Welcome to Investors’ Edge—your daily dose of business insights, trends, and updates that matter. In this space, we go beyond the headlines to explore the evolving world of companies and industries. Each day, we bring you thoughtfully curated insights, sharp observations, and key developments shaping the business landscape. Whether it's a strategic pivot by a market leader or an under-the-radar company making waves, we break it down for you—clearly, concisely, and consistently.

Today is 20th May, and we bring you great insights from multiple concalls for Q4 FY25, along with an interesting look at an industry that leads in return ratios within the healthcare space…

Arvind Fashion

Strategic Focus on Return on Capital Employed

“The cornerstone of our strategy over the last few years has been to improve the return on capital employed we're delighted to report that AFL crossed the milestone of generating more than 20% return on capital employed this year and we hope to continue to improve upon this as we move ahead"...."The key highlight of FY 25 as Kulin just mentioned has been achievement of 20% mark on ROSI in the last 3 years AFL has moved from small negative ROCE now to more than 20% ROCE mark"

— Shailesh Chaturvedi, Managing Director & CEO

Hyundai Motor

FY25 was overall a challenging year

"...financially 2025 was a challenging and transformative year for the Indian automotive industry the overall environment remained tough with a combination of a macroeconomic uncertainties impacting consumer sentiments and the purchasing decision on top of that we were up against a high base from the previous years which further amplify the impact despite these headwind HMIL navigated the turbulence with agility with our quality of growth strategy solidifying its position further in India"

— Unsoo Kim, Managing DirectorGoing EV for next leg of growth

"we are excited to announce that we will be launching 26 products this will includes a mix of new models full model changes and the product enhancements by the end of financial year 2030 this will comprise 20 from ICE and six from EV segment additionally we shall be introducing new eco-friendly power train like hybrids"

— Unsoo Kim, Managing Director

Eureka Forbes

Clear Business Transformation Progress

The management views the last two years as a significant transformation journey, moving from changing the long-term trajectory in FY24 to achieving a "step jump" in all performance parameters in FY25, with confidence in further improvement in FY26.

Category Growth as a Key Enabler

The overall category growth in which the company operates has decisively inflected, now in mid to high teens, enabled by the company's own actions, increased category visibility, and greater consumer recognition of health and hygiene.

Vacuum Cleaners, Especially Robotics, Show Significant Growth Potential

The perception of vacuum cleaners in India is changing, similar to the historical growth of washing machines. Convenient cleaning segments like handheld, cordless, and particularly robotics, are seeing strong acceptance and adoption. Robotics is viewed as a breakout segment driving category growth, with market leadership and high growth rates expected to continue, playing to the company's offline strengths as adoption spreads beyond e-commerce.

PB Fintech

Challenges in the Savings Business

"I think our savings business at this point is very challenging. We are struggling to grow and we're thinking very hard about that". They noted a "sharp slowdown" in the industry, particularly in February and March, which reflected in their Q4 performance. They anticipate the first two quarters of the new financial year will also be "quite slow on savings"

Unexpected Strength of the Health Business

"And the health business has surprisingly continued to grow. By now, I would have expected it to slow down a little bit, but now it's been nine quarters and it's been growing very very strongly". The growth rate in health for new business acquisition is significantly higher than their general expectation for industry growth. "

AI Strategy: 'Man in the Middle' and Brand Importance

They are leveraging AI for tasks like collections and initial customer warm-ups. However, they believe that for insurance sales, particularly in life and health, human interaction is crucial to explain complex products and ensure proper disclosure. Their approach is a "man in the middle" format, where AI enhances the productivity and effectiveness of the person. A philosophical point was made that "AI is commodity and basically consumer brands are going to be the differentiator because the human mind is still limited"

LT Foods

Home consumption goes up in recession times in America

“So, what we have seen in history, we have seen 2-3 times, we acquired this business in 2008 and there was a recession in 2009-10. But what we have seen in all the times, even in Covid time and all the time when the recession come, home consumption goes up in America, especially in the food side. So historically this has happened. We have not seen any negative on the consumption side.”

— Ashwani Kumar Arora

Company can get to 10,000cr of revenue and 13% of margins next year

“So, volume growth is roughly overall the consolidated we are expecting 7%. So, consol level, consolidated, that's the volume we are expecting. This year we are expecting a full year with the integration of the balance 49, we are expecting the revenue to be Rs. 10,000 crores.”... “Yes, we are targeting in the range of 13% EBITDA margin.”

— Ashwani Kumar Arora

VIP Industries

Strong channel-led balance-sheet repair

“Our debt during the year was reduced by Rs. 118 crore. We also got a favorable judgment in the high value indirect tax litigation. Contingent liability to the tune of Rs. 357 crore have been taken away, so contingent liability is no more existing now.We also got a favorable judgment in the high value indirect tax litigation. Contingent liability to the tune of Rs.357 crore have been taken away, so contingent liability is no more existing now.”

— Neetu Kashiramka

E-commerce driving double-digit growth

“E-commerce continued to be the fastest growing space for us at 40% both for the quarter as well as for full year. Focused approach for B2B partnership also resulted in a double-digit growth for this channel.”

— Neetu Kashiramka

Kaynes Technologies

Surging and Margin-Accretive Order Book

“A key indicator of future growth is the order book, which saw a substantial increase. The order book grew from 41,152 million in Q4 FY24 to 65,969 million in Q4 FY25. Sequentially, it grew from 60,471 million in Q3 FY25 to 65,969 million in Q4 FY25. The average monthly order inflow also increased handsomely. The management noted that the increase in the order book came from aerospace, industrial, and automotive segments, and these orders are margin accretive, containing margins higher than what they are currently delivering. The order book is expected to be executed over a 1.5-year timeframe”

Focus on High-Value, High-Tech Segments

“Growth is expected especially in EV and aerospace verticals. The order book increase is driven by aerospace, industrial (including smart meters), and automotive (with tier one global clients). The space tech venture, a strategic partner to ISRO, aims to be a premier vendor for parts in satellites, launch vehicles, etc., focusing on high-tech manufacturing which offers good margins and a high growth rate”

Increasing Export Orientation and China+1 Benefit

Over a 4-5 year timeframe, they target 20-25% minimum of their business coming from outside India, including both direct exports and business done within acquired geographies like Canada. They see a clear benefit from large OEMs seriously considering alternatives to China for new products, viewing India as a safer haven due to risks with providing new technology to Chinese vendors

Godawari Power and Ispat Limited

Next leg of growth

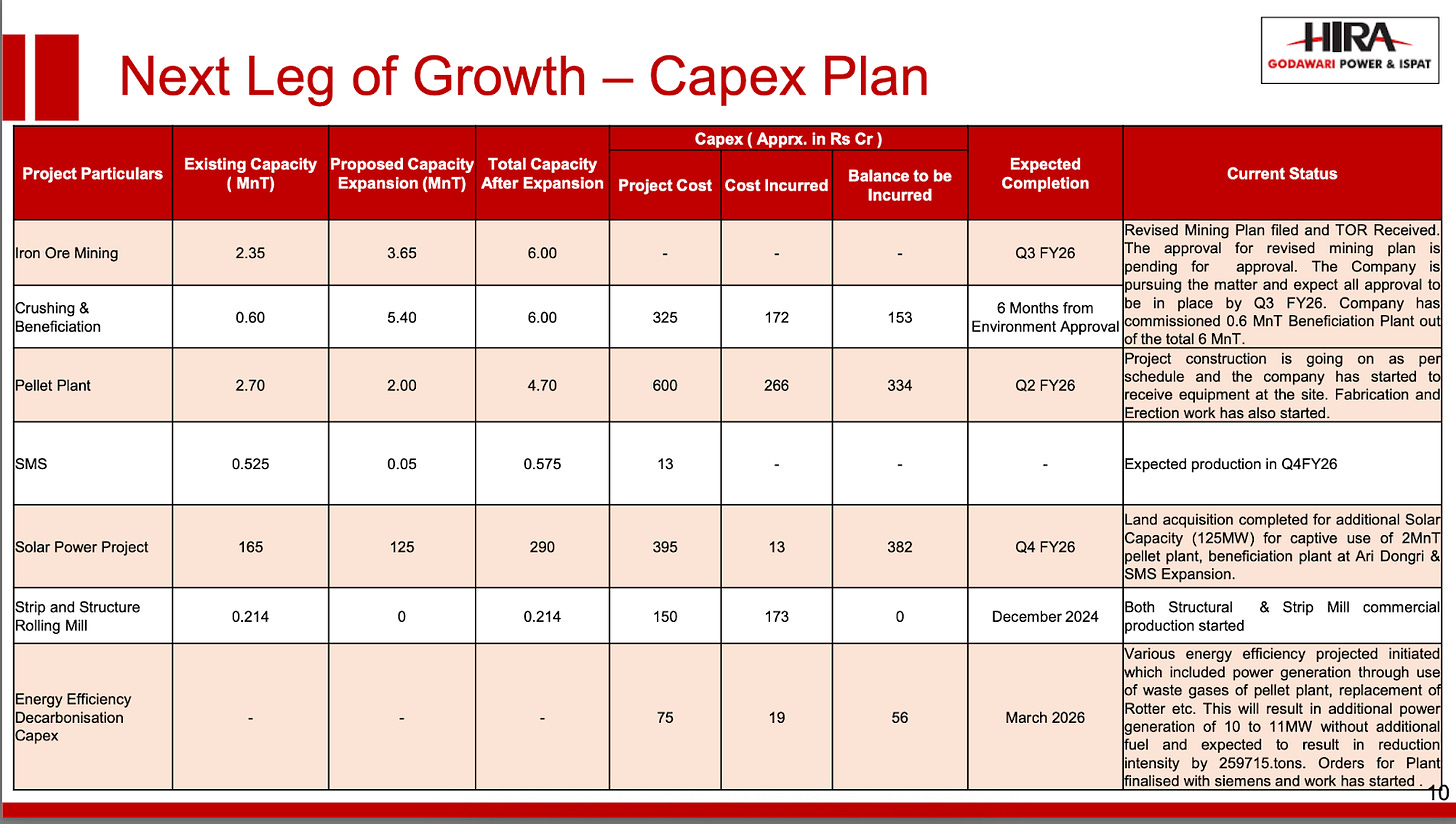

Key highlights include tripling mining output to 6 MnT, ramping up beneficiation and pellet capacity to 6 MnT and 4.7 MnT respectively, and adding a 0.575 MnT steel-melting shop, all slated for commissioning between Q2 and Q4 FY 26. A 290 MW solar park will power these assets, while a new rolling mill is already live and energy‐efficiency upgrades will recover 10–11 MW of wasted heat, cutting carbon intensity by over 250,000 tons annually

Diagnostics - “2nd Fastest growing segment under the healthcare space after CRO/CDMO”

Diagnostic earnings calls offer investors and observers a concise view of the industry's revenue, profits, R&D, products, regulations, trends, and management perspectives, crucial for understanding its current state and future —

Diagnostics in India: A High-Growth, Under-Penetrated Market

India’s USD 12 billion diagnostics sector is growing at a healthy mid- to high-teens pace, yet the organised players account for just ~15% of the market. With penetration still low outside major metros, Tier-2 to Tier-4 towns are poised to drive the next wave of volume growth as collection centres and labs proliferate in “Bharat.”

Consolidation & Competition

As more organised chains enter, competition intensifies—both among large players jockeying for scale and versus unorganised local labs in smaller towns. While talent poaching and pricing pressure can spike in metros, many regional markets remain dominated by mom-and-pop outfits, leaving room for strong brands to standardise quality and capture share.

Strategic Models: PPP, B2B & B2C

Several players are differentiating through unique models:

PPP partnerships (e.g., Krsnaa Diagnostics) win large-scale, free-testing government tenders and embed deep in non-urban health infrastructure.

B2C pushes (e.g., Metropolis, Vijaya) focus on branded patient engagement under one-stop pathology+radiology centres, exiting low-margin institutional contracts.

Pure B2B specialists (e.g., Thyrocare) remain the platform of choice for smaller labs, clinics, and online health apps.

Specialisation, Technology & Quality

Advanced testing (genomics, reproductive and autoimmune panels) is fast becoming a high-margin growth driver as awareness among doctors and patients climbs. Meanwhile, digital tools—AI‐assisted imaging, mobile apps and recommendation engines—are streamlining operations and reporting, but not replacing human expertise. Accreditation (NABL/NABH) continues to be a critical trust signal that supports both pricing and PPP-tender wins.

Pricing, Margins & Working Capital

Though base test prices in non-metros remain broadly comparable, the retail and specialised-test mix lifts revenue per patient. Wellness packages boost volumes but can compress gross margins when heavily discounted; overall EBITDA expands, however, through scale and efficiency. On the downside, government receivables (60–150+ days) can strain cash flows, with working-capital relief expected only as state payments normalise.

Here are the key insights from diagnostics players in India -

Krsnaa Diagnostics

We are different from others !

"We are not built like traditional diagnostic players, while others focus on dense urban markets, retail-led models and premium price points, Krsnaa is fundamentally different. We are a deep penetration public-private healthcare infrastructure partner and purpose-built to serve"

— Yash Mutha, MDHimachal and Karnataka has high receivables

"So I may be misinterpreted this . So our outstanding with Himachal Pradesh and Karnataka in the range of INR140 crores to INR150 crores."

— Pawan Daga, CFO

Aims to move from B2G to B2C

"Yes. So B2C will always be at the forefront when it's going to be the revenue mix in the overall retail space. And it's always the r aspirations to be somewhere near to 70-30 B2C, B2B mix

— Yash Mutha, MD

Vijaya Diagnostics

Entering new geography

"We have ventured into Bengaluru market with the launch of operations at both our hub centers in April. Given the strong potential of the market, we're actively looking at a few more strategic locations for our hub expansion to strengthen our presence in this region."

Q4 margins have been soft because of higher mix of wellness packages

"Anshul, actually it is because of wellness because I think wellness has contributed 15% of our revenue. And generally, wellness -whenever wellness grows, you see some contraction in gross margin, right, because this wellness is at a discounted price. So that's one of the primary reasons."

And still the margins can be soft as new facilities commercialises

"So, like we said before, Anshul, so first 2 to 3 quarters till the time these centers breakeven and like we also said, there are three more hubs that are going to come in Kolkata in 4 to 5 months' time and then two in Andhra and Telangana, we should see some dip to the extent of 1% to 2% on the EBITDA front." …. "So basically, if you see Pune, right, 95% of the revenue comes from six centers, three hubs and three spokes, right? And all of a sudden, we've added two hubs and two spokes. That means we have increased the capacity almost close by 70%, 75%, right? So obviously, initial days, the cost will kick in, but the revenue will take some time, right?"

Thyrocare

Focus on affordability would not shift

"First, I will reiterate our value proposition to the customer. We will continue to remain an affordable option to all patients with good quality and on-time reports."

— Rahul Guha, MD and CEO

What drove the margins up for the company

"So if I draw a bridge from the 25% odd to 35% or the 10% EBITDA improvement, 4% is from gross margin, largely because of year end credit notes for increased volumes, 2% is operating leverage and 4% is because of reduced provisioning of doubtful debts because we've been quite diligent in ensuring we collect our money and our outstanding is within range."

— Rahul Guha, MD and CEO

What is the FY26 outlook

"So I would say, while not a specific guidance, I would say, we would be happy with mid-teens growth with". And also, "So, I don't want to build expectations on -- yes, while in the second half of the year, we have... So, I think on an annualized basis, normalized for ESOP cost, we are around 31%. If we can keep that 31% next year, I will be happy."

— Rahul Guha, MD and CEO

Metropolis Healthcare

Diversifying geography

"Our objective is to transition from being predominantly focused on west and south to establish ourselves as a truly panindia diagnostics brand with more revenues coming in from north and east and margin expansion through disciplined execution of our productivity initiatives, operational efficiencies and lower incremental costs from infrastructure and IT upgrades."

— Ameera Shah, Chairman

Discontinued certain institutional and government contracts that contributed volume

"However overall volumes were partially impacted by the discontinuation of certain institutional and government contracts these engagements contributed to volume but had impact limited impact on margin As part of a deliberate strategy, we chose to exit this business in order to provide growth in the B2C segment and enhance the quality and profitability of our B2B portfolio."

— Ameera Shah, Chairman

Dr. Lalpath Labs

FY25 growth was primarily volume driven

"On the operational front, we sustained a strong growth trajectory in Q4 driven by volume growth and mix improvement without taking any price hikes.". And also, "Effectively, it's a 3% better performance than last year because there is no price increase in FY25 v/s there was a price increase in FY24."

Management clarified their strategic stance on future price increases

"Price increase is something which for us will be a very strategic decision. I think in some previous call also we had discussed that if there is, you know, if we see the need, whether it is in terms of costs or whether it is in terms of the whole pricing table in the industry moving in a certain direction where we are left behind, if any of those things happen, then we may consider, but it is not something which we will do for any tactical reason right now, because maintaining the price table also has its advantages in terms of overall growth that we are trying to achieve."

Management emphasized the maturity period for new network additions

"the infrastructure expansion push that we have taken in the last 12 - 18 months over the new labs and collection networks and incremental areas around that, those will obviously start maturing. It takes anything between 18 - 36 months for these networks to mature. And we believe that they will help us improve our patient volume number.".

Conclusion

Today's insights reveal several key trends across various industries. Arvind Fashion's focus on ROCE, Hyundai's EV pivot, and Eureka Forbes' transformation journey highlight strategic shifts. PB Fintech faces challenges in savings but sees strength in health, while LT Foods anticipates growth driven by home consumption in America. VIP Industries is repairing its balance sheet, Kaynes Technologies is experiencing a surge in orders, and the diagnostics sector is emerging as a high-growth area. These diverse observations offer a snapshot of the dynamic business landscape and the varying strategies companies are employing to navigate current market conditions.

You guys are doing wonders keep up the work team SOIC

Thank you for sharing