LTTS: Best from L&T group?

There is a common perception that Tata Elxsi or LTTS are similar businesses when compared to other IT services companies like Infosys,Birlasoft or a coforge. But the truth is that these businesses come under a category of Engineering and R&D businesses. These service providers aren’t like a typical IT services company. We like to call them “CRADS” Businesses i.e. basically, Contract Research and Development services for different products and verticals like medical devices, lifesciences, Electric Vehicles etc. We find these businesses to be similar to what Syngene is doing as a Contract Research Organisation in the pharma space.

As we have talked about LTTS in some of our videos and webinars, today we will be going a bit deeper to dissect LTTS business for all of you. Get ready to know this ER&D services player from India.

Watson: Sherlock, I have come up with another interesting company to look at in Indian markets.

Sherlock: Tell me Watson. India is buzzing these days, isn't it? Quite a listing for Zomato recently.

Watson: Yeah, everyone is hoping this decade to be India's decade and maybe this century to be India's century.

Sherlock: Let's maybe analyse this macro picture some other day,as narrative investing rarely works. Which case do you have for me today?

Watson: It is LTTS (L&T Technology Services). Find out all about them, what they do, what are the prospects and where are they headed?

Sherlock: Need not tell me Watson.

Sherlock goes back to research and shows up a few days later.

Sherlock: Watson, I have completed my research and we have really got an interesting player in the hand here.

Watson: Tell me, what do they do?

Sherlock: LTTS is an ER&D services company. ER&D is Engineering, Research & Development. So what they do is, they partner with any other company from let’s say automotive space, or manufacturing space, or telecom, or medical space to add value to the design and development of their products or services. We will understand this in detail with some case studies later. ER&D businesses are often confused with IT services. This is not the case Dear Watson. Most of the investors see but they do not observe. ER&D businesses are more lumpy, not so long ago Tata Elxsi was written off and used to trade at 15times Earnings ;). Similarly, LTTS didn’t report any growth between 2019 to 2021. Let’s look at the differences between the two types of businesses:

Coming back, LTTS is present in five main segments: Transportation, Telecom and Hi-Tech, Industrial Products, Plant Engineering and Medical Devices. In each of these business segments, they offer world-class Engineering Research and Development (ER&D) services and digitalisation solutions.

Watson: I am intrigued to know what kind of offerings they have in each of these segments.

Sherlock: Let’s talk about transportation first. Here, LTTS deals with the top OEMs (Original Equipment Manufacturers) and Tier 1 suppliers across the Automotive, Trucks & Off-Highway Vehicles and Aerospace sector.

Let me give you one example of this:

So let’s say you run an automobile company and you are going to launch a new car which should have some advanced driver assistance features. These could be that your car should be able to detect lanes on the road, detect pedestrians, traffic signs, etc. LTTS comes into picture by offering such systems for OEMs.

Watson: This is interesting! It is a proxy play on autonomous cars and EV systems that are likely to be the future.

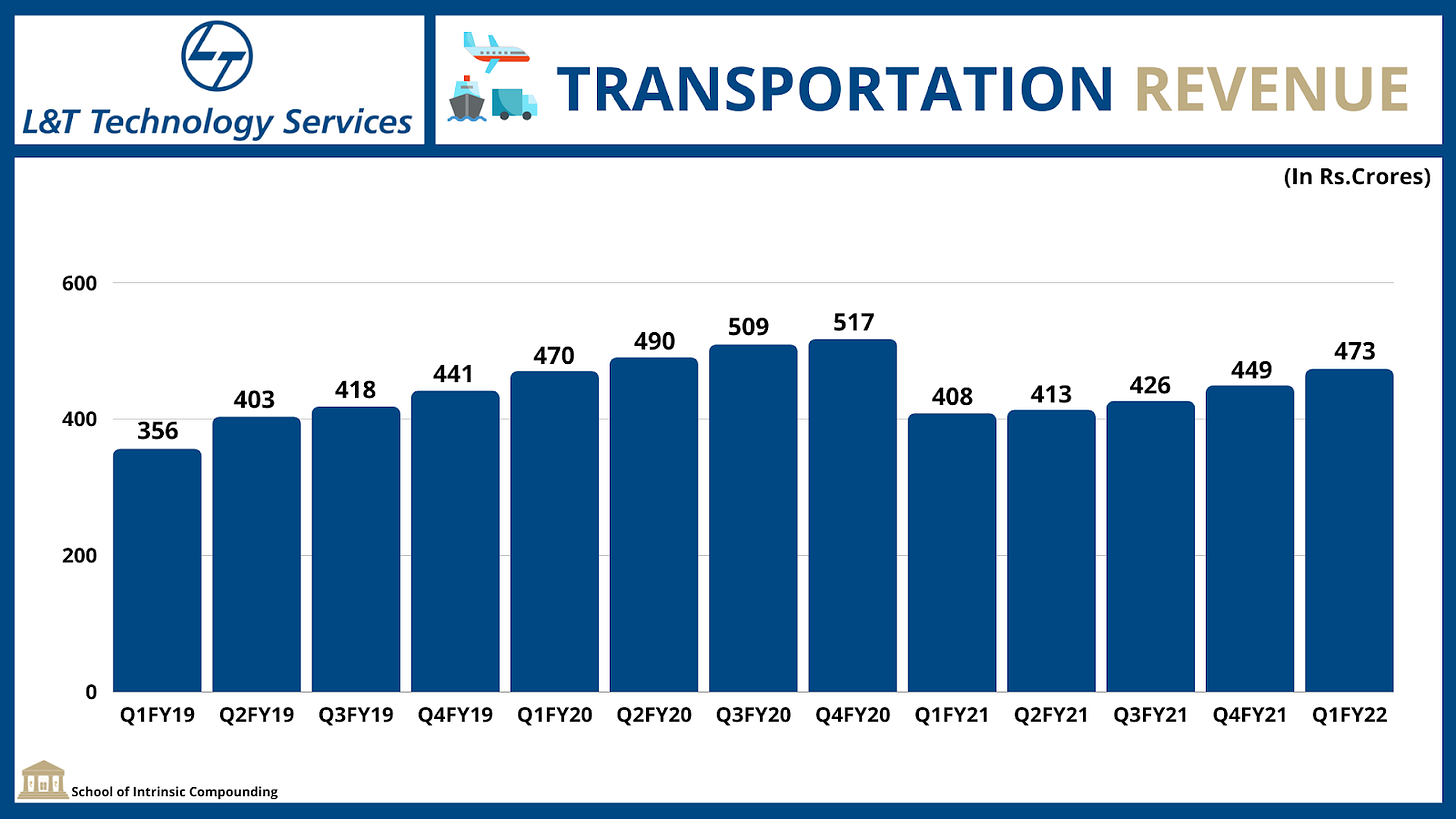

Sherlock: Indeed it is. Let’s look at how they have performed in this segment. LTTS has consistently grown its revenues in the transportation segment, except the degrowth that was observed in FY21 due to the impact of COVID-19.

Sherlock: Let’s look at the next segment, the Industrial Products. LTTS supports its global customers across industries such as Building Automation, Power & Utilities, Machinery and Test & Measurement through services in the areas of product, digital and value engineering.

Let’s go through one example for this as well:

Imagine that you are running a company and you are tired of the continuous machine wear and tear, and maintenance costs. ER&D players like LTTS again come into picture over here. With the help of sensors, IoT and cloud, LTTS has the capability to build predictive machine learning models which can predict the machine wear and tear in advance and also tell us about what external conditions cause this wear and tear. So, what these sensors essentially do is that they connect with machines and collect data around weather, humidity, machine speed, machine vibration, etc. and upload that data on the cloud (AWS/Azure/Google Cloud). Then that data is collected and a machine learning model runs on top of that data to predict which conditions likely cause the machine wear and tear.

Watson: This segment might have taken a hit I guess, due to the global economic slowdown that happened pre-COVID. Then COVID also would have impacted it, I assume.

Sherlock: Yes, exact things have happened with LTTS in this segment. If you look at their revenues QoQ, you will find lumpiness in the numbers. Concerns of global trade war between US & China plagued this segment, and then the impact of COVID is also visible.

Watson: I see, what other segments do we have for LTTS?

Sherlock: So the next segment is Telecom & Hi-Tech. In the Telecom and Hi-Tech vertical, LTTS offers engineering services and solutions for five key segments: Telecom, Consumer Electronics, Semiconductor, ISV and Media & Entertainment.

We have an interesting and most relatable example here to understand:

LTTS has the capability to build OTT apps for media and entertainment providers. So let’s say there is some producer/director in Mumbai who wants to produce a web series for the masses. He can approach LTTS to build a multi-lingual OTT app for the web series company. Recently, LTTS developed a similar product which has over 50M active users.

Watson: This is interesting! How are the growth trends over here?

Sherlock: This segment also has lumpiness. One of the reasons for this was the cancellation of order in FY-20 that brought degrowth in this segment.

Watson: These segments are quite cyclical. Seems like despite LTTS being in a growing industry space, it has gone through a lot of headwinds.

Sherlock: Yes, that is part of our antithesis later. There is cyclicality in some of these segments, but still on the company level, let’s see if this diversification across segments can smoothen the journey.

Watson: Yes, that would be appreciated by investors. So, what are the other two segments?

Sherlock: Next one is Plant Engineering. LTTS is involved in every phase of a manufacturer’s plant lifecycle–from conceptualisation to commissioning. LTTS takes a consulting-led approach to offer state-of-the-art digital solutions that help customers upgrade/integrate their legacy systems to smart platforms for better synergy.

Here, LTTS offers interesting solutions. For example, you are a site manager of a large brownfield manufacturing site. You want to simulate how your manufacturing site would operate. LTTS offers solutions which help in this area. With the help of laser scanning, one can get the complete 3D digital twin of a running manufacturing site. As a site manager, now you can analyse that digital twin and see how your machines are working, how much of the workforce is needed at the site, how robots are functioning, how is the inventory on the site being managed, which components are using high energy, etc. Now, as a site manager you can create multiple scenarios on that digital twin without impacting the actual operations of the site. Hence, such design optimisation activities can lead to substantial reduction in the operational costs of a site.

Watson: This seems interesting! So essentially, what you are trying to say is, that one can simulate the activities at a plant through some computer model.

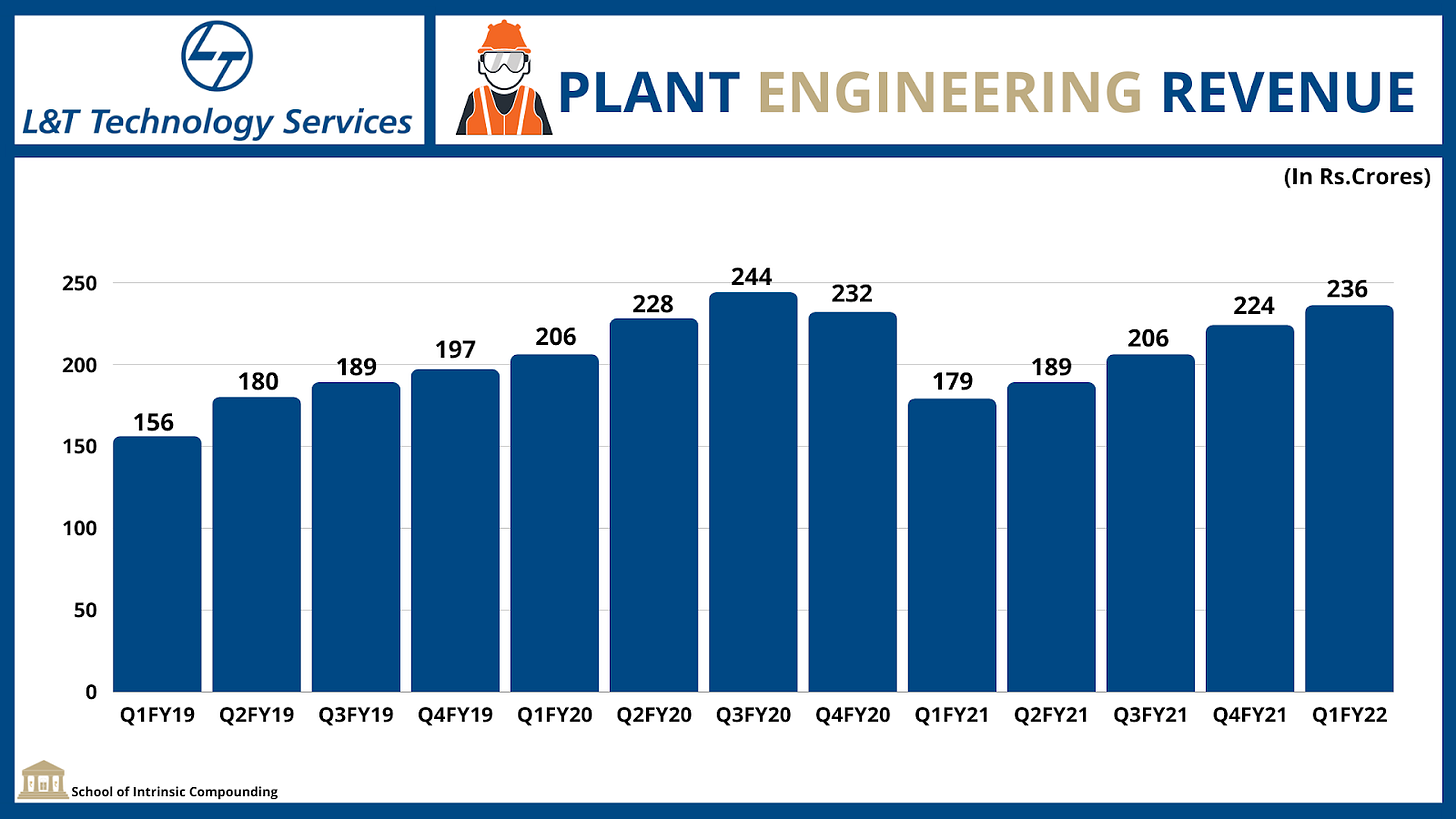

Sherlock: Yes, kind of. Simulation helps you to create scenarios. Another place where such tools are used is for example, an airline designer wants to design a new aeroplane. They can create multiple models of an aeroplane digitally and then run scenarios to determine which one would work best. This saves a lot of cost and time for the designer. The growth in this segment had been quite decent until COVID hit.

Watson: Such things make LTTS truly a new age services player. Go on Sherlock with our last segment.

Sherlock: So, our last segment is Medical Devices, this has been the fastest growing vertical where LTTS helps medical OEMs speed up product development cycles and shorten the time-to-market. The company works with global names in the medical devices and healthcare division to devise solutions around remote medical care, in-vitro diagnostics, patient mobility services, home healthcare, and medical Internet of Things (MIoT).

So, recently they have developed a blood cell counting machine using a machine learning algorithm of their own, which has reduced the cost of blood analysis without compromising on the accuracy of the results.

This segment has grown between 25%- 30% between FY-19 and FY-21.

Watson: I see LTTS is a diversified player across different verticals.

Sherlock: Yes, it is kind of a double edged sword. The diversification de-risks revenue from any one segment but can also pull down growth due to the cyclical nature of some other segments.

Watson: Yes, you are right Sherlock. How do these segments contribute to LTTS revenues and what are the margins by each segment?

Sherlock: Transportation contributes close to 35% of revenues for LTTS, followed by Telecom & Hi-Tech with 22%, Industrial Products with 19%, Plant Engineering with 15% and Medical Devices close to 11%.

Interestingly, the margin mix is not uniform across these segments, which means that LTTS blended EBIT margins have fluctuated between 15-20% over the years. Transportation & Telecom which contributes 50% of the revenues have a margin profile of 15-17%, while other three segments have relatively higher margins. In the figure below, we see margin fluctuation across all the segments. We will talk about this later in the blog.

Watson: I see huge variations in the margins across segments. Transportation and Telecom have lower margins and bring the margins at company level down.

Sherlock: Yes, although management has indicated that they are working towards improving the margins for these two segments.

Let me now quickly show you some other metrics important for an IT business.

Sherlock: If you see below visual, LTTS is highly dependent on the North American markets and Europe for its revenues. Any disruption in these markets can cause significant revenue losses.

Sherlock: Next comes, Onsite-Offsite mix. LTTS has a substantial number of people working at its onsite locations and labs in the U.S.A, EU, Israel, etc. LTTS Onsite-Offsite mix has remained close to 44:55 in the past until some improvement happened in the recent quarter. If we compare the same metric with its peers like Tata Elxsi, their Onsite-Offsite mix has come close to 30:70 in FY21. This is one of the reasons why LTTS has lower EBIT margins in the range of 18-20% while Tata Elxsi has EBIT margins over 25%.

Watson: This is quite insightful!

Sherlock: Let’s now talk about how the account value has evolved. This is very important to track as an IT business growth, is hinged on how much it can mine existing clients and grow account value apart from adding new clients.

Watson: So, what I see here is that LTTS has a huge scope of making these accounts bigger. Maybe now post COVID we should expect that from LTTS.

Sherlock: Yes. Let’s now talk about Client Concentration. This is another important metric to track, as concentrated client mix poses risk to the business if any of the top customers is lost. LTTS Client Mix has improved over FY-21 and top 5 clients contribute 16% revenues.

Watson: How has the utilisation and attrition levels at LTTS been?

Sherlock: Utilisation rate is a very important metric in IT services. In any IT business, optimal utilisation of the workforce is important. Utilisation is the ratio of billed revenue vs. total revenue. If we see the figure below, we can see that LTTS’ EBIT margins have contracted whenever utilisation in the business has gone down. Utilisation going down means that more people are sitting on the bench and not contributing to any client project. This is an important efficiency metric.

However, LTTS’ management clearly specified that they would also not want utilisation levels to go more than 80%. As an ER&D business, LTTS needs some people on the bench to continuously innovate on technologies and also serve as a replacement of existing people in the company, in case of attrition.

Sherlock: Regarding attrition, LTTS’ headcount grew substantially in FY-19, however, due to headwinds in the business post FY-19 and COVID’s impact coming in, headcounts have not increased substantially. This metric is important to track in an IT business, as it is a lead indicator of the growth going forward. Similarly, attrition rates in ER&D business are also very important to track as ER&D business requires deep domain expertise of every individual involved in a client project. Tata Elxsi, a peer of LTTS, fares better here with 7% of attrition rate.

Watson: These metrics are quite important to track for getting the LTTS’ story right. So Sherlock, what forms our thesis for LTTS?

Sherlock: Our thesis for LTTS is:

The ER&D services industry is growing in the mid-double digits, and players like LTTS with innovation and technological capability stand apart to take advantage of this growth. For now, LTTS’ management has given 15-17% growth guidance for FY-22.

LTTS is a truly diversified ER&D player in the country across all five segments, which can actually prevent them from steep headwinds arising due to downturn in any one industry.

Possibility of margin improvement:

LTTS has faced headwinds in the past 2-3 years and their utilisation levels in Telecom and Transportation segments have led to lower margins. Also, due to COVID-19, overall margins got depressed due to operating deleverage.

However, management believes in a post COVID world, if they can keep the utilisation levels close to 80% and decrease the onsite mix in the transport segment and sign more deals in telecom, they are still multiple levers to improve on EBIT margins. Let’s see how this story pans out.

Watson: As you have repeatedly said that knowing the risk is more important than knowing the obvious. So what forms our antithesis here?

Sherlock: Yes, keep your thesis close but antithesis closer. Below points form our anti-thesis.

LTTS has faced headwinds in the past few years due to the global economic tensions such as, US-China trade war and COVID-19, when many of the customers delayed or cut ER&D expenditure. Any global economic slowdown again, can pose significant risk to the operations of the company.

LTTS derives over 60% of revenues from North America and here lies the geographic concentration risk.

Also, every IT company faces some common risks such as:

Attrition risk: ER&D players’ biggest assets are its people and significant increase in attrition can lead to loss of projects.

Foreign exchange risk: If INR appreciates against USD, then IT companies stand to lose as they generate the majority of revenues in USD.

Increase in competitive intensity and slow innovation:

Players like LTTS would need to keep pressing the pedal of innovation as the ER&D industry, unlike Traditional IT, requires innovative solutions to meet customer’s needs. Hence, any increase in competitiveness in the industry or decline in the innovative pace of LTTS can cause major risk to the business.

Watson: I will be closely watching this story unfold. Readers, write in the comments section to let us know how you view this emerging story.

About the Author

Simrat is a Software Engineer, fitness enthusiast, and a passionate reader of multidisciplinary topics. He enjoys reading about businesses across India and the world to find suitable opportunities for equity investing.

His twitter profile link: https://twitter.com/simrat11exp/

Disclosure:Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website.