Welcome to Investors’ Edge— your daily dose of business insights, trends, and updates that matter. In this space, we go beyond the headlines to explore the evolving world of companies and industries. Each day, we bring you thoughtfully curated insights, sharp observations, and key developments shaping the business landscape.

Whether it's a strategic pivot by a market leader or an under-the-radar company making waves, we break it down for you — clearly, concisely, and consistently.

Today we bring you great insights from multiple concalls for Q4FY25

1. JM Financial

Strategic Pivot and Loan Book Reduction (FY25 being the reset year):

"In line with earlier guidance and a shift to an off balance sheet model, the loan book across wholesale real estate including land funding and financial institution financing and MSME has run down from approximately 7,500 crores as of March 31st 2024 to 3,570 crores as of March 31st 2025.This is a significant reduction that we have achieved and with minimal impact on balance sheet."

- Vishal Kampani, MD

New Focus for the company to be Private markets:

“Our focus will now be on the big opportunities in the private markets business comprising of private credit across corporate spoken real estate with a focus on origination to syndication and also private investments on the equity side through a private equity fund on growth focused funds and investments in REIT… Management aims for a private markets book of around 10,000 crores within 3 years, funded with a 1:1 net debt to equity ratio, with syndication over and above this balance sheet size. They expect to syndicate at least 1 to 1.5 times what is on the balance sheet.”

- Vishal Kampani, MD

Why did the management cut down on wholesale lending:

"there are a lot of changes in regulation which came from RBI... some of them increasing provisions and some of them sort of raising a question mark on what kind of financing is possible through an NBSC structure"... “the recoveries from many of these segments take much longer compared to what we had estimated earlier and that digs into ROA that really reduces RO ROA by almost 100 to 150 basis points”

- Vishal Kampani, MD

ROE trajectory to be upwards from here on:

"we are budgeting that we will be at roughly 11 and a half to 12% in FY28 and roughly 14% by FY30."

- Vishal Kampani, MD

2.Larsen and Tubro

Gas to Power is emerging to be a big opportunity:

“I come to green and clean energy. Here again, multiple opportunities are emerging in the Gas to Power sector, particularly in the international markets. Given the size and complexity of these projects, a dedicated focus is essential in this area as well.”

- P. Ramakrishnan, Executive Vice President

“The Green and Clean Energy portfolio, the prospects for FY26 is at Rs 0.70 trillion as compared to Rs 0.10 trillion last year. This is primarily due to the addition of several Gas to Power related opportunities outside of India.”

- P. Ramakrishnan, Executive Vice President

“And there's a lot of positivity around that, in terms of Renewable, Batteries, including Power Transmission. As you add more-and-more renewables, the power transmission infrastructure has to change, as the Saudi is also moving from, liquid fuels to gas fuels, so they are also adding a lot of power plants i.e. Gas to Power plants and then they also need to add the required infrastructure. So I think these two businesses, there is absolutely no change in the sentiment. In terms of hydrocarbon, again, I'll split it between oil and gas. Gas is absolutely going very strong and that will continue to be strong. Oil maybe you will have to see. maybe if the oil prices come down drastically. I think at the current levels it’s an aberration. I think if the oil prices remain between USD 55-65 range, I don't expect any major slowdown because a good amount of capital also goes in maintaining potential, and gas will continue to go full blast.”

- Subramanian Sarma, Deputy Managing Director & President

India and Middle East are showing strong resilience amidst "Ambiguous World Order”

“We are currently navigating an extremely complex and uncertain macroeconomic landscape. In our view, there are seismic shifts underway which is leading to an “Ambiguous World Order”. The continuing trade and military conflicts are clearly leading to a corrosion of globalization, disruption in supply chain, and culminating into higher financial market volatility. Amidst all this chaos, we are pleased to inform you that both our primary geographies for the Projects and Manufacturing businesses, that India and Middle East are demonstrating surprising resilience in terms of continued capex spends.”

- P. Ramakrishnan, Executive Vice President

3.Cartrade

OLX India Turnaround Story:

“OLX has consistently grown quarter after quarter with a strong 72% growth in profits in Q4... and has now achieved its highest profitability in history after years of losses."

- Vinay Sanghi, CMD

Auto Industry Growth Not a Constraint:

"Despite auto industry growing 0–5%, we’re optimistic because of our increasing role in the consumer journey. New vehicle launches always help platform traffic and ad spends."

- Vinay Sanghi, CMD

Strong Confidence in Future Growth Despite Industry Headwinds:

“We think the current year has been a landmark year... and we feel very enthusiastic and optimistic about the prospects of the company in the coming years.”

“We are making a lot of investments in product and technology — AI and other tools — across CarWale, BikeWale, and OLX. A lot of these will help us in the coming years.”

- Vinay Sanghi, CMD

4.Sonata Software

Second largest deal wins in the 40 years history of company:

“Win number one, which is a very large deal and a material deal for Sonata to go forward. Our client is a leading American TMT company, which delivers programs for its clients on a technology platform. Sonata has been selected as a strategic technology partner to lead a comprehensive modernization program across their platforms, data services, platform transformation, Workday, Salesforce, and cybersecurity. This marks the second-largest TCP win in Sonata's 40-year history. Let me repeat, this marks the second-largest TCP win in Sonata's 40-year history, a proud milestone for all of us Sonatians.”

- Sami Dhir, CEO

Making the Work force AI ready:

“Today, 97% of our workforce is trained in Gen AI, underscoring our commitment to future-ready skills and broad applicability of AI across our delivery, engineering, and consulting operations.”

- Samir Dhir, CEO

Pace of growth slowed down because of budget cuts by the largest customer:

“We made progress despite facing headwinds in retail and manufacturing verticals, budget cuts in the second half of the year from our largest client, and broader macroeconomic uncertainty. While we didn't grow at the pace of the prior two years, we have built a strong foundation for growth.”

- Samir Dhir, CEO

5.GE shipping

Red Sea crisis last FY has resulted in good earnings but that is now done with:

"Q4 of the previous FY was when we just started having the Red Sea problem, where the Houthis were attacking ships passing by the Bab El-Mandeb. Therefore, ships were rerouted around Africa, significantly tightening the tanker market. That effect has now played out, and markets were quite weak subsequently."- G. Shivakumar, Executive Director & CFO

Impact of US-China Trade wars:

“So, you may have seen the recent announcement which just happened today declaring the lowering of these tariffs. Of course, it’s for a 90-day period, and we don’t know whether those rates will again change in the future. And as the tariff rate change, the way trading patterns in general will get affected and which commodities get covered in these tariffs will change. But just to have a very broad view because you mentioned crude, you mentioned oil and dry bulk. So, what we have seen is 2 things you have to keep in mind. You have to keep in mind the tariff rates between the 2 countries on the commodity in question. So, oil has been largely exempted from this tariff. China imposed a tariff previously on crude exports from U.S. to China. But the amount of trade that happens between these 2 countries on crude is very minimal. And that’s why China could very easily find alternate buyers for that crude. China would be able to buy from other countries, and U.S. would also find alternate places to sell that. So, there is close to minimal to 0 impact on crude. On product trade, there is barely any product trade, if any. So, that did not get affected by the tariffs. On dry bulk also the volume between the 2 countries is very minimal. The major commodity that gets affected is soybean. We had seen that in Trump’s first term. And basically, what happened was to just oversimplify, U.S.’ exports of soybean to China basically went more to Europe. And Brazil, Argentina, which sends a certain amount to Europe, sent it to China. So, you had a realignment of the trade. And basically, the 2 countries were able to more or less evade the imposition of these tariffs. Now of course, today, we just saw the announcement before the meeting that the tariff rates have changed. And so this impact may not be there”

- Rahul Sheth, Addl. Director (Non Executive)

6.Radico Khaitan

FTA Advantage:

Radico as, Mr. Abhishek Khaitan mentioned a little while ago, that we plan to import Blended Malt Scotch to the extent of INR 250 crores in FY26 for blending with our products, and that reduction, which is likely to happen, will give us substantial cost advantages and a marginuptake. So, hence, it is a net positive for Radico.”-Mr. Amar Sinha,COO

Debt Reduction:

“So, as the debt is coming down now, we expect to be almost debt-free by FY27. For FY26, it will come down by around 35% to 40% and after that, we will be almost debt-free.”-Mr.Dilip Banthiya,CFOWorking Capital Improvement:

“The best thing that has happened in UP with the new excise policy is that you have got composite shops, which have come up which have expanded the universe of outlets by almost 40%.Another big advantage that has accrued to the industry is that in IMFL,the wholesalers are now paying the excise duty, which means that the industry is lowering its working capital requirement, which is a big plus. This also means that any established player like Radico will reap huge benefits because the traction for fast-moving brands will be much more, because wholesaler would like to take cash and rotate it faster. So, that's a very big plus which has happened.”

-Mr. Amar Sinha,COOCapex:

“See, about last 2 years back, we had put up our Sitapur unit, which is one of the largest in Asia. And with this, I think we are quite self- sufficient for the next 3 to 4 years.”-Mr.Abhishek Khaitan,MD

7.APL Apollo

World’s Largest downstream steel player outside of China:

"We crossed 3.1 million tons as sales volume for the full year, making APL Apollo the world's largest downstream steel player outside China. In terms of structural steel tubes, we would even be bigger than the largest Chinese steel pipe company."-Anubhav Gupta, Chief Strategy Officer

EBITDA Margins to turns back again to Rs. 5000/ ton:

"EBITDA spreads, depressed below ₹4,000 per ton in FY25 due to macroeconomic pressures, are expected to rebound near ₹5,000 per ton in FY26, driven by improved product mix, international market expansion, and operating leverage."

- Anubhav Gupta, Chief Strategy Officer

Aggressive ROCE targets:

"We closed FY25 with a ROCE of 25%, but our target for FY26 is around 35%, and within the next 2-3 years, we aim to achieve a ROCE exceeding 50%. Our strategic initiatives in cost management and premium positioning will drive this improvement."- Sanjay Gupta, Chairman & Managing Director

Structural Steel Tubes demand to double up in 5-6 years:

"The demand for structural steel tubes in India is expected to double from 9 million tons to 18 million tons over the next 5-6 years, driven by a shift from secondary routes (sponge iron) to primary route products (hot-rolled coil-based tubes), further benefiting our growth trajectory."- Sanjay Gupta, Chairman & Managing Director

8.Jash Engineering

Massive Growth Pipeline in India’s Water Infrastructure:

“We see a potential today of close to ₹1,500 crore worth of business... Today we are only doing ₹275 crore. If this ₹1,500 crore plus market potential comes into being, we can expect the growth in excess of 18% on the domestic market.”-Pratik Patel, CMD

Tariff impact to be minimal on the company:

“One of the key question troubling most of the people is the US tariff. We are given a circular to NSE in which we are clarified our position. However, I would like to take this occasion to reinforce what we have stated in our letter on NSE. Out of Rodney Hunt USD 34 million revenue, the purchases from India were only 31% so of those purchases, also only Rs.30-40 crore is subject to new US tariff. Now if the tariff of 25% stands, that will cost us Rs.8-10 crore. We are in talks with our client on how we can pass on. In some cases, we will be able to pass on, in many cases we will not be able to pass on.”-Pratik Patel, CMD

Human Capital is the True Bottleneck, Not Capex:

“The stress at Rodney Hunt Orange is not revenue, the stress... is people. We have not been able to get manufacturing people there.”... “However, Orange problem of getting people and so we have already planned for a new plant in Houston. This may happen in 2027 however, I am going there this month, and it is possible, based on the US business potential, we may expedite this and execute this plant in 2026 as well.”

-Pratik Patel, CMD

9.Manyavar

Transitioning from tough times:

“We are not trying to be defensive as a Company when we say that these were the reasons. I think there is certainly a need to do better in everything that we do. Times are tough, but we need to take hard measures to ensure that we are able to grow in the future.”- Vedant Modi, Chief Revenue Officer

Strategic Shift in Marketing – From Hero Campaigns to Micro Bursts:

“We are moving from one or two big campaigns to 12–13 mini-campaigns... we believe this will change the way modern marketing has been functioning.”

- Vedant Modi, Chief Revenue Officer

10.TD Power Systems

Market is on fire !

“One of the key commentary here by the management was that the “Market is on Fire” and customers are booking capacities 2-3 years out and and demand is nowhere is looking to stop for now. Main demand driver is capex related to AI and Data centre related capex.” …. “Also on the front of US tariffs because of strong demand OEMs are able to pass on any such impact to the end customer”-Mr.Nikhil Kumar,MD

11.PG Electroplast

Confidence in Growth Guidance Despite Industry Cautiousness:

“So basically you know as we told that we are serving 35 plus brands. So it is the market situation is always very dynamic. Sometimes some brands are doing well sometimes some brands on may not have their own you know their issues. So for us this business is looking very strong as of now also in spite of the fact that overall industry is facing certain inventory issues because of the rains early arrival of the rains but for us as a company we are not seeing major challenge as far as June quarter is concerned and going forward also we have a the guidance that we have given we are very confident that we'll be able to meet those guidance the only reason is because we are serving 35 plus grand So we are able to diversify the risk and diversify those issues with us you know that normally some customers face."

- Vishal Gupta, MD

Strategic Inventory Build-up Due to Compressor Uncertainty:

“So if you look at our cash flow this year uh basically we are carrying a very large amount of inventory and uh you know uh we have a uh we have close to about 1,300 cr of inventory closing inventory uh at the end of the quarter. U obviously some of it is going to get uh a significant part of it going to get shed in the April May June quarter because we have uh we we are not seeing a very uh any big challenge as of yet in the AC business. But uh one of the reasons also which we were carrying some of this inventory was because there was an uncertainty on account of uh compressor uh BIS uh uh related uncertainty because BIS was getting over for some of the Chinese players and we are uh we uh consciously kept higher inventory of compressor and we are carrying that yet.”

- Vishal Gupta, MD

12.Triveni Turbines

Order Book:

“Given our growth of orderbook, we are confident of order book growth in the coming year. Some of this growth will be lumpy but having said that, the order book gives good visibility of growth for the coming year and the enquiry book gives visibility for the future.” -Mr. Nikhil Sawhney, Vice Chairman & MD“API enquiry pipeline is quite robust and we are quite bullish. We are in the approved vendor list across the major refineries and complexes across the globe. We are quite bullish because we are there in the drive turbine as well as power application of the API machines with that it is going to be a strong growth driver for us.”-Mr. S.N. Prasad, CEO

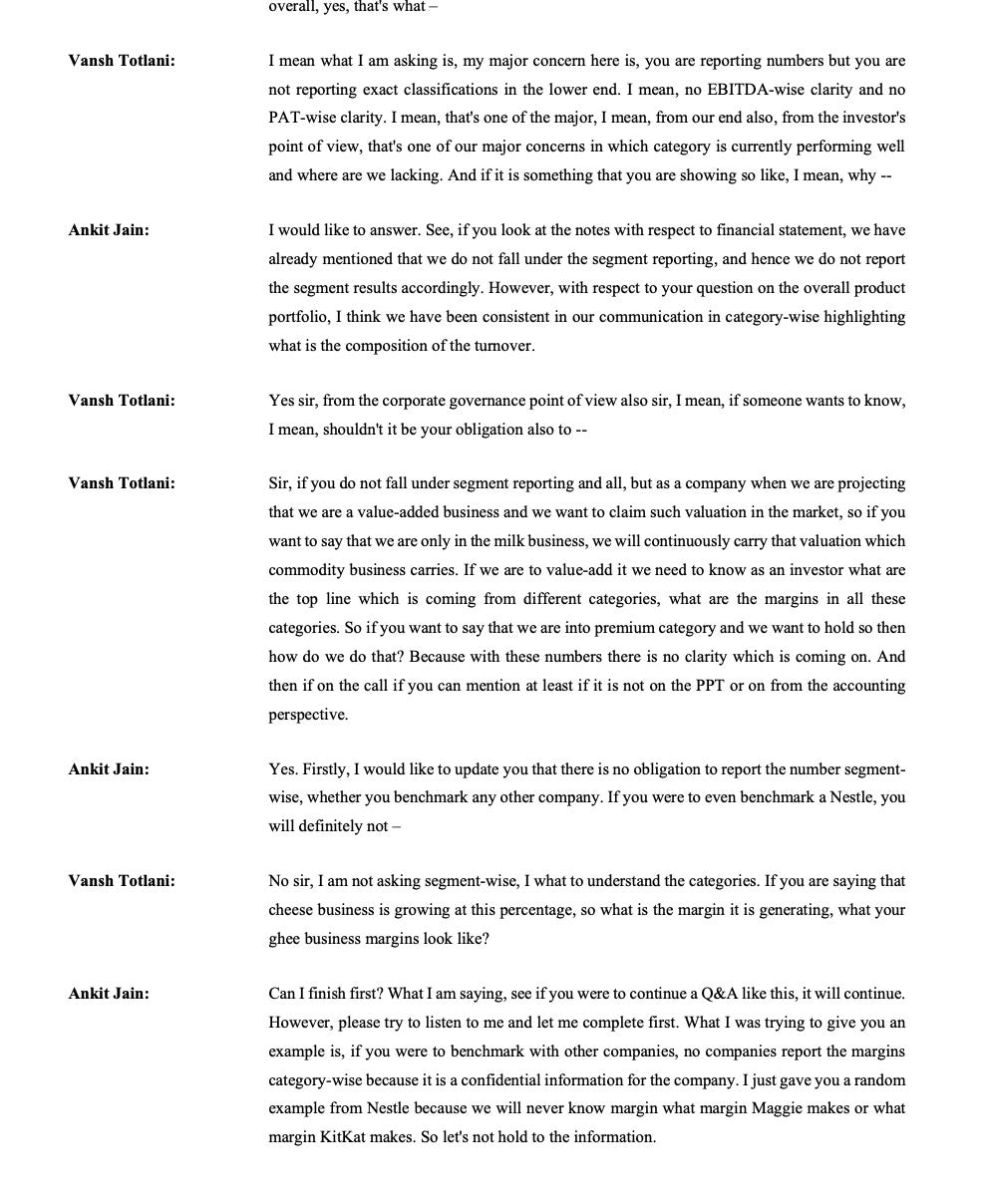

At last an interesting concall snippet to see how over the long term when the value in the business gets destroyed is highly correlated with the investors getting super frustrated ! (Parag milk foods)

SUPERB SIR THANKS

Thankyou soic for these insights :)