Phoenix Mills Ltd: A Proxy Play on India’s Urban Consumption

9 mins readPublishing Date : 2023-02-19

Phoenix Mills is India’s largest mall developer and a play on the urban consumption story. With consumption in malls growing at a CAGR of 9.6%, the company is well-positioned to take advantage of the opportunity.

The Indian retail market is the fourth largest in the world and is expected to grow at an exponential rate to reach $1.5 trillion in FY30, doubling in market size. Simultaneously, online commerce is expected to grow fast to reach $350 billion in Gross Merchandise Value by FY30. This implies, contradictory to the common belief, that Indian retail will continue to be driven by offline channels, claiming more than three-fourth of market share.

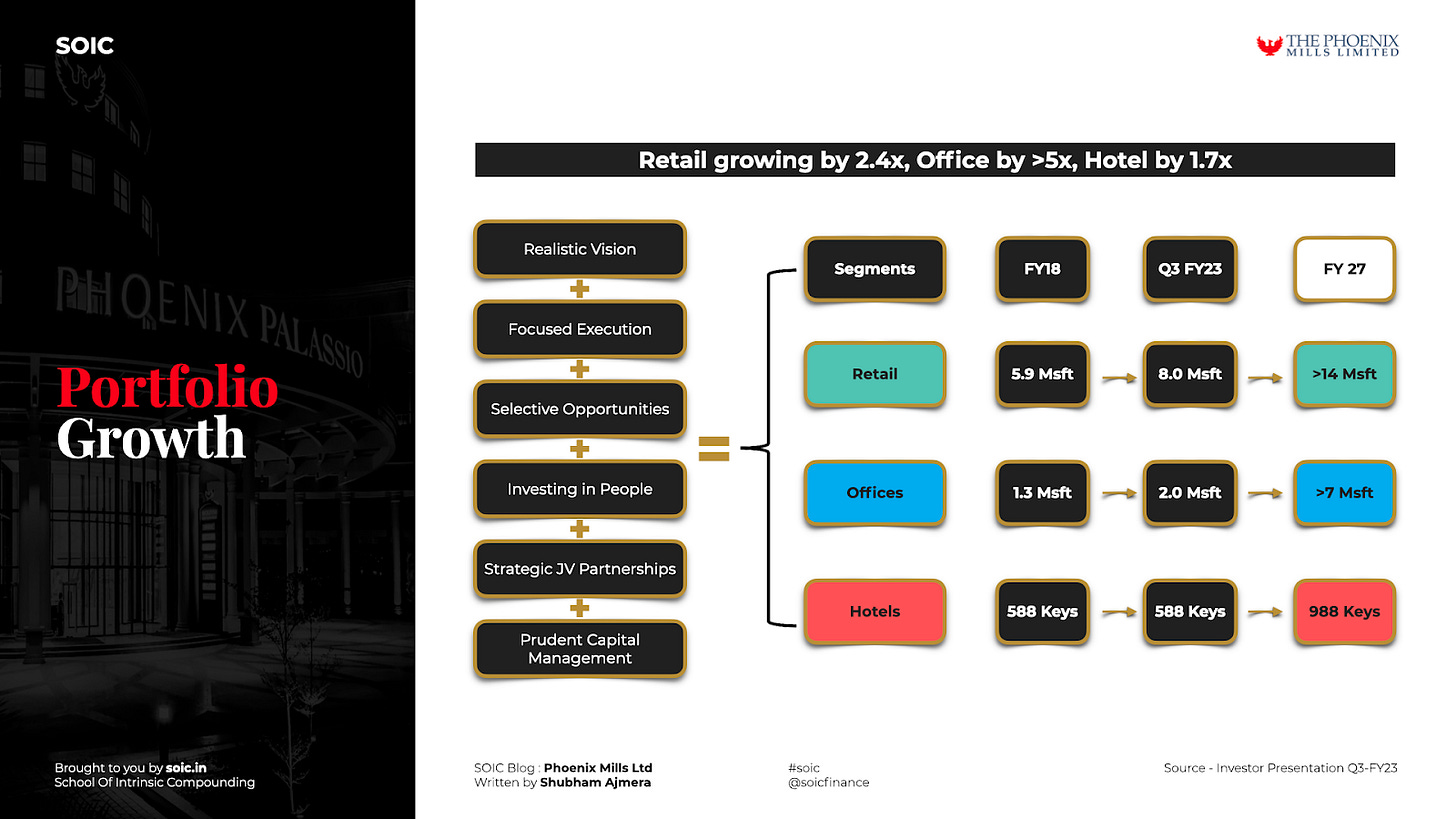

Phoenix Mills has a healthy balance sheet with a net debt:equity ratio of 0.26x, and has formed partnerships with marquee investors to further strengthen its financial position. The company is currently planning to increase its retail footprint from ~8msf to ~14msf and its office portfolio from ~2msf to 7msf in order to meet the rising demand for space. This ambitious expansion plan presents an attractive investment opportunity for those interested in India's rapidly growing urban consumption story.

PML, an acclaimed leader in retail real estate and a proxy for consumption story, has seen its retail rental income grow at a CAGR of 10%, owing to its integrated development strategy, which has enabled it to develop office, hospitality and residential assets around its malls, thus boosting consumption and profitability.

Having concluded its previous capex phase around FY14, PML used its surplus operating cash flow to consolidate its holdings and reduce debt. Over the past few years, the company has entered into partnerships with prominent investors such as CPPIB and GIC and raised funds to expand its portfolio. It has embarked on the next phase of growth, aiming to expand its retail footprint from ~8msf to ~14msf and its office portfolio ~3.5x to 7msf, with plans to open a new mall every year.

PML has created residential projects with world-class amenities, luxurious lifestyle and modern designs. These projects feature a range of different housing types, from 1 BHK apartments to ultra luxury villas. The company's residential projects are developed in strategic locations, providing easy access to key amenities and transport links.

PML also has a strong presence in the hospitality sector, with its hotels being located in some of the most sought-after destinations in India. The hotels offer guests a range of services and amenities, such as state-of-the-art gyms and spa facilities, restaurants serving local cuisine and international cuisine, swimming pools, cafes and bars. In addition to this, PML’s hotels also provide business facilities such as conference halls, meeting rooms and boardrooms.

What Caught My Attention About This Business

Retail consumption – a secular growth story

The retail real estate market is distinct from the housing and office realty segments, as the demand for housing is contingent upon the inherent need for a house in a country with a growing population, while office space demand is contingent upon corporate expansion. These are both intrinsically linked to the overall economic cycle of a country, while the retail realty space is linked to the country's consumption story. Malls are a reflection of urban consumption, which is connected to the rising urbanisation in the country, higher disposable incomes, and the propensity to spend in a country where more than half of the population is less than 25 years of age. This consumption story is much more secular in nature compared to corporate growth or housing space demand.

This is evidenced by the fact that, over much of the past decade, housing demand was sluggish due to India's economic growth losing momentum, while office demand was mainly driven by foreign companies setting up shop in India and not from domestic firms which were focused on cost cutting. On the other hand, retail consumption flourished despite the slowdown in economic growth. This makes the retail real estate space much more resilient compared to housing or office space, which became even more evident over the past year when consumption quickly recovered post the covid, while office demand is still not that robust.

Even in the recent past when everyone was hovering around with the inflation and recession data, the company posted a very good set of numbers in Q3-FY23 & in Jan-2023 and the company is confident to maintain the same growth in future as well, they are not seeing any slowdown in the spending pattern.

Play the Indian urban consumption story

A new way to participate in the Indian urban consumption market is provided by PML. In cities where its malls are already functioning or in the process of being built, it covers around 18% of the urban population and 42% of the population in metropolitan cities (as per 2011 census). Consumption in its malls has grown at a CAGR of 9.6% between FY14-20. Compared to India's nominal GDP growth over FY13-18, consumption at its malls has almost doubled. Therefore, it can be concluded that PML is a direct outcome of India's consumption story.

As malls become more established, the trading densities increase and thus the tenants' capacity to pay rentals increases. The trading densities for the entire portfolio has almost doubled in FY13-20. On average, the trading densities for the entire portfolio has nearly doubled in the period FY13-20. Thus, PML's retail rental income has grown at a CAGR of about 10% from FY14-20, a bit higher than the consumption. PML could be seen as a good representation of the urban consumption story with an added advantage of rental growth being higher than the consumption growth.

Portfolio expansion to fast-track growth journey

Over the past twenty years, PML has experienced a phase of rapid growth, followed by a time of solidification. After their previous capital expenditure cycle finished around FY14, they took advantage of the surplus cash flow generated by their investments to boost their stake in various assets and reduce their debt. Now, they have gone back to an ambitious growth trajectory. In the retail sector, they are constructing five new malls - in Bangalore and Pune, they are making additional malls (in different areas) which will be live in Q1-FY24 in addition to those already in existence; they have entered into Indore in Dec-22, and are entering into Ahmedabad in Feb or Mar 23, acquired land in Surat and Kolkata to create new malls. Furthermore, they are adding shopping space to existing malls in Mumbai and Bangalore. The company's aim is to open a fresh mall for customers each year.

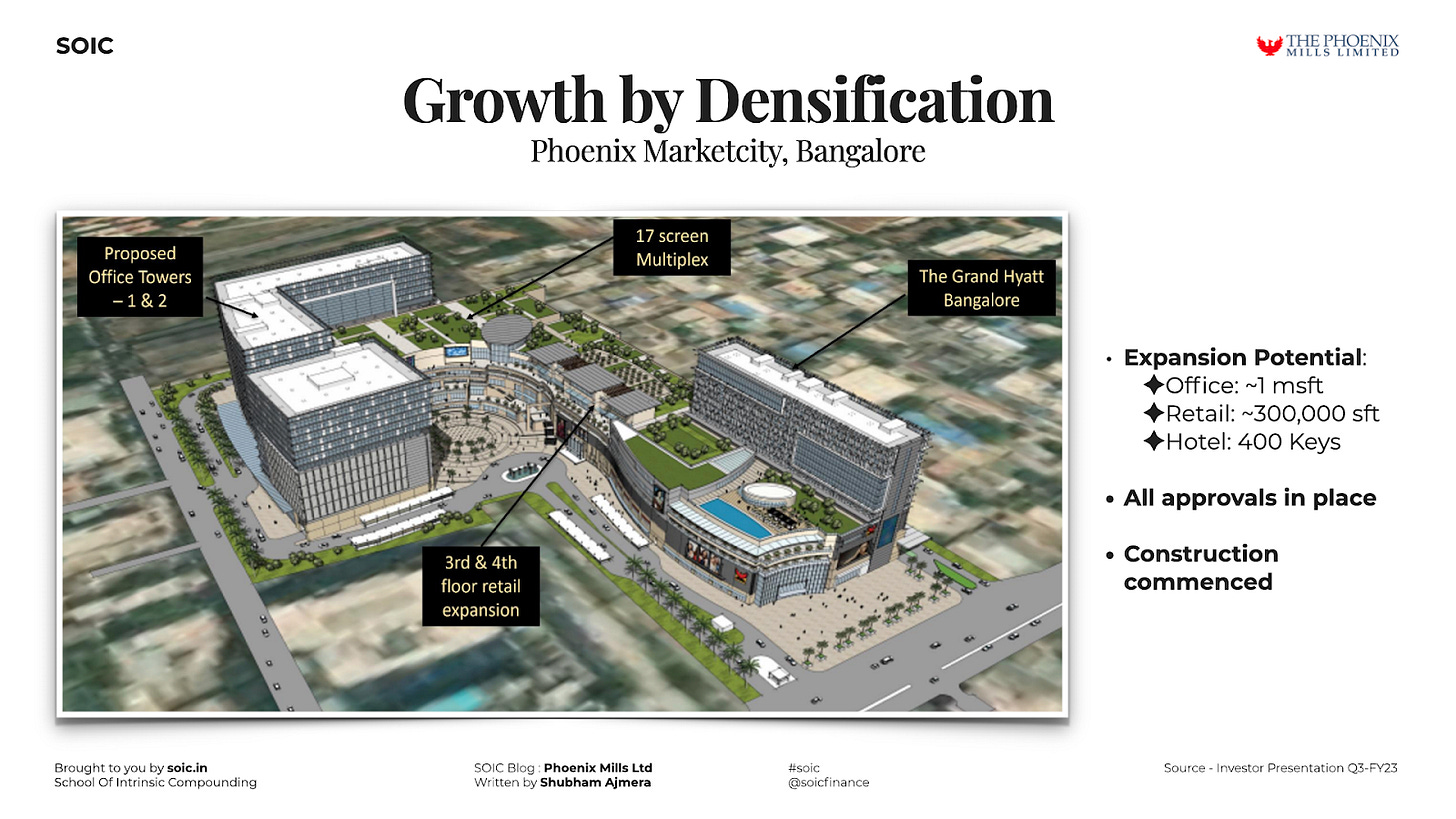

In terms of office space, PML has plans to add space close to existing malls in Mumbai, Chennai and Bangalore, in addition to constructing office space at the brand-new malls in Pune and Bangalore.

They also have intentions to construct a 400-key Grand Hyatt hotel in Bangalore to add to its existing two hotels.

Upon completion of these plans, the company’s retail GLA will increase from ~8msf to ~14msf, office portfolio from ~2msf to ~8msf and hospitality portfolio from 588 to 988 keys. This could lead to significant value creation going ahead.

Strategic partnerships, Robust balance sheet spur Financial firepower

In the past, the business has consistently joined forces with strategic investors in times of capital expenditure to decrease the financial strain. In April 2017, it forged an alliance with CPPIB to obtain, develop, and manage retail-oriented developments; CPPIB has already put INR16.6bn in the platform. In the last 24 months they have raised equity for more than Rs. 4800cr with marquee investors like CPPIB & GIC and they also raised QIP worth Rs. 1100 cr in Aug 2020.

Through a mix of healthy operating cash flows and timely fund raise, PML has kept balance sheet stress at bay. At Q2-FY23 end, the company had cash and cash equivalents including current investments of ~INR2,100cr.

Due to the annuity nature of the business and the comfort on the cash flow front, PML has amongst the lowest cost of debts in the industry (~8.41% at Q3-FY23).

Journey of the company

Acclaimed leader in retail real estate, Phoenix Mills Limited (PML) started its retail journey in the 1990s through High Speed Phoenix (HSP) at Lower Parel, Mumbai. PML is today the largest mall developer in the country and is synonymous with quality and innovation in the retail realty space. In order to make the most of its value offerings and utilise FSI efficiently, PML follows an integrated model wherein it builds offices, hotels and sometimes even residential projects around its malls. This has the added benefit of creating a captive consumer base for its malls, thus increasing their footfall.

Today, PML boasts a well-rounded portfolio of ~8msf of operational retail space, 2msf of office space, 588 hotel keys in the hospitality segment and three residential projects. The company is committed to providing its customers with innovative solutions that meet their needs and exceed their expectations. With its integrated model and unrelenting commitment to excellence, PML is fast becoming one of India’s foremost real estate players.

The company has presence in various cities all over India.

Key growth drivers for the company

Acclaimed leader in retail real estate with expanding aggressively at various locations

PML is a highly respected name in Indian retail real estate and is renowned for offering quality and innovative solutions. The company's journey in the retail space began in the 1990s with High Speed Phoenix (HSP) in Lower Parel, Mumbai, where it opened its first hypermarket concept in 2001.

Currently, PML has 7 million square feet of operational portfolio and 6 million square feet of retail GLA under development or in the planning stage, making it the largest mall developer in India and a leader in the country's retail real estate development. PML has three different types of retail assets: HSP, the flagship asset in Lower Parel; Market City format, which are malls in major consumption hubs like Bengaluru, Pune, Chennai, Lucknow, Indore and Kurla (Mumbai); and Phoenix United format, consisting of smaller malls in Lucknow and Bareilly.

In retail, the company is building four new malls. Bangalore and Pune are building new malls (in various micro markets) in addition to existing malls. They recently launched a mall in Indore which started operations from Dec-22 and stands at approximately 1 million square feet. It is invading Ahmedabad and Kolkata to develop new malls. It is also adding retail space to existing malls in Mumbai and Bangalore.

The company's goal is to open a new shopping center each year for its customers. Ahmedabad's Phoenix Palladium will open in the current month i.e Feb 2023, it has retail GLA of approximately 770,000 square feet. This will be followed by the launch of Phoenix Mall of Asia at Bangalore and Phoenix Mall of the Millennium at Pune in Q1 FY24.

In the future, PML will consider cities such as Chandigarh, Hyderabad, Surat, Jaipur, Gurugram and Navi Mumbai apart from already existing cities such as Mumbai, Bangalore, Chennai and Kolkata to expand its retail presence.

On the office side, in addition to developing office space in new malls in Pune and Bangalore, the company is planning to add office space near existing malls in Mumbai, Chennai and Bangalore. PML does not build standalone offices but integrates them into developed with shopping malls. These offices are not for tech companies, but businesses in general. These PML-developed office spaces have many advantages compared to peers. Land costs for these properties were paid when the company buys land to build a trade center; so the viability is much better when compared to other office projects. Furthermore, these office spaces have amenities such as larger floor plates, central air conditioning and a higher ceiling height than traditional offices, allowing them to be more flexible and adaptable to the needs of tenants.

In addition, these offices are often built above shopping malls, like in Phoenix Millennium Office (Pune), Phoenix Mall of Asia (Bengaluru) and Palladium, Chennai. Therefore, the construction time is much shorter because the company saves time on establishing. This also improves the profitability of these assets. Finally, PML plans to build a 400-room Grand Hyatt hotel in Bangalore to add to its two existing hotels.

The launch of Phoenix's 1msf Indore mall (Citadel) in December has already seen strong rental growth, with over 40% trading occupancy in its first month. Over the next two quarters, PML plans to open malls in Ahmedabad, Pune and Bangalore (~3msf). These malls are projected to reach a state of stability by the end of FY24. The establishment of these malls is expected to add more than Rs6bn to gross rentals (PML share 50%), on top of the 5-7% annual growth in rentals from operational malls due to contractual and consumption-linked factors.

PML is making significant strides in its rental income, with the addition of a new mall in FY 23/24 and the expected addition of ~1msf each of Retail space in Kolkata and Surat beyond FY26. Moreover, it is looking at greenfield projects in cities such as Jaipur and Chandigarh across its own/CPPIB/GIC platform. Additionally, it is actively reviving its Residential portfolio and entering into Warehousing/Data Centres as well.

HSP Mumbai has, on average, contributed about a fourth of overall annual consumption in recent years, followed by the Bengaluru mall and Pune, Chennai, and Kurla malls.

As the malls mature, trading densities increase, enabling tenants to pay higher rentals, resulting in PML's retail rental income growing. HSP, due to its premium location in Mumbai and maturity compared to other malls, contributes around a third of PML's annual retail rentals. The rental to consumption ratio is higher in the initial years after mall opening, but as consumption increases, so do rentals. Trading occupancy has been moving up M-o-M to ~92% in Dec’22 vs ~87% in Jun’22; whereas leased occupancy is now ~98%.

In conclusion, PML can be seen as a proxy for the urban consumption story, with the added benefit of rental growth outpacing consumption growth.

Lastly, PML has plans to build a 400-key Grand Hyatt hotel in Bengaluru to add to its existing two hotels. This will provide an additional source of revenue for the company as well as strengthen its hospitality portfolio in the region.

Optimal use of free cash flow to consolidate holdings

When PML embarked on its mall development spree in the 2000s, it partnered with various financial institutions for development of these retail assets. Along with them, it developed office and hospitality assets as well. Its stake in various projects during the construction stage ranged from ~25% to 65%.

Once these assets became operational, they started generating free cash flow. PML used these cash flows to increase its stake in various assets and give exit to its financial partners. This approach allowed the company to leverage limited resources and invest in a large number of assets. Furthermore, it enabled PML to increase its exposure when the risky construction stage was complete and the asset was throwing surplus cash, sending a signal regarding its confidence in the attractiveness of the asset.

Moreover, this strategy had other benefits such as reducing debt levels and decreasing capital costs associated with projects by sharing risks with partner institutions. This also increased the efficiency of operations by providing access to more financing options and increasing flexibility when making decisions related to project developments.

The company has a strong cash flow position and its new malls has started yielding results which will make its balance sheet even stronger and company will have adequate liquidity for further expansion.

Residential Portfolio: Another fountain of cash flow

PML has developed three residential assets– one in Chennai and two in Bengaluru, namely Crest, Kessaku, and One Bangalore West. The Chennai project, Crest, is on top of the PMC Chennai mall and comprises three towers spanning 0.54 msf with negligible inventory left. Kessaku has five towers spanning 1.03msf and has already been completed. One Bangalore West has nine towers spanning 2.41msf out of which tower 8 and 9 spanning 0.61msf are yet to be launched, while towers 1-6 have been completed and tower 7 was launched in July 2019.

PML is witnessing very good traction in residential sales, mainly led by robust demand of ready to move in inventory and faster conversions. They achieved overall sales of Rs. 104 crores in Q3 FY23, of which Rs. 14 crores worth of sale is pending registration. Momentum in sale continues with sales of Rs. 275 crores in the period from April to December 2022. Further, they have now crossed the sale of Rs. 300 crores if we take the first week of February also into consideration.

They are following through on their strategy on marquee residential projects in mature markets and recently have done an acquisition of a very prime 5.5-acre land parcel in Alipore, Kolkata for consideration of Rs. 430 crores. This is a premium location and the neighborhood of that market has typically seen sales at a rate of about Rs. 17,000-18,000 which goes up to Rs. 20,000-21,000 for good quality projects per square foot. So, this is the kind of micro market where PML likes to build out the residential projects. This project will cost close to Rs. 1000 cr for the company.

The residential portfolio will thus provide another source of cash flow for PML which can be utilised for the under construction retail and office assets. For now, PML does not have any plans to develop any more residential projects.

Robust Balance Sheet To Aid Growth Prospects

PML has always followed a conservative balance sheet policy. Through a mix of healthy operating cash flows, timely fund raise and partnerships, it ensures that its balance sheet is never stressed. During its earlier capex phase (prior to FY15), it tied up with various financial institutions as partners to ensure that the entire capex burden does not have to be borne by the company. After the capex ended, it used surplus cash flow to consolidate its holdings and to reduce debt. Consequently, its net debt:equity declined in FY16 and FY17 after peaking in FY15.

Post FY17, it again initiated a new capex phase; it tied up with CPPIB and GIC to fund this capex. It also raised ~INR11bn funds through a QIP in August 2020.

With surplus cash flow coming in from the residential vertical, PML was on a very strong footing as far as its balance sheet was concerned before the outbreak of COVID-19. This put PML in a great position to weather any potential disruption due to the pandemic and enabled them to easily fund their under-construction and planned projects.

In addition to this strong financial footing, PML had already reduced their debt in segments which were more vulnerable to disruption prior to the pandemic.

The annuity nature of PML’s business and their strong comfort on cash flow front is why they have one of the lowest cost of debts in the industry; their average cost of debt is currently at 8.41%. The company has a healthy liquidity position with debt to equity at 0.26x and Interest coverage ratio at 4.2x.

Key Risks:

Aggressive expansion in new cities:

PML is making substantial investments in their retail and commercial property holdings, constructing multiple projects in major cities. This strategic move is likely to result in an increase in their debt burden and an increase in capital employed, and if the results were not as fruitful as expected it could be risky on the return ratios as it is an asset heavy business. The increased investment could help PML to generate higher returns from the development projects, but there are associated risks that need to be taken into consideration. PML must ensure that the projects are carefully planned and managed, with strong risk management processes in place to ensure that the projects remain on track and provide a satisfactory return on investment. In addition, PML should make sure that their current financial position is sufficiently robust to cope with any unexpected increases in debt or other costs associated with these investments.

Slowdown in economic growth:

The performance of retail assets, office and hotel properties is inextricably linked to the economic growth rate. When the growth rate slows down, these assets can be adversely affected, as the demand and prices for these properties may decline. This can lead to decreased occupancy rates and diminished revenues, thus negatively impacting the performance of these assets. Moreover, when economic growth is slow, retailers may be unable to afford rent on their retail spaces and office tenants may be unable to pay for their leases, resulting in further losses for property owners. As such, it is important for investors to monitor economic indicators in order to gauge how these assets may be impacted by changes in economic conditions.

We want to hear from you! Have you visited any of the Phoenix malls recently? If so, what was your experience like? Did you find it crowded or was there a good amount of footfall? Let us know in the comments below. We'd love to hear your thoughts and opinions on the Phoenix mall experience.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.

Nice study