PI Industries - A win-win Business

PI Industries - A win-win Business

Before I start the business analysis. Let me tell you about a really important mental model which all of us use in our daily lives. I promise it will be well worth the read before we come to the business analysis.

What is the easiest way to succeed in life? The answer lies in the kind of relations we forge with other human beings and our environment. The most successful human beings have created Win-Win relationships all around them. Success can come in multiple ways and it is not just limited to the financial area of life. Things like a happy and successful marriage, raising a child well, maintaining friendships, creating a positive impact on the society, or running a successful organization which employs many are all the examples of the area in which one can be successful. The building blocks of all these relationships and other successful ventures is creating Win-Win situations in life. Those who do this, they tilt the odds in their favor. This is not only limited to us, but we also find the existence of symbiotic relationships within nature itself. A symbiotic relationship is the one in which both species benefit from each other. I recently came across such a relationship that exists between Sharks and Remora fishes.

The Beginning:

Remora & Shark:

Sharks roam around in the ocean with Remora Fishes swimming around them. Remora is a small fish that usually grows 1 foot long. If you’re wondering what sharks and fishes have to with business analysis. Don’t worry you will find out soon :) Remora fishes eat scraps of prey dropped by sharks and they also feed off the parasites on sharks skin and in its mouth. In turn, the sharks protect them from predators and give them free transportation across the ocean. Now, if you stop to think about, both species are in a symbiotic relationship. The value proposition for both of them is immense. This is what I call a Win-Win kind of relationship. Similar to their relationship, in this business analysis, we’ll be talking about a company that has created Win-Win relationships with its customers.

PI Industries: A win-win business model

In 2009, Mayank Singhal an Engineering and Management graduate from the UK, the grandson of PP Singhal (who founded the company) took over as the Managing director of the company. He redirected the company to focus more on the export side of the business and since then the revenue and profits from the export business have grown at a Robust pace and PI industries has been one of the best-performing stocks of the last decade. Which tailwind did they catch that led to this result? In this analysis we’ll be focusing on the following:

Lay off the land

The journey of PI industries

Different business units

Why is it a differentiated business model?

Our Parameters

Key Risks to the thesis

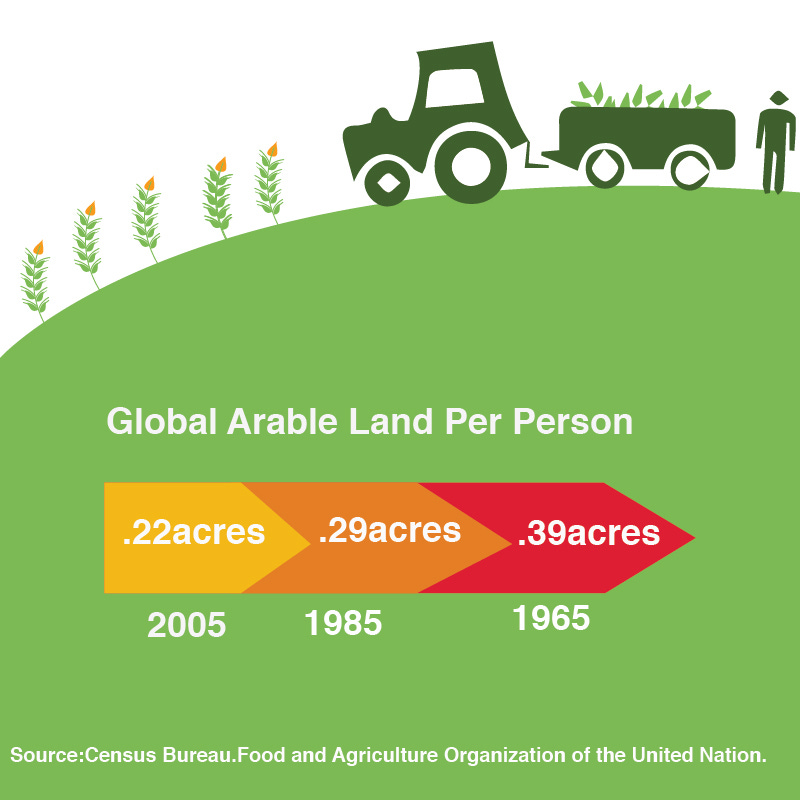

Indian Agrochemical Industry: Lay off the land

A large portion of the Indian population still depends on agriculture for their livelihood. More than 54% of the population is dependent upon the agrarian economy which contributes close to 17% to the GDP. India is the second-largest food grain producer in the world and food grain production has grown at a CAGR of 2.8% from FY2015-FY2019. The primary objective of the agriculture sector is to produce a reliable supply of food for the ever-increasing world population. India’s journey from being a food deficient country in the 1960s to a food surplus one after the Green Revolution in the 1970s has been a tale of success world over. But continuous shrinking in agricultural land in the last three decades is certainly a cause of concern especially when the population has increased by 41 percent since 1981. In India, the agricultural land is decreasing at a rate of 0.03 million hectares per year (30,000 hectares), not only in India, the entire world is losing arable land which is fit for agriculture every year.

This is the reason why Agrochemicals are required. Agrochemicals which mainly include pesticides are used for efficient and economical production of agricultural produce which in turn increases the yield generated from the agricultural land. How do they do it? Agrochemicals are used for crop protection, crops are damaged by different types of pests, locusts, fungus, weeds, etc. Remember the recent Locus attack, that is an example of a pest destroying crops. To protect our crops against such infestations, the need for pesticides arises.

Pesticides are of various types such as insecticides, fungicides, herbicides, and biopesticides. In India, the production of agrochemicals has grown at a CAGR of 4.3% during FY14-18. In 2019, production has risen by 2.9%. The market for pesticides is projected to rise by 8.1% Cagr from 2019-2024. India today is the 5th largest exporter of pesticides. India’s pesticide penetration is significantly lower at 0.6 kg/ha compared to 5-7 kg/ha in the US and 11-12 kg/ha in Japan. Despite such under penetration it is important to remember that agriculture is a cyclical industry as it depends on n number of factors like farmgate prices, food inflation, monsoons, etc.

For eg- Indian agriculture is majorly dependent on monsoons as only 45% of the arable land has access to irrigation. This is why I am not too much interested in the domestic agrochemical producers and moreover the industry is very fragmented in nature with over 800 formulators and 125 technical grade manufacturers, the business that we will be focusing on in this report has created something structural out of a cyclical industry by grabbing on to the massive tailwinds presented by the export opportunity and is one of its kind business model in the Indian Agrochemical industry with no peers of similar size or capabilities (For a primer on agrochemical industry download this)

Industry Value Chain:

Segments of Agricultural Inputs Industry

The journey of PI Industries:

PI industries was established in 1946 by Mr. P P Singhal as an edible oil refiner, which was shut down later. Sensing an opportunity in the growing agrochemical industry, Pi industries entered agrochemical formulation and manufacturing in 1967 and changed its name from Mewar oil to Pesticides India in 1989 ant to Pi industries in 1992. In the 1970s and in the 1990s the company entered technical formulations, custom synthesis (90s), and polymer compounding business. This is what the entire timeline of Pi industries looks like :

Journey of PI Industries (ANNUAL REPORT)

PI Industries has 2 business segments in which it operates:

Custom Synthesis Manufacturing for global innovators

Domestic Market

Let’s talk about Custom Synthesis Manufacturing first:

PI industries started the custom synthesis manufacturing business in 1996 and work with global innovators like BASF, Kumai, Du Pont, etc. Out of the top 20 global innovators, 18 of them are Pi industries’ customers. PI industries got their first contract for CSM business way back in 1997-1998. Initially, the global innovators were very apprehensive about giving contracts to PI industries. However, the size and scale of the CSM business changed due to 2 important changes:

2 Major Changes

In December 2004 the Indian Congress-led UPA government issued a presidential ordinance to bring the country into mandatory compliance with TRIPS by January 1, 2005. This gave the global innovators a lot of comfort in terms of sharing their molecule which they have developed after years of research and development.

Mayank Singhal, the son of PP Singhal was elevated to the post of the Managing Director. The focus of the entire organization shifted towards the export business. And PI sold off its Polymer compounding business to Rhodia, as a part of its business strategy of focusing on exports. From thereon, Pi has grown rapidly in the last decade. But before I talk more about the CSM business, many of you would be wondering, what the hell is custom synthesis manufacturing? Let me clear the concept first.

Mr Singhal - Export Business

What is CSM and what does PI do for its clients?

Custom synthesis means the exclusive synthesis of compounds on behalf of the customer, i.e., you can order a specific molecule that is only synthesized on your request on the scale, with the purity and with the specification or methods you require. Don’t worry it is not that complicated. Basically what PI does that it operates as a contract manufacturer for patented molecules of Innovators. These molecules are made after years of Research and Development by Innovators and they get it patented if it proves to be successful. These Global MNCs like BASF, Kumiai outsource the manufacturing of these molecules to players like PI industries in order to reduce costs. Just imagine the amount of trust that is required for an MNC to give you a molecule on which it spent close to $250million+ in discovering? This is why PI industries is a unique and one of its kind business model.

PI industries involve itself in every phase of a patented molecule lifecycle after a global innovator/MNC has successfully discovered and invented the molecule.

Following are the services provided by PI industries to its clients:

Pi offers several services that go into commercializing a molecule. Once a molecule successfully commercialized, PI gets the order for intermediate and technicals supply which where the margins are. (these are basically the building blocks of what go in a pesticide) . Process development, manufacturing, and scaling up the manufacturing process is the real bread and butter in PI industries business.

In this segment, 95% of the business that PI industries does comes from the manufacturing of Patented molecules which is a high margin area, and barriers to entry are huge. This reminds me of 2 similar businesses that do the same in pharmaceuticals, One is DIVI’s and the other one Suven Pharmaceuticals. Both of them also have very high margins.

The company has close to 25 molecules on the commercial side on which it works and has plans of launching 4-5 new products every year. Usually, the molecules which are 4-5 years old have a different scale and size as compared to the ones which are launched recently.

On the competitive side, for every molecule, global manufacturers have only two suppliers as this business involves a lot of trust and respect for IPR. Moreover, coupled with the fact that Global innovators don’t want to deal with too many suppliers.

Competitors:

Anurag Sarna

Actually for new products as a prudent strategy nobody keeps a single source, but usually for new products, for IP protection, and for other confidentiality issues they also do not keep more than two sources, at maximum. If it is a huge global blockbustor kind of thing then they may have three sources, but usually not more that two sources.

Source- FY11 Concall

Top 5-6 molecules contribute to 70% of the sales from this division. This is the case with most of the CSM manufacturers. Pi has in the past set up dedicated plants for some of its clients for manufacturing the end product.It takes 2-3 years to commercialize a molecule in R&D business and sometimes it can take up to 5 years. The lifecycle of one product can be upto 15-20 years and the growth phase is usually for 7-8 years.

What has been the historical performance of CSM business:

PI industries currently has a market share of 5% in the industry and Pi has been growing by taking away market share in the industry, the industry has mostly remained flat as it follows cyclical pattern (more on this later). Industry size is currently $5billion.

Manish Mahawar

But What could be the size of CSM market now in billion dollars ?

Rajnish Sarna

It would not have changed dramatically because the customer market or the customer industry size has not dramatically changed, so the market would have also remained almost at a same level. So, if you are looking at CSM per se across the verticals it would be substantially high; $30 billion to $40 billion, but if you are talking only about the Ag Chem may be $4 billion to $5 billion around that .

Manish Mahawar

Our Market Share should be in the range of around 5% ?

Rajnish Sarna

Yes around 5%

Source- Q1FY20

65:70% of the contracts for CSM business are long term in nature and the remaining don’t have long term contracts, but even here the company is only 1 of the two suppliers that the innovators have. The company invests in new plants, only when there is visibility of orders coming in.t Strategically the company focuses on only new products and on those molecules where only 1 or 2 players can supply.

Mayank Singhal, Managing Director and CEO

No, I mean certainly we have certain visbility contracts in place and then only we invest. This has been effective for the last couple of years now.

Prateek Podder, Analyst

Okay so investment will not be done if there is no visibility.

Mayank Singhal, Managing Director and CEO

Certainly.

Source: Q2FY14

The Domestic Business:

In the domestic markets, PI Industries has over 10,000 channel partners and has more than 84,000+ retail points. PI is the 3rd largest player in a fragmented domestic market where it competes with more than 300+ formulators. The company has over 30 depots and has implemented SAP (ERP)

Domestic Product portfolio

PI has differentiated in the Domestic markets by creating brands and by collaborating with the MNC’s/innovators for launching products in India.

PI follows 3 strategies in its domestic business: in-licensing the molecules that it thinks can have potential in the domestic markets, co-marketing, and marketing/manufacturing select branded generics.

In licensing a molecule that PI thinks can do well is another differentiated approach. As a global innovator, it just needs to give the rights to Pi industries and Pi would use its distribution strength and network to create the market.

PI’s domestic product portfolio: Sales of this business

PI has recently launched Awkira (Pyroxasulfone) as wheat herbicide and management believes there is considerable opportunity for growth in this product. Domestic business is fairly concentrated as top 5-6 products contribute 60% to the sales. Company follows a product life management process, and has plans to launch 2-3 new products every year in the next 3 years to keep the portfolio fresh.

PI launched Nominee gold which is a rice herbicide in 2010 was a major hit as company inlicensed it from Kumiai chemicals Japan, ever since the product has gone generic, close to 30 new players have entered and PI faces margin pressure. As a result, PI has form a JV with Kumiai chemicals to produce the molecule locally, earlier it was imported. (Bispyribac Sodium)

PRODUCT PORTFOLIO TABLE

Why is it a differentiated business model and future areas of growth:

Switching Costs/Symbiotic Relationship

Entry Barriers

GEOGRAPHICAL PRESENCE:

Exit Barriers

Symbiotic Relationship/Switching cost

Like the symbiotic relationship we talked about, PI industries has created switching costs as PI is involved from the beginning in a molecule's commercialization journey. Innovators don’t want to deal with many suppliers and don’t want to disrupt the supply chain either. That is why PI offers take or pay contracts, and 70% of the business comes via long term contracts. PI also works on a price pass through basis, basically, any fluctuations in the prices of Raw materials can be passed on, this ensures the stability of the margins. PI Ind has pricing power to pass on the raw material volatility in the CSM business.

GP MARGIN:

CASH CONVERSION CYCLE:

Entry Barriers:

This symbiotic relationship has ensured that no other player from India can enter the CSM business. As it is a very long gestation business and Global innovators prefer to deal with limited suppliers. This has ensured PI remains as one of a kind business that is listed on the bourses. PI has proven itself over years to be a prudent supplier to its customers when it comes to respecting their Intellectual Property.

Exit Barriers:

The global innovators typically name PI Industries as a manufacturer of the relevant product while registering the product overseas, amending which would require a lot of additional time and costs. This acts as an exit barrier.

Distribution:

In the domestic business Pi benefits from its unique inlicensing strategy and has considerable presence in distribution.

Future Areas of Growth:

PI industries currently has an order book of nearly $1.5 Billion which is to be executed over the next 4-5 years. This order book provides a lot of visibility on the growth front. Current sales of csm business ---- and order book is of 11,250 crores which is outstanding.

R&D Cost of Global Innovators:

The increasing cost of R&D for global innovators has led to increase in outsourcing for players like PI Industries.

R&D Cost of Global Innovators

CHINA POLLUTION LEVEL - BLUE SKY POLICY & INDIA GAINING MARKET SHARE:

The management has done a capex of nearly 1000 crores in 2020 (incluiding acquisition) and has plans for a capex of rs600 crores in 2021. This capex, assuming an asset turnover of 1.5x, can lead to doubling of revenues in the next 3-4 years in the CSM business. The company has moreover nearly doubled its gross block in the last 2 years.

India Market Share in Chemical Exports:

Such is the power of compound interest, that we can see a PI like company being built in the next 3 years by PI itself. Took them 73 years to get till a revenue of 3366crores, would take them 3-4 years to double from here.

PI has also recently acquired ISAGRO Italy’s plant in Panoli. PI paid rs345 crores to acquire the 2 facilities of ISAGRO, and 65% of the sales come from domestic business and est comes from exports. There are considerable levers for PI to expand the sales of ISAGRO, as capacity utilisation of ISAGRO’s plant is only at 35% which PI wants to ramp up to 80% by FY22. At 80%, Isagro acquisition can contribute to 500-600 crores of sales.

Diversifying into adjacent spaces: PI has been working on diversifying into csm of pharma or other speciality chemicals like imaging, electronics etc. The size of opportunity here is 8x the size of the market PI is in right now. Management has plans of doing an inorganic acquisition to shorten the process. As Pharma intermediates CSM/Cdmo is a long gestation process. Acquiring any other company would shorten the lead time for PI to enter the Contract Development and Manufacturing business.

Launch of Awkira (pyroxasulfone) which is a wheat herbicide has already proven its success in markets abroad (Axeev by KUMIAI). This can prove to be another successful product like the launch of Nominee Gold (that happened in 2010)

The company has completed absorbing the MMH technology which is likely to be a game changer for its expansion into pharmaceuticals and other specialty chemicals business. Monomethylhydrazine (hereinafter referred to as "MMH") is a very valuable compound which is widely used in the industries of pharmaceuticals and agricultural chemicals, the chemical industries, the aerospace and missile industries and other various industries.

An example of the usage of this technology (used to make chemicals that are used in various industries)

Rocket engines consume Monomethlyhydrazine

5 Forces Analysis:

Key Risks to the business:

Product concentration risk:

There are significant product concentration risks in both the CSM and Domestic business. As in CSM businesses, top 5-6 molecules contribute 70% to the sales. And in the domestic business like other players in the industry top 5-6 products are 50-60% of the sales.

Nitin Gosar

It wold be ideal to understand that top five products or top five molecules could be giving more than 60% - 70% of the number ?

Mayank Singhal

Yes, There is a standard reach of any business that it will be at 70% from 30% molecules.

Source FY18-Q3 (Csm Risk)

To mitigate these risks PI is growing its pipeline of molecules and has a strategy of launching 2-3 new products in the domestic market going forward.

Negative externality:

Chemical industry/agrochemical causes considerable harm to nature and humans if the plants are not regulated well. There is moreover, always a risk of fire etc as indicated recently by a fire at their plant in Jambusar. In which 2 people lost their lives. PI has so far apart from this incident has a demonstrated track-record of safety and respect for environmental norms.

Products going off patents:

In case products go off patent like what happened with Nominee gold. As soon as the product went off patent, close to 30 generic players entered the market to compete with PI. As a result, there has been price erosion despite expansion in the size of the market from 500kl to 900kl in the last 3 years.

Availability of Raw Material:

In the past PI has faced issues sourcing Raw material from China for producing Active ingredient and intermediates. Earlier the dependence was close to 30-35%, To mitigate the risk PI has backwards integrated and started sourcing these raw materials from the local sources. As a result, the dependance on chinese sources for Raw Material has gone down from 30-35% to 12-14% (further down from fy 18)

FY18 Q3-Concall

As a company we had started this initiative maybe one year back. We have already from 32% to 35% of our total raw material dependence on China,we have already come to less than 20%. And we are hoping that in next six to nine months, this percentage of whatever 15% - 18% as of today will further go down substantially. So this is what we are doing

Deferment of shipments:

The growth in csm business was impacted between 2016-2018 as agriculture is a cyclical activity and there was a lot of channel stuffing in 2016-2018. Moreover, the merger/consolidation between the global players led to a lot of uncertainty regarding new orders. This is what led to deferment of shipments and slow sales growth in 2016-2018.

Moderate Pricing power in the domestic business:

Moderate pricing power in the domestic business due to intense competition. To mitigate this, the company is launching new differentiated products and growth might soon come back in the domestic business (which is cyclical) on the back of these new product launches like Awkira (pyroxasulfone). Moreover, the core ROCE has gone up in the domestic business as the company has taken cost cutting measures in the last 3-4 years. (Q4-FY20 Concall)

Conclusion:

PI is a unique business model which is based on years of trust and win-win partnership PI has made with the global innovators. In next 3-5 years it seems quite plausible that the growth of 20-25% will continue in the CSM.

But, beyond that to increase its size of opportunity PI has to enter new markets like it has been trying to enter into Adjacent vertical of CSM in Pharmaceuticals ($40 billion market size vs $5billion in CSM)and Speciality chemicals (recently they have made shipments for a pharma intermediate to a client in Japan which is for Covid 19) Otherwise this can happen:

Management has indicated that business from pharma/spechem will go in double digits of sales in next 2-3 years.

I won’t do valuations, as value lies in the eye of the beholder. Dear, reader I would encourage you to read about the business, think carefully about it before you start valuing it. The best fiction writers are not the ones who are writing best selling books, but are the ones who are valuing companies without understanding the business.

Sectoral analysis and newsletter are a part of the SOIC Intensive Course. To know more : www.soic.in/course

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author does hold a tracking position in the company, his views can be biased.