Welcome to Investors’ Edge— your daily dose of business insights, trends, and updates that matter. In this space, we go beyond the headlines to explore the evolving world of companies and industries. Each day, we bring you thoughtfully curated insights, sharp observations, and key developments shaping the business landscape.

Whether it's a strategic pivot by a market leader or an under-the-radar company making waves, we break it down for you — clearly, concisely, and consistently.

Released on July 10th, the 15th edition of Investor's Edge highlights "Special Situations (Spin-Offs)". Demergers (spin-offs) have emerged as a powerful strategy for unlocking shareholder value. By splitting a conglomerate into focused standalone entities, companies often witness significant long-term price appreciation for investors.

This blog explores why demergers generally create wealth in India, examines case studies of both successful and unsuccessful demergers, provides a checklist for evaluating spin-offs, and highlights several recent demergers and their objectives.

Why Demergers Tend to Create Wealth in India

Empirical evidence – both global and Indian – shows that corporate break-ups can create substantial shareholder value.

Sharper Management Focus: A demerger reverses the ill effects of “diworsification” (diversification into too many areas) by giving the new entity dedicated managerial time and focus.

Disappearance of the Conglomerate Discount: Markets often assign a conglomerate discount – the combined entity is valued less than the sum-of-parts. Post-demerger, this discount gradually vanishes as each business gets valued on stand-alone merits.

Improved Capital Allocation: After a spin-off, each entity can allocate capital to its own best opportunities instead of internal tussles for budget. Profitable segments are no longer dragged down by capital-hungry or low-ROCE divisions.

Lower Information Asymmetry & Value Discovery: When diverse businesses are lumped together, investors and analysts struggle to evaluate each part, often undervaluing the best divisions. Demergers provide clarity and transparency, attracting focused analyst coverage and investor interest in each entity.

Investor Base Optimization: A spin-off can also result in a technical uplift – for example, if the new entity is small, some large institutions might be forced to sell due to size mandates, temporarily depressing the price.

Let’s Dive into some of the interesting case studies -

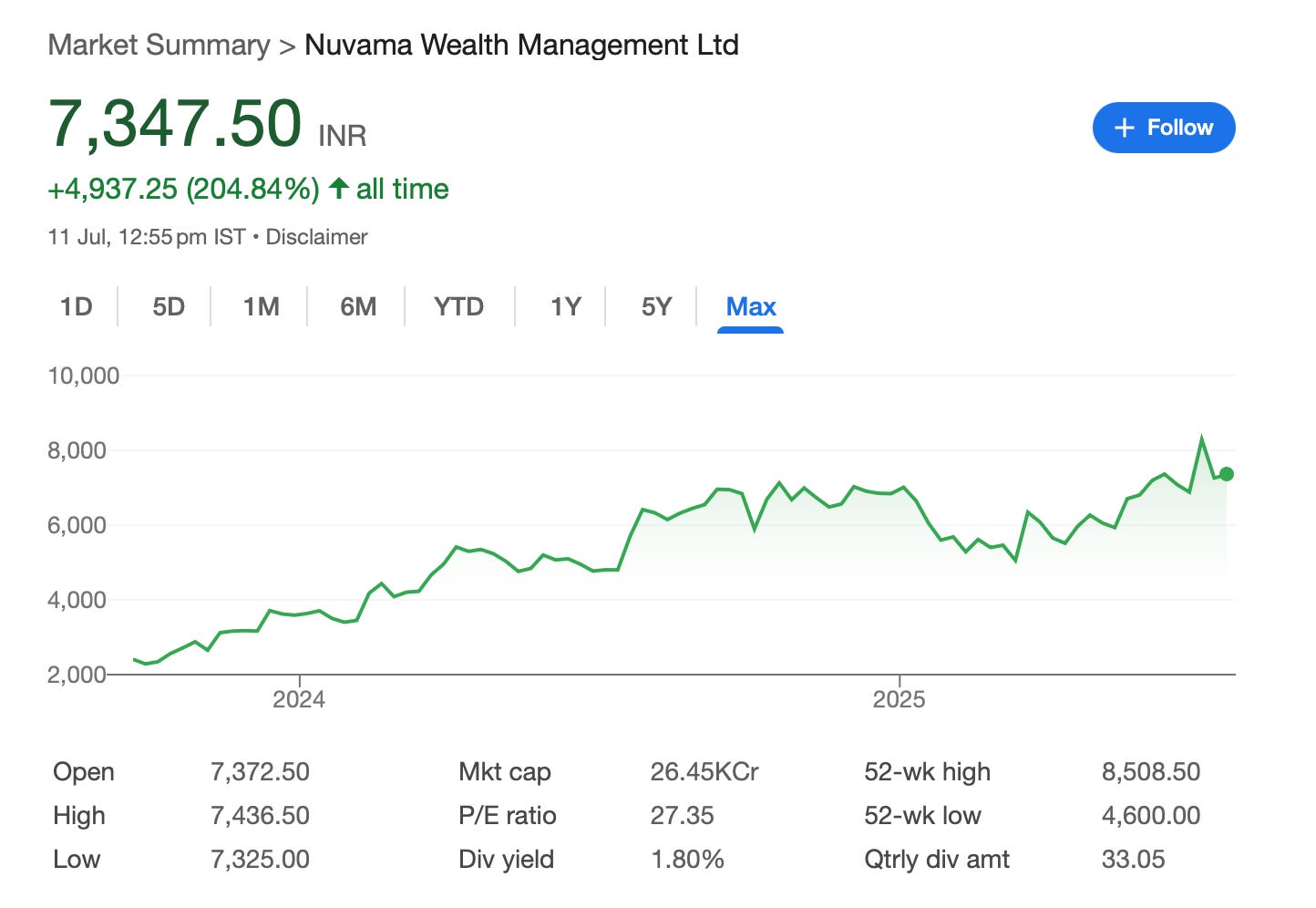

Nuvama Wealth Management (Edelweiss Financial Services)

When Edelweiss Financial Services decided to demerge its wealth management arm in 2023, the rationale was to give the business dedicated focus under a new brand – Nuvama Wealth. The demerger was approved in April 2023 and became effective in May.

Nuvama Wealth listed on the NSE in September 2023 at a price of ₹2,750 per share, instantly valuing it as a major player in the wealth management space. On listing day, the stock hit a 5% lower circuit (closing around ₹2,612) as some investors booked profits.

Freed from the conglomerate structure, Nuvama can now extend its presence beyond 100 cities and deepen its product-neutral wealth offerings (from broking to mutual funds to insurance).“Wealth management as a space is expanding” and that Edelweiss’s move allows Nuvama to fully capitalize on this growth

Suven Pharmaceuticals (Cohance)

Suven Pharmaceuticals Ltd (SPL) is a textbook example of value unlocking via demerger. It was spun off from its parent Suven Life Sciences (SLSL) in 2020, separating the profitable CRAMS (Contract Research and Manufacturing) business into a new listed entity. Over 2020–2022, it grew into “one of the leaders in India’s pharma CDMO space with >20% CAGR and >43% EBITDA margins”, far outpacing the parent’s legacy business.

The ultimate validation came in late 2022 when global private equity firm Advent International agreed to acquire a 50.1% stake in Suven Pharma at ₹495 per share, valuing the company at ₹6,313 crore

This price was a substantial premium and implies multi-fold returns for original Suven Life shareholders (who effectively received Suven Pharma shares at a much lower base cost). Advent’s open offer at ₹495 and plan to potentially merge Suven with its portfolio company Cohance Life Sciences underscore the unlocked value

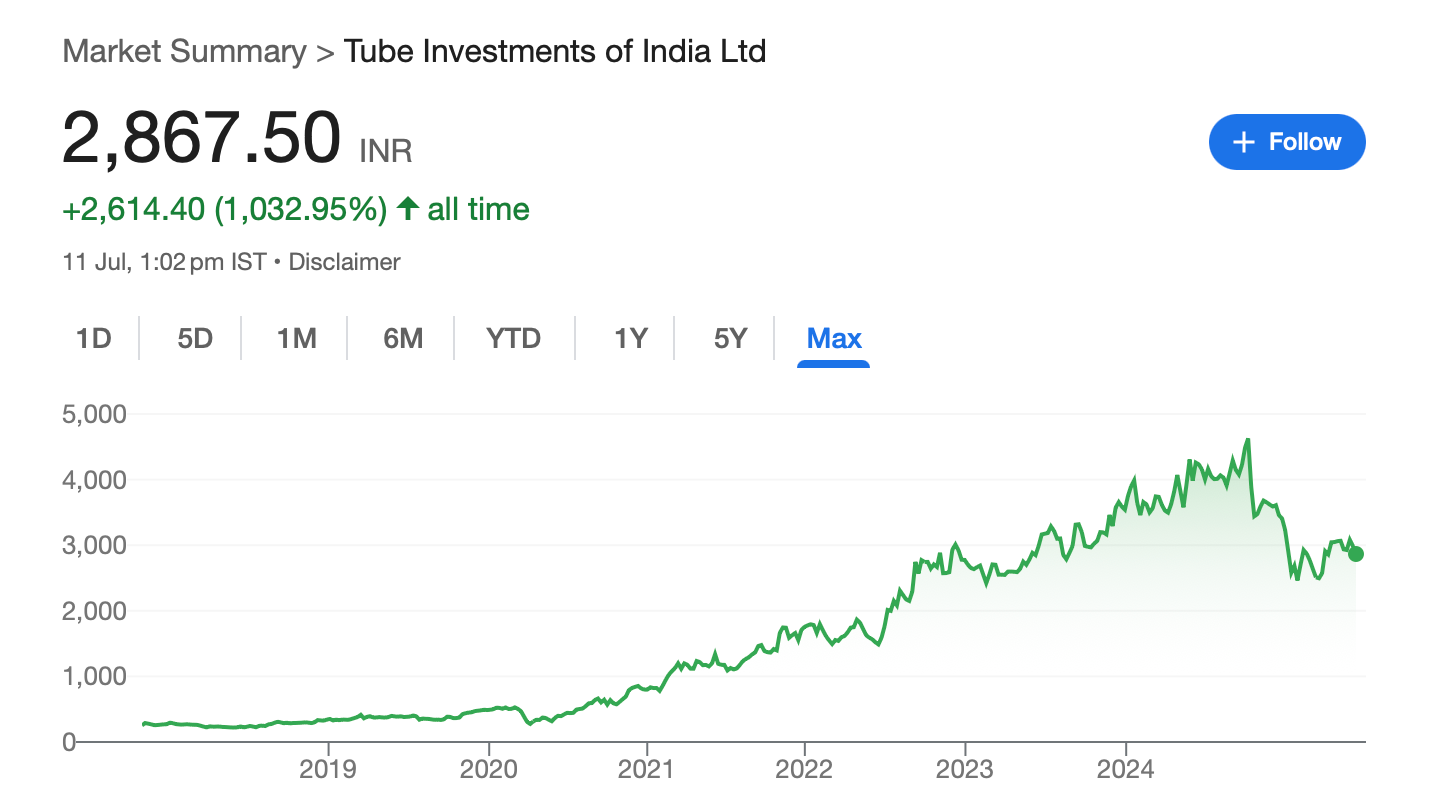

Murugappa Group Restructuring – Tube Investments, Cholamandalam Finance

Tube Investments of India (TII) underwent a demerger in 2017, separating its manufacturing business from its financial services business. The manufacturing business was transferred to a newly formed entity, also named Tube Investments of India Limited, while the original company, Tube Investment India Limited, was renamed TI Financial Holdings Limited and focused on financial services. The demerger was approved by the National Company Law Tribunal (NCLT) with an effective date of April 1, 2016.

Shareholders of the original Tube Investment India Limited received one share of the newly formed Tube Investments of India Limited for each share they held in the original company.

Demerger helped unlock the value for the shareholders of Tube Investment allowing both the business which have different risk profiles to pursue in their own optimum manner

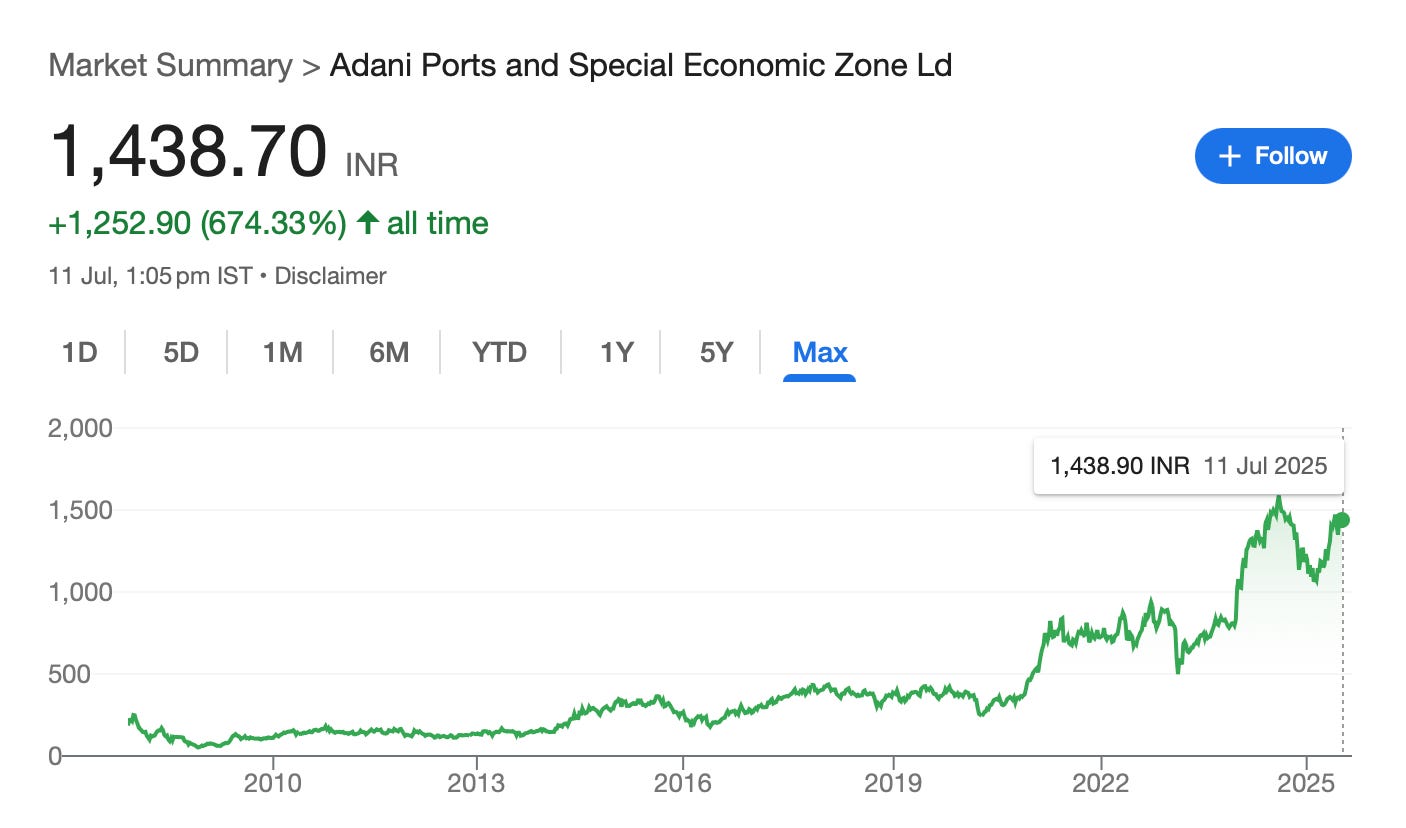

Adani Ports & SEZ (Adani Enterprises Demerger)

Adani Ports & Special Economic Zone Ltd (APSEZ) was originally listed via an initial public offering in November 2007, not by a demerger. Specifically, the IPO of Mundra Port and Special Economic Zone. Separately, in January 2015 Adani Enterprises Ltd. approved a corporate demerger (effective April 1, 2015) under which its ports business was placed into the already-listed APSEZ. However, this transaction merely transferred shareholding from the parent to shareholders directly — APSEZ itself was already trading on the exchanges by then

This was a mega-demerger aimed at simplifying the conglomerate and removing the deep conglomerate discount in AEL’s valuation. Shareholders of Adani Enterprises received shares in the new companies: e.g. 14,123 APSEZ shares for every 10,000 AEL shares (and similar ratios for Adani Power and Adani Trans

The result has been a dramatic creation of wealth, particularly via Adani Ports (APSEZ). Post-demerger, APSEZ emerged as India’s largest private port operator and its market capitalization soared over the subsequent years, reflecting its strong growth and infrastructure focus.

It’s noteworthy that APSEZ – the ports business – has been among the most stable and wealth-generating of the Adani group stocks since the demerger, validating the decision to give it independent status

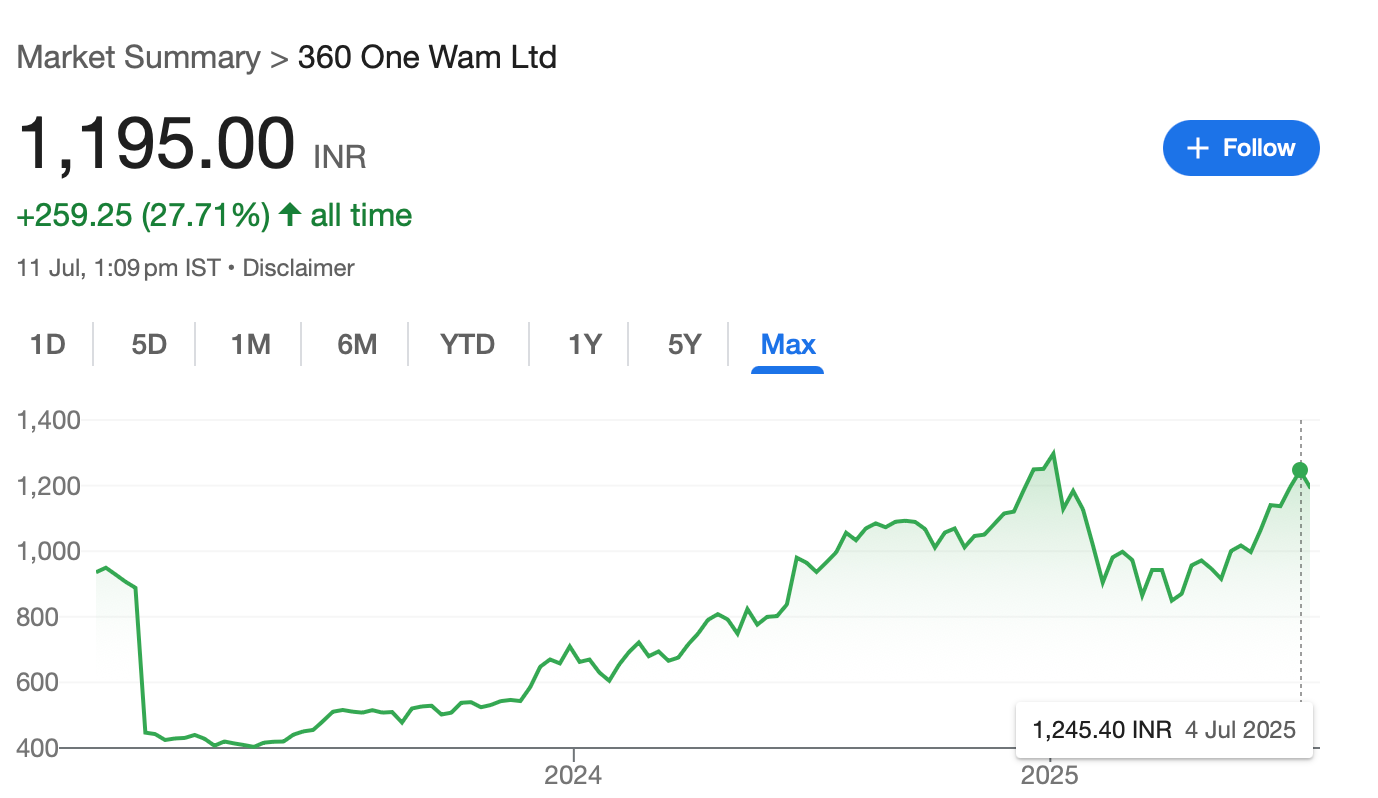

360 One WAM (IIFL Wealth) – Demerger of IIFL Holdings

When IIFL Holdings split into three in 2019, it created what is today 360 One Wealth Asset Management (WAM) – one of India’s leading wealth/asset managers. IIFL Holdings Ltd separated its finance business (now IIFL Finance), its brokerage business (IIFL Securities), and its wealth & asset management business (IIFL Wealth, rebranded to 360 One WAM).

Since then, 360 One WAM has delivered strong returns and growth. The stock has roughly doubled from its demerger-adjusted base, recently trading around ₹1,200 (with dividends/bonuses along the way).

More importantly, the business itself flourished: as an independent company, 360 One could implement its own strategy (focusing on ultra-high-net-worth clients, scaling up AUM, doing strategic acquisitions) without competing for capital with IIFL’s other arms. By 2023, 360 One’s AUM and profits had grown substantially, and it attracted a premium valuation similar to global wealth managers. Investors benefitted as the market recognized 360 One’s high ROE, annuity-income business model, re-rating the stock upwards.

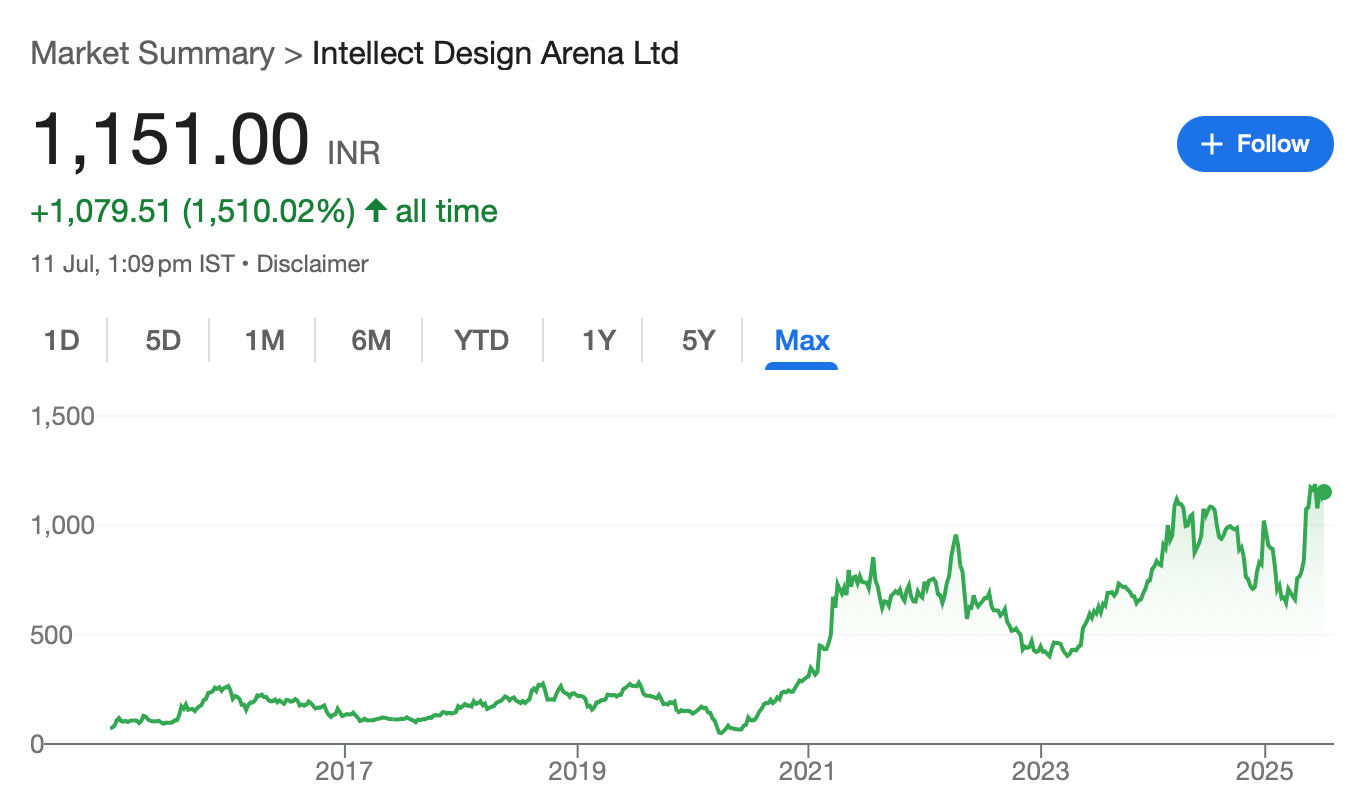

Intellect Design Arena (Polaris Software)

In 2014, Polaris Financial Technology decided to split its business, leading to the birth of Intellect Design Arena Ltd. Polaris was a software company with two distinct segments: an IT services arm and a products business (which developed banking software products under the “Intellect” suite). These had very different growth profiles and valuation metrics. The company demerged the products division into a new entity, Intellect, which listed in December 2014 at around ₹70 per share

Post listing, Intellect Design Arena unlocked tremendous value as one of the only pure-play banking product software companies in India. In the ensuing years, Intellect grew its product suite and client base globally, driving its stock up manifold. By late 2021, Intellect’s share price had risen to around ₹700+ (a 10x gain from listing in 7 years), before settling in the mid-₹600s in 2023-24 amid market swings

This performance far outshone what Polaris as a combined entity had achieved. The demerger allowed Intellect to raise capital, attract product-specialist investors, and recruit talent with product-domain expertise – all of which fueled growth. Meanwhile, Polaris’s services arm (renamed Virtusa Polaris and later acquired by Virtusa) also realized value for shareholders through a separate M&A.

These case studies illustrate a common theme: demergers often set the stage for re-rating and growth. The successful spin-offs (Nuvama, Suven, Aarti Pharmalabs, Chola/TI, Adani Ports, 360 One, Hindustan Foods, Intellect, etc.) each became more valuable as independent entities than they were under conglomerate umbrellas.

Recent Demergers to Watch (2024–2025)

The Indian market has seen a flurry of demergers in the past year. While it’s too early to judge their long-term stock performance, it’s worth briefly reviewing some recently completed spin-offs – highlighting their stated objectives and new structures:

Siemens Energy India (Siemens Ltd demerger, 2025)

In April 2025, Siemens India (the diversified engineering MNC) demerged its energy products and solutions division into a new entity, Siemens Energy India Ltd, which got listed in June 2025

The move mirrored the global Siemens AG spin-off. Siemens Energy India is now the country’s largest listed pure-play power generation and T&D equipment company, encompassing gas turbines, transmission gear, etc.

The goal was to allow Siemens Ltd to focus on core industrial automation, mobility and digital industries, while Siemens Energy pursued opportunities in the power infra space (including green energy transition projects).

OneSource Specialty Pharma (Strides Pharma demerger, 2024/25)

Strides Pharma Science Ltd, a mid-sized pharmaceutical company, completed a demerger of its CDMO and specialty pharma division into a separate company named OneSource Specialty Pharma Ltd.

This spin-off effectively creates India’s first listed multi-modality CDMO pure-play. OneSource houses multiple manufacturing and development facilities that cater to global pharma companies (across injectables, orals, etc.). By demerging, Strides aimed to unlock the value of its B2B CDMO operations, which have different growth drivers than Strides’ own branded generics business.

Raymond Realty (Raymond Ltd demerger #2, 2025)

After spinning off its apparel business earlier, Raymond Ltd in 2025 demerged its Real Estate division into “Raymond Realty”, which was listed separately around May 2025

Raymond’s realty arm has a large land bank and is already executing residential projects (notably a big township in Thane on the land adjoining its old factory). The demerger’s aim was to unlock the latent value of Raymond’s land and real estate business, which was not being fully appreciated while embedded in a textiles company. As expected, on the ex-date the remaining Raymond stock price adjusted sharply (dropping ~66%) to reflect the carving out of realty

Raymond ex of realty and lifestyle is now a very unique precision engineering business which serves to both aerospace and defence and Auto comps precision engineering

In the current organisational structure company plans to eventually demerge the non-auto precision engineering business into a separate listed enterprise which could again create another value unlock opportunity

Quess Corp’s 3-Way Demerger (2025)

Business services provider Quess Corp Ltd undertook a complex restructuring in 2024–25, splitting into three separate listed companies. Quess carved out two subsidiaries – Digitide Solutions Ltd (housing its digital IT services arm) and Bluspring Enterprises Ltd (housing the facilities management and infrastructure services arm) – while the parent Quess Corp continues with core workforce & staffing solutions

Upon listing on June 11, 2025, the three companies had a combined market cap of about ₹9,400 crore – roughly double Quess’s pre-demerger value of ₹4,770 crore

This implies immediate value creation, though part of it might be re-rating and part pure price discovery. Notably, the two spin-offs had contrasting debuts: Digitide listed at a strong premium (₹245 vs ₹155 indicative, +58%) while Bluspring opened weak (around ₹86 and fell to ₹82, about half its expected value)

Aditya Birla Fashion & Retail (ABFRL)

Madura vs Pantaloons Demerger (2025): In May 2025, ABFRL, a leading branded apparel company, split itself into two listed companies to sharpen focus. The Madura Fashion and Lifestyle division – which houses big brands like Louis Philippe, Van Heusen, Allen Solly (men’s formal wear), plus innerwear and international brands like Reebok, Forever21 – was demerged into a new company Aditya Birla Lifestyle Brands Ltd (ABLBL)

The remaining ABFRL retained the Pantaloons value retail chain and the ethnic wear portfolio (including recent acquisition TCNS Clothing, and luxury partnerships like Sabyasachi, Tarun Tahiliani, etc.)

The motive is to allow more targeted strategies: ABFRL (post-demerger) focuses on ethnic, casual and value segments with high growth potential in tier-2/3 cities, while ABLBL becomes India’s dominant western wear powerhouse (formal menswear, sportswear, innerwear) that can pursue its own growth or partnerships.

Rossell India – Aerospace & Defence Demerger (2024)

Rossell India Ltd, originally a tea plantations company that diversified into Aerospace & Defense (A&D) electronics, decided to demerge its A&D division into a separate company Rossell Techsys Ltd in 2024

The A&D division, which supplies electronic systems and engineering services to global aviation and defense firms, had become a significant growth driver (with marquee clients like Boeing). However, it was getting little credit inside Rossell, whose primary business (tea estates) is slow-growing. The demerger, effective late 2024, gave shareholders one share of Rossell Techsys for every share of Rossell India. Rossell Techsys listed on the NSE in December 2024

Apollo Hospitals - Apollo HealthTech

The pharmacy distribution arm (Keimed + Apollo Pharmacies) and the Apollo 24/7 digital vertical sit inside a hospital conglomerate and are valued with a hold-co discount.

O2O pharmacy/consumer healthcare needs working-capital lines and is a WC heavy business vs hospitals in majorly a capex heavy business. NewCo carries its own net-debt of ₹1,934 cr—mostly WC facilities from banks.

AHEL keeps 15 % (17.5 % including FHPL) and a board seat; Advent has skin in the game (₹2,475 cr) plus a performance-linked upside pool for executives; NewCo will own 100 % of the front-end pharmacy once the ₹300 cr AMPL buy-out closes.

Board cleared composite scheme 30 Jun 2025; NCLT filing due Q3; IPO aimed 18-21 months out.

Hindustan Unilever - Kwality Wall’s India

HUL is a ₹60,000 cr FMCG titan with 23 % operating margin and Kwality wall’s is a ₹2,200 cr ice-cream vertical growing >15 % CAGR, peak summer EBITDA margin near 18 %.

Ring-fenced entity can bolt on frozen desserts, collaborate with food-delivery apps and even court a strategic freezer-asset partner all distractions for a giant like HUL but needle-moving for a ₹2 k-cr pure-play.

Ice-cream grows about twice as fast as HUL’s staple portfolio , standalone focus could lift both growth and margins

Board green-lit Jan; BSE “no-objection” 14 May; shareholder vote July; listing targeted Q4 FY-26.

Reliance Industries - New Reliance Consumer Products

Reliance is a big conglomerate with O2C, Jio, and the country’s largest retail chain; group EBITDA >₹1.6 trn.

Early-stage FMCG Campa, Independence staples, personal care—already ₹2,000 cr revenue and tripling distribution reach annually via JioMart.

The move de-congests Reliance Retail’s P&L while giving investors an uncluttered bet on Mukesh Ambani’s FMCG ambitions.

Early stage but high-growth FMCG could attract pure-play valuations instead of a conglomerate discount.

NCLT approval 25 Jun 2025; spin-off announced 3 Jul 2025; listing expected within 12 months; RIL keeps 83.6 %.

But there’s a catch - Demergers are not always Rosy

While most Indian demergers in recent decades have been positive, there are notable instances where the spin-off did not create wealth – in fact, shareholders ended up losing value. These cautionary tales often come down to poor business fundamentals of the spun entity, bad timing, or structural issues that the demerger couldn’t fix.

Saregama India – Digidrive Distributors Demerger

Leading music label Saregama India Ltd attempted a demerger in 2023, carving out its low-margin e-commerce and distribution division (which handled distribution of Carvaan music players and other products) into a new entity called Digidrive Distributors Ltd

However, this demerger has not created wealth – if anything, it’s been a minor value drag. Why? Firstly, Digidrive is a tiny, loss-making business with negligible standalone value. Saregama’s main value lies in its music licensing and film content, whereas the Carvaan/distribution unit was actually incurring losses. Spinning it off did not unlock any hidden gem; it simply removed a small drag from Saregama’s P&L.

Secondly, any “conglomerate discount” was minimal since Saregama was never a wide conglomerate – its distribution arm was already known to be a weak segment. The demerger thus didn’t change Saregama’s valuation much; Saregama’s stock price largely continued to track the fortunes of its music business

Piramal Enterprises – Piramal Pharma Demerger

Conglomerate Piramal Enterprises Ltd (PEL) undertook a major demerger in 2022, spinning off its pharmaceuticals business into a new listed company Piramal Pharma Ltd (PPL). PEL’s goal was to let its pharma arm (which includes contract development & manufacturing, critical care, and OTC pharma) chart its own course, while PEL focused on financial services.

Piramal Pharma listed on October 19, 2022 at around ₹201.80, but within a few weeks the stock plunged ~48% to ₹125.

The sharp decline was due to several factors: heavy technical selling pressure (PEL was part of indices, and after demerger, PPL – being smaller – faced selling, including MSCI index reclassification-driven sells)

but more worryingly, weak fundamentals – Piramal Pharma’s earnings were under strain with a slowdown in its CDMO orders, a dip in complex hospital generic sales, and forex losses

Investors were not enthused by its high initial valuation (it listed at ~31x forward earnings, which suddenly looked rich given its growth issues)

NIIT Ltd – NIIT Learning Systems Demerger

In 2023, NIIT Ltd, a leading skills and training company, split its business into two: the Corporate Learning Group (CLG), which became NIIT Learning Systems Ltd (NLSL), and the remaining NIIT Ltd focusing on individual skills & careers training.

The idea was to separate the high-growth corporate training contracts division from the smaller retail training division. While strategically sound, the initial market reaction indicates wealth was not created for NIIT’s shareholders – at least in the short run. Why the lukewarm outcome?

One reason is business dynamics: NLSL (the corporate learning arm) – while profitable – is essentially an IT/BPO services business dependent on large clients, and it faces broad IT sector headwinds (slowdowns in tech spending, etc.). So its growth slowed, and the market tempered its valuation multiple.

The key lesson: if one of the resulting companies is sub-scale or if industry conditions turn unfavorable, a demerger can result in wealth stagnation or decline, despite the best intentions.

Raymond Ltd – Raymond Lifestyle Demerger

Raymond Ltd, a famed textiles and apparel company, pursued a series of restructurings. In 2023, it demerged its core Lifestyle (branded textiles and apparel) business into a new company Raymond Lifestyle Ltd (RLL), which got listed in September 2024

Unfortunately, the Raymond Lifestyle demerger has been a mixed bag at best, and arguably a wealth destroyer for some shareholders.

However, a wave of forced selling by index funds and other technical factors saw the stock witness heavy volatility and fall soon after listing. Moreover, Raymond’s legendary corporate governance issues cast a cloud: soon after listing, proxy advisory firms raised governance red flags – opposing the appointment of promoter Gautam Singhania as Chairman of RLL due to high remuneration and past issues

And also one of the reasons is that the lifestyle business still was a complicated business which to be focused on brands part actually was a branded + garmenting business which in itself had a lot of business verticals.

These examples show that while demergers can unlock value, outcomes vary. Key pitfalls include spinning off weak or indebted businesses, lack of strategic clarity post-breakup, poor governance, or simply adverse market cycles. Investors should therefore approach each demerger case by case, doing due diligence.

A Practical Checklist for Evaluating Demergers

Not every spin-off is a gold mine. How can investors identify the most promising demergers? A carefully pre-selected deal to invest in can improve returns. Drawing on their framework (which in turn channels insights from value investors like Joel Greenblatt), here is a checklist of questions to ask when analyzing a demerger

Insider Actions – Are insiders showing confidence?

Business Quality – What is being spun off (and why)?

Valuation and “Hidden” Value – Will the spin-off unlock a conglomerate discount?

Management Incentives – Is the spin-off’s management motivated?

Capital Structure – Is either entity overburdened with debt?

Post-Demerger Shareholder Dynamics – Any forced or technical selling?

Strategic Rationale – Is the breakup logically enhancing focus?

Offloading of Problems – Is the parent dumping a problem asset?

Insider Shareholding and Activity – Who ends up owning what?

Growth and Moat – Are the spin-off businesses fundamentally strong?

Conclusion -

In the Indian context, demergers have generally proven to be a win-win for companies and shareholders. When executed for the right reasons – better focus, transparency, and unlocking growth potential – a spin-off can catalyze long-term wealth creation. The underlying drivers are intuitive: the market rewards clarity and punishes complexity. As conglomerates break into focused units, good businesses get the valuations they deserve, and even average businesses can improve under dedicated management.

Importantly, focus on the long term. Demergers are not about quick arbitrage (in fact, we deliberately avoided any discussion of merger arbitrage or short-term special-situation trades). Instead, think of a demerger as buying into two (or more) separate companies and holding them as distinct investments. Some of the greatest fortunes have been made by holding onto high-quality spin-offs that the market initially underappreciated – patience allowed their true value to be realized.

Legendary investor Joel Greenblatt quipped that “you can make a lot of money investing in spin-offs” because oftentimes other investors don’t have the patience or mandate to hold them. There is a very interesting chapter on spin offs (Chapter 3) in his book “You can be a Stock Market Genius”