mismatch which makes a lending business fragile. Average loan tenor of loans on the assets side stands at 16 months whereas average period of borrowings on the liability side is at 19 months.

As long as the period of borrowings is longer than tenor of loans disbursed, there is nothing to worry about.

As of Q4FY21 their cost of borrowing was at 12.25% and margin for MFI products was around 9.25-9.5% (limit is at 10% until RBI paper is approved). Management believes there is less probability of costs of funds going down. The only lever for reducing cost now left is improving efficiency.

Branches and Cost

As most of the business of Arman Financial happens in rural areas the expenditure of opening a branch is not huge and for them to break even MFI branches require 500-700 customers and MSME is little lower at around 450 customers. Total capex for a branch is around Rs.2.5-3 lakh the reason for it being cheap is rural locality. Therefore, opening a branch is not an issue running it efficiently can be.

Small Finance/Banks vs NBFCs

Competition from small finance banks is real but not alarming. Most banks indulge in the MFI segment (unless they are laser focused like Bandhan) to increase their yield. Further similar gold loan 5-10% difference on small ticket loans doesn’t make a huge difference, rather customers would look for comfort.

Valuation

As discussed various times at SOIC, investing is a game of probabilities so having scenarios set in mind is a good way to value a business. Let’s first look at what can happen in the next 2 years.

If we assume 35% growth rate for FY22 assuming no COVID third wave and management guidance of 40% growth once the dust settles and then 25% growth rate for FY23, the book value would reach to Rs.295 in FY22 and Rs.370 in FY23.

Bear case: During downfall of economy the P to BV multiple Arman gets is around 2 times leading to stock price in FY23 could be at Rs.740.

Base case: In a stable economy it gets 3-3.5 times multiple leading to stock price of Rs.1110-1295 in FY23.

Bull case: In a no COVID world and good economic conditions the multiple reaches to 5-6 times which implies a stock price of Rs.1850-Rs.2,220 in FY23.

Note: If we don’t include the FY21 numbers as due to COVID management had stopped disbursement and started focusing on safety rather than growth, the book value has grown at 35% between FY18-FY20. Further, these numbers are just rough estimates for creating probabilistic scenarios, don't take them to precision.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC both own the stock in their portfolio at the date this post was published.

About the Author

Arjun Badola is a law student who has interest in analyzing businesses. He shares his thoughts on investing via his blog and twitter. In case you have anything to discuss related to investing, feel free to reach out to him.

Blog: arjunbadola.blog Twitter: @badola_arjun