National Stock Exchange: Proxy to India’s Capital Market

In the last few months, we have seen various news articles flashing out mentioning the number of new Demat accounts opening. Post-COVID-19 pandemic retail participation in the Indian stock market saw a huge uptick. More and more individuals were seemingly turning towards stock trading and investing, with the number of new Demat and trading accounts witnessing meteoric growth. Factors like a sharp surge in the market in the last 2 years, work-from-home investment opportunities, increased penetration of internet services, and the desire for a secondary source of income led to the rapid rise in the number of Demat account holders in the country. There's a paradigm shift underway in the Indian economy and it is powered by the “aam aadmi”: Retail investors.

As per the data reported by NSDL & CSDL, the total number of Demat accounts in India has now increased to 10.6 crores by adding 18 lakh new accounts in Nov 2022 alone. This number was nearly 4.1 crores in March 2020 which means in the last 2.5 years the number of Demat accounts has more than doubled.

As per RBI data, Indian families have shown a 2.5x jump in mutual fund investments in FY22 vs FY21. Over 10 million new investors started a SIP and invested a total of ₹1.2 trillion in FY22.

The growth in investor registrations was driven by non-metro cities. The cities beyond the top 50 cities accounted for 57% of new investor registrations; cities beyond the top 100 cities contributed 43%, indicating a widening interest in equity markets.

This is leading to the financialization of Indian household savings which is a strong tailwind for the Indian Stock Markets. Today we will be discussing a company that is the proxy to play this theme and participate in the journey of changing patterns in Indian savings and the way India invests.

National Stock Exchange Ltd.

NSE is India’s largest stock exchange which comprises more than 2,000 listed companies. These companies span a range of sectors. It is a preferred designated stock exchange for some of the largest Indian companies.

NSE was incorporated in 1992 and recognized as a stock exchange by the Securities and Exchange Board of India (SEBI) in April 1993, commenced operations in 1994 with the launch of the wholesale debt market, followed shortly by the launch of the cash market segment.

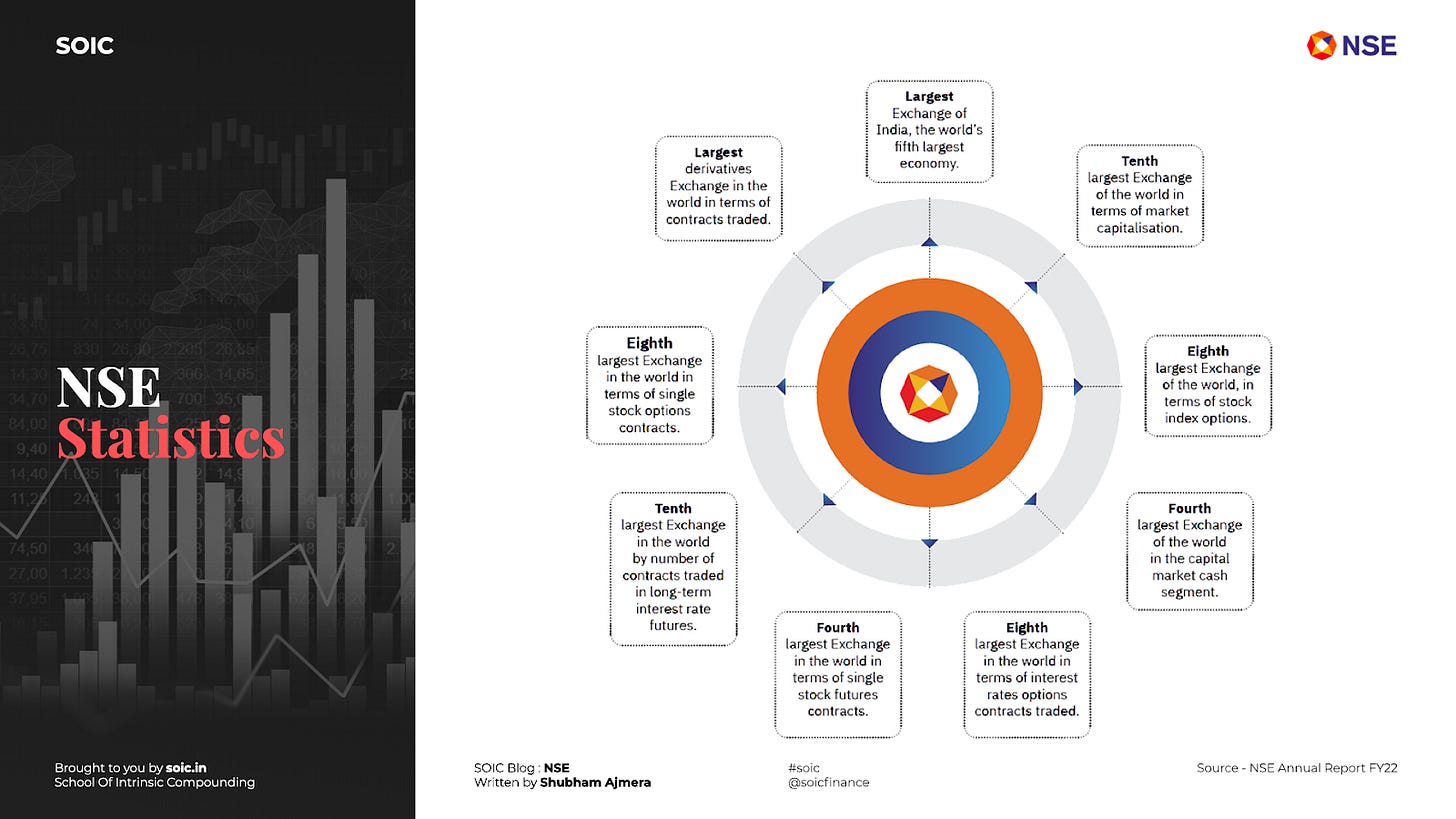

It has been consistently ranked as the largest stock exchange in India in terms of total and average daily turnover for equity shares since 1995 (based on SEBI data). It is the largest derivatives exchange globally in terms of the number of contracts traded.

NSE has comprehensive coverage of the Indian capital markets across asset classes. The company’s fully-integrated business model comprises exchange listing, trading services, clearing and settlement services, indices, market data feeds, technology solutions and financial education offerings. The company oversees compliance by trading cum clearing members as well as listed companies in line with SEBI and Exchange regulations. Its derivatives market offers trading opportunities in various forms of derivatives, such as futures and options on stocks and indices, currency futures and options, interest rate futures and options and commodities futures and options.

NSE is the first exchange in the country to provide a modern, fully automated screen-based electronic trading system that offered an easy trading facility to investors spread across the country. NSE offers trading in equity, equity derivatives, debt, currency derivatives and commodity derivatives segments. Partly due to the inefficiency of BSE and their inability to adopt Electronic Trading. NSE ended up pulling ahead (from the book, Absolute Power).

Key Products, Market Leadership and growth of NSE

Equity Derivatives: NSE was ranked first globally in the derivatives segment based on the total number of contracts traded during the calendar year 2021. The number of traded contracts at NSE stood at 17.26bn — almost double the number of contracts traded in the previous year and ~97% higher than the Brazilian B3 (Brasil Bolsa Balcão) Exchange (8.76bn contracts), followed by CME Group at 4.9bn contracts. Among the top 10 exchanges globally, four were from the US, three from China and one each from India, Brazil and Korea.

Before going into the depth of business first let's understand the meaning and types of Equity Derivatives:

Equity derivatives are financial products/instruments whose value is derived from the increase or decrease in the underlying assets, i.e., equity stocks or shares in the secondary market.

Investors can use equity derivatives to hedge the risk associated with taking long or short positions in stocks, or they can use them to speculate on the price movements of the underlying asset.

Types of Equity Derivatives

Options and futures are by far the most common equity derivatives.

Options give the holder of the option the right, but not the obligation, to buy (call option) or sell (put option) a particular stock at a given price. The contract provides information about the given price, which is called the strike price, the expiration date, and the terms and conditions of the contract. An options contract is best suited for investors who want to protect or hedge themselves from increases or decreases in prices in the future.

In a futures contract, the buyer agrees to buy the asset on a future date and at a specific price. Unlike options, in a futures contract, the buyer has an obligation to buy the asset. In simple terms, the buyer must buy the asset on the date mentioned on the contract at the specified price.

Equity Options

Since the launch of the Index Derivatives on the popular benchmark Nifty 50 Index in 2000, NSE today has moved ahead with a varied product offering in equity derivatives. The Exchange currently provides trading in Futures and Options contracts on 4 major indices (NIFTY 50, Nifty Bank and FINNIFTY) and more than 100 securities. NSE launched futures and options on the Nifty Midcap Select index in the equity derivatives segment from January 24, 2022.

The derivatives market has witnessed robust growth in volumes since inception, led by options. The derivatives segment is clearly dominated by NSE, with 100% market share. BSE ventured into the equity derivatives segment in 2000, but was unable to attract volumes from NSE.

The option volume saw tepid growth in the last few years, NSE’s options turnover has increased 50x over the 2015-2022 period. During H1-FY23 the equity options volume has grown by 113% on YoY basis.

Higher margin requirements by SEBI to reduce the leverage in the capital markets has been one of the main reasons for sudden jump in the option volumes. Higher margin requirements have hurt liquidity in the cash and futures market. Investors can no longer put highly leveraged trades using these securities. However, the margin requirements for options are lower than those for other instruments.

Also even in option turnover, more than 90% of turnover is on indices, trading in stock options is very low.

Equity Futures:

As discussed above due to margin rules by SEBI the volumes in Futures has been growing in single digit since last year. NSE enjoys pure monopoly in this segment as well with 100% market share. In H1-FY23 the equity futures volumes have grown at 7% on YoY basis.

The key difference between option & futures volume trading is in futures volumes stocks have a share of ~75% as compared to just ~5% in options.

2. Cash Market:

NSE has dominated the cash and derivative markets. It commands a healthy market share of ~93% in the cash segment. NSE has been consistently gaining market share from BSE. From 84% market share in 2017 NSE has now reached to 93% in H1-FY23. Higher volumes in NSE lead to lower impact costs, and as rightly said, volume begets volume, making BSE a less attractive exchange. Just for an example- take any stock with low float. Just see the pricing difference between the Bids/ask on both Bse and NSE.

Products in this segment include equity shares, exchange-traded funds, Infrastructure Investment Trust (InvITs), Real Estate Investment Trusts (REITs), mutual funds, Sovereign Gold Bond (SGB), Government securities, treasury bills, state development loan and STRIPS. Services include primary market issuance (IPO), new fund offer (NFO) platform and offer for sale (OFS).

It has been observed that the cash equity volume growth does not follow a secular uptrend, it is highly cyclical and dependent on the indices performance like Nifty.

During H1-FY23 when the market has not done relatively well and both sensex and nifty have given negative returns the volume in cash segment during the period has degrown by 18% on YoY basis.

3. Currency Derivatives

A currency future, also known as FX future, is a futures contract to exchange one currency for another at a specified date in the future at a price (exchange rate) that is fixed on the purchase date. The investor buys or sells specific units of fixed currency on a pre-specified date and rate. These contracts are actively traded on the stock exchanges and are mainly used by importers and exporters to hedge against domestic currency fluctuation.

On NSE the price of a future contract is in terms of INR per unit of other currency e.g. US Dollars. Currency on NSE Derivatives are available on four currency pairs viz. US Dollars (USD), Euro (EUR), Great Britain Pound (GBP) and Japanese Yen (JPY). Cross Currency Futures & Options contracts on EUR-USD, GBP-USD and USD-JPY are also available for trading in the Currency Derivatives segment.

NSE has a market share of 69% in Currency Futures and 96% in Currency Options during H1-FY23, based on premium value.

NSE launched weekly futures on the US Dollar – Indian Rupee currency pair in the currency derivatives segment from October 11, 2021. With this launch, 11 serial weekly contracts expiring on Fridays are being made available, excluding the expiry week wherein monthly contracts will expire on that Friday in addition to 12 serial monthly contracts in futures. The weekly futures is expected to complement the already available weekly options on the US Dollar – Indian rupee currency pair.

There has been a spike in the volumes for currency derivatives during H1-FY23 as currency futures volume has grown by 61% and currency options volume has grown by 103% based on premium value.

Now let’s understand how Exchanges make money in all above-mentioned products; this is how an order flows in the stock exchange:

Sources of revenue for NSE: How does NSE make money?

Transaction Charges: Transaction revenue comprises the bread and butter for any exchange. These are charges based on turnover under various products discussed above. Transaction revenue constitutes ~78% of revenue from operations on a consolidated basis. During H1-FY23 the transaction charges revenue has grown by 67% (64% growth in FY22). When we split this revenue then 75% of it comes from Equity Derivatives (Futures & Options) 20% comes from cash segment and 5% comes from other segments like currency derivatives and other products.

The key reason for the jump in revenue is the increase in options volume as options trading now accounts for ~75% of its transaction income. This number was less than 35% just five years back.

The jump in options volume is due to the following reasons:

The introduction of peak margin rules by SEBI for Futures has increased the volumes in options.

The introduction of smaller lot size has helped the small retailers to trade in more lots.

Increase in the number of demat accounts which shows retail participation has increased now.

Along with the jump in option volume the other reasons for increase in transaction income are:

Increase in transaction charges by NSE: In FY21 NSE has increased the transaction charges across equity and derivative markets with ~ 6-8%.

Increase in volumes of currency derivatives: Though current contribution from currency segment is less than 5% but currency trading is growing at a very fast pace for NSE. In H1-FY23 the currency derivatives volumes have grown at 103%. This could be a good opportunity for the NSE in the medium term.

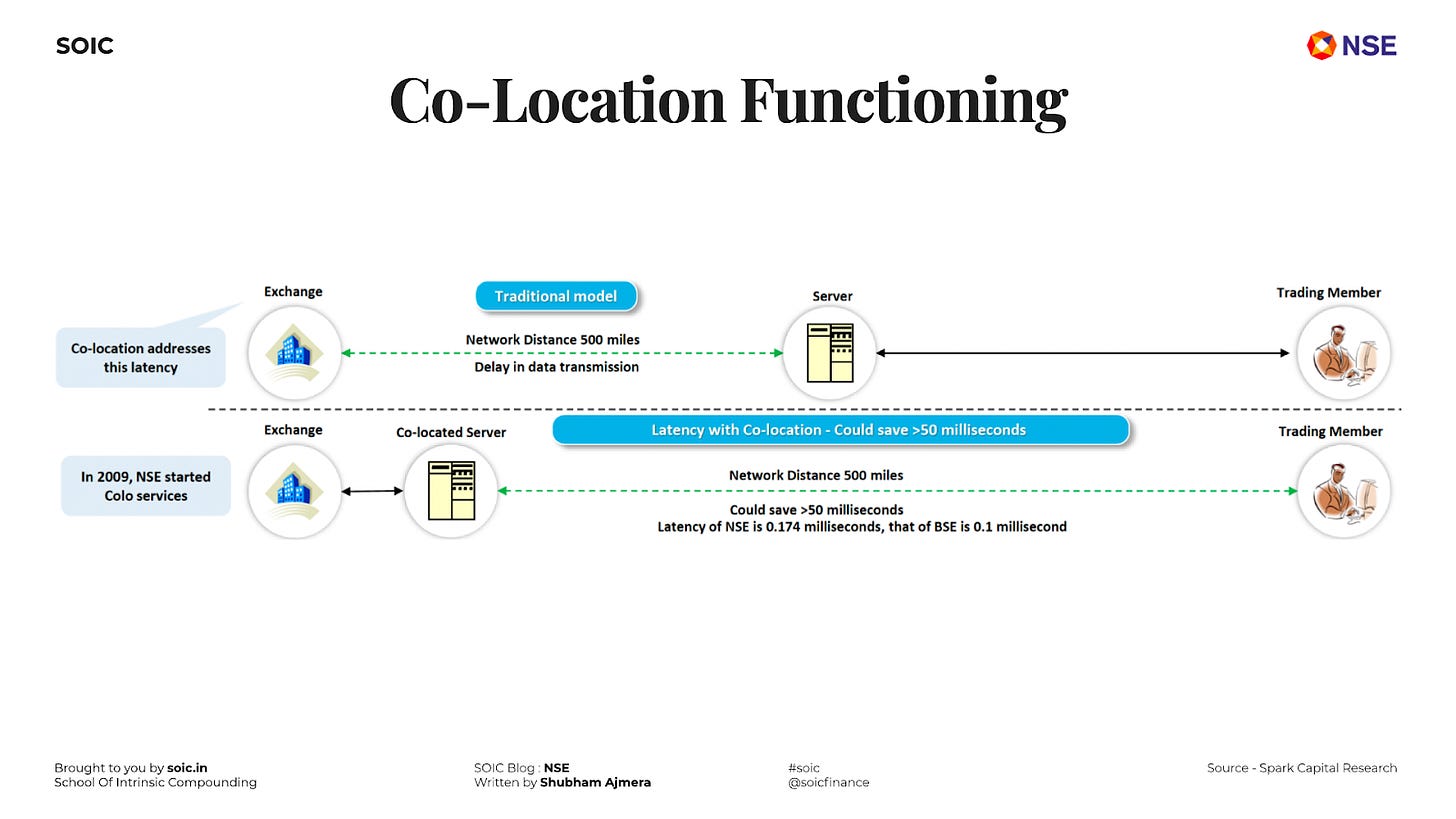

2) Co-location charges: In 2009 NSE introduced the co-location facility, which allowed brokers to place their servers in the data centre of NSE. The benefit of colocation is that it allows faster access to the price feed (buy/sell quotes) distributed by the stock exchange. That is because the broker’s server sits right next to the stock exchange’s server and so the data has to only travel a very short distance from the exchange server to the broker’s server.

The revenue contribution from co-location charges is ~5% in total revenue of NSE. This income is growing at a fast pace, during H1-FY23 it has grown at 50% on YoY basis and 55% growth in FY22.

Demand for higher racks & rise in rack rates led to strong growth in co-location charges. The charges are as follows:

3) Listing Fees:

The listing income is the fees charged by the NSE at the time of listing the share on the exchange and annual fees charged by NSE after that. This revenue is annuity in nature. Its contribution is less than 2% in total revenue for NSE as compared to ~40% for BSE as number of companies listed on BSE is higher than NSE and NSE does not generate much revenue from derivatives.

NSE has hiked the listing fees from April-22 onwards. The listing fees are as follows:

4) Book Building Business:

Book building in normal terms can be called IPO services. NSE decided to offer this infrastructure for conducting online IPOs through the Book Building process. NSE operates a fully automated screen based bidding system called NEAT IPO that enables trading members to enter bids directly from their offices through a sophisticated telecommunication network.

The revenue from this segment is very miniscule, during Q2-FY23 NSE has done the listing process of 4 new IPOs.

These are the major sources of revenue for NSE, along with these since NSE is a cash cow which generates huge free cash flow so NSE has created multiple subsidiaries and invested into various different businesses and different asset classes from which they earn dividend, interest income, etc.

NSE Investments Ltd:

The NSE has invested in different companies via NSE Investments Ltd, this is one of the major subsidiary company for the NSE.

NSE Investments is the primary CIC arm of NSE to explore investment opportunities in Technology, Indices, Education, Private Marketplaces & Exchanges, Payments, Database Services, Trading Platform, Exchange, Machine Learning, among others. During FY22 it has generated a Net Profit of ₹223 cr and has made investments of ₹2,934cr.

NSE Clearing Ltd:

NSE Clearing Ltd is another major subsidiary for the NSE, it is the wholly owned subsidiary of NSE and is responsible for clearing and settlement of all securities and instruments traded on the exchange. NCL also moved from the T+2 settlement cycle to T+1 during the year for select securities in the equity segment. This will help reduce the settlement risk, release funds faster and thereby increase liquidity in the market.

NSE Clearing has introduced Interoperability among Clearing Corporations for Cash Market, Equity Derivatives and Currency Derivatives segments. Interoperability among Clearing Corporations allows market participants to consolidate their clearing and settlement functions at a single CCP, irrespective of the Stock Exchanges on which the trades are executed. It is expected to lead to efficient allocation of capital for the market participants, thereby saving on cost as well as provide better execution of trades.

During the financial year 2021-22, NCL earned a Profit of ₹ 460.55 Cr in the year 2021-22 as compared to net profit after tax of ₹ 210.55 Cr for the year 2020-21.

NSE IFSC Ltd:

NSE IFSC, a wholly owned subsidiary of NSE, commenced operations as a Stock Exchange in GIFT City, Gandhinagar. It could be a huge potential opportunity for the NSE. GIFT city, setup in Jan '17,targets business segments like offshore banking, offshore asset management, capital markets players etc., by granting various tax incentives.

IFT city, which is a special economic zone, is India's first IFSC. Exchange and Financial Services units located in GIFT IFSC are offered competitive tax structure and facilitative regulatory framework. The benefits include exemptions from security transaction tax, commodity transaction tax, dividend distribution tax, capital gain tax waivers and no income tax.

NSE International Exchange has been launched to grow the financial market as well as expected to bring capital into India. Stock exchanges operating in the GIFT IFSC are permitted to offer trading in securities in any currency other than the Indian rupee.

NSE IFSC has introduced trading in Global Stocks - India’s first Unsponsored Depositary Receipts (NSE IFSC Receipts) under the IFSCA Regulatory Sandbox which offers, Indian retail investors to transact on the NSE IFSC platform under the Liberalised Remittance Scheme.

NSE IFSC launched derivatives on Nifty Financial Services Index (FINNIFTY) on April 30, 2021, to offer more flexibility to foreign investors to hedge their portfolio. Currently NSE IFSC offers index derivatives on NIFTY50, BANK NIFTY and NIFTYIT.

Currently BSE is the market leader in GIFT with ~98% share in the Equity F&O volumes.

NSE & SGX were in discussions for a proposed collaboration in NSE IFSC Ltd. at Gujarat International Finance Tec-City (GIFT city) Gujarat. NSE and SGX entered into a formal Collaboration Agreement to cement the key terms for operationalising the NSE IFSC-SGX Connect which will bring together international and GIFT City participants to create a bigger liquidity pool for Nifty products in GIFT City.

Key Risks in the Business: Linked to Mr. Market’s Behaviour

- Highly Cyclical nature of business:

Currently transaction income contributes around 75% of the total revenue of NSE which is majorly driven by equity derivatives specially options, since F&O is risky asset segment and currently options volume are growing at very fast pace, to protect the interest of retail investors as new investors do not fully understand the risks involved SEBI may put some restrictions on the options trading to reduce the option volumes. These restrictions could be investor level or margin requirements for trading in options.

To protect the interests of retailers and reduce the speculation activities in the market the SEBI has done it in Futures as well and in some way they got successful as volumes came down in that segment; if it happens in options then the growth for the company may slow down.

- Losing market share in GIFT City to BSE:

BSE has been growing its INX platform exponentially ever since it commenced trading activities at GIFT City. India INX continues to be the dominant IFSC exchange in GIFT city with the market share of ~98% in derivatives trading.

NSE IFSC-SGX Connect which is collaboration between NSE and Singapore exchange (SGX) to build stock index based products from GIFT city has not seen any actively trading volumes. NSE currently is not charging any transaction fee in IFSC as a result of which they have reported a net loss of 53 cr in FY 21-22.

This could be a threat for NSE in the longer term as the NSE IFSC platform could be a huge opportunity for the company and could lead the next leg of growth for NSE. If they are not able to gain the market share here then the growth may slow down for the company in the medium to long term.

- NSE Co-location Case:

As discussed above how co-location service works wherein NSE allowed the trading members to setup their servers at NSE data center for high-frequency and algo trading. traders can rent such spaces and set up their systems or programs to trade in markets.

The NSE, the country's largest bourse, rolled out the co-location services in August 2009. Owing to the close proximity to stock exchange servers, traders in these facilities had an advantage over others as they got faster access to the price feed (buy/sell quotes) distributed by the stock exchange. The faster access to the data, helped traders get the quote first and execute the trade faster, thereby, making huge profits. Also, since the charge for these services was high, only big brokers could afford to rent such a space. This has been a legal practice and followed world wide.

The scam in NSE’s co-location facility took place almost a decade ago. It was alleged that one of the trading members, OPG Securities aided by certain employees of NSE, was provided unfair access between 2012 and 2014 that enabled him to log in first to the secondary server and get the data before others in the co-location facility. This preferential access allowed the algo trades of this member to be ahead of others in the order execution.

In 2016, SEBI asked NSE to carry out a forensic audit of its systems and deposit the entire revenue from its co-location facilities into an escrow account. Deloitte was tasked with the job of conducting a forensic audit of NSE’s systems.

In 2019, SEBI passed its order on the issue, asking NSE to pay ₹625 crore with an interest of 12 per cent and the second order it passed a direction to deposit a sum of ₹62.58 crores along with interest at the rate of 12% p.a.

NSE has filed the appeal with SAT; SAT vide its interim order has asked NSE to transfer the amount of ₹687 cr to SEBI and to transfer all revenues emanating from its co-location facility to a separate bank account.

- Delay in listing of the share:

NSE is currently available in unlisted space only and it is trying to get itself listed on mainboard since 2014 but due to ongoing investing in co-location scam it is getting delayed again and again as due to investigation SEBI is not giving them the permission. Due to this its share is illiquid and very hard to derive its correct valuations as if listing gets delayed from here as well then it would be trading valuations lower than the listed players. Also at the time of writing this blog we obtained quotes of the stock price from multiple brokers and we received the price from the range of ₹2,800 to ₹3,500 which is very high divergence, hence it becomes very difficult to get the exact valuations of the company.

Financials of the company and Valuations:

NSE is market leader in Indian Capital Market and at the time of writing the company is valued at P/E multiple of 25x on TTM basis in unlisted space. Its nearest competitor is BSE Ltd which is very small in size as compared to NSE and is trading at P/E multiples of 36x.

But there is huge difference in the business model of BSE & NSE; in case of BSE the majority of revenue ~31% comes from listing fees which is annuity in nature and does not have any cyclicality whereas in NSE the annuity income is just 2% and majority of income ~75% is transaction income which is dependent on volumes traded on the exchange.

Now looking at the financial metrics of the company and comparing the valuations with the closest peer of the company i.e, BSE Ltd:

*Market cap is calculated on the basis of share price at ₹3,000; since it is an illiquid stock in unlisted space some brokers also quoted the price of ₹3,500 and even at ₹2,800.

Do let us know in the comment section below how you look at the business of NSE and can it grow at such a fast pace with revenue growth of ~55% and will the volume in Options come down in near future.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.