SOIC Jan 2021 Newsletter

SOIC Jan 2021 Newsletter

13 mins readPublishing Date : 2021-01-17

Happy New Year!

PDF LINK- Click to download

I hope everyone is doing good and have already set their new year’s resolutions. There is one thing about resolutions that I don’t like personally, the very idea of resolution makes us to be intense with the tasks we have set out for ourselves. What most of us need to realize, it is the consistency that matters the most. I’ve set out the DCP motto for the entire team at SOIC. DCP basically stands for Discipline, Consistency, and Patience. If I have enough discipline to research about one business a week, I am consistent by researching at least 50 ideas a year. All that is required at the end is Patience to let the magic of compounding work. Thus, DCP way of working was born at SOIC. This is something we are doing at the moment. We will apply this framework in improving our understanding of the business in this newsletter.

We will learn how to evaluate the Unit economics of a business, one idea where We will learn how to evaluate the Unit economics of a business, one idea where we think variant perception can play out and why is it important to be roughly right than precisely wrong.

Let’s start by learning about the Unit Economics of a business by reading this very interesting conversation between Sherlock and Watson:

Watson: Hey Sherlock! How are you doing today?

Sherlock: (Seemingly lost in a thought) I am doing good Watson. Finally, you’ve come to see me. I Hope Marry is doing well.

Watson: She is indeed. Thank you for asking.

Sherlock: So Watson, what brings you to me?

Watson: Sherlock, actually there is something which I need to talk to you about.

Sherlock: Go ahead!

Watson: There is this case which I was discussing with Mary last week. However, we couldn’t come to a precise answer.

Sherlock: Is it the same case our friends at SOIC asked us about?

Watson: Indeed Sherlock! I have to send the answer to students at SOIC about, “How to evaluate the Unit Economics of a business”

Sherlock: It is quite an interesting case, that we have been asked to take up. I have given it some thought and taken out practical case studies from businesses listed in the Indian stock market. Before we start the discussion John(first name of Watson). Throw out all your preconceived notions about the subject and have a beginner’s mind. We will play a game of Socratic Solitaire. That is basically, disciplined questioning that can lead our thoughts in multiple directions. Helping us to improve our own understanding of the concept.

Watson: This sounds very interesting indeed Sherlock.

Sherlock: Right. You can begin John.

Watson: Sherlock, what do we mean by Unit Economics of a business? I know it’s an important concept, but very few people or analysts talk about it.

Sherlock: Very few people reason from the scratch, that is one of the reasons for poor understanding of concepts. If one is a better businessman, one is a better investor and if one is a better investor, one automatically ends up becoming a good businessman. Unit economics is something that both a businessman and an investor should know about.

Watson: Interesting..

Sherlock: Unit economics refers to how much value each unit can generate for the business. Value is a question of how much profit can a business generate on a given amount of capital. It is perhaps one of the important concepts, that good investors use to understand the economics of a business (a component of analyzing economics)

Watson: How to calculate it, Sherlock? What are the different constituents?

Sherlock: to get to the understanding of Unit economics, one needs to understand the derivation of “Return on Capital Employed”. ROCE is made up of two parts, one is the “Return”(Profitability) and the second is the “Capital employed” to generate those returns. Thus, it is called

*Return on Capital Employed*.

Watson: oh. Very interesting indeed Sherlock.

Sherlock: Right. Let’s understand the essence of ROCE with examples from the Indian context.

As I mentioned before, that ROCE has two parts i.e Profitability and capital employed.

Let’s understand what goes in the Denominator i.e capital employed. There are various ways in which analysts calculate the capital employed. Some use the Liabilities side of the Balance sheet to calculate capital employed (Debt+Equity) and some use the assets side of the balance sheet to calculate capital employed i.e Net-fixed assets + Net working capital.

Watson: What are Net fixed assets, Sherlock?

Sherlock: Net fixed assets are basically the investment that a business makes in the land, machinery, and other equipment. Do not get confused between gross fixed assets and net fixed assets. What we see on the balance sheet are net fixed assets. Net fixed assets are essentially Gross fixed assets less accumulated depreciation.

Watson: is there any other concept linked to Net-Fixed assets that we should be aware of?

Sherlock: Yes, John. Linked to Net fixed assets is Net Fixed Assets Turnover, which is basically calculated as Sales/NFA. This ratio tells us about the Per Rs of sales that the business is generating on Per Rs of Net Fixed assets employed. Eg: A shop has Rs2 of assets and does Rs6 of sales. That is basically, Rs3 of sales per unit of Fixed assets employed.

Watson: This can be very important while talking about the capex that the companies do, it can give us an idea into the revenue generation capability of the assets being created. What about the other aspect of the capital employed, Sherlock, i.e Working Capital?

Sherlock: Working capital is calculated by taking into account the Account Receivables, Inventory, Payables, and the other relevant current assets used in operating the business. Some people do like to include only Accounts receivable+Inventory-Payables, they call it the Networking capital, this is what the core business activity uses. Whatever, the answer comes to divide that by the sales of the company(do include other income) to get an idea about how much

Of the operating income (sales) gets stuck in the working capital of the business. For eg: Suppose you have a shop that does sales of Rs100 and requires working capital of Rs 10, thus the work capital ratio will be 10%. Basically indicating that 10% of sales will be stuck in working capital. Now you can express this in days by simply multiplying 365 days with 10%. Thus, the answer comes to 36.5 days.

John: I have never looked it at these numbers in that way. Amazing insight Sherlock!

Sherlock: Now the question arises why is ROCE important? The answer is simple your Return on capital must be higher than your cost of capital.

John: What is cost of capital, Sherlock?

Sherlock: Cost of capital, is a term that is very simple to understand. Yet you see finance professors, making a simple concept extremely complex. Charlie Munger says that he has never heard an intelligent discussion about cost of capital.

John: interesting. What would be our cost of capital in the Indian context?

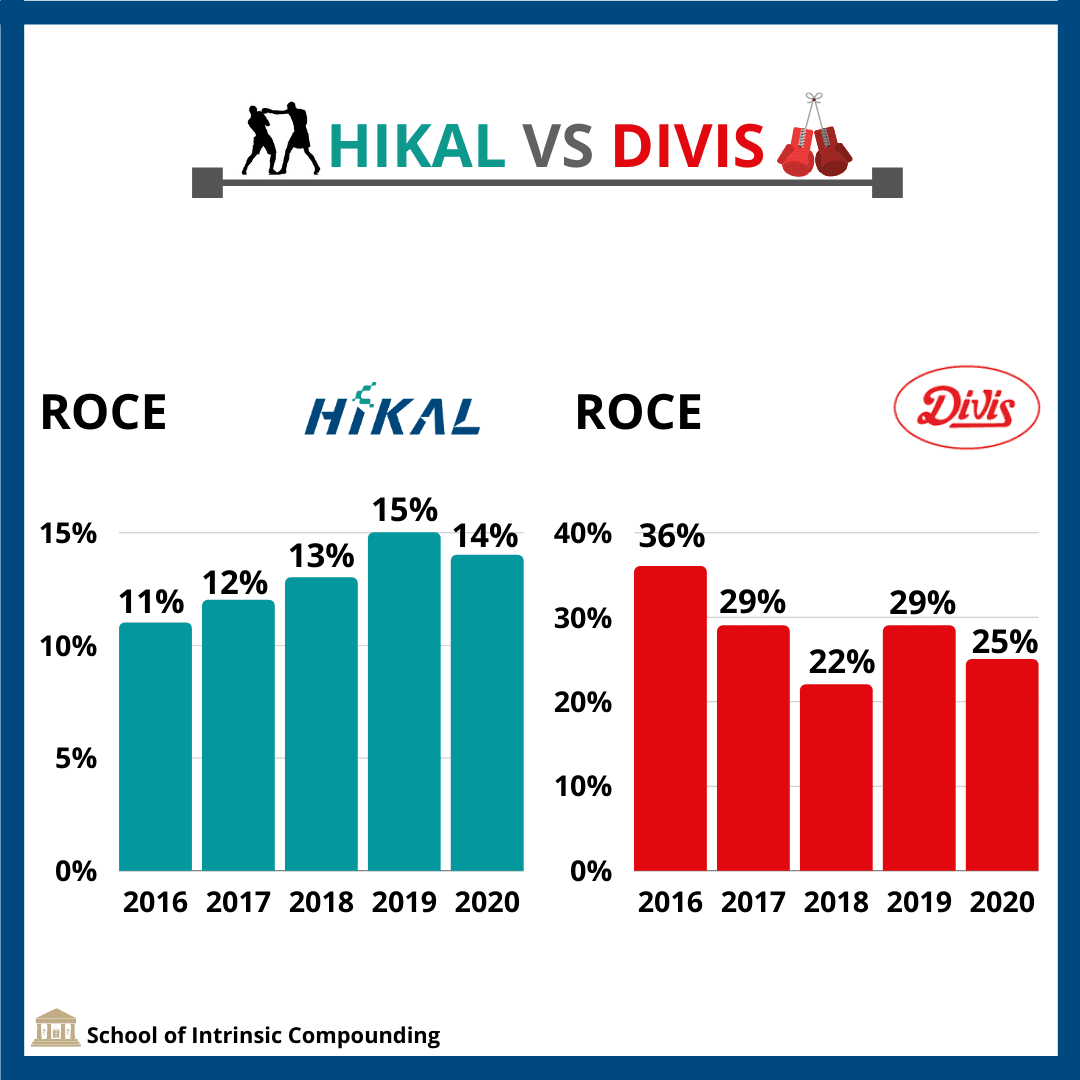

Sherlock: any business that is not making a ROCE of 12-14% is earning below its cost of capital essentially. Most of the businesses that earn ROCE of less than 14%, end up becoming value traps. There are other reasons for becoming a value trap which we shall discuss someday later :) Let me give you an example here: Hikal Ltd. All the other listed CRAMS players in Indian have done very, in spite of the trend, Hikal has been a value trap for more than a decade. Let’s look at the ROCE for Hikal and compare it to Divis Labs.

Now let’s put it all together and summarize what we have learned so far:

-EBIT and EBIT Margins

-Net Fixed Assets

-Net Fixed Assets turnover

-Working capital in % of sales

We’ll take an example to understand this,

Suppose from the earlier shop example we have to calculate the ROCE of the business. This business has:

1) Net Fixed Assets turn of 3x i.e basically for every Rs1 of Land, building, Machinery etc. This business can generate sales of Rs3. Thus, NFAT=3 times. The shop has Rs 100 fixed assets and does sales of Rs 300. (300/100)

2) The working capital requirement as a % of the sales is 10%. This means for doing sales of Rs300, the working capital required would be Rs30.

Thus, the denominator i.e the capital employed= NetFixed Assets + Net Working capital

=100+30=Rs130

3)Now coming to the numerator of the ROCE equation. Suppose this business earns Rs 60 of EBIT on sales of Rs 300. The EBIT Margin would be 20% i.e 60/300

4) This is how the ROCE will look like:

Rs 60/130= 46.15%

Has this business outearned its cost of capital i.e 12-14%. The answer is a resounding Yes!

This is how we calculate the unit economics John.

Watson: this was very insightful. I am sure people at SOIC would be delighted. Just a question Sherlock, what are the ways to apply it in Indian businesses?

Sherlock: that is a very good question, John. Let’s take the example of Apl Apollo and Laurus Labs.

APL Apollo: let’s understand the significance of the Change that has happened in the business. This has been one of the reasons of the recent outperformance: This has been one of the reasons of the recent outperformance:

Apl Apollo is into the business of converting steel into steel tubes. Essentially it earns very low margins (5-7% EBIT margins). However, the capital employed turnover compensates for the low margins, which helps it to make a ROCE of 20%+.

However, recently what has happened is that APL has moved to cash and carry model, thereby reducing the debtors considerably. This has led to ROCE expansion and moreover, whenever steel prices rise, Apl tends to do well as its EBITDA per tonne increases.

Lesson: Structural shift in ROCE upwards due to a reduction in capital employed as the need for working capital has reduced.

Laurus Labs: Now Laurus Labs is a very interesting business,However it was going through a painful period between 2017-2019. As a considerable amount of capital employed wasn’t earning any returns as Laurus forward integrated into formulation business which is higher margin in nature.

What happened when the formulation business started firing? ROCE expansion, let’s see the expansion:

This happened primarily due to two reasons, first is the expansion in margins, due to the formulation business that is higher margin in nature and secondly due to improvement in capital employed turnover. As fixed assets which were idle, started generating sales.

Watson: This was very interesting indeed Sherlock. I will write this down for SOIC students :)

Sherlock: No worries John!

This was the insightful conversation between Sherlock and Watson on understanding the key drivers of the unit economics of a business.

Now students with this conversation in mind, think about the entire purpose of Variant Perception mental model:

One more business where I think this might play out in the coming years is Sequent Scientific due to the following reasons:

1) Concentrated industry

2) Launch of higher-margin products

3) Improving capital employed turnover

4) Growing faster than the industry

What new are we doing?

-Currently, we are in the process of creating an entire course on how to build your own screener sheet from scratch and how to use SOIC sheet :)

-Some of you have asked us about our reading habits: We read the Wall Street Journal, investing interviews, The Economist, one business a week and non-investing books. After reading 30-40 investing books, most of the concepts become repetitive. What matters the most is how we apply these concepts in our investing journey and how do we learn from them.

SOIC New Year Resolution:

-Be disciplined, consistent, and patient with research and learn 1 new idea before going to sleep.

-Be disciplined, consistent, and patient with fitness.

-Be disciplined, consistent, and patient with serving the students.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author does hold a tracking position in the company, his views can be biased.