The stock market has experienced significant volatility following President Trump's announcement of reciprocal tariffs, with major indices like the S&P 500 dropping nearly 6% on April 4, 2025. These tariffs, ranging up to 49% on certain countries and a baseline 10% on all imports, aim to address trade deficits but have sparked fears of a global trade war.

Market Breadth

The recent tariff noise appears to be causing a divergence in sector performance, potentially narrowing breadth as investors shift focus. The Nifty 50, a key benchmark index, closed at 22,904.45 on April 4, down from 23,519 on March 28, indicating a weekly decline of approximately 2.61%. This drop suggests a bearish trend, potentially driven by external pressures such as international trade tensions and domestic investor sentiment.

Sectoral Performance

As of April 4, 2025, several key sectors showed significant losses, likely indicative of weekly underperformance:

NIFTY METAL: Down 6.56%

NIFTY PHARMA: Down 4.03%

NIFTY IT: Down 3.58%

NIFTY AUTO: Down 2.70%

NIFTY REALTY: Down 3.60%

The dominance of decliners, particularly in sectors like metals, pharma, and IT, points to potential risks from global economic factors, such as U.S. tariff announcements, which may have contributed to the sell-off.

In contrast, defensive sectors appeared more resilient:

NIFTY FMCG: Up 0.04%

NIFTY PRIVATE BANK: Down only 0.13%

Investors found safety in the domestic focused banks and NBFCs and some other domestic focused sectors such as hotels, hospitals might also not be the ones that would be the patients of the global turmoil, while sectors exposed to global markets faced greater challenges.

Relative Performance

Because of all the market turmoil a lot of new sectors came in the top this week.

Sectors like small banks and microfinance NBFCs performed well on the back of improving collection efficiencies. Also Value retail fashion also performed well on the back of continued strong momentum in SSSG growth. Private banks and FMCG might have performed better because of the investors' flight to safety to the defence forces in the uncertain times. Also sectors like edible oils and cement also did well in the past week.

Stay on top of markets: StockScans.in delivers powerful, real-time screeners tailored for the Indian market.

{ Join our SOIC Membership now with the exclusive New Financial Year offer

Coupon Code: SOICFY2026 (valid for 48 hours)

Enrol for 1 year or 3 years: https://learn.soic.in/learn/fast-checkout/97666?priceId=36137 }

The Saga of Tariff Wars!

The Trump administration's latest round of tariffs has created a new maze of regulations for international trade. The US shift toward protectionism has resulted in surprising and unexpected consequences. The consequences will not just have a one faced impact on the US and the global supply chain but it will also be more of a domino effect where more than one thing will fall out of place and things still are uncertain as there will be the sequence of trade negotiations and counter tariffs to tackle the “Reciprocal Tariffs”.

The imposition of very high reciprocal tariffs by the US on its major trading partners, including India, will likely have large negative consequences for

Global and US GDP growth,

Global and US inflation and

The profitability of certain sectors and companies in India.

The “Factory of the World” Asia has seen the worst changes in tariffs from the US. Cambodia facing tariffs of 49 per cent, Vietnam 46 per cent, Thailand 37 per cent, China 34 per cent, Taiwan 32 per cent and Indonesia 32 per cent, India 26 per cent, all well above the blanket 20 per cent rate imposed on US imports from the EU, for example.

The majority of exports from Asian countries to the US will not be covered by the limited list of exempted goods announced by the White House, adding to the woes of these nations. These exemptions, even if temporary - include pharmaceuticals, semiconductors, lumber, and certain minerals - send a clear message to Asian countries that their staple exports to the US could be early casualties of a new trade war.

An example of why the whole situation is so uncertain is that, just the day after announcing the exemption on sectors like pharmaceuticals, semiconductors, lumber and certain minerals and takes a U-turn the next day and announces that Pharma will be handled separately!

So how does India fit into this tariff situation?

Tariffs on sectors including chemicals, electronics, gems and jewelry, and textiles will face a significant increase. The larger concern is the risk of retaliatory tariffs, which could negatively impact global trade and investment, US and global growth, and inflation.

But on a relative basis India has received lower tariffs compared to the most Asian countries that has a top hand in exporting to US.

India’s export to the US is dominated by textiles (furnishings and apparels), gems and jewellery (diamonds), pharmaceutical products (medicaments), electronics (mobile phones), etc.

The goal of reciprocal tariffs is to protect and grow the US domestic manufacturing sector (Make America Great Again). The macroeconomic impact on India should be minimal in the near term, due to the relatively low effective tariff. However, trade disruptions will increase from here on, with increasing risks of retaliatory tariffs and a global growth slowdown. The various scenarios of exports to the US getting impacted are currently difficult to quantify due to the domino effect it will have.

What does US wants from India to Import from US more to make bilateral trade agreement for a tariff relief as mentioned in few of the past interviews and the interview of Mr. Modi and President Trump in the White House are Energy and Electronics to compensate for the tariffs?

Impact of US Reciprocal Tariffs on the Indian Specialty Chemicals Sector

The recent imposition of reciprocal tariffs by the US is expected to negatively affect the global chemical industry, including Indian specialty chemical companies. Here’s a simplified breakdown of the key points:

The US is placing higher tariffs on imports, leading to potential trade tensions and retaliatory tariffs from other countries.

This move is likely to slow down the global economy, particularly key industries that use chemicals, such as automobiles, construction, and home appliances.

Impact on the Chemical Industry

Reduced Demand: Slower global growth means less demand for chemicals in major sectors.

Tougher Competition: Chinese overcapacity may lead to more aggressive pricing in non-US markets, increasing pressure on Indian exporters.

Margin Pressure: US buyers may negotiate lower prices, and rising costs in the US could attract new competitors, squeezing margins.

Delayed Recovery: Hopes of a recovery in chemical prices are likely to be pushed back indefinitely

Impact on Indian Specialty Chemical Companies

Most Exposed:

PI Industries (43% revenue from US)

-May face margin pressure and pricing shifts in key products like pyroxasulfone.

-US farmers may downgrade to generics, opening competition.Vinati Organics (20%)

-Could see reduced demand for products like ATBS.

-Potential customer renegotiations and new competition risks.Clean Science (17%)

-Current US sales mainly from MEHQ; however, HALS, a future growth product, is heavily US-focused.Navin Fluorine (14%)

Key US clients include Honeywell (HFOs) and Corteva (agrochemicals).

May face reduced demand and pricing challenges.

More discussion around this topic will be made in a Youtube Live Q&A on the same topic.

Banking Slowdown

Key Reasons for Slowdown in Banking and Credit Growth

1. Sluggish Loan Growth

Loan growth has slowed down, especially for large private banks, compared to PSU banks.

This is not due to an excess of credit in the system but because of lower demand and some supply-side constraints.

2. Weaker Demand for Loans

Economic activity isn’t driving strong credit demand.

Microfinance and lower-income borrower segments are showing early signs of stress, though their impact on overall bank performance is limited.

3. Supply Challenges in Lending

Banks are being cautious in giving loans due to:

Pricing issues (interest rate challenges),

Funding pressures (liquidity or deposit issues),

Asset quality concerns.

HDFC Bank and Axis Bank, for example, are dealing with deposit-related issues, slowing their loan disbursals.

4. NIM Pressure (Net Interest Margin)

Interest rates are beginning to soften, but not sharply enough to boost loan demand.

As a result, NIMs are likely to remain under pressure, especially for banks with large loan books linked to external benchmarks (EBLR).

5. No Further Boost from Asset Quality

Banks have already benefited from very low credit costs (loan defaults).

That phase is behind us, and while asset quality remains solid, further improvements are unlikely.

Stress is visible particularly in unsecured retail loans and microfinance, mainly among informal and lower-income borrowers.

6. Earnings Growth Set to Remain Weak

With limited loan growth, pressured margins, and normalising credit costs, earnings growth for FY26 is expected to be weak.

This makes it difficult for banks—especially large private ones—to see a re-rating or significant jump in stock valuations.

Key market announcements

Order wins/ New launches / New Product

Godrej Properties - Godrej Properties sells homes worth over INR 2,000 crores.

LTTS - L&T Technology Services wins €50 million deal in Mobility segment.

Kalpatru projects - KPIL awarded new orders worth ₹ 621 Crores.

Avantel - Received purchase order worth Rs.11.36 Crores from Goa Shipyard.

NCC - Company received orders totaling Rs. 5,773 Crore in March 2025.

Newgen software - Newgen Software's subsidiary secures USD 1.27 million agreement.

Engineers India - EIL awarded consultancy assignments worth Rs. 245 crores.

HBL engineering - Central Railway awards HBL contracts worth Rs. 762.56 Crores.

Paytm - Paytm partners with GHMC for property tax collection.

Valiant communication - Valiant awarded project for ransomware resilient data center equipment.

Kernex - Kernex awarded Rs. 85.14 Crores project for KAVACH system.

Ganesh Benzoplast - Ganesh Benzoplast awarded Rs. 169.24 crore order from JSW.

Transrail - Transrail Lighting secures ₹240 crore T&D order.

KEC international - KEC International secures new orders worth Rs. 1,236 crores.

Newgen software - Received purchase order worth INR 17.51 Cr.

Sterling and Wilson - SWREL announces three new solar/hybrid projects worth INR 1,470 crore.

Larsen and tubro - L&T wins large orders for power transmission projects.

Interarch - Company received a Letter of Intent for a new order worth 300 cr

Focus lighting - Focus Lighting and Fixtures Limited has informed about revision in intimation on receiving of order from Marwadi Educare Foundation worth 1.27crs

VVIP Infratech - Award of Rs. 414 Crores in infrastructure projects.

GE Power - GE Power India bags INR 382 million contract from NTPC.

BEL - BEL receives orders worth Rs.593.22 Crores from Indian Air Force.

Mahindra life - Mahindra Lifespace to redevelop two societies worth ₹1,200 crore.

Kilburn - Award of orders worth Rs. 10244 Lacs.

Focus lighting - Focus Lighting and Fixtures Limited has informed about receiving of an order from Lightalive Solutions Private Limited worth Rs. 2,12,87,318/-

Focus lighting - Focus Lighting and Fixtures Limited has informed about receiving of an order from Avid AV Technologies Private Limited worth Rs. 5,71,21,074.93/-

Refex renewables - Award of tender for Bio-CNG plant at Salem.

ABB - ABB India delivers automation solutions for IndianOil's pipeline network.

GPT Infraprojects - GPT Infraprojects wins contract worth 481.11 Crores.

TVS Motor - TVS Motor integrates ION Mobility to enhance EV presence.

Purvankara - Received LOI for Rs. 118.63 Cr project 'Ranka Ankura'.

Godrej properties - Godrej Properties to develop project in Versova, Mumbai.

Paytm - Paytm launches MahaKumbh Soundbox for instant payment alerts.

SpiceJet - SpiceJet launches daily non-stop flights to Kathmandu.

Veranda learning - Veranda RACE signs MoU for IIT Indore certified BFSI program.

Dee Development - Company bags a purchase order worth INR 55 Crores.

Gr Infraprojects - Award of arbitration for Rs. 106.44 Cr.

Surya Roshni - UltraTech Cement to acquire Wonder WallCare for Rs. 235 crores.

Paras Defence - Paras Defence signs MoU with MicroCon for drone technology.

Zaggle - Zaggle enters agreement with Thomas Cook for corporate travel.

BHEL - BHEL signs contract for 6000 MW HVDC Terminal Station.

Hitachi energy - Hitachi Energy awarded contract for HVDC project.

Shakti pumps - Shakti Pumps awarded Rs. 12.42 Crores solar project.

Man Industries - Inclusion in Qatar Energy LNG's Approved Vendor List.

Gland Pharma - Gland Pharma receives US FDA approval for Acetaminophen Injection.

Capex and Acquisitions

Suyog Telematics - Acquisition of 95% stake in Lotus Tele Infra.

Pitti Engineering - Commissioning of new capacity at Chhatrapati Sambhaji Nagar plant.

Ajmera Realty - Joint Development Agreement for luxury villa project.

AGI Greenpack - AGI Greenpac to invest ₹700 Crore in new glass plant. AGI Greenpac anticipates commencing commercial production within 24 months

Automotive axles - Automotive Axles enters services agreement with Meritor HVS.

Swaraj suitings - Swaraj Suiting Limited has informed about Commencement of commercial production/operations

Safari - Safari Manufacturing acquires land for Rs. 1.12 Crore.

Dalmia bharat - Dalmia Cement starts commercial production at Rohtas, increasing capacity by 0.5 MTPA.

JSW Steel - JSW Steel declared successful bidder for Dugda Coal Washery.

Greenpanel - Commencement of commercial production at MDF plant in Andhra Pradesh.

Ashok Leyland -Investment of GBP 45 million in Optare PLC.

Gabriel India - Gabriel India completes acquisition of assets from Marelli.

Sandhar technologies - Sandhar Technologies acquires Sundaram-Clayton's die casting business.

Piramal Pharma - Commencement of Sevoflurane production in Telangana facility.

Hindustan copper -Malanjkhand Copper Project achieves record ore production.

Sky gold - Acquisition of land for capacity expansion.

Shree Cement - Shree Cement starts commercial production at new unit.

Fortis Health - Fortis Healthcare confirms acquisition of trademarks for INR 200 crores.

Reliance Industries - Reliance to invest Rs. 65,000 crores in CBG plants.

Popular vehicles - Opening of a new 3S facility in Bangalore.

Mazdock - Keel laying ceremony for Multi-Purpose Vessel Y21001.

Kirloskar oil - Kirloskar Oil Engines receives order for 6MW marine diesel engine.

Endurance tech - Endurance completes acquisition of 60% stake in Stöferle GmbH.

Vinati organics - Vinati Organics invests ₹61.44 Crores in Veeral Organics.

Firstcry - Investment of INR 73 Cr in Globalbees CCPS.

Choice international - Acquired 100% stake in Choice AMC Private Limited.

HSCL - Acquisition of 60% stake in Trancemarine and Confreight Logistics.

ITC - ITC acquires 43.75% stake in Ample Foods for ₹131 crores.

Rane Holdings - Rane Steering Systems sold land for Rs.50.50 Crores.

Afcons - Raghavpur Multipurpose Project receives environmental clearance.

Emcure Pharma - Tillomed acquires Manx's pharma portfolio for £19.7 mn.

Nuvoco Vistas - Nuvoco Vistas acquires Vadraj Cement for ₹1,800 crores.

Jio Financial - Investment of Rs. 63 crore in Jio BlackRock Asset Management.

Gabriel India - Commencement of commercial production in Pune facility.

Aluvius - USFDA issues EIR with VAI status for manufacturing facility.

Ultratech - UltraTech Cement to acquire Wonder WallCare for Rs. 235 crores.

Balaji amines - Commissioning of 6 MWAC Solar Power Plant.

Sai Life Sciences - Sai Life Sciences opens Peptide Research Center in Hyderabad.

Nestle - Groundbreaking of Nestlé India's first factory in Eastern India.

Ami Organics - Commissioning of 10.8 MW solar power plant.

Management Change

Uniparts - Resignation of CIO Badri Krishnan effective March 31, 2025.

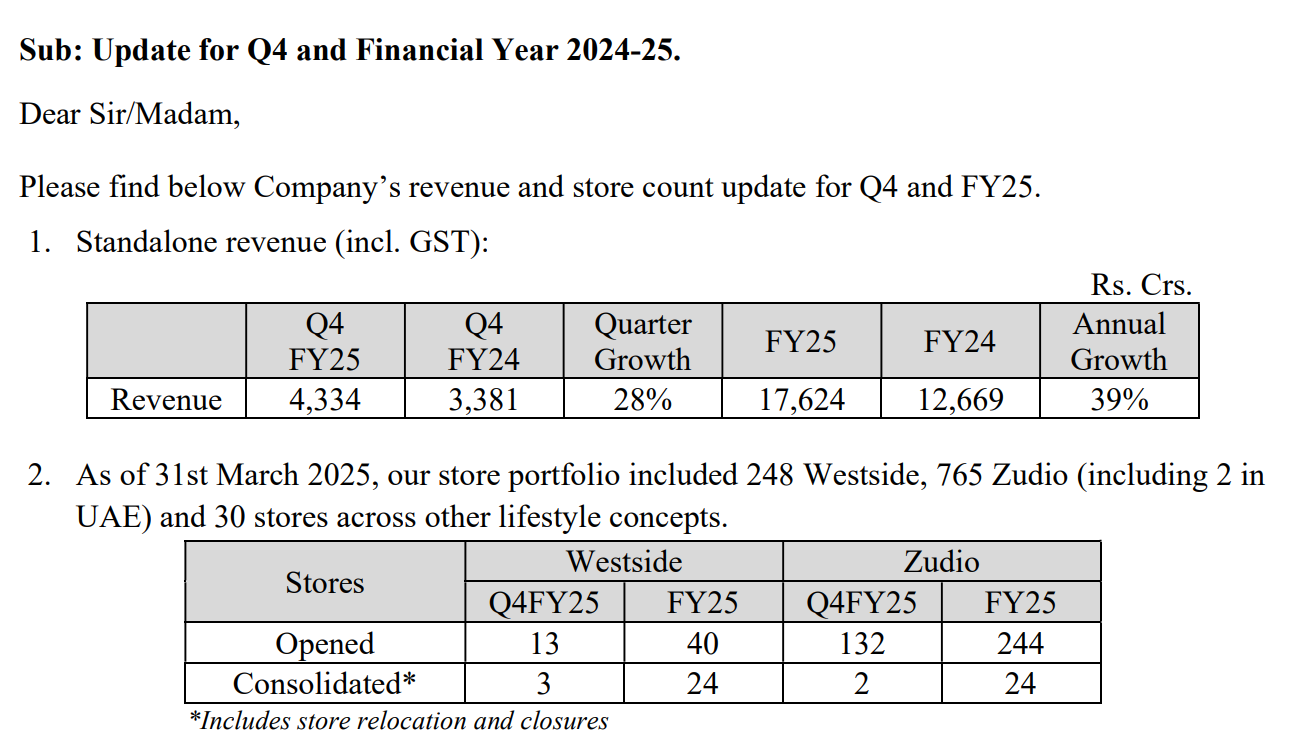

Trent - Trent Limited crosses 1000 fashion stores milestone. (including 248 Westside and 757 Zudio stores)

Rama steel tubes - Resignation of Company Secretary and Compliance Officer.

AGI Greenpack - Appointment of new senior management personnel at AGI Greenpac.

Blue star - Blue Star appoints Mohit Sud as Group President.

Vadilal - Gandhi family agreement to restructure Vadilal management.

Biocon and Syngene - Peter Bains resigns as Group CEO, effective April 1, 2025.

Pidilite - Appointment of new Managing Director and Joint Managing Director. Mr. Sudhanshu Vats

SBI Cards - Salila Pande appointed as MD & CEO of SBI Card.

Voltas - Resignation of Mr. Rakesh Rampratap Tripathi, Head - Commercial Air Conditioning.

Bajaj Health - Resignation of CFO Mr. Dayashankar Patel effective April 15, 2025.

Paushak - Resignation of CEO Abhijit Joshi and appointment of Chintan Gosaliya.

CCl Products - Resignation of CEO Venkataramana Prasad Alam from Ngon Coffee Limited.

Business updates

Adani Ports - APSEZ reports record cargo volume in FY25.

MRPL - Achieved highest-ever crude processing throughput of 18 MMTPA.

Surya Roshni - Achieved highest monthly sales volume of 1,00,239 M.T.

Ola electric - Ola Electric registers 3,44,005 units, maintains 30% market share.

Mahindra and Mahindra - Mahindra reports 23% growth in auto sales for March 2025.

Sg finserve - SG Finserve reports AUM growth to INR 2,325 crores.

Eicher motors - Eicher Motors reports record motorcycle sales for FY 2024-25.

Godrej properties - Godrej Properties sells homes worth over INR 2,000 crores.

Hariom Pipes - Strong growth in Value-Added Products for Q4 & FY25.

PNB Housing - PNB Housing crosses INR 5,000 crore in Affordable loan book.

BDL - BDL reports record turnover and export growth for FY 2024-25.

IEX - IEX reports record electricity trading volumes for FY'25.

Others

ICICI Lombard - Income-tax demand of ₹ 11,161,604,504 raised by authorities.

Shaily Engineering - CARE Ratings upgraded Shaily Engineering's bank facilities ratings.

Aditya Birla capital - Amalgamation of Aditya Birla Finance with Aditya Birla Capital.

ABREAL - Aditya Birla divests Pulp and Paper for Rs. 3498 Cr.

BLS International - Acquisition of Beijing Biaoshi delayed to June 30, 2025.

AGI greenpack - CARE Ratings upgraded AGI Greenpac's credit ratings.

Krsnaa Diagnostic - Acquisition of 23.53% stake in Apulki Healthcare.

HCL Technologies - HCLTech launches US subsidiary for public sector solutions.

HAL - HAL registers Rs. 30,400 crores revenue despite supply chain issues.

TVS Motors - TVS Motor divests stake in ION Mobility for USD 1.75 million.

GRSE - GRSE records 32% YoY growth and secures major contracts.

Eris Lifescience - Corporate guarantee of INR One Billion for EHPL.

Kohinoor foods - Sale of factory unit for INR 190 Crores.

Deepak fertilizers - Penalty of Rs. 226.33 Cr imposed on Mahadhan AgriTech.

Somany ceramics - Completed disinvestment of 51% stake in Amora Tiles.

Indigo - Penalty of Rs. 944.20 Cr imposed by Income Tax Authority.

Fusion Finance - Approval of ₹800 crore rights issue by Fusion Finance.

BajajHind - CARE Ratings downgraded credit rating to CARE D.

Bharti Airtel - Bharti Airtel and Nokia expand 5G service collaboration.

Parag milk foods - Parag Milk Foods expands product portfolio with high-protein offerings.

Paras defence - Signing of MoU with MicroCon Vision Ltd.

Reliance infra -Settlement agreement with Yes Bank terminated due to payment delay.

Mold tek technologies - MOU with Interarch for global collaboration on projects.

Alembic pharma - Alembic Pharmaceuticals receives USFDA approval for Pantoprazole Sodium injection.

Man Industries - Man Industries monetizes Navi Mumbai land for ₹720 Crores.

United drilling - Award of INR 16.14 million order from Cactus for oil services.

Glenmark - Glenmark launches Vancomycin Hydrochloride for Injection USP.

Wockhardt - Successful treatment of drug-resistant infection in US patient.

Senores pharma - Corporate guarantee of Rs. 40.53 Crores for Ratnatris.

Maruti Suzuki - Maruti Suzuki announces price increase on car models.

Sky Gold - Establishment of a Wholly Owned Subsidiary in Dubai.

Adani power - NCLT sanctions amalgamation of Adani Power subsidiaries.

Jindal drill - Rane Steering Systems sold land for Rs.50.50 Crores.

Samhi hotels - CARE Ratings upgraded SAMHI Hotels' credit ratings.

Narayna Hrudyalaya - Narayana Hrudayalaya Limited signed an agreement to operate a 110-bed hospital in Bengaluru South, opening in FY 2026-27.

We host a biweekly video series called Insights with SOIC, where we break down all the key developments in the markets and share interesting updates for our members.

As a bonus, SOIC Membership also gives you full access to our in-depth course on Fundamental Analysis—perfect for building strong investing foundations.

Both the video series and the fundamental analysis course are included as part of your SOIC Membership (coupon code and link given above).

Insider Trades

Insider Buy:

Top sectors where significant promoter buying was seen were Steel, Jewellery, Cap goods, Auto ancillaries and IT software.

Insider Sell:

Top sectors where significant promoter selling was seen were Dyes and pigments, Spec chem, EPC, Steel products and Trading companies.

P2P analysis of the key Q4FY25 business updates

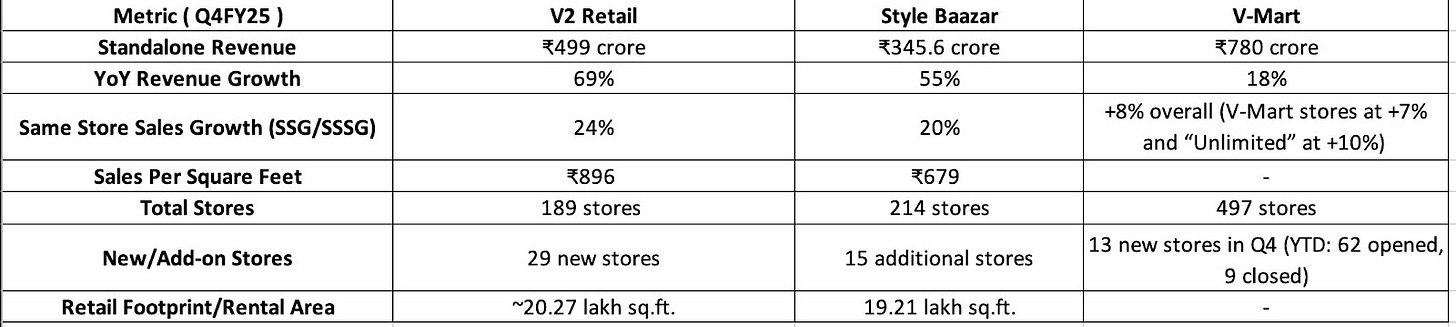

Value Retail Fashion:

Same Store Sales Growth:

V2Retail > 24%

Style Baazar > 20%

VMart > 8%

V2 Retail is still leading the growth metrics amongst the pack. Trent still is showing good 39% growth but is still lower in both relative and historical perspective. V2 retail has shown 695 of rev growth.

Key Mental Models and a Book Recommendation

"Invent and Wander" provides valuable insight into Jeff Bezos’s thinking, conveyed through his letters to shareholders, where he explores themes like innovation, customer focus, long-term vision, risk-taking, and the principles behind building enduring businesses.

Key Themes:

Amazon’s guiding principles (customer-centricity, innovation, and long-term focus)

Space exploration through Blue Origin

Free cash flow and business fundamentals

Day 1 mentality

Vision for the future

Jeff Bezos beautifully explains the importance of free cash flow as a metric, emphasising it as the most accurate indicator of a company’s long-term value creation and operational efficiency

"Free cash flow per share stands as the most critical financial measure for long-term value creation, reflecting the true economic performance of a business beyond accounting profits."

"Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per share."

Why not focus first and foremost, as many do, on earnings, earnings per share or earnings growth?

The simple answer is that earnings don’t directly translate into cash flows, and shares are worth only the present value of their future cash flows, not the present value of their future earnings.

Future earnings are a component—but not the only important component—of future cash flow per share.Working capital and capital expenditures are also important, as is future share dilution.Though some may find it counterintuitive, a company can actually impair shareholder value in certain circumstances by growing earnings.

This happens when the capital investments required for growth exceed the present value of the cash flow derived from those investments.

Our Most Important Financial Measure: Free Cash Flow per Share

Amazon.com’s financial focus is on long-term growth in free cash flow per share.

Amazon.com’s free cash flow is driven primarily by increasing operating profit dollars and efficiently managing both working capital and capital expenditures.

We work to increase operating profit by focusing on improving all aspects of the customer experience to grow sales and by maintaining a lean cost structure.

We have a cash generative operating cycle because we turn our inventory quickly, collecting payments from our customers before payments are due to suppliers. Our high inventory turnover means we maintain a relatively low level of investment in Inventory.

Efficiently managing share count means more cash flow per share and more long-term value for owners.

This focus on free cash flow isn’t new for Amazon.com.

We made it clear in our 1997 letter to shareholders—our first as a public company—that when “forced to choose between optimising GAAP accounting and maximising the present value of future cash flows, we’ll take the cash flows.”

👉 Click here to register for the SOIC Membership

Do let us know about your thoughts in the comments below!

Disclaimer:

SOIC Intelligent Research LLP is a SEBI-registered research analyst with SEBI Registration No. INH000012582. Registration granted by SEBI and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors. Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.