Fluorination Temperature Check: SRF vs Navin vs GFL

8 mins readPublishing Date : 2022-11-29

Here is another Temperature Check for Fluorochemical Industry. Before we begin, let's understand the need for Temperature Check - Basically, when you feel gloomy or sick you wonder what you ate or drank the night before. Usually, we check the temperature of the body so that it’s not a fever. There are certain criteria that help you know the actual cause and happening of that incident.

Indian chemical manufacturers are poised to emerge as a credible alternative and, in some cases, primary suppliers to global firms. While all players in the Indian chemical industry would benefit from this shift, specialty chemical manufacturers could gain the most due to higher entry barriers and the potential for value-added niche products.

So here is the Temperature Check for the Fluorochemical Industry whereby reading certain pointers about these top 3 companies that hold a major part of the industry you will have a better understanding of the entire sector and the company that looks favorable to you.

Global Fluorochemical Industry Overview

Fluorochemicals comprise fluorine, an incombustible, viscose, and dense chemical that are reactive, electronegative, and tends to form stable compounds. These attributes make fluorine integral to several industries (cooling, refrigerants, dyeing, automotive, electronics, agriculture pesticides, herbicides, insecticides, textiles, electronics, and pharmaceuticals). The fluorochemicals industry is expected to grow at a CAGR of 5.2% to an estimated US$ 25.1 billion between now and 2026.

Fluorination In The Refrigerant Industry

Refrigerant gases are indispensable to air conditioning and refrigeration systems, and a variety of discrete synthetic chemicals many containing fluorine in their chemical architecture are deployed for this purpose along with blends. The market for these gases has been growing except for some disruption due to COVID-19, but the choice of one refrigerant over another has been driven majorly by regulatory pressures.

Fluorination In Pharmaceuticals, Agrochemicals and Other Applications

Fluorinated organic compounds are of interest in the pharmaceutical and agrochemical sectors. Fluoro pharmaceuticals and fluoro agrochemicals are utilized in the manufacture of drugs and pesticides, which are finding increased acceptance. Around 20% of pharmaceutical compounds and 34% of agrochemicals contain the fluorine atom.

The application of fluoro-organic compounds can be attributed to their unique metabolic stability, lipophilicity, and binding affinity offered by them. The market size of the therapies in which fluorine is used is expected to grow at a 5% CAGR, from US$ 423 billion in CY20 to US$ 535 billion in CY25. By statistics, 22% of the drugs approved by the FDA in the last two decades contain at least one fluorine atom, on average. Further, 53% of pesticides introduced during 1998-2020 contain the fluorine atom.

The global fluoropolymer market is forecast to witness over 10% CAGR by 2024. The segment accounted for over 15% of the industry share in 2015. Heat resistance, durability, and high strength are key properties to use the product in fire safety equipment in automobiles and aircraft. Within the fluoropolymers, PTFE and PVDF will be the highest growing segment owing to increasing consumption in electronics and aerospace industries for insulation and coatings. Commodity Fluoropolymers are dominated by China and Value-added ones are with Western companies.

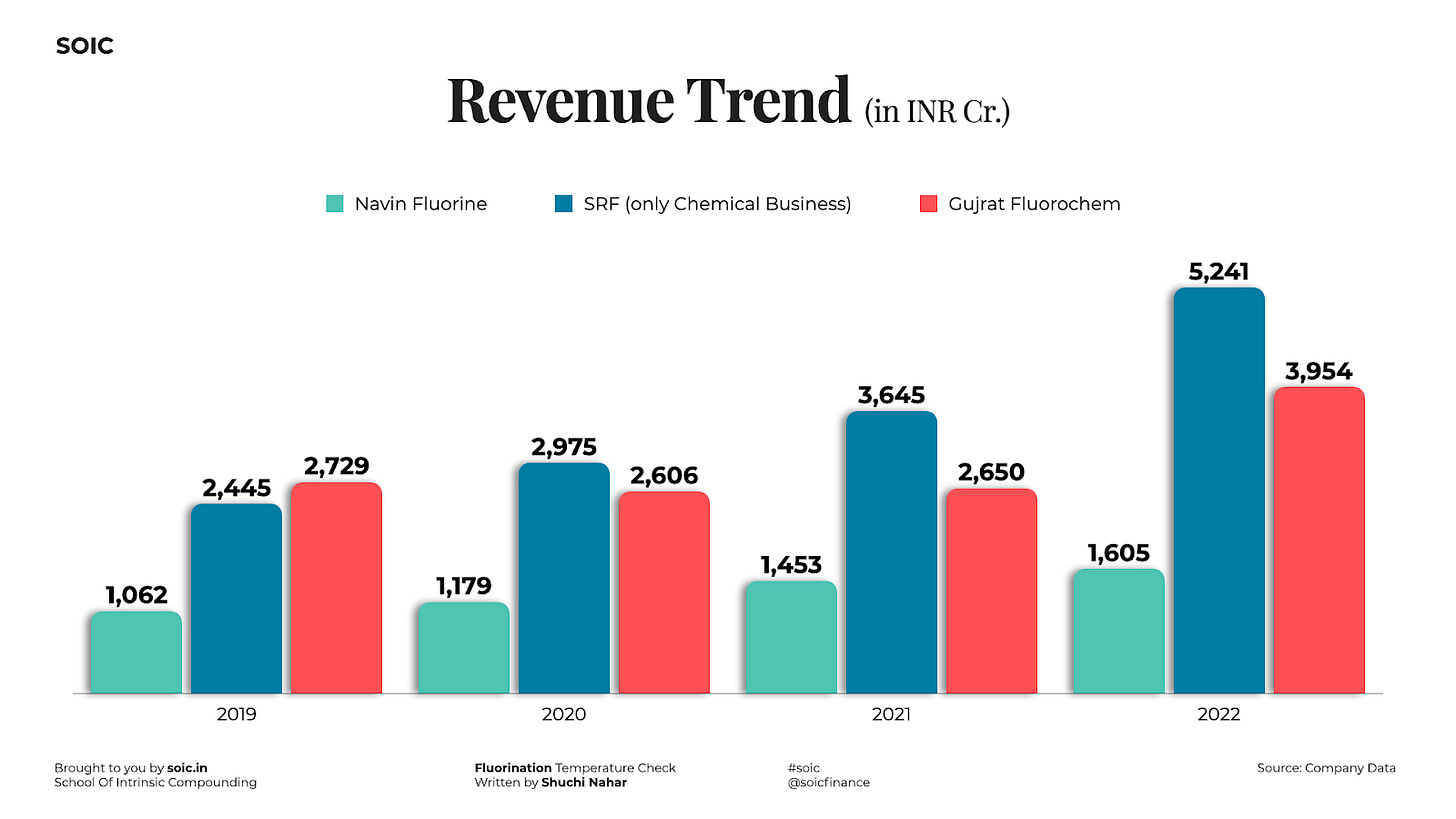

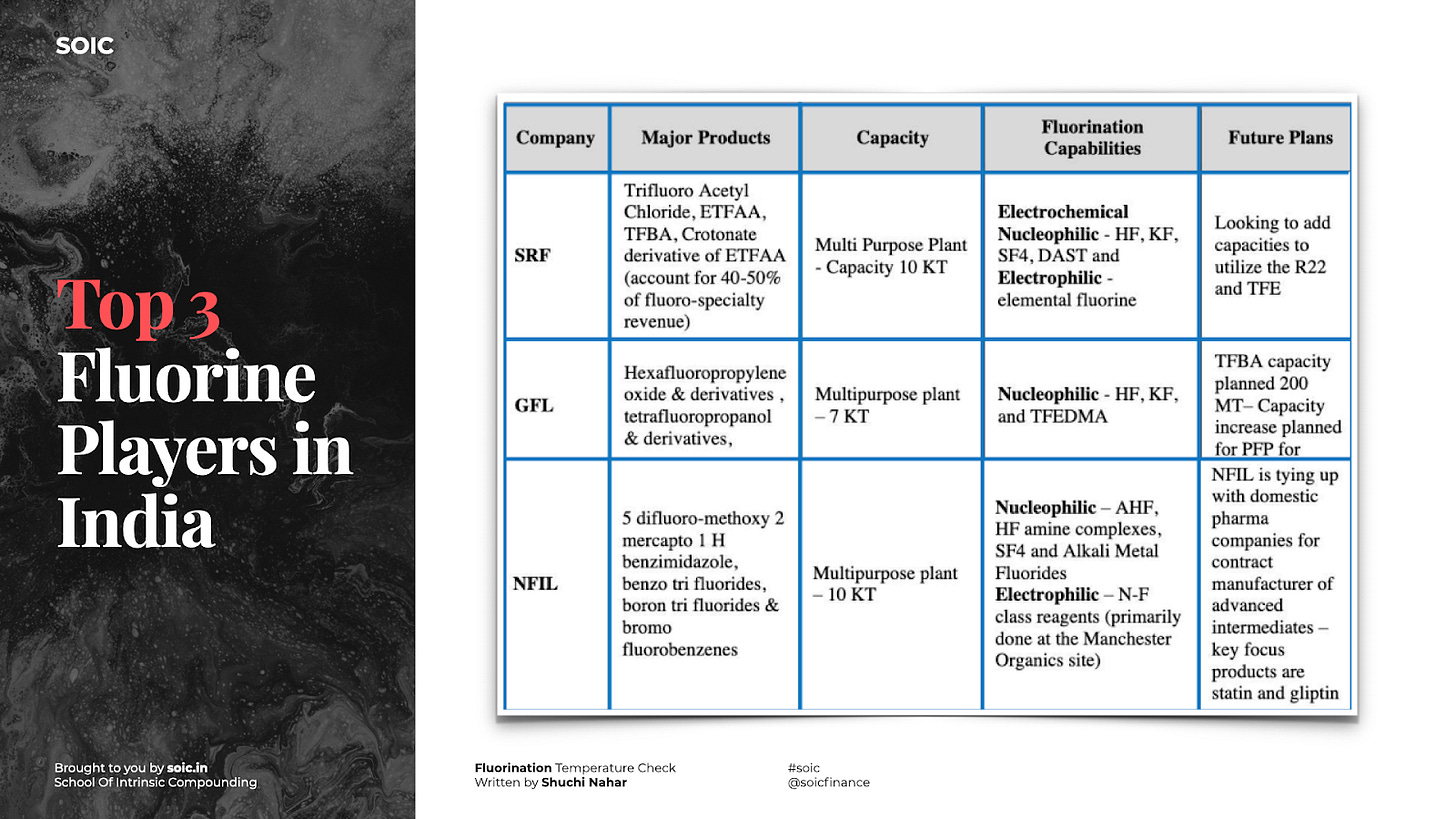

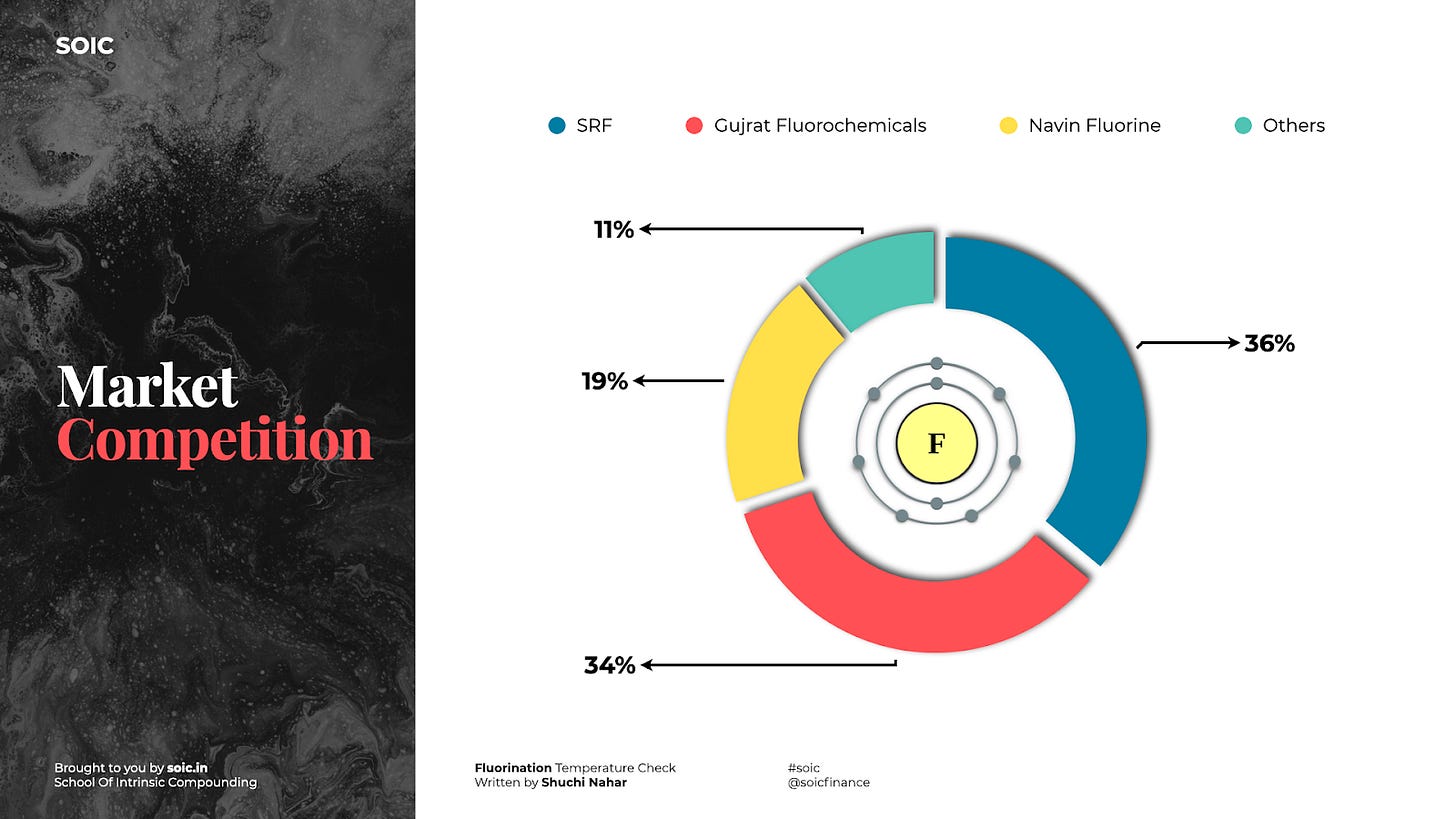

Top 3 Fluorine Players in India

Indian Fluorochemicals Market

What Are the Different Types of Products Within the Fluorine Industry?

Fluor specialty used in Agro, Pharma, Industrial, and other uses. High Margins

Fluoropolymers - Commodity-grade and value-added. Commoditized + High Margins in VAP

Inorganic Fluorides - Used in the steel and glass industry. Low Margins

Industrial chemicals like Chloromethane.

Pharma Propellent - Used in Metered Dose Inhalers as a propellant. Only SRF can make this.

CRAMS for Pharma - Navin is doing. High Margins

Navin Fluorine International Ltd

Navin Fluorine does contract manufacturing for Pharma innovators and has many biotechs as its clients. Currently, there are two molecules under commercial production. Navin Fluorine is an intermediates manufacturer under this division of the business. Navin is also planning to do forward integration into the API. Navin Fluorine has 3 cGMP Plants for this and will be setting up an additional one will be debottlenecking the third plant.

Honeywell 2.0 plant + HFC will drive growth in the next few years –

Honeywell contract revenues were at Rs600mn in Q2FY23; it was hit due to the unavailability of a key raw material (CTC). NAVIN’S has a long-term contract with a supplier whose CTC plant commissioning was delayed but has now been commercialized. The company expects full revenue delivery (Rs1.1bn per quarter) to start from Q4FY23. Honeywell's contract margin should also improve as it was impacted due to the higher price paid for CTC (which NAVIN’S had to buy from the spot market), and operating leverage from the rise in plant utilization.

NAVIN’S will start discussions with Honeywell on doubling its HFO (intermediate) capacity in CY23 the plant should take another 18 months to commercialize. The company has provisioned adequate land in Dahej for this purpose.

HFC is an exciting opportunity for NAVIN. The company has announced its R-32 plant commissioning by Q1FY24 with an initial capacity of 4 ktpa. It has evaluated plans to add another 30 ktpa capacity in R-32 using efficient liquid phase technology, but the plant may take 5-6 years to reach breakeven, due to demand-supply imbalance. The plan would involve an investment of Rs10bn and is now put on hold.

HFO will remain a long-term opportunity for Navin. The company is in discussion with Honeywell for the supply of HFO blends in India and the Middle East markets where NFL has a strong presence / established distribution.

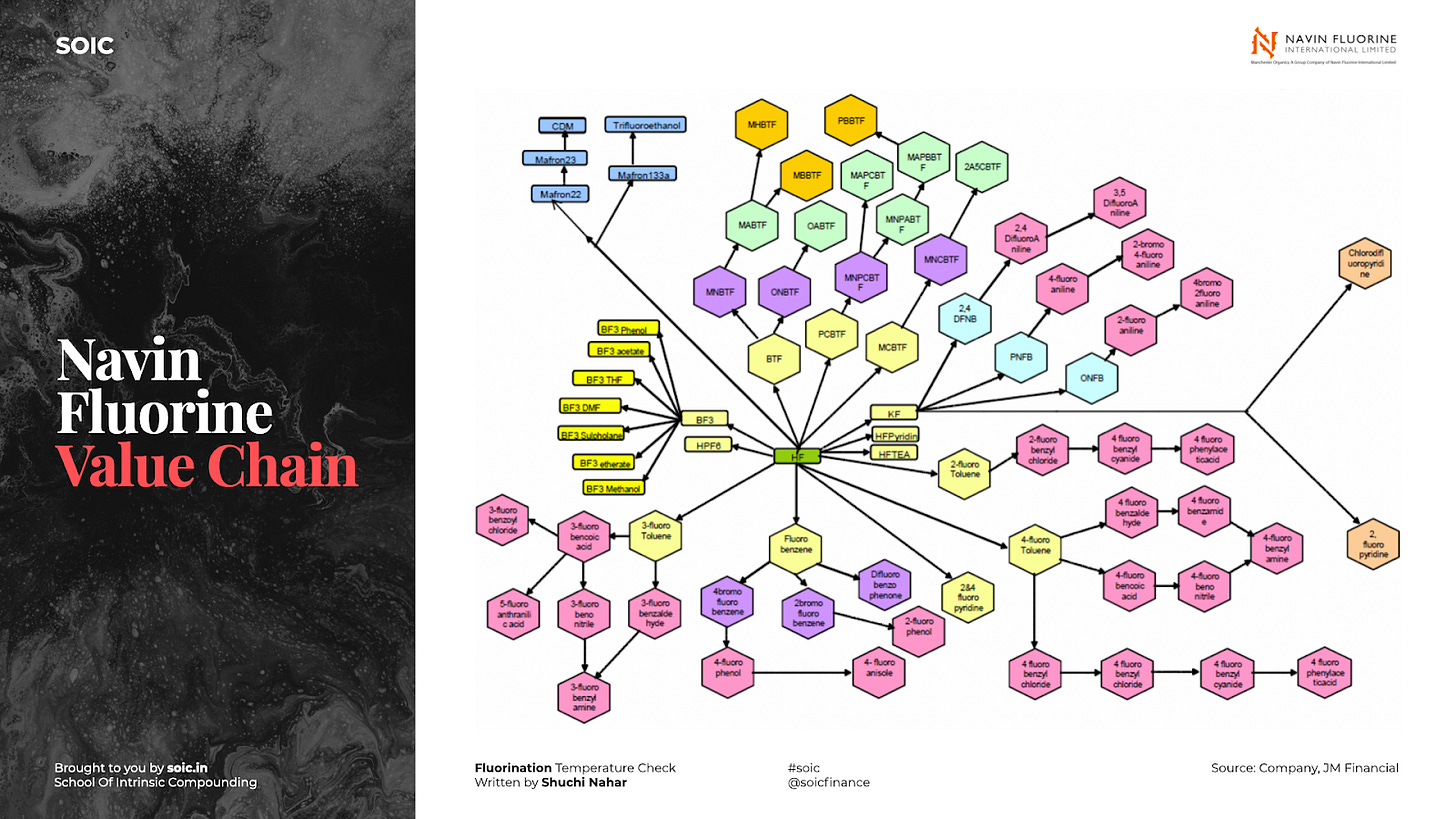

Chemistry

Navin Fluorine International Limited has developed competencies in the fluorine chemistry space across decades. The Company’s long-term contracts with supply intermediate in the pharma and agrochemical industry validate its capabilities. A specialization in fluorination, coupled with expertise in synthesis, will empower the Company to capitalize on opportunities arising from the pharma and agrochemical industries.

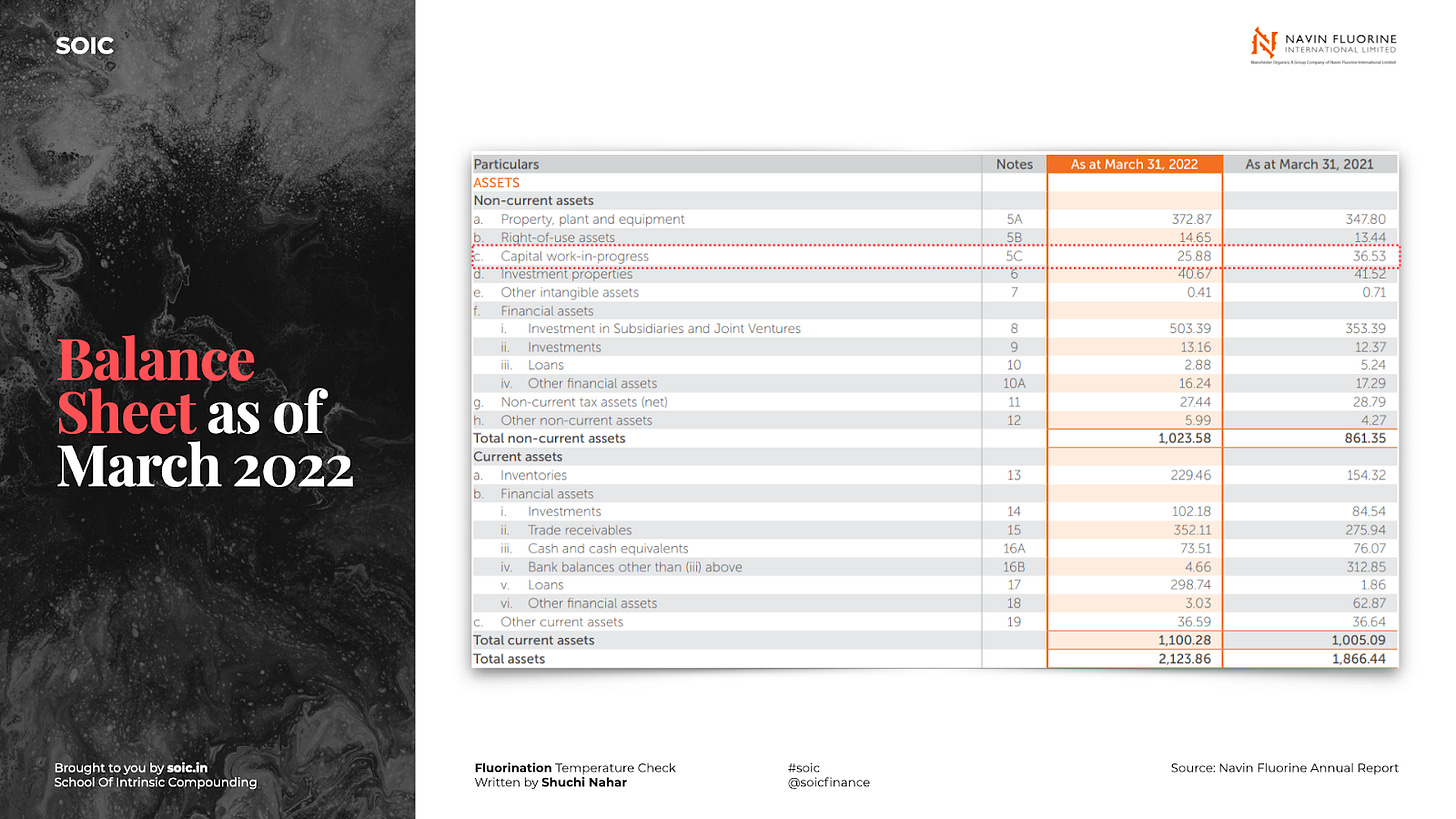

Balance sheet as of March 2022

Number of CAPEX announced by the company

Company harbors CAPEX ambition of >Rs18bn over CY24-CY25 in addition to the Rs17bn-18bn it is already implementing over CY21-CY23.

The company has expanded research capacities in Dewas by adding analytical validation laboratory facility along with an increase in the team of scientists and a CAPEX of 70 crores is approved for further augmenting R&D and pilot facility at Surat. Dedicated plant worth 120 crores will lead to 160 crores of revenue.

MHPP segment faces a big opportunity in R-32 (NFL's announced capacity: 4ktpa) more such MPPs and Dedicated Plants are possible. MPP worth 195 Crores which will lead to 260-280 crores of revenue. Large Quantum of CAPEX in new age refrigerants gas.

NFIL has announced R-32 capacity addition with CAPEX of Rs800mn and potential revenue of Rs2bn.

Debottlenecking CAPEX of Rs. 80 Crores approved by the board for a new molecule in the HPP business unit in Surat.

$410 Mn Multi-Year Contract in High-Performance Product (HPP).

The complexity of fluorine chemistry has also increased with up to six fluorine atoms in a molecule. Only a handful of global players have technical expertise in fluorochemicals. Navin has already commercialized a hexafluoro (6 atoms) platform in pharma.

The Company is looking to raise debt to fund CAPEX. This is the first time Navin will be doing this in the last 5 years. Clearly outlining the growth opportunities in front of the company.

Optionality from Electric Vehicles and Other opportunities

Long-term target of $100 million revenue of Crams (760 crores).

Large Quantum of CAPEX in new age Ref Gas

Upcoming de-bottlenecking and cGMP Unit 4. Capex spends to be close to 500 crores.

Working on HPP Intermediates and HPP has water applications. Opens Fluoropolymers space for Navin Fluorine.

Navin is working on 2 Lithium Based molecules in Hexafluoride chemistry. One of the molecules is in collaboration with a French Company. The molecule is manufactured through the Organic route and is touted to replace Lithium.

Company is executing projects worth 18cr on top of this they might be looking for QIP

Navin’s value chain

Product Pipeline

Specialty chemicals will have the biggest opportunity on the back of Navin’s deep relationship with 3 agrochemical companies, and emerging opportunities in niche chemistry with companies such as 3M. CDMO's ambition of reaching revenues of US$100mn will find support from the upcoming cGMP-4 plant, which will have larger reactors, and likely late-stage CRO contracts. Electronic chemical applications focused on India market are likely emerging opportunities from FY25 onward.

HPP segment faces a big opportunity in R-32 (Navin’s announced capacity - 4ktpa). There is also big potential in HFO/blends in India and the Middle East in partnership with Honeywell. Navin’s expects a doubling of the Honeywell contract.

The company is working on its fourth business segment: electronic chemicals. This product group will focus on application business in battery solutions, semiconductors, and solar industries, largely in the India market.

Navin Fluorine is primarily into manufacturing of R-22 with a capacity of 9,000 tonnes out of which 40% is exported to the Middle East and South Africa and balance is sold in India. Navin has 20% market share in India. Navin Fluorine's customers include premium A/C manufacturers such as LG, Samsung, Voltas and from other industries like Reliance, Piramal, Godrej etc.

Navin also imports R-134a from China and sells it in India under the brand name – Mafron. This business segment is prone to seasonality. The season for refrigerants typically starts in June/July depending on when the monsoon begins both in India as well as Middle East.

Application

The Company’s speciality chemicals business produces niche fluorine-based molecules, with downstream applications across crop science, pharma key starting materials, and industrial chemicals. Market applications such as automotive, oil and gas, pharmaceutical, and transportation industries.

Top Customers

Navin Fluorine's customers include premium A/C manufacturers such as LG, Samsung, and Voltas and from other industries like Reliance, Piramal, Godrej etc.

Navin Acquired Manchester Organics

Manchester Organics Ltd established in 1996 has a strong legacy in fluorination & high special chemistry. On one side, MOL directly works with innovative pharma companies on the milligram to the multi-kilo research phase. On the other, Navin has capabilities of CRAMS with experience in multi-hundred kilos to multi-ton production.

MOL brings access to global innovator pharma companies and to cutting-edge fluorination chemistries which enhances the value-added product portfolio of CRAMS & specialty chemicals.

Many molecules which started off with Manchester Organics are now getting commercialized in Deva's facility. In 2011, MOL had a catalog of 8,000 chemicals. Fast forward to 2020, and this catalog has grown to 51,000 chemicals.

Risk

Contract execution of big contracts

Navin’s capability to scale MPP products into dedicated plants

Cross-selling of value-added products to existing customers

Anticipation of cGMP-4 plant soon to drive growth in CDMO

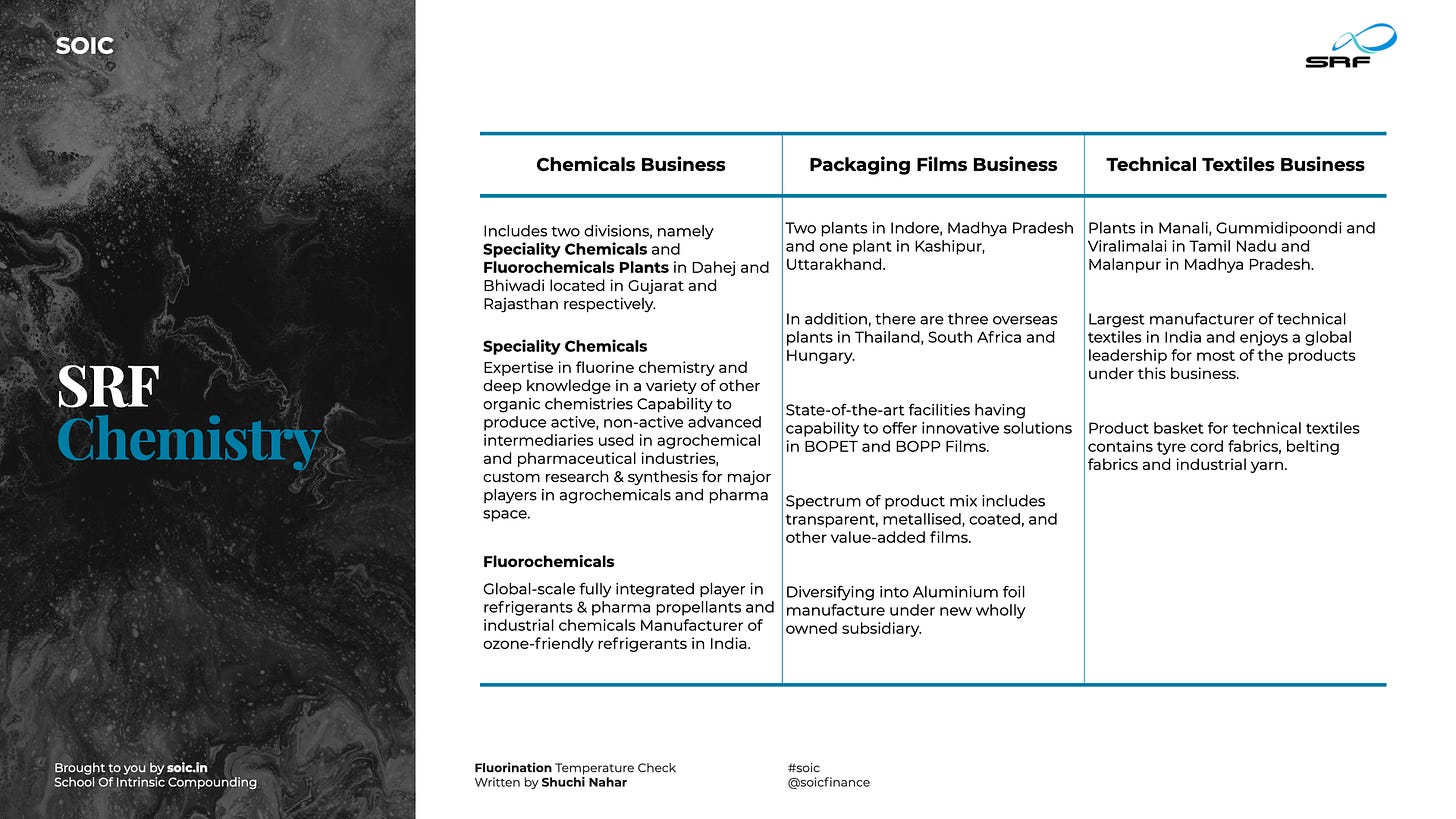

SRF

Incorporated in 1970, SRF started with nylon cord tires and thereafter diversified into refrigerant gases, specialty chemicals, and packaging film to name a few over time. The Chemical division forms 43% of overall revenue followed by packaging film (39%), technical textile (15%), and others (3%). The company exports to more than 90+ countries. Revenue from the international market constitutes 57% of overall revenue while the rest is from the domestic market segment.

Anti-Dumping Duty on Chinese Supply in India. Both Navin and GFL not expanding in HFCs. Production cuts are to start in India in 2032. China is required to freeze production capacity for all HFCs in 2024 before slowly phasing-down production to just 20 percent of current levels by 2045. A replacement Market will still exist for the products. SRF is the only Indian Company with that wide Portfolio of HFC Gases, HFO's and HCFC's.

Chemistry

Capex

Continuous CAPEX towards speciality chemicals on the back of higher consumption of fluoro compounds across agrochemical and pharma to support strong business performance in years to come. The board has approved a Capex of Rs. 604 crores for four new agrochemical plants and capacity expansion for an existing plant in Dahej. These initiatives, which are components of their broader speciality chemicals business expansion strategy are expected to come on stream within the next 10 to 12 months.

For speciality business companies YTD announced CAPEX of ~1250 crore. They are well on track to fulfil the stated objective the company had spoken of earlier.

The board has approved a project aggregating. 604 crores for four new plants in the agrochemical space and capacity enhancement of an existing plant at Dahej. The proposed capacity addition is ~4000 MTPA and the estimated period is 10-12 months.

The mode of financing is a mix of debt and internal accruals. The project is basically a margin expansion project and will probably be dedicated to AI.

In addition, the board has approved a project to develop a Kilo Lab at Bhiwadi to address the needs of the pharma market at a projected cost of 9.8 crores.

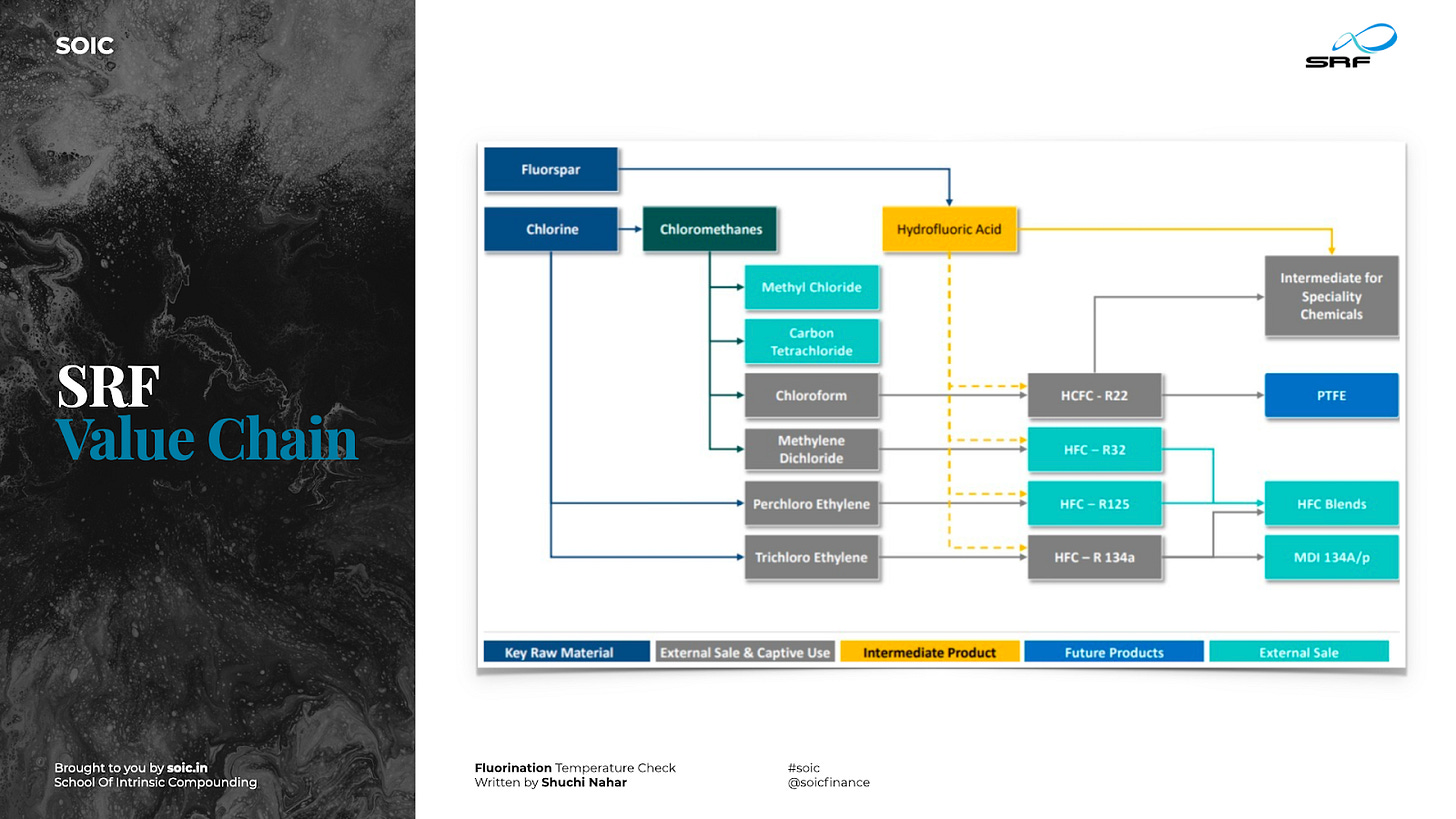

SRF Value Chain

Product Pipeline

During the year FY22, the company launched 4 new products in the agrochemicals and 2 in the pharmaceuticals segment during the year. In addition, the company is also seeing traction in the Active Ingredients (AI) space and building its capabilities on this front.

From Speciality Chemical Business the company launched three new agro products and one new pharma product in H1FY23. Strong customer engagement on more complex and downstream products. Focus on the launch of new products including MPP4.

On the Fluorochemicals, the front company focuses on ramping up sales of the new CMS plant and product approvals for the upcoming PTFE plant.

On Packaging Films, the Business focus lies on enhancing sales from the new BOPP film line in India and expanding the value-added product portfolio. SRF plans for inorganic growth opportunities in packaging films. The aluminum foil business provides SRF an opportunity to service customers as a one-stop shop for their packaging material requirements.

SRF has announced Rs15bn CAPEX in the next 18 months in specialty chemicals business, which will help double its fluoro-specialty revenues. The agrochemical space, and fluorine chemistry, is getting crowded with competitors, SRF believes it is rising in the value chain with 8-9 AIs under development.

Application

Fluorochemical has its Product application in room air-conditioners, pharma, automobile air-conditioners, refrigerators, and chillers.

Packaging Films Business applications in fast-moving consumer goods, Food & Agro, confectionery, soaps & detergents, solar panels, labeling, overwraps, embossing, etc.

Technical Textiles Business is used in varied applications, such as tyres, seatbelts, conveyor belts, and other industrial applications. Technical Textiles business offers a wide range of high-performance reinforcements, covering both nylon and polyester yarns and fabrics for diverse non-consumer and lifestyle applications.

Top customers

Acquisition

SRF acquired the Dymel® HFA 134a/P medical propellant brand from DuPontTM in January 2015 along with the technology to convert its technical grade of F 134a to the propellant grade.

In the process, it became one of the few manufacturers of Pharma grade HFA 134a/ P in the world which is used in Metered Dose Inhalers as a propellant.

Risks

· Faster than expected CAPEX aiding stronger earnings growth

· Further increase in ref-gas prices downside risk

· Higher than expected drop in non-chemicals business margins

· Higher than expected dip in ref-gas prices

Gujarat Fluorochemicals Limited

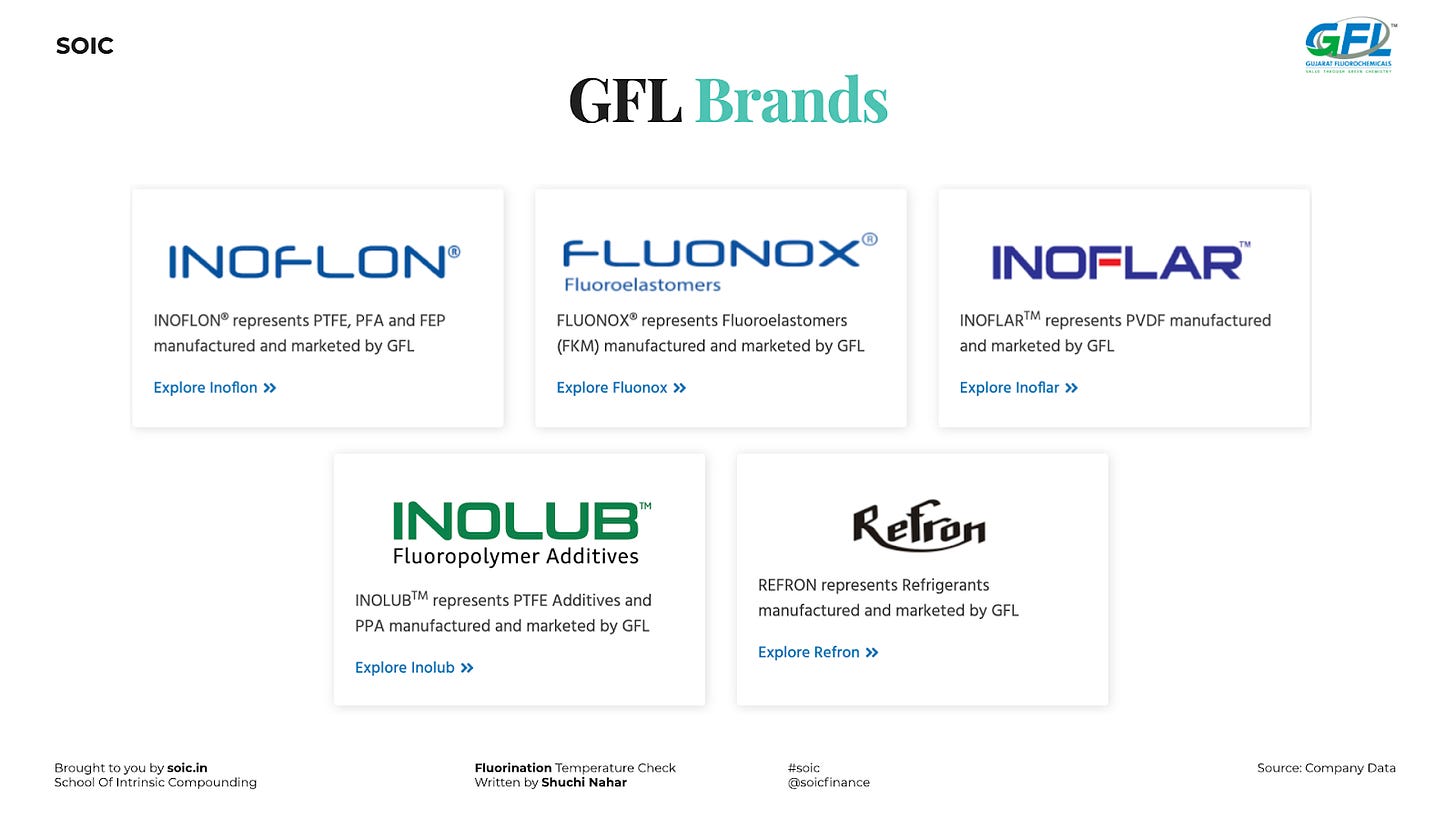

Established in 1987, Gujarat Fluorochemicals Limited (GFL) has emerged as one of the acclaimed and major players in the Fluoropolymers, Fluorospecialties and Refrigerants space on the strength of relentless R&D, deep integration across the value chain and a culture of professionalism.

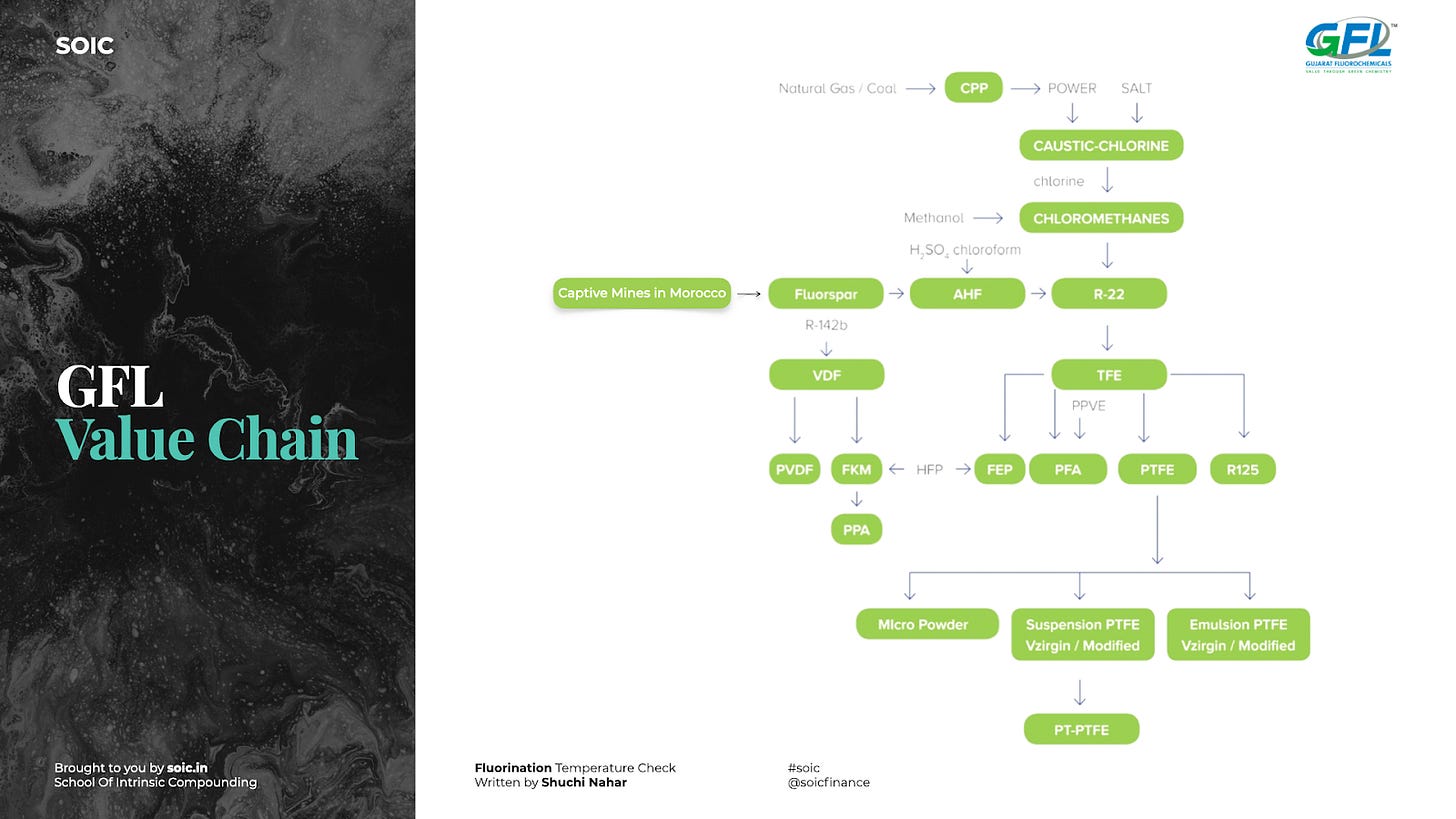

GFL’s PTFE production capacity is 18ktpa, and it plans to expand to 21ktpa via debottlenecking in CY23. It has sufficient TFE / R-22 capacity to support higher PTFE production.

85% of the PTFE sold by GFL is in the value-added grades where Chinese presence is limited. Europe and US are key markets for GFL (it has strong sales teams, warehousing services, and a large basket of product approvals in the two regions). We believe the company was making painstaking efforts over the past decade, which helped scale up the business.

The company has brands like INOFLON, FLUONOX, INOFLAR, INOLUB & REFRON

Chemistry

Gujarat Fluorochemicals Ltd, Dahej is India’s only Fluoropolymer producer and among the top few globally. It is also a major supplier of Fluoropolymers to Europe and the USA. Company has expertise in Fluorine Chemistry, full vertical integration right from natural minerals to value-added Fluoropolymers, and strong R&D have been the cornerstones of our success.

The company will continue its focus on building a business with green chemistry, enhancing its value-added portfolio, driving cost efficiencies, and expanding its global presence.

Fluorochem value chain

Capex

Ranjitnagar has made further investments in capacity expansion of R142b refrigerants grades used for thermostatic control switches, the intermediate of aerial propellant, and the important raw material for vinylidene fluoride. Business volume is expected to increase further from 2022-23.

Gujarat Fluorochemicals Ltd is currently investing and has planned Capex towards expanding its capacities for Chemicals for backward integration, Fluoropolymers, and New Age Products. The company has planned CAPEX for FY-2022 Rs. 660 Cr. FY-2023 Rs. 1250 Cr. FY 2024 Rs. 1250 Cr.

New fluoropolymer – 2 new additional reactors for FKM to get commissioned in Q3FY23 whose sales would be reflected from Q4FY23. Capacity addition plans for FKM to be at 200 tpm and for PVDF is 100 tpm. It intends to do CAPEX for R32 with 10,000tpa of capacity to the tune of INR 1,250 Mn. R32 will act as a replacement to R22 gas. PFA will see additional capacities by March 24 up to 2400tpa.

FY24 CAPEX also includes investment into the integrated battery chemicals plant. However, the company believes a large opportunity for investment may arise post-FY25 as its battery chemicals business gains traction.

Post FY25, the company anticipates significant CAPEX allocation to for battery chemicals and backward integration of essential chemicals. In the near term, it has already identified a supplier of lithium carbonate, but for future expansion, it is also evaluating backward integration into lithium carbonate production.

GFL has secured approval for large FKM grades and is considered a reliable supplier due to backward integration for R-142B. The company is in the process to expand its FKM capacity from one reactor in FY22 to seven by FY23-end. This should take FKM's total capacity to 7ktpa, and the company has said the entire capacity is pre-booked. The current realization is strong at ~US$30/kg.

For PVDF incremental capacity expansion targeted at battery grade. GFL has one reactor (1.2kpta), which caters to demand from the coating and moulding industry. Demand for PVDF has surged due to its use for binding purposes in lithium-ion batteries. One GWh of battery production need 50te of PVDF for bidder. GFL has developed battery-grade PVDF and believes (from internal assignments) that its product quality is equivalent to global peers.

It has sent its PVDF for certification and approval from Chinese battery manufacturers and a few others, but the company’s medium-term target will be to grow its market share in India, US, and Europe. The typical approval cycle is 3-4 months.

Company expects to commission four reactors by FY23, which will take its total PVDF capacity to 4.8ktpa. In the medium term, it anticipates PVDF capacity to jump to 12ktpa, with 9.6ktpa likely dedicated for battery grade. Realisations are elevated for PVDF in the current situation due to significant demand-supply mismatch.

GFL anticipates significant PVDF capacity expansion to happen post-FY25 onwards as battery capacities ramp-up in India, Europe and US.

GFL has already restarted its R-125 plant (via the TFE route) with a total capacity of 6ktpa. It believes R-125 demand may start tapering in the next 4-5 years as it has a very high GWP. It has also announced a 10ktpa capacity in R-32, which has low GWP, and expects the product to be in use for a very long period (probably till CY40).

The company is confident of starting the plant before Dec’23 post which new capacity addition for emissive use will be frozen globally. R-32 will also allow GFL to produce R-410a (made by an equal mixture of R-125 and R-32), which is the most popular HFC for RACs today.

GFL has already started discussing with potential battery manufacturers in India, particularly with players who have applied under the PLI scheme. It also expects to produce sodium-based electrolyte salt and will require a similar manufacturing setup as LiPF6.

The company plans to expand its AHF capacity from 120tpd to 220tpd, which will help supply key starting raw materials for fluoropolymer, ref-gas, and battery chemicals. It has a TFE capacity of 36ktpa post debottlenecking in TFE-3, which will take care of the requirements for PTFE, PFA, R-125, and other products.

It expects to start its VDC plant by FY23-end, which means it will buy VCM (bulk commodity to manufacture R-142B, a key feedstock for FKM and PVDF). It plans to reach ~30ktpa capacity in R-142b. Morocco mine currently produces 2ktpm fluorspar, and the company is planning to expand production to 4ktpm, which will take care of 35% of GFL’s expanded capacity requirement.

GFL’s PTFE production capacity is 18ktpa, and it plans to expand to 21ktpa via debottlenecking in CY23. It has sufficient TFE / R-22 capacity to support higher PTFE production.

Management has also indicated that the majority of its future CAPEX would be directed toward the FPs and battery chemicals. Management guided for Rs. 2,500 Cr CAPEX for the next 2 years and further Rs4,500-6,000 Cr. CAPEX for the next 3 years (primarily towards battery chemicals and PVDF) largely be funded through internal accruals.

Rs.2500 Crore CAPEX upcoming for a battery chemical complex with 1.5x asset turns. New-age verticals are higher margins in nature. Potential for margins to expand. Potential for revenue and pat growth of more than 25%. Backward integration into all the major fluoropolymers.

Catering to all new age verticals like EV, Hydrogen Fuel Cells, semiconductors, etc. RTPs might get resolved by FY23 as per the guidance. By the FY22 end, they can do 4500-5000 crores of sales with the current gross block.

GFL in its earning presentation disclosed CAPEX of Rs11.5bn for FY23, but it expects some frontloading of CAPEX for fluoropolymers during the year, so CAPEX can jump to Rs15bn. FY24 CAPEX also includes investment into the integrated battery chemicals plant. However, the company believes a large opportunity for investment may arise post-FY25 as its battery chemicals business gains traction.

Product Pipeline

Battery chemicals plant to commence by FY23-end. Gujarat Fluorochemicals Ltd is close to completing the integrated battery chemicals complex at Dahej. The plant is intended for the production of LiPF6, the most popular electrolyte salt for lithium-ion batteries, with an initial capacity of 1,800tpa to be expanded in two equal phases.

The company plans to expand its AHF capacity from 120tpd to 220tpd, which will help supply key starting raw materials for fluoropolymer, ref-gas, and battery chemicals. It has a TFE capacity of 36ktpa post debottlenecking in TFE-3, which will take care of the requirements for PTFE, PFA, R-125, and other products. It still sees more opportunity to expand its TFE capacity by debottlenecking in the future in case of requirement.

It expects to start its VDC plant by FY23-end, which means it will buy VCM (bulk commodity to manufacture R-142B, a key feedstock for FKM and PVDF). It plans to reach ~30ktpa capacity in R-142b. Morocco mine currently produces 2ktpm fluorspar, and the company is planning to expand production to 4ktpm, which will take care of 35% of Gujarat Fluorochemicals Ltd’s expanded capacity requirement.

The company’s focus will remain on business expansion only in fluoropolymers and battery chemicals in the medium term, and it does not expect any incremental investment in the fluoro specialty business (intermediate for agro / pharma products).

Application

Fluoropolymers are the most convenient and superior material to manufacture green technology applications, from wind turbines to photovoltaic panels. Fluoropolymers help in improving durability by providing protection against extreme weather and environments, including hail, rain, humidity, UV light, wind, and extreme temperatures. Fluoropolymers in newer applications such as Automobile, Telecom and semiconductor are further encouraging.

Top Customers

Entering new areas

Gujarat Fluorochemicals Ltd will be manufacturing Proton Exchange Membrane which is at the heart of Fuel Cell technology. Gujarat Fluorochemicals Ltd is manufacturing PFA which will be used in Semiconductor Manufacturing. Rs.2500 Crore CAPEX upcoming for a battery chemical complex with 1.5x asset turns. New-age verticals are higher margins in nature. Potential for margins to expand. Potential for revenue and pat growth of more than 25%.

Backward integration into all the major fluoropolymers. Catering to all new age verticals like EV, Hydrogen Fuel Cell, semiconductor, etc. RTPs might get resolved by FY23 as per the guidance. By the FY22 end, they can do 4500-5000 crores of sales with the current gross block.

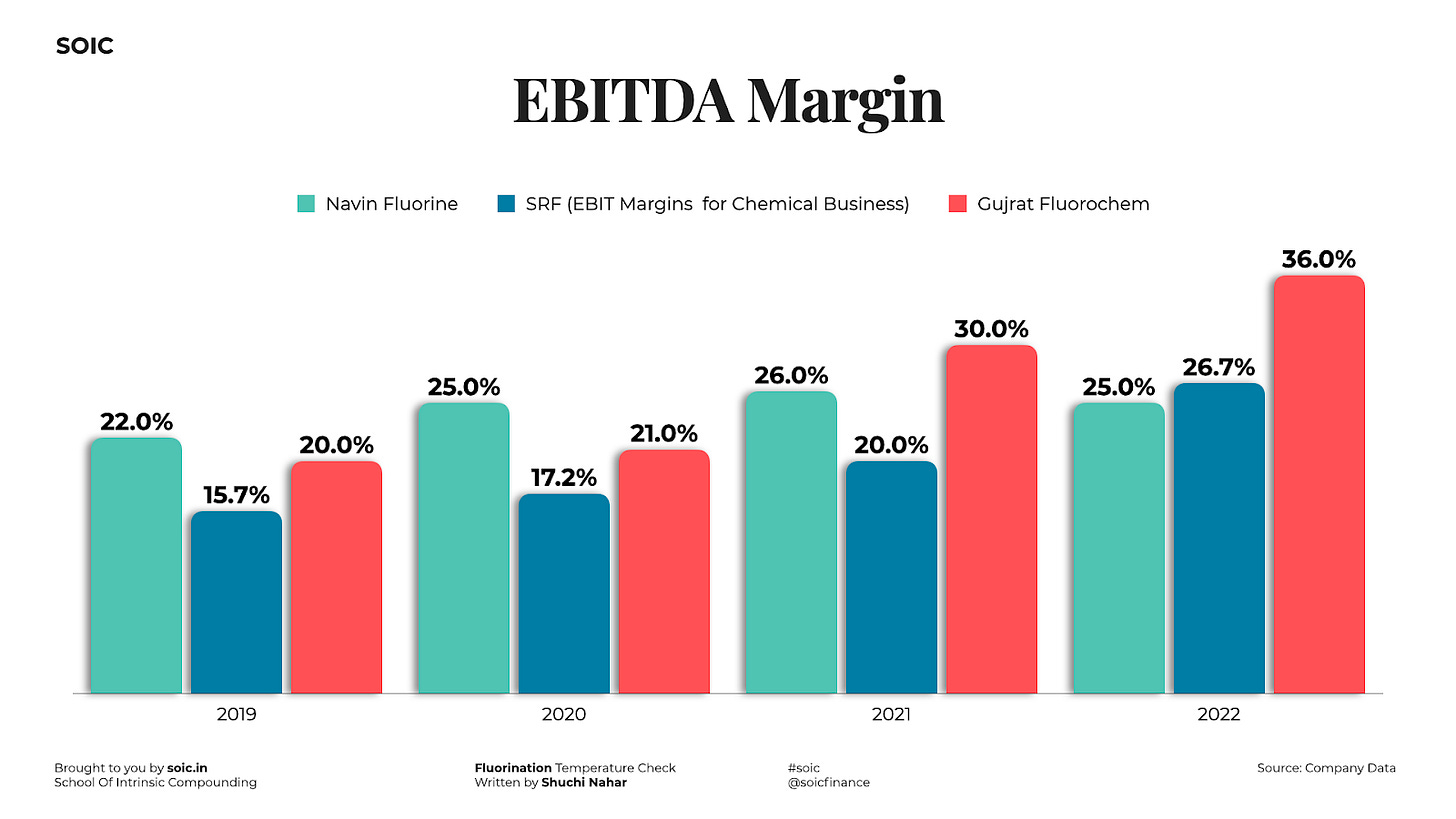

So here we come to the conclusion of our temperature check. Here after reading 3 different companies dealing with the same chemistry fluorination is still catering to different demands leading to multiple channels of products. The growing application of fluorinated organic compounds across multiple sectors including pharma, agrochemical, refrigerants, EV batteries, etc has led to significant re-rating of fluorinated chemical companies.

While these 3 fluorochemical companies have a common base in terms of fluorination chemistry, they have a differentiated business model. Gujarat Fluorochemicals Ltd has focussed on Fluoropolymers (FPs) like PTFE and new FPs. That puts Gujarat Fluorochemicals Ltd in an advantageous position as the company will be able to capitalize on increasing opportunities arising from new-age technologies like EV, Solar, 5G, etc through growing demand for PVDF, new FPs, and battery chemicals.

Navin has opted to focus on producing fluoro-based intermediates / APIs for Agri / pharma applications. On the other hand, SRF has created a significantly diversified business model with a focus on Ref Gas and fluoro-based intermediates /APIs along with packaging and technical textiles.

Risk

Slower than expected ramp-up in capacity utilization

Faster than expected drop in prices

Completion of HFC project before capacity addition freeze kicks in (Dec’23)

Impact of Caustic soda prices

AUTHOR

Shuchi Nahar

Masters in Finance with 5 years of industry experience. My approach is to take one sector at a time and explore plausible Investment ideas.