How can you apply Operating Leverage in Stock Picking and Life?

Small changes in individual performances leading to massive changes in results, is termed as the concept of leverage. Archimedes, was one of the most famous mathematicians in Ancient Greece, once said “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” The word leverage dates back to 1724, and was originally used to describe the action of a lever. In other words, levers enable the gain of disproportionate strength when compared to the force that the individual applied.

In the modern world, can you think of the biggest leverage that anyone has? Just imagine yourself living in 14th century India. You are an accomplished writer and want to spread your ideas far and across. However, the biggest problem that you will face in this type of environment is the medium that you can use. In earlier times, small changes in productivity didn’t create a disproportionate impact on the outcomes. In spite of being a good writer, it's very difficult to spread the work you have published.

Now let's assume that you are an excellent writer who has a broad understanding of subjects, but you live in the 21st century and have access to the internet to reach out to people. In the modern world, given the tools that we have built, small changes in productivity can lead to disproportionate impact on the outcomes. Leverage truly unleashes the potential of what one can achieve in the modern world. For example, I really like to read “The Ken,” because their in-depth business stories and the quality of journalism is hard to find in the Indian media. Now, would something like “The Ken” exist 15 years ago when the primary mode of consuming information was via newspapers delivered to your house? The increasing penetration of the internet has made it possible for such sources to exist and provide good quality business journalism.

Similarly, this concept of leverage can be applied to businesses. When small changes in operations and efficiency lead to disproportionate impact on margins and operating profits, this is what we call‘operating leverage.’ Let’s understand operating leverage with an example and let’s see how this operating leverage has played out in some of the listed businesses.

Suppose, you own a manufacturing business (think of chemicals, pharma or textile). One of the hallmarks of a manufacturing business is to spend before the products start generating revenues. Once you spend before your manufacturing plant starts generating revenues, this often leads to preproduction costs. Think of a factory that is completely ready but isn’t generating revenues yet, as it is being audited by its customers. However, the factory will still have to pay for the salaries of its employees, the electricity costs, rent costs, and other miscellaneous costs that are involved in the day-to-day operations. This is what we call ‘pre-production costs,’ as costs are being incurred before the production starts.

Now let's assume that your factory is up and running after getting customer approvals. In the first year of business, your business has done sales close to Rs.1 crore and your operating profit is at Rs. 20 lakhs. Thus, your operating expenses are close to Rs. 80 lakhs. Out of these operating expenses, pre-production costs are fixed at Rs. 24 lakhs. While other operating expenses are Rs. 56 lakhs that is almost 56% of the sales (Rs. 56 lakhs as a % of Rs. 1 crore). Effectively your operating margin is at 20%.

Now your sales increase by 40% in the next year, whereas your pre-production costs stay at Rs. 24 lakhs and the other operating expenses remain at 56% of the sales. This is how the operating margins will look like. Before you read further, I will ask you to stop and think about the impact of what happens when sales increase and the operating expenses remain fixed?

Think about what will happen to the margins?

Think about why it will happen?

Think about what is the key driver of operating leverage that is kicking in?

This is what happens in the second year of the business, sales increase by 40% and reach close to Rs. 1.4 crore. Pre-production expenses remain the same at Rs. 24 lakhs and the operating expenses which are close to 56% of sales are at Rs. 78.4 lakhs. Now let’s see what happens to the margins:

Sales - Operating Costs = Operating Profit

1,40,00,000 - 1,02,40,000 = Rs.37,60,000 (37.6 lakhs)

Now, my operating profit margin expands effectively to 26.8%.

Similarly, my capacity utilisation (no. of units I can produce) hits close to 100%, and at 100% utilisation, your sales grow further by 40%. Notice how your operating margins keep expanding with the growth in sales:

This is effectively what we call the concept of operating leverage. Before I proceed, just ask yourself what are the most common elements that are leading to such expansion in the operating margins?

These are the 4 common properties of operating leverage:

1. As a rule of thumb, higher the fixed costs higher would the operating leverage be in a business.

2. The key determinant of operating leverage is sales growth. Thus, small improvements in sales leading to disproportionate outcomes in the margins.

3. Degree or how much operating leverage is built into a business can be calculated as:

% Change in EBIT

%Change in Sales

4. Operating leverage also works in reverse if a business experiences declining sales, this often leads to contraction in margins.

Now you will think: “Yes, Ishmohit has explained the concept well, but where is the SOIC way of teaching through case studies?” Don’t worry, I will cover plenty of case studies of the Indian Businesses where operating leverage has played out and will play out in the future.

Example 1: Vaibhav Global

Vaibhav Global, is a vertically integrated E-commerce business which has significant operating leverage built into its business model. Close to 60% of the costs are fixed, which is spent on employees and other costs (majority on TV carriage & web marketing). Let’s see what has happened to the operating margins, EBIT and the sales since 2016. Since 2016 sales have nearly doubled. Whereas, the operating profit has almost multiplied by 7x. This is the power of operating leverage.

Thus, once increase in sales is enough to cover the fixed costs, the incremental sales flow down to the EBITDA of the business. This is similar to what happens in a lot of SAAS businesses that are listed abroad.

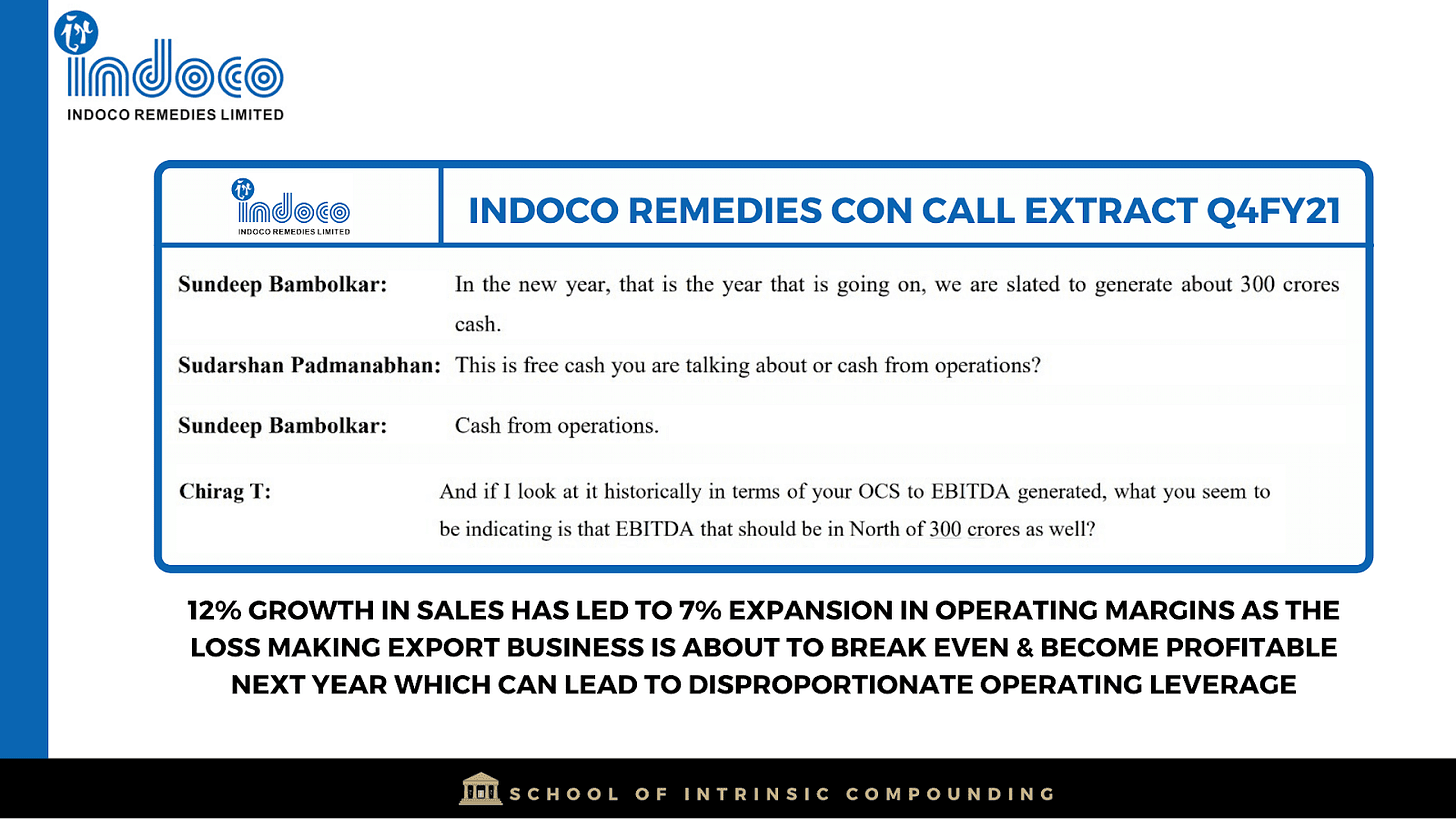

Example 2: Indoco Remedies

Indoco Remedies is a pharma business that operates in the domestic pharma market, U.S. Complex Generics Business, Injectables, and APIs.

Let’s see what the management is guiding for in terms of cash flow and sales growth next year:

Example 3: What happens when both gross margins and operating margins expand?

The classic example of this is Laurus Labs, and similarly this is what is about to happen in Sequent as the business mix changes more towards regulated markets. Gross margin expansion and operating margin expansion are two powerful levers which can lead to disproportionate increase in the earnings growth and the margins of a business. Doubling of sales since 2019, led to the doubling of operating margins, and almost 10x growth in operating profits.

Both the gross margins expanded in Laurus due to forward integration and the operating margins expanded when the pre-production costs were spread over higher sales. This led to super fast earnings and ROCE Expansion.

Thus, operating leverage can be a powerful source of generating returns if understood well by the investors. There is also a flip side to operating leverage, this is the problem of operating deleverage. If sales de-grow and operating costs remain the same, this leads to contraction in margins and results that can surprise on the negative side. Businesses like theme parks, hotel businesses, chemical businesses, or manufacturing businesses, where fixed costs are high, can be substantially worse off if the sales degrow or the economy goes through a downturn. Let’s look at EIH which operates the “Oberoi” brand of hotels. Let’s see how the operating margins and operating profitability fluctuates with declining sales or increasing sales, this is how the concept of operating deleverage works:

How can I apply the concept of Operating Leverage in my Life?

Coming to the more important concept of how operating leverage can be applied to our lives. How can we improve the operations of our life in such a way that it leads to a disproportionate impact on the quality of our life? Here are the three points I could think of:

1. Unlike companies where pre-production costs are fixed. One of the most important things that we can work on is to improve our environment. Consider this, more than 50% of the cortex or the surface of the brain is devoted to visual processing. A small change in what we can see can lead to big changes in what we can do. James Clear, the author of Atomic Habits talks about:

“Environment Design is powerful not only because it influences how we engage with the world but also because we rarely do it. Most people live in a world others have created for them. But you can alter the spaces where you live and work to increase your exposure to positive cues and reduce your exposure to negative ones. Environment design allows you to take back control and become the architect of your life.” -Atomic Habits

Key learning is to design the environment in such a way that it enforces good habits. For e.g., when I wake up in the morning, the first thing I pick up is a book instead of checking my mobile phone. A simple trick of keeping my mobile phone in my cupboard and not next to me has worked wonders. I have already finished 10 books so far this year, I’m currently reading the 11th one.

2. Just like manufacturing companies have to invest upfront and incur pre-production costs and impacts on operating margins. Similarly, you have to be patient with the process. Howard Marks once said that “I became famous overnight after writing for 10 years.”

कर्म करो फल की चिंता मत करो : श्रीमद भगवद गीता

3. The third and final way to use operating leverage in one's life is to use tools that enable you to take advantage of leverage. Never has it been easier in the lifetime of humans to connect with each other just by clicking a button. Technology and social media has enabled carriers which one couldn’t even dream of having in the world where there was no internet. Engaging in tools or activities where small changes in productivity (operations) can lead to massive changes in the absolute impact. This is how truly one can maximise the idea of operating leverage in one's own life. Be willing to learn everything that will expand your ideas to the masses. All of us have won the ovarian lottery of being born in a world where such tools are at our disposal!

What do you think?

Thank you for reading the blog! Today, SOIC has almost completed one year. This has been a year of immense learning for all of us. Without your love and support we wouldn’t have reached these levels. The SOIC Team would like to convey our deepest gratitude to everyone who has supported us. We hope to keep adding value to your investing journey!