Welcome to Investors’ Edge— your daily dose of business insights, trends, and updates that matter. In this space, we go beyond the headlines to explore the evolving world of companies and industries. Each day, we bring you thoughtfully curated insights, sharp observations, and key developments shaping the business landscape.

Whether it's a strategic pivot by a market leader or an under-the-radar company making waves, we break it down for you — clearly, concisely, and consistently.

The 16th edition of Investor's Edge, released on July 10th, offers compelling insights. This issue highlights key takeaways from Q1FY26 concalls of noteworthy companies, alongside interesting business updates and corporate announcements. Let's dive in!

Interesting Con-call Insights

Tata Elxsi

Is the current demand scenario the absolute lowest point for this company?

“The confidence is because we had certain -- between the customer and us, we had to achieve certain ramp-ups in Q1. And we have certain ramp-up to happen in Q2 and beyond, right? So I'm happy to tell you that the Q1 ramp-up has happened as per expectation, right? So we don't see any pullback. We don't see any slowdown that is happening from that ramp-up perspective. Of course, given that the markets are not very -- in a very favourable position and so on, but still the ramp-ups have happened. And the sort of engagement that we're having with customers, right, the sort of reviews that we're having on a regular basis gives us the confidence that, look, this ramp-up, whatever deal that we have planned is going as per original plan. We're not changing any of those deal terms, right, so far, right? And that is a commitment in Q2 as well that look -- this is a ramp-up that we will have, and we are progressing as per that schedule. There is no pullback. There's no budget cuts. The projects are coming in, engagements that are happening with the customers. So all of that is happening as per plan. So that's why we are pretty confident that those deals are going ahead as per plan.

I think our growth will be led by the transportation business. That would continue because on the back of the deals that have signed and also on the traction that we see in the market, the growth for the company will definitely by the transportation business. Media and Communication business will recover, and that's the plan that we are working on. So we hopefully will see the growth from Q2 itself. Healthcare, I would be a little careful there. It's -- I mean, there's tariff-related issues and so on and the fact that it's a smaller business for us and we do have -- we don't have a large list of customers. It's a select set of good customers that we have. So that will be a little volatile for us. And -- but however, we hope in H2, we will start seeing the growth in that particular business. We have done a lot of investments there, including from a leadership perspective, from a sales perspective. We have done a lot of investments, and we are hoping that from H2 onwards we will see an uptick in business there. And this business is also a little bit of a long lead cycle business. So we are working on some good opportunities and so on, but closure times -- closure takes time in the Healthcare business. So yes, so that's how the 3 businesses would pan out.”

— Manoj Raghavan

TCS

AI Modernisation is coming out to be a strong theme

So Reema from a new age service line perspective, when you look at AI, data, cybersecurity, interactive, some of the modernization services in terms of movement to cloud application modernization. These service lines have grown well this quarter. And we see, especially on AI and data, strong demand from our customers. Customers are investing in industry-specific solutions. AI for modernization is coming across as a strong theme because AI is -- Gen AI is now becoming the tool to really understand the legacy core and use Gen AI to convert and forward engineer to a modernized architecture and application. So these are all new opportunities. And when you look at Enterprise Solutions modernization, with SaaS platforms, so significant demand there as well.

—Aarthi Subramanian

Investing in building AI competencies

Absolutely. Absolutely. As you have been saying from the last so many quarters, we have been sharing with you in terms of how we are building AI competency across the organization. Now we are telling you how we are basically taking it -- building a pyramid around that and that building higher order competencies will continue to improve quarter-after-quarter, and that is the path.

—Milind Lakkad

GTPL Hathway

Massive Headroom for Growth in India’s Cable, Broadband & Content Ecosystem

“No, you look into another way that out of around 3 million households only 200 million households are around 200 million sold TV households state. The spread of 140 million, 150 million households are where the TV is not there and then to the router, there to the areas or cable task areas and in India. So that's why one of the strategy, which every has gone for the heated in the sky, it is second line so that we can cover all over and get footprint in the 1 goal. And we can start providing the services all over India. So that's on the CATV side. So still we have a very big opportunity. Apart from that, we have the opportunity that out of around 80 million cable numbers, which is the own out of only organized we just have around 35 million to 40 million. Still 40 million to 45 million as well the smaller MSOs and smaller players. The plan opportunity is large for the consolidation. So it's a large opportunity, which is there in the cable side also plus the second will come into the broadband side. Broadband, if I talk about out of 350 million households, 1 million to 50 million or so 7 to 8, maximum 40 million households are there in the wired broadband, which is hardly 12% to 13%. So there is a large [indiscernible scope that will go up for the decade and it will go up with a really good way via broadband, which is more sustainable and which will remain cost effective for the households. So both the businesses have a lot of opportunities right now. Plus, as we combine both broadband and today then, plus, you're bringing more content on that [indiscernible] start putting more of laying of the services and bank, more services than that, then you can make more customers at [indiscernible] So that's the strategy which we have to go. So the opportunity is in India, both sides, both the businesses the opportunity is very large. You just have to tap that in the right way and the high strategy and both businesses we grow.”

— Piyush Pankaj

Anand Rathi Wealth Ltd.

Building a Brick-by-Brick Global Wealth Strategy to Tap Rising NRI Flows into India

“Point two, I think as soon as you start a business, it's not going to be a huge contributor. But what is our vision for international NRIs or investing agencies. We can see a large opportunity, given the interest levels of NRIs, which [is visible] in India, we want to make sure that we have our offices in place and the strategy in place. Point three, SEBI has been creating several platforms, which make it very easy sort of pooled investments, okay, especially from international [standpoint] in the GIFT City and the AIFs and other businesses, which can channelize money into India are developing beautifully. So we have just got licenses or we are in the process of getting licenses. But I think the long-term vision is, we believe that there will be a lot of money from NRIs flowing into India for the next decade, and we want to capitalize on that. And not just with one office. But once we finish 10 years in a specific business then that is when we try to build our business brick by brick. We just finished 10 years in Dubai. After having seen an office and profitability and the pros and cons in the international products, now we were confident to have other locations. That's why you see Bahrain and U.K. We are a wealth manager, which tries to build it, brick-by-brick. And so we are reasonably bullish on international money coming to India and getting the pie of it.

See AUM is like a photograph. And revenue is like a movie. AUM depends on where markets ended on 30th June. Revenue is an outcome of every day's action and every day's revenue. 30th June, if the market fell 3% hypothetically, would my -- there won't my AUM be INR 88,000 crores, approximately? The answer is, no. It would have been INR 86,000 crores. So when you look at AUM as an average, then there'll be sanctity with the revenue. So what has happened is you've added INR 3,800 crores. And in the first quarter, NIFTY has given about 7%, 8% return. And our model portfolio of mutual funds have out beaten that by 2.47% as of day before yesterday. So AUM, that's why we are not revising the INR 1 lakh number because 31st March”

Elecon Engineering

Ambitious Export Growth Target

"In line with our strategic vision, we aim to increase the sale of exports to 50% of total revenue by FY30. This ambitious global expansion is powered by our strong R&D capabilities, continuous investment in product innovation and strategic part. partnership with OEMs across international market."

New Manufacturing Facility's Short-Term Margin Impact

"In Q4 FY25, we capitalize our new manufacturing facility in gear division. While this marks a significant step towards enhancing our capacity and long-term growth. It has had a short-term impact on margins in Cuba. This is due to accelerated depreciation without corresponding revenue contribution from the new facility. As we ramp up production and begin generating revenue from this new capacity. We expect the margin in the gear division return to normalized level."

"A bit margin was also impacted by accelerated deprecation on the new manufacturing facility while the corresponding revenue has still not come in."

Expecting some strong orders even from the defence division for the company

"See we are expecting uh you know close to 200 cr this year and next year we are expecting a uh better numbers...There are various uh opportunities are there in the different sectors. what we see in the Q2 uh we are expecting an order of nearly 200 cr the large order for the you know the P7 the you know the uh and now the you know new version which is called the P7 bra which we are expecting and which is going to come maybe it may come in the Q4 or maybe in the next year sometime...it will be 1,000 cr plus order."

Strategic Capital Expenditure (Capex) for Growth

"Looking ahead, the capital expenditure budget for Fy26 to Fy28 is rupes 400 crores for the next 3-year period."..."400 cr 400 cr will be in the gear division and about this 400 cr 35 cr we are going to spend in MHE division also..." "we are mainly gearing up ourself for the export market where we see a good momentum is coming up for the from the OEM business and we have to keep ourself ready for any kind of volume which we estimated to work for."

5 Paisa Capital

Strategic Focus on Core Business (Broking and Investing) rather than Diversification

"do you do you want to cross-sell like insurance you know the answer is no uh at least in the short term we don't have any plans to to do third party products I want I think there's a lot there is a lot to focus on in in this segment itself and to be the best player in investing in trading and that's what our strategic focus is” …. "at this point in time we are not looking to get into wealth or any any any such related trajectory. Um We think there's a lot to do in this space as well and being the best top three top five player in the industry in the next in the next few years."

Proactive Adoption of AI for Investor Benefit

"In line with our vision of adopting AI for the benefit of investors, we've introduced a couple AI powered features like live news, extreme API assistance um to support real-time decision making and streamline developer onboarding. A major milestone is the launch of IPA MCP... which is essentially an AI trading companion.".... "an AI assistant as well as it has the capability to integrate with your trading account and you can basically use that to do whatever you want to do with your trading. It is not an algo trading platform."

Interesting Q1FY26 Business Updates and corporate announcements to keep a watch on

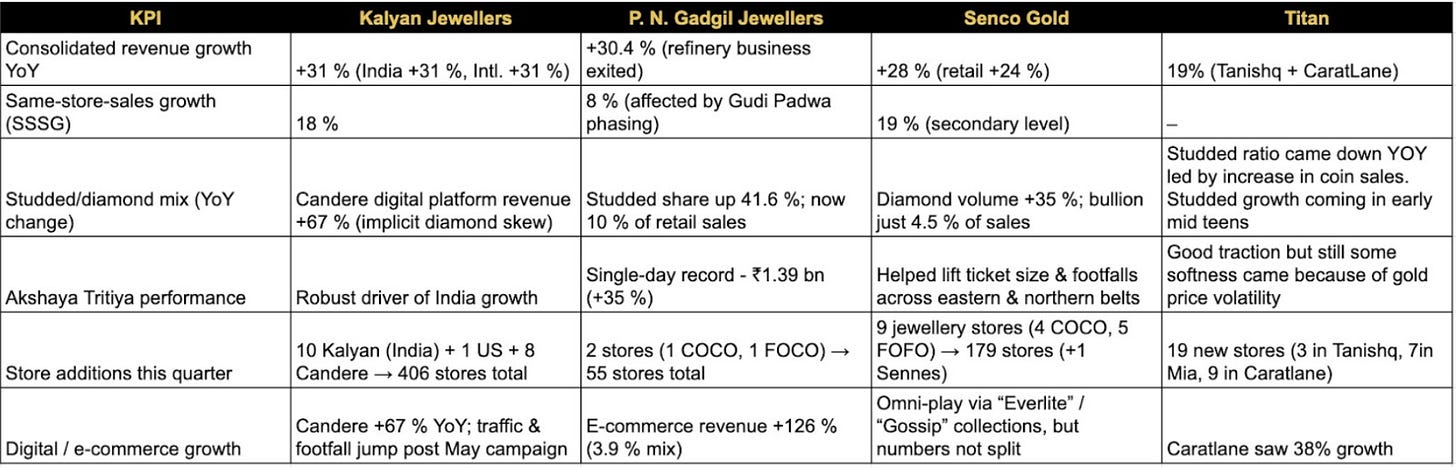

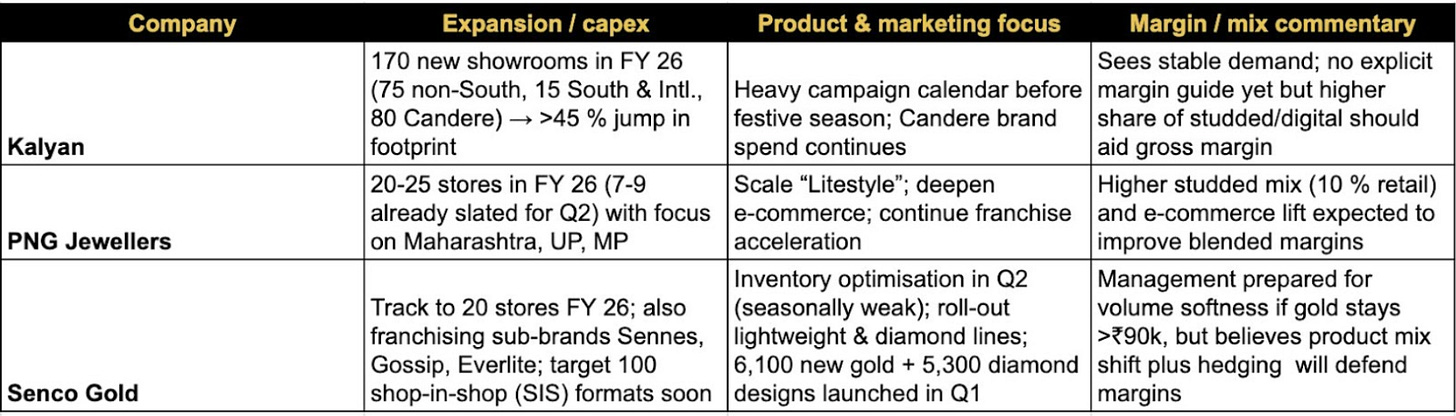

Jewellery Retailers

- Kalyan points to “multiple demand pauses” triggered by price swings and geopolitics, yet sees resilient wedding demand

- Senco quantifies the spike: domestic gold hit ₹86.9k–₹1.01 lakh/10 g (+32 % YoY). They saw “modest softness” in low-ticket mass/bridal volumes but offset this with old-gold exchange (40 % of sales)

- PNG calls out a “cautious consumer environment”, but festive-led spikes (Akshaya Tritiya) still delivered record days

Also companies highlight of the consumer shift towards more design led jewellery

- Senco highlights brisk diamond, 14 k–18 k growth and is already prototyping 9 k collections

- PNG launched “Litestyle” for lightweight fashion pieces

- Kalyan’s Candere push rides exactly this trend, capturing younger, online-first customers

Here's what management guides and sets a 12 month road map

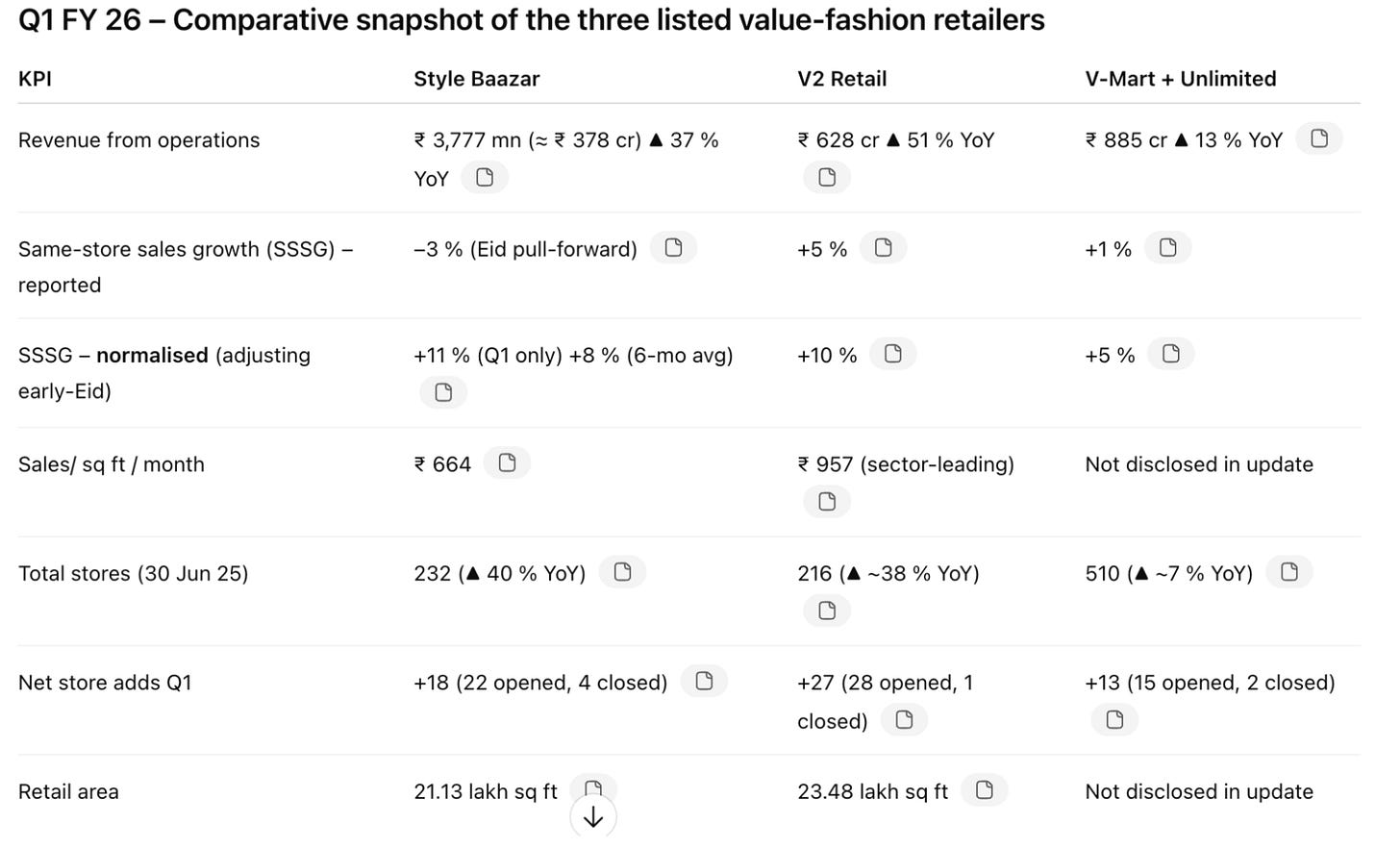

Value Fashion Retailers

> V2 Retail +51% revenue, Style Baazar +37%, V-Mart +13%

> V2 tops productivity (₹957/sq ft) & adds 28 stores; Style Baazar scaling fast but PSF trails

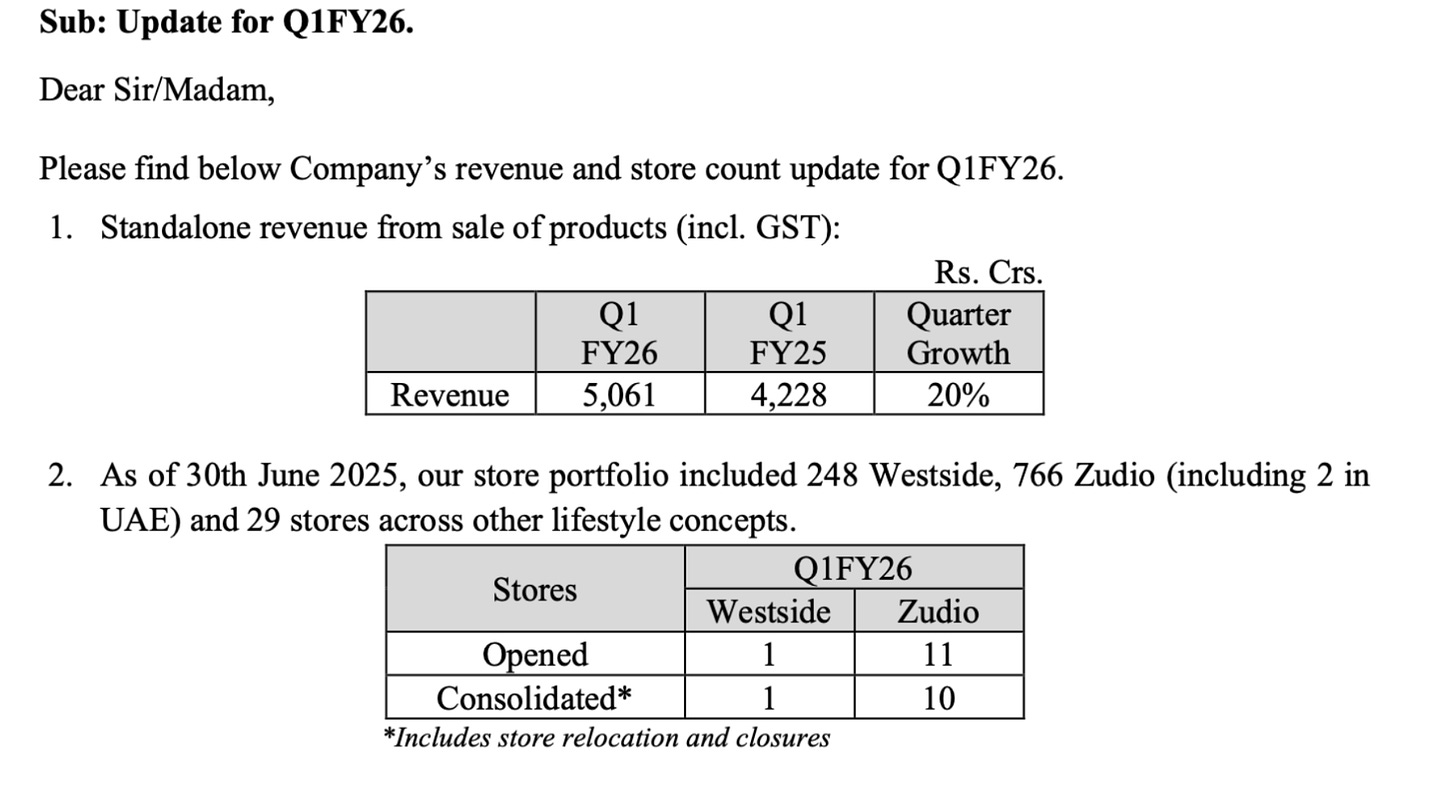

Trent used to grow 30-40%+ when the base was at 1000-2000 crores.

Now, at 4000+ crores a sales per quarter. It's natural that growth rates will come down. Given the size is huge.

New growth rates could be at 20% or below it..investor expectations will adjust accordingly.

The same stands true for really large AUM too..Warren Buffett has often talked about the Law of Large Numbers in Berkshire Hathaway meetings

Real estate Developers

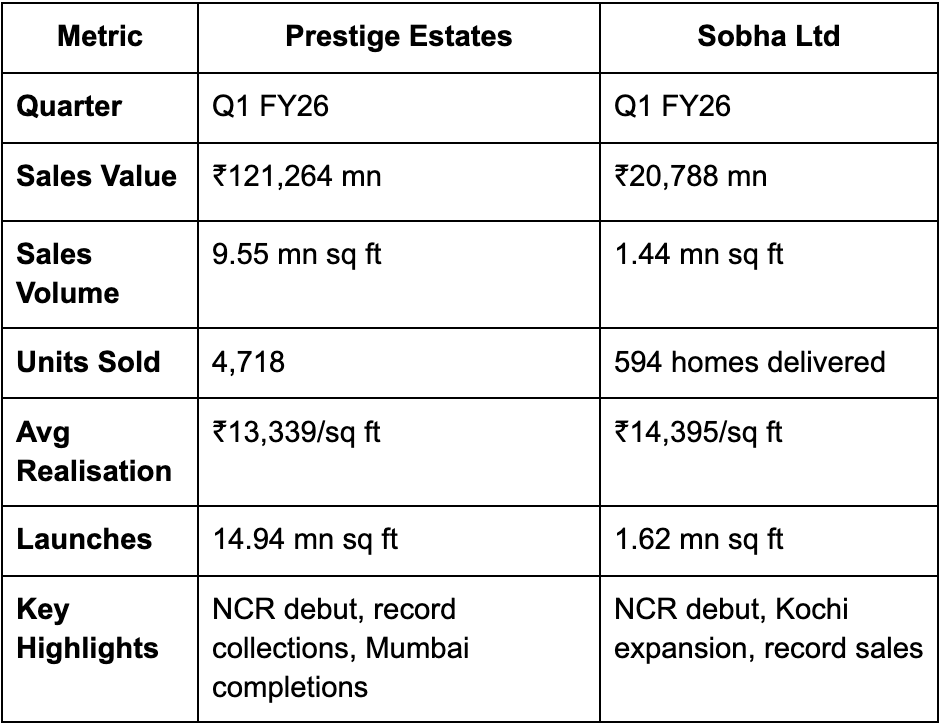

Prestige’s Record Quarter: Kicked off FY26 with its strongest-ever performance, recording ₹121,264 mn in sales—a 300% YoY jump—selling 4,718 units (9.55 mn sq ft) and collecting ₹45,227 mn (+55% YoY) .

Geographic Diversification & New Launches: Launched 14.94 mn sq ft across four projects—including maiden NCR launches at Mulberry and Oakwood in The Prestige City—and shifted its sales mix to 59% NCR, 21% Bengaluru, 12% Mumbai, 5% Hyderabad, and 3% other markets .

Completions & Annuity Growth: Completed 5.45 mn sq ft across five residential projects (including first Mumbai handovers) and Prestige Turf Tower in Mahalaxmi; its office portfolio leased 1.21 mn sq ft at 93.7% occupancy and retail malls posted ₹5,900 mn GTO at 98.9% occupancy .

Sobha’s Historic Milestone: Delivered its highest-ever quarterly sales value of ₹20,788 mn (Sobha share ₹17,172 mn), crossing the ₹2,000 Cr mark; achieved 1.44 mn sq ft of new sales area at an average realization of ₹14,395 / sq ft .

Regional Performance & Execution: Bengaluru led with ₹6,024 mn, followed by Gurgaon ₹3,524 mn and Kerala ₹2,097 mn; completed 594 homes (1.07 mn sq ft) across multiple projects, reflecting strong in‑house execution capabilities .

Expansion via New Launches: Unveiled SOBHA Aurum in Greater Noida (701,051 sq ft, 420 units) and four Marina One towers in Kochi (920,593 sq ft, 362 units), taking its footprint to 13 cities and tapping premium housing demand beyond Tier 1 markets .

Phoenix Mills (Q1 FY26) – Key Business Updates & Commentary

Retail Consumption: Grew 12% YoY across all operational malls, led by strong performance at Phoenix Palassio (Lucknow), Phoenix Citadel (Indore), Phoenix Palladium (Mumbai) and Palladium Ahmedabad, plus ramp‑up at new assets Phoenix Mall of the Millennium and Phoenix Mall of Asia.

Trading Occupancy: Stood at 89% (vs. 91% in Q4 FY25), with a slight dip reflecting planned transitional vacancy for tenant‑mix optimization and space upgrades.

Office Leasing & Occupancy: Achieved gross leasing of ~407,000 sq ft in Mumbai, Pune, Bangalore and Chennai. Overall occupancy in core assets (Mumbai & Pune Vimannagar) improved to 69% (from 67% in March 2025).

Hospitality Performance:

The St. Regis, Mumbai: Occupancy 84% (vs. 85% in Q1 FY25), ARR ₹18,502 (+13% YoY), RevPAR ₹15,477 (+11% YoY).

Courtyard by Marriott, Agra: Occupancy 71% (vs. 63% in Q1 FY25), ARR ₹4,374 (+5% YoY), RevPAR ₹3,175 (+22% YoY).

Residential Sales & Collections: Gross sales of ~₹168 cr (vs. ~₹50 cr in Q1 FY25) and collections of ~₹99 cr (vs. ~₹60 cr in Q1 FY25), underscoring improved absorption.

Management Commentary:

“Strategic repositioning is underway across the Phoenix MarketCity portfolio through space optimization and a refreshed, curated tenant mix—all aimed at driving long‑term value and elevating the customer experience.”

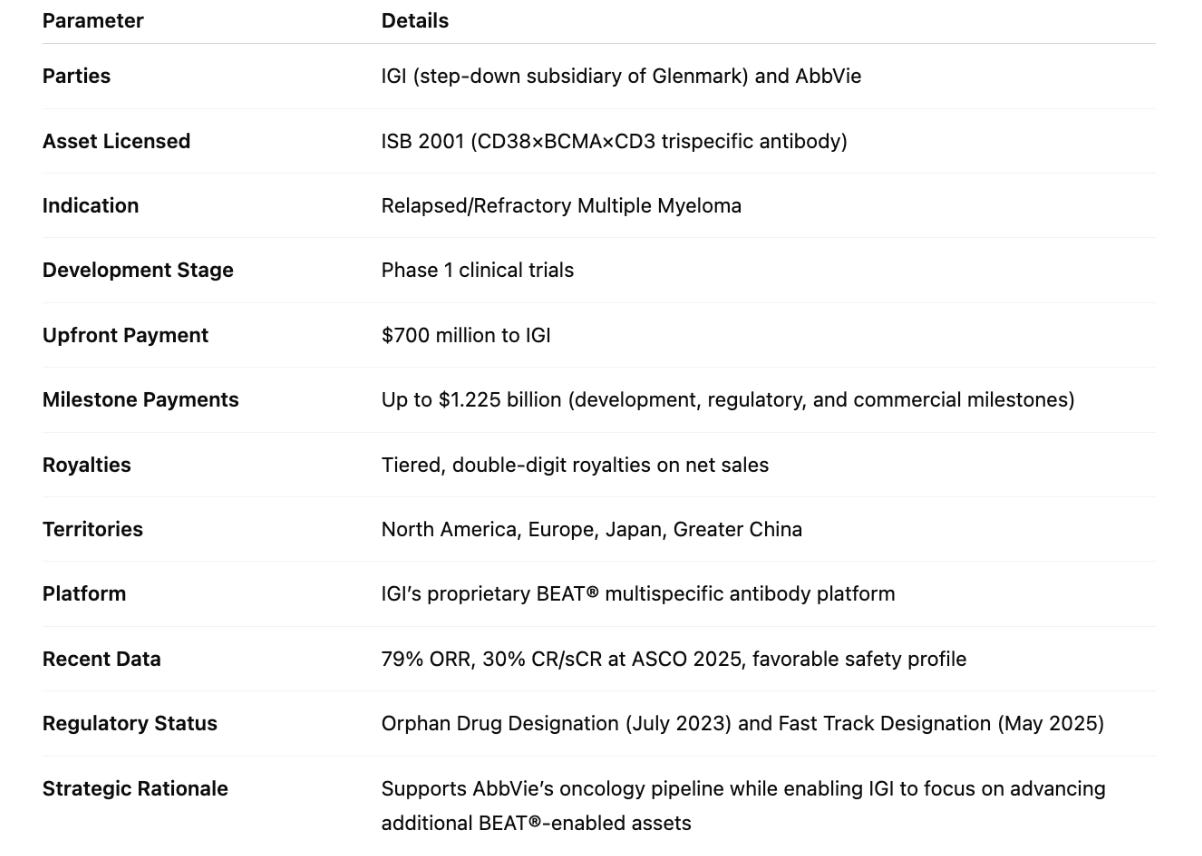

Glenmark – AbbVie Licensing of ISB 2001

Glenmark’s step-down subsidiary Ichnos Glenmark Innovation (IGI) has entered an exclusive global licensing agreement with AbbVie for its lead asset ISB 2001, a first-in-class CD38×BCMA×CD3 trispecific antibody targeting relapsed/refractory multiple myeloma. AbbVie will develop, manufacture, and commercialize ISB 2001 in North America, Europe, Japan, and Greater China. IGI will receive $700 million upfront, with potential milestone payments of up to $1.225 billion plus tiered double-digit royalties on net sales

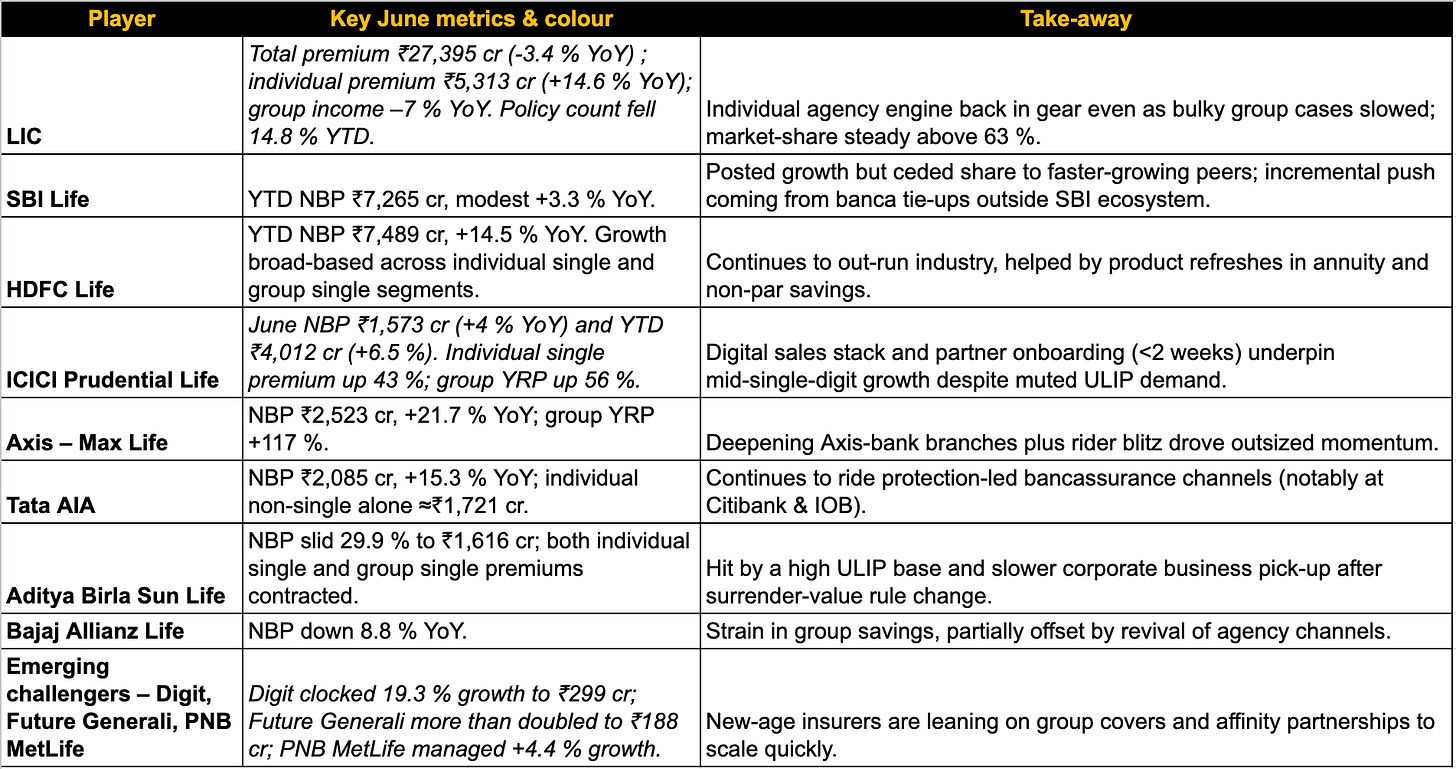

Life Insurance Business updates

Industry at a glance

New-business premium (NBP) for June came in at ₹41,117 cr, down 3.1 % YoY. A heavy base in group single-premium dragged the aggregate; nevertheless, on an FY-26 YTD basis (Apr-Jun) the sector is still up 4.25 % at ₹93,544 cr.

Private insurers kept the engine running – their YTD NBP grew 5.72 % to ₹34,134 cr, even as LIC still controlled 63.5 % of June premiums.

Mix shift continued: group single-premium remained the work-horse (₹26,038 cr; 63 % of June NBP) while the fastest growth came from group yearly-renewable plans (+61 % YoY).

Conclusion

As we wrap up this edition of Investor's Edge, it's clear that the business landscape is dynamic and full of opportunities. From the cautious optimism in the IT sector's demand recovery and AI adoption to the massive growth headroom in India's cable and broadband, and the strategic plays in real estate and wealth management, staying informed is key. The shifts in the jewellery retail market and the evolving dynamics of the life insurance sector further underscore the importance of nuanced insights.

We'll be bringing you more interesting insights every alternate day, so you won't miss a beat. Stay tuned! Do subscribe and stay tuned to this curated insights, sharp observations, and key developments shaping the business world.