8 mins readPublishing Date : 2022-12-20

Agrochemicals Industry Overview

Agrochemicals play a vital role in reducing the crop losses from a range of insects, herbs, fungus, nematodes, rodents, etc. It plays a significant role in improving yields and farm income. Crop protection chemicals (Agrochemicals) are primarily classified into insecticides, herbicides and fungicides. This classification is based on whether a crop needs protection from insects, herbs, fungus. Let’s understand these 3 categories in detail:

Insecticides: Insecticides are pesticides that are formulated to kill, harm, repel or mitigate one or more species of insect. Insecticides work in different ways. Some insecticides disrupt the nervous system, whereas others may damage their exoskeletons, repel them or control them by some other means. They can also be packaged in various forms including sprays, dusts, gels, and baits.

Herbicides: It is also commonly known as weed killers, are substances used to control undesired plants, also known as weeds. Selective herbicides control specific weed species, while leaving the desired crop relatively unharmed, while non-selective herbicides (sometimes called total weed killers in commercial products) can be used to clear waste ground, industrial and construction sites, as they kill all plant material with which they come into contact.

Fungicides: Fungicides are pesticides that kill or prevent the growth of fungi and their spores. They can be used to control fungi that damage plants, including rusts, mildews and blights. Fungicides work in a variety of ways, but most of them damage fungal cell membranes or interfere with energy production within fungal cells.

The agrochemical industry players are categorized majorly into innovators and generics. Innovators are research & development (R&D) patented product-based players like Bayer, Sumitomo chemical company, Syngenta, BASF etc. While the off-patented product-based players are termed generic players. Generic players have a key strength of low-cost manufacturing and a wide distribution network.

Global Crop Protection Market:

The global crop protection market was valued at US$ 62.5 billion in 2019 and is expected to grow at a CAGR of 6.6% to reach US$ 86 billion by 2024. Having been dominated by synthetic products for many decades, the industry is now witnessing growing popularity of bio-pesticides, which are estimated to grow at a much faster CAGR of 16% to reach USD15.5 bn in 2024, from its current base of USD7.5 bn in 2019.

The primary demand driver for the crop protection chemicals market is the increasing demand for food security in order to meet the needs of the growing population. Due to instances of increased pest attacks across the world, crop protection chemicals are expected to see a rapid growth.

Indian Crop Protection Market:

India plays a critical role in the global agrochemical landscape, primarily on the back of a large domestic market coupled with a globally competitive agrochemical manufacturing ecosystem that helps it export surplus production.

India is the fourth largest producer of crop protection chemicals after the United States, Japan & China. The Indian agrochemicals industry is valued at around ₹42,000 cr equally split (50:50) between domestic and exports, in 2019. The industry is expected to grow at a CAGR of 8–10% till 2025 with exports contribution increasing to 55%.

The growth in the industry will be driven by several growth levers like increasing population, decreasing arable land, increasing demand for high-value agricultural products and increasing efforts from the industry and the Government to promote awareness and technology penetration. The Indian agrochemical industry is highly reliant on the import of raw materials and technical intermediates.

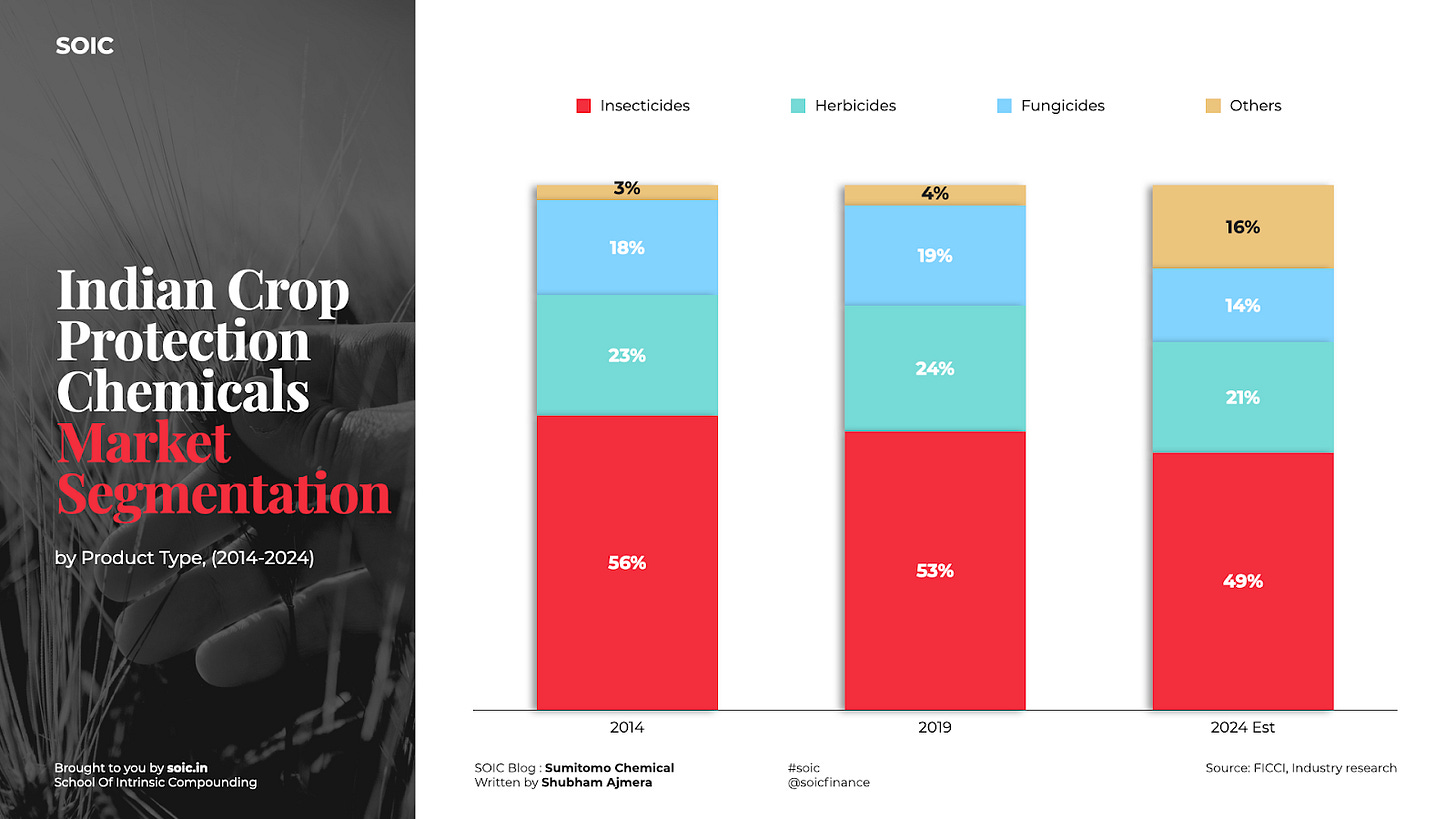

Insecticides contribute the highest market share in the Indian crop protection chemicals market, accounting for slightly more than half of the total market share followed by Herbicides and Fungicides. India has approximately 10,000 types of plant eating insects.

India’s crop protection chemicals market is expected to have a high market share of ‘other’ crop protection chemicals, such as bio-pesticides, nematicides, rodenticides and plant growth regulators, in 2024. Since biopesticides are expected to grow at a high CAGR during 2019-2024, it is expected to have the highest market share in the ‘others’ category.

Seasonality in demand in India:

Agriculture has two main sowing seasons in India, Kharif & Rabi. Kharif Crops are sown between June to October whereas Rabi Crops are sown around November. Of the overall food grain production of ~285 MT, around 60% contribution came from Kharif crops of which rice, maize, soybean, cotton and sugarcane are prominent crops. The corresponding crops for Rabi are wheat and gram.

Another important thing that we need to understand before moving forward is the Types of Product Registration:

- Registration u/s 9(3b): Any new molecule/ pesticide which has to be registered for the first time in the country is registered provisionally for a period of 2 years on conditions specified by the registration committee. This registration is for data generation purpose only and the commercialisation of the product is not allowed.

- Registration u/s 9(3): After fulfilling the pending enquiry or the conditions as specified by the registration committee during the provisional certification i.e, 9(3b), the pesticide may be registered regularly under this section. It is a permanent registration and commercialisation is allowed.

Once the product is registered under Section 9(3), competition cannot seek registration for the same product for typically three years. Products can enjoy the first-mover advantage as well as market leadership over the next 3-4 years.

- Registration u/s 9(4): Under Section 9(4) where an insecticide has already been registered by the Originator and another person (hereinafter "the Subsequent Applicant') wishes to import or manufacture that insecticide in India, the Subsequent Applicant is required to provide only bioequivalence data to the relevant Authority. i.e. subsequent applicants can get registration under Section 9(4) for the same product on payment of nominal fee 'without having to submit any data'.

Ingredients for success in Agrochemicals Market:

The critical success factors for companies involved in crop protection chemicals are as follows:

Backward integration of technical active ingredients: Formulators are required to have backward integration of their technical active ingredients in order to succeed in gaining high profit margins in the market.

Comprehensive product portfolio: ‘One stop solution’ for farmers of all the agrochemical needs drives the success of one firm over another.

Strong distribution network: Distribution network plays a vital role in reaching the fragmented farmers’ base across the world, enabling excellent feedback mechanism and deep customer relations.

One such company which we will be analysing today is a Subsidiary of a global innovator in agrochemical space, i.e, Sumitomo Chemicals India Ltd (SCIL) .

Company Overview:

Sumitomo Chemicals India Ltd (SCIL) is a part of the Sumitomo Chemicals Company Ltd (SCC), which is a very well diversified R&D focused agrochemical company and is among the leading global innovators in the agrochemical space.

SCC was founded in 1913 and undertakes several chemical related businesses as an independent listed company. SCC is a Japanese research driven diversified chemical company listed on the Tokyo Stock Exchange with consolidated sales revenue of more than US$ 22.5 bn. It offers a diverse range of products globally in 5 business sectors: petrochemicals, energy and functional materials, IT related chemicals and materials, pharmaceuticals and health and crop sciences sector. SCC holds 12,600+ Patents of which ~34% are in the Health & Crop Science segment.

SCC has been operating in India through its Indian subsidiary (SCIL) since the past 2 decades. During the initial phase, the company entered India in 2000 as a distribution company to market SCC's products household insecticides (HHI) in India. In 2001, Sumitomo entered a manufacturing JV with New Chemi. New Chemi only had formulation facilities and any technical products required were either imported (from SCC for specialty products) or sourced locally (for the generic products).

In FY11, SCC merged New Chemi Industries Limited, Scott Pharmaceuticals Private Limited (a subsidiary of New Chemi) and SC Enviro Agro India Private Limited (a subsidiary of SCC) into SCIL. Subsequently in FY17, it acquired a listed company - Excel Crop Care Limited (ECC) - and eventually merged it with itself. Thus, over the last two decades, SCIL has grown organically and inorganically.

This is the first time in the history of India that a Japanese Company has got listed through the reverse merger showing the commitment towards India and vision to grow in India. Since ECC was a listed entity, SCIL, post-merger, was listed on the Indian stock exchanges in Jan '20.

SCC is a century old corporation and global giant in agrochem space is first time setting up manufacturing site outside Japan and which country they chose out of their operation in → India. SCIL is the only technical and generic grade manufacturing site for SCC outside Japan.

Product Portfolio & Distribution reach of Sumitomo Chemicals:

SCIL has a very diverse product portfolio with no single product contributing more than 16% of overall revenue thereby reducing product concentration risk. Its key product Glyphosate is in the range of ~11-12% of overall revenue, while other top selling molecules includes Chlorpyrifos and Tebuconazole which contributes to ~12-13%.

Its Top 10 products contributes less than 45% of Total Revenue. Also revenue is diversified across key crops, going forward concentrated efforts are being made to focus on high growth segments such as fruits, vegetables & paddy.

Post the merger with Excel Crop Care, SCIL has become the 3rd largest player in India, with domestic market share of 11% in FY20. SCIL has a wide range of generics and speciality products providing crop protection solutions. It has more than 200+ brands with 700+ SKUs creating strong stickiness with farmers & dealers. It has 20+ mega brands with high brand recall. These brands are distributed through a vast network of 16000+ distributors; ~40,000 dealers and 68 Depots helping the company in expanding brand visibility and connect. The company has adopted “Digital Marketing” as a parallel support to traditional marketing system for boosting its sales.

In the exports market, SCIL exports branded products manufactured in India, especially to African markets and also undertakes exports of the bulk technical products to various global markets.

Manufacturing Facilities

SCIL has 5 manufacturing plants based across Gujarat & Maharashtra with around 4 branches and 68 depots across India. It provides connectivity to major cities and proximity to main highways, ports reduces logistic time and costs.

Company has also Signed and registered agreements to buy 2 additional land parcels and transfer process is expected to be completed soon

~20 acre privately owned land parcel adjoining our existing Bhavnagar Site.

~50 acre privately owned land parcel at a prime location at Dahej within PCPIR Zone.

Growth Triggers in the Company:

Esteemed parentage provides competitive edge to the company: We believe that esteemed parentage from SCC provides competitive edge to SCIL over its peers in the agrochemicals business. SCIL’s parent provides several advantages like:

World class access to portfolios across geographies;

Technical expertise, R&D focus for developing proprietary products and technologies;

Financial strength and larger market reach; and

Strong product pipeline and portfolio with increasing presence into the specialty molecules.

There are three major growth areas for SCIL where esteemed parentage provides an edge. These are:

- India’s formulation business: Grabbing market share in Indian agrochemical space by marketing SCC’s proprietary products with help of its strong marketing & distribution network.

- SCC sourcing its proprietary products from India: SCC sourcing its proprietary products from India by shifting some part of its existing and additional manufacturing requirement from Japan.

- Contract manufacturing of generics for SCC group: Contract manufacturing opportunity in generics by leveraging SCIL’s manufacturing strength (technical/formulations) for meeting SCC group’s global requirement particularly in South America.

SCC would continue to support SCIL which would further strengthen SCIL’s position in the agrochemical business. The company intends to boost its exports by leveraging its parent company's global presence and distribution network. The company intends to enhance its exports in regions like North/South America, Africa and Europe.

Currently SCIL has a market share of around 12-13% in the domestic agrochemical market with 3rd or 4th position. Its aim is to become no. 1 player in the domestic agrochemicals market. SCC Japan is looking at India as a growth driver for the consolidated performance and have mentioned about the same in their presentation.

SCC is also helping SCIL in Research & Development as SCC has over the past few years invested significantly in Research and Development (R&D). According to the Company, SCC is one of the top investors in the R&D space (spending ~7-8% of the total revenue in R&D).

In FY22 SCC had spent ¥174.9billion which is approximately 6.3% of their revenue in Research & Development.

It has 12,600 patents, of which 34% are in the Health and Crop Science segment. Some of these products are now being launched globally in a phased manner. While, the R&D team in India is focussed in launching products in the domestic market and also developing the production and process for getting the contract manufacturing from the parent - on the skill and cost efficiency.

Well diversified product portfolio and launching new products: SCIL has a very diverse product portfolio with top 10 products contributing less than 45% of Total Revenue. Its revenue is Diversified across key crops. Company is now making concentrated efforts on fruits & vegetables, paddy and other high growth segments.

The company is taking efforts on high growth and high profitable segments such as Herbicides, PGR, Bio-rational products. SCIL is now focusing more on Plant Growth Regulators (PGR) , increasing contributions from the PGR segment and offerings for both Kharif and Rabi crops to reduce seasonality in the business. PGR currently contributes around 8-10% in overall revenue. They have launched 8 new products in H1FY23 which includes 3 insecticides, 1 fungicide, 1 metal phosphide and 3 PGR products. This included three 9(3) products - Sumi Blue Diamond, Pyclome and Danitol NXT.

The company has also received registration for two products with large potential in the LATAM market. The plant for these products is likely to be ready in 4QFY23 and commercial exports are expected to start in 1QFY24.

Capex plans to drive growth of the company : In FY-2021 company has disclosed its capex plan wherein apart from the maintenance capex of ₹ 70-75 cr p.a. they discussed about ₹ 120cr capex for FY22 & FY23 to manufacture additional proprietary technical grade active ingredients products for the parent company SCC Japan and our global affiliates with the revenue potential of ₹200 to 250 cr from these capex. Out of these one project has begun commercial production recently and the company is expecting to ramp up production in H2. The second project which involves multiple molecules is expected to begin commercial production in Q1-FY24.

Going forward the company will be aggressively doing capex as per management estimates, they could announce a capex of around ₹250 to 300 cr for FY24 which is currently in discussion stage with SCC Japan with an asset turnover ratio of above 2 times and in FY 25-26 major chunk of capex will be done at Dahej. Company is also expected to double its capacity for one of its key products i.e, Tebuconazole in next few years.

Make in India and export to the World: SCC parentage gives SCIL unique advantage of access to world class portfolio, greener chemistries, superior innovative capabilities, good brand recall and wider access to international markets for its products. Exports could be a fast growth engine for SCIL in the medium term as SCIL is the only technical and generic grade manufacturing site for SCC outside Japan.

SCIL is on firm footing to tap contract manufacturing opportunities from its parent SCC Japan. SCIL has taken the first step in this direction for supply of five proprietary molecules to its parent with one molecule commercialized in Q2-FY22 and remaining four by Q1-FY23. The company has indicated a total revenue potential of ₹ 200-250 crore (asset turnover of 2-2.5x) from these five products.

Further, SCIL will support to gain growing opportunities in generic markets globally. SCIL intends to enhance exports to regions like Africa and Europe by leveraging SCC's global supply chain and marketing network.

Key Risks in the business:

Ban on 27 Pesticides in India:

In May 2020, the government of India has proposed to ban 27 pesticides in India for the import, manufacture, sale, transport, distribution and usage in India as these pesticides are highly hazardous with potential to cause severe health problems, including, hormonal changes, carcinogenic, neurotoxic, reproductive and development health effect as well as environmental impacts, such as, higher toxicity level for bees.

The market size for these pesticides was ₹ 12,000 crore domestically and is expected to be replaced with other alternative pesticides which are less severe to the human or animal or environmental cause. These 27 pesticides include chlorpyriphos and quninalphos which are one of the key products of SCIL.

Based on our scuttlebutt with the distributors and discussion with management of the company both these products are the insecticides and majorly used in the Paddy, beans and gram. These are widely used in the first or second spray of insecticides in the farms and low cost products for the farmers. Due to its wide sprayed use and budget friendly insecticides for farmers, ban on these products is unlikely. To mitigate the risk on the same company is focusing on export of chlorpyriphos to Latin America.

Restriction on use of its key product Glyphosate:

Glyphosate (Herbicide) is one of the key product for SCIL which contributes around 11 to 12% of the company's revenue. On 25th Oct 2022, the government of India has put the restrictions on the mode of application of glyphosates wherein now the spray of this product should be done through Pest Control Officers (PCO’s) only, farmers are not allowed to spray it on their own like they do for other pesticides.

With our discussion with the management and some distributors we understood the impact of the same, glyphosate is used to kill irrelevant herbicides in the farms which restricts the growth of crops. This product is majorly used in Tea and Rubber plantation. The management believes that glyphosate is an important and economical product for farmers. There is no replacement for glyphosate in the market currently.

Last month Stay order issued by the Delhi High Court over domestic Glyphosate sales for three months from the date of government notification. This stay order gives company a chance to prepare for the restriction but there are still many confusions regarding the same like one mentioned by the management that there is no any ban on selling of products by the company there is just restriction on use of the product so PCO will buy the products from retailers or the company has to sell it only to PCO and not via distributors and retailers. Currently the company is selling the product as normal via its retail chain.

SCIL enjoys market leadership in Glyphosate with more than 30% market share in the domestic market.

Total Market size of Glyphosate in India: ₹ 1,100 cr

SCIL Glyphosate sales:

Domestic: ~310 to 320 cr

Export: 50 cr (No restriction on Export)

Gross Margins: ~25% as compared to overall margins 37-38% at company level

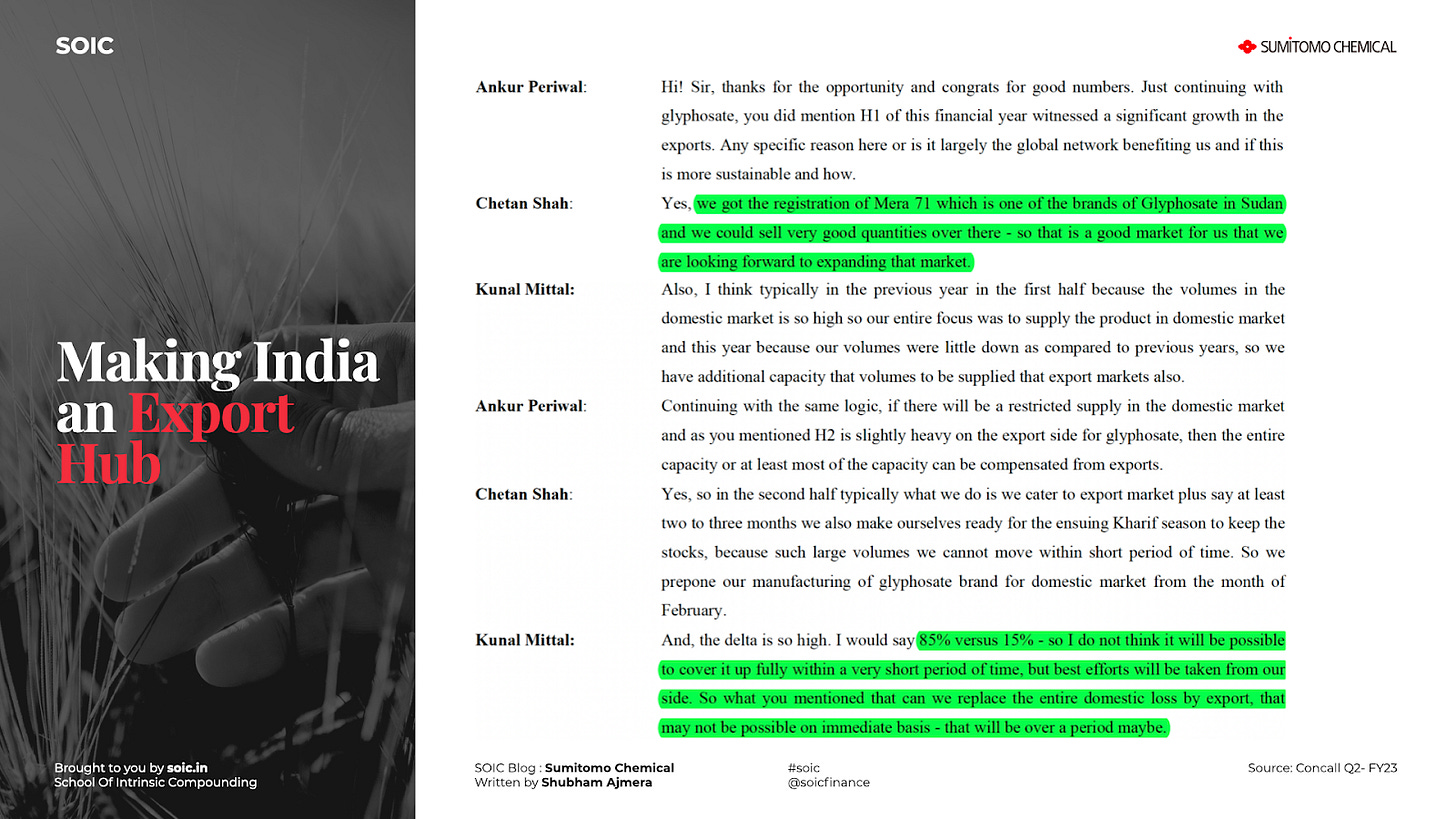

Company is taking some steps to appoint PCO and train the field staff for PCO licence and & get it done through them. Management believes infrastructure creation and training for glyphosate application will take 3-6 months. Normally in H2 glyphosate is exported due to the weak season in India, the company is looking for an opportunity in the export market.

Currently in Glyphosate sale the export share is very small around 15-17% but there are some tailwinds in the export market for the product as China is considered to be the world leader in Glyphosate with an annual capacity of ~8,00,000 tonnes/annum. China plans to cut this production capacity by a third - 20,000 tonnes per month (cut of 2,40,000 tonnes/annum), from mid-Nov’22. This move by China is in accordance with the country’s carbon emission norms.

The reduction in capacity in China will be beneficial for India as Glyphosate, which is regarded as the most used pesticide in the world with a market size of ~US$5.6bn, will create additional export opportunities for India. Plants in China are already running at full capacity, which indicates that demand in the market is strong. This, along with high exports (90% production is exported) from China provide evidence of high demand for Glyphosate in the global market. Nonetheless regulatory risk in domestic markets for glyphosate remains.

Financials of the Company & Valuations:

SCIL has a presence over its complete value chain of agrochemicals from R&D to manufacturing to distribution. At the time of writing the company is valued at P/E multiple of 48x. It's possible that with the completion of these capex’s the company might be able to grow the revenues at 18-20%. All valuation exercises are flawed, but these are done to just get a rough idea on how much risk we are assuming vs the reward we will get. I will urge you to do your own valuation exercise, using the inputs from the blog. Here is mine:-

The company is currently trading at 41x P/E of one year forward.

Do let us know in the comment section below, how you see the risk-reward playing out over here at current valuations and what you think about the impact of restriction on Glyphosate and can it become the export hub for the SCC Japan.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.

AUTHOR

Shubham Ajmera

Shubham Ajmera is a Chartered Accountant by profession working as equity research analyst with SOIC.

Grt inputs and thanks