Neogen Company – On its way to big opportunities and stronger M&A’s

10 mins readPublishing Date : 2023-03-14

Neogen Company – On its way to big opportunities and stronger M&A’s

Incorporated in 1989, Neogen Chemicals Ltd. in India’s one of the leading manufacturers of Bromine-based and Lithium-based specialty chemicals. Its specialty chemicals product offerings comprise Organic as well as Inorganic chemicals. Its products are used in pharmaceutical and agrochemical intermediates, engineering fluids, electronic chemicals, polymer additives, water treatment, construction chemicals, aroma chemicals, flavors and fragrances, specialty polymers, Chemicals, and Vapour Absorption Chillers – original-equipment manufacturers, and with new upcoming usage in lithium-ion battery materials for energy storage and Electric Vehicles (EV) application.

Over the years, Neogen has expanded its range of products and at present, manufactures an extensive range of specialty chemicals that find application across various industries in India and the world. It has a product portfolio of over 242 products.

In addition to manufacturing specialty chemicals, Neogen also undertakes custom synthesis and contract manufacturing where the product is developed and customized primarily for a specific customer, but process know-how and technical specifications are developed in-house.

The Company has recently announced plans to utilize its three decades of experience in Lithium Chemistry to manufacture.

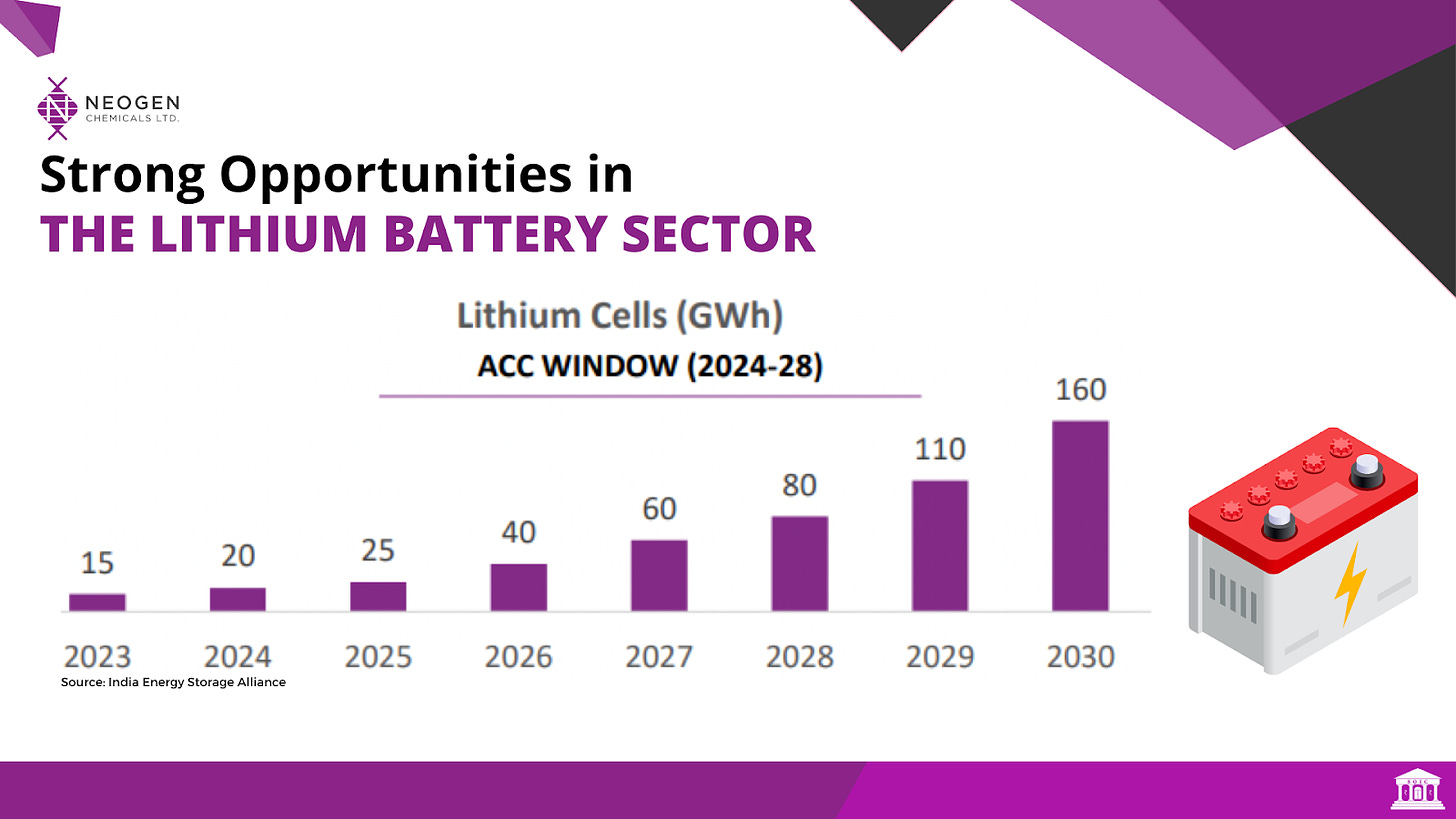

Strong Opportunities in the Lithium Battery sector

This will translate into Electrolyte demand of >150,000 MT by 2030 as per Company estimates.

After inviting global bids for giga-scale Advanced Chemistry Cell (ACC) production units, the GoI selected four bidders from ten for allotment of 50 GWh of battery capacity which includes Reliance New Energy Solar Ltd., Ola Electric Mobility Pvt. Ltd., Rajesh Exports Ltd., and Hyundai Global Motors Company Ltd.

They will receive incentives under India’s Rs. 18,100 crore programs to boost local battery cell production. The battery manufacturers would have to set up ACC capacities under the PLI scheme within a period of two years. This will lead to a direct investment of around Rs. 45,000 crores in ACC Battery storage manufacturing projects.

PLI scheme is expected to accelerate EV adoption – Will translate into net savings of Rs. 2,00,000 crores to Rs. 2,50,000 crores on account of oil import bill and increase the share of renewable energy at the national grid level.

Government focuses on self-reliance in battery manufacturing has opened new prospects.

Evolution of Neogen Chemicals

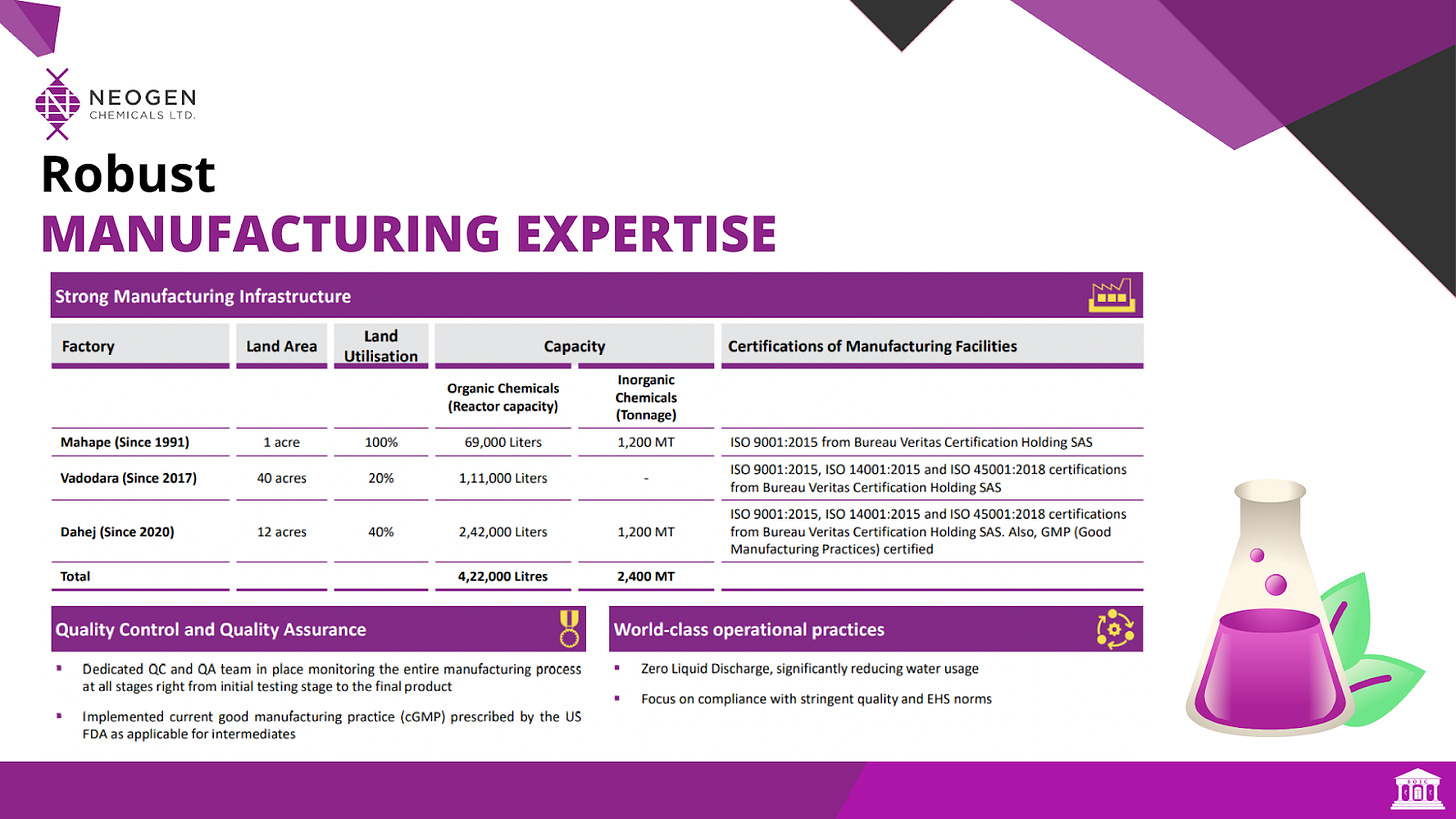

Lithium-Ion battery materials with an initial investment plan of manufacturing electrolytes and Lithium salts needed for electrolytes. The Company operates out of its three manufacturing facilities located in Mahape, Navi Mumbai in Maharashtra, and, Dahej SEZ, Bharuch as well as Karakhadi, Vadodara in Gujarat.

Business Value Chain

Robust Manufacturing Expertise

Strong R&D capabilities

Established two in-house R&D units, one each in Mahape and Vadodara, with an endeavor to develop new processes and improve existing processes.

Developed a 58-member dedicated R&D team, including 7 senior personnel with doctorates in chemistry (Ph. D.) from reputed institutions and with 15+ years of experience.

CMD and MD are actively involved and spend significant time overseeing the functioning of both R&D divisions.

Post commissioning of dedicated R&D units in 2001, the product portfolio has grown from 20 products in 2001 to 242 products in Q3 FY23 (excluding products developed under contract manufacturing.

Company is exporting to 29 countries, with key export geographies in the United States, Europe, Japan, and the Middle East Export sales of 44% in FY22.

Update on various expansion initiatives

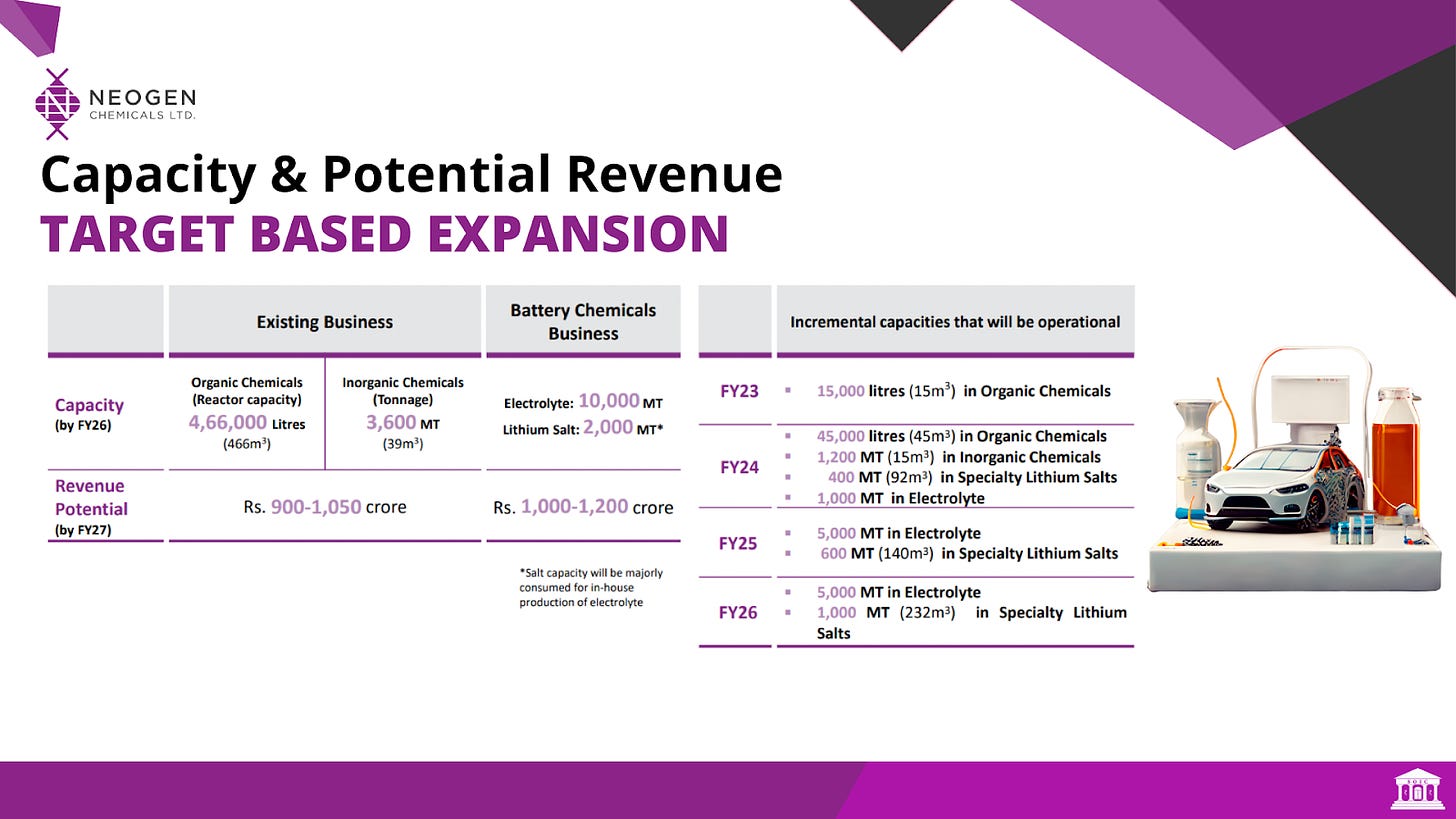

New CAPEX announcements

Board approval for expansion of: – Electrolyte capacity to 5,000 MT to be operational by June 2024 – Specialty Lithium Salts capacity to 1,000 MT (232m3) to be operational by June 2024 – This is in line with robust demand environment for FY25 & beyond.

The board has also approved: – Greenfield expansion of Electrolyte and Specialty Lithium Salts at a new site for dedicated battery materials – This includes an additional 5,000 MT of Electrolyte capacity and an additional 1,000 MT (232m^3 ) of Specialty Lithium Salts – to be operational by Sept 2025 – This will cater to incremental demand coming in FY26.

Once operational, these projects will add to revenues from FY25 and will peak in FY26/ FY27.

Collective CAPEX for all the new projects is ~Rs. 450 crores.

Debt: Equity will continue to remain below 1.25x

At a consolidated level, aim to achieve >30% revenue CAGR over the next 3-4 years, translating into Rs. 2,000- 2,250 crore revenue by FY26-27

Capacity & potential revenue target based on expansion.

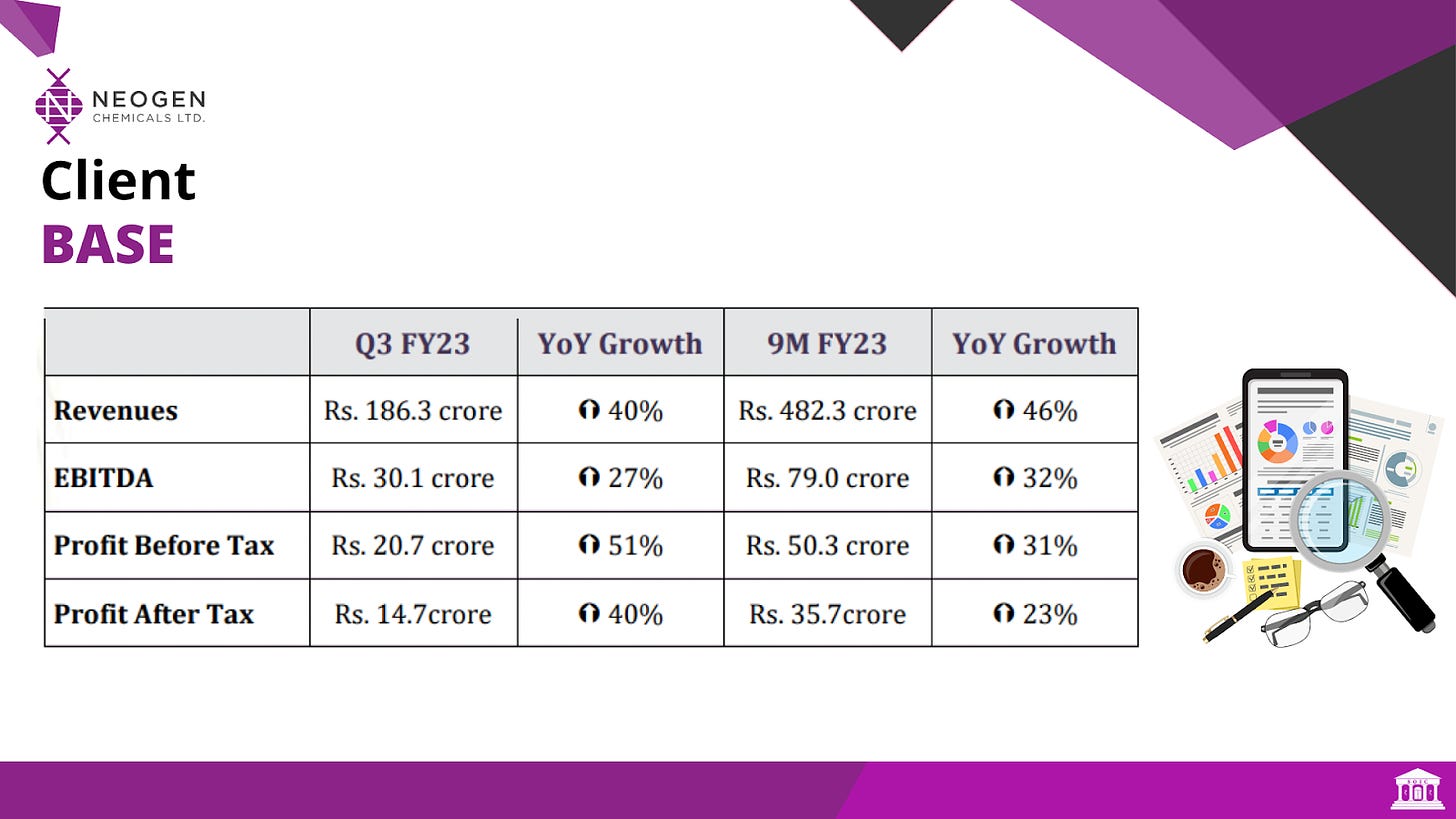

The company registered a solid performance trajectory in Q3 FY23, bolstered by 40% Y-o-Y gains in revenue with healthy profitability, where both EBITDA and PAT increased by 27% and 40% Y-o-Y respectively. Their performance has been consistent, and they are witnessing accelerated build-up in their business based on strong visibility and a continued positive demand environment.

The capabilities of chosen chemistries are exceptional and well appreciated by their partner customers. In line with their focus on high value-addition, they are scaling up revenues across both advanced intermediates and custom synthesis manufacturing as reflected in better profitability trends.

This was achieved despite continued high inflation in some input and utility costs during the period under review. Their expansion plans are ambitious, but modular in nature. Their intent is to cement their leadership position in the existing business while garnering substantial market share in the high-potential Lithium-ion battery chemicals space.

All the strategic initiatives undertaken this quarter including new CAPEX announcements and forming a separate entity for the battery chemicals business are steps in the right direction to gain early mover advantage, be future-ready with capacities meeting demand, and strengthen their technological expertise.

A favorable demand outlook and India's emergence as a favored manufacturing hub will expand the market size and draw in additional customers along the value chain.

Acquisition of 100% stake in BuLi Chemicals India Pvt. Ltd.

Neogen Chemicals enters into a definitive agreement to acquire a 100% stake in BuLi Chemicals India Pvt. Ltd. from Livent

BuLi Chem is a subsidiary of Livent USA Corporation (formerly known as FMC Lithium USA Corp) and Livent Corporation (formerly known as FMC Lithium USA Holding Corp).

It owns the technology to manufacture N Butyl Lithium and other organolithium products using Lithium metal, which are key reagents for Lithiation reactions used in the manufacturing of several complex pharmaceutical and agrochemical intermediates.

Advantage from the Acquisition of Neogen Chemicals

Organic Lithium compounds are critical in manufacturing several Pharmaceutical & Agrochemical Intermediates.

The technology to use highly reactive Lithium metal and to manufacture N Butyl Lithium and other Organo Lithium derivatives house along with Neogen’s ability to recycle Lithium will give a significant competitive advantage by providing Neogen an additional Technology Platform which can be leveraged across the above segments to generate more Custom Synthesis and Manufacturing business.

Post completion of the said acquisition, Neogen will be the only Company in the world to make organolithium products and captively use them for complex Pharma intermediates, along with the ability to recycle Lithium waste from the same. Neogen’s ability to recycle lithium as a by-product from such reactions will enable Neogen to provide excellent cost economics to its customers for Pharma Intermediates and Inorganic Lithium customers. Based on the available technology, the Company will use its expertise to introduce new and more complex products in the future.

Client Base

Financial Performance

In 9M YTD, the Company delivered 46% growth in revenues, a 32% increase in EBITDA, and a 23% growth in Profit After Tax (PAT). In 9M FY23, revenues were at Rs. 482.3 crores, with a growth of 46% Y-o-Y. Growth was strengthened by increased utilization of plants, driven by stable demand from key end-user industries.

Efforts to expand the high-margin advanced intermediates and custom synthesis manufacturing business have begun to show positive results. EBITDA at Rs. 79.0 crore in 9M FY23 was up 32% in spite of the ongoing inflation in certain raw materials and utilities, strong EBITDA results were achieved through favorable management of the product mix. The Company experienced an increase in certain costs such as employee expenses, etc., consistent with management's plan to expand the workforce across departments.

The Company delivered a healthy EBITDA performance mainly because it was able to pass on the significant cost increase in the prices of Lithium raw materials to customers. As a result, the absolute EBITDA remained protected. Profit after tax (PAT) stood at Rs. 35.7 crores during 9M FY23, higher by 23% compared to Rs. 29.0 crores in 9M FY22. The growth in PAT reflected the operational performance, moderately affected by high depreciation associated with new capacity additions and an increase in finance costs due to elevated interest rates.

During the period under review, the Company witnessed a significant increase in the prices of Lithium raw materials which the Company was able to pass on to the customers, thereby protecting the absolute EBITDA. The EBITDA percentage margin considers the impact of higher revenues and higher RM costs with preserved absolute earnings.

Robust growth in revenues was aided by higher utilization levels across plants supported by sustained demand trajectory across key end-user industries. Initiatives around scaling up the high-margin advanced intermediates and custom synthesis manufacturing business have started yielding positive results.

Strong EBITDA performance was delivered despite continued inflationary pressures across certain raw materials and utilities. This was countered by favorable product mix management. The Company witnessed an increase in certain cost line items like employee cost, etc. which was in line with mgt.’s efforts of expanding the employee bandwidth across functions.

Growth in Profit After Tax was in accordance with the operational performance, moderately impacted by high depreciation linked to new capacities added and an increase in finance costs due to elevated interest rates.

The company plans to increase its Custom Synthesis & Contract Manufacturing portfolio. Foraying into the sunrise sector of Lithium-Ion Batteries. Focus on operational efficiency and functional excellence. Focus on advanced specialty intermediates.

Industry tailwinds and Government focus on self-reliance in battery manufacturing have opened new prospects for Lithium Battery Sector.

Disclaimer

So here we conclude our findings on the company. Do your own research before investing. As you are aware that we are an educational organization, and our objective is to educate people about how to invest. We are not registered with SEBI therefore, we do not give any buy/sell/hold investment advice, suggestions, or recommendations or provide any Portfolio Management Services, we believe that conviction cannot be borrowed.