MRS BECTOR FOODS: A PROXY FOR QSR?

India is a land of opportunities and many claim next decade to be India’s period for glory. A country of such a large population provides ample opportunities to consumer facing businesses in particular. With the income levels of people rising, making them more aspirational, the categories under FMCG that are still less penetrated or there is a good scope of value growth have a large open ground to cover. Today we take a look at one such business that is present across categories in FMCG under biscuits and breads segment with their popular brands ‘Cremica’ & ‘English Oven’. The name of the business is Mrs. Bector’s Food and it houses many interesting aspects that warrant your consideration. With this let’s start the analysis.

Business Overview

Mrs. Bector’s Food Specialities Ltd. is a leading company in the premium and mid-premium biscuits industry. It is also the leading exporter of biscuits from India. It manufactures and markets a wide range of biscuits under its flagship brand ‘Mrs. Bector’s Cremica’.

The company has a strong presence in North India, which it intends to leverage to expand its footprint to the other regions of the country. It has launched new products, such as Trufills, Premium Sugar and Classic Crackers, Pista Almond Cookies, Non-Stop Potato Crackers etc. The brand is among the top 2 in the premium and mid-premium biscuits segment in Punjab, Himachal Pradesh, Ladakh and Jammu & Kashmir.

Furthermore, the company’s bakery brand, ‘English Oven’, is the fastest growing premium bakery brand in India. The Company is the largest premium selling brand in Delhi NCR, Mumbai and Bengaluru. It has 283+ distributors and 23,000+ retail outlets. Notably, the Company is one of the few bakery companies in India that can handle fresh, chilled and frozen products which enables the Company to maintain quality and shelf life thus enabling pan-India distribution. The Company is also a leading player in the institutional bakery/QSR segment.

The company has 3 business divisions:

Biscuits

Branded breads & bakery products

Contract Manufacturing

Let’s cover each business segment in detail:

1. Biscuit Division

The Indian biscuits market is expected to grow at a CAGR of 9% to reach ₹62K Cr by FY25 from ₹40K Cr in FY20. Currently India contributes close to 5% of the global biscuit market which is expected to increase to 6% by 2025.

Biscuits priced below ₹100/kg are classified as mass-end and comprise the glucose category. Biscuits priced at ₹100-200/kg are classified as mid-premium and comprise the Marie biscuit and crackers categories. Biscuits priced above ₹200/kg are classified as premium and comprise the cookies, digestives and cream categories.

The Indian Biscuit market is dominated by the branded players owing to their distribution network, innovation and variety of product offerings. The non-branded space is dominated by small bakery units, cottage & household industry manufacturing units, which thrive on catering to the local tastes and their committed relationships with retailers. There are over 30,000 small, very small and tiny biscuits units spread across the country.

India lags significantly in per capita biscuit consumption at a mere 2.5 kg, vis-à-vis 4.25 kg in South East Asian countries like Singapore, Hong Kong, Thailand and Indonesia and more than 10 kg in the US and Western Europe. This gap represents a bright spot for market players and comprises a multi-decade opportunity to grow and expand the organised market for biscuits and bakery products.

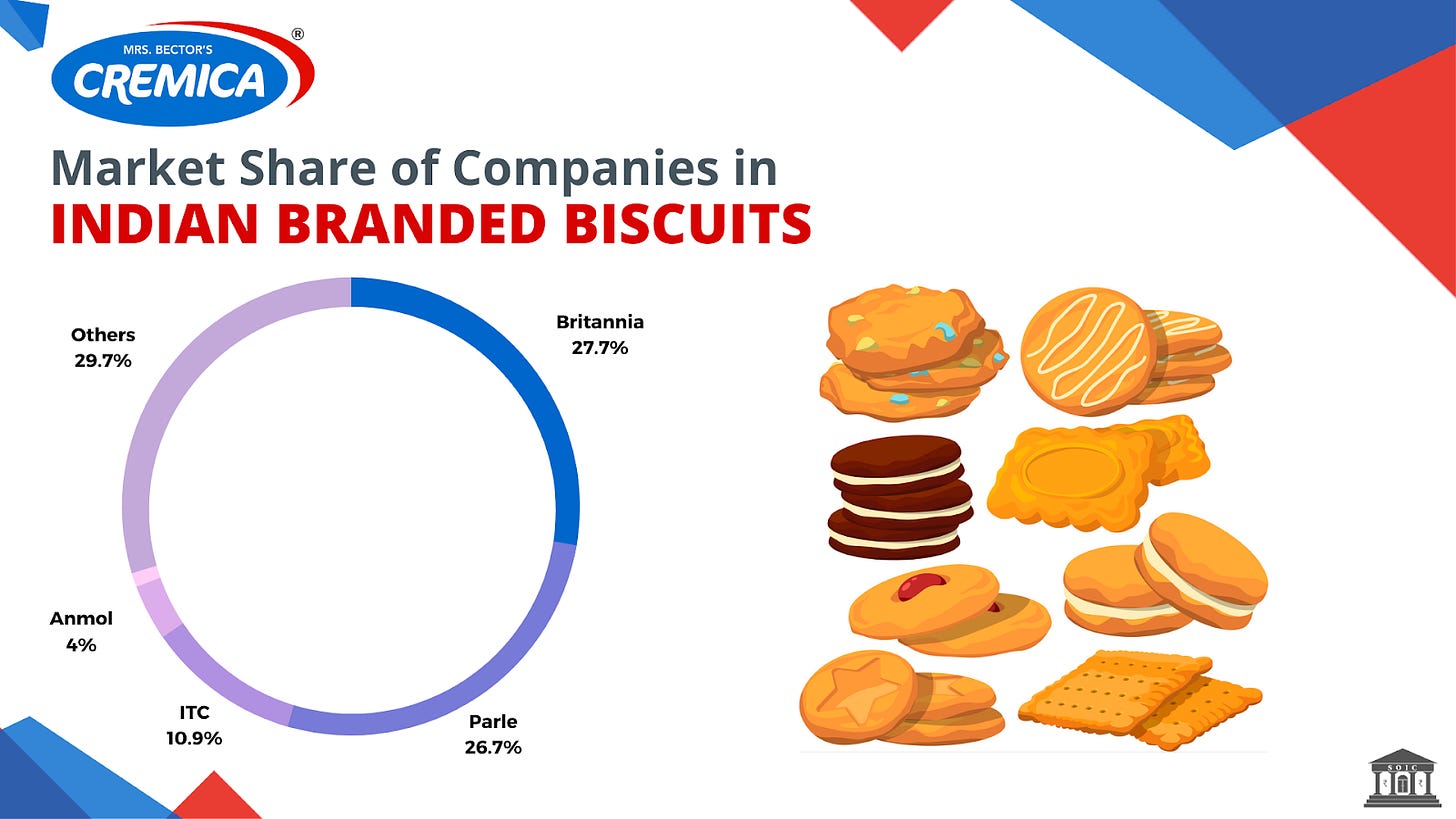

The biscuit market is dominated by lead players such as Britannia, Parle and ITC which together comprise ~65% of the market. Britannia is the market leader in value terms, whereas in terms of volume, Parle is the #1 player. Parle derives a large portion of its revenues from mass-end products, while Britannia’s revenues are driven by premium and mid-premium products.

Over the years, consumer trend is shifting towards premium and mid-premium biscuit range leading to value growth in the branded biscuit segment. The penetration of branded biscuits will continue to grow because of increasing consumer preference and spending power.

Currently, the company generates around 60% of its revenue from the biscuit segment. Going forward, the company is focusing on increasing the share of premium products in its portfolio in the biscuits segment.

As we mentioned before the company has recently launched new products such as ‘Trufills’, ‘Premium Sugar and Classic Crackers’, ‘Pista Almond Cookies’, ‘Choco Chip Cookies’, ‘Non-Stop Potato Crackers’.

The company sells their biscuits across 23 states in India through a widespread network of 220+ super stockists and 900+ distributors supplying to a wide range of customers through 550K retail outlets and 5,000+ preferred outlets. The company is also one of the largest suppliers of biscuits to Canteen Stores Department of Government of India (“CSD”) supplying in 34 locations across India and approved listed suppliers for Indian Railways having strong presence across Railway Station Canteens and their stores in North India.

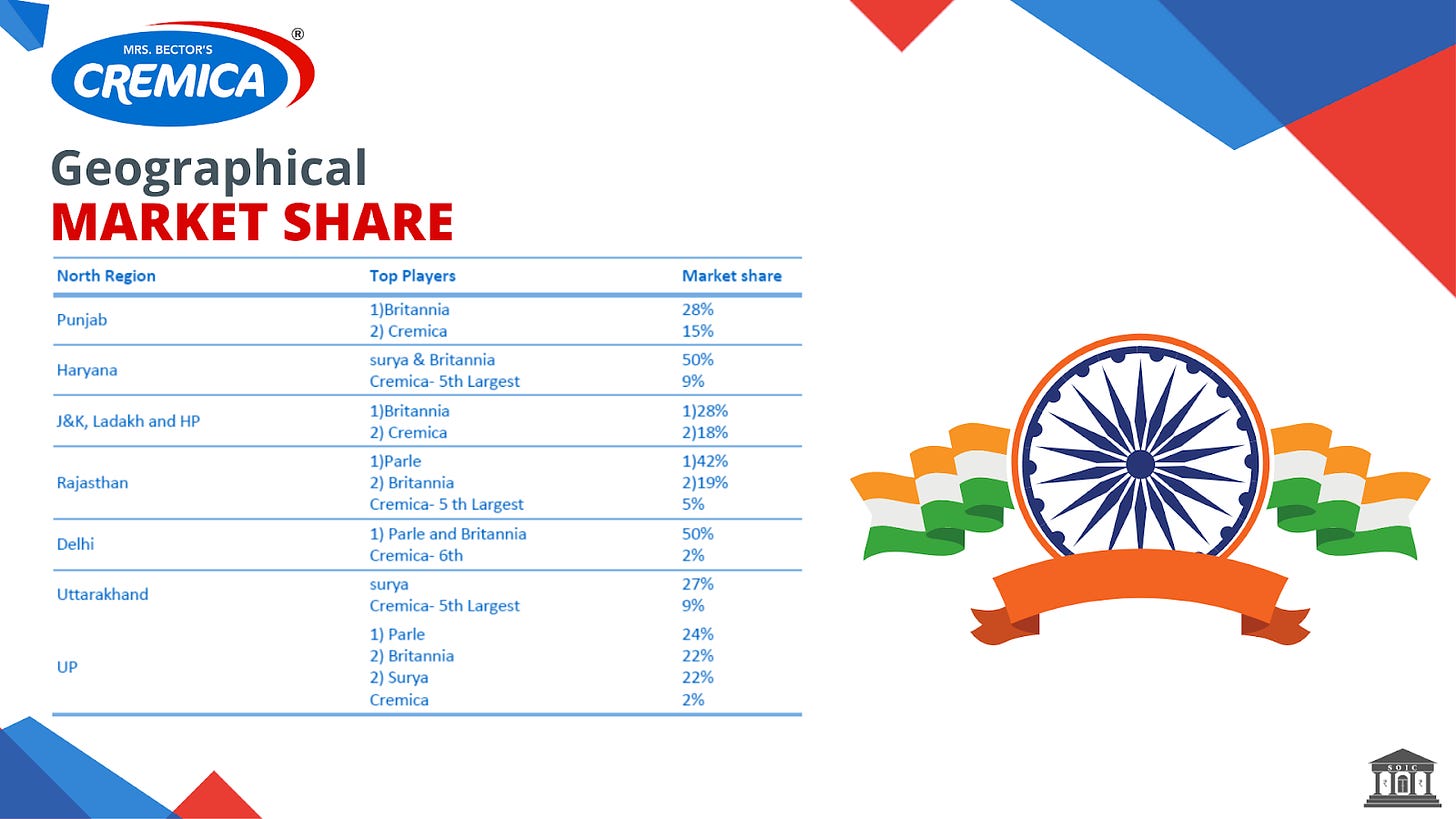

The Company commands 4.5% market share in North India in the mid-premium and premium biscuits market. It has a strong market position in the states of Punjab and Himachal Pradesh and the union territory of Jammu & Kashmir, with over 15% market share; its market share in Haryana is ~5%. The largest sub-segment of the Company is cookies & creams, followed by crackers. In terms of state-wise revenue contribution, Punjab, Himachal Pradesh, Jammu & Kashmir (union territories), Uttar Pradesh and Haryana are the major markets for domestic biscuits division.

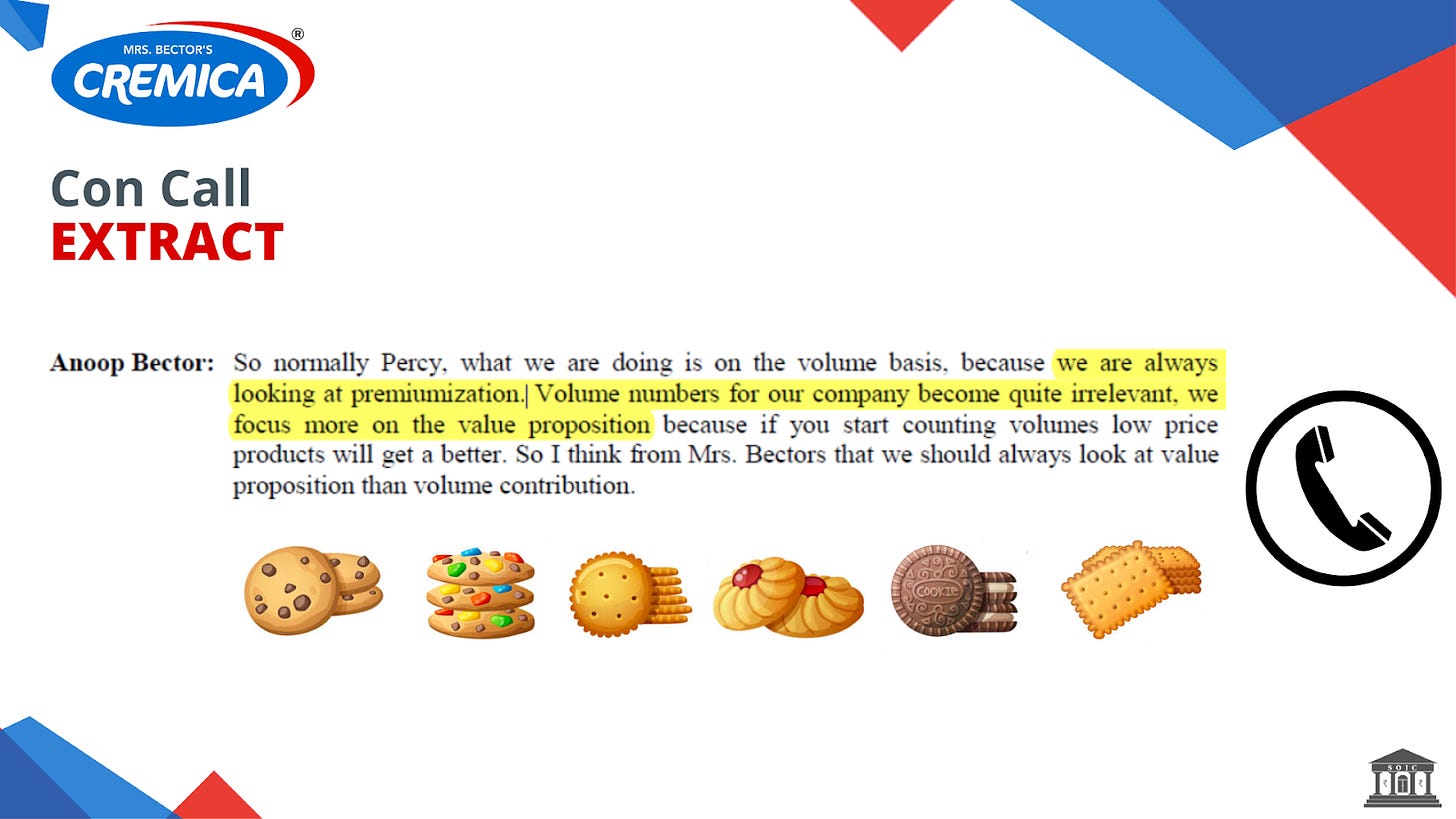

The management believes the revenue growth from the domestic biscuit segment will be driven majorly by value growth rather than volume growth as they are looking at premiumization and focusing more on value proposition.

Biscuits Exports

Global export of biscuits has grown at 0.70% in value terms, it has grown by volume at a CAGR of 11.70%. The faster growth in volume has been due to increase in consumption in developing markets like Africa, Asia etc.

Indian biscuit exports have maintained a share of 2% of total world exports by value and 2-3% by volume. The key markets for Indian Exports have been USA, Africa countries, Caribbean Islands and Middle East.

Parle, Britannia and Bector’s Food are the leading exporters of biscuits from India. Britannia and Bector’s Food had a share of ~22% and ~12% respectively in the total exports of biscuits from India.

Mrs. Bector’s Food - A leading exporter of biscuits from India

The Company is one of the leading exporters of biscuits from India, with approximately 12% share of the Indian biscuits export market in FY22. Mrs. Bector’s Food has an established market outside India with exports to 63 countries across Asia, Australasia, Europe, MENA region, North America and Africa among others. They export various types of cookies such as danish cookies, choco chip cookies and centre filled cookies, creams, crackers and some glucose biscuits.

The company’s export realisation is also in the uptrend from ₹81/kg in FY18 to more than ₹100/kg in FY22. The company generated around 22% of its revenue from export business in FY20 which increased to 27% in FY22.

The company also has international tie-ups with global retailers such as Monteagle International (UK) Limited, Lulu Hypermarket Trading Co, E-Mart Inc., Atlas Global (HK) Limited, Omni Trade Services Limited, Universal Trade Limited, Shoprite and World Wide Imports (2008) Ltd.

In exports, the company is significantly increasing its branded sales in developing markets such as the Middle East region specifically the 6 GCC countries and rapidly expanding in the North American market.

Currently, the company is growing its export business at a double-digit growth and it continues to see growth at this pace with target focus being North American and GCC markets.

Let’s move on to the next business division.

2. Branded Breads & Bakery

The Indian breads industry is expected to clock a CAGR of 9% by FY25. The unbranded segment comprises 45% of the bread industry in India. The bread industry is divided between branded and unbranded players. In the branded segment, Britannia, Modern and English Oven are the market leaders, with 45% share of the industry. There are about 85,000 breads manufacturers in the unbranded segment in India.

Mrs. Bectors Food manufactures and sells various types of premium bakery products in savoury and sweets categories for retail customers such as breads, buns, pizza bases, and cakes under the ‘English Oven’ brand, which caters to the premium segment in Delhi NCR, Mumbai, and Bengaluru. The ‘English Oven’ is one of the fastest growing large-scale premium bakery brands in India. Currently, this segment contributes around 35% in its total revenue.

English Oven has ~15% of the market (including mass-end breads) in the Delhi NCR region. With brand equity already established, the focus is now on reaching more outlets in this region. Mrs. Bectors Food is one of the few bakery companies in India that can handle fresh, chilled and frozen products which enables the Company to distribute its products across India.

It has a comprehensive portfolio in breads which includes white breads, brown breads, fruit breads, kulchas, pav, multi-grain and whole-wheat breads, burger buns and pizza bases, and others.

The other sub-segment in this division is Institutional Bakery Division

The Company manufactures and sells a variety of bakery and frozen products such as buns, kulchas, pizzas, and cakes to their QSR customers with pan India presence, cloud kitchens such as Rebel Foods Private Limited since 2015, multiplexes such as PVR Limited, as well as certain hotels, restaurants and cafés. The company is also the largest bun supplier to leading QSR customers such as Burger King India, Connaught Plaza Restaurants, Hardcastle Restaurants, and Yum! Restaurants (India). It has stayed the ‘preferred supplier’ of burger buns and pan muffins (fresh) for Hardcastle Restaurants since 2007.

The company has expanded manufacturing facilities and introduced stringent quality control processes, which have enabled them to serve other reputed QSR chains. The Greater Noida Manufacturing Facility, Khopoli Manufacturing Facility and Bengaluru Manufacturing Facility have dedicated lines for manufacturing buns to serve QSR customers.

Further, the company has been developing new products through investments in new technologies. It has commissioned a sheeting line in its Greater Noida plant, which is capable of producing various types of breads, such as focaccia, panini and ciabatta, among others. It has also installed large blast freezing, individual quick freezing and holding freezers in its Greater Noida facility, for the manufacture of frozen products. It is increasing its manufacturing capacity by installing an automated bread and bun manufacturing line from Germany and USA, respectively, at its Greater Noida facility.

An array of new products would open up cross selling opportunities to existing institutional clients. The institutional relationships can also be leveraged to offer business opportunities with the affiliates of these customers, in India and globally. Further, a wide portfolio of premium and differentiated products would also allow the company to tap the growth opportunities in additional segments such as casual dining, hotels and cafes, apart from the existing QSR channel.

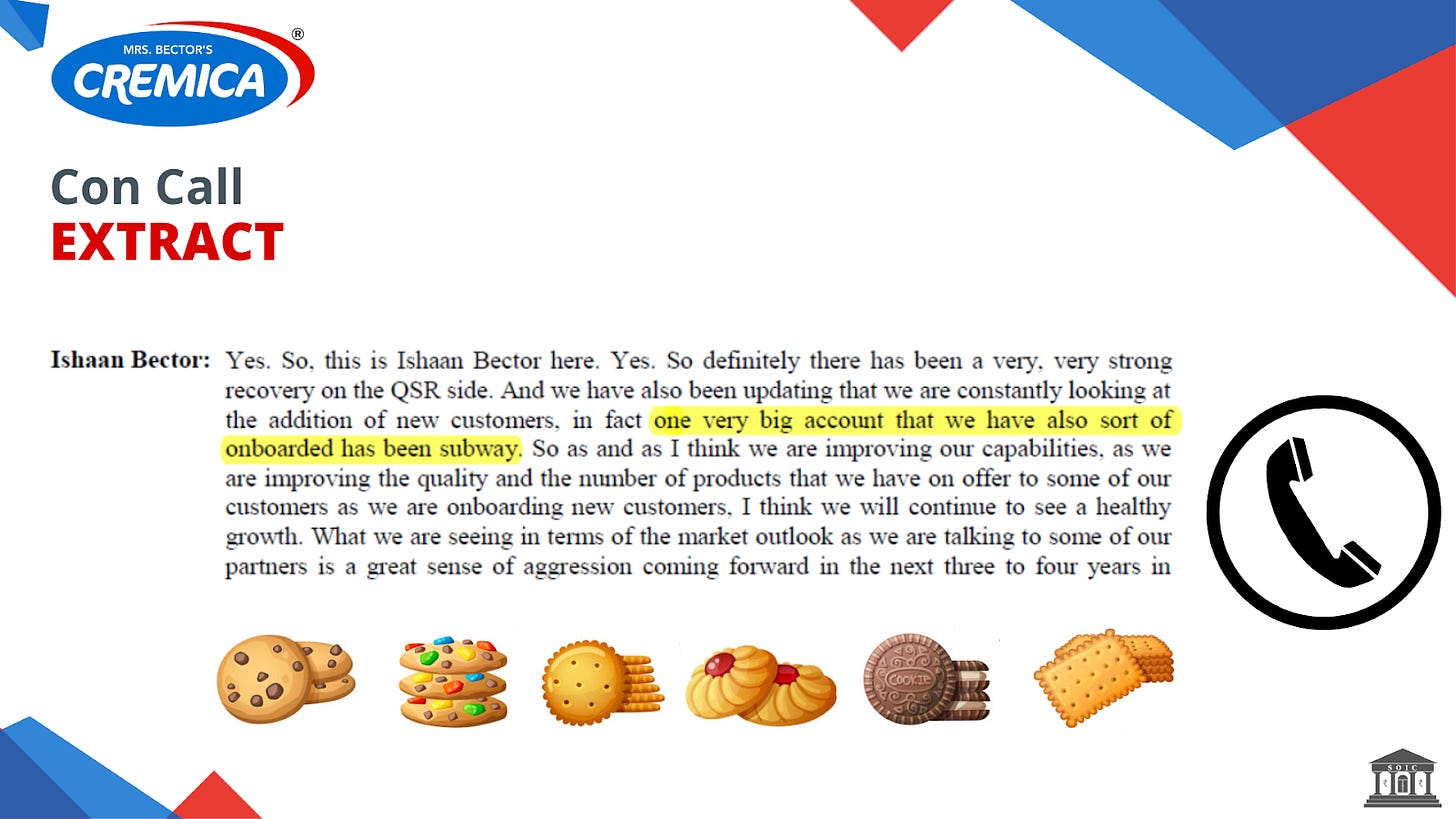

In this segment the company has also onboarded Subway as a new client in the list.

On to the last business segment.

3. Contract Manufacturing

In this segment they manufacture ‘Oreo’ biscuits and ‘Chocobakes’ cookies on contract basis for Mondelez India Foods Pvt. Ltd. They also manufacture and supply biscuits for some of its international customers under its brand ‘Mrs. Bectors Cremica’ and under their private labels respectively. Currently this segment is very small and contributes just 4-5% of the total revenue. Hence we are not covering it in depth, will look into this once the segment matures and generates substantial revenue.

Now coming to the Manufacturing facilities & Capex plans of the company:

Bectors Food has set up six state of the art manufacturing facilities across India adhering to stringent quality controls. The company has received several quality certifications and accreditations, including certification from the FSSC 22000, the U.S. Food and Drugs Administration, British Retail Consortium (BRC) and Sedex Members Ethical Trade Audit (SMETA).

The company has 6 plants at various locations.

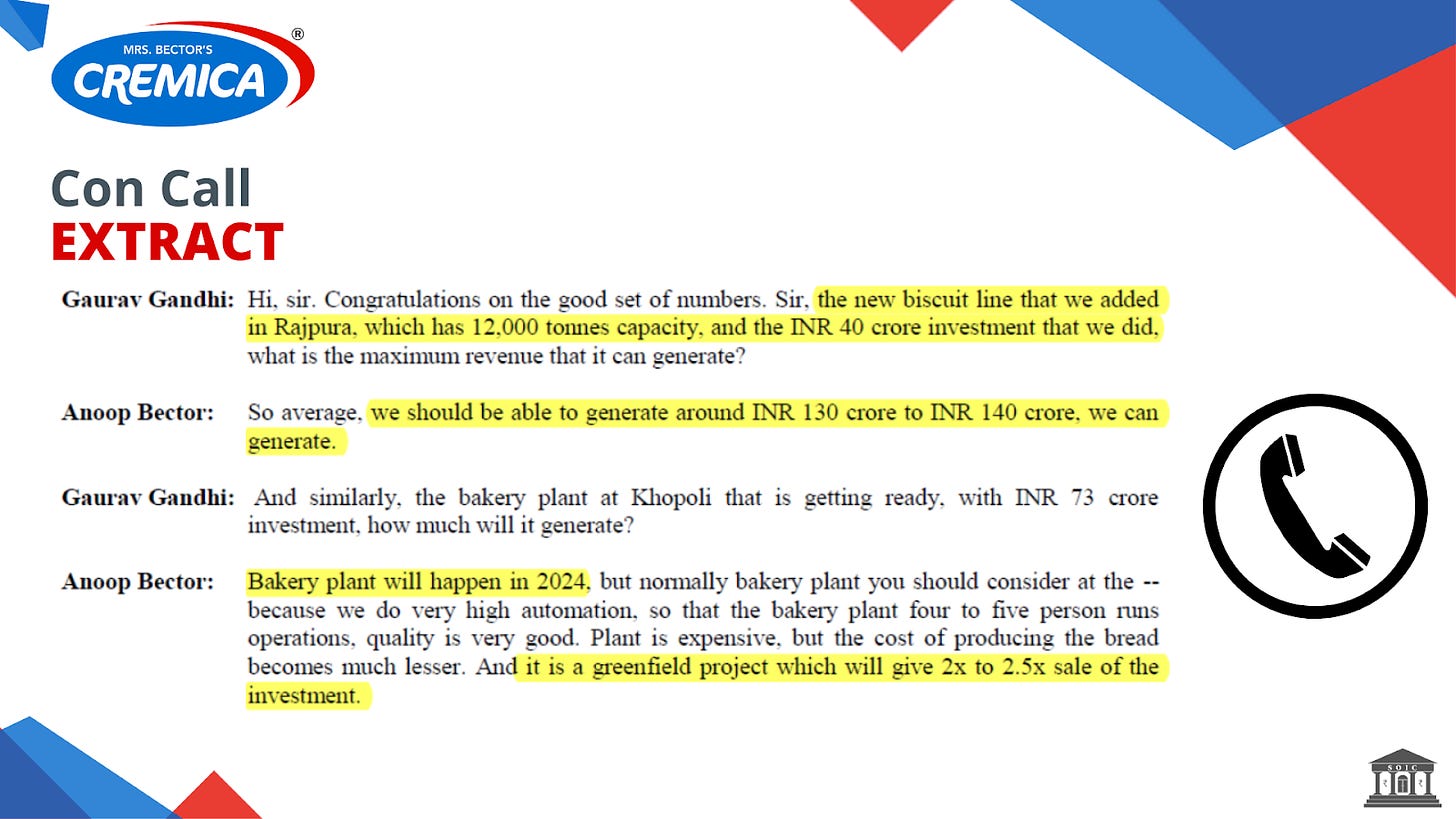

The new production line of biscuits at Rajpura plant has started commercial production in July 2022. This line comes with an installed capacity of 12,000 tonnes per annum, and has been effective from July 15, 2022.

The Company manufactures 100% of its products in-house providing them full control over the quality and also led to higher margins. The larger players such as Britannia and Parle have adopted a combined model of in-house as well as outsourcing. No company in the industry has adopted a 100% outsourcing model owing to multiple benefits of in-house manufacturing such as quality control, better margins, export viability, food safety and faster product development cycle.

On the capex front, the company has just completed the capex of expanding Rajpura facility with cost of ₹40.5 crores in Punjab and is in the process to set up a Greenfield facility in Dhar, Madhya Pradesh to cater to the West and South India. The ongoing project in Dhar will help the company to cater to the newer markets and provide further geographical diversification.

Besides, for bakery plant extension in Mumbai, the Company has already purchased land in Khopoli adjacent to current factory. The total project cost is estimated at Rs. 73 crores, including land, out of which Rs. 25 crores would be invested in FY2023 and the balance in FY2024. Commercial production is planned to start by October 2023.

Growth Strategies of the company:

1. Premiumization of Products: Company is looking at premiumization of products in both Biscuits as well as Bakery division as a long term tactical shift and they are also focusing on the same.

Currently, the company generates around 80% of its biscuit revenue from the sale of cookies of which 20% comes from premium products. Going forward, the company is focusing on increasing the share of premium products in its portfolio in both biscuits and bakery products such as digestive biscuits, Bourbon and premium creams. The management believes the revenue growth will be driven majorly by value growth rather than volume growth acquiring more market share.

The company continues to focus on increasing distribution and premiumization of the products. In premium products margins are much superior as compared to current and it also improves the return ratios of the company.

2. Extensive Distribution Network: Biscuits have shelf life of approximately six months. Like any other FMCG products, direct reach of products to retail points is pertinent to sales off-take. The reduction of distribution cost and consequently inventory cost has been the area of focus for every biscuit brand. They have expanded their retail footprint through distributors, direct reach and modern retail outlets.

The company has a retail customer base across 23 states in India and institutional clientele having presence pan India. Mrs. Bectors Food has global presence with exports in 63 countries across six continents through a strong global distribution network and tie-ups with retailers, distributors and buying houses. The company also has a strong distribution network of 250+ super stockists, 900+ distributors, 5,000+ Cremica Preferred outlets and 15 depots across India. The company has employed more than 250 personnel in the sales team to look after the sales of its products across 557K retail outlets. The company is directly associated with 33% of the total retailers where its products are sold.

The company has developed in-house automation tool ‘Peri’ to increase productivity of the super stockists and distributors by enabling them with access to critical information of sales and products and strategic information about sales trends, on a real-time basis which is beneficial for the company’s on-ground sales teams.

Additionally, the company’s products are sold through modern trade channels including Walmart India Private Limited. Also, they directly supply their biscuits to institutional clients like CSDs, Indian Railway Canteens and stores in North India.

For Bakery business, the company sells its products through modern trade, general trades and various e-commerce platforms under the brand ‘English Oven’. The company has a network of 210 distributors and over 18,000+ retail outlets all situated in Delhi NCR region, Mumbai, Pune and Bengaluru through direct sales to supermarkets, departmental stores and distributors.

3. State of the Art Manufacturing Facilities & automation: Mrs. Bector's Food has set up six state of the art manufacturing facilities across India adhering to stringent quality controls. Mrs. Bectors Food manufactures 100% of its products in-house providing them full control over the quality and also leading to higher margins.

The company has upgraded its manufacturing plants with latest technology imported from the reputed suppliers across the world. The company has built state of the art production lines which will enable them to compete in the global biscuit export market.

Also, the company is one of the few bun suppliers in India equipped with dedicated modern manufacturing facilities enabling them to undertake large orders for their QSR customers.

Company is further focusing on technology to drive efficiency both on sales and supply chain side hence company has initiated to implement salesforce automation and distributors management system, which will help them to drive availability, market share and premium outlet reach to improve sales efficiency

Going forward, the company is expected to further expand and upgrade its production facilities to different regions to cover more market share and generate higher returns.

4. Improving capacity utilisation to result in a better return profile: Company has done the significant capex in the past five years, primarily on the greenfield expansion in Rajpura for commissioning a state-of-the-art facility for cookies and biscuits, introduction of a new bread line at its Greater Noida facility, new production for breads at its Bengaluru facility, and land acquisition at Dhar.

However, sales growth during this period has been subdued due to disruptions in the wholesale channel post demonetisation, covid and macroeconomic issues in some of the export markets.

Further, in next few years the capex intensity will be low only for automation and already announced capex like greenfield capex in Madhya Pradesh and bakery plant extension in Mumbai will be done.

As capacity utilisation of these new capacities increases with sales growth, and with increase in mix of new and more premium products, the company’s gross asset turnover should also inch upward from 1.6x currently in the medium term.

Key Risks in the company:

1. Restriction on use of brand name: Company manufacture and supply biscuits and premium bakery products under brands, ‘Mrs. Bector’s Cremica’ and ‘English Oven’.

Due to infighting between promoter family, company do not have any right to use the brand ‘Mrs. Bector’s Cremica’ for the purposes of marketing any other products that they may foray into in the future, it may require them to invest considerably in establishing new brands which may not be accepted by consumers and therefore, may adversely affect the business, financial condition and results of operations.

Further, the company could not use the brand name ‘Mrs. Bector’s Cremica’ for sale of breads to retail customers, and therefore, they developed and sold breads and bakery products to retail customers under the brand ‘English Oven’.

2. No long term contracts with QSR customers: The Company does not have any long term contracts with its QSR customers and any disruption in the business operations with QSR customers will adversely affect its business, financial condition and results of operations. The supply of its products to such QSR customers is typically contingent on demand arising on a day to day basis which is subject to fluctuation.

It is always prudent to stay aware of the risks that are present in the business we have decided to analyse.

Valuations of the company:

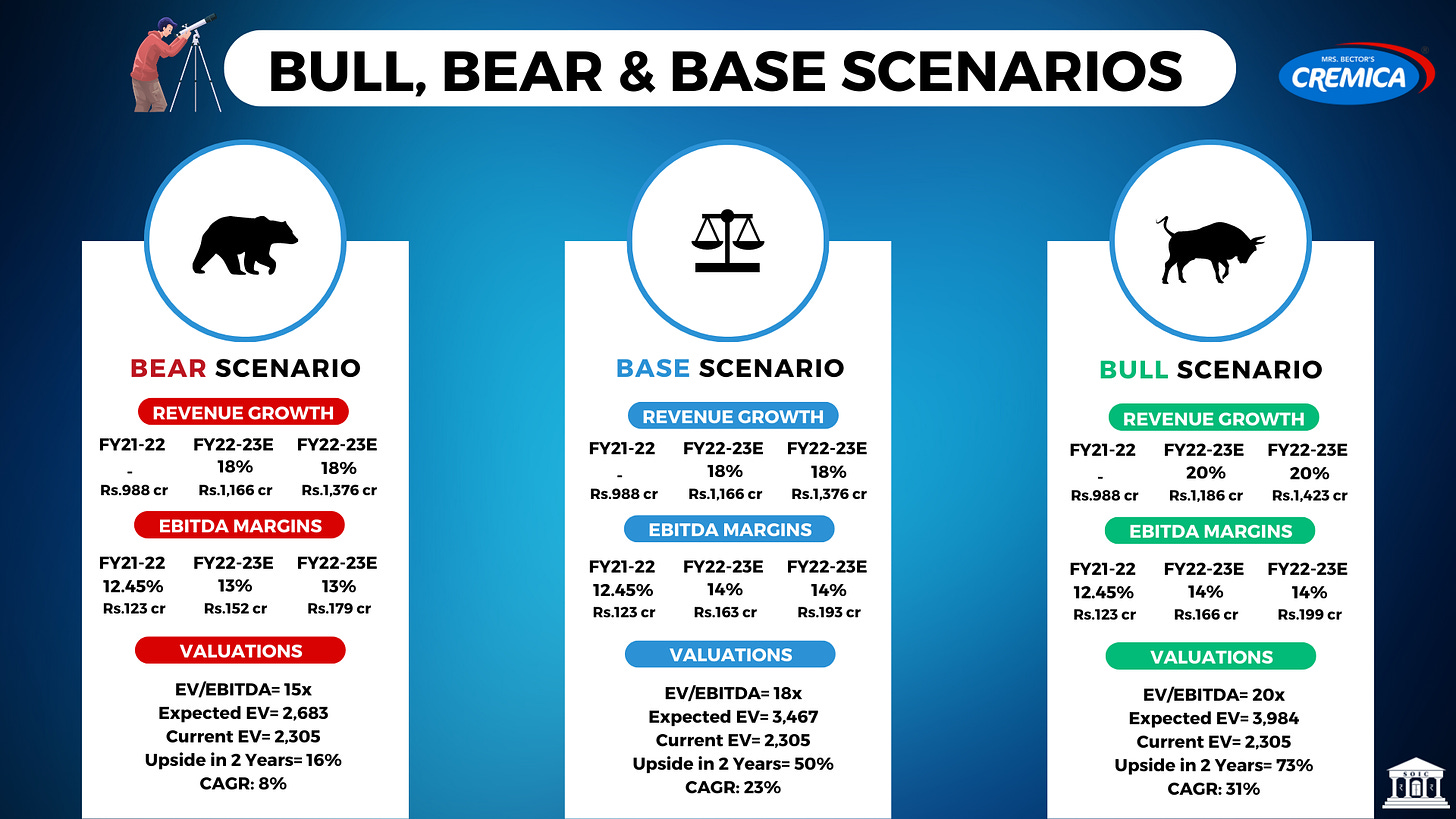

Valuation is the most important aspect of analysing a business. We are valuing the company with the SOIC framework of Bear Case, Base Case and Bull Case scenario.

At the time of writing the company is valued at 40 times Price to Earnings ratio and EV to EBITDA of 17.6 times. Management expects to grow top line at 18-20% for next few years and EBITDA margins to sustain at 13-14%.

I have done a brief bull/bear/base scenario analysis for Bector foods in the google sheet below. Feel free to play around with the assumptions.

Hope we were able to add value and you liked the analyses. Looking forward to your feedback and questions in the comment section below.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.

AUTHOR

Shubham Ajmera

Shubham Ajmera is a Chartered Accountant by profession working as equity research analyst with SOIC.