Astec Lifesciences: A better tomorrow?

Astec Lifesciences: A better tomorrow?

“It’s the future that counts, go where the puck is going to be not where it is today. Current multiple interacts with reinvestment of capital and the rate at which that capital is invested to determine the attractiveness of something”. - Warren Buffett at one of the AGMs of Berkshire Hathaway. If there was something about investing I wish I knew at the beginning of my journey, it will probably be these lines mentioned by Warren Buffett when asked about how he goes about analyzing a potential investment.

In this post, I will be analyzing one such business where future returns on capital can be a lot higher than what they are today. The name of the business is Astec Lifesciences, which is owned by Godrej Agrovet. I will handover the analysis to the two of my very smart friends, Sherlock and Watson, and let them carry this further.

Watson: Hi Sherlock! How are you doing?

Sherlock: (seemingly uninterested, facing the window). Lately, I haven’t got anything interesting on my plate. I am bored Watson. I need a case.

Watson: This is the exact reason why I came here.

Sherlock: (Gets up enthusiastically) What is it, Watson?

Tell me!

Watson: business analysis of Astec Lifesciences which most of the analyst community has ignored.

Sherlock: Wonderful! Let me gather the facts.

Watson: take your time Sherlock. We will meet in a day or two, I have to go to the theater with Mary.

Sherlock: (already lost in his thought) Sure.

(They meet after 2 days, both having done their research)

Sherlock: Before we start the discussion, let me just tell you. When it comes to investing, there are no right answers. One has to know that there only the right questions since investing is inherently an act of forecasting the future(tomorrow will be better today, and then reasoning why). Watson, ask the right questions and we will have a fruitful discussion. If you ask stupid ones, we will end up wasting time (smirks)

Watson: Don’t worry Sherlock, I have done my homework this time (nodding).

Sherlock: questions that are inquisitive in nature, like What does Astec do? Why are we analyzing Astec? What are the business segments? What is Astec doing currently that can make the future return metrics look different would be appreciated.

Watson: Give me an opportunity Sherlock, I have done my work this time :)

Sherlock: Sure.

Watson: While reading about the business, I came across the term “Triazole Fungicides”. What is exactly Triazole Fungicides Sherlock?

Sherlock: Let’s break that question into 2 parts. Let’s understand what are Fungicides first. Fungicides like Herbicides and Insecticides are a type of Pesticides. They are used to control the fungal disease by killing the Fungi causing the disease in the plant.

Watson: Interesting...

Sherlock: What is more interesting to note is that fungicides are used mainly as a preventive rather than a curative measure against the Fungal disease.

Watson: What do you mean, Sherlock?

Sherlock: Unlike other diseases, fungicides cannot heal symptoms already present, even if the pathogen is killed. Fungicides only protect the new uninfected plant from the disease. There only a few fungicides that have curative properties.

Watson: Noted. What will be the market size of Fungicides globally and in India, Sherlock?

Sherlock: Fungicides represent 27.3% market share($16.3billion) in the global crop protection market which is valued at $67.6 Billion. Other segments like insecticides and herbicide represent 25.3% and 43.8% respectively. Thus, out of all the segments herbicides are the largest, followed by fungicides.

Watson: What about the Indian market, Sherlock?

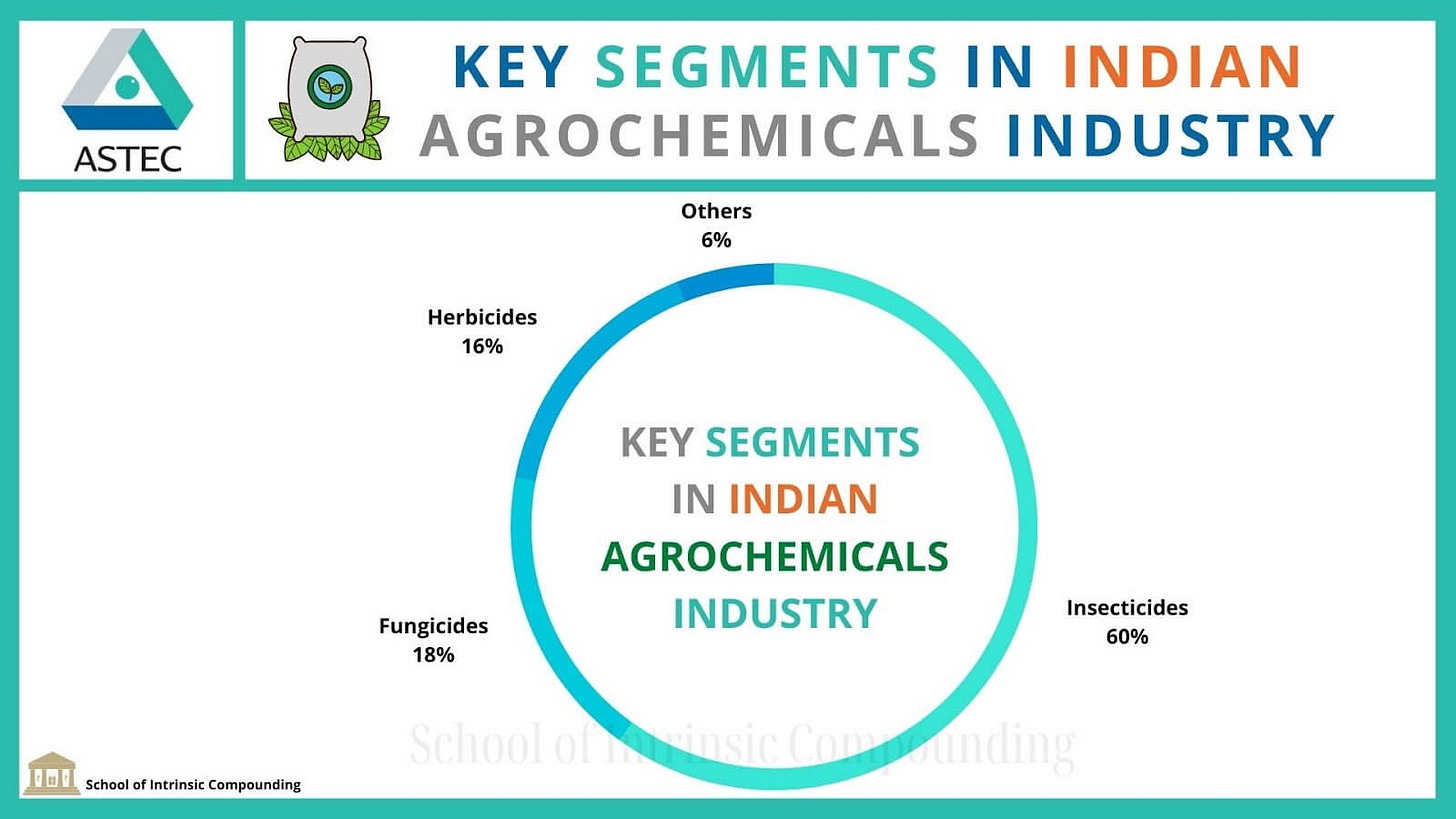

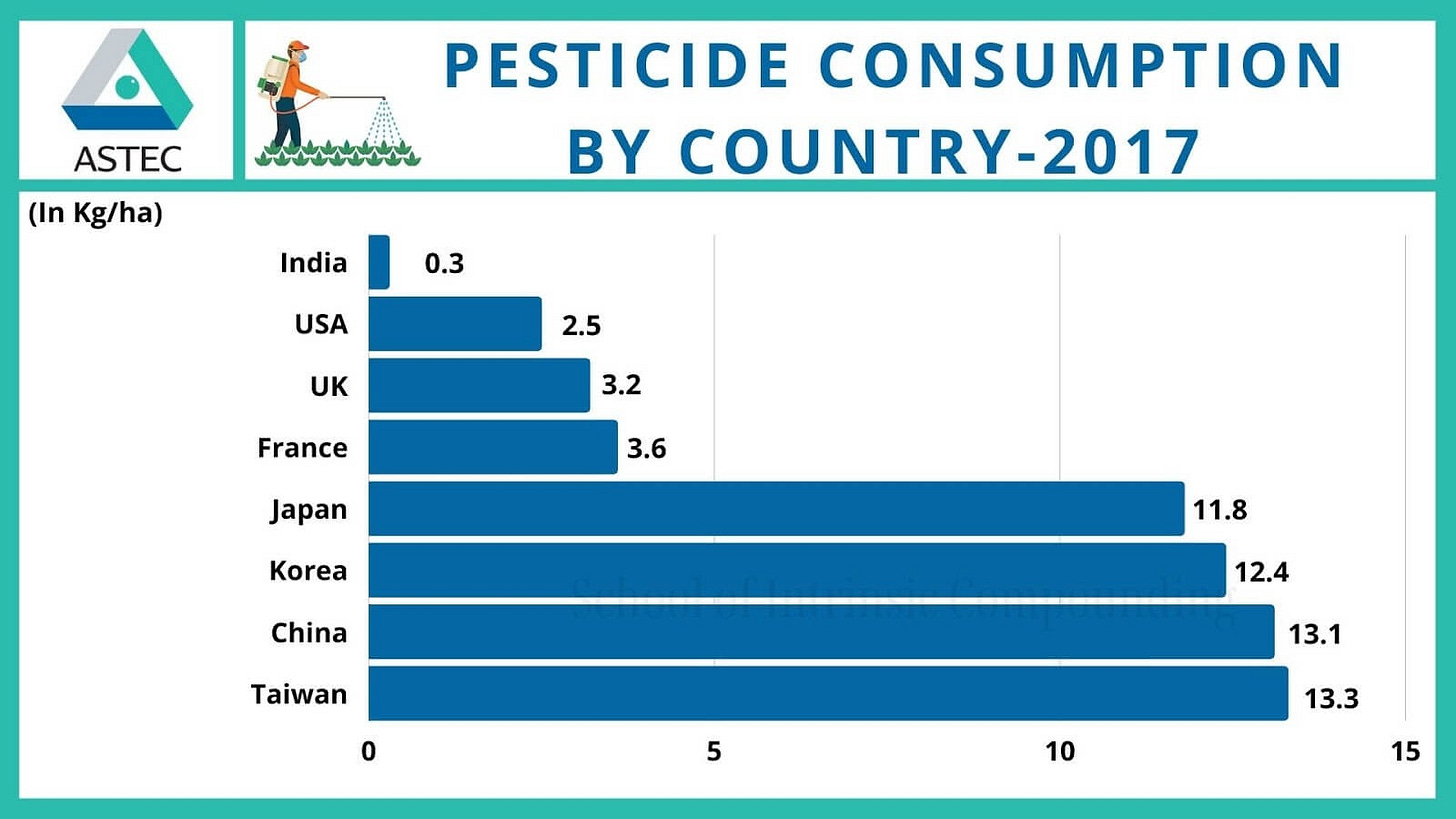

Sherlock: The Indian Market largely consists of insecticides which are nearly 60% of the market, followed by Fungicides which are at 18% and Herbicides which are at 16%. The Indian Agrochemical industry is at an estimated size of $3.04 Billion. Moreover, the consumption of agrochemicals per Hectare in India is lower compared to countries like China, Taiwan etc.

(Indian Agrochemical Market)

Watson: is there any particular reason for lower per hectare consumption in India?

Sherlock: there is indeed a very big reason behind it Watson which dates back to the land distribution pattern amongst the farmers in India. That is a topic we will discuss some other day.

Watson: okay Sherlock. Where does Triazole Fungicides in which Astec has expertise in, fits in the overall Fungicides market?

Sherlock: I was about to come to that (Sherlock Grins). The Fungicide group, Demethylation Inhibitors (DMI), which contains the Triazole Fungicides, was introduced in the early 1970s. Bayers was the first to launch a Triazole, in 1973 (triadimefon), followed up by the launch of 2 more Triazole products. In 1979, one of the most famous Triazole products namely propiconazole was launched, which is also one of the key products of Astec Lifesciences.

Watson: How does this thing actually work Sherlock?

Sherlock: Basically Watson, how Triazoles work is that they contain one specif enzyme, by the name of C14-Demethylase which leads to abnormal growth in the Fungi and eventually death.

Watson: One more question related to this Sherlock, as we discussed earlier, is used for its curative properties (after the disease) or preventive?

Sherlock:all fungicide types work best before disease is present.All have protective functions, even triazoles, Triazoles however are often associated with curative ones. These type of fungicides are applied 24-48 hours after the infection has occured.

Watson: Thanks for clarifying that. What about the market size of this particular group of fungicides?

Sherlock: Triazole market is of $3.2 Billion in size, that is almost 20% of the entire fungicides market globally, and it continues to grow at low single digits and it has degrown in some of the years in the last 5-7 years, and the Indian Market is of approx $90-100 million in size.

Before we proceed, there is one key problem I would like to highlight Watson.

Watson: What is that Sherlock?

Sherlock: The key problem is related to the rise of resistance in Fungi, which over a period of time adapt to Fungicides. Since, the mode of action in many of the fungicides is very specific, as they target a particular enzyme or proteins.

Watson: This might lead to resistance?

Sherlock: Aha! Finally you have made the right conclusion. This is exactly what has happened with Triazoles and its successors. Other fungicides like SDHI and Stroliburins, have been experiencing the same problems of reduced efficacy (effectiveness) due to Fungi developing resistance. Take this for an example: As per the data collection of BASF in 2018 from UK and Ireland, the data concludes that nearly 50% of the Septoria population (a type of fungi casusing leaf spot disease) has become more tolerant to SDHI,which was supposed to be the replacement of Triazoles.

Watson: How are the Agrochemical companies countering this?

Sherlock: the answer is simple, they have been introducing combinations of Triazoles with other family of fungicides, As using a mixture or a combination still works, since the Fungi hasn’t developed resistance to the combination of Fungicides.

Eg:Basf has recently launched a mixture of an old triazole fungicide with SDHI to make it more potent in protecting barley and wheat.

This explains what Astec Lifesciences management has been mentioning this in its concalls:

Watson: Interesting… What about the history of Astec? When was it started and who is the promoter?

Sherlock: Astec Lifesciences was incorporated in 1994 and was taken over in Feb 1994, by Ashok Hiremath and Pratap Gurad. It started its first manufacturing unit by acquiring a sick unit in Dombivli, Maharashtra having an installed capacity of 120mt for the manufacture of DICAP (Pharma Intermediate). It was acquired by Godrej Agrovet in 2016.

Watson: and Sherlock, what about Mr Hiremath? What is his background?

Sherlock: As you know Watson. I personally like technocrat Promoters in the Agrochemical/chemical industry. Mr Ashok Hiremath has a masters degree in Engineering from the university of Oxford and a Post Graduate Diploma in Chemical Engineering from University of London. He has over 37 years of experience in the chemical industry.

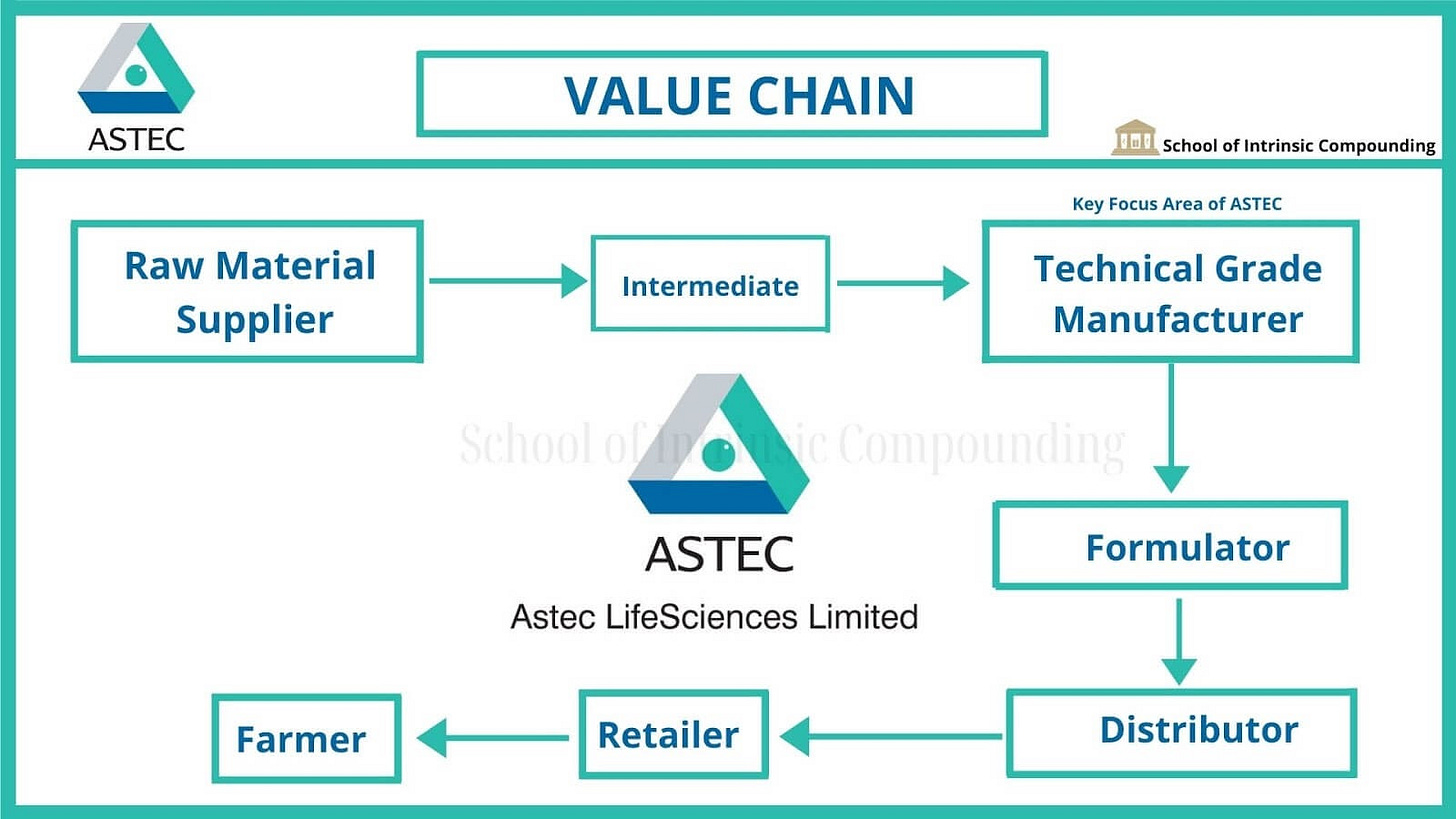

Watson: Given that you have laid down the context of the case, Where does Astec operate in the value chain? What are its various business segments?

Sherlock: This is how the value chain looks like:

Astec mainly operates in manufacturing of Triazole active ingredients (Technical grade) which constitutes nearly 80% of its sales, and it has over the years developed deep expertise in Triazole chemistry in which it can enter more products as claimed by the management and seen in their numbers over the years. The other 20% of the business comes from the CRAMS segment, we will talk about this segment later. This is the more interesting business of the two. Less than 5% of the business comes from Pharmaceutical intermediates.

This is how the product portfolio looks like:

Watson: can you throw some light on their Triazole business and its future prospects?

Sherlock: This line of their business is also known as Enterpise business and they cater to both the domestic market and the export market in this line of business. Domestic business in Trizoles is nearly 50% of the sales and exports also contribute 50% of the sales (as of 2018, based on a report by Motilal Oswal). Astec claims to be cost competitive against the Chinese Capabilities in this line. This is a claim I will take with a pinch of salt though :)

Watson: But wasn’t there disruption in terms of procurement of raw materials for making Triazole products?

Sherlock: See Watson, there are three big problems when it comes to this line of business. First one is that Astec is dependent on China for the procurement of Starting Raw Materials and Intermediates for making the Active Ingredients. However, due to the Blue sky policy and the relocation of Chinese chemical plants, the prices of these Raw Materials started going up. To mitigate the impact, Astec has invested in Backward integration and commissioned 2 plants to become self Sufficient in the supply of key intermediates.

Watson: one interesting observation that I can draw by comparing Astec and Bharat Rasayan is that both of them are investing heavily into backwards integration (Producing KSM/Intermediates in house)

Sherlock: There is a very strong reason behind this,if you want to diversify away from China (From MNCs perspective), you would actually want to partner with good reliable suppliers who are self sufficient in making their own Raw materials. For instance: Pi industries which is the largest CSM player of agrochemicals has reduced its dependence on China for Raw materials from 30%+ to somewhere close to 10% now.

Watson: that makes a lot of sense Sherlock. What are the other problems you can think of in this line of business?

Sherlock: the one about fungal resistance we have already talked about, apart from this the biggest problem can arise when a few of their products are banned. Since pesticides are harmful products for humans as well, over the years I have observed that governments take unilateral action on certain product categories. Just to give you an example, Propiconazole which was one of the key products was banned in Europe, which led to a situation of oversupply in the Market. They compensated for it by selling off the product to other countries like India. However,what I have observed is that once one product is banned somewhere, other countries start following the lead. It will really depend on Astec’s expertise of handling the Triazole chemistry to keep coming up with new products.

Watson: it seems as if in this line of business, Astec is a story of market share gain and they cannot afford to rest. As MNCs are looking to diversify away from China as the only source of procurement of technical grades and other raw materials.

Sherlock: Exactly Watson! Now let's talk about the second line of business, that is of Contract, Research and Manufacturing services. This is what excites me about the story of Astec Lifesciences both qualitatively and quantitatively in terms of where the business is headed. Before we start talking about this, let me just show you how the Export business has been growing as compared to the domestic one:

Watson: very interesting trends.

(Reader, try to draw your inferences about what does this mean in terms of gaining more traction in exports, who are they exporting to, what does this indicate, do mention in the comment box below :) )

Sherlock: Coming to the question which many people have been asking, is it something like what Pi industries is doing? The answer is yes and no. Astec is indeed going to undertake contract manufacturing of molecules, however the key difference lies in the fact that more than 90%+ of the business for Pi Industries comes from Patented molecules,whereas, for Astec they are entering contract manufacturing of the Proprietary off patent products, where the size of the molecules is smaller. In my understanding margins could be similar, but scalability is lesser when compared to patented molecules.

Watson: what about the capex plans, is this capex meant for the crams business or what?

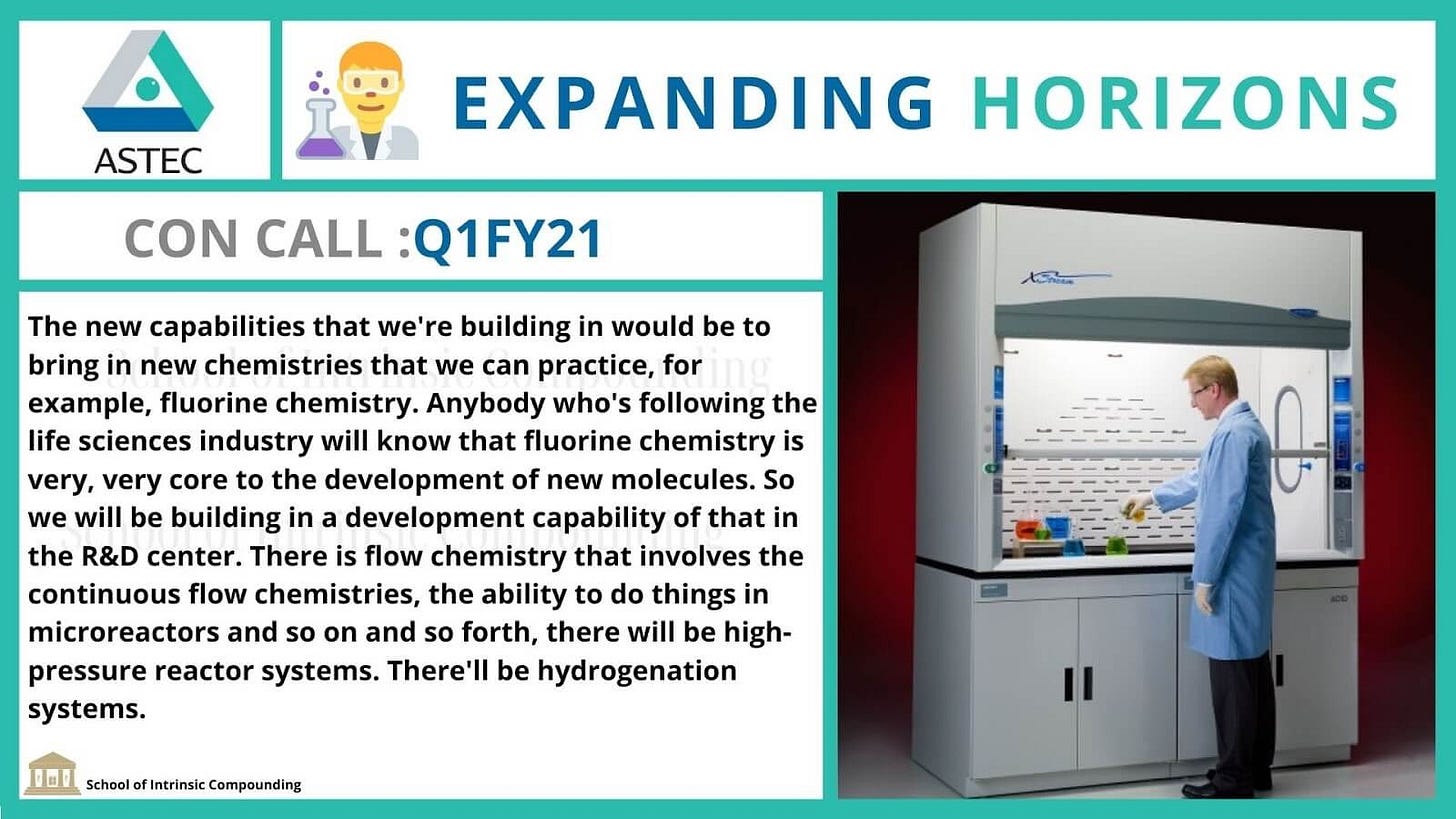

Sherlock: In terms of capex, Astec is investing heavily in two lines i.e. a new R&D centre and second is on a new Herbicide capacity which will be used from CRAMS. Coming to the first bit, Astec is upgrading itself, let’s see what the management has to say in the concalls:

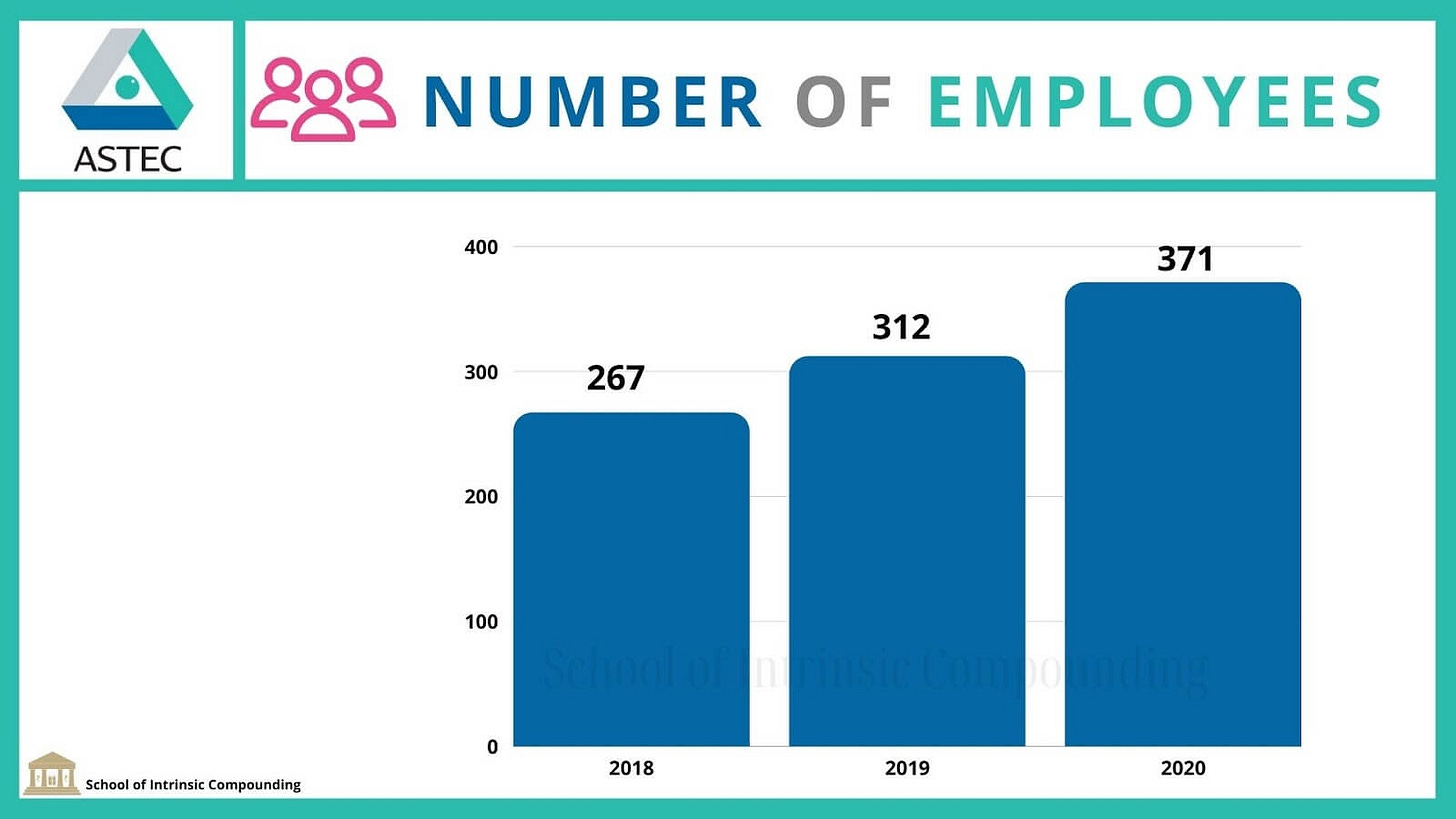

Sherlock: increasing the Fume cupboard capacities by 5x will help them to handle more projects, and they are increasing their hiring in R&D by nearly 50-70% (what the management says). A fume cupboard is basically a local ventilation device that is designed to limit exposure to hazardous or toxic vapors, fumes, and dusts. This type of laboratory equipment is designed to protect workers or researchers from inhaling toxic gases while protecting the product or the experiment.Now,one way to understand what is happening in knowledge based businesses, is to check the employee base and the employee benefit expenses. We have seen managements in the past who have claimed that they are increasing their R&D expenses, yet they hire very few people incrementally. However, this is not the case with Astec, Look at this:

Astec Employees

Astec Employee Benefit Expenses:

Watson:that is a good way to find out, Sherlock! When it comes to R&D, what are the other capabilities they are working on?

Sherlock: Apart from this, one other interesting thing they are working on is building expertise to handle Fluorine Capabilities. Fluorine is a very interesting compound, fluorinated molecules act as building blocks for Pharmaceutical and Agrochemical products. Increasingly what has been happening is that Fluorine is replacing Chlorine in a wide variety of industries, as chlorine is more harmful to the environment. Another interesting aspect about fluorine is that nearly 50% of agrochemicals today contain fluorine and secondly : During 2019, the US Food and Drug Administration (FDA) approved 48 new drugs (38 new chemical entities and 10 biologics). This strengthened the case for fluorine; four of every ten small molecules contained at least one of these atoms. More than a quarter (14 out of 48) of the drugs approved by FDA contained fluorine. (Navin Fluorines Annual report)

Watson: This just shows the importance of understanding the industry and its components, you have already read Navin and Srf. You were able to draw connections between them.

Sherlock: Knowledge compounds over a period of time :) Coming back to Astec, this is what their management mentions about building other capabilities in terms of their R&D:

Watson: Sherlock, going forward how can the product mix change?

Sherlock: What the management has been guiding for is that in next couple of years, the mix between Crams business and Triazoles would be at 50-50%, from the current 20-80%. In lieu of this, they are spending 80-85crores on a Herbicides plant. This is supposed to have asset turns of 2-2.5x, and lead to 175-200 crores of sales. What is important to note, is that margins over here would be higher than the enterprise business. (25% EBITDA Margins)(expected capitalization in Q4FY21)

Watson: This is very interesting indeed. Sherlock, can we calculate the Returns on capital that this project will lead to?

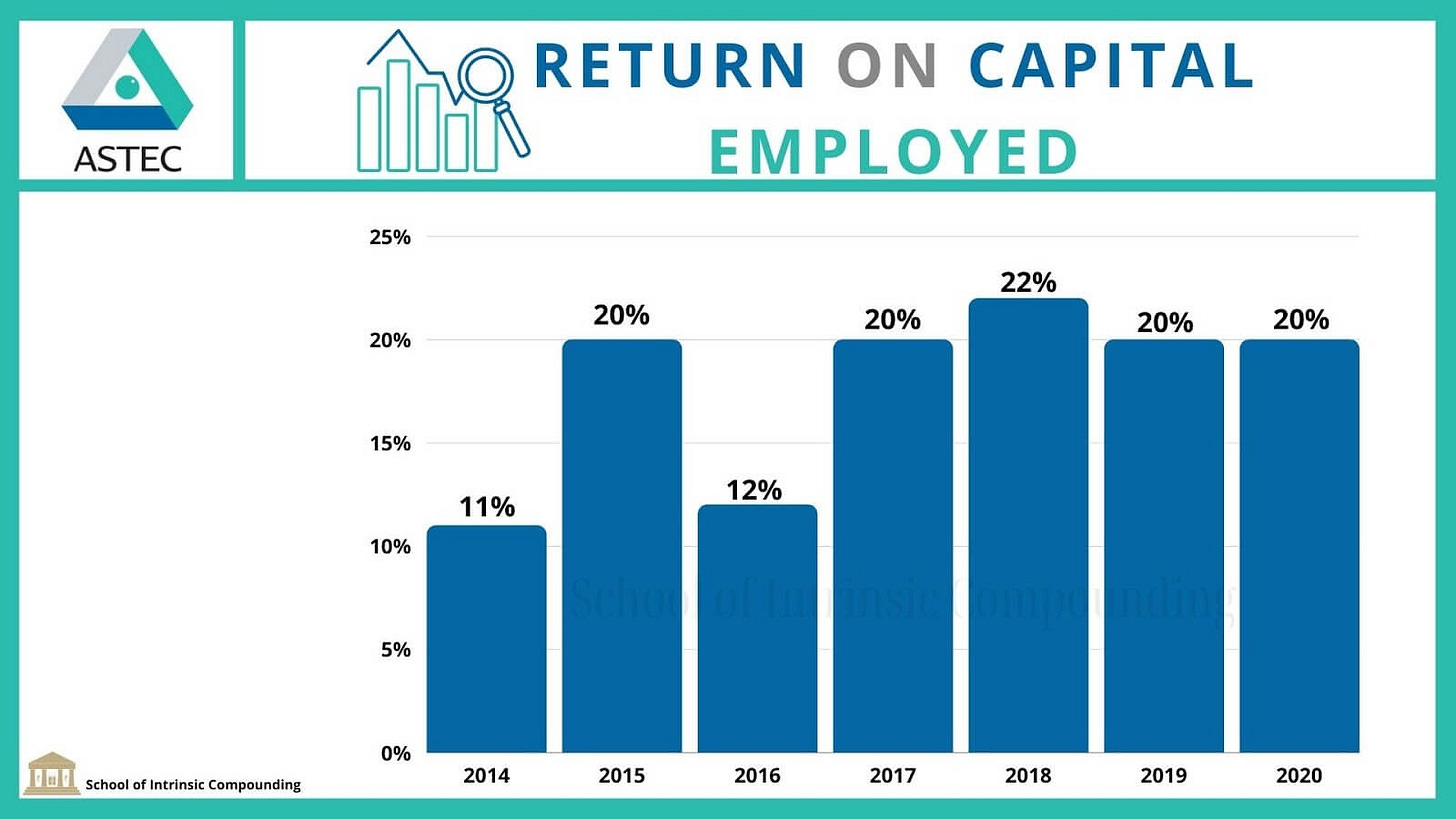

Sherlock: when it comes to having an idea about Future returns on capital, it is better to be roughly right than precisely wrong. Let’s assume that Astec is able to generate 175 crores of sales by investing 85 crores. Asset turns would be somewhere close to 2x (2.05 to be precise, but trying to be roughly right :p). Thus, on a fixed asset base of 85 crores, sales would be of 175 crores, Astec would be generating EBIT margins of 22-23%. Working capital days would be somewhere between 70-80 days(assumption looking at others like Pi). Working capital required would be 35-40 crores. With a total capital employed of 125 odd crores (Fixed assets+Working capital), Astec would be able to generate sales close to 175 crores and EBIT margins of 22%. ROCE works out to be somewhere close to 30% (22%*1.4times)

Watson: What is the current ROCE?

Sherlock: this is how the current ROCE chart looks like:

This is how the sales growth and the operating margin of the last few years look like:

I won’t be assigning multiples or try valuing Astec, but let’s read the lines said by Warren Buffett again:

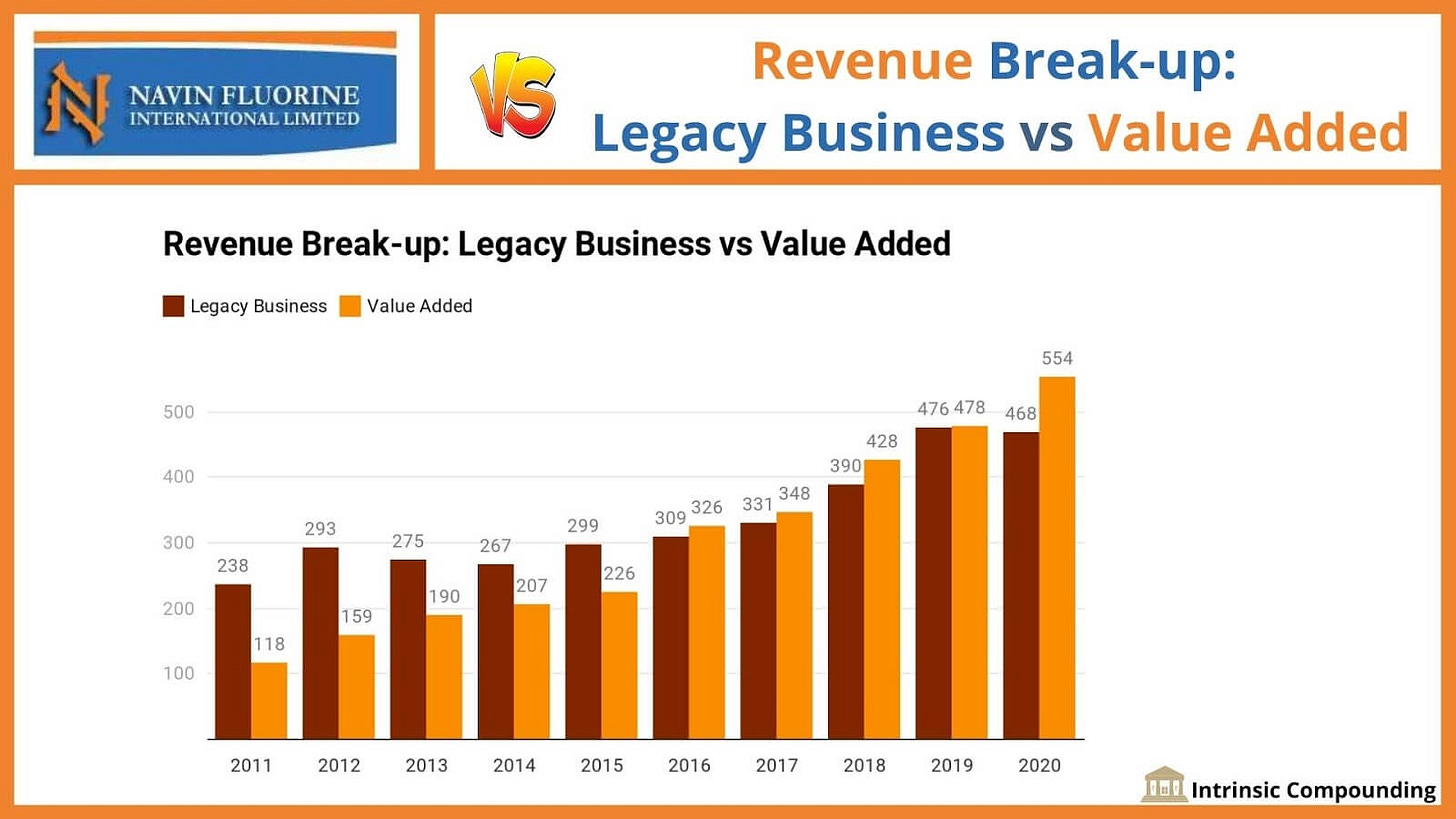

Let’s see what has been the outcome in Navin Fluorine once the Value Added segment of CRAMS business and Speciality chemicals overtook the legacy business of Refrigerants and Inorganic Fluorides, where margins and ROCEs are much lower.

Once the story was evident to Mr Market, the stock has rapidly been re-rated to more than 50 times and has nearly multiplied by 6-7 times in the last 5 years. Could something similar happen in Astec? That is a possibility worth pondering over. (Sherlock smirks)

Watson: Sherlock, you’ve laid down the case perfectly. However, since investing is probabilistic, can you tell me about the sources of risks? As a very clever investor once said, Risk comes from not knowing what you’re doing. What is it that all the interested investors should know about the downside risks in Astec lifesciences?

Sherlock: Key risks to the thesis include 3 major factors, let's start with the first one. First major risk comes from Volatility/Availability of Raw materials. I have observed in the past that many chemical,pharma and agrochemical companies have faced problems in the past due to lack of availability/hike in prices of Key starting material and Intermediates they import from China. For instance: Suven Pharma, one of the companies that indulges in Crams, has faced production difficulties in the past due to lack of RM availability from China. This is one of the major reasons why many of these players have to invest in backward integration if they want to be proven as reliable suppliers.

Second key risk, which is perhaps the biggest one is the merger with Godrej Agrovet. Over the years, what I have seen is that many big business houses go on Empire building missions. In case if Astec lifesciences is merged with Godrej Agrovet (good and clean group otherwise), then the entire thesis will collapse. Margin profile and ROCE profile of both the businesses are very different. This was about to happen, but apparently due to protests by minority shareholders it was reversed. In case if this risk plays out in the future, this is one thing to keep an eye out for.

Third major risk stems from Resistance that the fungus develops over a period of time to various fungicides. This is akin to running on a treadmill. In order to mitigate this risk, Astec has to identify new products in Triazoles chemistry and diversify in to other categories, full plaudits to the management they have already started doing this with the new R&D plant(Next year Jan onwards) and by commissioning the new Herbicides plant in Q4FY21.

Watson: Thank you for laying out the case wonderfully Sherlock!

Sherlock: Answering the questions made it easy. Now, it's up to the reader to decide whether Astec has a better tomorrow or not. Our role of business analysis is done here. Case Solved!

Sectoral analysis and newsletter are a part of the SOIC Intensive Course. To know more : www.soic.in/course

Disclaimer: This Blog,its owner,creator & contributor is not a SEBI registered research analyst or an Investment Advisor and expressing opinion only as an Investor in Indian equities.He/She is not responsible for any loss arising out of any information,post or opinion appearing on this blog.Investors are advised to do own due diligence and/or consult financial their financial advisor before acting on any such information. We are only into providing education and not stock recommendations.