Hikal: What is the Variant Perception?

Hikal: What is the Variant Perception?

Recently, I was listening to one of the talks by Warren Buffett and Charlie Munger about how to value businesses. One thing which stood out to me was what Warren Buffett mentioned on ‘How to teach Valuations’. This is what he had to say:

“If I were teaching a course on investments, there would simply be one valuation case study after another, with students trying to identify the key variables in that particular business and evaluating how predictable they were because that is the first step. If something is not very predictable forget it. The important thing to know when you find that you really do know the key variables, which ones are important and you do think that you have got a fix on them”.

The importance of identifying the key variables of the bet is one of the most important skills that you have to learn as an investor. Why most people get confused while doing valuations, is that they demand a precise answer. Ever since our childhood, the way we have been taught in schools, we have learned that there are absolute truths. There is a defined answer, everything is binary (Either a Yes or a no). However, in the world of investing and business one thing that I have learned, valuations are never ever static. The underlying variables keep changing, most good investors that I have come across while analyzing any potential company, have this ability to differentiate between the signal and noise and bring down the entire thesis about a business to a few key variables that are worth tracking. Let’s see what Warren and Charlie further have to say about the importance of identifying variables:

“Where we have done well, Charlie and I have made a dozen or so very big decisions relative to net worth. We have known we were right based on those before going in. We knew we were focusing on the right variables and they were dominant. We knew we couldn’t take it out to 5 decimal places or anything like that, we knew that in general(Emphasis Mine), we were right about them”

This is over the years what I have learned about valuations. You have to get the business and the key triggers right, a DCF analysis or any manual formulas for eg: PE is less than 15 times. Just do not work in the market unless the understanding of the key drivers of the business and the underlying odds of the bet isn’t there. I hope I have been able to layout a brief outlook on our loosely structured framework on how we view valuations. There is no point in missing the big pictures just because the decimal point didn’t work. With this, we will start the business analysis of Hikal Ltd, which can be another case study in applying variant perception.

I have divided the business analysis into 6 parts, in the first part, we will talk about history of Hikal. In the second part, we will discuss about the business segments of Hikal. In the third part, we will discuss what can potentially change in the business. In other parts, we will be discussing:

1. History of Hikal Ltd

2. Two key business segments of Hikal

3. What has gone wrong till now

4. What can potentially change in the business

5. Sources of risk

6. Valuation

History of Hikal Ltd

Let’s start talking about the history of Hikal Ltd which a Contract Development and Manufacturing Player which operates in Crop protection, Animal Health, and Human Pharma.

Hikal was incorporated in 1988 by Mr. Jai Hiremath(son in law of Neelkanth Kalyani, Bharat Forge) with equity participation from the Kalyani group, Hiremaths, and the Sumitomo Corporation of Japan. In 1991, Hikal acquired Merck’s facility in Mahad and started its crop protection business. Hikal ventured into the Pharma API business by acquiring the manufacturing site from Novartis, in Panoli, Gujarat. In 1996, the company came with a public issue to part-finance the expansion project of Thiabendazole. Hikal is one of the unique listed CDMO’s in the country which has a Hybrid model. It deals in both crop protection and the pharma side of things. Most of the listed CDMOs specialize in one vertical. For instance: Pi Industries dealing majorly in Agchem Crams (they are diversifying into pharma intermediates), Divis Labs being majorly a Pharma based CDMO player.

While reading about the company one thing which was quite impressive is the regulatory track record, across all its Pharma Manufacturing sites i.e in Bangalore and Panoli the company has had a near-perfect regulatory compliance track record.

Moreover, Hikal is providing CDMO services to MNC’s like Syngenta, Merck, and Co, BASF, Zoetis, Pfizer, and Bayers. However, in spite of having Tier 1 customers and a compelling proposition, unlike its peers (Pi Industries, Divis, etc), Hikal has been a story of disappointment in terms of stock returns that the shareholders have earned. In this post, we will understand the reason why this happened and what could change the trajectory. Let’s look at the two Key Business segments of Hikal and their overall Revenue contribution:

Crop Protection Business:

Let’s start by talking about the Crop protection business out of the 2 business segments. Crop protection business contributes close to 40% to the sales and is the older of the two divisions. Here they compete with the likes of Pi Industries, Saltigo, and Lonza globally.

(To read more about how CRAMS for Agrochemicals works, Read our blog on: https://soic.in/blog-description/pi=industries)

In the crop protection business, Hikal operates under two models. In the first, Hikal Partners with crop protection companies for custom synthesis and Custom Manufacturing of intermediates and Active Ingredients. Hikal manufactures Herbicides, Fungicides and insecticides. This business began in 1991 when the company signed a long term supply agreement with Hoechst India from the then newly established Mahad (Maharashtra) facility. Contract manufacturing for global innovators in Agrochemicals accounts for 70% of the business. Hikal helps both in early-stage products and late-stage product management. The development cycle in the crop development business is shorter than Pharma. Here the company has close to 10-11 products under contract manufacturing and going forward they expect to launch 3-4 new products under CRAMS. Hikal has capabilities of scaling up molecule from Gram to Kilo to Ton levels of Production.

The second part involves the launch of its own Proprietary product. Hikal aims to launch its own products and partner with formulation players across the world. Currently, this segment contributed to 30% of sales in the crop protection business, and going forward Hikal has plans of launching 2 Proprietary Products of its own. This segment includes products like specialty biocides, antimicrobial actives, and additives. One of the key products under the crop protection segment is by the name of Thiabendazole (accounts for less than 15% of sales). Thiabendazole is used on grapes, potatoes, tobacco, and vegetables and Hikal is the world’s largest Supplier of Thiabendazole.

Some of the key products/relationships that Hikal has developed in its Crop Protection business over the years:

This is how the sales look in this division:

These are how the EBIT Margins look like:

Major manufacturing facilities of Hikal for crop protection are situated at Panoli, Taloja, and Mahad. Going forward Hikal has announced a 150 crore capex in this line of business (More on capex later). As compared to the other line of business i.e Pharmaceuticals. Hikal earns a higher ROCE (more than 20%) and assets are fully depreciated under the crop protection segment.

Pharma Segment

-Now coming to the Pharma segment, in this division Hikal provides CDMO services to global innovators for intermediates and Active Pharma Ingredients. (To know more about Pharma Crams, read our blog on Syngene: https://soic.in/blog-description/crams-industries)

It also has its own portfolio of Generic products. It also includes the Animal CDMO services division which contributes 20-25% of sales in the Pharma division.

-Pharma division as a whole contributes to 60% of the total sales. The business is split between 50% of its own product portfolio sales and 50% of sales being done under the Contract Manufacturing division. Starting with the CRAMS division, currently, Hikal has 5-6 products under development in the pipeline with various projects being under Phase 2 or Phase 3. In the generic products division, Hikal has close to 8-9 products and it is the world’s largest supplier of Gabapentin and has nearly 40% of market share in the world. It supplies Gabapentin to nearly 70 customers which includes the innovator. Gabapentin is used to control and prevent seizures. Currently, this contributes 40% to the total sales in the Pharma division and close to 16% in the consolidated sales of the company.

-Hikal is trying to diversify away from its dependence on Gabapentin and has launched other products like Pregabalin (treats epilepsy), Venlafaxine (Anti-depressant) and other products like Quetiapine (used to treat schizophrenia). For Pregabalin, Hikal has developed an enzymatic process of manufacturing:

It currently has 3-4 new products under development under its generic pipeline and expects to keep filing 3-4 DMF’s every year (Drug Master File (DMF) is a submission to the Food and Drug Administration (FDA) (One can study their filing from here: (https://www.pharmacompass.com/us-drug-master-files-dmfs/hikal)

-Under the Animal Health division, this is what the portfolio looks like:

Apart from this in the Animal Health division, Hikal is one thee few CDMOs from India who has successfully partnered with Zoetis (Global Animal Pharma Innovator):

(Credits: Dr. Punit Bansal)

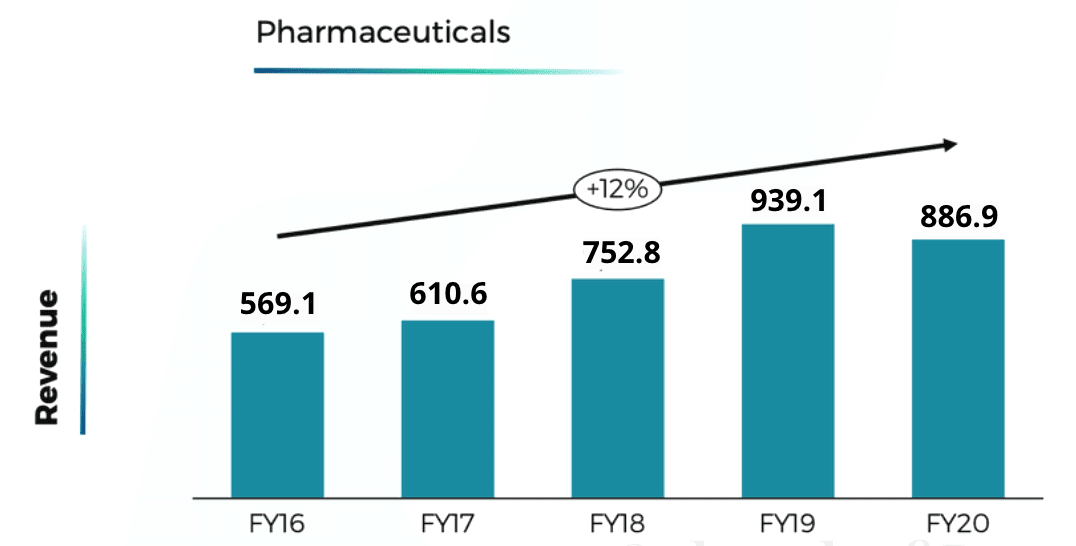

This is how the sales growth looks like in the Pharma segment:

This is how the EBIT Margins look like in the Pharma Division:

What has gone wrong in the business:

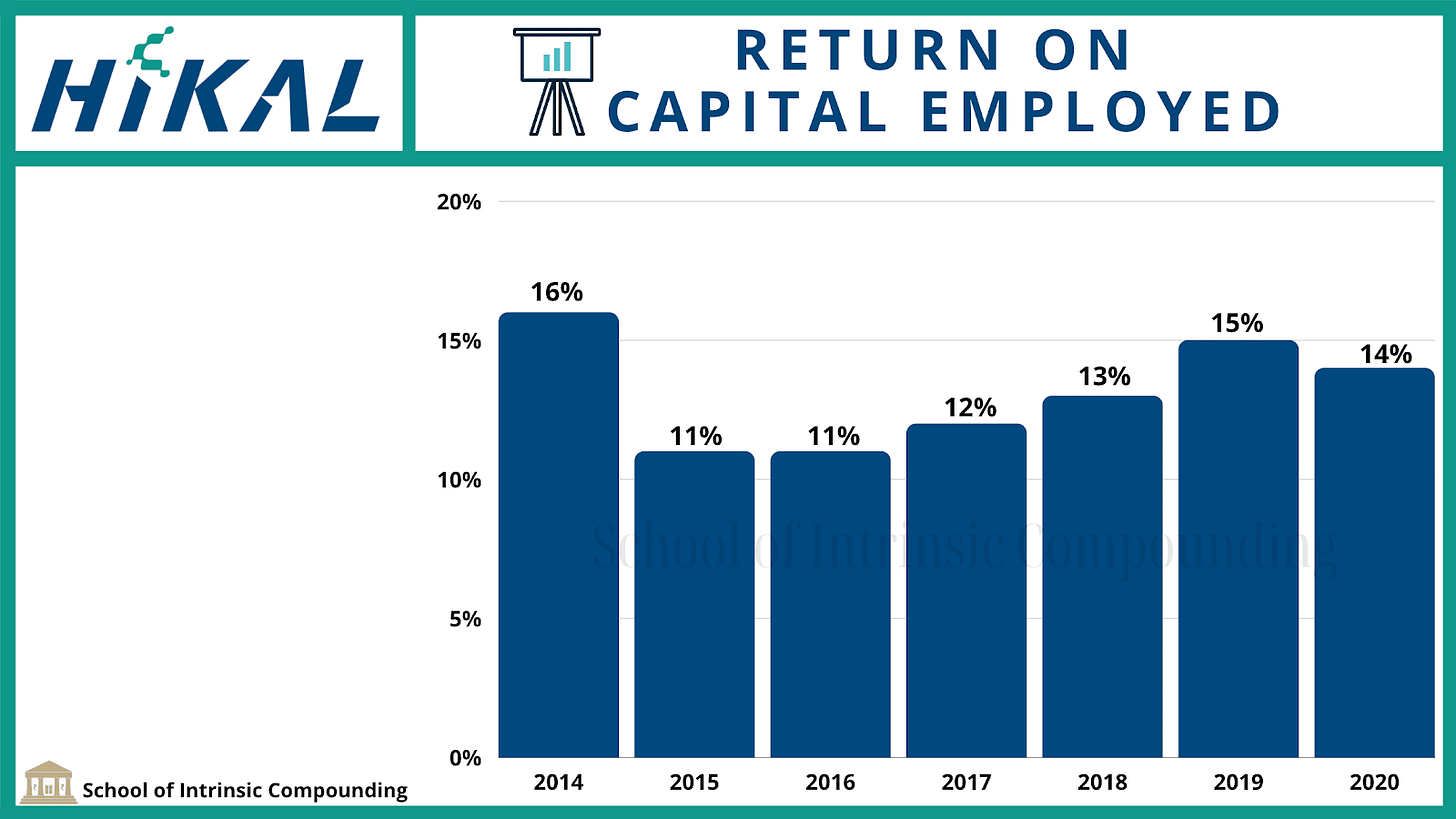

In order to understand what can go right, first, let’s understand what has gone wrong in Hikal’s case till now. Unlike its peers, Divis and Pi Industries, Hikal hasn’t been able to make Returns of capital that are consistently above 15%. These are the 3 major reasons behind Hikal being a value trap till now:

1) Disruption in Pharma Business post-2012: In the early part of this decade (2011,2012,2013). Hikal was making EBIT margins of 25%+ in its pharmaceuticals division. However, this declined consistently from 25% to mid-teens. ROCE in the Pharma division has remained between 10-12% in the last 4-5 years. One of the major reasons for this was the change in the contract by one of the key customers in 2013. As earlier the contract was based on cost-plus basis, as the customer used to supply the intermediate for API manufacturing. However, this was changed to Hikal procuring the intermediates on its own, which led to a decline in the margins.

2)Greenfield Capex and Low Asset Turns: The capex which Hikal has done throughout the decade involved considerable investments in the infrastructure including water treatment plants, utilities, etc. This led to asset turns between 0.8-1 times. Unlike the agrochemical division where some of the assets are fully depreciated, Pharma assets aren’t. This coupled with the earlier reasons has led to poor returns on capital for Hikal.

Consolidated ROCE:

3) Lower Margins in the Legacy Portfolio: Since Hikal earns 60-70% of its revenues from Custom synthesis, the Operating margins in this part are closer to 25%+. Let’s look at the consolidated Operating margins first:

Now, let’s look at this snippet from concall, this clearly indicates that the old molecules/Legacy Portfolio is making commodity margins (6-8% OPM’s):

This is one of the major reasons why ROCE has remained low for a considerable period of time. Addressing the key question, Why analyse it now Ishmohit? Aren’t there other players who are much more efficient as compared to Hikal. Let’s see how the future going forward can be considerably different than in the past. These will be the key variables that will play a role in valuations.

What can potentially change in the business:

1)Brownfield Capex: according to Hikal’s credit rating, it is in the midst of a 600 crore Brownfield capex. Out of which Management has talked about completing 300 crores of capex by the end of FY22. Since this capex is Brownfield in nature, it is supposed to have asset turns of more than 1.5 times. At its manufacturing locations, Hikal has 30%-50% spare land available which can further aid the momentum in brownfield capex.

2) Changing Product Mix: Hikal is working to launch new products under both its crop protection and pharma portfolio. According to the management, the new products will have higher margins. These products will replace older products which have lower margins (as we saw in the concall snippet earlier)

Before we start talking about the valuations, let’s discuss the sources of risks first.

Sources of Risks:

The first key source of risk that is there in the business comes from Poor disclosures by the Management. Just to give you an example, in 2019, there was a flood incident at Mahad where one of their manufacturing units is located. For 3 months the plant wasn’t functioning properly, this material incident wasn’t disclosed to the investors who were shocked to see the subsequent quarters result.

All the shareholders have the right to know whenever such an incident takes place. Management didn’t disclose this issue to the public. If such an issue happens again, I am not so sure whether the shareholders will get to know or not.

The second key source of risk comes from the fact that Hikal imports 35% of its RM requirement from China. Other players like Pi Industries have reduced their dependence from China from 30%+ to high single digits. Any disruption in the supply of Raw materials can lead to margin volatility in Hikals case. There were forex-related write-offs in the early part of the decade. (Generally apprehensive of companies following inconsistent forex policy)

The third key source of risk comes from the asset-heavy nature of the business. It remains to be seen whether the ROCE post the capex increased to somewhere close to 20% or not. As Hikal (mentioned in concalls) has had a very asset-heavy business historically.

The last key source of risk comes from product concentration risks. Gabapentin still contributes to nearly 16% of the total turnover. Going forward even though the management expects this to come down, however, any drastic reduction in demand for Gabapentin can be disruptive for Hikal.

Valuations: Coming to the most important aspect. At the beginning of the analysis, we talked about how good investors are able to boil down a bet to a few key variables. Let’s see what these key variables are:

I won’t be getting into DCF and decimal places. In our framework of valuations, if Hikal is able to execute on its plans of improving ROCE to 20%+, in a general framework of valuations when compared with the peers, it does look cheap to us. Some of its peers trade at 50times+ Earnings and command Price/sale multiples of more than 7-8 times when compared to 22 times earnings and 1.5 times P/S for Hikal ltd. However, risks are also there given the poor disclosures and concentration of revenues.

You, the reader, let us know which side of the bet are you on!

Sectoral analysis and newsletter are a part of the Soic intensive course. To know more : www.soic.in/course

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author does hold a tracking position in the company, his views can be biased.