Onward Technologies Limited

Onward Technologies Ltd.

Business Analysis

Purpose

The purpose of this article is to understand the business of Onward Technologies Limited. Various factors covered in this article include the history of the business and the transformation it is going through, the total addressable market, competitors, financials and the thesis as well as anti-thesis pointers.

Authors: Mahesh Sohoni and team SOIC

History of Onward Technologies Limited

Onward Technologies Limited (OTL) has a long history as it has been a listed business since 1995. OTL’s founder, Mr. Harish Mehta also founded NASSCOM, which is India’s trade association for IT services. Until FY 17, OTL was focused on offering mechanical engineering design services for Indian and non-Indian clients. Additionally, it also offered IT services such as application development, maintenance, testing, data management, etc.

The focus changed to ER&D and Digital Transformation:

In FY17, second-generation entrepreneur, Mr. Jigar Mehta was elevated to the role of managing director of OTL. Under his leadership, OTL leveraged its domain and IT services experience to pivot into a higher-margin business that is ER&D and digital transformation.

Bright Growth Prospects of the ER&D Industry

The global ER&D spend in 2022 was approximately $1.81 trillion and is expected to grow to approximately $2.67 trillion by 2026, which is a CAGR of 10%.

Out of this total ER&D spend, part of the spend will be outsourced to third parties such as OTL. The outsourcing of ER&D to third-party service providers reached $105-$110 billion in 2022 and is anticipated to grow at a CAGR of 11% to 13% between 2022 and 2026 as per the Zinnov report from RHP of Tata Technologies .

It is noteworthy that out of the total ER&D spend, 48% will be borne by “manufacturing-led” industries such as automotive, industrial equipment, heavy machinery, etc. which are major verticals of OTL.

Where Does OTL Fit In

OTL has three focus verticals, out of which the top two contributed 87% to the revenue in Q2FY24. These two verticals are transportation and mobility, and Industrial Equipment & Heavy Machinery. Both of them belong to the “manufacturing-led” industries from which 48% of the ER&D spend is expected to be generated. Focus verticals and associated industries are as shown below.

OTL Service offerings

Moving Up The Value Chain

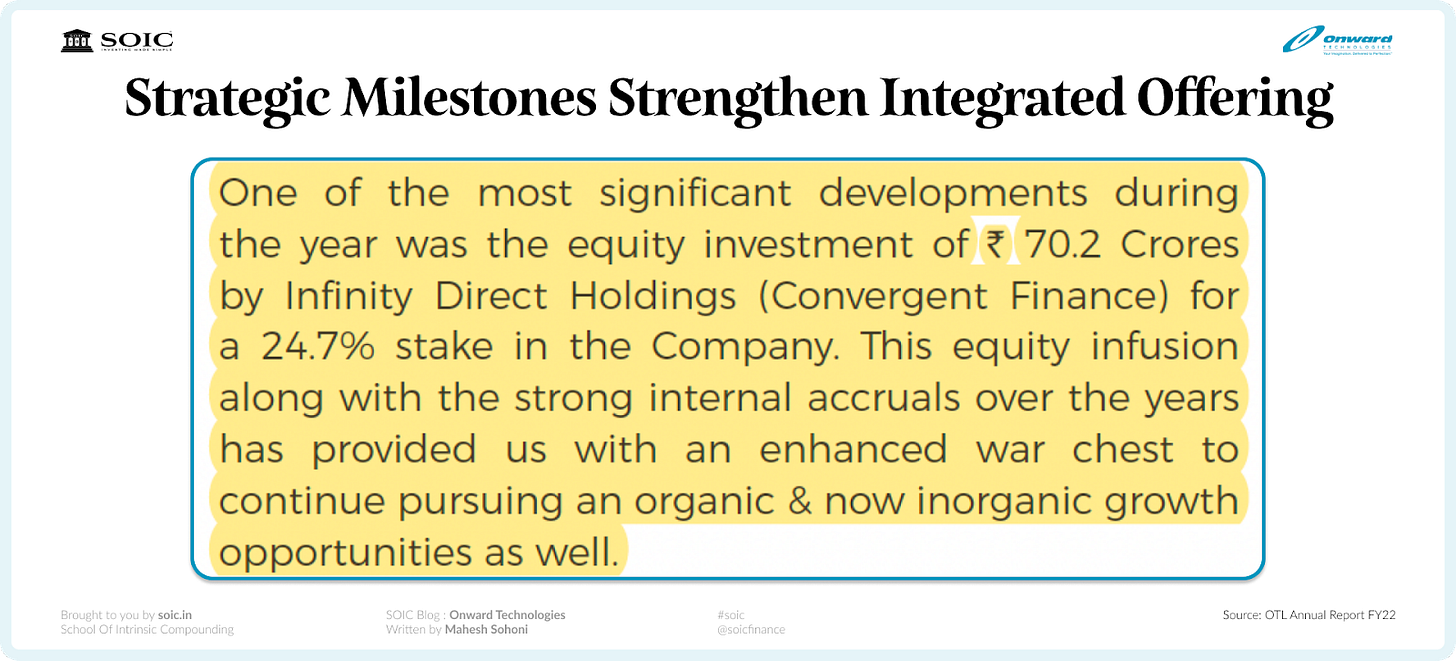

Investment by PE Firm for Enabling Growth:

In FY22, PE firm Infinity Direct Holdings acquired a 24.7% stake. Through this transaction, OTL raised INR 70.2 crore. The funds were utilised for building new capabilities in the form of hiring talent, establishing a presence in Canada, and the Netherlands, opening a digital CoE in Hyderabad and expanding capacities at Chennai and Bengaluru.

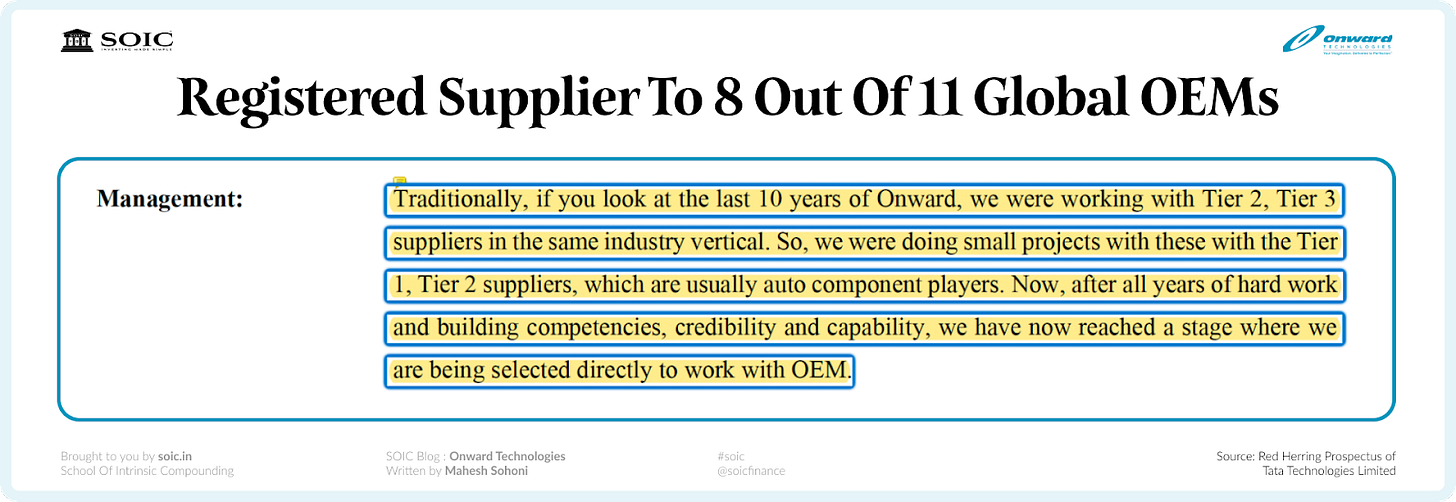

Became a Registered Supplier to 8 out of 11 Global OEMs:

Before COVID-19, OTL was primarily working with tier 2 and tier 3 suppliers of large clients (OEMs). Post-Covid, Onward Tech has moved up the value chain and started working directly with OEMs. It boasts 8 out of 11 global OEMs as its customers. To win business from OEMs, Onward Tech leveraged its decades' worth of experience in providing mechanical engineering services. It is worth noting that becoming a registered vendor of any large OEM takes a few years as the supplier has to build capacity, showcase proof of concept, go through site visits by clients, etc.

Increased Focus on Export Business

The focus on improving the revenue mix from the export business is yielding results for OTL, especially in the case of European business. In FY 17, OTL earned 64% revenue from India and only 3% from Europe. In the latest quarter, that is Q2FY24, Europe business contributed 14% to the revenue while Indian business contribution went down to 49%. Currently, the overall export business contribution to revenue is 51% which the management aims to increase to 70% by FY26.

Phasing out of Legacy Business which is Domestic and has Low Margins

Post-COVID, OTL has been phasing out its legacy IT services business to pivot to ER&D and digital transformation business. The change in the business model is evident from the revenue contribution trend. The legacy ITS business’s revenue contribution has dropped from 27% in FY20 to 3% in the latest quarter.

Competition

The ER&D services space is crowded. Providers such as Tata Technologies , LTTS , Tata Elxsi , HCL tech , etc. have a much bigger scale compared to OTL and also have different margin profiles. Therefore, the comparison will not be fair.

We compare OTL with the Engineering Design business of AxisCades Technologies .

The revenue growth comparison shows that OTL has been able to grow its revenue at a faster pace compared to AxisCades barring the latest quarter (Q2FY 24). It must be noted that AxisCades has a different customer profile than OTL. AxisCades heavily caters to clients from aerospace and defence whereas OTL offers services to customers from heavy equipment, mining, automotive, etc.

Financials

Revenue Growth Tapered Off but a higher EBITDA Margin has sustained

Since FY22, OTL posted impressive revenue growth for two consecutive years in FY22 and FY23. After achieving a yearly revenue growth of 43% in FY23, the growth has tapered off with H1FY 24 growing at 17%. Management has announced that new contracts with european customers have been signed for which billing will commence in the coming quarters.

However, the investments in building capabilities are paying off as EBITDA margin has expanded from ~6% to ~12.5%. Management expects the EBITDA margins to sustain going further.

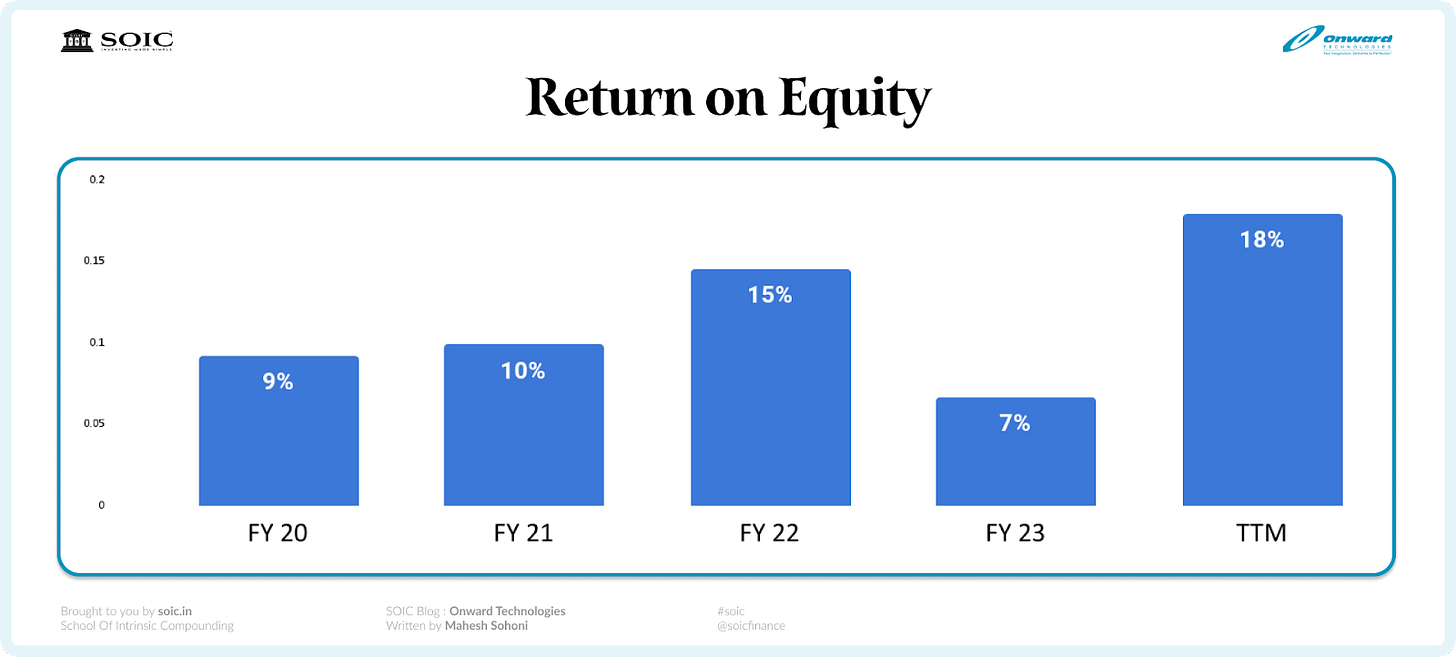

Zero Debt and Potential to Improve RoE

OTL has zero interest-bearing debt. Its RoE in FY23 at 7% was depressed due to investment in hiring subject matter experts and sales staff at onsite locations. Due to this necessary operational expenditure for future growth, RoE in FY23 was low. However, as the employees are staffed on billable projects, the RoE improves. In the last twelve months, RoE has gone up to 18%.

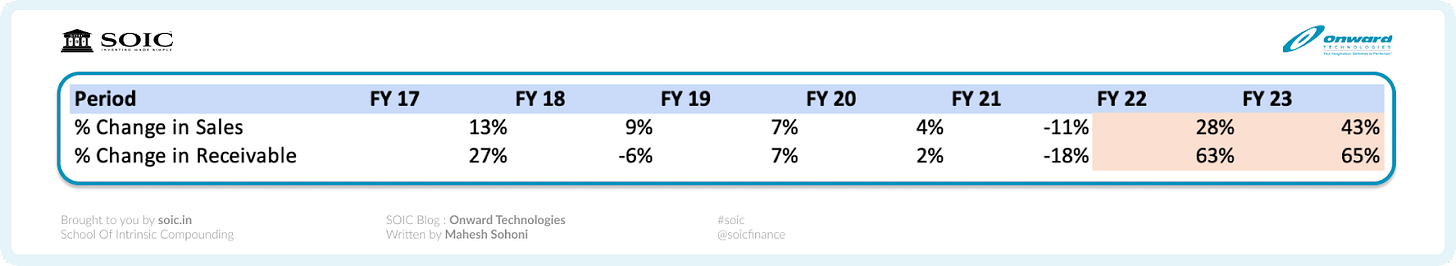

Lumpy Conversion of Profit to Actual Cash Flow

OTL’s conversion of net profit (PAT) to cash flow (CFO) has been lumpy over the years but it has been healthy. However, since FY22, the CFO to PAT has been quite low due to increased receivable days. Past three years cumulative CFO to PAT has been 82%.

The reason behind the poor CFO to PAT ratio over the last two years is a faster increase in receivable days than the increase in sales. In other words, OTL is selling work at a fast pace which is good, but customers owe even more to OTL, which is not so good. As per the management, for a growth company, it is normal and since they are working with large OEMs, they do not foresee any issues in recovering the payments from their customers. It is worth keeping an eye on how receivable days evolve in future.

Other Financial Integrity Checks

Adjudication Order by SEBI to Mr. Jigar Mehta

As per SEBI’s audit in 2019, it was found that Mr. Jigar Mehta purchased OTL shares without proper disclosures to the authority back in 2014. Mr. Mehta agreed to commit the mistake out of ignorance. SEBI fined INR 2 lakh to Mr. Mehta. More details are available on the SEBI website here .

Promoter Reducing the Stake Slowly

Quarterly trends show that promoters have reduced their stake from 46.97% in December 2021 to 44.96% in September 2023. Although the sell-off by the promoter group is not huge, a small quantity is being sold off each quarter.

Unfavourable Remark by the Auditor

In the FY23 annual report, the auditor called out that the holding company had received unfavourable remarks.

As per the auditor, OTL has adequate internal controls that were effective by 31st Mar 2023.

Related Party Transactions

As per the FY23 annual report, a dividend payment worth INR 251.67 lakhs was made to the holding company in both FY23 and FY22. However, the FY annual report AR has no mention of the dividend paid.

Apart from rent and expense reimbursement, no significant business is being done with any related party, which is positive.

Unaudited Subsidiaries Generated ~7% Revenue

As per the auditor, three subsidiaries that generated INR 32 crores worth of revenue have not been audited by any auditor.

No Contingent Liability

OTL has no contingent liability as per the annual report of FY23.

Miscellaneous Expenses as % Sales are Immaterial

The miscellaneous expenses as % of sales have trended below 0.8% of sales for the past four years for OTL.

Intangible Assets as % Net Worth are Immaterial

OTL recognizes software as its major intangible asset on the balance sheet. Even though the intangible as a % of net worth was moderately high at 6% in FY20, the same is now below 2% which is fairly below any level that may cause a concern.

Zero Write-Off as % of Trade Receivable

OTL has no history of writing off trade receivables. It has been consistently recording some amount of loss allowance which trends ~1% of trade receivable, which can be considered immaterial.

Levers for margin improvement and growth

Improvement in the Offshore Mix

For an IT services provider, delivering work from offshore(India) instead of onsite is beneficial from a cost perspective. In the Q3FY23 concall, the management clearly stated that as OTL becomes mature and clients have more confidence in them, moving work offshore will be the biggest lever to improve margin.

Potential to move from Time and Material(T&M) contracts to Fixed Priced Contracts

A fixed-priced contract is usually a higher margin business for an IT service provider. However, it is more risky as the onus of delivering on time is on the service provider.

OTL management believes that since they are relatively new to the area of ER&D and digital transformation, they prefer T&M contracts. T&M contracts are 90% of all the contracts as of Q2 FY24.

However, management believes as OTL stabilises and gains more confidence, they plan to start bidding for large, fixed-priced contracts.

Growth in Export Business

As elaborated previously, OTL management wants to focus on the export business which currently contributes to 51% of the revenue. Over the next few years, management aims to improve the mix to 70%. Due to currency differential, improvement in export business will be margin accretive.

New Customers Won in IE&HM Vertical Recently

As per management, OTL has signed a few customers recently and billing is yet to begin. Although management did not comment on the quantum of revenue that can be added through these new customers, there may be some upside.

In-house Learning and Development Program

Before establishing an in-house program for training employees on niche skill sets, OTL relied on hiring experts from outside, which is expensive. OTL set up an initiative called the Talent Acceleration Program (TAP). OTL hires fresh graduates and trains them under the TAP initiative before staffing them on a billable project. The TAP initiative has been margin accretive.

Management’s Ambition by FY26

Achieve $100 mn revenue by FY26. Currently, OTL is posting around $50 mn annually. It means they want to roughly double in three years, a CAGR of ~25%.

To have EBITDA in the mid-teens which is currently at 12.5%.

Grow the export business so that it contributes 70% to the revenue. Currently export business contributes ~51%.

Focus on mining the top 25 customers and moving up the value chain instead of expanding the customer base. Currently, the top 25 clients contribute 85% of the revenue.

Antithesis/Risks

Slowdown in growth

As stated previously, the revenue growth in H1FY24 has slowed down to 17% after posting two consecutive years of strong revenue growth. However, for customers, IT services are a discretionary expense and they can delay or cancel the projects. A recession in North America may hamper or decelerate future growth for OTL.

Size of the Business

OTL is currently a relatively smaller ER&D and digital services provider. Therefore, it can afford to price its services attractively to win smaller projects from customers instead of bidding for large-sized and high-margin projects for which larger peers compete (such as Tata Technologies, HCL Tech, and LTTS ).

However, as OTL grows in size, it is highly likely to face competition from other listed and unlisted ER&D services providers.

Concentration Risk

The top 25 customers of OTL contribute 85% to the revenue. Hence, a slowdown in top customers will impact OTL’s growth prospects.

High Attrition

In Q1FY23 concall, as per the management, the last 12 months’ attrition was 33%. Surprisingly, management also mentioned that it was lower compared to similar-sized peers. Back-filling employees and training them in a niche area like ER&D is time-consuming. Hence, uncontrolled attrition is a risk to be monitored. In subsequent concalls, management declined to share attrition numbers.

Execution Risk

Since OTL is a relatively young organisation in the area of digital transformation and ER&D space, management opined that executing the contracts efficiently is important. In case of major slip-ups in execution, OTL may lose the customer’s faith and its reputation which may result in not being able to win future work. Considering OTL’s strategy of having fewer customers that will contribute highly to the revenue, execution becomes all the more important.

Currency Risk

Management intends to ramp up the export business such that it contributes to 70% of the revenue from the current level of 50%. As OTL pivots towards the export business, its exposure to currency movements will go up. How the management handles the currency risk through hedging should be watched out.

Valuation

We use a PE multiple approach to estimate FY26 market capitalization of OTL. There are three scenarios.

The bull scenario assumes that management meets its guidance of achieving $100 mn revenue and mid-teens EBITDA margin by FY26. The base and bear case scenarios assume lower growth and EBITDA margins.

Technical Analysis

As per the long-term chart:

The price is in an upward trend in stage 2 (markup) as seen in the weekly chart.

30 Day EMA is trending upward.

VStop at a multiplier of 2 has turned negative over the past ~6 weeks.

ADX (at 14) is at 52 which is strong.

RSI is at 57.

Summary

OTL is an IT services provider that recently pivoted from offering mechanical engineering services to offering ER&D and digital services that have higher margins. Previously, its customer base was Tier 2 and Tier 3 suppliers of OEMs. It has moved up the value chain as it has become a registered supplier of 8 out of the top 11 OEMs in the world.

The investment thesis relies on revenue growth coming back from recently won customers and on OTL’s execution ability, i.e. hire, train and staff employees on projects.

Growth: Needs to be Tracked

Due to tailwinds in the ER&D services industry, OTL posted impressive YoY revenue growth (between ~25% to 50%) for two years. However, the growth has slowed down in Q2FY24 significantly.

Even though higher EBITDA margins of 12% have been sustained if the revenue growth continues to be slow, it could derail the investment thesis.

RoE: On improving Trajectory

Due to pivoting to higher-margin business, OTL’s RoE based on TTM net profit has improved substantially from ~7% to 17%, which is a huge positive factor.

Valuation: On the Higher Side

Currently, OTL trades at a PE of nearly 47 which is on the higher side. Even though bigger ER&D service providers such as KPIT, LTTS, Tata Technologies, etc. trade at a much higher valuation, OTL has only recently entered the ER&D space.

Signs of an IT service provider reaching maturity such as setting up strong knowledge-sharing practices, the ability to build frameworks and accelerators, culture of nurturing ideas and innovation are yet to be seen within OTL.

Considering the above factors, if current valuations undergo a correction by 15% to 20% (~towards PE of 30 to 35), OTL may be an interesting opportunity.

Disclaimer:

This article is meant for educational purposes only and should not be viewed as investment advice.