Ganesha Ecosphere: Turning Waste into Wealth

“ Tell me and I forget, teach me and I may remember, involve me and I learn” Benjamin Franklin

In today’s day and age, the world is full of PET waste. The consumption of PET bottles has increased manifold around us. Here we will study a business that is more than doubling its capacity and is a waste to wealth story.

This is a special blog as this blog is written by two SOIC Tribe Members :) Recently I gave a homework assignment which was to analyse the business of Ganesha Ecosphere involving both the risks and rewards. I received more than 100+ homeworks. It was extremely challenging to select one winner. The quality of work was extremely impressive. This is why I was forced to announce 2 winners and not 1 winner. We are featuring the blogs of both so that the entire community can participate.

The Winners are: SURENDER SINGH SOLANKI & SHIVAKUMAR BIRADAR

(Both the winners will get an exclusive copy of ‘Poor Charlie’s Almanack’ and SOIC Official T-Shirts)

Please read both the analysis below and do leave feedback in the comment section.

ENTRY 1: Surender Singh Solanki

OVERVIEW

Company was originally incorporated as Ganesh Polytex Limited on October 30, 1987 with the Registrar of Companies, Uttar Pradesh at Kanpur under the provisions of Companies Act, 1956. It received the certificate for commencement of its business on April 12, 1988. The name of Company was changed to Ganesha Ecosphere Limited pursuant to a fresh certificate of incorporation consequent upon change of name dated October 7, 2011.

Presently operates through manufacturing units at Kanpur (Uttar Pradesh), Rudrapur (Uttarakhand), and Bilaspur (Uttar Pradesh) and Company also has a unit in Nepal and is currently setting up a unit in Warangal as well.

It has received ISO 9001:2015, ISO 14001:2015 and OHSAS 18001:2007 quality certifications from BSCIC with respect to (i) quality management system; (ii) environmental management system; and (iii) occupational health and safety management systems, which sights that the quality of products produced by company are top class.

The Company is in the business of recycling PET waste and it basically recycles it into Polyester staple fibre (PSF), HDPE, PP, recycled POY, FDY and recycled PET. Besides this, it is also India's leading manufacturer of value added RPET fibre and it also manufactures RPET Yarn.

Company has more than 30 competitors, but it is still ahead of all of them as it has a great Board of Directors, and it is among the very few Companies in India that ventured into such business.

Company operates in a highly innovative industry, where it has the advantage of Economies of scale which leads to better financial performance. There are more than 30 players in this Industry, but none of them are this big in size. The basic raw material used in the industry is PET waste/scrap, and this is the biggest entry barrier in this Industry which is the sourcing of PET bottles. Company collects PET waste through various vendors, and it also sources it from countries like Bangladesh, Korea etc.

COMPANY ANALYSIS THROUGH PORTER FORCES:

1. COMPETITION IN THE INDUSTRY:

Competition in the industry is quite stiff as there are more than 30 players, and all of them are fighting for sourcing the PET waste. In addition, there are a few unorganised players as well who hinder the procurement of the PET waste. The competitors of the company are JB Ecotex, Aki India Ltd, Alchemist Ltd. etc.

2. THREAT OF NEW ENTRANT:

There are very high chances that a new player with excess capital and top-notch machinery disrupt the industry, and the Government regulations are also not that strict when it comes to this Industry.

3. THREAT OF SUBSTITUTE PRODUCT:

There are very high chances in this industry that the product can replace each other quite easily as RPET competes directly with Virgin PET and Cotton. Price rise in one can shoot up the demand for another, and it's currently happening that the demand for Polyester is more as the Cotton prices are up.

4. BARGAINING POWER OF SUPPLIERS:

The suppliers don’t enter into a fixed contract with the Company as a result the timely and prompt supply of PET waste is not possible. Sourcing of raw material (PET Bottles) is the real game changer in this industry.

5. BARGAINING POWER OF BUYERS:

The bargaining power of power is also quite high, as the raw material prices dip the buyers of the company to start asking for relief in price, and as a result the company loses its pricing power. In order to mitigate this risk, the company from the past few years has diversified its customer base and has ventured into high volume high margin products.

FEW INSIGHTS:

Since 2018 the company has enhanced its exports significantly and as of Q4FY22 they amount to ₹128 Cr. The company gets indirectly affected by crude oil prices which are quite volatile, and it also affects its raw material, and if a situation arises, where crude prices are high and cotton prices are low, Company can get affected severely as there will be a threat of substitution. There are several cases that are filed by the company and are currently being heard by the National Green Tribunal (NGT). Moreover, Company has also launched brands named “Rivivere” in RPSF and “GO REWISE”, through which it is entering the bottle to bottle segment. Company was once cheated by one of its foreign suppliers where they had sent gravels instead of PET Waste and therefore suffered a loss of ₹26 lakh in the year 2018.

SWOT ANALYSIS:

STRENGTHS:

Operational efficiency: As the Company is able to deliver quality products to its clients, it has a pretty decent cash conversion cycle, inventory management is quite good and last but not least the working capital cycle of the company has reduced from 105 days in FY20-21 to 82 days in FY22. It is basically a commodity business so the introduction of brands like Go Rewise would certainly help the company to lift its sales numbers and increase its traction. Company gets tax benefits in India as well as in Nepal.

WEAKNESS:

Company does not have any pricing power on the supply side, as a result raw material procurement becomes a huge challenge. Company does face litigation issues because of the nature of the industry in which it operates. Industry in which the Company operates is capital intensive, therefore the company has to rely on debt to finance its operations.

OPPORTUNITIES:

Industry size is bound to grow and Company is one of the giants in this sector. Government policies are in its favour as the government wants to increase the use of recycled PET. Company also has an advantage as China banned recycling of PET in 2017 and therefore countries are looking for an alternative to recycle PET bottles. Better affordability levels, health conscious nature of consumers over the last few years, per capita disposable incomes of Indian consumers have grown at a healthy rate improving their affordability. Consumers are also becoming more health conscious. As a result, they increasingly prefer packaged and branded food/non-food items over unpacked, non-branded items, which increases demand for PET.

THREATS:

Company may face a threat of new entrant as this space is growing in India. If the prices of cotton drops significantly then the demand of products produced by the Company can go down too. Company can get itself delisted as it has previously done in UP Stock Exchange and Delhi Stock Exchange. Company can face action by NGT, which can hamper its operations. There is always a threat of fire which hampers the production and it has happened in FY17-18 as well as in FY 21-22.

INSIGHTS FROM Q4FY22:

Triggers: Company has done capex in the Warangal plant and soon it will be operational. Besides this, Company will be manufacturing RPSF, Recycled FDY and bottle to bottle chips which will increase the company's margins. Moreover, the souring of the raw material would become cheaper as previously Company used to source raw material from south to north, but now with a plant in Warangal company will get this benefit of cost. Company showed an 8% yearly growth in volume terms of the production sold. The average realisation per tonne has increased to 9218 in FY22 as compared to 7302 in FY21. Slowdown in China has helped Company to zoom its exports numbers as they have grown by 112% to ₹128 crore rupees in FY22. The bottle-to-bottle chips are expected to fetch company good margins as compared to RPSF.

Company grabbed some big international Vendors like Inditex and Target. The EBITDA/Tonne has improved as compared to previous quarters. Company was able to improve its cash cycle from 105 days to 75 days and it also improved its working capital cycle from 105 days to 82 days. Company managed to grow its Profit after tax by 54%. In Nepal, the company has started washing operations and they are currently operational. Company is working on rigid plastic as well and that operation is being run on pilot as of now. Company will add HDPE and PP to its product portfolio which will help to lift the sales numbers.

Besides this Company will be manufacturing medium tenacity fibres which will fetch ROE of 18% and EBITDA Margins of 25-30% and demand of this product is bound to grow in future.

New Government rules for brand owners and manufacturers to have 30% recycled plastic in their plastic packaging would definitely help the company to increase its sales numbers.

Operational Efficiency with introduction of renewable energy sources is likely to reduce the power cost and thereby reduction in the expenses segment which would be a boost to profitability.

Company is backward integrated and the bottle-to-bottle chips produced can get higher realisation when sold in Nepal. In order to enhance it margins company is manufacturing coloured yarns, melange yarns and some of the fancy yarns which will fetch higher margins as compared to black and white yarns, as the realisation of dyed and spun yarns ranges between ₹220-240 per kg.

Company gets raw material at a discount of 15% in Nepal where it is currently producing bottle to bottle chips and it is also getting a tax benefit of 3% (12% instead of 15%) as it is recycled. Company is also in constant hunt to add new customers to its client base and it is constantly sending samples for approval. Realisation of RPSF has improved by 20 -25% and this has pumped the sales numbers also the demand for polyester is going up. The yarn business earned EBITDA margins of 16- 18%.

CAPEX:

Company is doing capex of ₹230 Cr on spinning project and it would fetch company around ₹250 crore in Top-line. Company would be spending ₹70-₹75 Cr in yarn project and ₹125 Cr in Warangal (in total ₹425 Cr)

Management Commentary:

Management expects Warangal unit to do top-line of ₹600 Cr and Nepal unit to do a top-line of ₹75 Cr, thereby indicating that the top-line will rise surely in future and besides this the HDPE and spinning unit are expected to add close ₹350 Cr to the top-line which means that the top-line of the company would almost doubly by 2025.

The HDPE plant would fetch 20% EBITDA margins and this would skyrocket the overall profitability of the company, the ROE from the spinning plant would be 18-20%. The management is very optimistic of its bottle to bottle unit.

RISKS;

The biggest risk that the company faces is of raw material procurement, if the prices of raw material (PET waste) increases then the company would not be able to pass it on to the customers as it lacks pricing power and thus it will hamper the financial health of the company.

Secondly, the company may face a risk that it is unable to secure various approval needed for bottle-to-bottle segment and this will ruin Company’s expansion plans and disturb its financials.

Thirdly, the company has to incur high power costs and with introduction of renewable sources at few locations it might not be able to produce the same quality of products.

Company has few variable expenses that are not affected by production so if production gets hampered then this would be a huge hit on profitability margins of the company.

ENTRY 2: Shivakumar Biradar

Business Understanding:

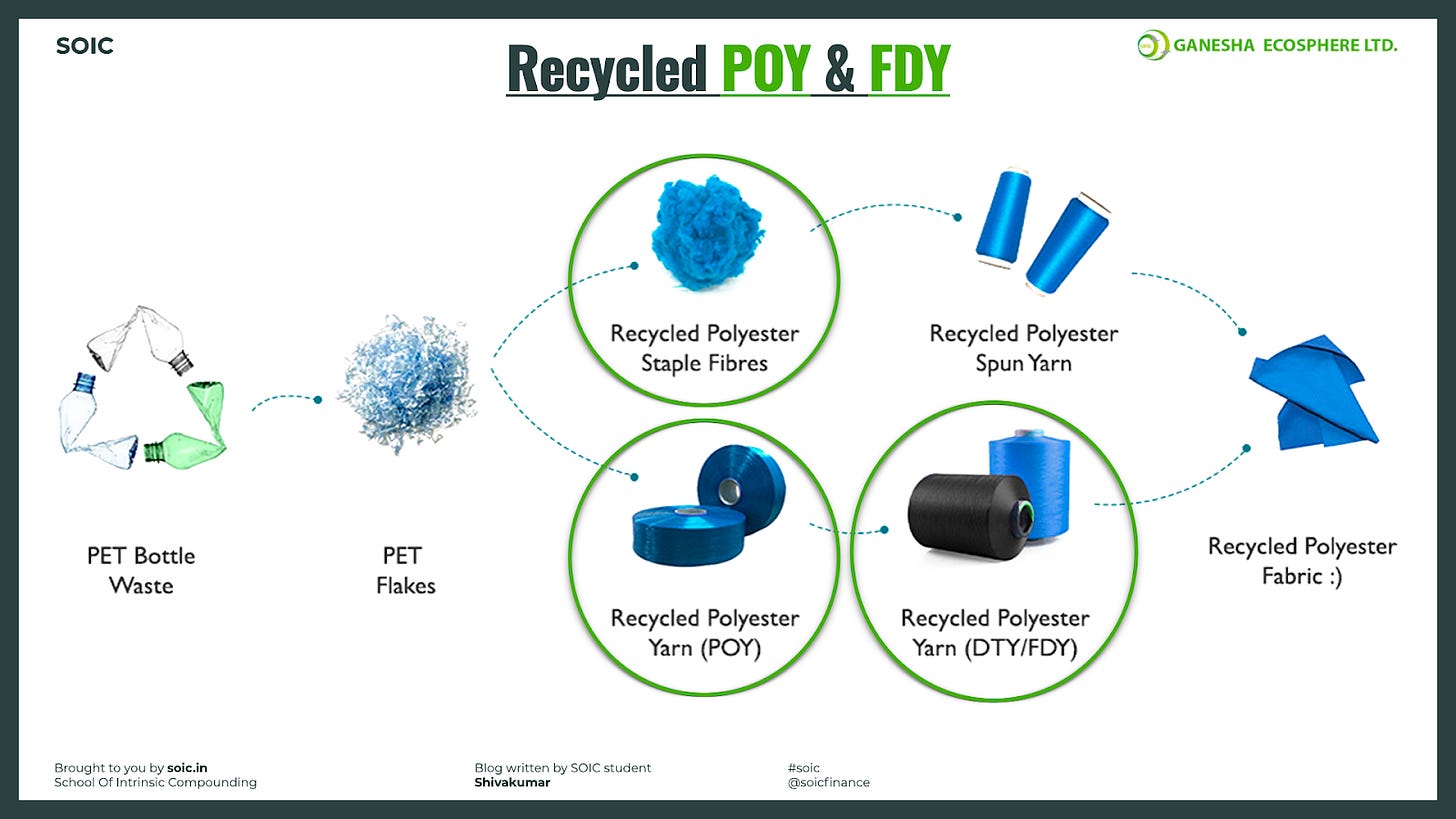

Ganesha Ecosphere Limited are into recycling of post-consumer PET bottle waste into rPET Fibre. Basically, pet bottles can be converted into 3 products roughly:

1. Recycled Polyester Staple Fiber (RPSF) – less margin

2. Recycled POY (Partially Oriented Yarn), FDY (Fully Drawn Yarn) – more margin

3. Recycled rPET (which is used for making rPET chips bottle-to-bottle grade) – more margin

Note: rPET bottle-to-bottle technology is employed to convert washed PET flakes to pure rPET pellets/chips.

What is rPET?

The simple definition of rPET is recycled PET, where the “r” stands for “recycled”. PET is the abbreviation for Polyethylene terephthalate plastic. Which is a commonly used plastic that’s found in many foods, drinks, and other consumer-product containers.

rPET is a vastly popular resin that is used to create reusable hard goods as well as polyester rPET fabric, which can in turn be made into a wide variety of clothing, bags, and other textile-based items. Equivalent in quality to virgin (non-recycled) polyester,

rPET polyester reduces the demand for new material, the use of natural resources, and the amount of plastic sent to landfills each year.

Products Usage:

Ganesha Ecosphere products are used in the manufacture of textiles (T-shirts and body warmers etc.), (non-woven air filter fabric, geo textiles, carpets and car upholstery) and fillings (pillows, duvets and toys).

Ganesha Ecosphere has 5 Manufacturing units:

1. Kanpur (Uttar Pradesh) – 12000 tons capacity loss due to fire and they are going to put up another production line which is suitable for making the recycled rigid plastic chips. (higher margin product)

2. Rudrapur (Uttarakhand) – 2nd generation recycling plant

3. Bilaspur (Uttar Pradesh) – 3rd generation recycling plant (Arvind, Trident and Vardhman clients are served)

4. Warangal (Telangana) – plans to do all 3 products – RPSF, POY & FDY yarns and rPET chips

5. Nepal (washing flakes and chips unit) - operate at full capacity by August-September, 2022

Ganesha Ecosphere possesses : (Annual Report 2021-2022)

The combined capacity of 1,06,800 TPA

96,600 TPA of rPET fibre

7,200 TPA of rPET yarn

3,000 TPA of dyed and texturized/twisted filament yarn

* global recycling sector - Growing at a CAGR of 5.1% during 2021-2026 (Annual report 21- 22)

Triggers: (Total new Sales revenue of 1000 crores)

India recycles 90% of its PET waste annually. During 2015-16, 900,000 tons of PET bottles were recycled in India – of which 65% was recycled at registered facilities, 15% in the unorganised sector and 10% was reused at home. India is more committed to PET recycling, and supporting the cause are several companies, environmental organisations, as well as the Indian cricket team. The latter even wore apparel made from recycled PET bottles in the 2015 ICC World Cup to give a big boost to PET recycling.

• Company brought down its cash cycle from 105 days to 75 days during the year

➢ Kanpur - recycled rigid plastic (HDPE, PP etc.) segment to fulfil EPR liability of brand owners & manufacturers consuming plastic packaging for their products, - pilot recycling line for rigid plastic which would be operational by July end. (300 tons per month and

can be ramped up to 1000 tons per month during the current financial year FY22)

Note: Extended Producer Responsibility (EPR) is an environmental policy that makes producers responsible for the entire life cycle of the products that they introduce on the market, from their design until the end of life (including waste collection and recycling).

2nd Trigger - In India also, regulations have been introduced whereby all the brand owners and manufacturers are required to have 30% recycled contents in their plastic packaging from FY 2025-26 and this limit would be extended by 10% every year till it reaches to 60%, i.e., by FY 2028-29

Expected Sales revenue – 90 to 100 Crores

➢ Bilaspur new unit – Expected Sales revenue – 250 Crores

➢ Warangal - Chips plant start production by July 2022 and Fibre and FDY plants can start by Sep 2022

Profit & Loss to start from the second half of the year – Q2FY22. sourcing the raw material from the south and freight element is less

Expected Sales revenue – 300 crores for FY2023 & 600 Crores for FY 2024

➢ Nepal –Expected Sales revenue - 75 Crores (washing flakes and chips unit) Hopeful to operate at full capacity by August-September, 2022

➢ margins are higher because of the lower raw material prices there because there is no recycling facility in Nepal and there is no use of the recycled material itself in Nepal

Capex size: (A total of 500+150+230+75 = 955 Crores)

1. Warangal – 300 Cr (Mar 2022) + 125 Cr + 75 Cr (Yarn facility) = Total 500 Crore in Warangal facility

2. Bilaspur – 150 Cr by FY 2024

Currently, 7200 Tons of spun yarn are made from yarn spinning units (using 28000 spindles). Additional 12000 tons capacity (new) is coming up, totalling it 19000 tons capacity.

➢ Rs 230 crore new greenfield project in 18 months

Management consciously decided to put up a spinning unit with a capacity of 34,000 spindles at Temra (Bilaspur), adjacent to our existing unit. It would be a green field project with an estimated project cost of Rs 230 crore and it would be implemented over a period of the next 18 months.

At optimum capacity utilisation, the unit would be producing around 12,000 tons of yarn valuing about Rs. 250 crores with a target ROE of 18%

3. Kanpur – 30 crores (can get funded through insurance claim)

Production line for recycled rigid plastic chips – Pilot plant of 300 tons/month. Can be ramped to 1000 tons per month post-successful implementation.

3000 ton capacity – textile-dyed yarn

4. Nepal – 75 Crore

Margin trajectory

1. Nepal – 25% EBITDA margin

2. Bilaspur 1 (current facility) – 13% to 14% of EBITDA margins

3. Bilaspur 2 (green field caped plant) - margins in the range of 25 to 30% EBITDA (over a period of 18 months)

4. Rudrapur - 10% to 11% EBITDA margins (may increase additional 5% to 7% from spinning mill)

5. Kanpur – 16 to 18% EBITDA margin textile dyed yarn and recycled rigid plastic chips

EBITDA margin of 20%

Risks:

➢ The biggest buyer is the European Union (siting the War scenario selling of yarns would be less)

➢ Fluctuation in price of crude and spinning cotton

➢ Scarcity of Pet bottles for fibre and spinning

➢ Bottle to Bottle market in India is a developing market.

Management Commentary:

• Launching brand “Go Rewise”

For capturing the demand for premium recycled products, ‘Go Rewise’ brand will be launched which symbolises recycling wisely. The brand has been patented. Ganesha Ecosphere is in the process of being on boarded by global brands after clearing their social audits. They have already started to use the patented DNA technology of ADNAS, USA in their products, wherever required, for physical traceability of the fibre in final finished products.

• Going forward management senses Bottle to Bottle (B2B) chips business will have accelerated growth

• Bottle-to-Bottle plant

• Warangal plant is already USFDA-approved technology and European market EFSA, already they have submitted all the documents - they are very much positive to get it in the next couple of weeks, some positive feedback from EFSA

• Taking the approvals from FSSAI Food Safety in India, they have mandated that any technology which has been approved by USFDA or EFSA would be okay for them to be implemented here.

• Imported the machinery from the Europe region for bottle-to-bottle plant (USFDA has approved two, or three technology across the world, only for this use of recycling it in plastic pet packaging

THE END

Hope you enjoyed both these efforts.

Congratulations to all who participated. Looking forward to more such power packed learnings.

Do give them your feedback in the comment section below!