Prince Pipes: On A Journey To Be The Next King?

Prince Pipes: On A Journey To Be The Next King?

In our Astral Poly Technik Stock Analysis we said that there are going to be multiple winners from the pipes industry as the industry is going through tailwinds leading to double digit growth.

In this blog we will be discussing one of the players who could have the potential to come out as a winner: Prince Pipes and Fittings Ltd.

About the Company

Company was started in 1987, which shows that it has around more than 3 decades of experience in the plastic pipes industry. It has three brands through which the company sells its products: PRINCE, Trubore (acquired in 2012), and FlowGuard Plus (a collaboration with Lubrizol).

The group got divided among the brothers in the 90s but both brothers were operating with the same name and logo. Around 2008 the competition started to intensify between the brothers due to which management focused on changing from being a quality product company to defeating their rival Prince SWR. This led to indulging in the practice of compromising on quality by using more calcium carbonate to save cost and extending credit policy which led to damaging the balance sheet. Later around 2014, the management started to wake up from the short-sighted vision of defeating Prince SWR as the end goal towards becoming much larger than that. Soon, they changed their logo to the current one and started focusing on branding. In 2018-2020 they brought in Akshay Kumar as a brand ambassador, tied up with Lubrizol, brought in a professional team (unlike previously fully managed by promoters), fixed up governance issues, etc. Now, the management seems to be hungry for growth and wants to be portrayed as a one stop shop for piping needs with premium quality.

Industry Structure

The industry structure has been already covered on SOIC’s YouTube channel but in short, the mental model of value migration is playing on in this industry where the value is getting migrated from metal pipes towards plastic pipes.

Business model

Prince Pipes does not sell pipes directly to the end users rather the value chain is as follows:Company - Distributor - Wholesaler/retailer - End User (plumber, farmer, etc)

I know this seems very inefficient in the world where start-ups are coming up and disrupting the supply chain by removing middlemen, but this is how traditional industries still function.

Product differentiation is not easy in this industry, the max a player can do is acquire high quality raw materials which is good enough to fight the unorganised player but to fight the organised ones there can be few ways.

Product Portfolio

Being in all the product segments is not the most profitable way to function in this industry as we can see, Astral is not present in every segment but they have been a great wealth creator. But Prince Pipes keeps making low margin products because they want to be considered as a brand with a basket of products in the industry.

Management on have basket of products:

Distribution and cost

If you remember from our APL Apollo video we learnt that they buy 2% of Indian steel consumption and 10% of Indian HR coil consumption, which enables them to get a 2% discount on their purchase. This led to them being very competitive at pricing and becoming a market leader with more than 50% market share. Therefore, a similar pattern can be seen in the Pipes industry where your distribution reach can give you a competitive edge over your peers.

Management using technology to optimize cost:

Management on distribution reach:

One interesting point to note is that 80% of our distributors of Prince Pipes are exclusive to them! This might not feel huge but think from the distributor’s point of view. All the hard work these distributors do will directly go to Prince Pipes’s revenues. But selecting the right distributors is very crucial. We do not want someone who doesn’t put any extra effort and is satisfied with marginal sales. Luckily, management is aware of this.

Prince’s management doesn’t want to blindly expand the number of distributors they have, rather they look for qualitative aspects in a distributor before taking them aboard.

Here is what they look for in a distributor:

Further to increase their presence across India and keep the cost in check Prince also outsources their manufacturing process to few contract manufacturers and each manufacturing unit has an employee of Prince placed there who keeps the quality in check.

Branding

Astral is known as “Dabangg wali pipe” or “Salman bhai wali pipe” which is a crucial element for their huge success as it helped them to reach tier 2 & 3 cities.

Branding also helps in creating a mind share in the people’s mind which helps a company to pass on any cost volatility without damaging their margins.

Here is an example:

In Q4FY21, they were the first one to pass on increased CPVC prices and rest followed:

Prof. Sanjay Bakshi once said in a podcast (referring to Warren Buffet) that we should think about the owner's earnings as true earnings by giving an example of Geico. If there is a lot of spending on advertising on a business model which is growing and is taking away market share, it should not be treated as advertisement. As at the end of the day it is adding value to a company's earning power.

Revenue mix

If we observe the revenue mix of the company, we can see that there is a trend playing out. Agriculture segment has gone down from 35% to 26% which is a low margin product (8-10%) and Plumbing segment has increased from 63 to 69% which is high margin product (12-14%). Further, if we look at the revenues across players Prince Pipes is a pure pipe industry play, as it has 100% of its revenue linked to the pipe industry.

Consolidation in the industry

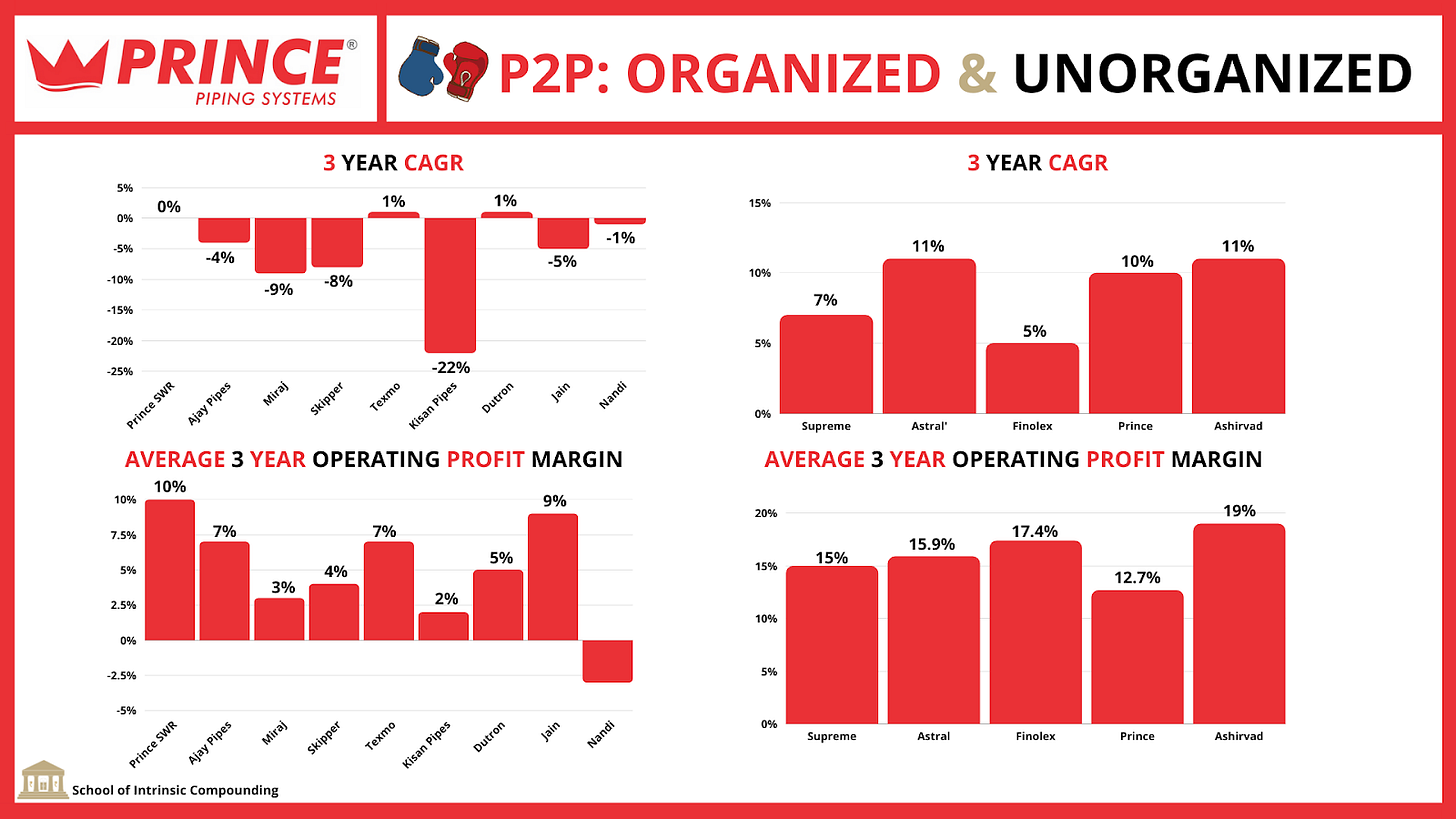

As capitalism is doing its work, we are seeing a wave of consolidation in the pipes industry. Inefficient and unorganised players losing market share to organised giants.

Especially in 2020, the main challenge was raw material sourcing and working capital management which became highly difficult during COVID. But COVID is not the only reason for consolidation. It had started long back but got accelerated from the pandemic.

GST: As raw material generally comes from organised players, they have to comply with GST norms which lead to increase in prices directly hitting the margins of the end pipe industry players.

NBFC crisis: As we had witnessed NBFC liquidity crisis around 2018, it had become difficult for many lenders to lend players which led many players to reduce their operations.

Anti-dumping duty: In 2020, the government brought in anti-dumping duty for five years against CPVC raw material being imported from China or Korea.

The market is consolidating not only by the way of unorganised segment share moving towards the organised but even within the organised players the big are getting bigger.

Management on consolidation:

Let’s have a look at the financial condition of the other players in the industry:

In the past most companies have been PVC players as the raw material sourcing is the cheapest there but now due to product superiority of CPVC pipes, the trend (which has been going on for a long time) is shifting towards premium products.

We have already discussed the benefits of CPVC pipes in our Astral video, hence will not touch upon it here.

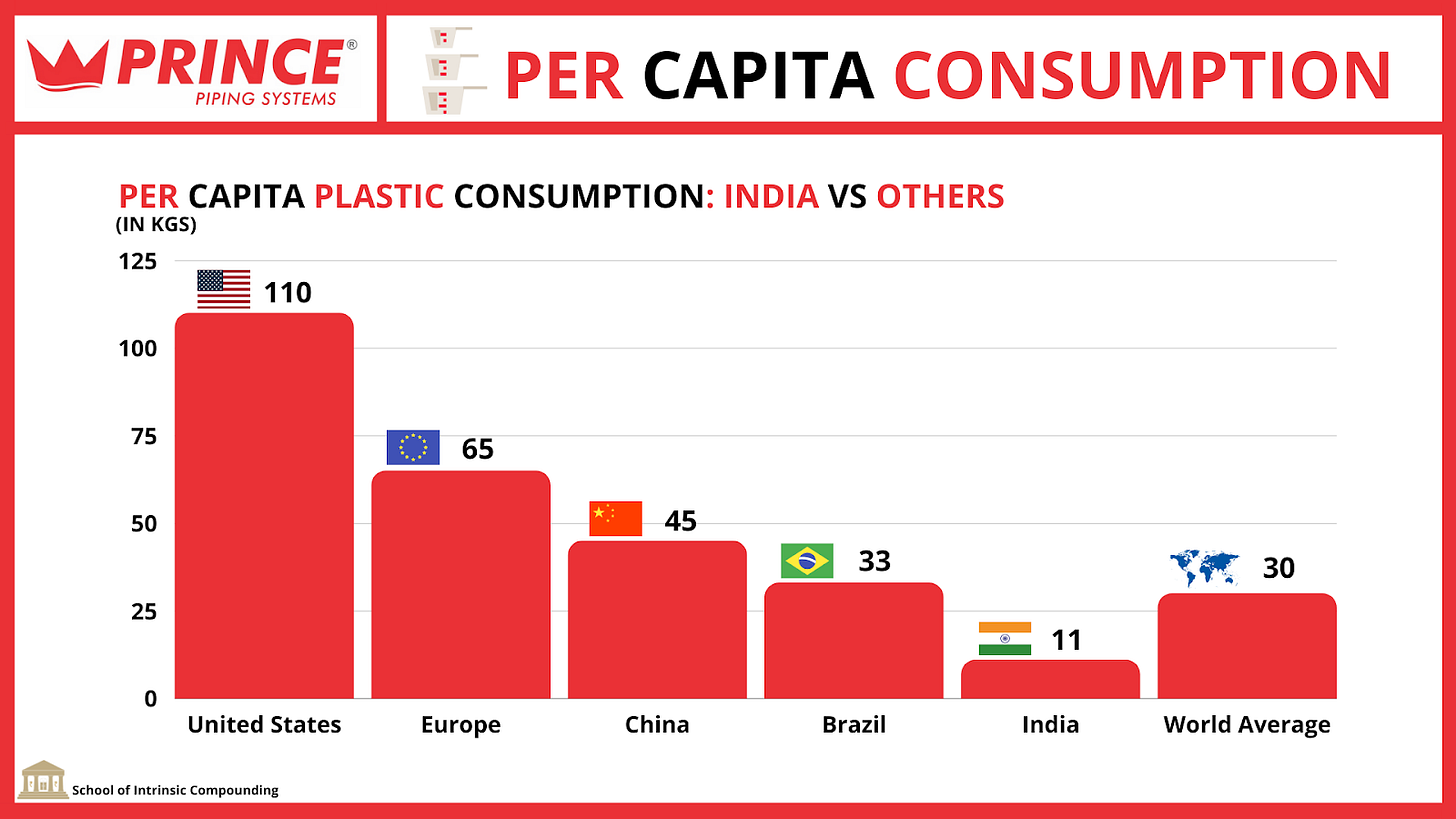

The Indian plastic pipes industry is expected to grow to Rs.550 billion in FY24 from Rs. 300 billion in FY19. India has been a very low per capita plastic consumption country with the number being only at 11kg whereas China stands at 45 kg and the global average is 30kg. This data shows that the industry is still under penetrated compared to other nations.

The question in mind would be that if the 65% market is already organised then where is the growth opportunity? It lies in the death of other players.

As the other organised players will keep on facing difficulty, they would lose market share.

Specially, the growth could come for Prince by change in product mix:

More than 70% revenue comes from PVC. As and when, CPVC pipes would start replacing and the CPVC industry would keep expanding, currently increasing at 20%. Prince’s mix will shift towards a high margin product which would be growing at more than 20%. CPVC pipes are generally 25-30% higher priced than PVC pipes with around 10% higher margins. Plumbing and drainage have a better value proposition than the agriculture segment and the focus of management is going to be on that.

Growth Triggers

Factory in Telangana

South India biggest market for CPVC pipes. So far, management did not focus much on South India as they did not have a manufacturing plant there. Haridwar and Athal plant used to cater for demand from South and used to take 4 to 15 days for delivery. As we know this industry is fright sensitive it is very important to reach the sale location to minimize cost. Initially management had given commentary that they would bring up the plant live by FY22 but this happened earlier than planned and the plant has now commenced its production in Q3FY21.

Now, the distributors in the south are going to get faster delivery leading them to have less inventory which will improve working capital requirement for the distributor and indirectly improve Prince’s working capital. Fright cost used to be around 4-6% but now it would come to 2-3%.

Improving Corporate Governance

There were a lot of governance issues with Prince Pipes, but the promoter has finally woken up and started to care about minority shareholders by way of settling the previous mistakes.

Pledge shares: Before IPO promoters had pledged around 35% of their holding but this was fixed within a few days of listing.

Contingent Liability: This remains an issue where the promoter group has a liability from another company where they are 20% partners in the business. But the maximum liability which they can face would be 180cr as the claim is about 9000cr.

Related Party Transaction(RPT): Earlier management used to have RPT but this was for getting Special Additional Duty benefit which stopped after 2018.

Real Estate properties: Management had taken money for buying real estate properties in personal capacity using company’s money. But this issue has been resolved now, as the management did not complete the transaction and returned the money.

Competition < Quality: As the brothers were fighting with each other, to undercut each other they went on to compromise on the product quality to price competitively.

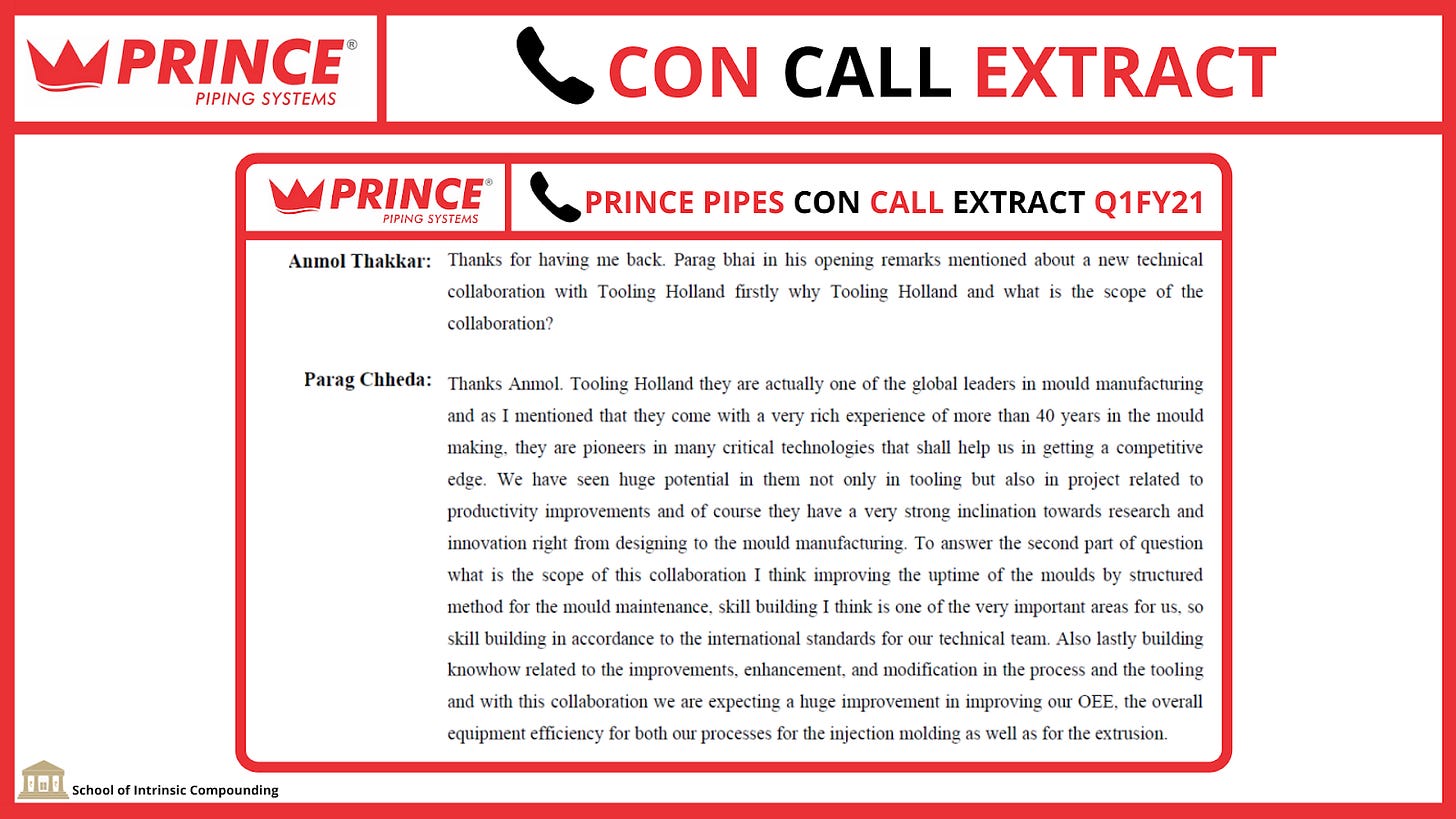

Technical collaboration with Tooling Holland

Prince has entered into a technical collaboration with Tooling Holland a European company who has around 40 years of experience in mould making and tooling. Now these things cannot be measured, all we know is that it is going to help them achieve “optimal product design and mould layout” leading to optimizing production costs.

Here is what management says about the collaboration:

Growth in DWC pipes

This segment is yet to kick start its growth. Management is working with consultants and developers trying to convince the government to accept this product as it is much more superior in quality, economically better, and has a better lifespan than concrete pipes (RCP).

Double Wall Corrugated (DWC) pipes are pipes with full circular dual-wall cross-section, with an outer corrugated pipe wall, a smooth inner surface and are used in the sewerage and drainage industry. Prince Pipes have also received a patent for their product in DWC pipes.

70% of India’s waste goes through open gutters today. Even though this number would make a perception of huge growth opportunity, that would be a very optimistic view as we all know how much importance the government gives to such projects.

Tank business

We have spoken about the mental model, Adjacencies and Derivatives, where we highlighted how businesses like Facebook, ICICI Securities, Astral, Navin Fluorine, etc have entered related business segments and benefited from that. A similar case seems to be happening with Prince here.

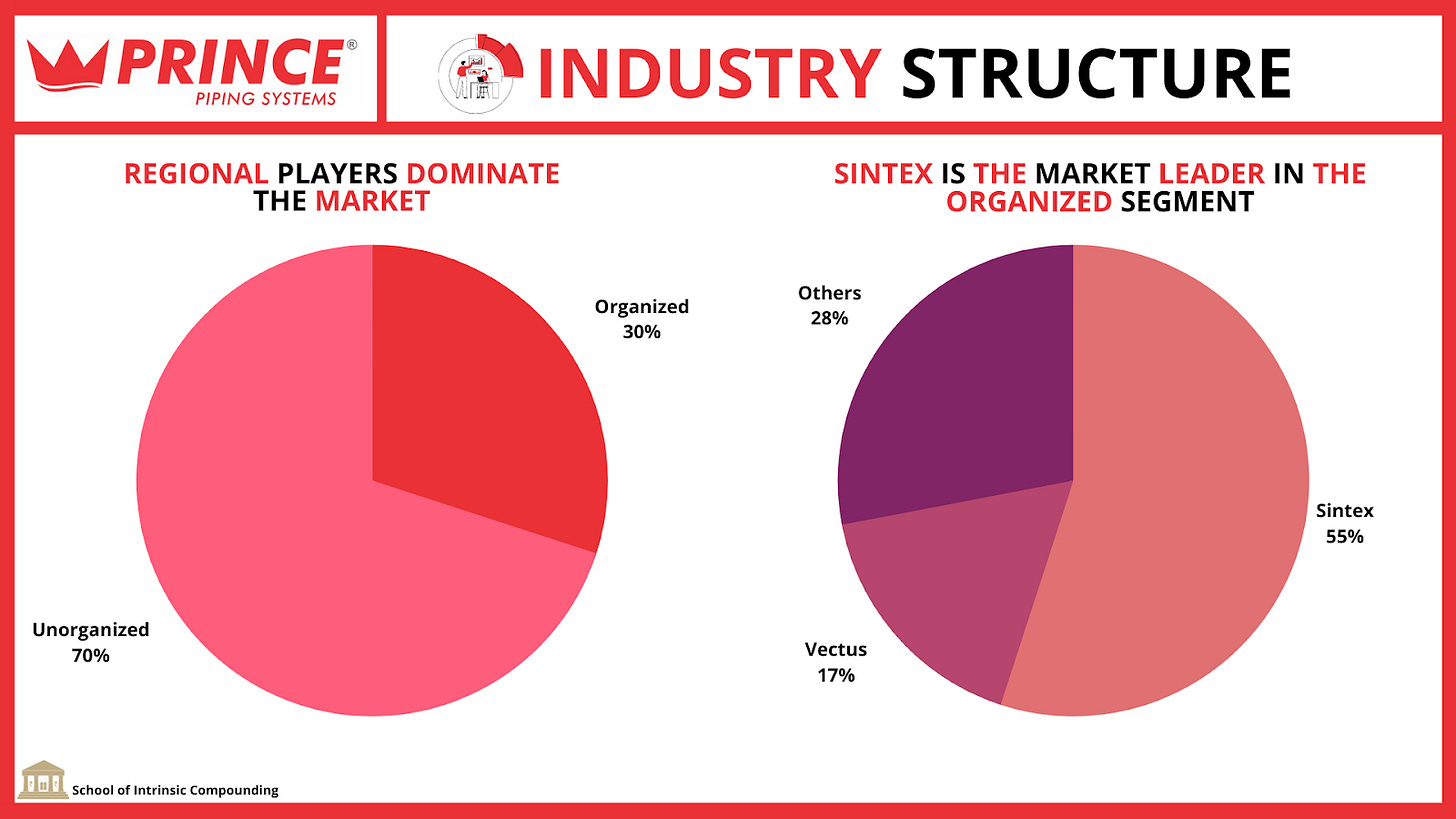

The tank business industry is around a market size of 4,000-6,000cr. 70% of the industry is unorganised because this business is very freight cost sensitive. So, the best way to go about it is to be near to the point of sale and have an extensive distribution system epically focused toward rural areas as that is where the most potential lies.

Management is going to use their current distribution network which is highest among the peers and will focus on providing premium products rather than volume. In management’s opinion, the current trend of selling 12–13-layer different tank products is just a marketing gimmick, and they believe there isn’t any real difference after 2-3 layer products so they are going to stick to that.

This industry is lucrative for three reasons: It has a cash & carry model where money is received within 3 days, high margin of around 15-16%, and less working capital requirement.

We all might be aware that this industry is ruled by a player named Sintex Industries, if you do not know this just go to your roof and check which tank does your house have. Sintex rules with around 55% market share and the second player, Vectus, has around 17% market share, leading to a total more than 70% market under the control of two players.

As we mentioned in our video that profit pools keep on shifting like public to private banks, railway to air passengers, etc. similarly there is high probability that the water tank industry will see a shift of profit pool from these two dominant players to more efficient organised players like Prince, Astral, etc. As the current players are struggling in the industry as they are facing liquidity issues.

Further as we all know where the industry seems to attract competition we start coming in and the same has started happening in the tank business where we can see players like Astral, Supreme, etc. entering this segment.

Here is what management has to say about it:

Government Initiatives

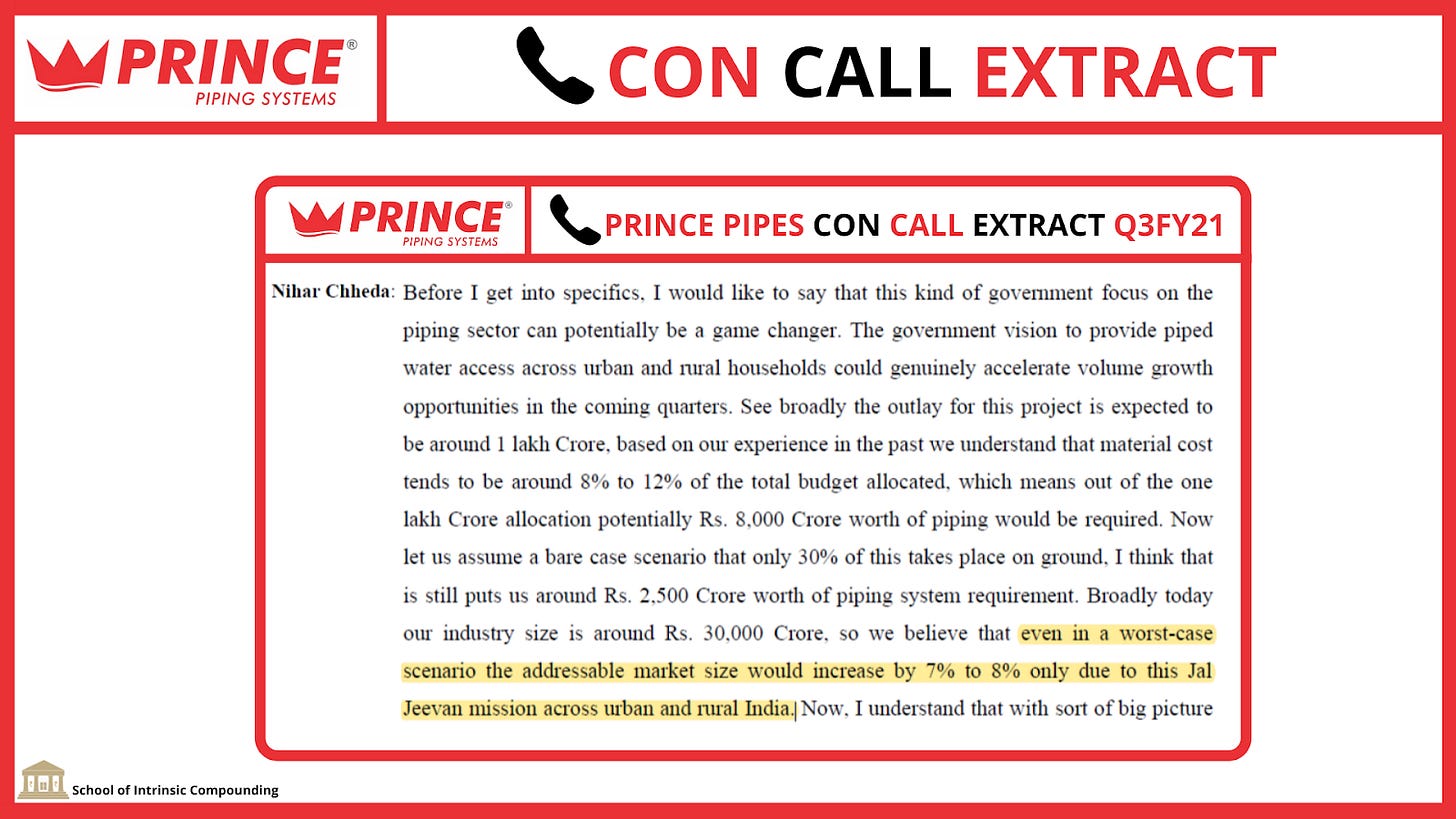

There are various government initiatives playing out in the sector like “Nal se Jal”, affordable housing, Union budget announcing around Rs.50,000cr plan for the urban and rural water supply scheme, which is over 4 times the previous budget.

Here is what management has to say about it:

Lubrizol: Icing on cake

Tie up with Lubrizol has come as icing on the cake as the industry itself was growing in double digit growth with consolidation happening.

Lubrizol had signed their first deal in 1998 with Astral Poly Technik who brought in CPVC manufacturing in India. Further, they had also licensed their FlowGuard brand to Ashirvad Pipes (still valid), Ajay Industrial Corporation, and Finolex. They have a CPVC raw material plant at Dahej, Gujarat from where Prince & Ashirvad are supplied. This deal will not only give access to FlowGuard Plus but also with sales team and distributor training programs (efficiency of it cannot be measured).

Ripple Effect

Prince was already among the top brands in PVC pipes but now with FlowGuard coming in it is very easy for them to convince their distributor to cross-sell their CPVC pipes as the quality will be top-notch.

Think about the psychological boost the sales team would be getting by this deal:

The cross selling has already started seeing traction:

Entry into B2B using the brand value of FlowGuard

As per management, FlowGuard is the undisputed market leader in the B2B segment. With the FlowGuard name a company would get access to prestigious projects in locations like Mumbai, Gurgaon, Bengaluru, Hyderabad, Chennai, etc. There are many developers who go only for FlowGuard which itself talks about the quality of the product.

But it’s not all good. There is a reason that the management never focused on the B2B segment, other than finding it difficult to enter. This segment is not very attractive in financial terms as it reduces the balance sheet quality as it demands higher working capital! Previously they have indirectly participated in this segment by selling to distributors who then sell it into a project. B2B is about relationships with a high gestation period and staying away from it could have been a wise decision.

Further this deal of sourcing raw material would come with increasing costs which is why it seems that the management wants to portray it as a premium product so as to extract most out of it.

All this will lead to margin expansion as this would lead to moving toward premium products.

Financials

Risks

Prince is currently the second brand who is using FlowGuard. So, there is no element of exclusivity.

Slowdowns in Real estate or government initiatives could affect the company.

The raw material of their product comes from crude oil which itself is very volatile hence brings in commodity risk and often leads to inventory gains or losses.

Anti-dumping duty: There is a 5-year anti-dumping duty so this risk has been mitigated.

Competition: More players can enter the industry of CPVC pipes as the barrier to entry is not high.

Valuation

It is rare to find businesses which are present in an industry which is growing at 20% (CPVC segment). Therefore, as the industry itself seems interesting which can bring in multiple winners we could value Prince by peer-to-peer comparison.

It seems that Prince Pipes is also on a similar track compared with its peers but not in terms of valuation. As their product mix would shift towards CPVC products it would lead to improvement in margins due to it being a higher margin product and soon that would reflect in their valuations. So, why is it still undervalued? Major reason was governance which is now being resolved.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC hold the stock in their portfolio at the date this post was published.

About the Author

Arjun Badola is a law student who has interest in analyzing businesses. He shares his thoughts on investing via his blog and twitter. In case you have anything to discuss related to investing, feel free to reach out to him.

Blog: arjunbadola.blog Twitter: @badola_arjun