Microsoft- The Cloner Spawner

8 mins readPublishing Date : 2022-11-25

Capitalism is extremely brutal. Almost all businesses will mature and die, and spawning helps keep the company alive. Spawning helps deal with what Joseph Schumpeter described as creative destruction. A “spawner” is a company with the necessary DNA to incubate new businesses that have the potential to become the next massive growth engine. The five main types of spawners are Adjacent Spawns (Companies that grow by venturing into adjacent markets with related products) , Embryonic Spawns (Companies that acquire new businesses and nurture them into larger businesses) , Non-Adjacent Spawns (Companies that create or buy businesses in unrelated areas) , Cloner Spawns (companies that don’t innovate, they simply copy successful products) and then there are Apex Spawners (These are the best spawners and they deploy the spawning tactics of all the above ).

If the need to deal with creative destruction was important when Schumpeter wrote about it almost 80 years ago, it is exponentially more important today.

Microsoft is an epitome of a Cloner Spawner, with Explorer, Surface, Azure, and Teams as its spawns.

Center Of The Global Economy

Microsoft products are ingrained in offices and households. It’s difficult to imagine a world without Microsoft. Organizations wouldn’t be able to function without Microsoft products. It runs Azure, one of the biggest cloud computing services, and maintains Windows 11 and the whole Office suite of software. It also makes plenty of Surface hardware and has a slew of gaming products, including the Xbox Series X. But the company is ever expanding — building new hardware, acquiring new game studios, and making sure that even if Microsoft doesn't run your phone, it can touch plenty of the apps on it.

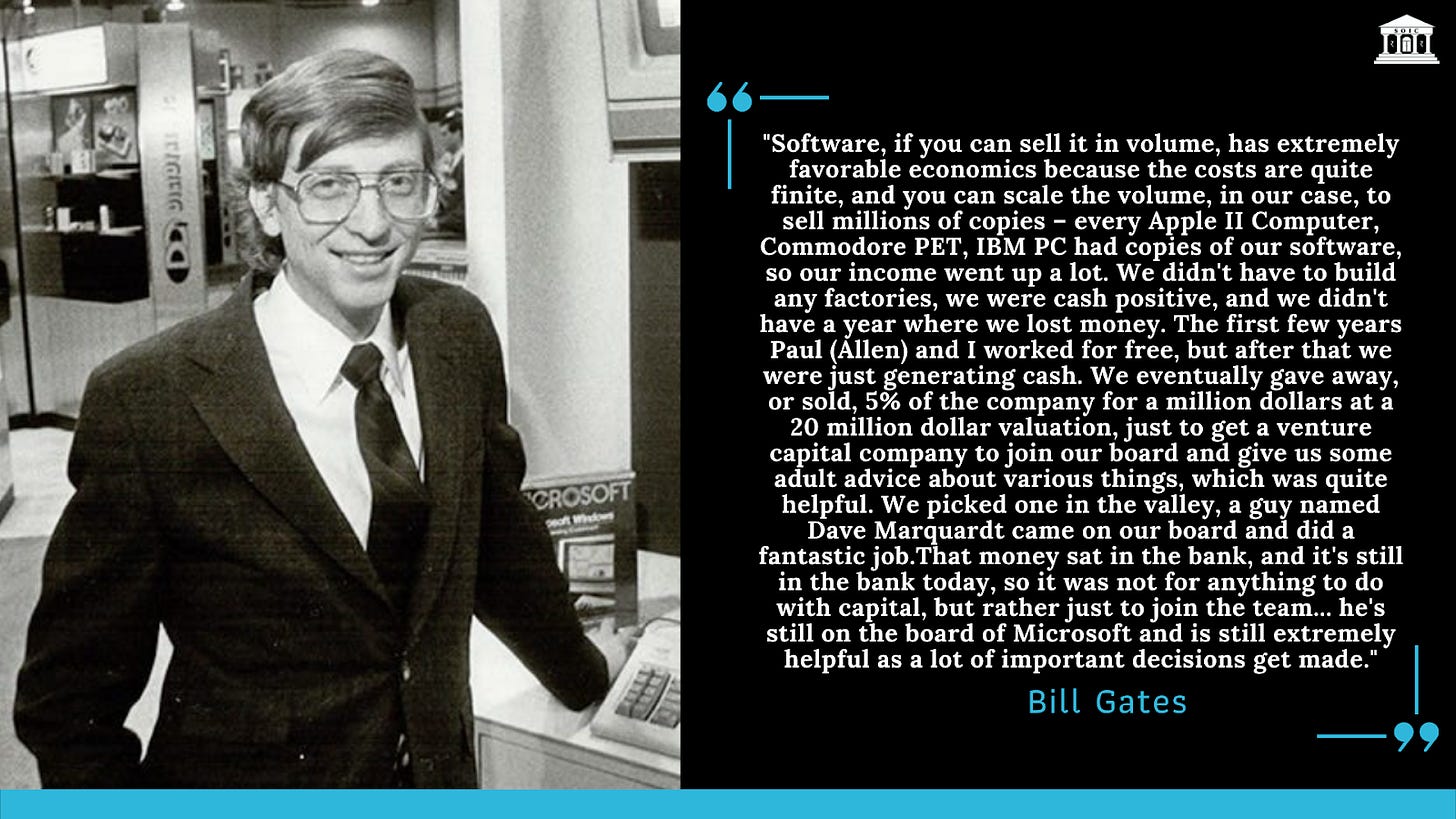

Just Too Profitable

Microsoft never took on external funding, yet grew to become the biggest and most powerful tech company operating today. In fact, Microsoft was too profitable to raise real VC money, so the founders owned 70% at IPO. Microsoft took on only $1 million in external investment, and not for the money. Bill Gates explains:

Some Historical Context To Discover What Microsoft Is Today

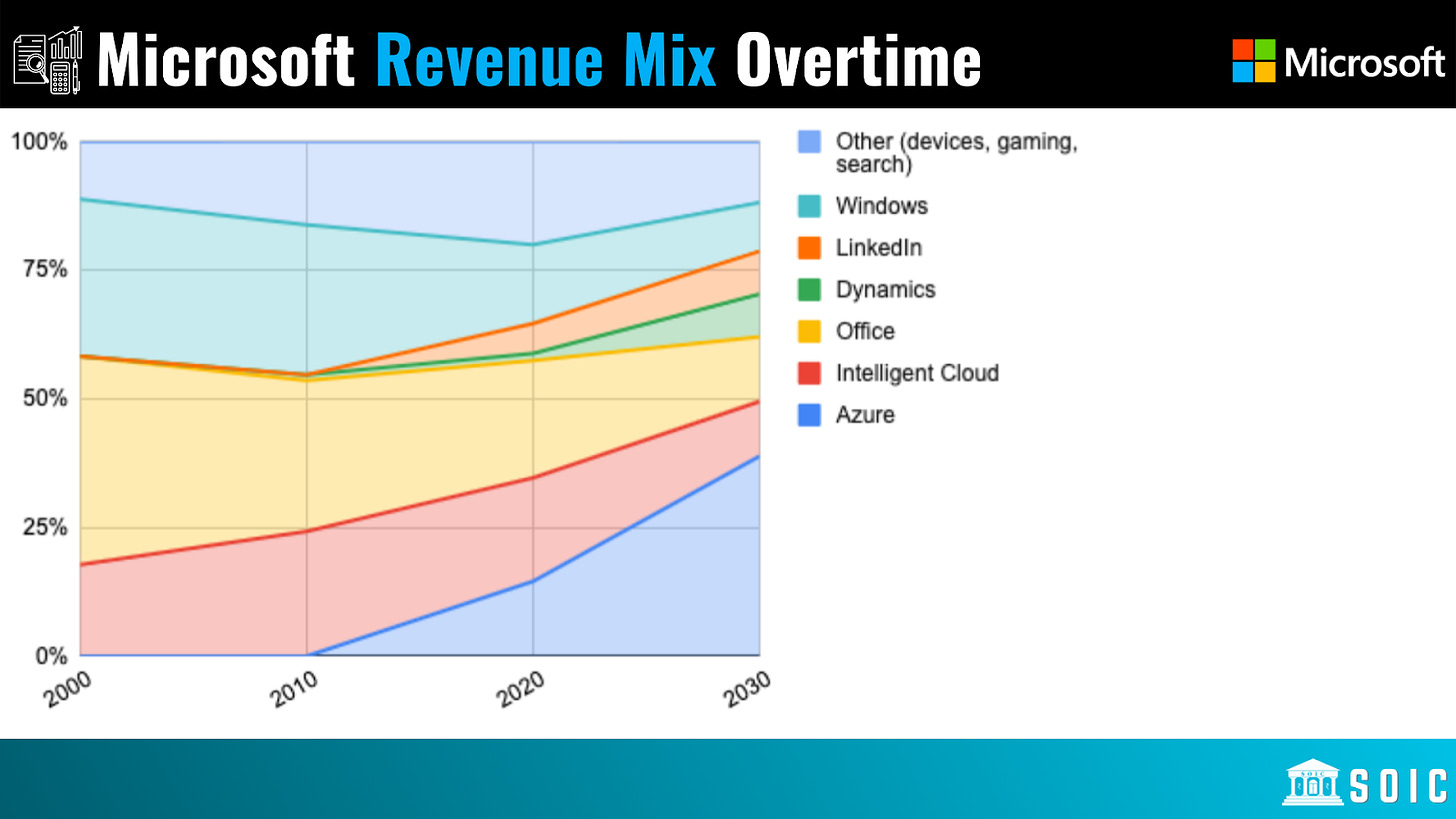

So what is Microsoft? It was the Windows company in the 2000s, became the Office company in the 2010s, and is becoming the cloud company in the 2020s. It is the sum of its core advantages: enterprise distribution, user trust, and an engineering talent gyre.

In December 1974, a 21-year-old college dropout named Paul Allen purchased the latest issue of the hobbyist magazine at a newsstand in Harvard Square and was barely able to contain his excitement. In bold letters, the cover headline screamed out that the world’s first minicomputer with the power to rival commercial models had been invented. Allen rushed six blocks to Harvard College, where his high-school friend Bill Gates was a student. The two had long wanted to write an operating program using the computer language called BASIC, but Gates had held off; he would start such a project, he told Allen, only when someone developed a computer with a fast processor. Allen thrust the magazine into Gates’s hands, and the two agreed: the moment had arrived.

In the early 1970s, most people thought personal computers were toys. But Bill Gates and Paul Allen disagreed. As hardware rapidly improved, Gates and Allen realized that the bigger opportunity was not in building the next computer kit, but in building software to make these hobbyist devices accessible to a mass audience.

Things moved quickly. In 1975, Gates and Allen saw that the Altair 8800 was the first minicomputer with the hardware specs to support a BASIC software complement. Gates, Allen, and another friend wrote a program they called Altair BASIC and persuaded the company that made the computer—MITS, in Albuquerque—to license it. They named their new company Micro-soft. Soon, the personal computer market was exploding. Micro-soft began selling its programs to bigger and bigger corporate players. Within two years, the company, renamed Microsoft, was setting the industry standards for microprocessor programming. They founded Microsoft with the founding mission of putting a computer in every home. As Gates described Microsoft: “What’s a microprocessor without it?”

In 1980, IBM—then the world’s largest computer maker—came to Gates and Allen and licensed their company to write the operating software for their soon-to-be-released product, the IBM P.C. It was Microsoft’s big break, bringing the company the riches it needed to finance its coming blast into the stratosphere. Bill Gates's fortune was minted in 1981 when he bought DOS (the disc operating system) for $50,000 and licensed it to IBM - with the option to license to other companies making IBM-compatible PCs. DOS was initially conceived as a ‘quick and dirty operating system to get IBM’s running and wasn’t expected to be the only game in town. When PCs exploded in the 1980s - they were all running DOS and Microsoft got paid for all of them.

The company started doubling and tripling in size every year, and the operating systems from Microsoft grew in sophistication. MS-DOS was a text-based system, but then came Windows, which brought a graphic interface—desktops, icons, and the like—to PCs and any other computer.

On August 24, 1995, Microsoft released what would then be its largest-selling operating system ever: Windows 95. Microsoft initially launched Windows as an add-on to MS-DOS, the original operating system of the PC. However, in 1990, when Microsoft launched Windows 3.0, it leveraged its relationships with PC manufacturers to preinstall the operating system (rather than shipping it separately). More than 30 manufacturers agreed to include the program for free and preinstalled it with every machine. As a result, Windows rapidly gained popularity — shipping over one million copies just two months after launch.

Once consumers had learned how to use Windows and compatible programs, most of them were reluctant to invest the time, cost, and effort to learn a new operating system and new programs. PC users effectively got themselves locked into the Microsoft ecosystem once they purchased their first Windows-equipped PC.

Windows 3.0 increases switching costs in three ways: (1) PC manufacturers preinstall Windows, increasing the effort needed to switch, (2) the graphical interface and new features steepen the learning curve, (3) Microsoft builds an ecosystem of Windows-compatible software to lock customers in via interoperability.

Due to the learning curve and software compatibility advantages, customers continuously come back to buy Windows PCs. This lock-in guarantees recurring licensing royalties from PC manufacturers and Windows sales to retail customers for over two decades.

A key component of Microsoft’s lock-in strategy is to boost the acquisition of developers to quickly increase the number of software applications available for the Windows ecosystem: Windows-compatible software rises from 700 before the launch of 3.0 to 1,200 one year later, and 5,000 by 1992.

In the mid-90s as the world wide web began to enter mainstream usage, the dominant web browser was Netscape. Following Bill Gates' internal "Internet Tidal Wave memo" on May 26, 1995, Microsoft stepped into the world of the web. Other than Netscape, Microsoft was the only major and established company that acted fast enough to be a part of the World Wide Web practically from the start. Microsoft sought to kill Netscape by introducing Internet Explorer. Internet Explorer was notable because it was free (previously a user had to pay for Netscape software). The company released Windows 95 on August 24, 1995, featuring pre-emptive multitasking. Windows 95 Plus was bundled with the online service MSN, and Internet Explorer, which led to it becoming the dominant browser. This practice caused trouble for Microsoft with an antitrust case that Microsoft spent years fighting.

The Lost Decade

Microsoft rode the PC growth wave for the next 25 years. In 1999, Microsoft was worth $620B, making it the most valuable company in the world. But by 2002, its market cap had dropped 60%.

In the 2000s, Bill Gates’ successors took his mission to put a computer in every home too literally, expanding the Windows empire indiscriminately in every direction. Business lines proliferated, and Microsoft’s identity became obscure. Was it the Windows company? Office? Xbox? Developer tools? By 2009, the company was worth 30% of its 1999 all-time high.

Microsoft’s growth was indexed to the wrong trend. Microsoft failed repeatedly to jump on emerging technologies because of the company’s allegiance to Windows and Office. This prejudice permeated the company, leaving it unable to move quickly when faced with challenges from new competitors.

Windows persisted as the linchpin of Microsoft’s strategy for over three decades for a very good reason: it made everything the company did possible. Windows had the ecosystem and the lock-in and provided the foundation for Office and Windows Server, both of which were built with the assumption of Windows at the center.

Without a clear growth driver, Microsoft went on the defensive in the late 2000s: Bing, Skype, and Surface were reactive moves. Bing lives in the shadow of Google, Surface lives in the shadow of iPad, and Skype lives in the shadow of Zoom.

The C.E.O Steve Ballmer’s key business philosophy for Microsoft during this period was not to be first to innovate but to be first to profit—in other words, it would be the first to make money by selling its own version of new technologies. But that depended on one fact: Microsoft could buy its way into the lead because it always had so much more cash on hand than any of its competitors.

In Walter Isaacson’s biography of Steve Jobs, Jobs acknowledged Ballmer’s role in Microsoft’s problems: “The company starts valuing the great salesmen because they’re the ones who can move the needle on revenues, not the product engineers and designers. So the salespeople end up running the company.… [Then] the product guys don’t matter so much, and a lot of them just turn off. It happened at Apple when [John] Sculley came in, which was my fault, and it happened when Ballmer took over at Microsoft. Apple was lucky and it rebounded, but I don’t think anything will change at Microsoft as long as Ballmer is running it .”

Jobs put the ultimate blame on Bill Gates: “They were never as ambitious product-wise as they should have been. Bill likes to portray himself as a man of the product, but he’s really not. He’s a businessperson. Winning business was more important than making great products. Microsoft never had the humanities and liberal arts in its DNA.”

A New Wave To Ride On

Satya Nadella, the current CEO understood that Windows will not drive future growth but understanding is one thing; identifying future drivers of said growth is another.

A significant growth driver for Microsoft since 2014 has been its cloud computing business (Azure), which has been a central focus of Satya Nadella.

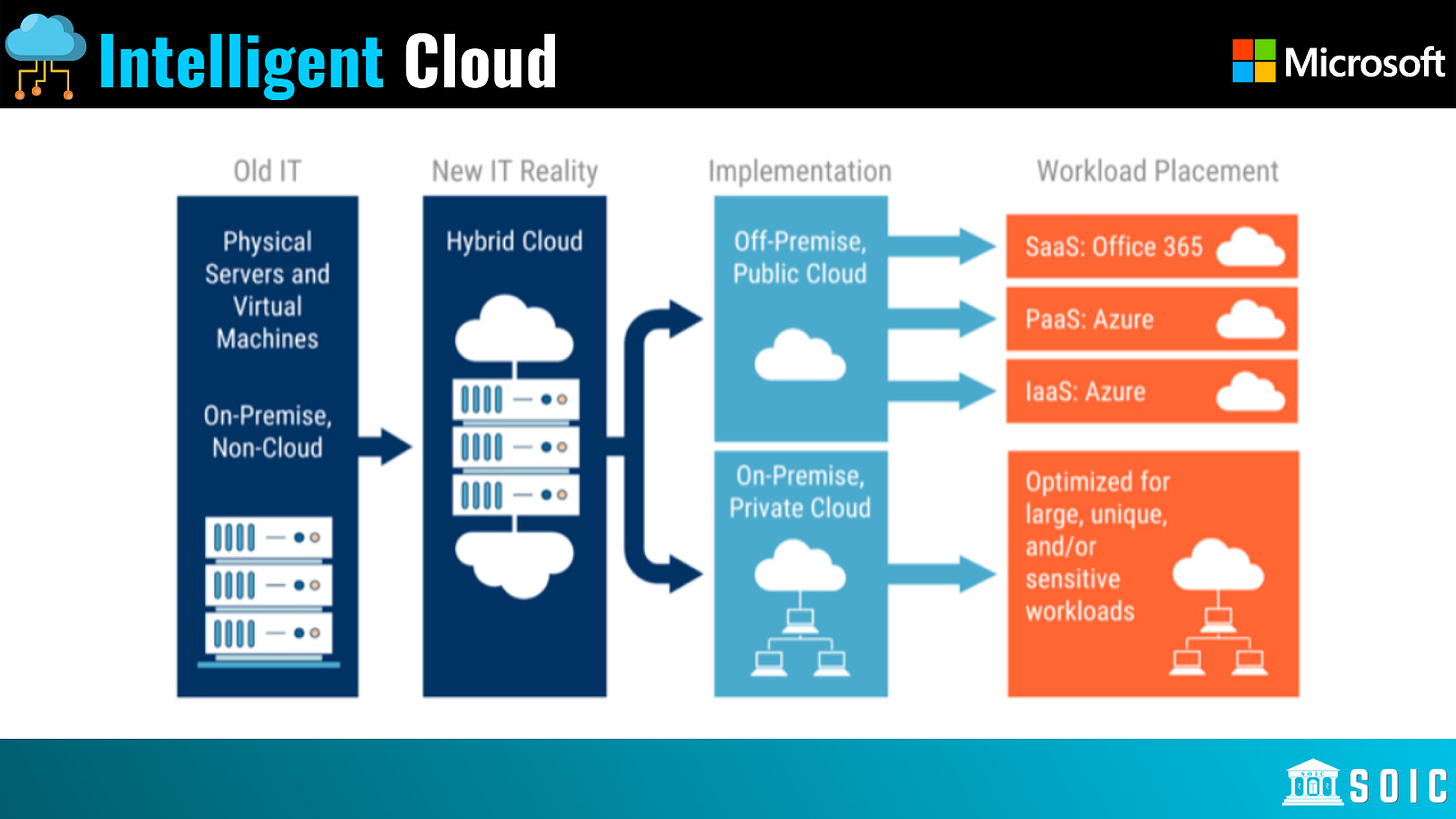

Azure started in 2006 as an experimental project under Chief Software Architect Ray Ozzie. Guided by the Windows-everywhere dream, Ozzie pitched Azure as “Windows in the Cloud”, or a cloud computing operating system. Ray Ozzie was one of the first and most prominent advocates of an innovative model of delivering software through the web which went on to become what is popularly known as Software as a Service (SaaS).

In a famous internal Microsoft memo dated October 28, 2005, Ozzie articulated his vision for building a disruptive platform that would replicate the design of Microsoft Windows OS, .NET application services, and Microsoft Office Suite on the Internet. Little was known that this idea would eventually translate into Azure IaaS, Azure PaaS, and Office 365.

AWS’ four-year head start gave Azure a second mover advantage: it instantly had the accumulated learnings from AWS, which launched 4 years earlier. But unlike Amazon, Microsoft already had enterprise distribution. Once Microsoft started including Azure credits and consumption in its existing enterprise deals, the business took off.

By the late 2010s, Azure’s edge in enterprise distribution created a powerhouse, moving the needle for the entire company.

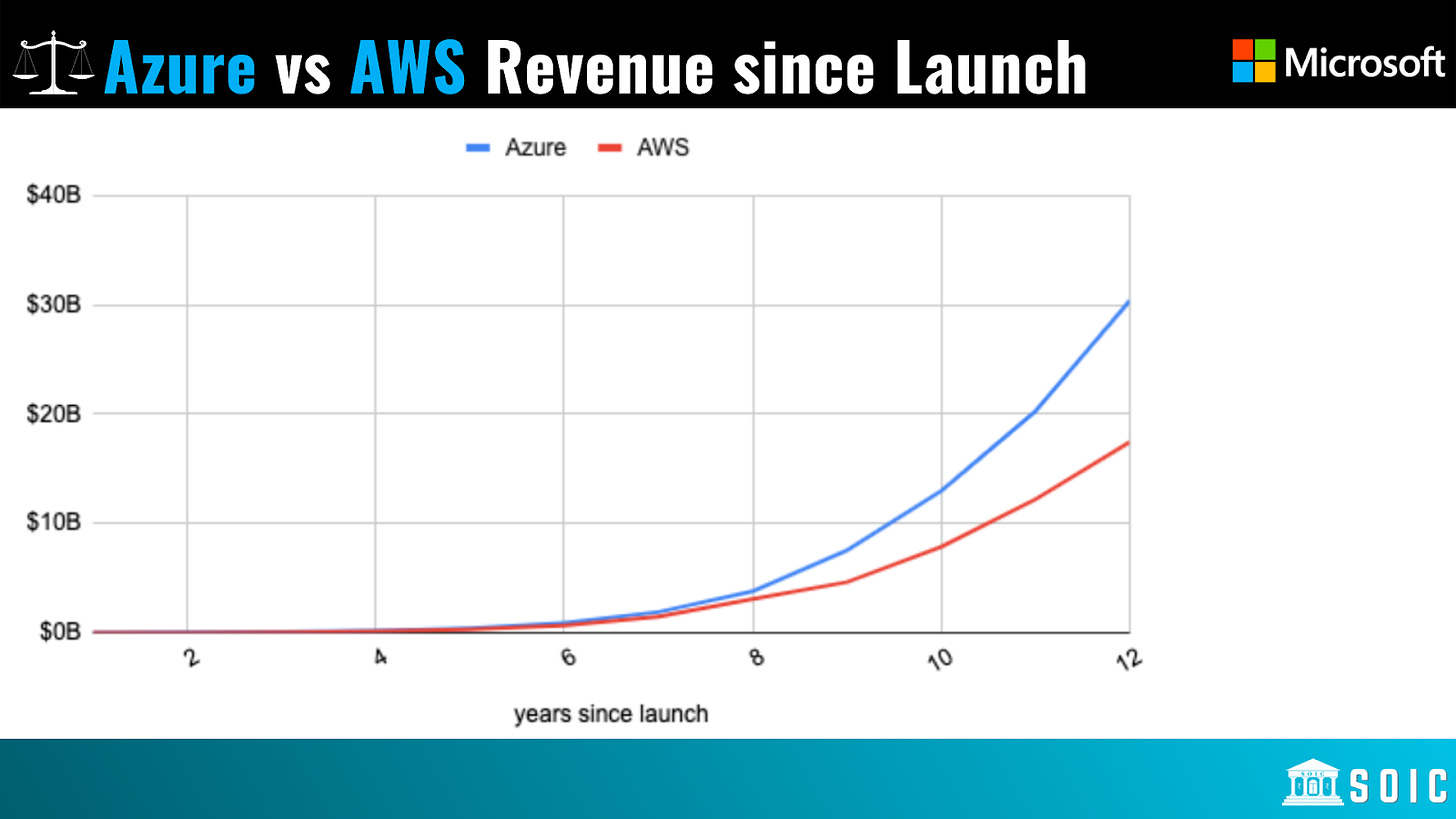

Azure reached a $10b run rate by early 2019, just nine years after launch. This is faster than AWS, which became generally available in 2006 and hit a $10b run rate by 2016, and GCP which launched in 2009 and hit $10b revenue in 2020.

Today, Azure is a monster with over $55b in revenue, growing over 40% YoY. And while Microsoft doesn’t break out the Azure margins separately, we know it’s an attractive business at scale: AWS has over 35% operating margins, driving the majority of Amazon’s net income.

In the 2020s, Azure will power most of the company’s growth. Azure gave Microsoft what it needed: a new wave to ride.

“At our core, Microsoft is the productivity and platform company for the mobile-first and cloud-first world. We will reinvent productivity to empower every person and every organization on the planet to do more and achieve more.” — Satya Nadella, in his first company-wide strategy memo

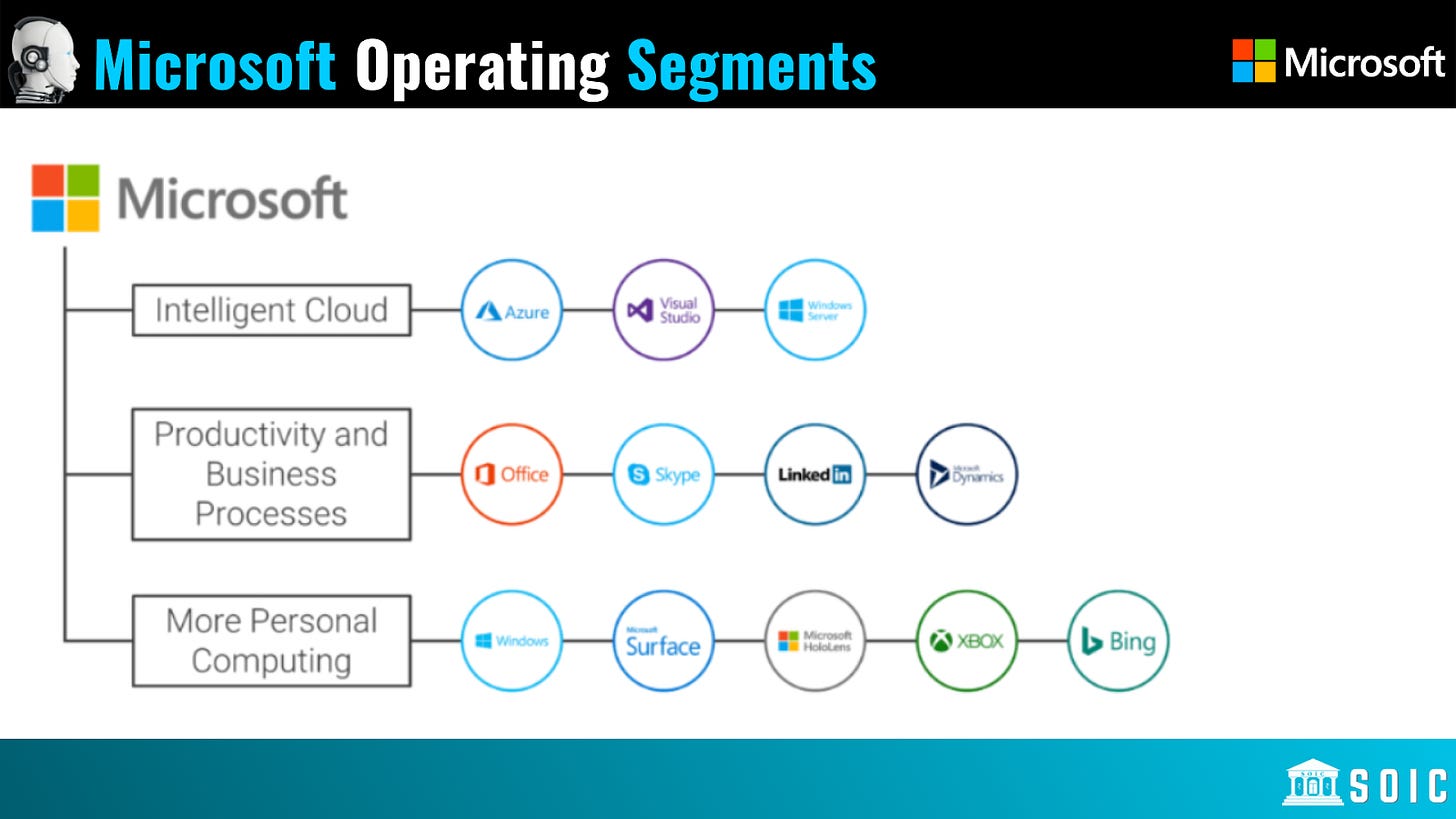

Microsoft’s Operating Segments:

Productivity and Business Processes

This segment consists of products and services in its portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. This operation delivered $53.9 billion in revenue, which represents 32% of total revenues and has around 45% operating margins. This segment grew by 11% in the last year and primarily comprises:

Office Commercial (Office 365 subscriptions, the Office 365 portion of Microsoft 365 Commercial subscriptions, and Office licensed on-premises, comprising Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, and Microsoft Viva). Office Commercial growth depends on Microsoft’s ability to reach new users in new markets such as frontline workers, small and medium businesses, and growth markets, as well as add value to its core product and service offerings to span productivity categories such as communication, collaboration, analytics, security, and compliance. Office Commercial revenue is mainly affected by a combination of continued installed base growth and average revenue per user expansion, as well as the continued shift from Office licensed on-premises to Office 365.

Office Consumer , including Microsoft 365 Consumer subscriptions, Office licensed on-premises, and other Office services. Office Consume’s growth depends on Microsoft’s ability to reach new users, add value to our core product set, and continue to expand our product and service offerings into new markets. Office Consumer revenue is mainly affected by the percentage of customers that buy Office with their new devices and the continued shift from Office licensed on-premises to Microsoft 365 Consumer subscriptions. Office Consumer Services revenue is mainly affected by the demand for communication and storage through Skype, Outlook.com, and OneDrive, which is largely driven by subscriptions, advertising, and the sale of minutes.

Microsoft is making a major change to its Microsoft Office branding. After more than 30 years, Microsoft Office is being renamed “Microsoft 365”. While Office apps like Excel, Outlook, Word, and PowerPoint aren’t going away, Microsoft will now mostly refer to these apps as part of Microsoft 365 instead of Microsoft Office.

The entire reason why Windows faltered as a strategic linchpin is that it was tied to a device — the PC — that was disrupted by a paradigm shift in hardware. Microsoft 365, on the other hand, is attached to the customer.

“With Microsoft 365 we provide a complete cloud-first experience that makes work better for today’s digitally connected and distributed workforce. Customers can save more than 60% compared to a patchwork of solutions. Microsoft 365 includes Teams plus the apps you always relied on — Word, Excel, Powerpoint, and Outlook — as well as new applications for creation and expression like Loop, Clipchamp, Stream, and Designer, and it’s all built on the Microsoft graph, which makes available to you the information about people, their relationships, all their work artifacts, meetings, events, documents, in one interconnected system. Thanks to the graph you can understand how work is changing and how your digitally distributed workforce is working. This is so critical, and it all comes alive in the new Microsoft 365 application”…

“Sometimes I think the new OS is not going to start from the hardware, because the classic OS definition, that Tanenbaum, one of the guys who wrote the book on Operating Systems that I read when I went to school was: “It does two things, it abstracts hardware, and it creates an app model”. Right now the abstraction of hardware has to start by abstracting all of the hardware in your life, so the notion that this is one device is interesting and important, it doesn’t mean the kernel that boots your device just goes away, it still exists, but the point of real relevance I think in our lives is “hey, what’s that abstraction of all the hardware in my life that I use?” – some of it is shared, some of it is personal. And then, what’s the app model for it? How do I write an experience that transcends all of that hardware? And that’s really what our pursuit of Microsoft 365 is all about”…

“What we are trying to do [with Microsoft 365] is bring home that notion that it’s about the user, the user is going to have relationships with other users and other people, they’re going to have a bunch of artifacts, their schedules, their projects, their documents, many other things, their to-do’s, and they are going to use a variety of different devices.”

LinkedIn connects the world’s professionals to make them more productive and successful and transforms the way companies hire, market, sell, and learn. Microsoft’s vision is to create economic opportunity for every member of the global workforce through the ongoing development of the world’s first Economic Graph, a digital representation of the global economy. In addition to LinkedIn’s free services, LinkedIn offers monetized solutions:

Talent Solutions: provides insights for workforce planning and tools to hire, nurture, and develop talent.

Marketing Solutions: help companies reach, engage, and convert their audiences at scale.

Premium Subscriptions: enable professionals to manage their professional identity, grow their network, and connect with talent through additional services like premium search.

Sales Solutions: help companies strengthen customer relationships, empower teams with digital selling tools, and acquire new opportunities.

Learning Solutions (including Glint): help businesses close critical skills gaps in times when companies are having to do more with existing talent.

“In our rapidly changing digital economy, people need a platform where they can acquire new skills, expand their networks, and connect with employers. The strong success of LinkedIn is a clear indicator of how important this is. In the five years since Microsoft acquired LinkedIn, revenue has nearly tripled and growth has accelerated.

Today, LinkedIn has more than 774 million members and is a leader in B2B advertising, professional hiring, corporate learning, and sales intelligence. From LinkedIn profiles within Office, to LinkedIn Learning courses within Microsoft Viva, and LinkedIn Sales Navigator leads within Dynamics 365, we continue to bring the power of LinkedIn and Microsoft together to transform how people learn, sell, and connect.”

3) Dynamics business solutions provide cloud-based and on-premises business solutions for Financial Management, Enterprise Resource Planning (“ERP”), Customer Relationship Management (“CRM”), Supply Chain Management, Customer Insights, and other application development platforms for small and medium businesses, large organizations, and divisions of global enterprises. Dynamics revenue is driven by the number of users licensed and applications consumed, expansion of average revenue per user, and the continued shift to Dynamics 365, a unified set of cloud-based intelligent business applications, including Power Apps and Power Automate. Dynamics 365 is purpose-built for this new world of business processes.

“Every organization is looking to digitize their end-to-end operations—from sales and customer service to supply chain management—so they can rapidly adapt to changing market dynamics.

With Dynamics 365, we’re building a new generation of business applications to meet this challenge. New integrations between Dynamics 365 and Teams enable everyone across an organization to view and collaborate on customer records seamlessly within Teams, and to meet, chat, and collaborate within Dynamics 365.

More broadly, we are leading the way with solutions tailored to the needs of key industries. During the past year, we introduced industry clouds for financial services, healthcare, manufacturing, nonprofits, and retail that make it easier for organizations to take advantage of the full power of our tech stack and to utilize new, industry-specific customizations that improve time to value, increase agility, and lower costs.

AI is technology’s most important priority, and healthcare is its most urgent application. And with our pending acquisition of Nuance Communications , we’ll provide ambient clinical intelligence capabilities for healthcare organizations that improve the patient experience and reduce the overwhelming burden of work that physicians struggle with today.”

Intelligent Cloud

This operation generated $60 billion in revenue or 35.74% of revenue and has over 40% operating margin. The intelligent cloud consists of Microsoft’s server products and cloud services business, including Azure and other cloud services; SQL Server, Windows Server, Visual Studio, System Center, and related Client Access Licenses (“CALs”); and Nuance and GitHub. This is the fastest-growing segment of the business, growing by 26% in the last year. Azure, in particular, grew by 50% in the last year.

Microsoft’s Server Products are designed to make IT professionals, developers, and their systems more productive and efficient. Server software is integrated server infrastructure and middleware designed to support software applications built on the Windows Server operating system. This includes the server platform, database, business intelligence, storage, management and operations, virtualization, service-oriented architecture platform, security, and identity software. Microsoft also licenses standalone and software development lifecycle tools for software architects, developers, testers, and project managers. GitHub provides a collaboration platform and code hosting service for developers. In 2018, Microsoft paid $7.5 billion for Github, which at the moment was generating $200-300 Million of recurring revenue. Recently, Microsoft announced that Github has surpassed 1 billion dollars in ARR.

“Since our acquisition, GitHub is now at $1 billion annual recurring revenue and GitHub’s developer-first ethos has never been stronger,… More than 90 million people now use the service to build software for any cloud, on any platform — up three times.”

“Three objectives will be top of mind for us as we build the future of GitHub: Ensuring GitHub is the best place to run productive communities and teams; Making GitHub accessible to more developers around the world; Reliability, security, and performance.”

Server product revenue is mainly affected by purchases through volume licensing programs, licenses sold to original equipment manufacturers (“OEM”), and retail packaged products. CALs provide access rights to certain server products, including SQL Server and Windows Server.

Enterprise Services is also included in this segment which is essentially a consulting arm for deploying cloud solutions, including Enterprise Support Services, and Microsoft Consulting Services, which assist customers in developing, deploying, and managing Microsoft server and desktop solutions and provide training and certification to developers and IT professionals on various Microsoft products.

Azure is the gold standard in cloud computing, networking, storage, and enterprises. Companies trust the security of Azure and trust Microsoft with their cloud needs. It is a comprehensive set of cloud services that offer developers, IT professionals, and enterprises the freedom to build, deploy, and manage applications on any platform or device. Customers can use Azure through our global network of data centers for computing, networking, storage, mobile and web application services, AI, IoT, cognitive services, and machine learning. Azure enables customers to devote more resources to the development and use of applications that benefit their organizations, rather than managing on-premises hardware and software. Azure revenue is mainly affected by infrastructure-as-a-service and platform-as-a-service consumption-based services, and per-user-based services such as Enterprise Mobility + Security.

Cloud substantially impacts just about all of Microsoft’s businesses and stands to upend a number of large industries. By differentiating itself across its businesses with Azure, Microsoft can better solidify its dominance in areas like enterprise software and gaming.

Do More With Less

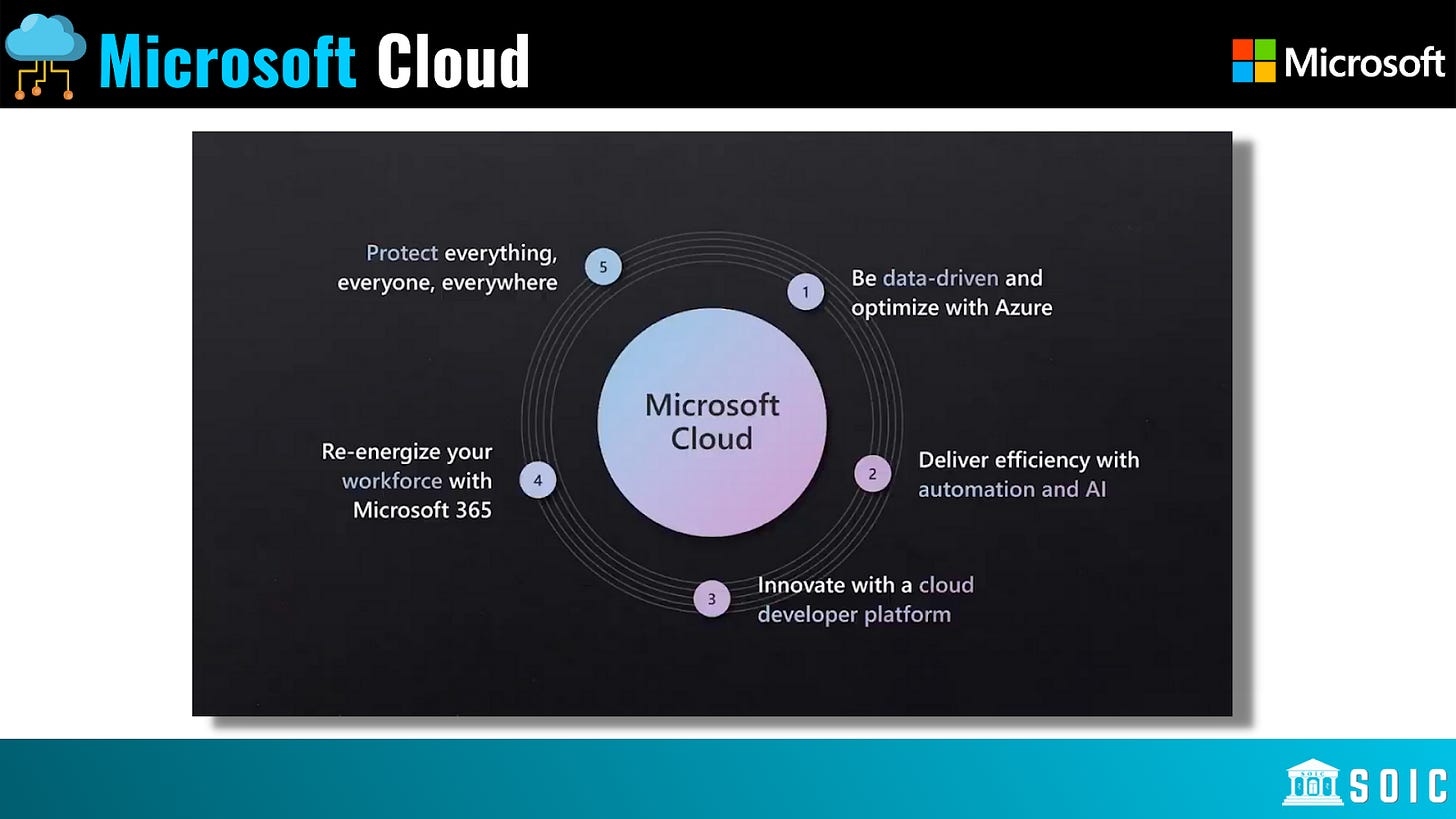

Satya Nadella at Microsoft’s recent worldwide partner conference:

“We’re going through a period of historic economic, societal, and technological change. But for all the uncertainty we continue to see in the world, one thing is clear: organizations in every industry are turning to you and your digital capability to help them do more with less, so that they can navigate this change and emerge stronger. You are the change agents who make doing more with less possible. Less time, less cost, less complexity, with more innovation, more agility, and more resilience. Doing more with less doesn’t mean working harder or longer — it’s not going to scale — it means applying technology to amplify what you can do and ultimately what an organization can achieve amidst today’s constraints.

Over the past few years, we have talked extensively about digital transformation. But today we need to deliver on the digital imperative for every organization. It all comes down to how we can help you do this with the Microsoft cloud. No other cloud offers the best of category products, and the best of suite solutions.”

According to Satya Nadella, no other cloud offers Microsoft Cloud breadth or depth. No other cloud offers not just best-in-class products, but best-in-suite solutions across the entire tech stack, in every area that matters most to the customers so that they can do more with less.

Throughout the presentation, Satya Nadella emphasized how much customers would save by going with a Microsoft bundle, but that was only the “with less” part of the message; each pitch also explained why the Microsoft approach was also better (i.e. “do more”). Start with security:

“The threat landscape has never been more complex or challenging, and security has never been more critical for our customers or society as a whole. In response, we will invest $20 billion over the next five years to advance our security solutions. Our goal is to help every organization strengthen its security capabilities through a Zero Trust architecture built on our comprehensive solutions that span identity, security, compliance, and device management across all clouds and platforms.

Security is the top priority for every organization undergoing digital transformation. The numbers are quite stark. Businesses are experiencing an increase in both the volume and sophistication of cyberattacks. Cybercrime is now expected to cost the world $10.5 trillion annually by 2025. We’re bringing together technology, threat intelligence and human expertise to provide a comprehensive security, compliance and management solutions that empowers you as our partners to solve security challenges for our customers of all sizes across all industries, on any cloud in any client platform. We integrate more than 50 security product categories from insider risk management to endpoint protection once again reducing cost and complexity.

Protecting is complex and get expensive. Every organization experiences this with so many different devices, connections to partners, and an ever shifting cloud resource deployment. The more agile you become, the more your security team struggles to manage the risk; the more connected we become, the faster a successful attacker can move laterally through the enterprise to their target. For far too long customer have been forced to adopt multiple disconnected solutions from disparate sources that don’t integrate well and leave gaps. We offer a better option: a natively integrated security solution that is supported by a vibrant partner ecosystem… you get a comprehensive solution that closes gaps and works for you at machine speed. On average, customers save more than 60% when they turn to use compared to a multi-vendor solution.”

Nadella’s argument: not only can you save money, but because all of the products come from one vendor you can rest assured that they are comprehensive and are designed to work together.

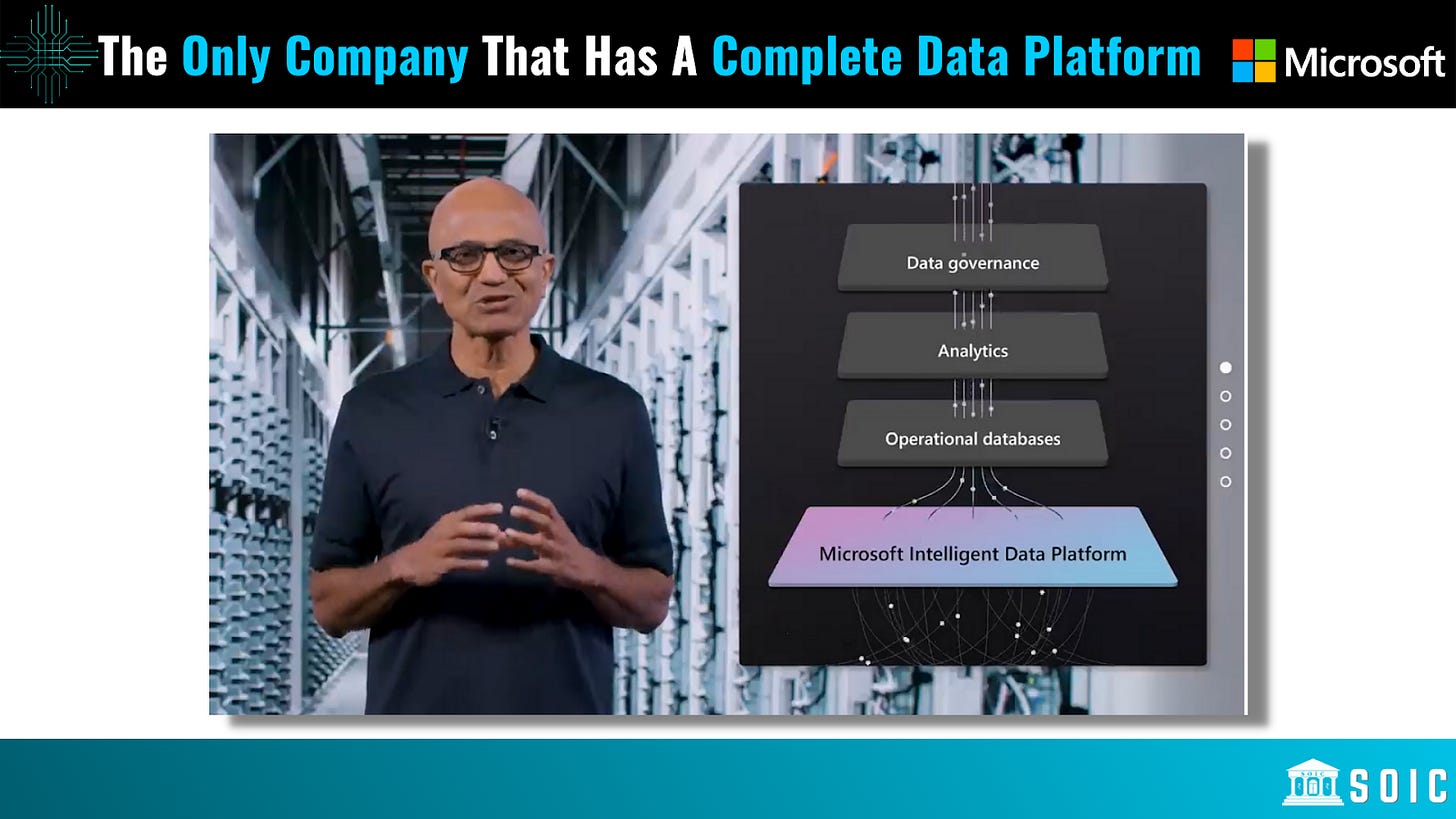

The Only Company That Has A Complete Data Platform

“Now let’s turn to data: with our Microsoft Intelligent Data Platform we provide a complete data fabric, from the operational stores to the analytics engines to data governance so that you can spend more time creating value and less time integrating and managing your data estate. Our goal is to provide you with the most comprehensive end-to-end data platforms so you don’t have to wrestle with the complexities of building and operating cloud scale data infrastructure yourself. Analytics alone on our data intelligence platform cost up to 59% less than any other cloud analytics out there.”

Microsoft has invested in cloud across a variety of entities, including its VC and accelerator arms as well as directly off Microsoft’s corporate balance sheet.

Many of the companies backed by Microsoft look to support the Azure cloud directly, while other investments go towards potential well-capitalized cloud customers. (Microsoft typically offers free cloud credits to portfolio companies, hoping to facilitate early dependency on Azure’s infrastructure, platforms, and services.)

Among its investment vehicles, Microsoft has backed companies ranging from container management platform Mesosphere, to private cloud infrastructure service CloudSimple, to container developer tool CodeFresh.

However, Microsoft's biggest investments in the cloud have been made internally — the most obvious being the company’s investment in data center locations around the world.

“Computing architecture is undergoing radical transformation as the number of connected devices and the volume of data generated at the edge increase dramatically. With more than 60 datacenter regions —including 15 new regions added this year on five continents—we are delivering faster access to data and cloud services while addressing critical data residency requirements.

We expanded our hybrid capabilities to enable organizations to build, manage, and deploy applications anywhere. With Azure Arc , customers can deploy Azure data services on-premises, at the edge, or in multicloud environments. Azure Space is extending Azure capabilities through worldwide satellite-based connectivity. And with Azure for Operators , we provide telecom operators and enterprises with the ultra-low latency cloud computing power at the edge needed for breakthrough scenarios like precision inventory tracking at ports and production lines that automatically adjust to changing demand.

We are also at the forefront of the enterprise metaverse , a new infrastructure layer made possible through the convergence of the digital and physical worlds. By combining the Internet of Things, AI, and mixed reality, this platform layer enables the creation of rich digital twin simulations of real-world processes, places, and things so organizations can monitor complex systems in real time, interact within them using mixed reality, and run simulations to model, analyze, and predict performance.”…

“Leaders in every industry are accelerating their migration to the cloud. and it’s not just lift and shift. Ninety-five percent of new digital workloads will be deployed on cloud-native platforms by 2025. IT and OT are coming together, and the cloud is foundational to how organizations will be competitive going forward. Every customer I speak with is clear-eyed about aligning their IT investments to scale with demand, and moving to the cloud allows them to just do that, converting their spending from CapEx to OpEx. This creates an opportunity for all of you to help organizations by providing your expertise. It’s all about helping customers drive operational efficiency, deliver faster time to value and reduce costs. You can measure success by how much compute you’re using and how efficiently you’re using it. I can’t say this enough. It’s all about doing more with less. Across our offerings, we offer the best value at every stage of the cloud migration. To just share two examples, it’s up to 80% less expensive to run Windows Server VMs on Azure and SQL Server VMs on Azure than it is with our main competitor. It’s not just about costs. We offer unique capabilities to simplify VM management and SQL Server compatibility to ease your move and are significantly investing in migration and modernization programs to help customers move forward with confidence. We’re building the next generation multi-cloud, multi-edge infrastructure to support this. It starts with Azure as the world’s computer. We have more datacenter regions than any other cloud provider. And I’m excited to announce that over the next year, we will launch 10 new datacenter regions in 10 markets, spanning four continents, delivering faster access to services and helping address data residency needs.”

AI—The Ultimate Amplifier

“When it comes to doing more with less, AI is the ultimate amplifier. It’s going to change what an application looks like, what the design language of an application is and how it gets built, and how it gets delivered… We have built the next-generation supercomputers in Azure that are being used by us, OpenAI, as well as customers like Meta, to train some of the largest and most powerful AI models. Azure provides almost 2x higher compute throughput per GPU and near-linear scaling to thousands of GPUs, thanks to world-class networking and system software optimization. And for inferencing, Azure is more cost effective than other clouds, delivering up to 2x the performance per dollar. In Azure we also offer the best tools across the machine learning lifecycle from data preparation to model management. Data scientists and machine learning engineers can use Azure Machine Learning to build, train, deploy and operate large scale AI models at scale. Azure is also the best platform for PyTorch. At Ignite, we’re excited to be launching the Azure Container for PyTorch, bringing together the latest PyTorch version with the best optimization software for training and inferencing, all tested and optimized for Azure. And we are helping you build responsibly with tools like our responsible AI dashboard, which helps you evaluate the performance and fairness of your models. We ourselves, along with our partners, are using all of these capabilities to train state-of-the art AI models. We are seeing exponential progress in their practical capabilities and are at a real inflection point. We have trained Turing for rich language understanding, Z-Code for translation across hundreds of languages, and Florence for breakthrough visual recognition. The other massive thing we have been doing is our work with OpenAI. We have trained the GPT family of models for human-like language generation, DALL-E for realistic image generation and editing, and Codex for code generation in more than a dozen programming languages.”…

“No asset is more strategic than data. In the next three years, we’ll create more data than we did in the past 10. But our ability to make sense of data is growing more difficult as the volume, velocity, and variety expand. The leading indicator of digital transformation success can be measured by an organization’s ability to build predictive and analytical power.

We offer organizations the ability to ensure their data is being used only for their benefit. Azure Synapse brings together data integration, data warehousing, and big data analytics so organizations can query data on their own terms at any scale. And, new Azure Purview offers organizations comprehensive data management and governance to map all their data, whether it resides on-premises, in the cloud, or in software as a service (SaaS) applications.

And we continue to bring rich AI capabilities directly into the data stack as large-scale models become powerful platforms in their own right. During the past year, our partner OpenAI achieved dramatic advances training models like GPT-3—the largest and most advanced language model in the world—on our Azure AI supercomputer. We exclusively licensed GPT-3 , allowing us to leverage its technical innovations to deliver advanced AI solutions for our customers, as well as create new solutions that harness the power of advanced natural language generation.”

Microsoft is investing $1 billion in OpenAI to support the building of artificial general intelligence (AGI) with widely distributed economic benefits. Microsoft is partnering to develop a hardware and software platform within Microsoft Azure which will scale to AGI.

More Personal Computing

This operation delivered $54 billion in revenue, representing 32.18% of total revenue, and has around 36% operating margin. This segment grew by 11% in the last year and primarily comprises:

Windows, including Windows OEM licensing (“Windows OEM”) and other non-volume licensing of the Windows operating system; Windows Commercial, comprising volume licensing of the Windows operating system, Windows cloud services, and other Windows commercial offerings; patent licensing; and Windows Internet of Things. The Windows operating system is designed to deliver a more personal computing experience for users by enabling consistency of experience, applications, and information across their devices. Windows OEM revenue is impacted significantly by the number of Windows operating system licenses purchased by OEMs, which they pre-install on the devices they sell. In addition to computing device market volume, Windows OEM revenue is impacted by:

The mix of computing devices is based on form factor and screen size.

Differences in device market demand between developed markets and growth markets.

Attachment of Windows to devices shipped.

Customer mix between consumers, small and medium businesses, and large enterprises.

Changes in inventory levels in the OEM channel.

Pricing changes and promotions, pricing variation that occurs when the mix of devices manufactured shifts from local and regional system builders to large multinational OEMs, and different pricing of Windows versions licensed.

Constraints in the supply chain of device components.

Piracy.

Windows Commercial revenue, which includes volume licensing of the Windows operating system and Windows cloud services such as Microsoft Defender Advanced Threat Protection, is affected mainly by the demand from commercial customers for volume licensing and Software Assurance (“SA”), as well as advanced security offerings. Windows Commercial revenue often reflects the number of information workers in a licensed enterprise and is relatively independent of the number of PCs sold in a given year.

Patent licensing includes programs to license patents Microsoft owns for use across a broad array of technology areas, including mobile devices and cloud offerings.

Windows IoT extends the power of Windows and the cloud to intelligent systems by delivering specialized operating systems, tools, and services for use in embedded devices.

2) Devices include Surface and PC accessories. Microsoft devices are designed to enable people and organizations to connect to the people and content that matter most using Windows and integrated Microsoft products and services. The surface is designed to help organizations, students, and consumers are more productive. Growth in Devices depends on total PC shipments, the ability to attract new customers, product roadmap, and expansion into new categories.

Microsoft’s foray into computing hardware has a lot to do with control. By optimizing its hardware for its software and operating systems, the company can offer a better overall experience for customers, while encouraging them to be reliant on multiple Microsoft offerings.

While Microsoft continues to work with third-party hardware partners, its Surface devices are the best way to use its software.

Moreover, each Surface device offers document cloud storage with Microsoft’s OneDrive. This directly links Microsoft’s Surface devices to its broader cloud business.

And though HoloLens is still experimenting with its hardware, the strategy is likely the same. Microsoft systems work best on Microsoft hardware.

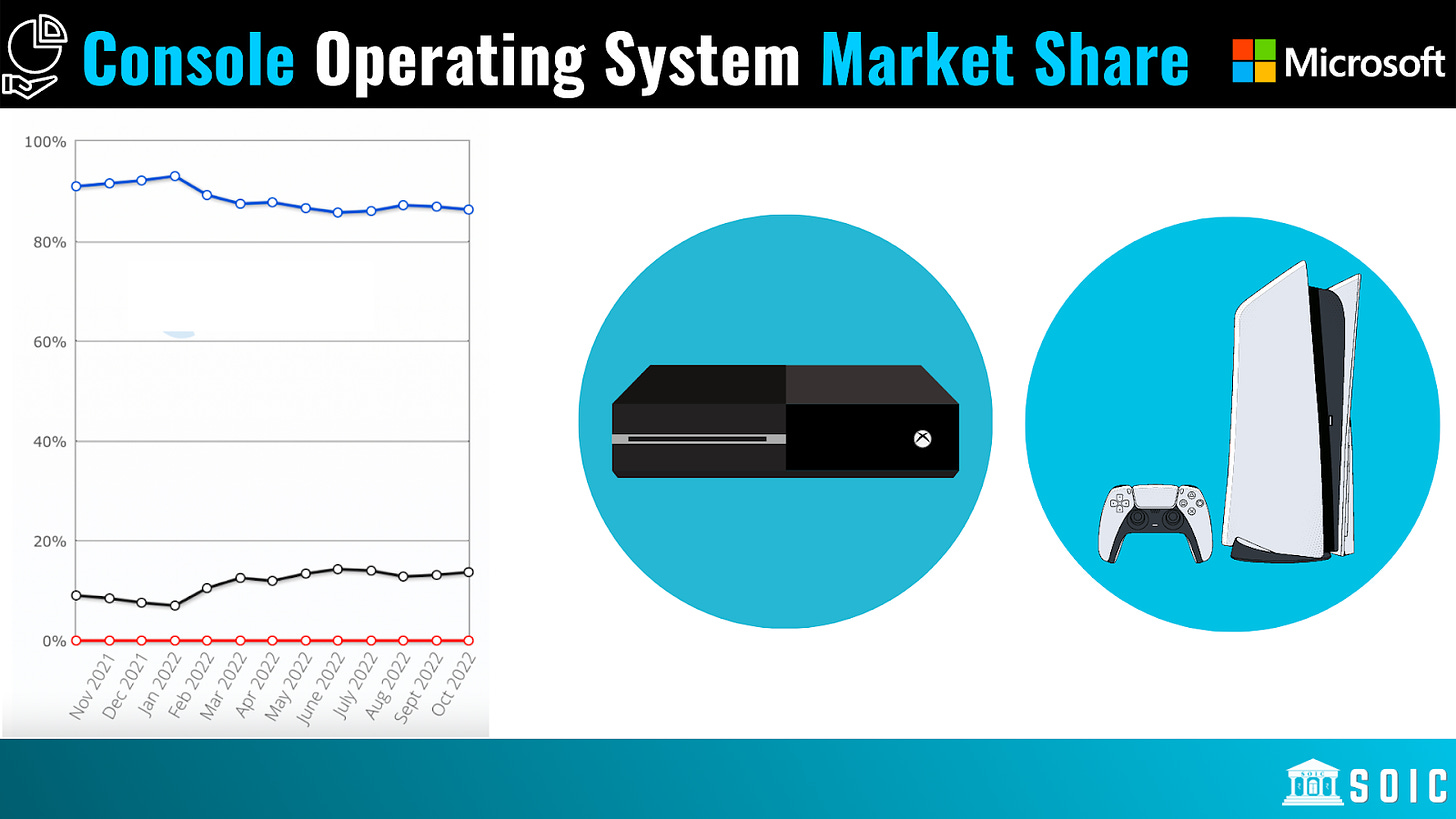

3) Gaming includes Xbox hardware and Xbox content and services, and comprises first- and third-party content (including games and in-game content), Xbox Game Pass and other subscriptions, Xbox Cloud Gaming, third-party disc royalties, advertising, and other cloud services. The gaming platform is designed to provide a variety of entertainment through a unique combination of content, community, and cloud. Microsoft’s exclusive game content is created through Xbox Game Studios, a collection of first-party studios creating iconic and differentiated gaming experiences. They continue to invest in new gaming studios and content to expand their IP roadmap and leverage new content creators. These unique gaming experiences are the cornerstone of Xbox Game Pass, a subscription service and gaming community with access to a curated library of over 100 first- and third-party console and PC titles.

Killing It In Gaming

When Satya Nadella took the helm at Microsoft in 2014, some Wall Street analysts urged the new CEO to sell the company’s gaming business, which it had entered with the launch of the first Xbox console in 2001. Rather than divest, Microsoft doubled down and recently shifted from a console-centric approach toward a “ubiquitous global gaming ecosystem” focused not just on gamers but on game developers and publishers. Investments in cloud gaming, the Game Pass subscription service, and cross-platform play have enabled this ecosystem to develop, to help gamers participate anywhere, anytime, on any device.

Notably, the Xbox division surpassed $10B in annual revenue at the close of Q2’18 (Microsoft’s 2018 year end), a first for the company. During the Q4’18 earnings call, Nadella said that the company will continue to invest in all areas of gaming:

“In gaming, we’re pursuing our expansive opportunity, from the way games are created and distributed, to how they’re played and viewed, surpassing $10 billion revenue this year for the first time. We’re investing aggressively in content, community, and cloud services across every end-point to expand usage and deepen engagement with gamers.”

In support of the strategic shift, Microsoft formed its Gaming Ecosystem Organization (GEO) in 2020, which looks after the needs of game creators across all of Microsoft’s software and services, including Xbox, Azure, and Microsoft 365.

The gaming industry is fundamentally a two-sided business with thousands of actors on one side, the developers and creators of the games, and millions of actors on the other side, the players, who are completely interlinked.

So a developer will create a game. They release it to the world. The players interact with it. Based on that interaction, the developer will continually iterate it. The player might also share something from the game. That leads to another interaction. And it’s a continuous loop. So it is an ecosystem that is reliant on the system reinforcing itself to grow.

The actors in the ecosystem are for one, the content creators which spans from the smallest indie developers to really large teams(triple-A developers). Then you have people who publish the content, drive the monetization engine around that content, bring it to retail, do it digitally versus physically, and promote it. Then you have storefronts, which used to be predominantly physical retail but increasingly, over time, are moving to digital. You have Xbox, PlayStation, and Nintendo on console, but then you’ve got PC actors like Windows Store, Steam, or Epic. And then you have actors on mobile like iOS and Android. And then you have the toolchains that people use to make the games.

Microsoft’s vision for the gaming industry is that anyone should be able to play any game, anywhere they want. That’s not how the industry works today. Right now the industry is split up by platform. It’s split up by type of game. It’s not possible to play seamlessly across devices.

That’s more a legacy of the way the industry has always been. Now, especially with the advent of the cloud, with toolsets like game engines, it doesn’t need to be that way. But Microsoft realized that to kick-start that flywheel, they had to change the way that games were made. That is where one can have the impact that sustains. This explains their move to acquire Activision Blizzard Inc., a leader in game development and interactive entertainment content publisher.

The acquisition also bolsters Microsoft’s Game Pass portfolio with plans to launch Activision Blizzard games into Game Pass, which has reached a new milestone of over 25 million subscribers. With Activision Blizzard’s nearly 400 million monthly active players in 190 countries and three billion-dollar franchises, this acquisition will make Game Pass one of the most compelling and diverse lineups of gaming content in the industry. Upon close, Microsoft will have 30 internal game development studios, along with additional publishing and esports production capabilities. Blizzard helps build the network effects for Game Pass’ 25 million subscribers, and scale de-risks gaming development as a hits-driven business.

Xbox Game Pass is a subscription-based library of more than 100 games. It’s playable on both console and PC. It’s playable on Android and now on iOS devices through the browser.

When Microsoft created Game Pass, they were looking at it as a product. Players would say they want a library of games, they want it to be more accessible. So, that’s how they built it but quickly saw that it was, in fact, a platform.

That’s because Game Pass wasn’t just acting on behalf of the player. It was also acting on behalf of the developer. And that created an ever-accelerating flywheel because once developers became eager [to put their games on Game Pass, then more players would play the games, which would drive monetization, which developers used to make more games, and it kept going and going.

“The realization that Game Pass is a platform was a big moment. Fortunately, we were already running the Xbox platform, and we’re part of a company that runs the Windows platform and the Azure platform. Our experience made it easier for us to see patterns and to figure out what to do. Fundamentally, Microsoft is a platform company and Xbox has always been a platform. Game Pass was an acceleration on top of what we had already created—platform inside of a platform, or maybe a platform beyond the original platform might be a better way to describe it…

There are enormous amounts of synergies between what Microsoft is doing in the cloud and what we are doing in gaming. Because what we’ve really done with Xbox Cloud Gaming—because we’ve put both the Xbox Series X and S into Azure—is to provide the capability to play a game rendered completely from Azure that can be played on any device, regardless of its local compute.

That [capability] takes our platform, which used to be tied to a specific piece of hardware, and it makes it playable anywhere. It dramatically accelerates [the platform’s] reach. It makes it dramatically more valuable for players because you can play anywhere.

And [that capability] makes [our platform] dramatically more valuable for developers because they can build a game that’s playable anywhere. So, it takes that core value proposition, which used to be linked to buying a $500 device, and it has unleashed it to be playable on any device on the planet.”

4) Search and News Advertising. Microsoft’s Search business, including Bing and Microsoft Advertising, is designed to deliver relevant online advertising to a global audience. They have several partnerships with other companies, including Verizon Media Group, through which they provide and monetize search queries. Growth depends on its ability to attract new users, understand intent, and match intent with relevant content and advertiser offerings. Microsoft doesn't break out advertising as a business segment, but the company disclosed in January that it had more than $10 billion in advertising revenue last year from Bing and LinkedIn combined.

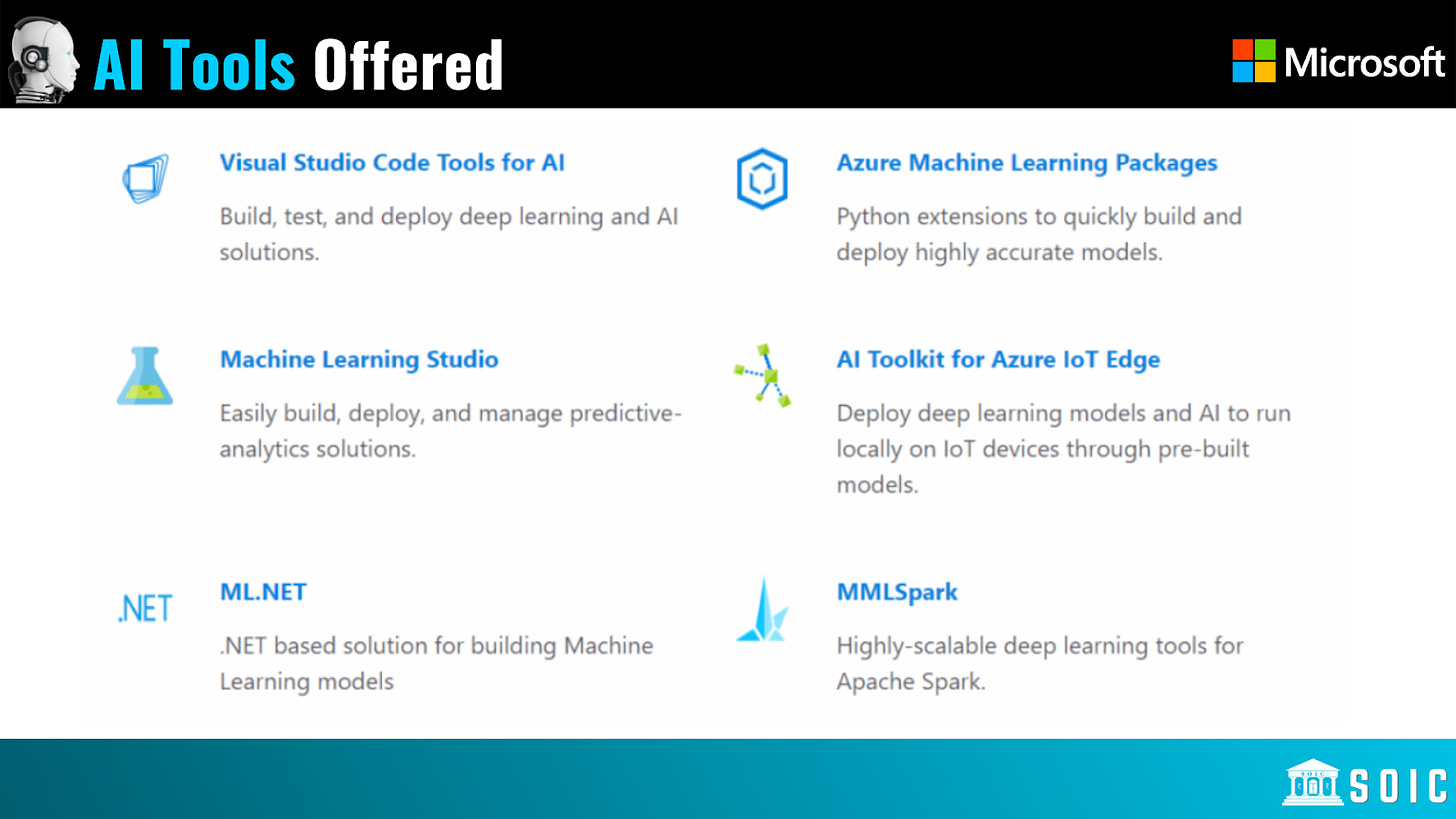

Infuse Everything With AI

In a keynote address, Nadella said that the company plans to “infuse everything with AI.” Based on the company’s recent investment activity, it seems that Microsoft is backing up this claim. Microsoft has heavily invested in artificial intelligence over the last few years.

Artificial intelligence can analyze tens of millions of data points and detect anomalies much faster than human analysts. Models also improve over time as they learn from the continuous data ingestion.

While artificial intelligence typically isn’t offered as a standalone product, Microsoft does generate revenue by selling its AI capabilities. For example, many clients develop, train, and implement AI using Azure’s tools and infrastructure.

Developers use these tools to add AI functionality to their own applications, without having to develop models from scratch. As shown above, Microsoft also specializes in specific AI use cases like IoT.

In addition to providing tools for developers, Microsoft also uses AI to improve its own products and internal operations.

For example, Microsoft uses AI in its data centers to reduce energy consumption. Artificial intelligence has allowed Microsoft’s data centers to remain 100% carbon neutral, according to a report published in May.

Microsoft is also using AI to gain deeper financial insight: the company plans to infuse Dynamics 365 with AI to help customers predict future business outcomes.

It has also used AI to improve security, which is a growing priority for both Microsoft and its customers.

Nadella outlined the importance of AI on productivity and collaboration within the workplace on Microsoft’s earnings call:

“The future of productivity and collaboration will be defined by AI innovation and new AI-driven features.”

AI is clearly a growing priority for the company. Whether in business analytics, security, gaming, or advertising, artificial intelligence is being baked into all of Microsoft’s products and services.

Microsoft benefits from AI in two key ways. First, the company can monetize its AI technology by helping cloud customers implement AI into their products, as well as by implementing the technology into products of its own. Second, Microsoft benefits from the increases in efficiency provided by AI. Reducing energy consumption in data centers with the power of artificial intelligence is a primary example.

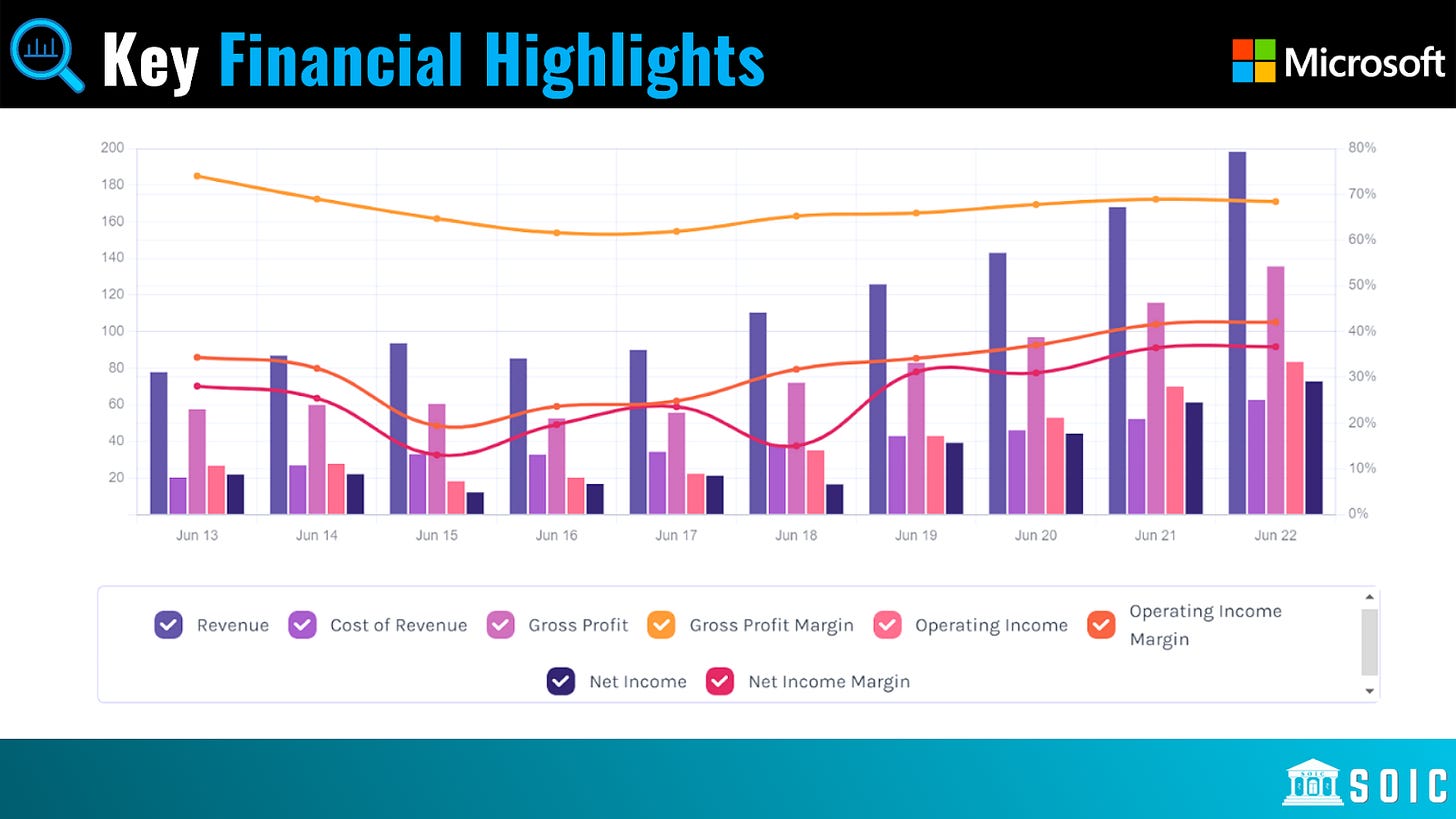

Top To Bottom

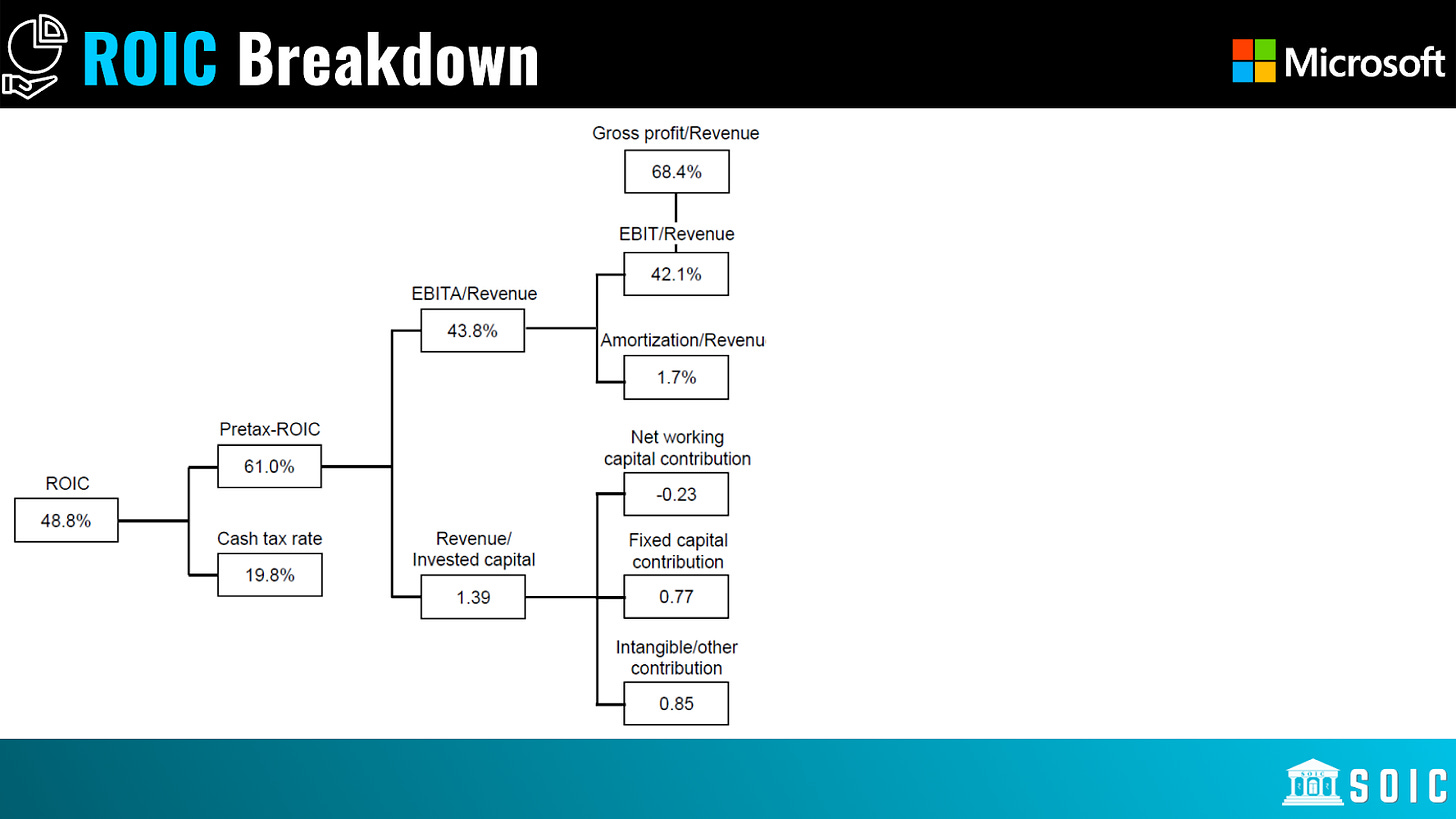

As of June 22, Microsoft brought in almost $200 Billion in revenues ($198.27), and with the cost of revenue being $62.5 Billion, a gross profit of $135.62 Billion. The 68.40% gross margin tells the degree of value it adds through its products and services.

From this gross profit, Microsoft invests almost 18% in R&D ($24.5 Billion) and around 20% in SG&A ($27.73 Billion), bringing in $83.38 in operating profits (42% operating margin).

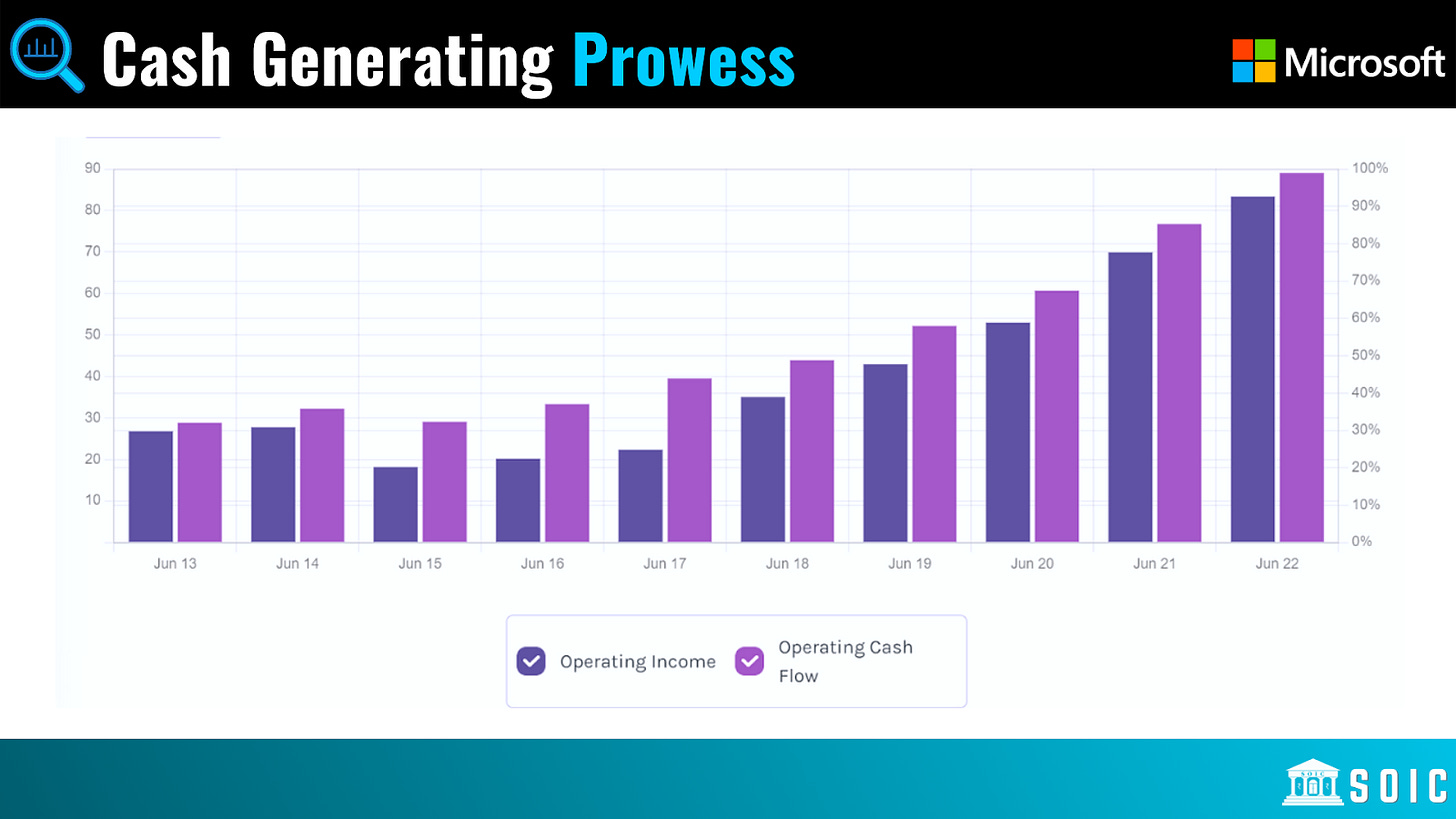

Microsoft generates more cash flow than its operating income suggests. It brought $89 billion in operating cash flow as opposed to $83 billion in operating income; signaling its cash-generating prowess.

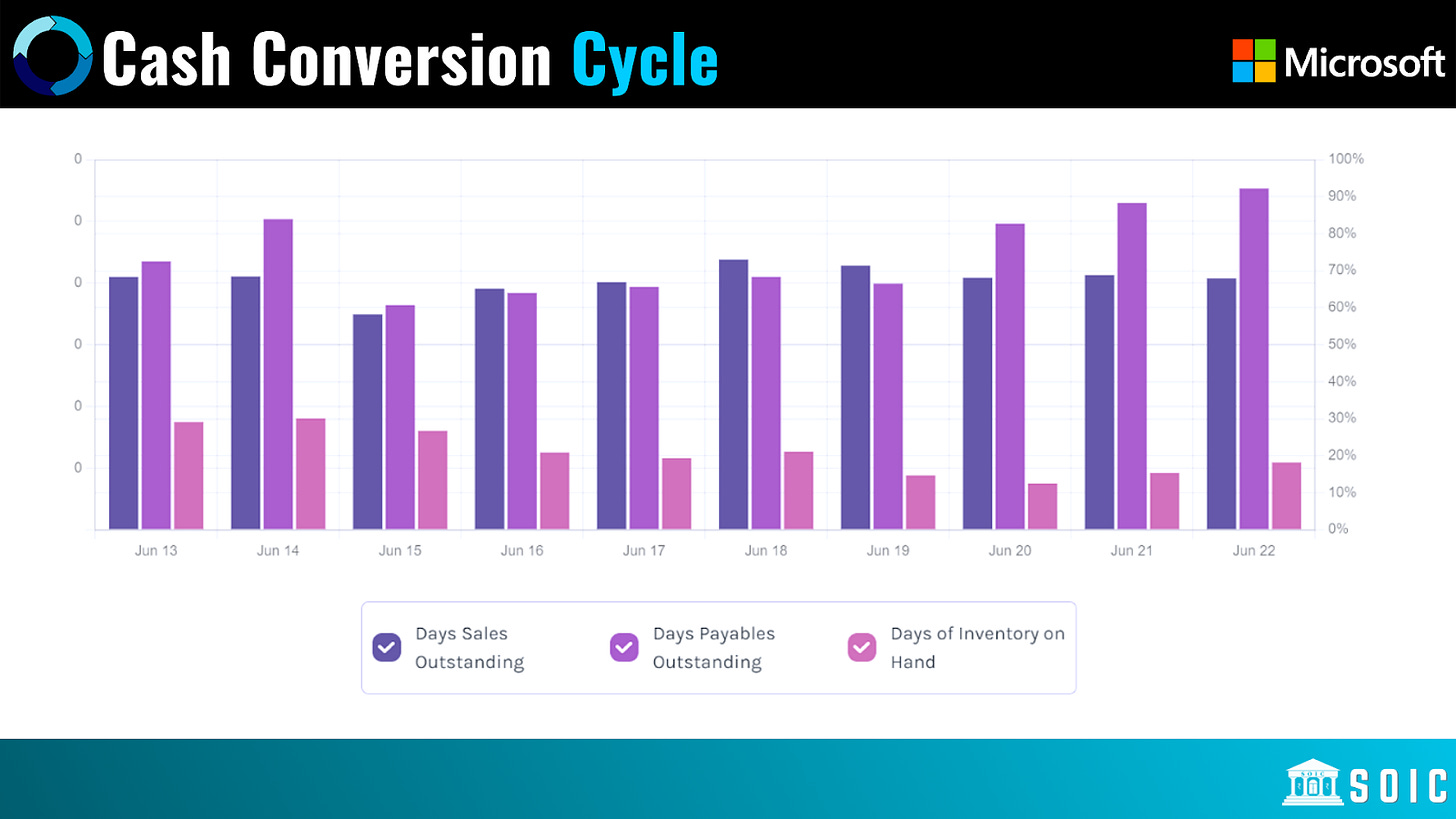

The key metric of a company’s cash-generating prowess is the cash conversion cycle, which is days of inventory plus days of sales outstanding (how long it takes your customers to pay you, basically), minus how many days it takes you to pay your suppliers.

Microsoft gets its money in about 80 days and pays its suppliers in about 110 days with 20 days of inventory, giving it negative net working capital.

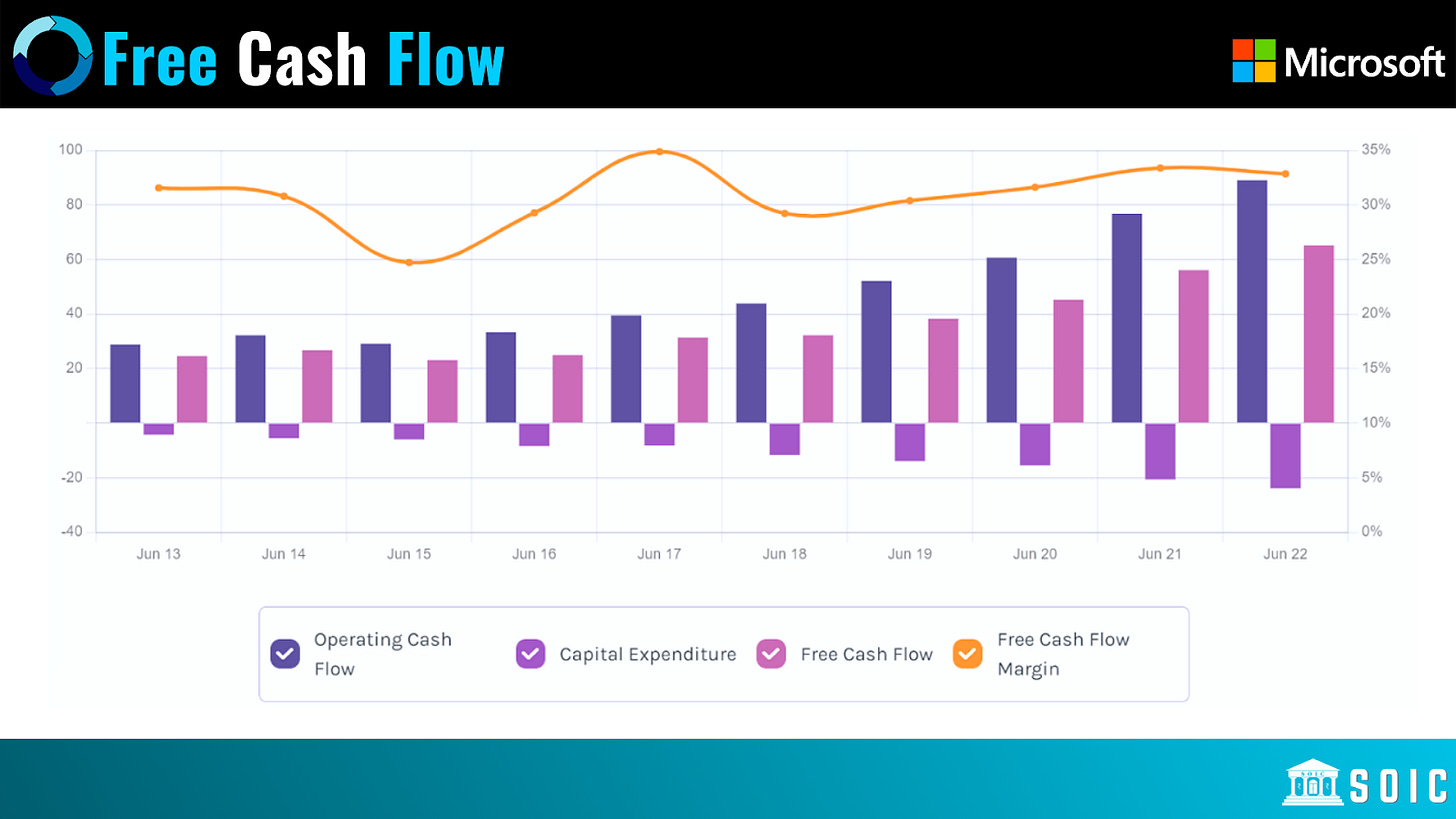

From the $89 billion cash flow it generated, it invested around $24 billion back into the business to generate a free cash flow of around $65 billion. Microsoft has been generating around 30% in free cash flow for many years.

The Rokda Test

Let’s now return to ROIC. For fiscal 2022, Microsoft’s NOPAT was $70 billion, its average invested capital was $143 billion (the average of $120 billion in fiscal 2021 and $165 billion in fiscal 2022), and its ROIC was 49 percent. We assumed the company needs cash equivalent to two percent of revenue, or $4 billion, for fiscal 2022. The company’s cash, cash equivalents, and short-term investments were $105 billion. Including this full amount would take invested capital from $165 billion to $266 billion and ROIC from 49 percent to 29 percent.

Goodwill and other intangibles represent nearly one-half of invested capital for Microsoft. Microsoft’s accumulated goodwill impairment as of year-end fiscal 2022 was $11.3 billion, the result of a $6.2 billion write-down in fiscal 2012 for aQuantive, a digital marketing service company acquired in 2007, and a $5.1 billion write-down in fiscal 2015 for Nokia, a mobile phone hardware business bought in 2014. We did not add back the goodwill but doing so reduces Microsoft’s ROIC for fiscal 2022 by about 3.5%.

If we capitalize Microsoft’s internally generated intangibles, the invested capital changes from $165 billion to $260 billion after reflecting $95 billion of net capitalized internally-generated intangibles. Invested capital is 58% greater. When we recalculate ROIC, the number goes from 49% to 34%.

This Empire Will Be More Durable Than The Old Microsoft Republic

Microsoft’s efforts to defend its strength in enterprise software and services span several initiatives. The company’s investments in artificial intelligence and open-source software have been two of its more recent and lucrative plays to bolster Microsoft’s dominance within the enterprise technology space.

Meanwhile, the company is also working to improve customer experiences (for both enterprises and consumers) from multiple angles, many of which have already shown themselves to be proven areas of growth. Its recent subscription strategies in gaming have increased accessibility for gamers, while recent initiatives in personal computing have shown progress from its hardware mistakes of the past.

The company’s reorganization and pragmatic investment/acquisition philosophy has helped Microsoft more efficiently deploy capital to the most promising opportunities for growth across business segments like cloud computing.

Cloud has been a recurring theme throughout all areas of the Microsoft organization, in addition to artificial intelligence and subscriptions.

Microsoft is taking a comprehensive approach to applying these offerings to all areas of its business. However, the question remains whether or not these efforts will help the company to differentiate its products and services enough from its thriving competition.

The all-encompassing dominant Microsoft of old is back, but in a version that is even stronger and more resilient than before. With the cloud as its linchpin, Microsoft 365, Gaming, and a wealth of opportunities across its product suite, Microsoft is set on a solid double-digit growth for the next decade. Given the present free cash flow, durability of return on capital employed, growth, demonstrated resilience, and optionality that comes with its spawning culture… is Microsoft at an enterprise value of $1.5 trillion a soft-ball or a curve-ball?

Thank you for reading, see you soon!

Do let us know in the comment section below your views on the valuations of the company and how much PE or EBITDA multiple you will ascribe to such companies.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.

AUTHOR

Neel Chhabra

Neel a student of Philosophy & Economics at DU, began investing at 16. He is insatiably curious & is on a quest to understand how the world works.