Capacity To Suffer: ITC, DMCC, Nestle

Capacity To Suffer: ITC, DMCC, Nestle

In the world of investing you must have heard about various frameworks used by different investors. For instance: some people use the CANSLIM approach (stocks hitting 52-week highs and growing their earnings), some others talk about mixing Fundamentals with technicals, and there are a few investors who have developed their own frameworks for analyzing opportunities. One of such examples would be the SMILE framework used by Vijay Kedia and the other one would be the 5 bucket framework that we use at SOIC to assess opportunities. Recently, I was thinking, why are frameworks important? I did some google search, talked to a few investors, and saw a few videos on various frameworks that are used in investing. I stumbled across a very interesting article on why Frameworks are important in developing applications. There was a line in the article which perfectly represents the importance of frameworks in investing as well:

“It provides a structure in which software developers can build programs for a specific platform”.

In the context of investing, this would simply mean, Frameworks are loosely held structures that help investors build an understanding of various opportunities that exist in the market. You would ask why Loosely held, Ishmohit? The answer is simple, unlike other subjects (Mathematics or the hard sciences) there is no absolute truth in investing. One has to keep searching for the right questions to ask and keep changing the framework with his own experiences of analyzing businesses and the outcomes. It pays to study different frameworks in the long term. One such framework that we will talk about in the Indian context is, “The Capacity to Suffer” by Thomas Russo. He’s a well-known investor who has identified various consumer brands like Nestle and Brown Forman (Jack Daniels) in the early part of their journey.

While reading and studying about the Capacity to suffer framework, we came across two very interesting examples which Thomas Russo has talked about in his interviews and investing talks.

1) Let’s talk about Nestle first. It took 15 years of investment spending for Nestle to break-even in developing Nespresso. The idea of Nespresso consisted of a single cup of coffee from a high-quality machine that provides the experience of drinking a coffee shop quality coffee. Further, the idea consisted of a retail club in major cities, where one could go and buy the machine and capsules. These capsules were meant to be used in machines and they delivered one single cup of premium quality coffee. Since Nespresso wasn’t being distributed through a grocery store chain, this led to savings on the margin end. Secondly, since Nestle held a patent on the aluminum coffee pods (Expired in 2011), this led to the creation of switching costs. Finally, the club type feeling among the customers created a sense of loyalty. The surprising thing about this business is, that it took Nestle 15 years to breakeven. Capacity to suffer in its essence is about long term thinking and short term impact on the profitability statement of the company.

2) Thomas Russo has talked about how Warren Buffett’s purchase of GEICO was in line with the capacity to suffer and the long term thinking framework. When Buffett bought GEICO, it had only one million policyholders, and Warren thought there were 112 million insured cars and he could not figure out why they did not have a greater market share. He was told the reason was the first year of a new policy generated $250 worth of losses. However, Warren understood that a new policy because of high persistency and low claims had a $2000 lifetime value whenever one was signed up. Warren knew that growing the company would result in operating losses. Warren didn’t care about the operating losses in the short term as growing the company would be more beneficial in the long run. As of 2017, GEICO has had more than 15million policyholders.

These are two of the examples which highlight why Capacity to suffer, long-term thinking, and capacity to reinvest are extremely important while analyzing businesses. Let’s apply capacity to suffer in the Indian context and look at businesses that have taken a long term strategic view and are willing to endure the short term pain that arises due to depressed earnings:

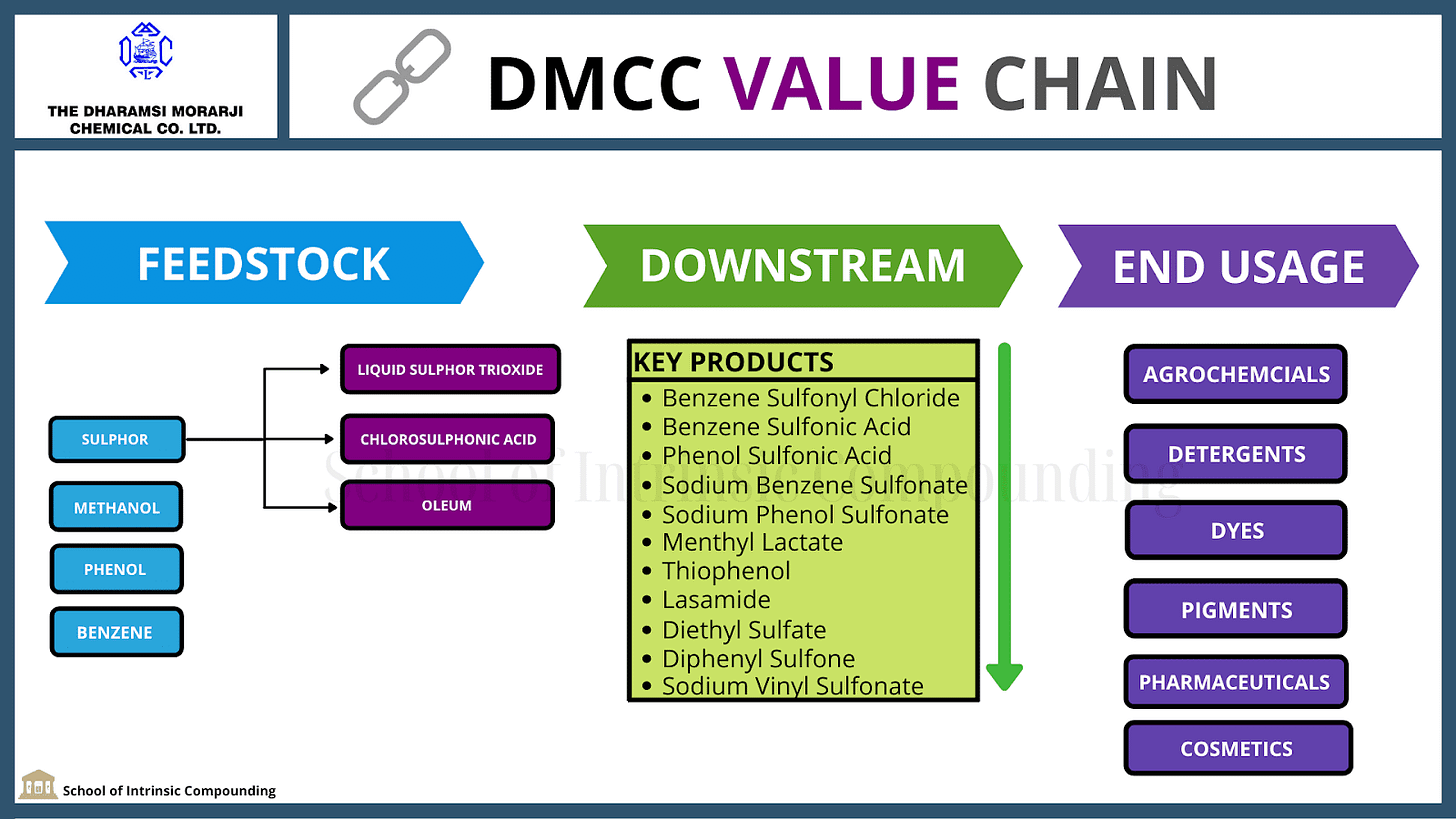

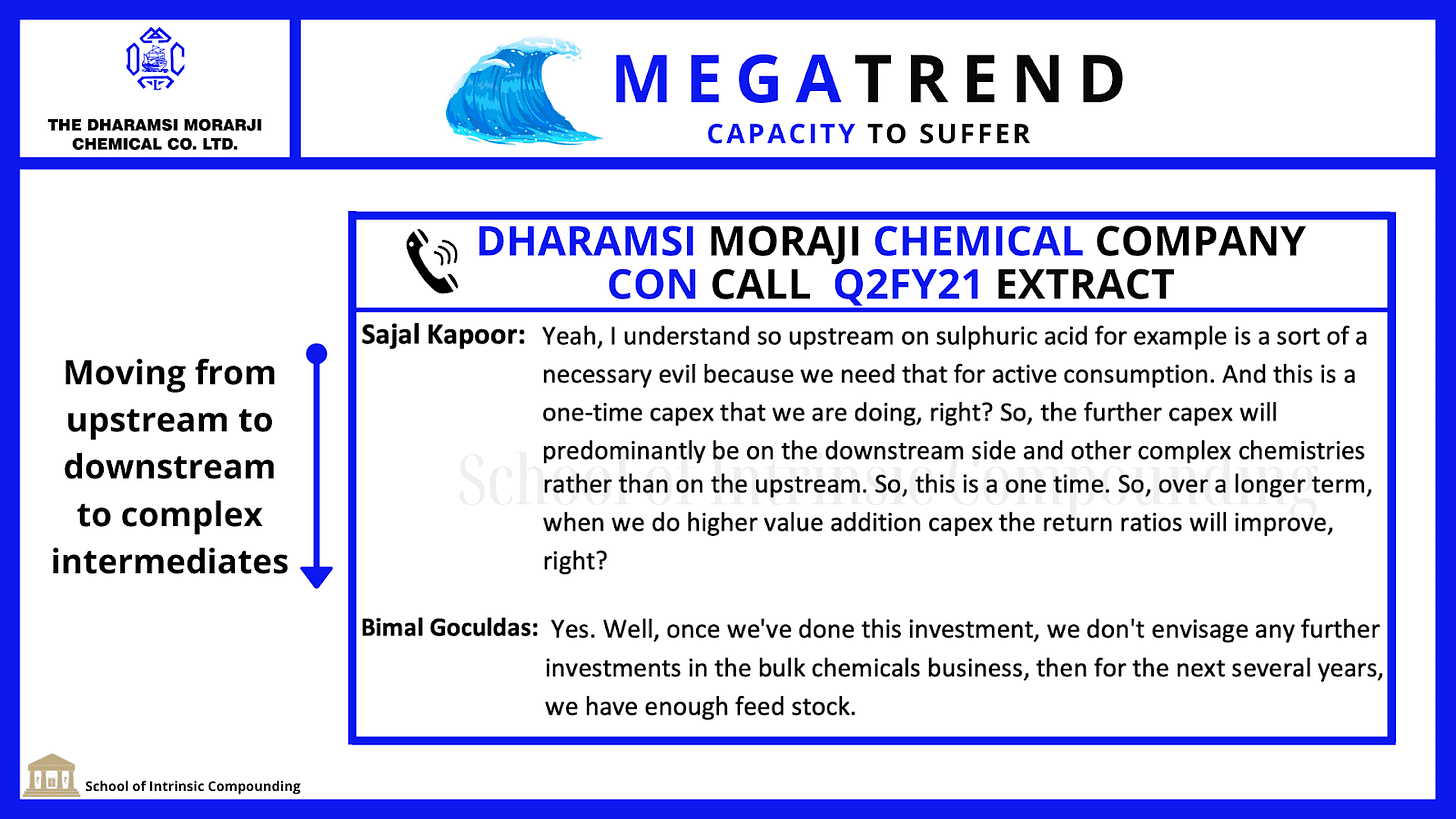

1) Dharamsi Morarji Chemical Company: there is a little known chemical company that has expertise in sulphur chemistry listed on BSE. DMCC was founded in 1919, with just one product and one manufacturing unit. It began its journey as a manufacturer of Sulphuric acid and Single Superphosphate Fertilizer. Throughout the last century, DMCC was focused on the fertilizer business which contributed 75% to the sales. However, in 2005 it started incurring losses and decided to exit the business. Under the new leadership of Bimal Goculdas, DMCC started focusing on the sulphur chemicals business and its downstream products which were lower competition but higher margin in nature. This is how the value chain looks like:

Let’s see how we can apply the capacity to suffer framework over here. Recently the company has announced a capex worth 100 crores,(currently has fixed assets of 100 crores). Out of the 100 crores capex, 50 crores is being spent on the bulk chemical segment (sulphuric acid). Setting up the capacity for bulk chemical becomes important as this will help the company to take care of its feedstock. Then to use this feedstock to move downwards in the value chain into the products that will be higher margin in nature. In the short term, the proportion of Bulk chemical business will increase and this will lead to contraction in the margins, but in the long run. This capex will take care of the feedstock requirement of the company for the next decade, this will allow the company to focus increasingly more on the downstream products that will be higher margin in nature. Mr. Market is clearly giving the valuations of a bulk chemical company. On the other hand, the thought process of moving downstream seems pretty clear after the requirement of feedstock is taken care of.

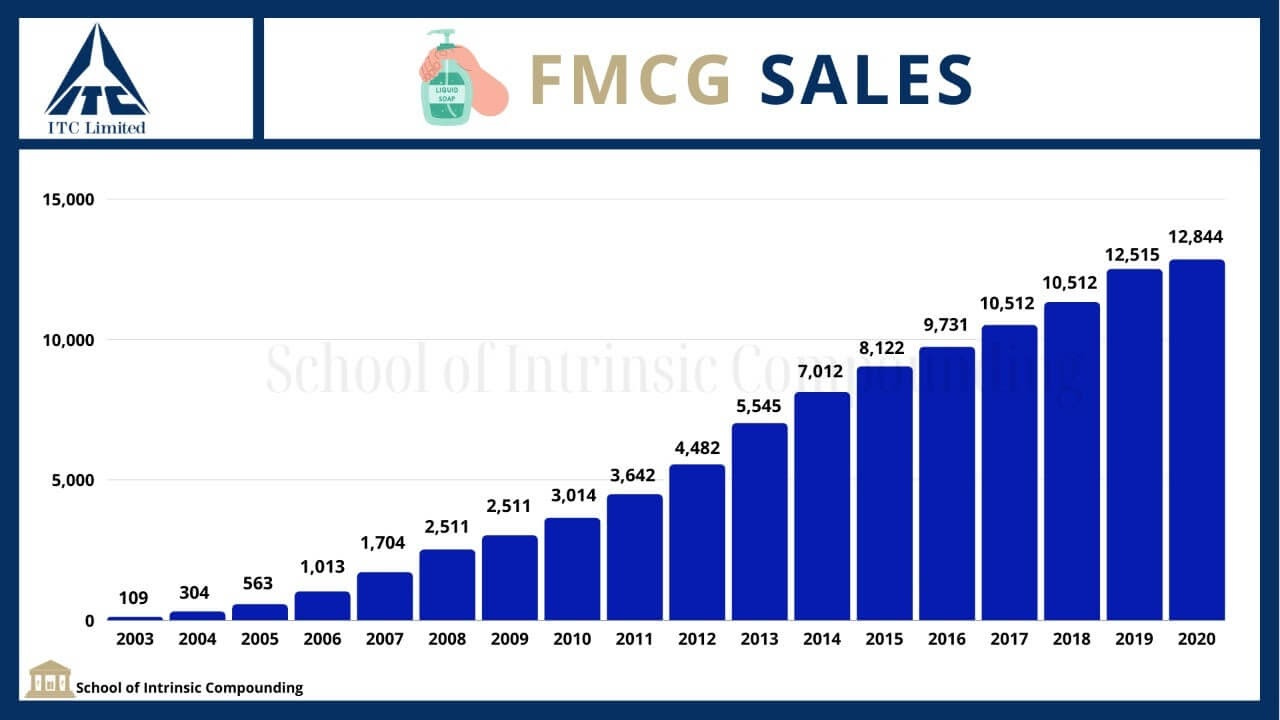

2) ITC Ltd: ITC is a diversified conglomerate that operates in various segments like Cigarettes, Hotels, FMCG and Agri, etc.ITC has taken the cash that it earns in the Cigarette Business and has significantly invested in its FMCG business over the years like Aashirvad, Sunfeast, Yippe Noodles, etc. (takes years to build brands). This is how the sales growth of the FMCG business looks like:

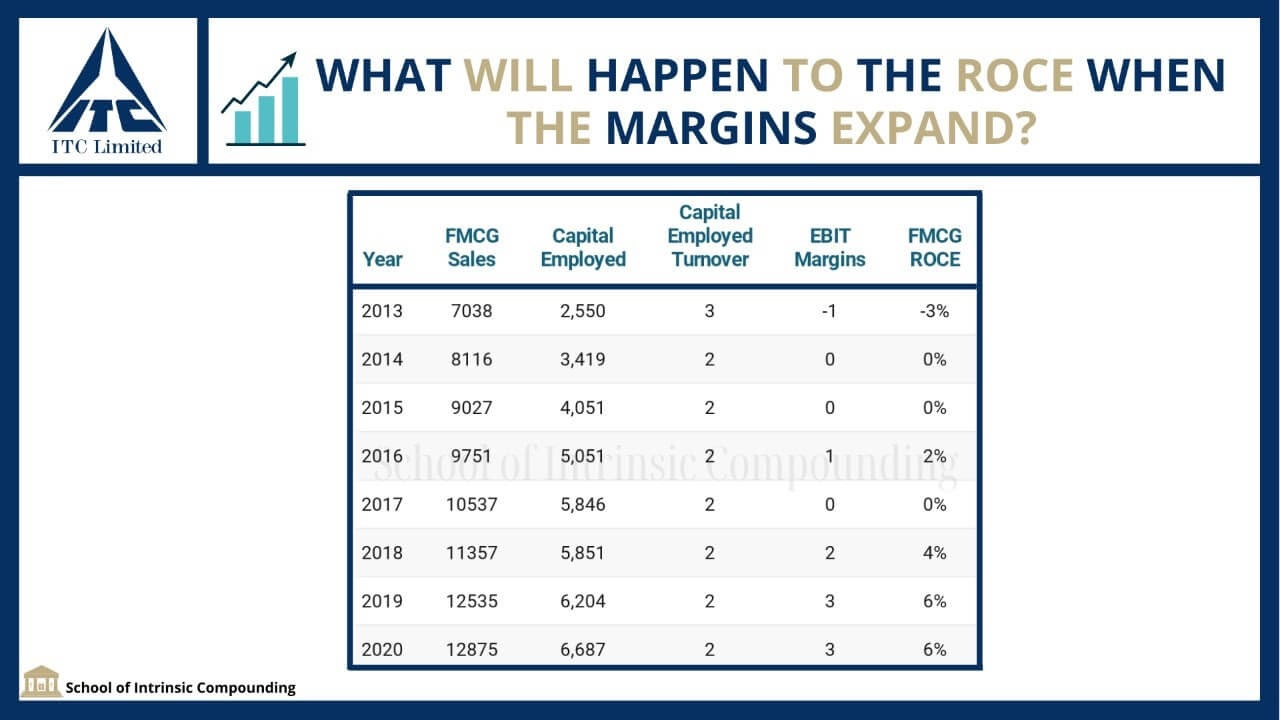

However, in the FMCG due to the phase of heavy investments the company earns very low EBIT margins.

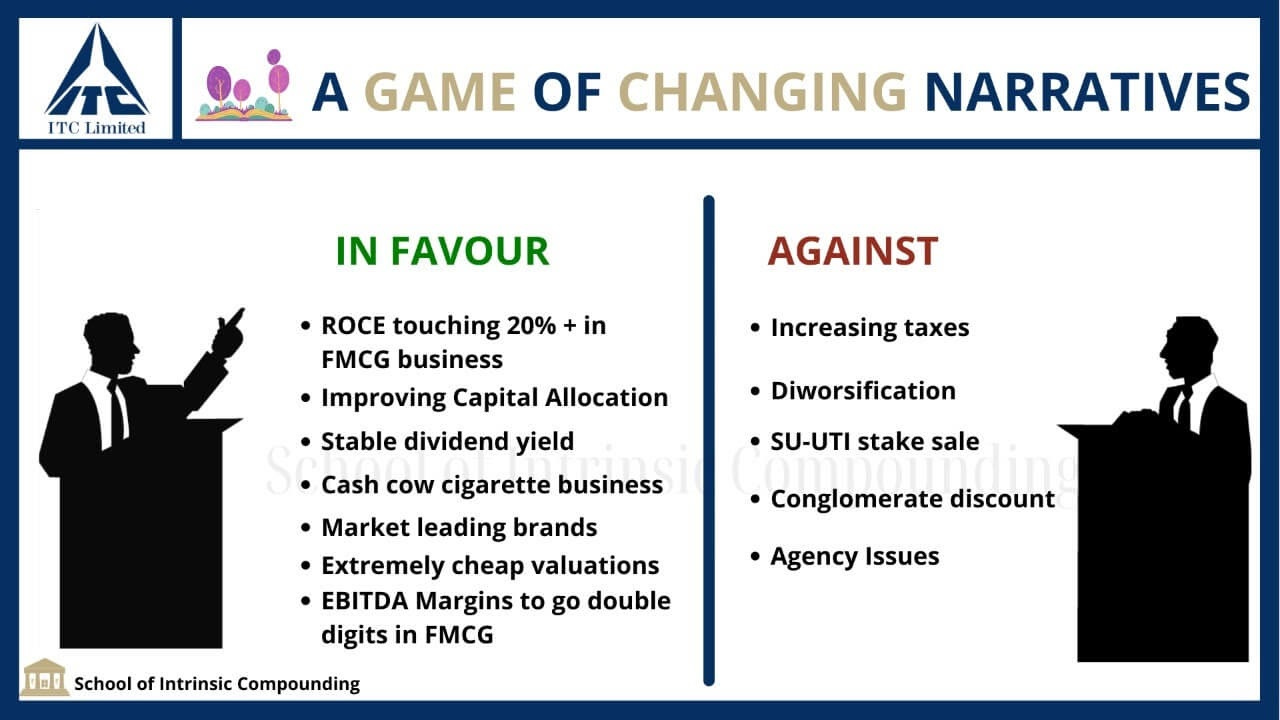

However, what is interesting to note is that margin expansion has started to play out in the FMCG business. After years of suffering from building up the brands and the FMCG business, this is how the narrative change can play out in ITC’s story:

3)Vinati Organics: one of the most interesting examples of Capacity to suffer comes from a business that over the years has adopted the strategy of investing in niche products, developing the best processes, and gaining market share. Mr. Vinod Saraf founded the company in 1989 and their first product was Iso Butyl Benzene (Used to make Ibuprofen). Vinati got its technology for manufacturing IBB from IFP, France. Vinati rapidly gained market share in IBB and became the world’s largest producer of IBB. Today it has a market share of more than 60% in this product.

Another product that showcases Vinati organic’s capacity to suffer is ATBS. Now, ATBS is a performance chemical that is used in small quantities to make some other chemical perform.It finds application in shale gas production, construction, and water treatment, etc. Very high levels of purity are required in this product, and even small impurities will lead to rejection by the clients. In 1999, NCL Pune developed a novel process for the manufacturing of ATBS, which was taken up by Vinati. In 2002, they set up their plant to produce ATBS. However, the ATBS produced by Vinati was rejected by the clients, as it didn’t have the desired levels of purity. For 4 years between 2002-2006, Vinati made cash losses in the ATBS plant. Yet, they persisted and hired an ex-Lubrizol executive(their biggest competitor in ATBS at that time, they had to exit the market as they couldn’t compete with the prices at which Vinati was selling ATBS). Who helped them to make adjustments and improvements in their processes. After 4 years of persistence, they were finally able to achieve the purity the customers desired. Today, Vinati has emerged as the lowest-cost producer and it key competitor Lubrizol has exited the market as they couldn’t match the prices at which Vinati was selling the product ($3vs$8 per kg).

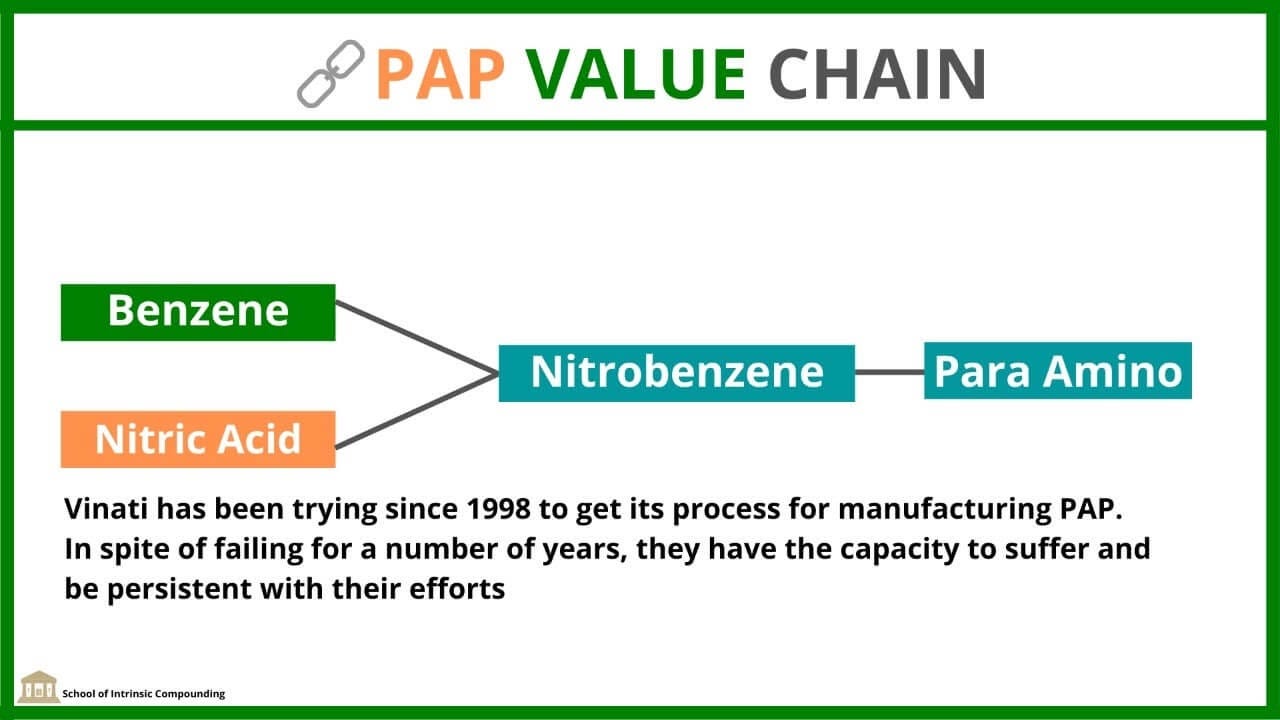

The culture of persistence and the capacity to be patient is displayed by another of their products by the name of Para Amino Phenol. PAP is an n-1 intermediate used to manufacture Paracetamol which is a widely used pain reliever. Vinati has been granted a patent for a unique one-step reaction to manufacture PAP.

This process would be greener and much more efficient when compared to other ways in which PAP is produced. There exists a huge demand in India for PAP production which is currently being catered entirely via imports. However, Vinati hasn’t been able to achieve the desired levels of purity as of now in this product. What is important to note that Vinati has been working on this product since 1998, which indicates the persistence that the management has displayed over the years. Recently they have applied under the PLI scheme to manufacture PAP. Could the breakout in PAP manufacturing be on the horizon after years of persistence?

Many businesses in India have displayed the capacity to suffer and the capacity to reinvest patiently over the years. Even in the Lending space, banks like Kotak Mahindra, Hdfc Bank, and even Canfin Homes (Housing Finance Company) have displayed their ability to say “No” and act in a countercyclical manner. Some common factor in the companies that have the capacity to reinvest and the capacity to suffer:

1)Culture of long term thinking

2)Doing things differently

3)Willingness to take short term impact on the Profit and Loss statement for the long term gain

4)Many of them have skin in the game i.e high promoter holding or someone at the top who understands the importance of allocating for the long term.

As investors going into the Year 2021, we need to have the capacity to suffer and the capacity to invest time in finding new opportunities or explore the current opportunities in depth. Happy New Year!

Sectoral analysis and newsletter are a part of the Soic intensive course. To know more : www.soic.in/course

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author does hold a tracking position in the company, his views can be biased.