KFINTECH: The Digital Solution Provider

7 mins readPublishing Date : 2023-05-09

KFin Technologies (KFIN) is a leading technology-driven financial services platform providing comprehensive services and solutions to the capital markets ecosystem. KFintech is a company that provides a wide range of financial services, such as mutual fund servicing, alternative investment fund servicing, and digital transformation services, to clients. The company's moat refers to the competitive advantage that it possesses in the market that enables it to sustain its position and generate higher returns than its competitors.

KFintech's services include fund accounting, transfer agency, shareholder services, and back-office processing for mutual funds, hedge funds, and private equity funds. The company also provides registry services for corporate clients, including shareholder record-keeping, dividend payments, and proxy voting.

Kfintech’s Revenue Model

Multi-asset platform to benefit from growth across markets.

Kfintech operates in multiple large markets in India, Hong Kong, Malaysia, and the Philippines, along with a presence in Oman and Maldives, across several asset classes. This has allowed the company to grow as a regional business and not just as an India-focused business. The company’s market leadership in India and its client relationships provide it with the platform to benefit from this anticipated growth in the Indian economy.

India’s GDP is forecast to grow at a faster pace than other economies, with real GDP expected to grow at 6.5-7% per annum between FY23 and FY25. It is poised to benefit from a focus on investments, a product-linked incentive scheme, which aims to improve the formalization of the Indian economy and accelerate per capita income growth. Kfintech’s market leadership in India and client relationships enable the platform to benefit from this anticipated growth in the Indian economy.

A diverse multi-asset servicing platform is well-positioned to benefit from strong growth across large markets in India and South-East Asia.

Kfintech operates in multiple large markets in India, Hong Kong, Malaysia, and the Philippines, across several financial asset classes. This has allowed the company to grow as a regional business and not just an India-focused one. Kfintech’s market leadership in India and client relationships provide them with the platform to benefit from this anticipated growth in the Indian economy.

The countries in South-East Asia and Hong Kong represent large mutual fund AUM, and such growth in mutual fund AUM across these countries and India is expected to enable the company to continue to grow its domestic mutual fund solutions business and their international investor solutions in Southeast Asia.

Top 5 Clients

The average client relationship between domestic mutual fund solutions and issuer solutions lasts more than 10 years. Thus, its market leadership position and long-term integrated client relationships across platforms put it in a favorable position to increase its share of business from these businesses and existing clients.

Key financial indicators of players providing Investor and Issuer Solutions and Wealth management services are companies like CAMS, KFintech, Link Intime, Bigshare Services, Miles Software Solutions Private Limited, and Applied Software Private Limited.

KFintech is the only investor and issuer solutions provider to mutual funds, offering services beyond India.

As on January 31, 2022, KFintech is the only investor and issuer solutions provider in India that offers services to both asset managers such as mutual funds, AIF, wealth managers, pensions, and corporate issuers in India, besides servicing overseas clients in Southeast Asia and Hong Kong. KFintech services more than 151.2 million folios as at December 31, 2021, as compared to 49.2 million as at December 31, 2021 for CAMS.

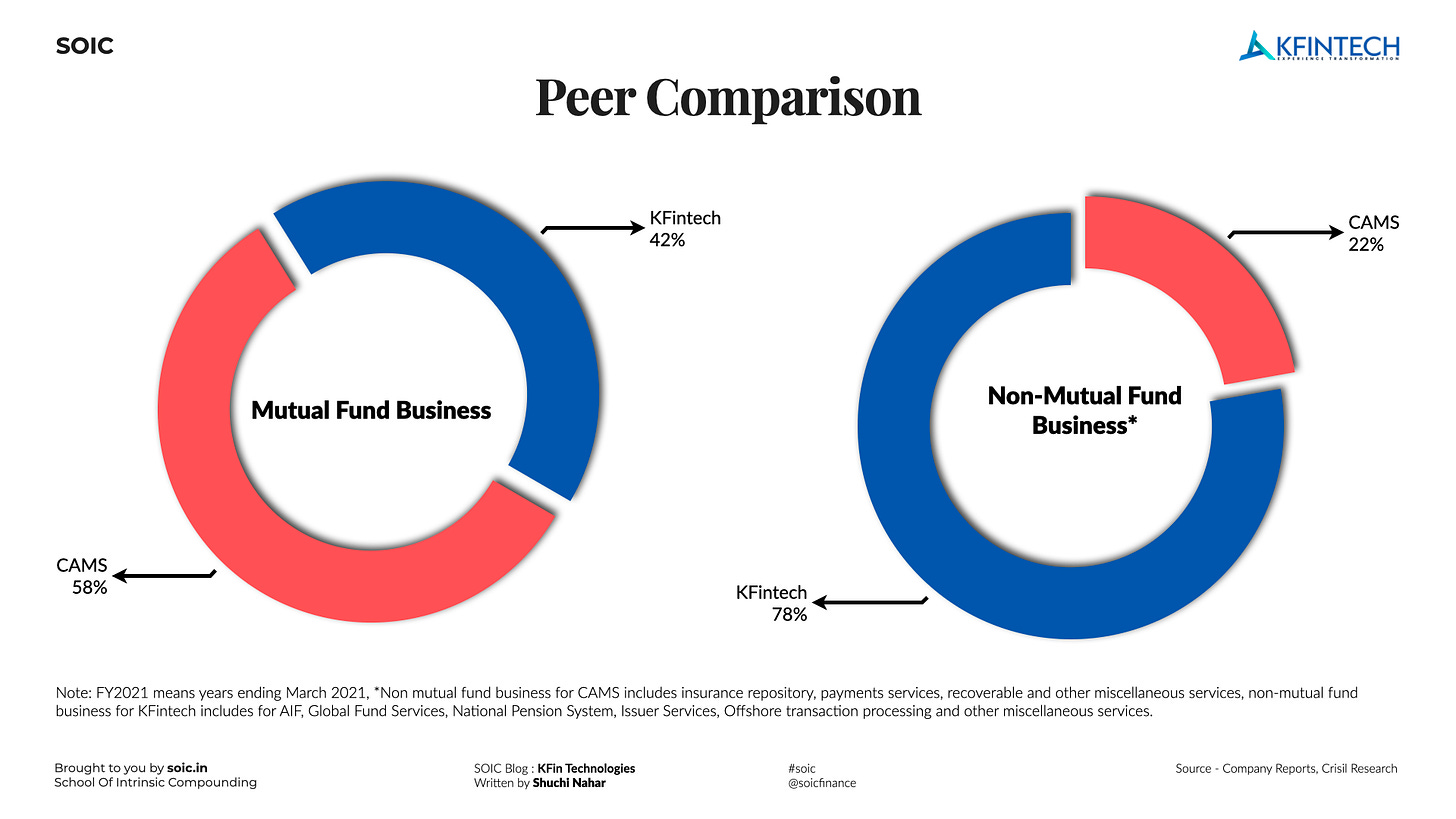

KFintech has a diverse revenue mix as compared to CAMS. KFintech is highly diversified with respect to its offerings and revenue mix as compared to CAMS. Currently, the mutual fund business accounts for 90.3% of overall CAMS revenue, whereas it is 66% for KFintech.

KFintech’s non-domestic mutual fund business includes global fund services (international investor solutions for international markets), CRA for the National Pension System, issuer solutions, and global business services (outsourced transaction processing).

Product mix of various investor and issuer solutions providers. Among the peer groups considered, KFintech has a wide variety of suites of products covering all segments.

CAMS also has a suite of services covering multiple business segments, such as mutual funds, AIFs, and insurance repositories. In addition, CAMS has received a CRA license for NPS and has commenced operations as of March 2022.

KFintech and CAMS have collaboratively developed MF Central, an investor services hub that allows investors to execute all financial and non-financial mutual fund transactions, and track transaction status, portfolio, and complaints on a real-time basis. Fund performance across categories.

Amongst the investor solution providers to the mutual fund industry, KFintech has the majority of the top 5 performing mutual funds in various categories as their clients, as compared to CAMS, which has, SBI and Kotak Mutual Fund as their clients.

Focused and selective international expansion

International Mutual Funds, specifically on the Southeast Asian side, see the opportunity size if you add up the geographies of Singapore, Hong Kong, Malaysia, the Philippines, Indonesia, and Thailand to be around $1.3 trillion, which has reached over two times the size of India, and KFin Tech renders both transfer agency and fund accounting administration services in this part of the world.

Kfintech is servicing 21 AMC clients in Malaysia, the Philippines, and Hong Kong and has signed on 3 AMCs in Malaysia and Singapore that are yet to go live with them. Additionally, the company has added 1 client each in Oman and the Maldives.

KFintech aims to become a leader in the third-party investor solutions business in these markets. The management has plans to expand internationally beyond the existing geographies by further enhancing the global delivery model, wherein they will look to become delivery partners to global investors and issuer service providers, to enter other markets.

While investor solutions on domestic funds and issuer solutions have been their traditional businesses, KFin Tech has expanded into international and other investor solutions, which have been the fastest-growing businesses.

Today, the company manages 33 international clients in Southeast Asia and beyond. In the case of central record agencies, they have one of the three CRAs and manage close to 0.9 million subscribers, which accounts for 7% of the total market share.

The company continues to expand internationally, both organically and inorganically in the form of acquisitions. International Investor Solutions has added 33 clients. The company has a total of 33 clients now, up from 22 for the previous 9 months ending December 2022. 8 international clients between Southeast Asia and Canada

The company has won its first client outside of India and Asia, in Canada, for providing full-scale fund administration services for two funds of this client. This is a good segway for us to expand into the western part of the world, where fund accounting administration is a large addressable market with a $6 billion+ ticket size.

The company started its operations in Gift City in February, and they have already boarded 6 funds in there, including Gift City Domiciled and 2 international funds. Expansion of their international clientele from 22 to 33. This is largely on the back of their acquisition of Hexagram, which has added international clients as well as organic growth of KFin Tech’s own all clients.

Pursue strategic acquisitions!

The company aims to continue to execute acquisitions to expand its platform and service offerings and acquire new clients to drive accelerated growth by leveraging its market access. They aim to focus their efforts on the following types of businesses:

• established businesses in the key markets and businesses so as to add more clients across their businesses.

• existing businesses in new geographies as a tool for market entry.

• broadening their product portfolio to deepen their client relationships.

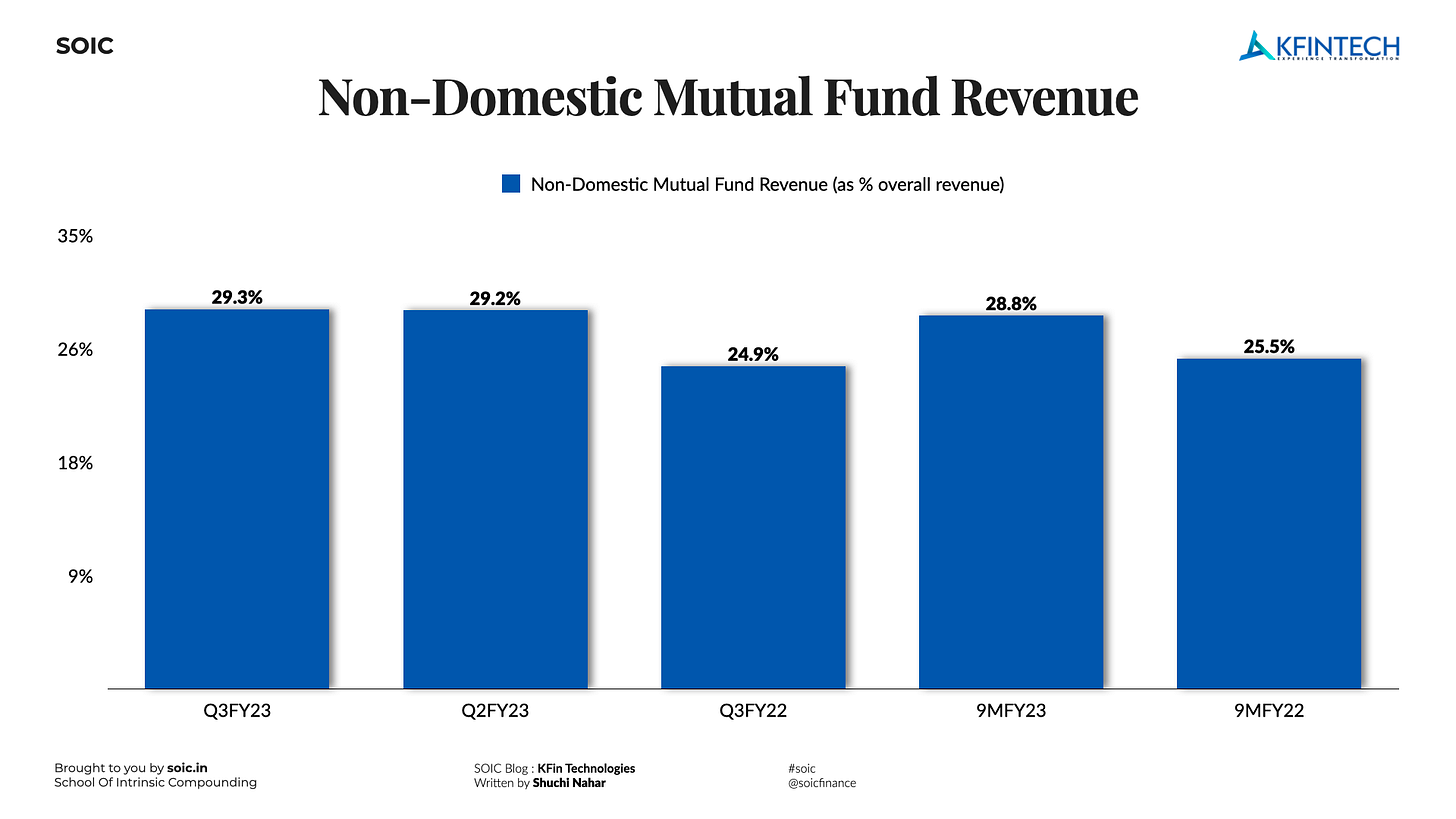

The share of non-domestic mutual fund revenue in overall revenue improved to 29% in 9MFY23 vs. 25% in 9MFY22.

An increase in the share of revenue from non-domestic mutual funds suggests that the company is gaining traction in its efforts to expand its business in international markets. This indicates that the company is developing new investment products that are appealing to international investors or that it is expanding its distribution network in foreign markets.

Focusing on non-domestic mutual fund revenue also indicates that the company is looking to diversify its revenue streams and reduce its reliance on domestic markets. By expanding its business in international markets, the company may be able to reduce its exposure to local economic conditions and regulatory risks.

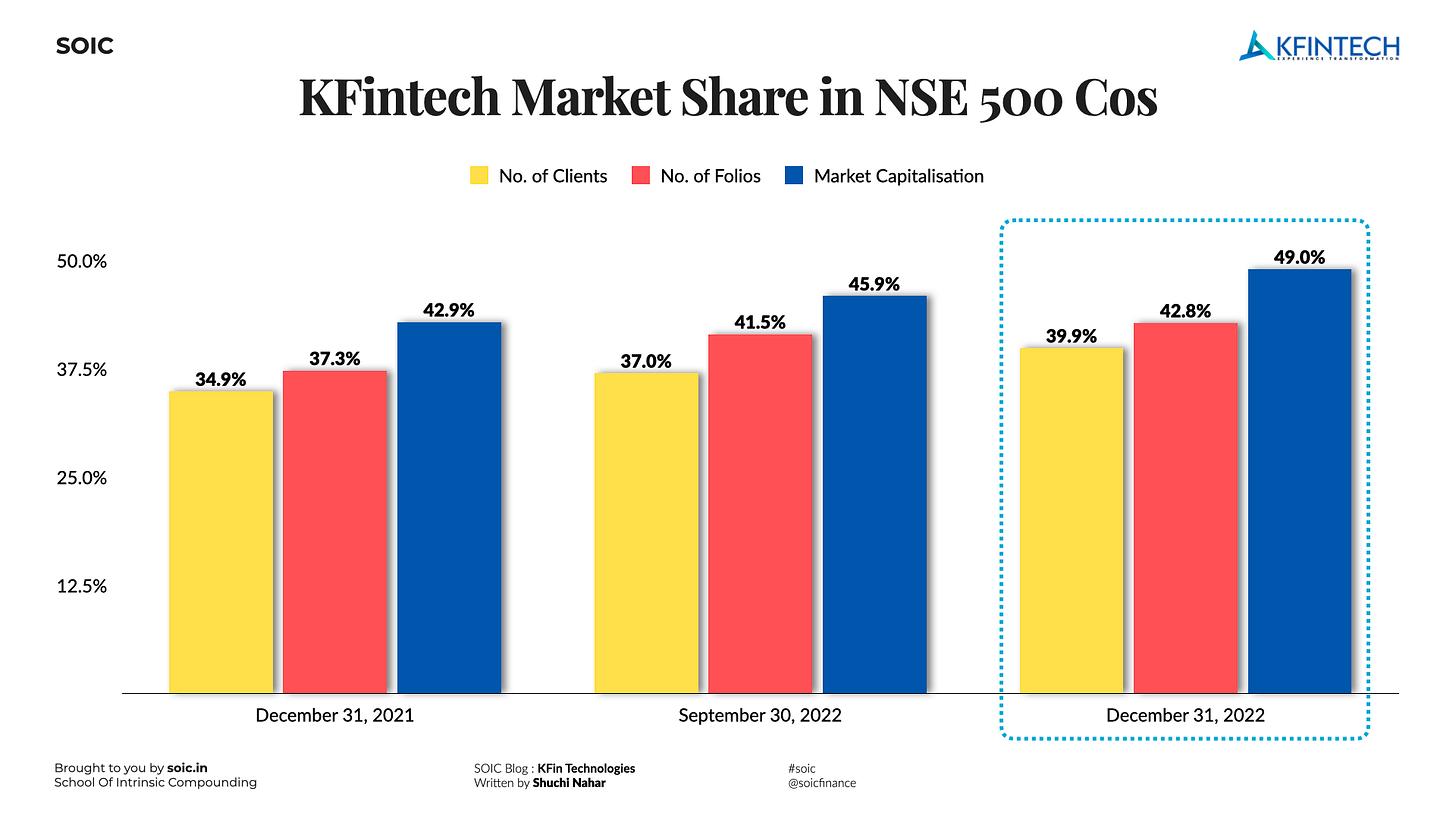

Kfintech’s market share in NSE 500 companies

▪ 128 clients added during Q3 - 409 clients added during 9MFY23

▪ 0.8 million folios were added during Q3; - 6.1 million folios added during 9MFY23.

▪ 5 mainboard IPOs during Q3 - 9 mainboard IPOs during 9MFY23

▪ 55.2% market share, as per issue size, in the mainboard IPO during 9MFY23

▪ Managed India’s largest IPO of LIC during 9MFY23

Kfintech v/s CAMS

Kfintech Key Performance Indicator

Company’s recent acquisition

On 06 April 2023, KFintech Acquires WebileApps to Accelerate Digital Transformation and Expand Offerings. The company invested and acquired a 100% equity stake into WebileApps (India) Private Limited (“WebileApps”), a Hyderabad-based enterprise product development and design company specializing in artificial intelligence, machine learning, mobility solutions, UI / UX, and other product development for banking and financial services industries. After this investment, WebileApps will become a wholly-owned subsidiary of KFintech.

Entering into definitive agreements on February 24, 2023, for, inter-alia, subscribing to 1,041,525 Equity Shares in Fintech Products and Solutions (India) Private Limited (“FPSIPL”) for a consideration of Rs. 6,50,00,000, translating into an equity shareholding of 25.63% of the post-issue share capital of FPSIPL (“Initial Primary Transaction”).

KFintech to invest into Fintech Products and Solutions to enter Account Aggregator business o The proposed investment will help KFintech to diversify its business by entering into the Technical Service Provider (TSP) and Account Aggregators (AA) domain o The proposed transaction will help FPSIPL to leverage KFintech’s technology prowess.

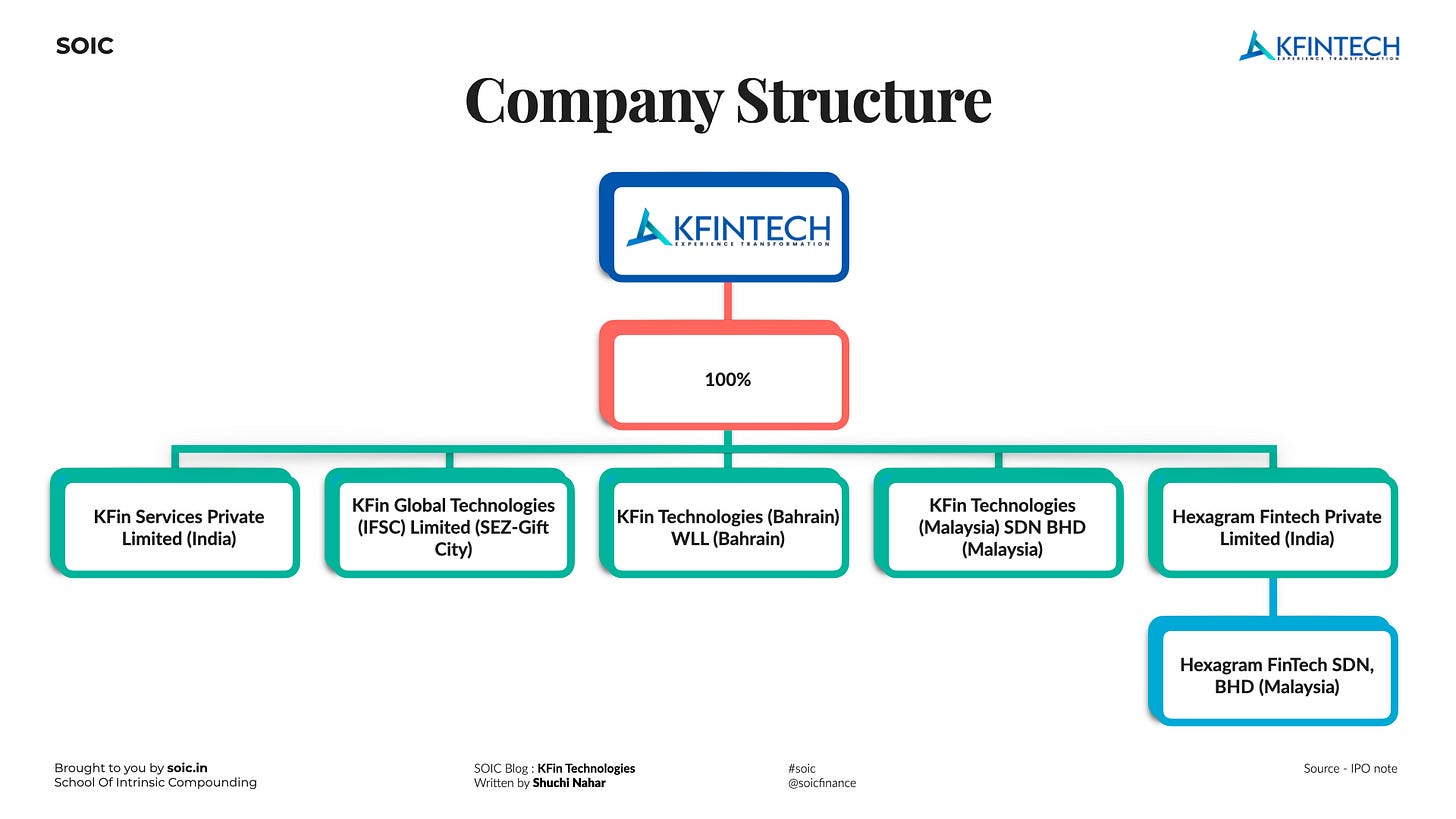

Hexagram will become a wholly-owned subsidiary of KFin Technologies. After the deal, KFin Technologies will expand its fintech product offerings by adding fund accounting and reconciliation solutions to its platform. The acquisition will also strengthen KFin Technologies’ presence in South-East Asia, helped by Hexagram’s established base of BFSI marquee clients in the region.

KFintech’s Expertise

Kfintech is its expertise in the mutual fund servicing space. The company has over two decades of experience in servicing mutual funds, which has enabled it to build deep domain expertise and a robust technology infrastructure that allows it to offer high-quality services to its clients. This expertise has helped KFintech to establish strong relationships with mutual fund houses, which has further strengthened its position in the market.

Another important advantage of KFintech is its focus on digital transformation. The company has invested heavily in building a comprehensive suite of digital solutions that enable its clients to access its services online, including through its mobile application. This focus on digital transformation has helped KFintech to improve its customer experience, reduce costs, and improve its operational efficiency.

Finally, KFintech's strong management team, which comprises experienced professionals from the financial services industry, is another advantage that has helped the company to sustain its competitive advantage. The management team's deep industry knowledge and expertise in various domains have enabled KFintech to identify and capitalize on new growth opportunities, which has further strengthened its position in the market.

Kfintech is India’s largest investor solutions provider to Indian mutual funds, providing services to 24 out of 41 AMCs in India as of September 2022. As of September 2022, KFIN had a 59% share in terms of clients.

As of December 31, 2022, Kfintech is India’s largest investor solutions provider (based on the number of AMC clients serviced), servicing 26 out of 46 AMCs in India, representing 49% of the market share based on the number of AMC clients.

One of the key strengths of KFintech is its technology platform, which enables it to deliver services efficiently and securely across multiple markets. The company has invested heavily in its technology infrastructure, including the development of proprietary software tools and the implementation of best-in-class security protocols.

Overall, KFintech is well-positioned to benefit from the continued growth of the asset management industry, particularly in emerging markets where there is significant demand for high-quality technology-enabled services. However, like any business, KFintech will need to continue to innovate and adapt to changing market conditions to maintain its competitive edge over the long term.

Kfintech has a significant opportunity to capitalize on the growing demand for financial technology services in India and abroad, by expanding its services other than mutual funds, enhancing its digital capabilities, and focusing on providing an exceptional customer experience.

Disclaimer: The information provided in this reference is for educational purposes only and should not be considered as investment advice or recommendation. As an educational organization, our objective is to provide general knowledge and understanding of investment concepts. We are not registered with SEBI (Securities and Exchange Board of India) and do not provide any buy/sell/hold investment advice, suggestions, or recommendations, nor do we provide any Portfolio Management Services.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and not be borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.

AUTHOR

Shuchi Nahar

Masters in Finance with 5 years of industry experience. My approach is to take one sector at a time and explore plausible Investment ideas.