Bearings are the mechanical parts that make the world go round

What are Bearings?

Bearings are machine elements that allow components to move with respect to each other. These are highly engineered, precision-made components that enable machinery to move at extremely high speeds and carry remarkable loads with ease and efficiency.

There are 2 key functions of a bearing:

1. Reduce friction and make rotation more smooth: Friction is bound to occur between the rotating shaft and the part that supports the rotation. Bearings are used between these two components.

The bearings serve to reduce friction and allow for smoother rotation. This cuts down on the amount of energy consumption.

2. Protect the part that supports the rotation, and maintain the correct position for the rotating shaft: A large amount of force is needed between the rotating shaft and the part that supports the rotation. Bearings perform the function of preventing damage from being done by this force to the part that supports the rotation, and also of maintaining the correct position of the rotating shaft.

This is how a bearing looks like:

The Indian bearing market is expected to grow at a CAGR of 8.2% due to its applications in mining, automotive, heavy machinery, infrastructure development, power generation and construction.

Investing in bearings and its components can be done as a proxy play on India’s capex revival theme.

The Bearings industry is very concentrated globally as well as domestically, few players like Timken India, Schaeffler India, SKF India, NRB bearings and NBC account for 3/4th of the industry. In the same way globally also top 5 players control 60% of the industry.

The bearings usually consist of the following components:

Inner ring

Outer ring

Rolling elements (rollers or balls)

Cage

Other elements of bearing apparatus

You can read a detailed blog on the bearings industry here .

The company which we are discussing today is Harsha Engineers International Limited which is a market leader in the Indian Bearing Cages industry.

Let’s cover the industry analysis of Indian Bearing Cages Market:

Bearing cages accounts for a small portion in the total cost of bearings. Bearing cages are primarily utilized to:

separate the rolling elements, reducing the frictional heat generated in the bearing

keep the rolling elements evenly spaced, optimizing load distribution on the bearing

guide the rolling elements in the unloaded zone of the bearing

retain the rolling elements of separable bearings when one bearing ring is removed during mounting or dismounting

Bearing cage is an important component within a bearing and requires the highest lead time for development and technical and tooling expertise, for its manufacture when compared to other components of a bearing.

Bearing cages are usually made of materials such as Steel, Brass, Polyamide, Polyetheretherketone, Phenolic Resin etc.

Growth Triggers:

As equity investors we should always look for industries which have a probability of high growth and sectors that are in tailwinds. One such sector in my opinion is India’s capex theme. As there is revival of capex in India after a long pause and we are seeing the early sign of the manufacturing boom which we saw in 2003-04. To play these I personally like companies which can be seen as a proxy to the main theme. If we do the sub-segmentation of the capex theme, one segment which emerges is Bearings, as these are used in almost all major industries. But in recent months the stock prices of major domestic bearing players have run a lot and now don’t provide margin of safety for new entrants. But to play this sector in tailwinds we can look for companies which provide parts to bearing companies as a proxy play. One such proxy play is cage supplier.

The growth trigger for cage market is as follows:

Growing outsourcing trend of bearing components: Earlier, players used to manufacture bearing components in house. However, in recent years, manufacturers have started outsourcing to emerging regions such as China, India due to low cost manufacturing advantages. This is likely to positively impact the bearing cages manufacturers.

Favourable policy and regulatory framework: The government plans to develop India as a manufacturing hub and has introduced several schemes like Make In India, Production Linked Incentives (PLIs) to attract foreign players. The schemes are also aimed at making Indian manufacturers globally competitive and enhance exports to make India an integral part of the global supply chain. This in turn is likely to positively impact the bearing components’ manufacturers including bearing cages.

Growing demand from end users: Growth in goods mobility segment is being led by the need to establish strong supply chains between producers and market which will be supported by investments being made to enhance connectivity by varied modes of transport like roads, railways etc. Moreover, growing demand for usage of bearings from end user industries such as aerospace, construction and mining, railways bodes well for bearing cage manufacturers.

Manufacturers diversifying global supply chain network: While China is considered the global manufacturing hub, recent industry developments such as US China trade war and global outbreak of Covid-19 led to manufacturers setting up manufacturing units in regions other than China to emerging economies like India which bodes well for bearing cage manufacturers.

Due to above discussed triggers the Indian bearing cages market is expected to grow at a CAGR of 8.3%.

Key global players in Bearing Cages along with their market share

The global bearing cage market is quite fragmented with the presence of global and regional players. Some of the key players operating in the global bearing cages market are:

Nakanishi Metal Works Co Ltd (NKC; Japan)

Harsha Engineers International Ltd (HEIL, India)

MPT Präzisionsteile GmbH Mittweida (MPT Group Gmbh, Germany) and

Manu Yantralaya Pvt Ltd (MYPT, India).

Business analysis of Harsha Engineering International Limited:

Harsha Engineers International Ltd (HEIL), incorporated in 2010, is the largest manufacturer of precision bearing cages, in terms of revenue, in the organised sector in India, and amongst the leading manufacturers of precision bearing cages in the world.

It has approximately 50-60% of the market share in the organised segment of the Indian bearing cages market and 6.5% of the market share in the global organised bearing cages market for brass, steel and polyamide cages.

They offer a wide range of bearing cages starting from 20 mm to 2,000 mm in diameter and their bearing cages find its application in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors etc.

Bearing cages are critical parts of bearings and it requires high precision technology to manufacture them. Given the critical function of a bearing cage, and the resultant quality requirements, global bearing companies have steadily increased outsourcing for manufacturing of bearing cages and the business from these bearing companies has gotten concentrated to a few bearing cage manufacturers.

As of March 31, 2022, they have been able to manufacture more than 7,205 bearing cages and more than 295 other products for customers in various sectors, allowing them to meet changing customer requirements. In the past 3 years their product development and innovation centre has developed more than 1,200 products in different bearing types.

Business Segments

The company operates in two business segments:

Engineering Business, under which it manufactures bearing cages (in brass, steel, and polyamide materials), complex and specialized precision stamped components, welded assemblies and brass castings and cages & bronze bushings; and

Solar EPC Business, under which it provides complete comprehensive turnkey solutions to all solar photovoltaic requirements.

Manufacturing Capacities:

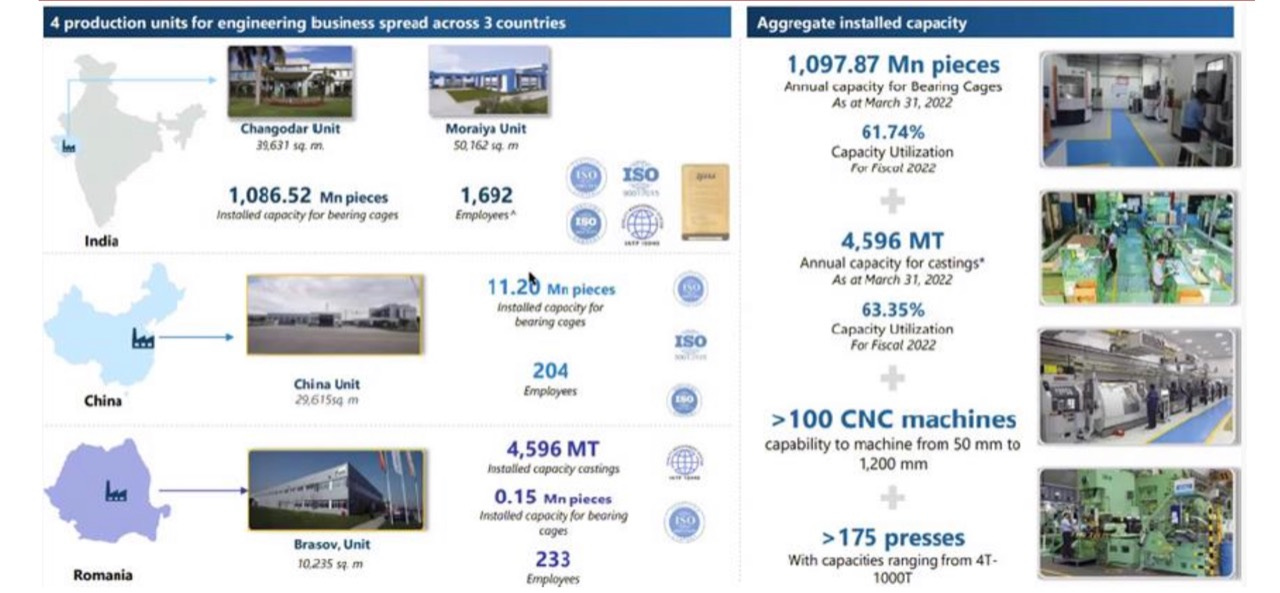

HEIL has four strategically located manufacturing facilities for its engineering business with two near Ahmedabad in Gujarat, India, and one manufacturing unit each at China and Romania.

The aggregate installed capacity across these manufacturing facilities was 4,596 MTPA for castings and 1,097.87 million pieces per annum for bearing cages.

Global presence helps the company to penetrate global markets more efficiently. It supplies products to customers in over 25 countries covering five continents i.e., North America, Europe, Asia, South America and Africa. To help them meet ‘just in time’ requirements of their customers, they have entered into arrangements to stock inventory in warehouses spread across more than 20 locations across the world including in Europe, US, China and South America. Their multinational presence has also allowed them to diversify their revenue geographically.

The capacity utilisation of these capacities is as follows:

Since current capacity utilisation is around 62% so there is ample headroom for growth and chances of operating leverage to kick in.

Product Range:

HEIL is a TPM certified Precision Engineering Company manufacturing Bearing Cages and Precision Components. It has a diversified product portfolio, expertise in Tooling, R&D and Automation.

HEIL Designs and manufactures more than 7500 products in the range of 20 mm to 2000 mm and has developed more than 1200 products in the last 3 years.

Bearing Cages: The bearing cage category comprises roller cages and ball bearing cages. The cages offer high rigidity, strength and high heat resistant operating conditions.

While bearing cages can be manufactured using various materials, HEIL primarily manufactures bearing cages out of brass, steel and polyamide, which represent the most common types of base materials used in the bearing cages market.

Brass Cages: Brass cages have salient characteristics of high rigidity and are suitable for high temperature operating conditions. HEIL had recently expanded the product portfolio to introduce sand casting and bronze bushings to cater to more end user industries such as wind, mining and shipping sectors.

Steel Cages: Capitalizing on expertise in stamping technology, HEIL is able to manufacture cages from various grades of steel as per the customer needs. These are light in weight, relatively high in strength and able to reduce friction & wear.

Polyamide Cages: HEIL manufactures injection moulded polyamide cages reinforced with glass fibres which are widely used today. Cages made of high-polymer materials are lightweight and corrosion resistant. They also have superior damping and better lubrication performance.

Stamped Components: In recent years, automotive & industrial stamping has emerged as a key market segment, wherein Harsha provides metal stamping solutions ranging from simple to complex designs and geometries.

The next business segment of the company is Solar EPC Business

HEIL is also an EPC service provider in the solar photovoltaic industry and also provides operations and maintenance services in the solar sector. They have over 10 years of operating history in the solar EPC business.

They have an inhouse design, engineering, procurement, project management and O&M team which has a combined experience of installing at least 500 MW and more than 60 MW commissioning experience in the roof top segment.

The revenue from solar EPC business aggregated to ₹ 82.95 crore for FY 2022, constituting 6.28% of the total revenue from operations.

Since its contribution in the overall business is just 6% so we will be ignoring this segment.

Promoters of the company:

Company’s founder Promoters, Harish Rangwala and Rajendra Shah, have more than 35 years of experience in the precision engineering and bearing cages manufacturing sector and have played a pivotal role in their innovation, success and growth.

Additionally, their second generation Promoters, Vishal Rangwala and Pilak Shah, are also involved in the overall operations, strategies and business of the company.

Growth Strategies of the company:

1) Enhance market leadership in bearing cages and expand the customer base: HEIL has started to expand their business into large diameter brass and steel bearing cages. Currently, for such large size brass and steel bearing cages in-house production by bearing companies is quite high considering the complexity of the production process.

They aim at further expanding their customer base in China as they are considered a versatile and consistent player in the bearing cages segment in China. Their aim is to focus on increased business from key Chinese customers.

They intend to further expand into the Japanese bearing market by supplying directly to their Japanese customers at their locations in Japan. In the past, they have been supplying to Japanese customers at their locations in India and to their locations outside of Japan. They have recently started supplying products directly to their locations in Japan.

Initially, the plant at Romania was manufacturing only brass casting and cages. With the takeover of Harsha Engineers Europe SRL, Romania, they have expanded their product portfolio to include bronze bushes. With the strengthening of the marketing and management team in Romania, they have started catering to additional European customers. They also intend to leverage their European presence to grow their India business share in Europe.

2) Growing the stamping and specialised component segment: HEIL plans to capitalise on the existing niche and low volume high value products in the stamping and special component segment and gradually scale up its business over next 3-5 years.

3) Emphasis on increasing operational efficiencies to improve returns: HEIL has adopted Total Productive Maintenance (“TPM”) initiative across their plants in India to improve their operational efficiency and the reliability of their manufacturing processes by lowering breakdowns and rejections.

They are working on automation of various processes to eliminate waste, improve efficiency and manpower optimization, continually working on cost reduction as part of TPM initiative including applying value analysis techniques to their products to reduce cost.

4) Increasing focus on developing products suited to capture market opportunity in the growing Electric Vehicle (EV) segment: As the automobile segment is shifting focus to Electric Vehicles (EV), the need for more silent and lighter bearings, and its components, will be felt, and the demand is likely to increasingly shift towards precise dimension and dirt-free bearing, steel and polyamide cages as a probable solution at a premium value.

HEIL’s inhouse tool and design facilities coupled with its latest machinery, specialised cleaning equipment and software would enable the company to manufacture precision stamping components and steel cages suited for the electric vehicle segment including as import substitutes. In addition, HEIL has also invested in enhancing its tool room and design capacity for faster cage mould development to focus more on developing polyamide cages in different categories to meet the increased demand from the electric vehicles space in the coming years.

Key Risks in the company:

Customer concentration: Company derives >70% revenue from top 5 customers. The loss of any of its major customer groups due to any adverse development or significant reduction in business from its major customer groups may adversely affect its business.

No long term agreements with customers: Company do not have long-term supply agreements with its customer groups and instead rely on purchase orders on spot basis wherein customers mention the quantity required at defined price.

High exposure to Europe: Export to Europe constitutes around 38% of their revenue, which is undergoing several issues at the moment due to high energy costs and facing a recessionary environment. Any kind of degrowth in the bearing industry in Europe may impact the business of the company.

High contingent liabilities: The contingent liabilities of the company is worth 90.54 crore which constitutes around 17.35% of Net Worth of the company. These liabilities could pose a risk.

Capital Employed on Solar EPC Business: Currently contribution from solar segment is around 6% which is a EBITDA loss making, if company goes aggressive here and increases the capital allocation in this segment then it could downgrade the overall return ratios of the company.

Utilisation of IPO Proceeds:

The ₹ 760 crore IPO consists of a fresh issue of ₹ 460 crore and OFS of ₹ 300 crore by promoters, which would result in the promoter & promoter’s group stake reducing to 74.6% post-IPO. The market cap post listing would stand at ₹ 3,005 crore.

Funds raised would be used to repay ₹ 270 crore debt, fund ₹ 80 crore capex while balance would be utilized towards general corporate purpose.

Now looking at the financial metrics of the company and comparing the valuations with the closest peer of the company i.e, Rolex Rings:

The company at its IPO price looks fairly valued as compared to its peers. But at the time of writing the grey market premium of the IPO is between 215-220 which values the company at Rs. 5008 crore implying P/E multiple of 54.48 times which is highly valued and does not provide any margin of safety.

Do let us know in the comment section below, would you apply for the IPO of the company and reasons for the same.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.

Yes both are not exactly comparable but compared since both are supplying to bearing companies, so we can say rings & cages are raw material for bearings.

Rolex Rings is not directly comparable with Harsha Engineers as the components produced by each of them are quite different even though both are bearing components - rings and cages are quite different in value terms too within the cost cake of a bearing