ICICI Securities: A one stop solution for your financial needs

ICICI Securities: A One Stop Shop for Your Financial Needs

In our previous blog post we left at the conclusion that there is a structural shift happening in the brokerage industry and the game is no longer about pricing.

Here is an estimate timeline for the industry trends:

Phase 1: Service Oriented (Traditional & Bank Backed brokers)🡪 Phase 2: Price War (Entrance of Discount brokers) 🡪 Phase 3: Basket of Services (Bank-Backed Brokers)

Phase 1: During this phase, the control of the system was with the traditional and Bank-Backed brokers as all were on the same footing. Nobody could lower their price after a certain level due to their huge cost. (And nobody wanted to!)

Phase 2: This phase led to the disruption of the industry. New players entered the market with asset light business models (Discount broking) and brought the old player onto their toes.

Phase 3: The price war in Phase 2 has now made broking business a dud business. There is almost no fee for equity orders and fees for derivatives is constantly under pressure. Such competition has led to brokers evolving towards being a One Stop Shop for any financial product one would need.

Therefore, this phase leads us to our mental model.

Adjacencies and Derivatives

This mental model talks about the ability of a company to enter related business segments.

Now, this diversification process gets much easier when your company has achieved the critical mass in terms of customers. In simple terms, a company which has a good number of stable customers can easily enter a product segment which would suit their existing customers to cross sell.

In our SOIC platform sectoral webinar we spoke about Facebook as an example of a business which entered into adjacencies and derivatives. It started as a single-sided platform for connecting people and turned itself into a six-sided platform.

But why would someone buy products from its broker? Well, the mental model of Foot In The Door technique will apply. We have already covered it in our Syngene analysis but in short, if one company is able to sell you one product then it is far easier for that company to sell you another related product compared with a company with whom you are unfamiliar as you have already built a trust with the first one.

We can expect a similar type of diversification in the broking industry.

The brokerage industry is no longer about just the broking business, but it is evolving towards becoming One Shop Stop for a basket of services and we believe Bank-Backed brokers are going to be in the best position to gain from this structural change as they get three things from their parentage linkage: Brand Name, Affluent Customer Base, and Wide Product Range.

Therefore, one such Bank-Backed broker is ICICI Securities Ltd.

About the company

Initially it was incorporated as a Joint Venture between ICICI Bank and JP Morgan in 1995. But around 2013, JP Morgan sold their entire stake as it did not have the controlling say in the company.

ICICI Bank who are the promoters of ICICI Securities hold 75% stake in the company. Promoters in December 2020 had sold their 2% stake through Offer For Sale (OFS) due to regulatory requirements and nothing related to the need of money.

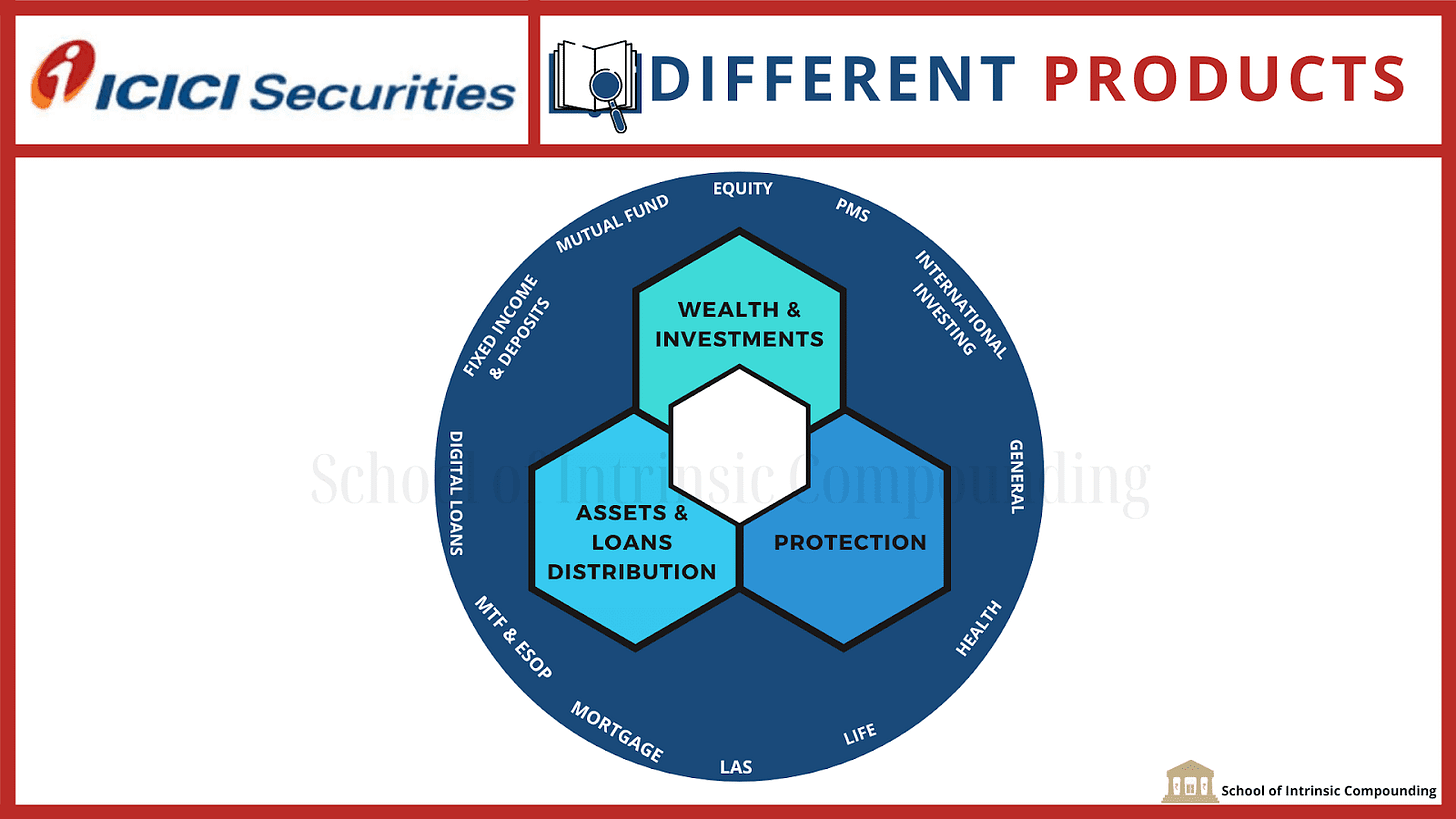

ICICI Securities deals into four business segments which are interconnected: broking (including margin lending), investment banking, distribution of financial products, and wealth management.

Currently more than 50% of the revenue comes from cyclical products but by becoming a One Stop Shop, we feel such mix could change leaning towards increase in non-cyclical products. Currently, 60% of the customers have 2 or more products.

But what non-cyclical products could they sell?

Industry Overview

Many people in India still consider the stock market as gambling and it is in fact gambling if one does not know what they are doing. The main problem being people enter the market for short term gains, get lured by getting rich quick stories, or never fully understand what they are doing. If one has a long-term horizon, stable income, and emotional stability, the stock market would be one of the best places for their money.

But unfortunately, due to lack of financial literacy one does not take the benefit of compounding provided by the stock market. This is also visible from the data that only 1-2% of the population of our country invest in equity compared to 20% in developed nations.

It's not like that we Indians do not invest our money anywhere, it's just not in equities. Maximum of our assets goes into buying Real Estate followed by Gold and FD.

Therefore, if one believes that more people will get financially educated in the future then there is huge headroom for growth for companies like ICICI Securities.

As ICICI Securities deals in various business segments partly or fully, its growth is also connected with the overall growth of that segment. So, let us look at them individually:

Broking Industry

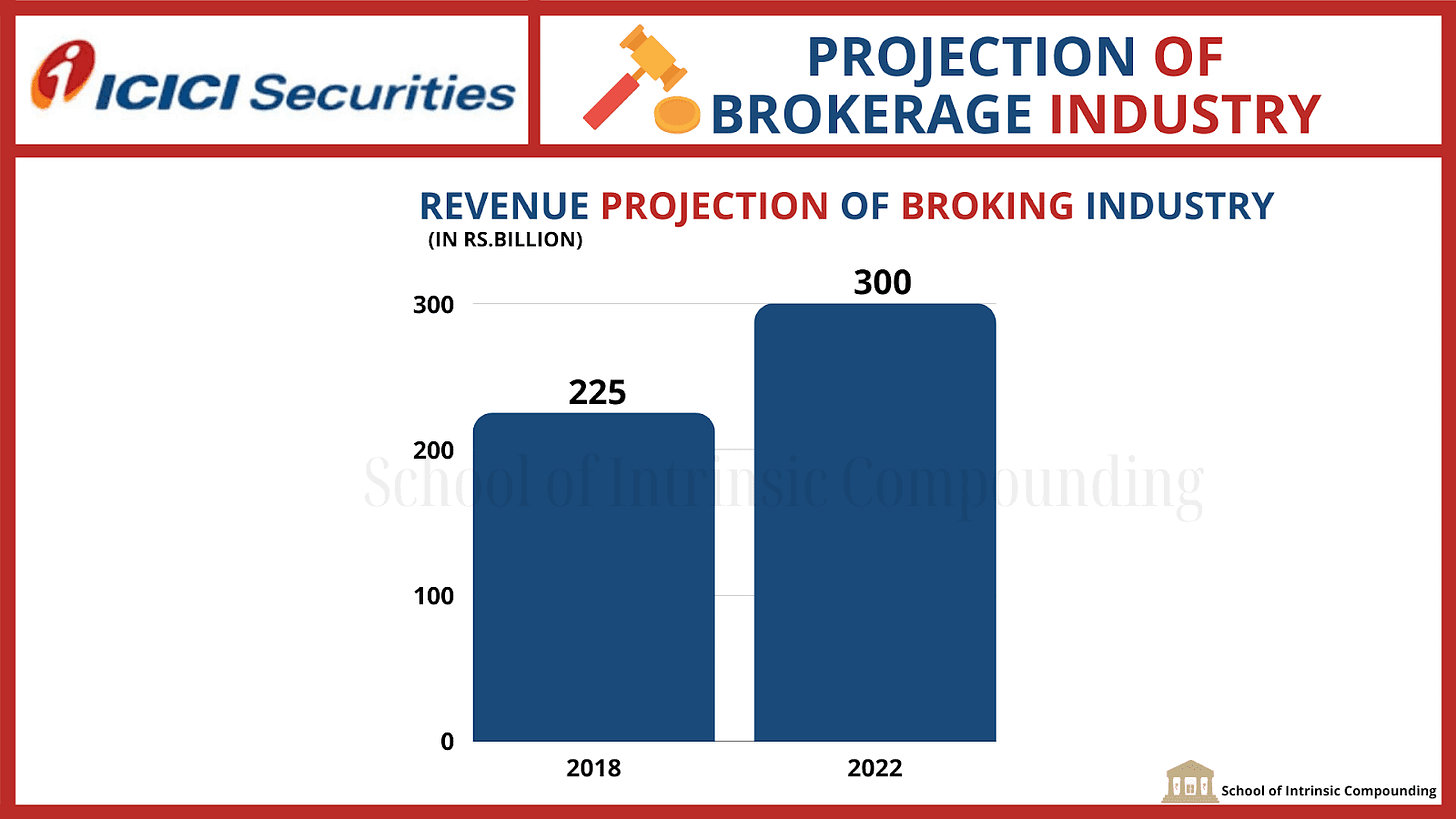

Currently the revenue of the broking industry stands at Rs 225 billion and according to CRISIL Research, it is expected to reach Rs. 300 billion by 2022. Main driver being the retail participation.

One must also note that there has been a recent surge in retail participation in the market which is visible from CDSL reaching 3 cr active demat account with 1 cr being created in the past one year. But such growth could be a cyclical one as we all know that all it would take is one bear market to wash out a huge chunk of retail participation who might have participated in the market with wrong expectations.

Historically the Average Daily Turnover (ADTO) of the industry has grown at 35% CAGR from 2015-2020.

For ICICI Securities, Average Daily Turnover Volume (ADTV) went from around 10,000 crores in FY16 to Rs 53,000 crores in FY19 but during the same period its brokerage yield slumped from 2.65 basis points to 0.70 basis points.

Further, there is another adjacent market where the ICICI Securities is looking to capture market share that is U.S. securities. Currently, the outflow of investment into the U.S. is $15 billion out of which only $0.5 billion gets into equity, rest gets into real estate, sending money to relatives, etc., and This market has been growing at 40% CAGR so far.

So, by the help of ICICI bank who has a feature called Money2World which allows to send money internationally and tying up with Interactive Brokers Inc. they have launched 'Global Investment Platform', which lets investors buy U.S. stocks/funds/ETF with no minimum ticket price.

Wealth Management Industry

Wealth management industry is expected, as per CRISIL, to reach at Rs 31 trillion from Rs. 17 trillion by 2025. Leading to growth of 11-13% CAGR over five-year period.

Further, the Assets Under Management in the Mutual Fund industry have also been on a rise.

The two main growth drivers for this industry would be the low penetration of the industry itself as AUM as a % of GDP is only 11% which is at the lower end compared to other nations and second driver would be the shift of wealth towards financial products like equity, bonds, alternative investments, etc.

Distribution business

For understanding the growth in the distribution business, we would need to see growth of many industries as distribution of those products is linked to industry growth.

We have already discussed the Broking industry and Wealth Management industry above which hints us how the distribution of equity related products would go in the future.

Looking at the Life insurance industry, as per CRISIL the total premium is expected to reach around Rs 10,000 billion by year 2025 from around Rs. 5,600 billion in 2020 with a CAGR of 11-13%.

Each bank pays out around Rs. 1000 crores every year to their distribution partner and ICICI Securities aims to get 10% share of this market. Currently they have partnered with HDFC Bank, Bank Baroda, etc and opened their system, meaning that they have started to sell third party products and are not restricted to only ICICI products.

Further, according to CRISIL, the Indian Mutual Fund Industry is expected to grow its AUM to Rs 45-50 trillion by 2025 logging around 15-17% CAGR, which will also benefit the distribution business as they are the 2nd largest non-bank mutual fund distributor (5th largest including banks).

One thing we must keep in mind is that the fee under the distribution business has been under constant pressure by SEBI, like SEBI banning the upfront commission for mutual fund distributors, and the trend has been towards direct funds.

Therefore, as shown above that many industries are growing one can say that if the industries keep growing the distribution of its products will also grow.

Consolidation in The Industry

As we had seen in our previous post that even after the entrance of Discount Brokers the Bank-Backed brokers were able to consistently gain clients and grow their revenues.

Now, looking at the market share of the overall broking industry one can clearly see space for consolidation.

What we see here is that around 40% of the market is in the hands of weak players and there are around 200 brokers in the industry.

The problem is one gets stuck in just comparing ICICI Securities with Zerodha and forgets that there are 200 brokers out there who sooner or later are going to get out of business as the regulations are getting stricter.

The regulatory changes happening:

Cash Margin Requirement: The new regulation requires a customer for a delivery transaction to give 20% margin. ICICI Securities and most of the top brokers already take 100% margin for delivery transactions.

Power of Attorney (POA): Earlier, brokers used to get POA from their clients and had the ability to transfer shares from their demat account but now there will be no POA. This also means that the old practice of pooling the securities of clients for providing margin to another client cannot be done.

T + 2: Previous regulation was of Buy Today Sell Tomorrow and with that sale proceeds one could take a new position but now the shares can only be sold after they get credited to your account i.e. after T +2 days.

Intraday Profits: Realised Intraday profits cannot be used for taking new positions on the same day.

Peak Margin Requirement: The clients would now be required to fulfil their peak margin during the day. It is being introduced in a phased manner. Reaching 100% upfront margin from September 1, 2021.

These regulations will affect the small brokers the most as they do not have the dry power to keep their shops running when hit by such regulations which require stricter practices. Plus, there are quite less reasons for using service of a small brokers as they generally lack the ability to have a robust technological platform or any research related services and after the Karvy scam broker’s image is one of the criteria people might care about, that’s where Bank’s brand image would give Bank-Backed brokers an edge (Perhaps, even if that comes with little higher brokerage?).

As of year 2020, 18 brokers from NSE and 16 from BSE have already defaulted and decided to pack their bags. In 2020, we have seen the highest number of defaults in the past 20 years. Therefore, such data somewhat hints about how the stricter regulations are leading the industry towards consolidation.

ICICI Bank: A godfather for ICICI Securities?

ICICI Securities’ one of the main advantages is that it has support of ICICI Bank which becomes a source for getting affluent clients.

Currently they have an agreement where ICICI bank agreed to give access to their clients who have at least been with the bank for T + 24 months. The revenue will be shared as 35% for 1st year and 25% for second year and nothing after that.

Sourcing from the bank happens by two methods.

Selling broking account during the client acquisition process of the bank

Cross-sell to an existing ICICI Bank customer

Now here is a double edge sword, ICICI Securities has consistently reduced their dependence on the bank as the % for total clients which now contributes about 55% in Q2FY21 as compared to about 80% in FY20. It is good that the company is getting on its own foot and is able attract customers but the problem here is that the customers they get from the bank are generally with higher income, leading to them having higher ARPU compared to other sources and reducing dependence on ICICI Bank could lead to acquisition of low quality clients.

Further, quality of customers can also be seen by looking at average DP holding per client. As it shows that ICICI Securities has a way higher holding period than zerodha indicating sticky customer base.

As of FY20, 37% of clients active who were active 14 years ago are still active. Further, more than 65% revenues in each of financial years (FY14 to FY20) was contributed by customers who have been with the company for more than 5 years. Further, according to Motilal Oswal’s report, a customer with over 5 years period has 25%+ higher ARPU than other customers, leading us to understand what type of customer quality ICICI Securities have.

Compared to discount brokers like Angel Broking who get more 50% of their customers through Performance marketing (i.e. paying partners only when there is client acquisition) and 11% through Digital Influencers who recommend their audience to open account with them, shows that the type of clients discount brokers get might be people who would be new to investing and perhaps got attracted to it by watching a YouTube Ad.

The Mindset Change: What is Changing?

The management no longer focuses on broking yield which has been consistently on a declining trend. Rather, now it is all about revenue per customer over a long period. They look at which product would cover the customer’s financial need currently and provide with the suitable product which could even be just a Fixed Deposit.

Such change in mindset means that the management is now focusing on increasing the non-cyclical stream of revenue. Currently the distribution business contributes 25% of the revenues: Mutual Fund Distribution (14%) & Non-Mutual Fund (11%).

The work has already begun which can be seen through the chart below that number of customers who have more than 2 products is on a rising trend:

Plus, it can also be seen by the change in Key Result Areas (KRA) of their Relationship Managers from focusing on getting broking revenue to cross selling.

Further the change in mindset is also visible by the cost reduction the company is doing. The management became aware of their potential of reducing the cost of the company during the lockdown. As it forced the company to shift to a fully digital model and made them rethink about the requirements of their current assets like branches. ICICI Securities can afford to reduce its branch because even after reducing them they still have their parent bank’s branches across the country to utilize.

Before the IPO, ICICI Securities restricted themselves only to ICICI Bank clients but now one can open a demat account with them even if their bank account is with another bank, which is yet another sign of mindset change.

Further brokers have now started to realize that the real money is not in the business of broking yield rather in cross selling additional services and this is a worldwide trend which is visible from Charles Schwab’s recent move to make brokerage zero. But do note, for them it was only 3-4% of their revenue.

Though, ICICI Securities does not seem to take the brokerage charges to zero but surely, they have made it quite affordable.

Here are some of their innovative plans:

Prime Subscription: It is a prepaid plan where you pay a certain amount, and you get a low brokerage rate for the whole year. Starting from Rs 299 to 2,999.

Option20: In this plan you get charged with Rs.20 per order and Rs.5 per lot in Options.

NEO: You are charged Rs 0 for Futures and Rs. 20 for Options.

All these plans are less than 50% charge what ICICI Securities used to charge earlier, which again shows us that the management’s mindset has changed and now they are aware that to stay in game for long term they would need to make broking affordable which would help in retaining and attracting customers to whom the cross selling could be done.

The Misunderstood Giant?

As mentioned in the previous post that being a Bank-Backed broker they can be slow and get stuck into a realm of approvals for making any changes but that does not mean that they cannot be innovative.

Here is a list of innovative things they have done so far:

They were amongst the first companies to bring in the integration of 3 in 1 account.

According to the Antique report, they are the only broker which provides you with 17 years of your data and was first to provide you data of your long term and short-term gains split on a daily basis, which is quite useful for traders.

They were amongst the first companies to offer systematic equity plans and “buy today, sell tomorrow” orders, which allow customers to sell their shares prior to the receipt of shares in their demat account.

It has a 3 tier disaster recovery plan. In simple terms, if one system which runs the platform fails it will trigger the second platform and so on. Such systems are never set up in the same city so as to minimize the risk further. Unlike Zerodha whose platform faced downtime due to their Optic Fibre Cable getting cut by some construction project.

New brokerage plans like NEO, Option20, Prime subscription, etc.

Innovative products like Stock SIP options, eATM, U.S equities, etc.

Variant Perception

Looking at the Variant Perception, we believe that five things could play out which could improve business performance:

Industry Cycle: As explained in the post that there is a structural change happening in the industry and ICICI Securities could be a potential beneficiary of it.

Product Mix Change: By bringing in new plans the company has started to capture those customers too who thought ICICI Securities had high brokerage.

Operating Leverage: Every platform business comes with operating leverage so, here too getting new customer onboard comes at no additional cost.

Cost Reduction: COVID is one of the key reasons which led to management realizing that they would be more cost efficient by making the whole process of client acquisition online and reducing the branch count.

Antithesis

Here are some pointers which could go against the narrative:

As mentioned above in the post that the company's mindset has changed towards cross selling and a rising trend of it is also visible but there is also a risk of not being able to sell more products.

Broking Revenue concentrated risk: As 5% clients contribute 60% of the revenues.

Slow to adapt to future changes: Being a Bank-Backed broker we must understand that the speed of bringing new products or adopting to change is going to be slower than the lean Start-up like discount brokers.

Failure to control the cost post-covid world.

After the 2008 Financial Crisis, the equity market had witnessed a huge downfall in activity. There is always a possibility of such events happening again.

Currently, the revenues of the company could be at a cyclical peak due to the robust activity we have recently witnessed in the market.

Valuation

In one of our recent videos, we spoke about Moat where we mentioned two types of Reinvestment Moats and Legacy Moats. ICICI Securities clearly falls into the latter due to their asset light business model.

According to our SOIC Valuation Bucket Framework, ICICI Securities seems like a company being treated as Bucket 5 company but it has the potential to move to Bucket 1.

It is important to note that one has to be right on the business first and valuation comes after that. The SOIC Valuation Bucket Framework is not a precise valuation metric but helps you to be roughly right and classify the business.

Currently the company is getting valued on the basis of only their cyclical revenue but if the narrative of becoming a One Stop Shop plays out the non-cyclical income could take the lead and there would be re-rating like we saw in the case of CDSL.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author holds the stock in his portfolio and stock is not part of SOIC’s portfolio.

About The Author

Arjun Badola is a law student who has interest in analyzing businesses. He shares his thoughts on investing via his blog and twitter. In case you have anything to discuss related to investing, feel free to reach out to him.

Blog: arjunbadola.blog Twitter: @badola_arjun