Capital Returns : Understand the industry structure

Capital Returns : Understand the industry structure

“Over the long term, businesses are determined by cash flows, which are themselves primarily influenced by Competitive advantage of an industry”- Capital Account (1993-2002)

Every year, we have made it a ritual to read Capital Account (1993-2002) and Capital Returns (2002-2015), just to reinforce the central thought in our investing philosophy i.e. the industry structure and the business economics is the real driver of returns and profitability. Earlier, we often used to ponder over questions like:

Why are some industries cyclical?

Why do some businesses grow structurally and defy capitalism?

What makes the economics of a business volatile, thereby leading to volatility in long term returns?

Why do business cycles matter?

Capital returns and its predecessor Capital account are two books which explain the importance of analyzing industry structures and changing environment in a very simple and lucid manner with numerous case studies from the experience of Marathon Asset Management. To understand the central theme of the book, let’s first read about Rahul and the story of his business:

Rahul opened his first business of selling Apparels at Kirti Nagar in New Delhi. Business was good and his merchandise used to fly off the shelves as he had the only Apparel shop in Kirti Nagar Area, which is home to the furniture market in Delhi. In the first year of the business, he invested capital worth Rs1,00,000 and made profits of Rs80,000. Thereby, his Returns on invested capital were close to 80% (80,000/1,00,000). Here is where things get interesting since we live in a capitalist society with free-market competition as the central tenet of capitalism. Seeing the Returns being made by Rahul, 20 other people set up their Apparel shop in Kirti Nagar.

(Before I proceed further with the story, I want you to keep thinking about what happens to the finite pool of profit when the competition on the supply side increases)

Now, due to the excess capacity which has come into place, the small apparel market of Kirti Nagar isn’t able to absorb excess supply as the demand for apparel is limited. Thus, some of the inefficient players in the industry go into losses. Moreover, even the Returns on invested Capital for the efficient players like Rahul have dropped from 80% to a meager 12-13% as the pricing war unleashed by competitors has led to erosion in the margins. Hypothetically, we come to the final stage where returns become so pathetic that the players who were making losses and poor returns on capital end up exiting the market. From 20 players, the players in the market have reduced to 4, which are the most efficient ones and they have survived by keeping their costs low and doing things better than the other businesses. Eventually, due to the reduced competition, the surviving players start making better returns on capital than they were making before.

Rahul’s story and changing nature of the supply side is the central idea in both the books: Capital Cycles. Let’s see how the capital cycle plays out in businesses:

Capital Cycle plays out in most of the industries as we live in an Economic system which encourages free-market competition and most of the businesses do not have any sustainable barriers to entry which can allow them to keep making returns on capital which are in excess of their cost of capital over long periods of time. The Capital cycle approach has had a profound impact on our thinking while analyzing industries and businesses. Here are the four key takeaways from Capital Returns and Capital Cycles which can be applied in the Indian context:

1) Lesson 1: Understanding How the supply side evolves over a period of time and the role it plays in determining both industry and individual return on capital

Most investors spend the bulk of their time trying to forecast the demand for the companies that they follow rather than focusing on the supply side. For instance: the Indian Aviation industry will grow by x percentage in the next 10 years, another one which I remember from one the recently cyclical upturns in the Auto industry, is that the Auto Penetration in India stands at 21 per thousand people vs China, where auto penetration is at 160 per thousand people. An auto analyst would try to forecast the long term demand of the Auto-industry in India. The true picture is that no one knows the answers to these questions.It is important to remember that *Long term demand projections are likely to result in forecasting errors*. As we have witnessed in the recent Auto downturn. Most of the time in cyclical sectors such as Auto’s, at the peak the narrative would be that India is an under-penetrated market for Auto. At the bottom of the cycle, the narrative would be that people are preferring Taxi aggregators over auto ownership, etc. The narrative often changes at the peak/bottom of the cycle.

Another example is that of the fibre cable industry boom in the USA in the 1990s. Following is a para from Capital Account which just shows us how much the demand increased in relation to the supply at the peak of the boom:

“In February 1999 Marathon observed that the capacity of the US telecoms networks was set to rise a hundredfold between 1997 and 2000: ‘Given the high fixed costs and undifferentiated nature of the product, it is hard to see how wholesale and retail prices can be maintained as new capacity comes on stream.’* Some six months later, they returned to the theme: ‘It is Marathon’s belief that the current over-investment in the telecoms industry is setting the scene for a monstrous shake-out in the not too distant future

Just consider this, that at the end of the boom by 2002, it was commonly reported that less than 5 percent of US telecoms capacity was in use. Thousands of miles of expensive fiber-optic networks remained ‘unlit’ beneath the ground. Some fifteen continental-wide telecoms networks, each providing a largely undifferentiated service, struggled for existence. Wholesale telecoms prices fell by more than 70 percent a year in 2001 and 2002. Some of the firms who were indulging in mammoth capex were expecting all the excess capacity to get absorbed by the demand growth in the market. This wasn’t the case, as the growth in supply exceeded the growth in demand, thereby inevitably leading to excess supply.

The key takeaway is that a capital cycle analysis always focuses on the supply side rather than the demand. Supply prospects are far less certain than the demand, and thus easier to forecast. As demand forecasts are often influenced by the euphoria/sentiments in the sector.

2)Lesson 2:Acquiring stock in companies which defy mean reversion

“The Higher Rate of compounding comes at a lower level of risk as the economics of a high return business tend to be more resilient to adverse shocks”

Ideally in a capitalist society what usually happens is that whenever someone is earning excess returns, competition comes in and eats away the returns on capital being made by the incumbent. However, there are a couple of businesses that have built Himalayan barriers to entry. These rare breeds of businesses keep earning High Returns on invested capital, and there is an even rarer breed that can redeploy incremental capital at high rates of return (These are the businesses we look for at SOIC aka Reinvestment Moats). These businesses typically defy mean reversion of margins, Return on equity, and Return on capital employed which most of the businesses face in a free market economy. Companies with strong competitive advantages, possessing what Buffett calls a “moat” are the ones which defy mean reversion. From a capital cycle perspective, it can be observed that a lack of competition prevents the supply side from shifting in response to higher profitability. Some sources of moats are:

Few Indian examples with very high barriers to entry are:

A) Some of the specialty companies earn very high returns on invested capital due to niche chemicals that they manufacture. One such company is CRODA (Listed in UK), in one of the products they manufacture they make extremely high margins. This is what was mentioned:

“Once(Croda) described to us how they made a 90% margin on a particular active ingredient for an anti-aging cosmetic.Given the success of the product (Matrixyl), they now regret not negotiating a royalty fee since the price charged represented less than one percent of the total sales price”.

One Indian Specialty chemical company that comes to mind is Vinati Organics. Vinati Organics manufactures ATBS, which is again a niche chemical that is used to enhance oil recovery, in construction chemicals, in adhesives and construction chemicals, etc. ATBS formed nearly 57% of sales of Vinati in 2020, and its product level ROCE and OPM’s are likely to be more than 40%. Apart from this, it is the lowest-cost producer of ATBS in the world and the largest manufacturer at the same time. Lubrizol which was one the key competitors of Vinati organics before they exited the market, was selling ATBS at $8 Per Kg, whereas, Vinati was selling it at $3 Per Kg. Even some of the complex API manufacturers make obscene margins as the supply side in such API’s is extremely constrained or these companies (think Divis) have found ways of manufacturing that makes them the lowest cost manufacturer in the world.

B) “While the history of the semiconductor business provides a classic example of the capital cycle, there are companies operating in niches of the industry which have delivered excellent long-term returns for shareholders”. Unlike the semiconductor industry which has experienced various cycles of booms and busts, there are Analog Semiconductor Players who only constitute 15% of the market. Analog Semiconductors condition and regulate “real world” functions such as temperature, speed, sound, and electrical current, whereas the Digital semiconductors process binary information, which are used by the computers. End-users of such include automobiles (sensor in an airbag) and the industrial economy (temperature sensor in process automation equipment). Companies operating in the sector like Analog devices and Linear technologies make more than 50% operating margins arising due to three key factors: sticky product, critical application, and the supply side is constrained (most of the new science graduates pursue the engineering of digital semiconductor). Moreover, analog products have a much wider and diverse market than digital, with a much wider range of products, numbering in thousands, and smaller average volume size.

In the Indian context, parallels can be drawn with Garware Technical Fibres. Which also manufactures products that have a very critical application. For instance: In deep-sea fishing, the quality of the net is of utmost importance. As the cost for one trip is somewhere close to $1million (7.2 crores) and the net constitutes only 5-8% of the cost. Just imagine if the net, which is one of the most critical elements in fishing fails. The cost of failure would be massive for the fishing company owners. Moreover, Garware manufactures more than 20,000 products, thus handling a lot of SKU’s becomes a challenge.

All these little advantages combined allow Garware Technical Fibres to make returns on capital of more than 20%.

C) When the customer is not involved directly in the purchasing decision, then higher prices can be used to bribe the purchaser’s agent and can result in both Higher Profit Margins and Sales Volume. One such business which is talked about is “Geberit”, the Swiss Sanitary Manufacturer.The company sells its products to plumbers via wholesalers who then install them in the end customers’ home or commercial building. Geberit has a push-pull marketing strategy, which has allowed it to make operating margins of more than 24% on a consistent basis.

Some other companies which capture the Agent to improve their competitive standing:

3) Lesson 3: Problems that can arise with family-led businesses

“Family control can cause problems for outside shareholders, but it can also provide an elegant solution to the agency problem”

Skin in the game is a very effective mental model to use while analyzing companies. Basically, looking for companies that have high promoter holding (Mind you, high promoter holding should not be the only criterion). Much has been said about professional ownership vs Private ownership. In Capital returns, a list of common family deficiencies that undermine the company’s success is given. We will apply that list in the Indian context:

1) Lack of Family Unity:

Family’s internal issues can lead to long-lasting damage for both the shareholders and the business. For instance: Italy’s Gucci Family was too busy fighting which led to a severe loss of market share in the fashion business. Similarly in the Indian context, two companies come to mind while discussing the lack of family unity. First is Reliance and the second is Mayur Uniquoters. In the first, the feud started after the death of Dhirubhai Ambani in 2002. His death led to a feud between the two brothers (Anil and Mukhesh) as he hadn’t left a will. Finally, peace was brokered by their mother and a demerger happened in 2005, which gave Mukesh control of oil and gas, petrochemicals, refining, and manufacturing while Anil took reign over electricity, telecoms, and financial services. However, in the entire episode shareholders and capital markets were taken for a ride due to uncertainty.

In the second case of Mayur Uniquoters (remains a very strong business), a dispute arose between Suresh Poddar and his son Manav Poddar regarding how the company should be run. Mr Suresh Poddar is in his 70s, and his only son (who still holds 15% stake) is not a part of the day to day business operations. However, in the recent concall (Q1FY21), Mr Suresh Poddar has indicated of professionalizing the board by hiring a COO and son in law is a part of the board.

Lack of family unity can lead to mistrust and uncertainty in the mind of the shareholders.

2)Loss of Business acumen:

The “Buddebrooks effect”, named after Thomas Mann’s novel of the name, describes how family businesses deteriorate over time as later generations become more interested in the trappings of wealth. For instance: the decline of US beauty company Estee lauder due to uninterested promoters of the business. In the Indian context, this reminds me of a business by the name of Indag Rubber which is in the business of pre-cured tread rubber, un-vulcanized rubber strip gum, universal spray cement, and tyre envelopes. Thei business in its heydays used to make Returns on capital that were more than 30% consistently, However, all this changed with the slowdown in the core business and the acquisition of companies in the Solar Energy sector. Which indicated capital misallocation from the management and all these companies were loss-making in nature. The stock has subsequently de-rated and Returns on capital have fallen drastically to single-digit levels.

3) Self Dealing:

Agency discount gets embedded into the multiple of family-owned businesses who pay scant regard to the principles of corporate governance, and these companies trade at a lower multiple. For instance: in the Amines industry, both Balaji Amines and Alkyl Amines are very credible players and operate in a segment which has economics to die for(duopoly, tight margin bands, consistent ROCE, annuity businesses).

However, Balaji has always traded at a multiple lower than that of Alkyl Amines. What is the reason?

The reason lies in agency costs arising in Balaji Amines due to de-worsification in other segments like CFL and the hotel business. I often wonder why would someone put capital in a business which barely makes single digit ROCE, when you already have a business which is inherently a duopoly with return on capital to die for (above 20% consistently).

Apart from these two businesses, be cautious of businesses that indulge in a lot of Related Party Transaction. It is very difficult to find out whether these have actually been done on “Arm's length basis or not”.

4)Poor Succession Planning:

Family-controlled businesses must be prepared to hand over the reins to the next generation. Poor succession planning can derail the company. For instance: Cupid ltd has been run very efficiently by Mr Om Prakash Garg. However, he is nearly 76 years old and no plan for succession has been laid out by the management. Poor succession planning does affect the longevity of the business. Another business where we think that succession planning has happened in a very prudent way is Deepak Nitrite. Where Maulik Mehta (son of Deepak C Mehta) has been elevated to the post of CEO recently. He has been working in the company for the past couple of years, just shows efficient and prudent planning by the management to groom the leaders of tomorrow of the company.

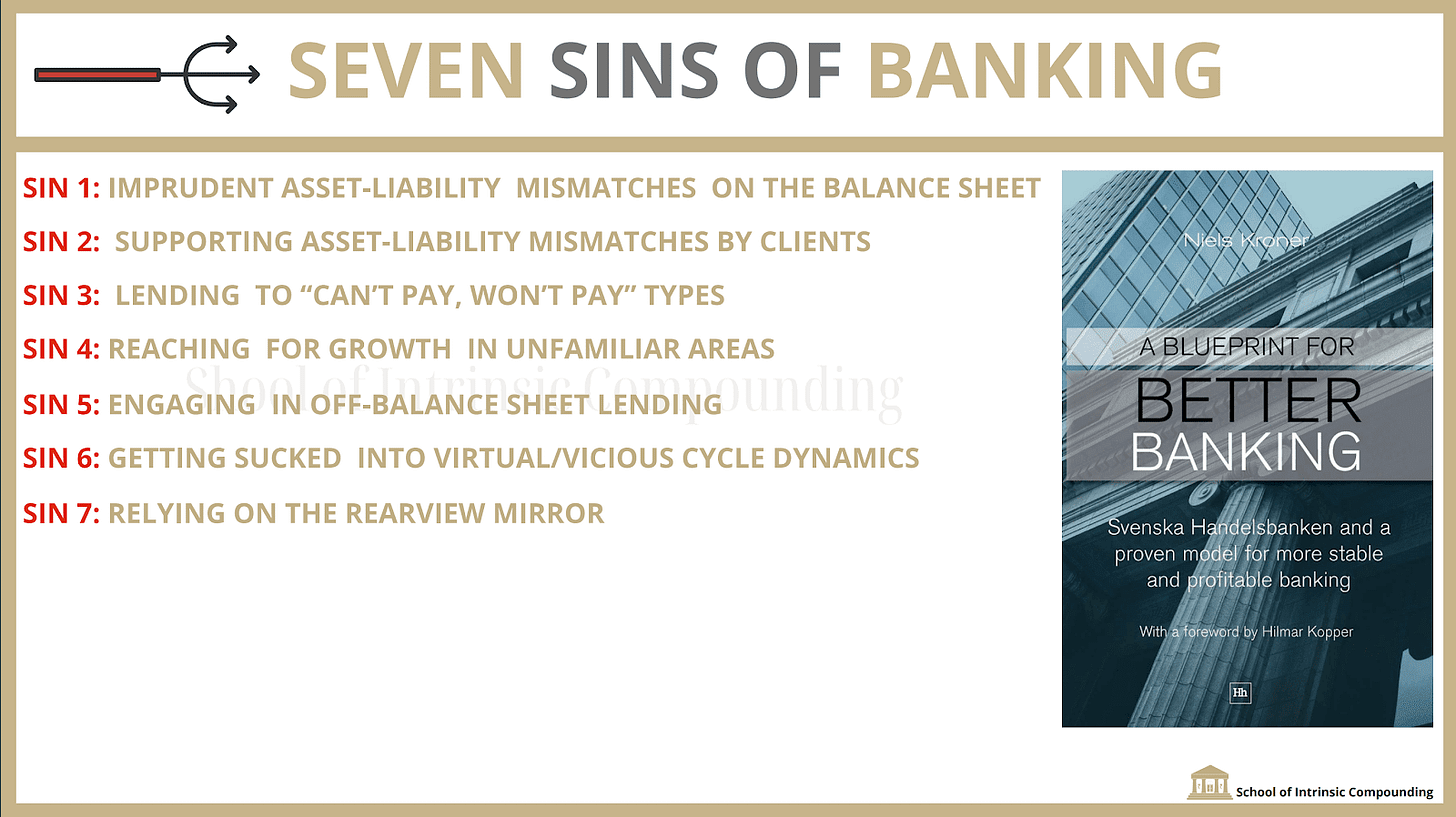

4) Lesson 4: Seven Sins of Banking: the author talks about the 7 sins of banking which are as follows.

Imprudent Asset-Liability Mismatches on the Balance Sheet: Many banks and financial institutions have gone bust by borrowing short and lending long. In simple words, suppose you are borrowing for a period of 1 year and giving out a loan to a friend for buying a house for 20 years. Now, when the person who has given you money comes and asks for it at the end of the first year, and since there is excess liquidity in the markets. You simply ask him to roll over the loan, and you promise to pay him next year. Next year the same thing happens as liquidity is still abundant and he agrees to roll over the loan to next year. However, in the third year, there has been a widespread financial crisis and there is a liquidity crunch in the market. Now, the lender (from whom you have borrowed money or Nbfcs borrowed money from :P) doesn’t agree to roll it over. What course of action are you left with?

Some will start shrinking the balance sheet and some others might go bust, as the perception of stability has vanished in an environment of crisis. Since these lenders have given out loans for long and borrowed on a short-term basis.

The root cause of the 2017 NBFC crisis is the dependence of NBFC’s on short term wholesale funding (we will discuss all the cycles that have happened in Banking and financials someday). This exacerbated the rollover risk, essentially the person that you have borrowed from for 1 year will extend your loan.

Supporting asset-liability mismatches by clients: The classic example here is foreign currency lending to households in Central European countries. Not long ago, European banks were providing low-interest euro and Swiss franc mortgages to Hungarian and Latvian consumers. It was unlikely these customers understood the foreign exchange risk they were running.

Lending to can’t pay, won’t pay types: “In company research meeting over the years, Handelsbanken told us that the banking industry had become obsessed with earning a few extra basis points of spreads each quarter,while losing sight of credit risk, namely the chance that borrowers might never be in a position to repay the principal”.

This reminds me of what Indusind Bank did when it provided a bridge loan till IL&FS could complete its rights issue. Indusind bank lent close to 3000 crores to a company that was insolvent since 2014. What was the reason behind providing a bridge loan? The simple answer is to earn a few extra basis points in fee income. This is what lending to can’ pay, won’t pay types looks like. The bank nearly bet 8% of its networth in an unsecured loan to an insolvent company. When the going is good everything is forgiven in banking, however if the environment takes turn for the worst, it doesn’t take much time for the High Price/book valuations to turn into Low Price/book and pessimism being all around the lender. Like what has happened in Indusind Banks case.

Reaching for growth in unfamiliar areas: “A number of European Banks have lost billions investing in US subprime CDO’s, having foolishly relied on experts who told them these were riskless AAA rated credits. In Scandinavia, many banks pursued growth in Baltic states and have suffered as GDP in the region has contracted by 15-20% this year”. A number of Indian Banks have been guilty of reaching for growth in Unfamiliar areas. For instance: Indusind bank’s acquisition of Bharat Financial which is into Microfinance. Indusind Bank which is predominantly a CV financier and a corporate financier diversifying into Microfinance, just doesn’t make sense to us. Another company which is the darling of many investors today is Manappuram finance, their gold loan business is their bread and butter. However, the other areas in which it has di-worsified like microfinance, commercial vehicle, MSME loans and affordable housing finance will cause trouble in a downcycle. This is one of the reasons behind the valuation gap between Muthoot (largely stuck to gold finance) and Manappuram finance (large part of the book is unseasoned with high NPA’s)

Engaging in Off the Balance Sheet Lending: “Handelsbanken approach is to accept only risks which it is prepared to hold on its balance sheet until maturity and not to lend money to those that are in the business of lending money themselves”. Important to look at contingent liability as a % of net worth and to check the exposure of banks to other lenders.

Getting sucked into virtuous/vicious cycle dynamics: many banks these days are claiming to be retail oriented. Whereas, what is HDFC bank doing at the moment? It has accelerated the loan growth to corporates. Hdfc has time and time again displayed this anti-cyclical behaviour. Defying what others are doing.

Relying on rearview mirror: Lending is one business where the batsmen has to keep focusing on each every ball as 5 balls out of 6 would be Yorkers and only one would be a full toss. Uday Kotak and the management at Kotak Bank have displayed remarkable consistency in identifying several such Yorkers and avoiding them way before anyone else. (One suggestion: concalls are a delight to read, they have identified problems emerging in one particular section 2-3 years ahead in time)

Thus, these are the 4 key learnings from the book in the Indian context, Capital Returns and Capital Cycles:

A)Understanding How the supply side evolves over a period of time and the role it plays in determining both industry and individual return on capital

B)Acquiring stock in companies which defy mean reversion

C)Problems that can arise with family-led businesses

D)Seven sins of Banking

These are the 4 key lessons of Capital returns in Indian context. Dear reader, do let us know which book should we review next in the Indian context in the comment section below 😁

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author does hold a tracking position in the company, his views can be biased.