What if, a time machine pulls up in front of you, and you could go back to 1993 and buy a partial ownership stake in the poster child of Indian IT — Infosys? The money you’d have today is stirring, right? Now, what if I told you that there exists an opportunity akin to that in the Indian CRDMO (CRO + CDMO) industry, and the poster child of that is… Yes, you guessed it right, Syngene.

Syngene is an integrated Contract Research, Development, and Manufacturing Organisation (CRDMO) providing Science as a Service—from early discovery to commercial supply.

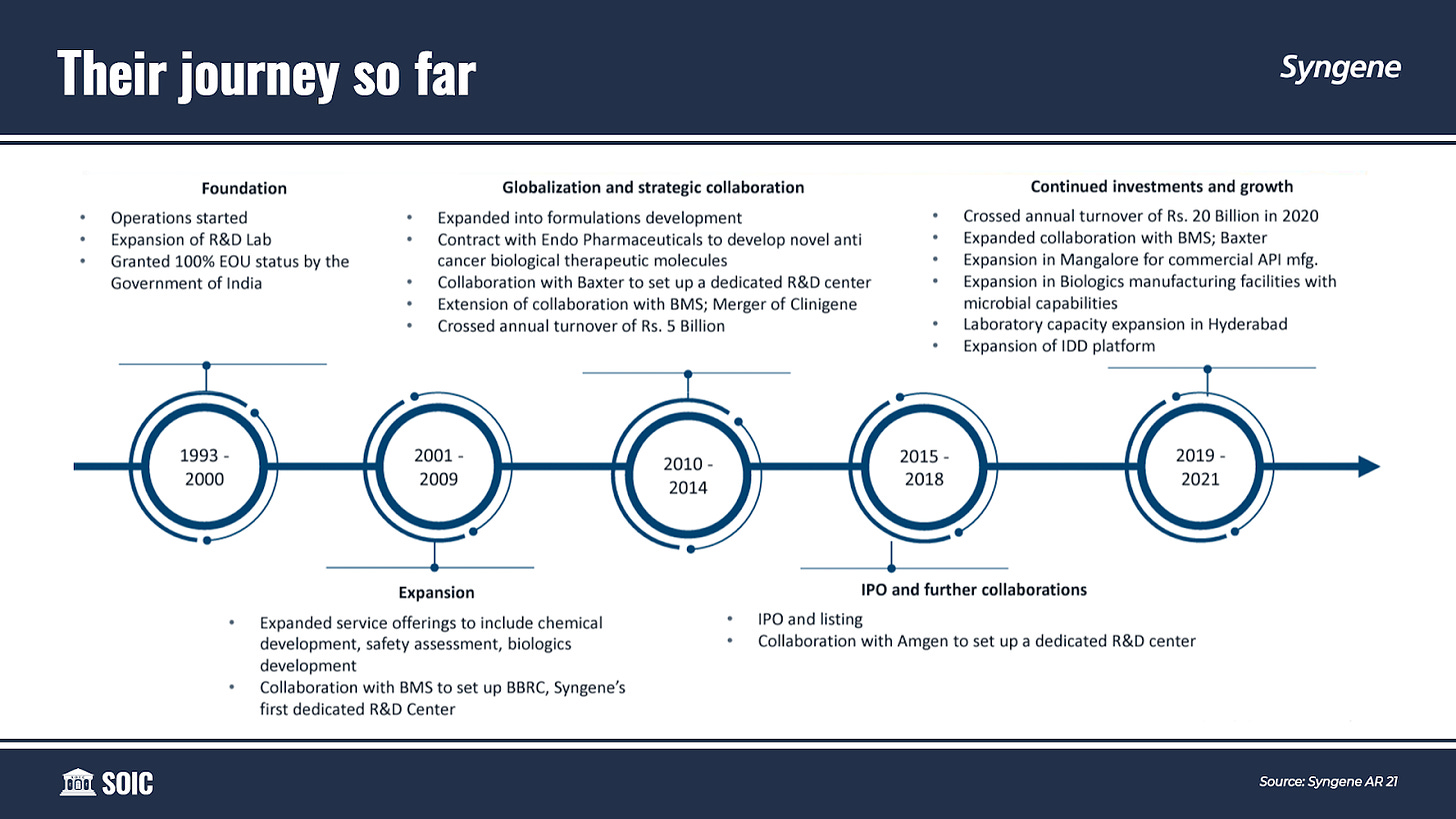

Before Syngene became a “CRDMO”, it was just an embryo, incubated in the womb of Biocon as India’s foremost Contract Research Organisations (CRO) in 1994, providing Discovery services. It later evolved into providing Development services in the 2000s. In 2015, finally, the umbilical cord got cut, and Syngene went public—Subsequently, venturing onto its strategy of “following the molecule” towards Commercialisation.

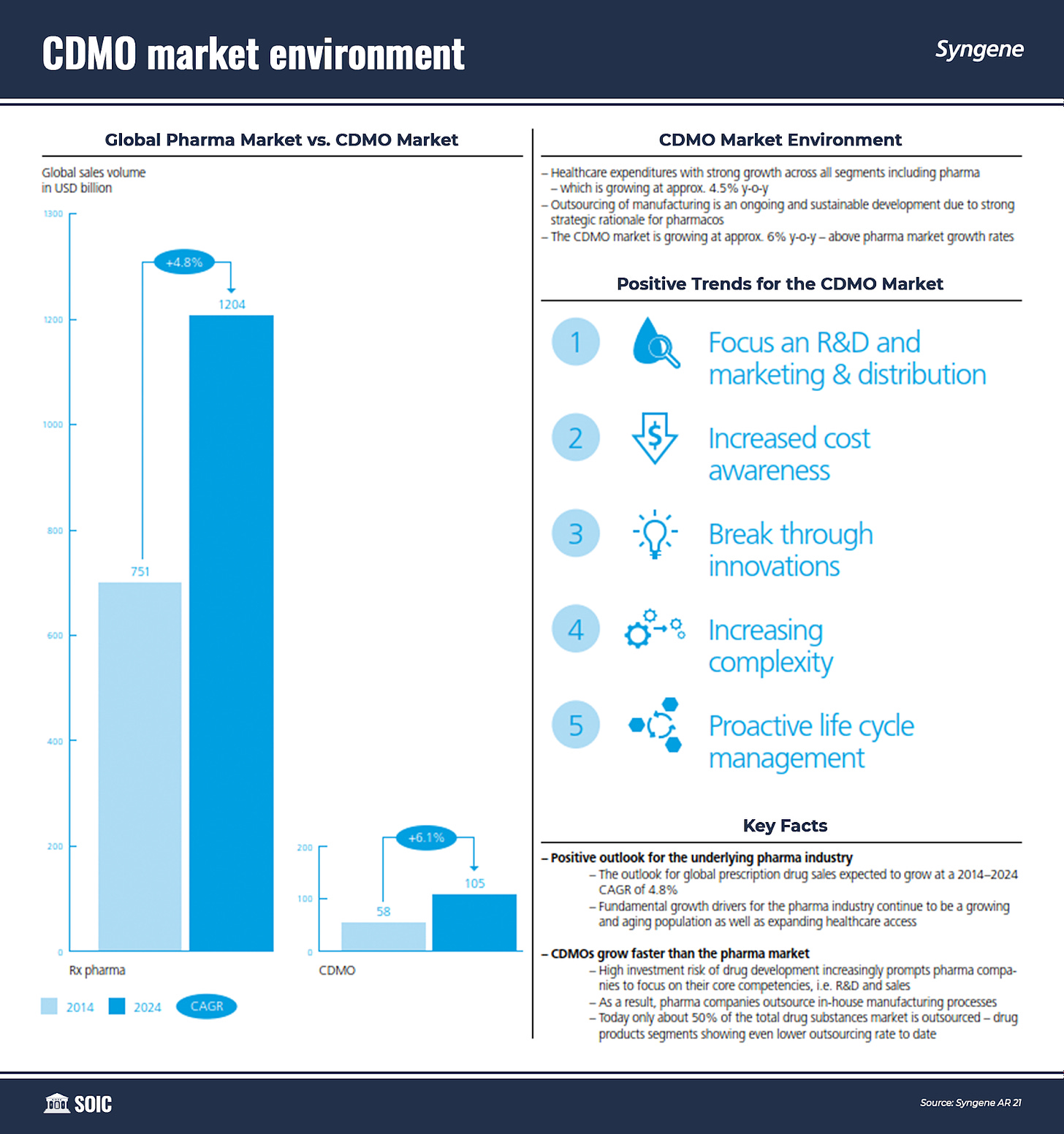

Syngene couldn’t have commenced its operations at a better time as it was the mid-90s when a structural change was going on in the pharmaceutical industry. A lot of innovator companies started outsourcing their work during that time as it was either cost-efficient or they were growing quickly and required solutions faster.

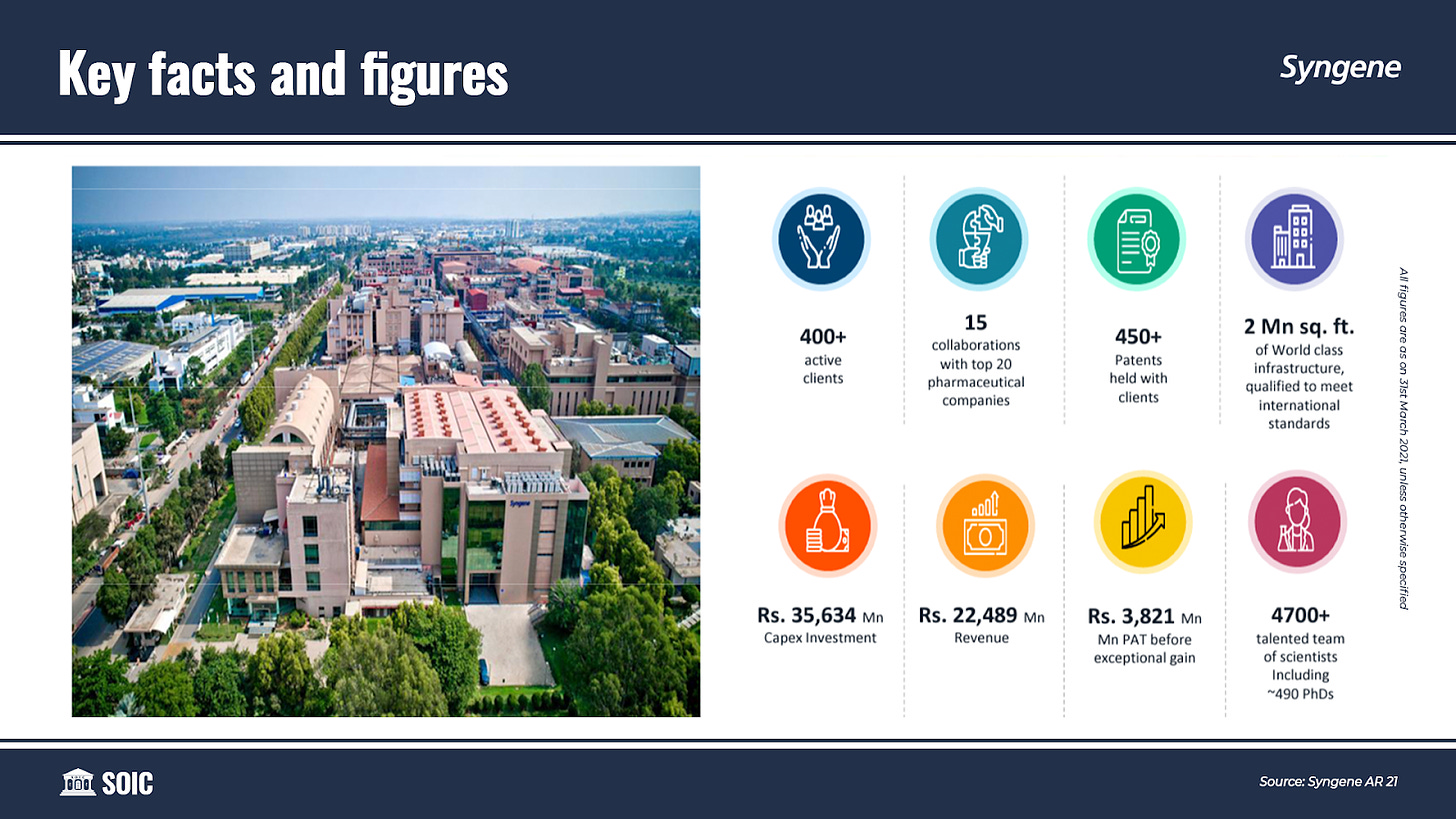

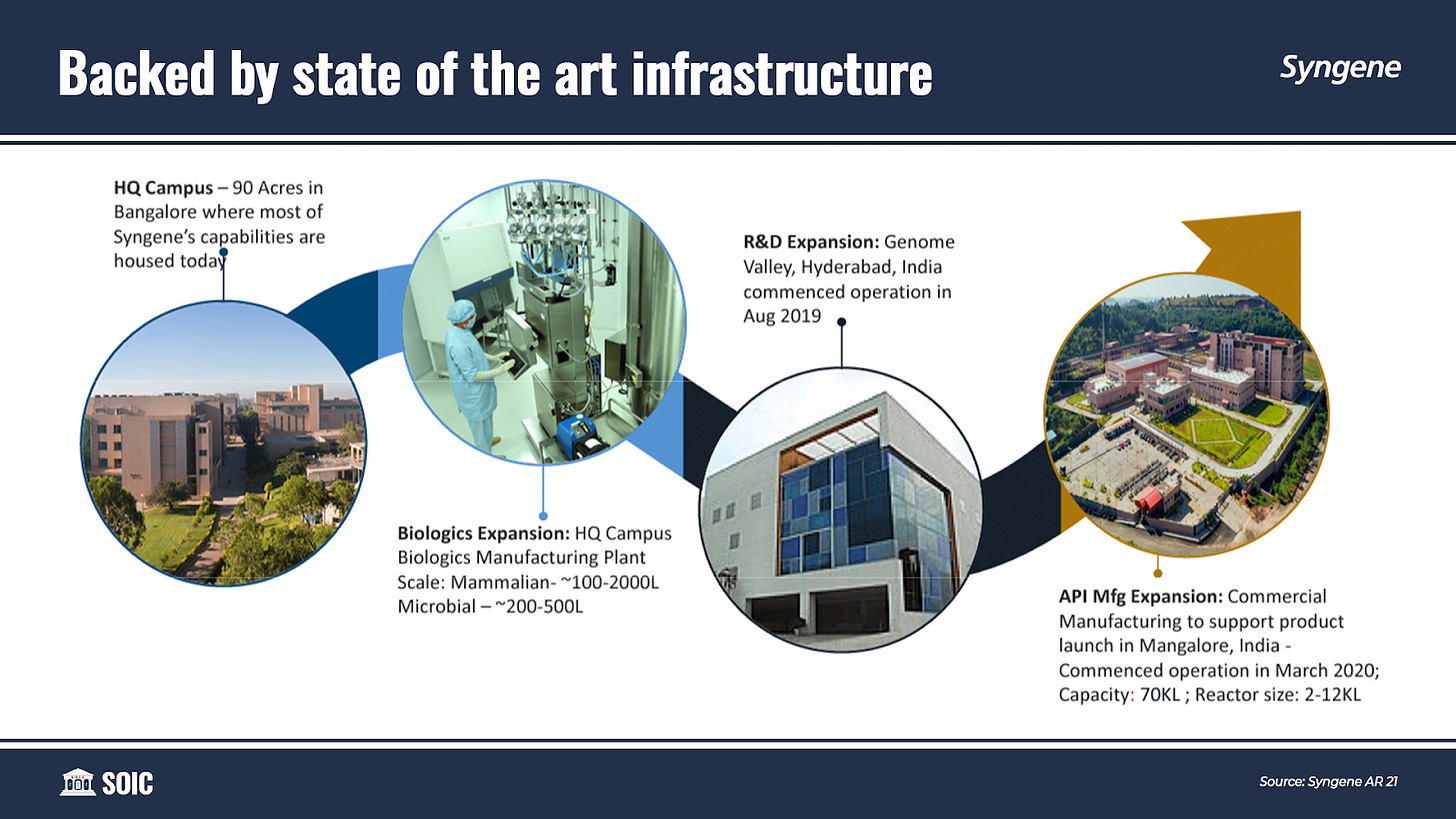

Over the last 20 years, Syngene has scaled up its business beautifully. From 20,000 sq. feet facility in 2001 to 20,00,000 sq. feet in 2021. Moreover, the employee base has gone from just 100 in 2001 to 5,400 in 2021 (out of which 4,700 are scientists including 490 PhDs). A balance sheet size of $550 million which was just $5 million in 2001—With a seed capital of less than $0.5 million from its parent company, Biocon in 1994. Since then, Syngene has never raised equity to fund growth, and all capital investment plans were self-funded.

Today, Syngene is the largest CRO player in India in terms of revenues (40% of India-derived CRO revenues) and profitability (75% of India-derived CRO profits).

“I see the macro view for CRAMS as very positive. They are able to deliver quality services at a substantially lower cost offshore. The opportunity is akin to the early 2000s of the IT boom.” — Rahul Guha, Partner and MD, BCG (India)

Way back in 1994, Mr. Narayan Murthy, then chairman of Infosys summarised the business opportunity as “American Revenues, Indian Costs”. The same can be said about the Indian CRDMO industry; Taking science from India to the world and repeating history once again.

Business Driven Investing

“Investment is most intelligent when it is most businesslike.” — Ben Graham in his landmark book, The Intelligent Investor

“These are the nine most important words ever written about investing.” — Warren Buffett, Graham's most famous student

The investor and the businessperson should look at the company in the same way, because they both want essentially the same thing. The businessperson wants to buy the entire company; the investor wants to buy portions of the company. Both will profit from the growth of the intrinsic value of the business they own.

One must have an insatiable desire to cut through to the fundamental building blocks of moneymaking. Everything about a business flows from a nucleus of customers, cash generation, return on invested capital, and growth.

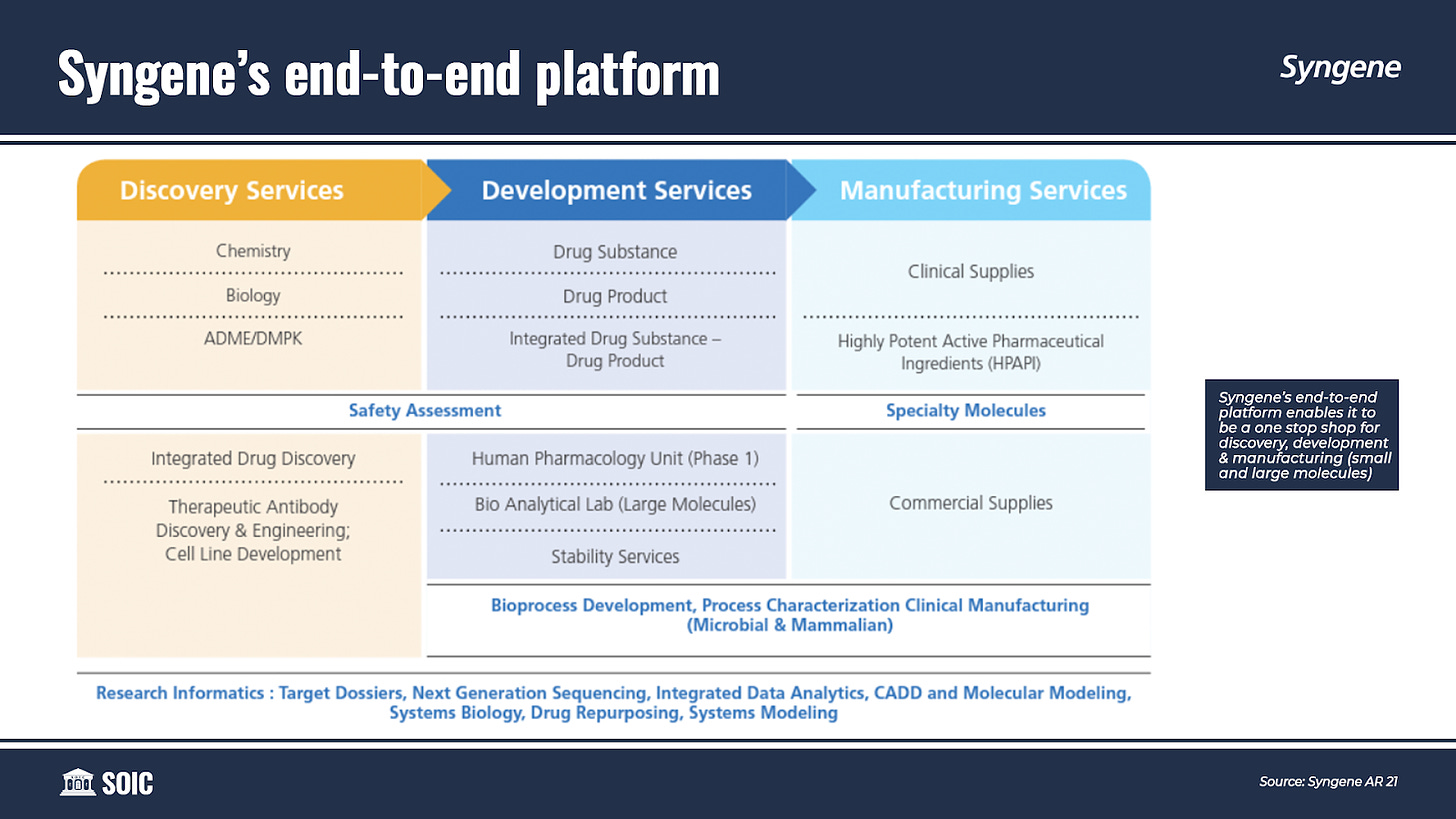

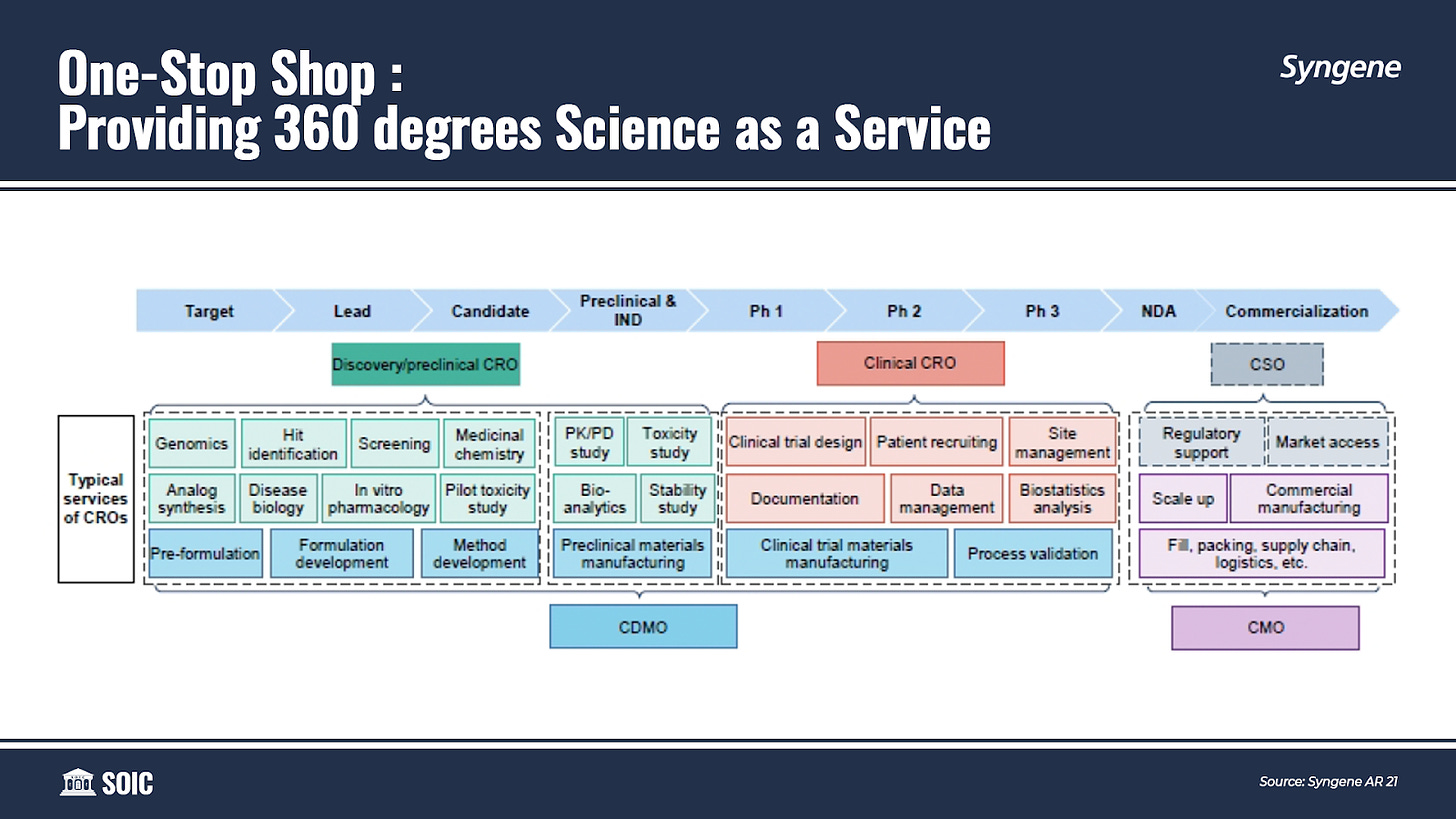

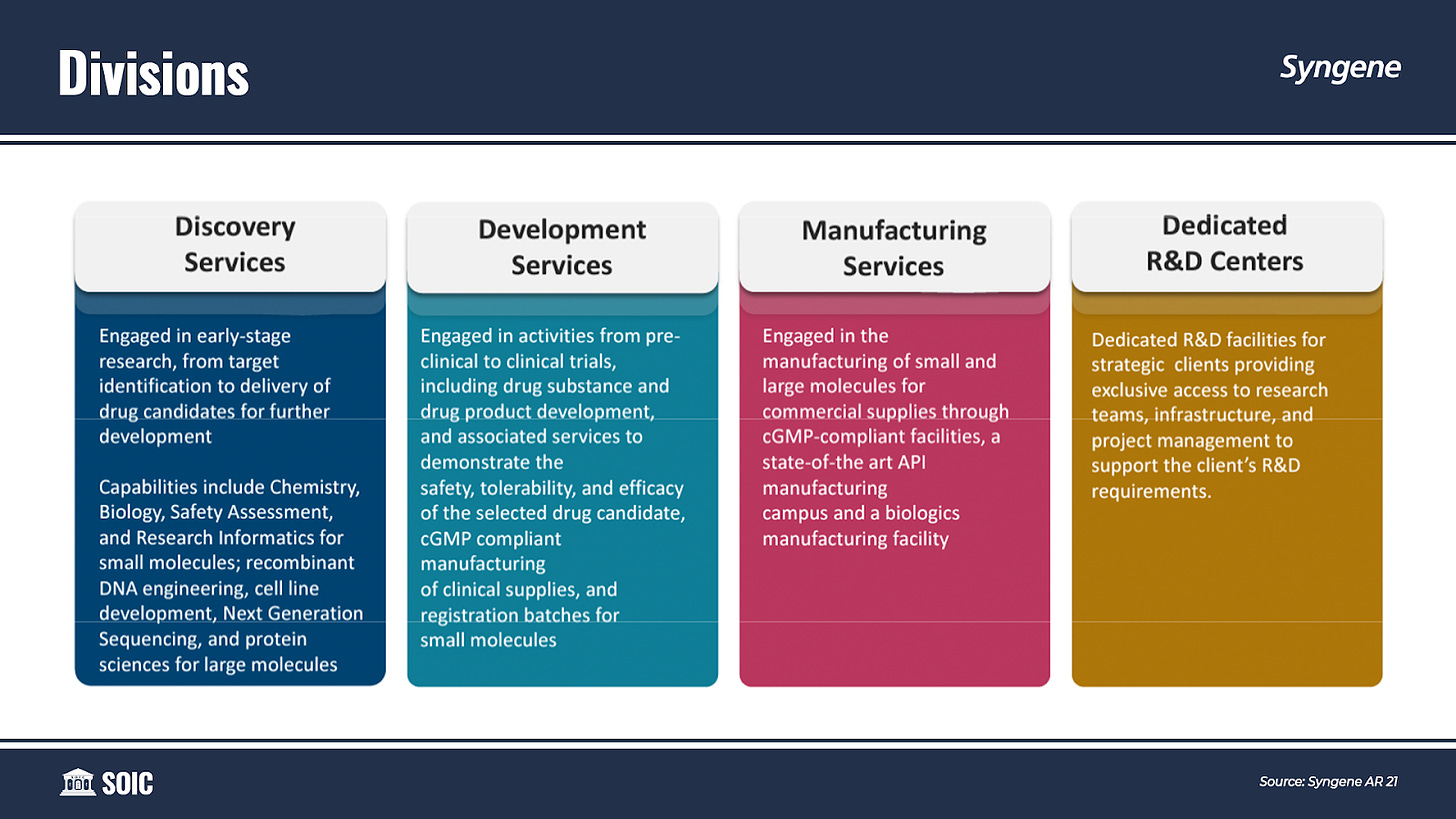

Syngene offers its customers an end-to-end platform tailored to meet their R&D and Manufacturing requirements. It provides seamless and customized services in the Discovery, Development, and Manufacturing of “Novel Molecules” — spanning across a wide spectrum of modalities including Small and Large molecules, Antibody-Drug Conjugates (ADCs), Peptides, Oligonucleotides, PROTACs, and CAR-T.

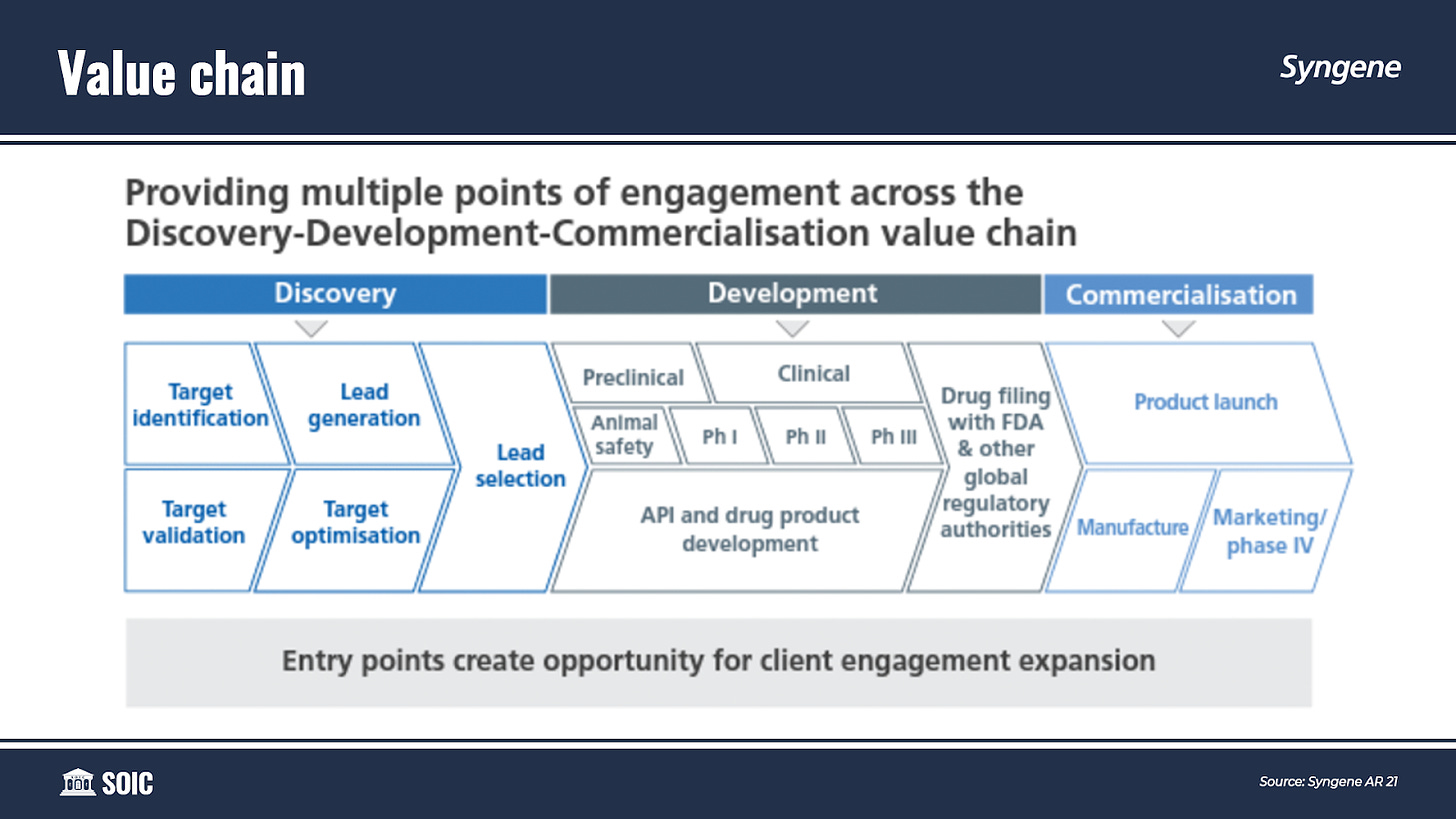

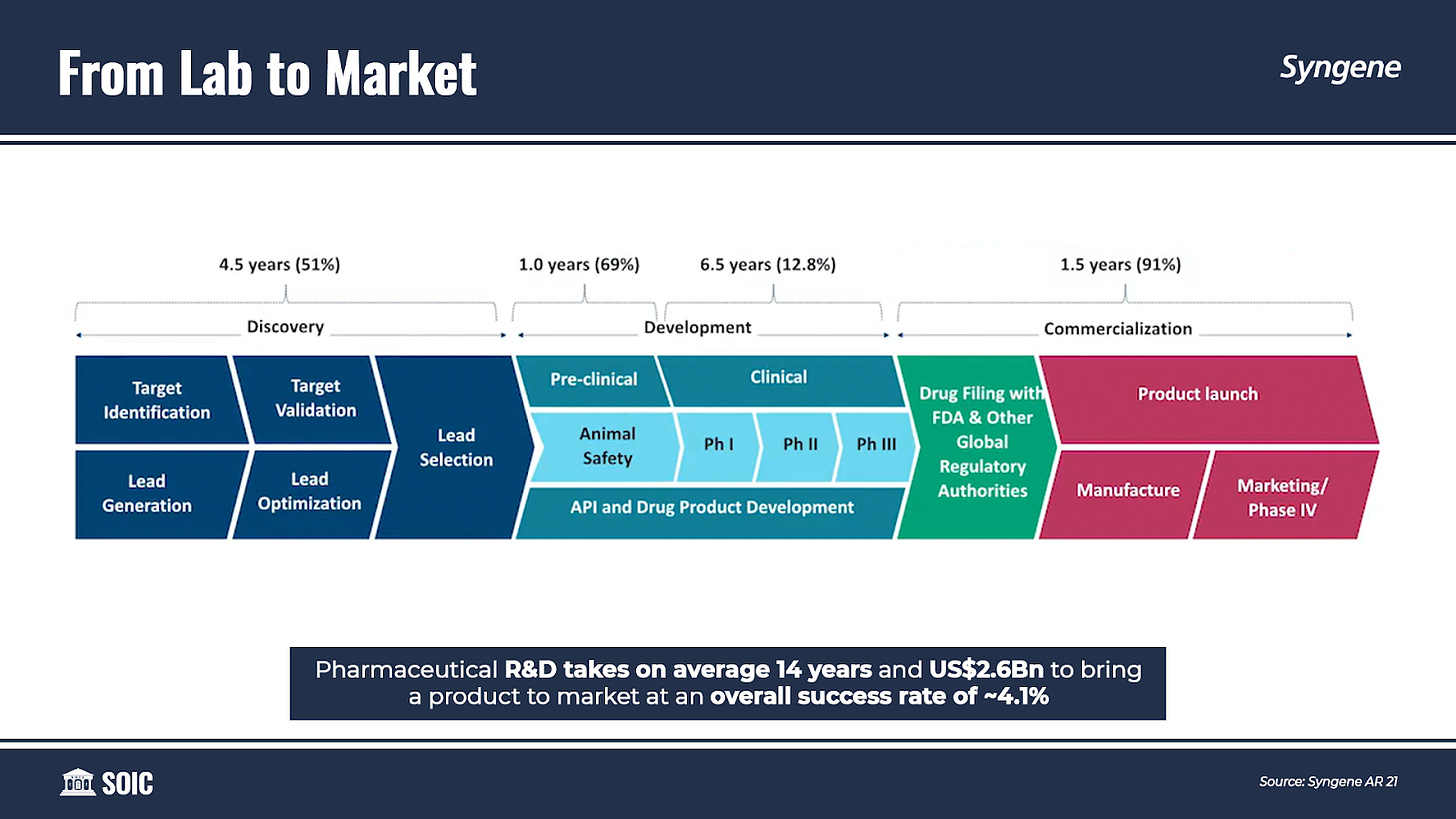

If you look at the value chain of a drug, it can be broadly classified into three phases— Discovery, Development, and Commercialisation.

Over the years, pharmaceutical companies have significantly reconfigured their activities. There was a time when being vertically integrated made sense for pharmaceutical companies because the cost of coordination was too high. As the industry has developed, various components of the value chain have become modules. This process of modularization has allowed the industry to flip from vertical to horizontal.

Syngene has a ‘Plug-and-play’ business model that creates opportunities for increased customer engagement and project expansion across the continuum.

This provides clients with multiple entry points across an integrated operating structure allowing Syngene to engage with the client at any point of the molecule’s discovery and development journey and ‘following the molecule’ to its commercialization.

What Syngene essentially does is mimick the entire value chain of its client; mirror the core capability replicate it in India and offer them back as a service with a cost advantage. This cost advantage ranges between 40-50% which is quite significant.

In essence, Syngene is not much different from its clients. The only distinction Syngene has is of not having its own pipeline and only putting its clients’ science to work.

This is a trade-off Syngene has made. Trade-offs are a critical milestone on the path to strategic positioning. Trade-offs are the strategic equivalent of a fork in the road. If you take one path, you cannot simultaneously take the other. By making this trade-off, Syngene simply eliminated conflict of interest and by ensuring the protection of its clients’ IP, gained the trust of global innovators, which is paramount.

The purpose of Syngene is two-fold:

To shorten the distance of the drug from lab to life by bending the curve of cost and time.

To convert its clients 'fixed' R&D and Manufacturing costs into a 'variable' cost.

Over the years, timelines, and costs for moving from R&D to commercialization have increased. Pharmaceutical R&D takes on average 14 years and $2.6 billion to bring a product to market at an overall success rate of just over 4%.

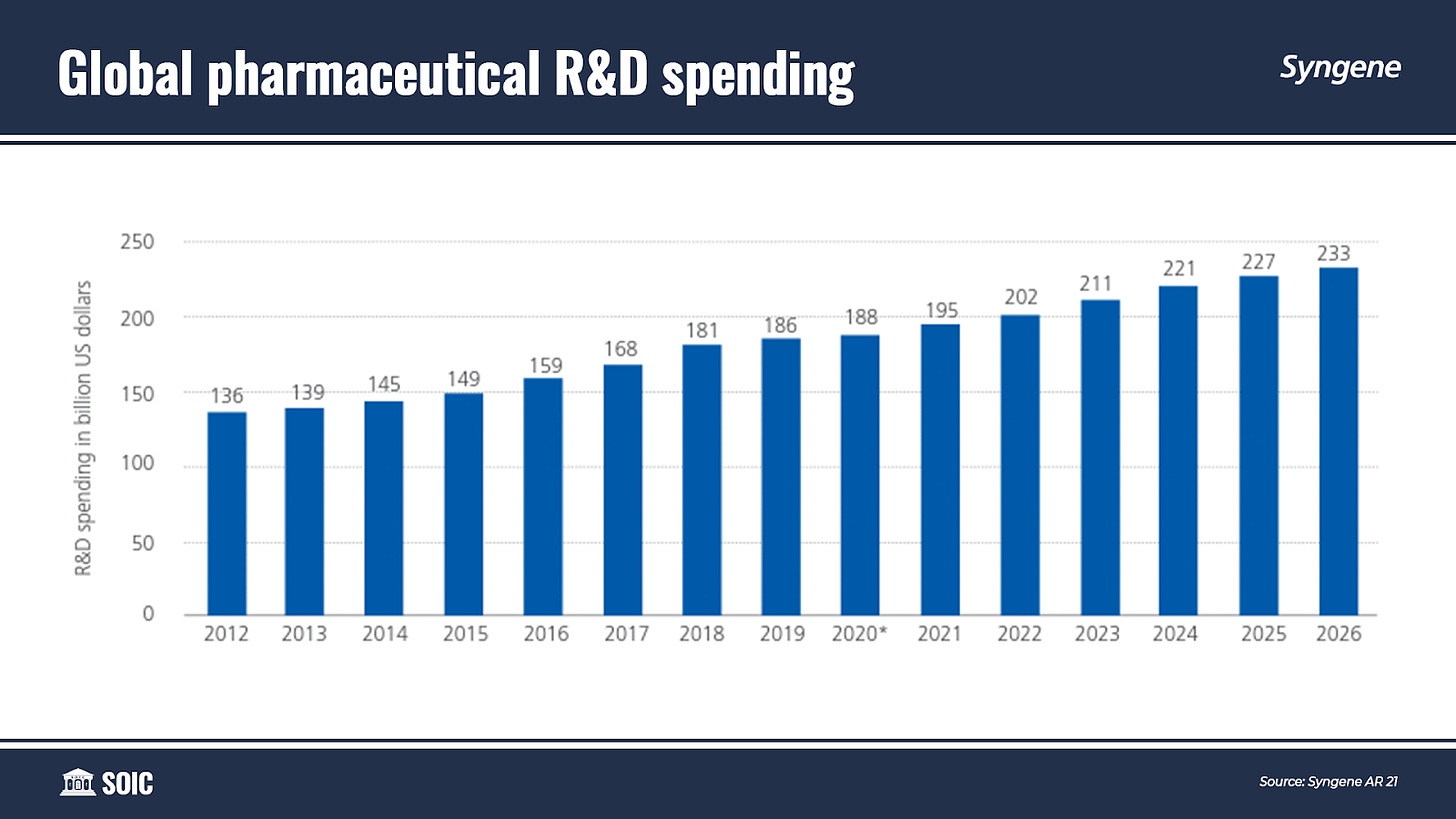

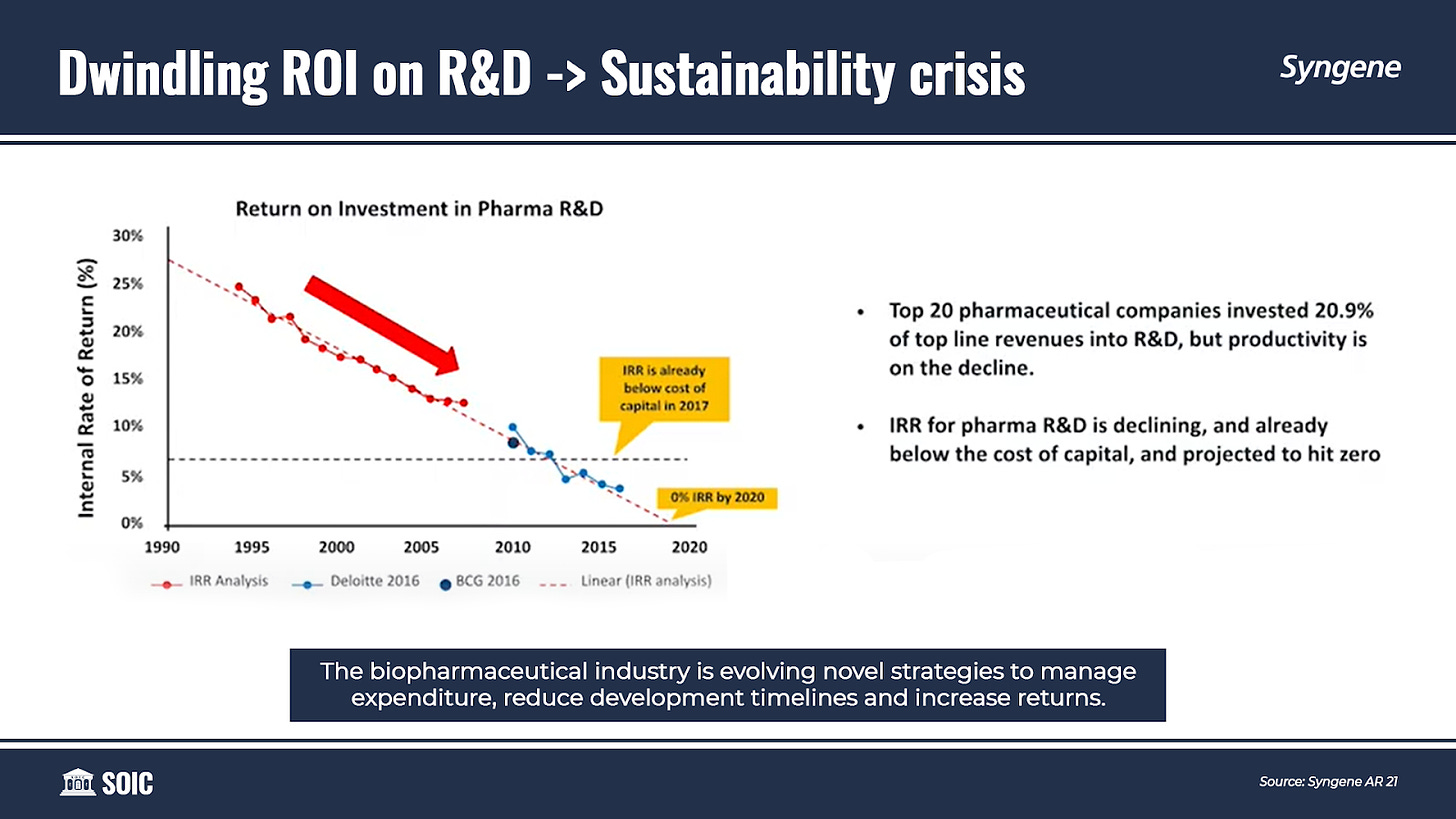

While R&D spending is increasing, innovator companies continue to be challenged by the declining return on investments in R&D. In the pharmaceutical industry, a considerable proportion of drug candidates fail during the regulatory process. This increases the average cost to develop and secure marketing approval for a new drug.

The declining returns are encouraging many drug developers to outsource large parts of their R&D activities, along with leveraging new technologies, to make drug discovery and development cost-efficient and faster.

The pharmaceutical sector’s growing dependence on CROs can be inferred from the fact that the latter was involved in 50% of drug development work in 2018, up from 18% in 2006. There is ample scope for growing the CRO services market as 70-75% of R&D spending by the global pharmaceutical industry can potentially be outsourced.

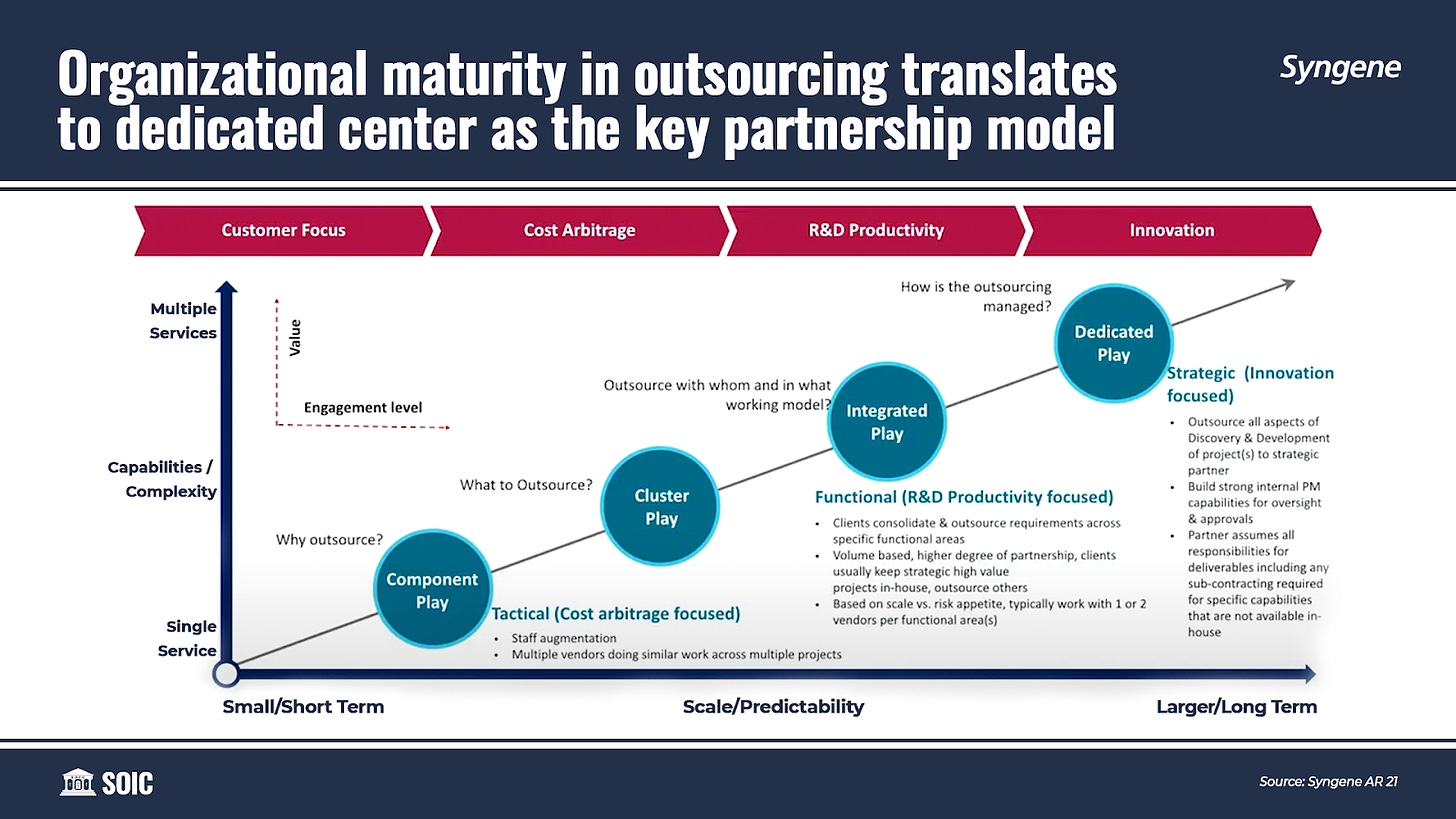

Over the years, R&D outsourcing has gradually transitioned from being largely a cost arbitrage strategy to one of enhancing R&D productivity and speed-to-market and strategic choices being made by innovator companies to focus on their core competencies.

This strategic relationship is mirrored in the increasing range of services being offered—If a drug company wants, it could do no work of its own at all, outsourcing the entire process to CROs.

The interplay of several factors positions the CRO industry to grow steadily in the coming years:

Expertise to manage complexities: With their extensive scientific expertise and regulatory knowledge, CROs help client companies efficiently navigate the complexities of the drug development process. CROs are also increasingly adopting and integrating advanced technologies, such as high-throughput screening, bioinformatics, and cheminformatics, to accelerate the discovery and development of a compound and improve R&D efficiency. According to research by Frost & Sullivan, the development duration for a new drug can be reduced by one-quarter to one-third with the help of CROs.

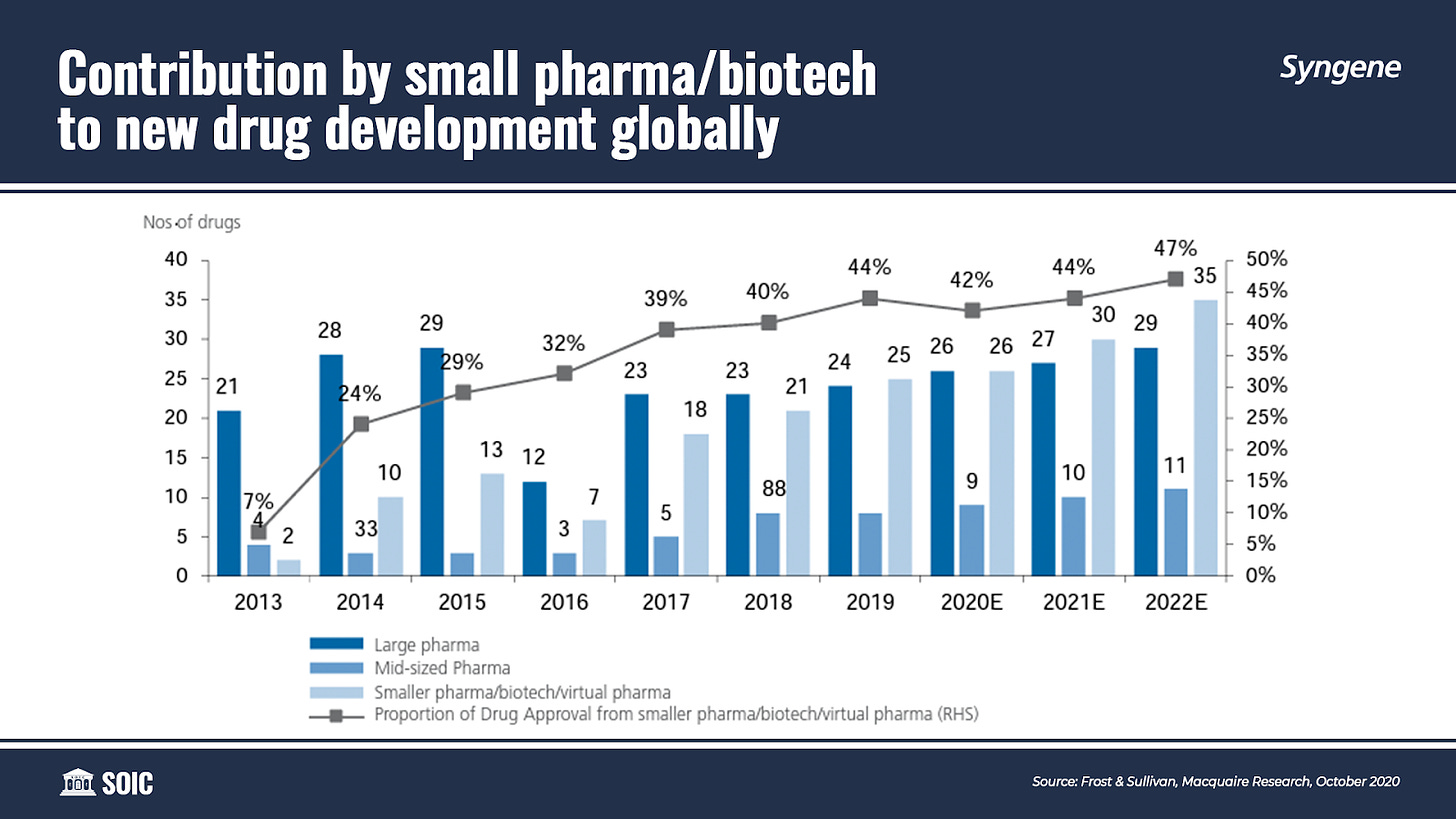

Partnering innovation in newer areas: The emergence of novel biological targets and therapeutic modalities offers promising opportunities for breakthrough drugs. The rising demand for personalized medicines also calls for innovation. However, biopharmaceutical companies, especially startups, do not always have the necessary expertise in-house to make the most of these developments. These emerging and virtual biotechnology companies often lack the internal infrastructure to run their research. Entering into strategic collaborations with specialized CROs and leveraging their broad spectrum of services increases the possibility for client companies to discover and develop advanced therapies. With a growing number of small biotech players in the market and their important contribution to the global R&D pipeline, the demand for CRO services is expected to further proliferate.

Driving flexibility in costs: Under the outsourced model, the client’s need to invest in in-house facilities, equipment, technology, and manpower has significantly reduced. This enables them to convert their traditional fixed costs into variable costs, thereby minimizing their investment risk. Small and mid-sized firms also find the externalization of R&D attractive as they can access high-quality services without committing to longer-term investments.

Along with R&D outsourcing, there is a rising trend of outsourcing manufacturing as well by Global Innovator companies. And if you think about it, it is quite rational.

Put yourself in the shoes of Global Innovator companies (such as Pfizer, Sanofi, Amgen, Bristol Myers Squibb, Novartis,…) You have put in all the hard work and finally occurred on a major technology breakthrough or a life-saving drug. You’ve got the license to print money for the foreseeable future (a patent). But, you don’t have the necessary experience; the capability, or the commercial-scale capacity to ramp up manufacturing.

Let’s suppose you have put in the commercial-scale facility, which you will have to do while the drug is still in clinical stages as it takes 3-4 years and significant upfront investment to build the facility. Your fortune hangs on the possibility of the drug clearing clinical trials successfully and that hangs on probability. If the drug fails, you are saddled with a high fixed cost and a redundant facility.

“For a pharmaceutical company, a major technology breakthrough or fast-track approval of a new drug should be cause for celebration. But happy times can quickly turn sour if the company lacks the necessary experience with commercial-scale production using a new technology or does not have the capacity to ramp up manufacturing.”

— The Boston Consulting Group

These challenges are why CMO/CDMOs exist in the first place. CMO/CDMO contracting became a real force in the late 1990s, addressing the time and expense required for pharmaceutical companies to build new facilities or refit existing ones.

Partnering with a CDMO is a strategic choice by many pharmaceutical companies – from big players to smaller specialty entities. The capital-intensive nature of the business and complexity of the manufacturing requirements are among the primary reasons driving pharmaceutical companies to outsource commercial manufacturing. Additional factors providing a solid foundation for the growth of the CDMO services market include the growing demand for generic medicines and biologics or large molecules.

The manufacture of biologics entails a far higher degree of expenditure and technical capabilities in comparison to small molecules. While a small molecule manufacturing facility calls for an investment of USD 30-100 million, the cost of building a large biotechnological facility can be USD 200-500 million.

The influx of small and virtual biotech players who lack the expertise or the infrastructure to manufacture their products in-house is also augmenting the global pharmaceutical CDMO market. Over 40% of innovative molecules are being developed by emerging biotech companies without later-stage manufacturing capabilities.

The ability for large pharmaceutical companies to rely on outsourced facilities and smaller companies with a lack of in-house production sites has provided the CDMO market the opportunity to flourish.

An important trend being witnessed in the CDMO market is that innovators prefer to enter into a strategic alliance with a one-stop-shop service provider (like Syngene) who has been involved in the discovery and development process because it helps to make the transition into commercial manufacturing more efficient and faster.

When it comes to drug commercialization, clients increasingly prefer to collaborate with service providers who have been involved in the discovery and development process. The primary reason for this is to leverage the extensive process knowledge gained while advancing the molecule along the value chain making drug commercialization simpler, seamless, and faster. Partnering with a single service provider eliminates the need for knowledge and technology transfers throughout the process accelerating time to market.

It is based on this insight that Syngene intended to evolve its strategy further broadening it from Discovery and Development focused to become a fully-fledged Contract Research, Development, and Manufacturing Organization (CRDMO) providing 360 degrees Science as a Service.

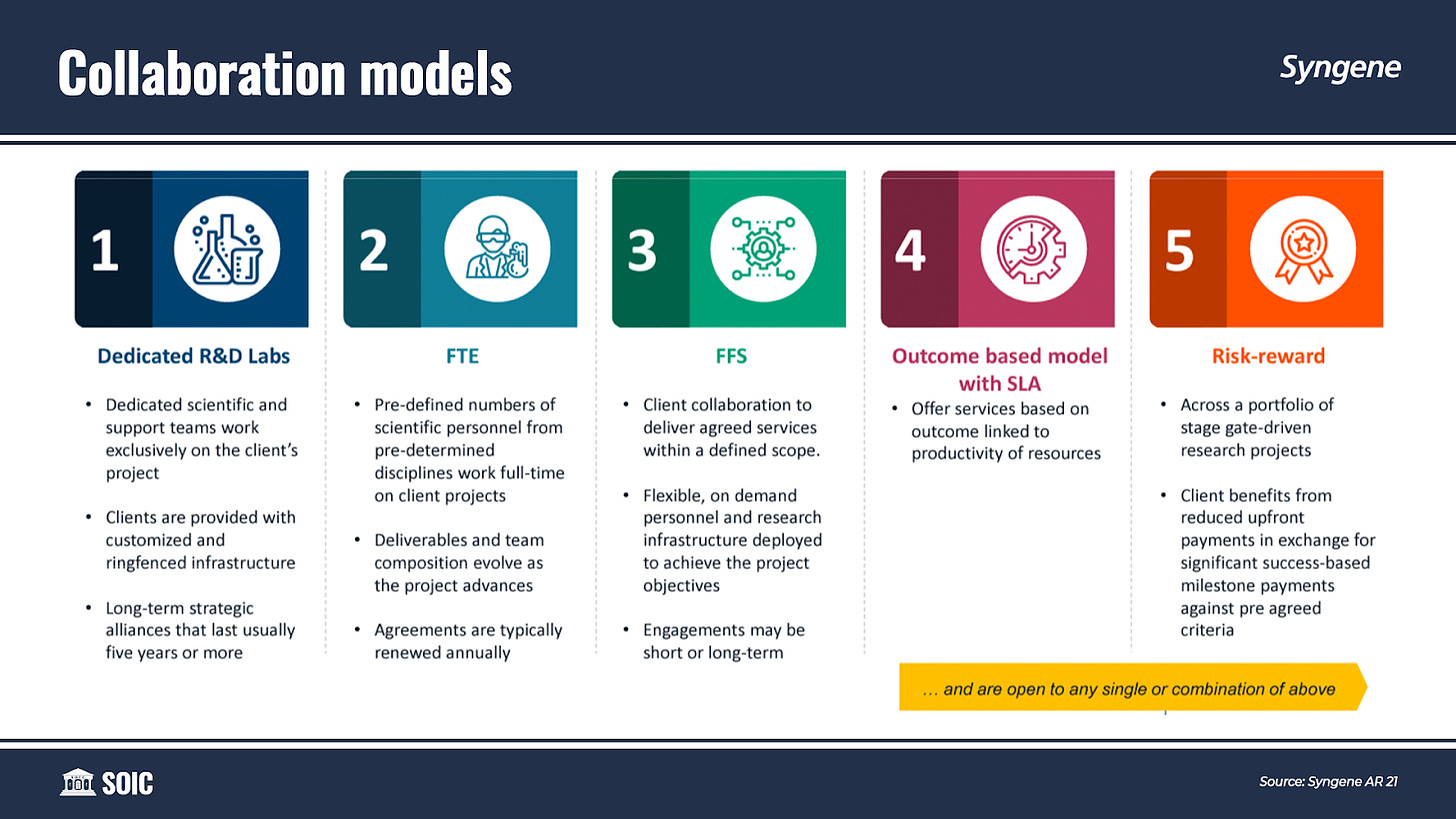

Syngene offers a range of collaboration models that assist flexibility and customization to meet individual requirements. Clients can select a single model or a combination to suit their R&D and Manufacturing requirements.

The collaboration models are:

Fee For Service (FFS): In FFS contracts, Syngene generally agrees to fixed prices for agreed services within a defined scope. While they may seek additional payments for work required outside the defined scope, they bear the risk of cost overruns for work within the scope. Flexible, on-demand personnel and research infrastructure is deployed to achieve the project objectives. The Engagements can be short or long-term.

Full-time equivalent (FTE): In FTE contracts, pre-defined numbers of scientific personnel from pre-determined disciplines work full-time on client projects. Syngene typically bills based on the number of scientists deployed. FTE contracts can be both long-term and short-term. In long-term contracts, clients agree to a minimum utilization of a specified number of scientists dedicated to that client’s work. The scope of services, deliverables, and team composition under FTE contracts generally evolve as the project advances. Under an FTE contract, the client pays Syngene a fixed amount without regard for the project’s eventual success or failure. Syngene agrees to absorb a certain quantum of material costs and then charge any additional spending on materials to the client. FTE contracts are generally renewable annually.

Dedicated Centers: The Dedicated Centers involve long-term strategic collaborations, usually for five-year periods or longer. As part of these long-term collaborations, Syngene sets up a dedicated, customized, and ring-fenced infrastructure, in line with the client’s requirements. These Dedicated Centers are generally multi-disciplinary, Full-Time Equivalent (FTE) based engagements that support a wide array of integrated R&D requirements of the clients.

Risk/Reward: In this collaboration model, the client benefits from reduced upfront payments in exchange for significant success-based milestone payments against pre-agreed criteria. It is provided across a portfolio of stage gate-driven research projects.

An outcome-based model with SLA: In this collaboration model, Syngene offers services based on outcomes linked to the productivity of resources.

Syngene is generally able to recover, at minimum, its investment costs when contracts are terminated. These contracts often require payment to Syngene of expenses to wind down a study or project, payment of fees earned to date, and, in some cases, a termination fee.

These contracts are usually priced in U.S. dollars and Syngene incurs costs, including employee and a significant portion of material costs relating to those contracts, in Indian Rupees — “American Revenues, Indian Costs”.

Resilience, Optionality, and Beyond Discounted Cash Flow

The most powerful investments merge dualities into one. This is where investment returns are at their most nonlinear. Syngene embodies both resilience and optionality.

While Syngene divides its business into four verticals: Discovery Services, Development Services, Manufacturing Services, and Dedicated R&D Centers. I think of Syngene as having two verticals: A vertical which consists of Discovery Services, Dedicated R&D Centers, and Development Services which are resilient and linear, and another vertical of Manufacturing which adds an element of optionality to the business.

Discovery Services usually start with a single service (component play), client engagement gradually leads to an expanded scope of services (cluster play) and eventually into an integrated play, where Syngene engages across multiple platforms, including setting up Dedicated Centers.

The Dedicated Centers involve long-term strategic collaborations, usually for five-year periods or longer. These Dedicated Centers are generally multi-disciplinary, Full-Time Equivalent (FTE) based engagements that support a wide array of integrated R&D requirements of clients.

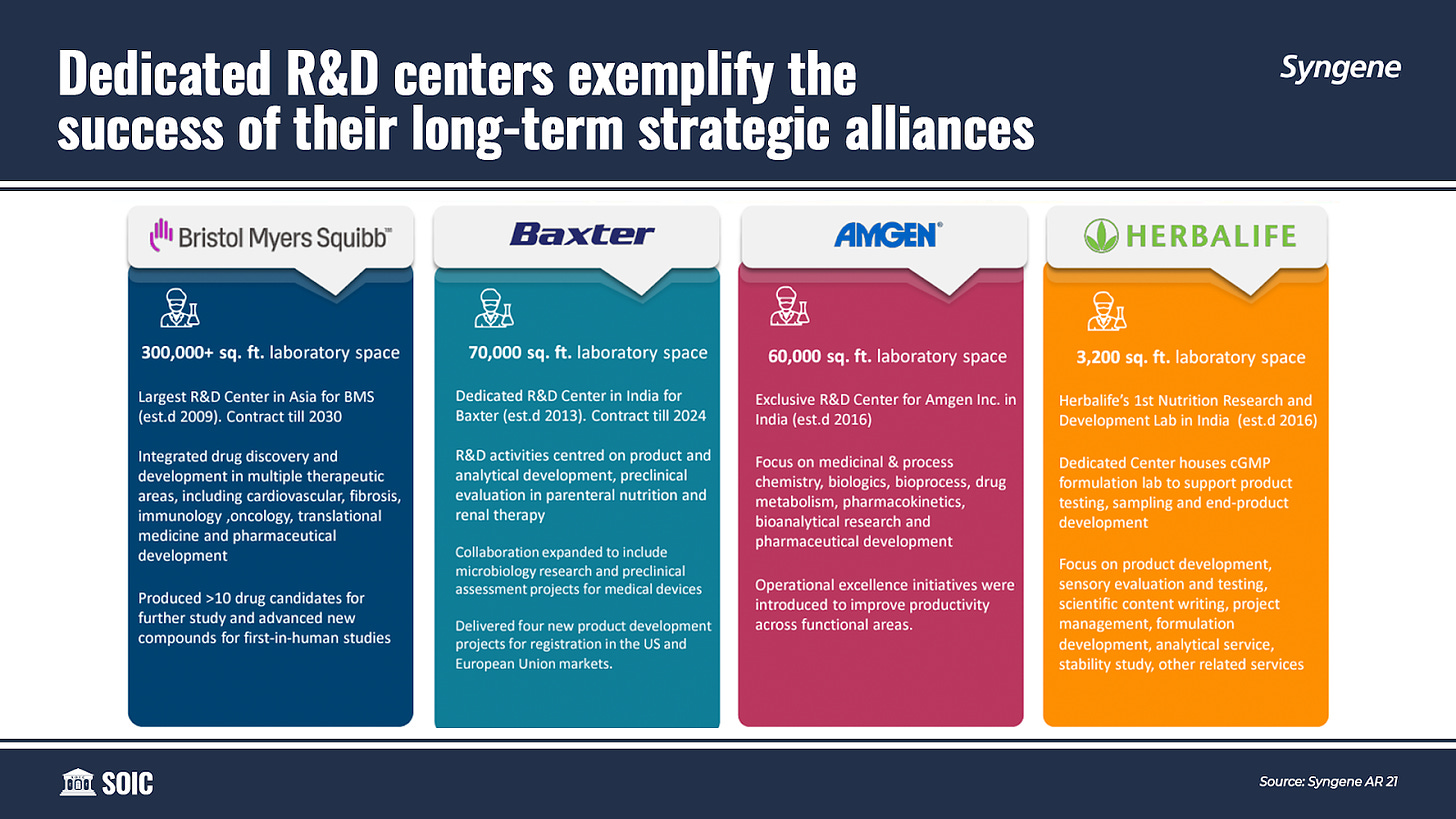

Syngene has set up dedicated research centers for four of its clients. These four dedicated R&D centers represent some of Syngene’s deepest client relationships, including Bristol Myers Squibb (BMS), Baxter Inc., Amgen Inc., and Herbalife.

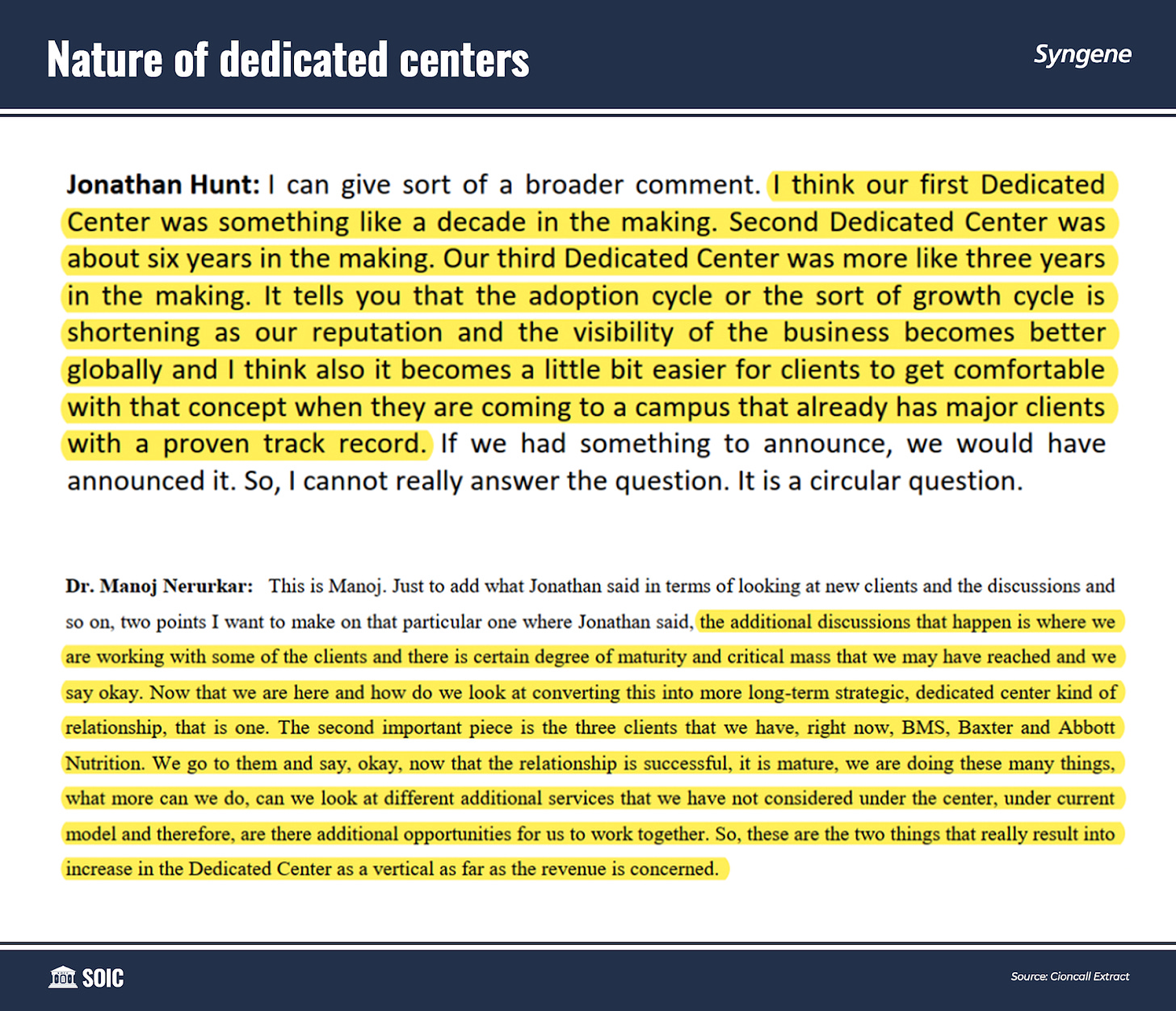

Jonathan Hunt credits Syngene’s success in part to the relationship with Bristol Myers Squibb that dates back to 1998. Syngene established a dedicated research facility for the US drugmaker in 2009 which he believes to be an inflection point for the company. It took 10 years for Syngene to be an overnight success.

Earlier in 2021, Syngene announced the addition of a new 50,000 sq.-ft. dedicated lab space to the facility. Syngene will additionally add 200 researchers—a 40% increase—to its staff as part of an extension of its contract through 2030. The center is the largest BMS R&D site run by a partner. This (the contract extension) shows that Syngene is getting something right if a client wants to extend their relationship for a whole decade, instead of a standard year.

Syngene has used this strategic partnership with BMS as a case study and has subsequently brought down the adoption cycle for other dedicated centers that it has built.

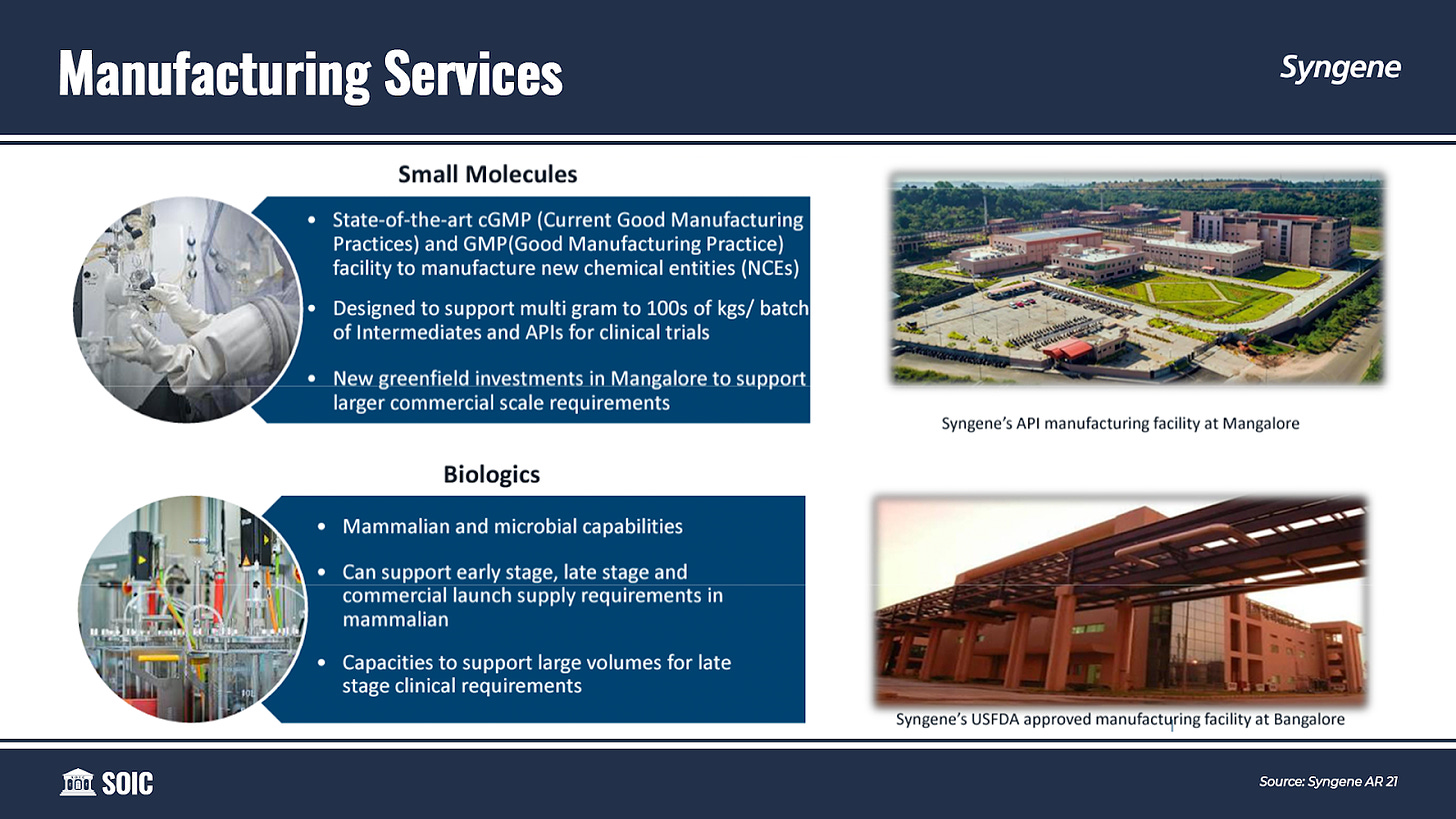

Under Development Services, Syngene offers preclinical development, API, and drug product development for both small and large molecules. It offers drug development services from lead generation to clinical supplies of drug substances and drug products. Clinical development services are across Phase I, II & III trials. It also supports its clients in drug filing with FDA and other global regulatory authorities. Seamless integration of these disciplines has enabled Syngene to establish a successful model for delivering on Chemistry, Manufacturing, and Control (CMC) projects.

Syngene offers Development Services as both stand-alone services, and as defined integrated activity bundles.

One of the strategic priorities for Syngene is to deliver added value from integrated, end-to-end discovery and development projects.

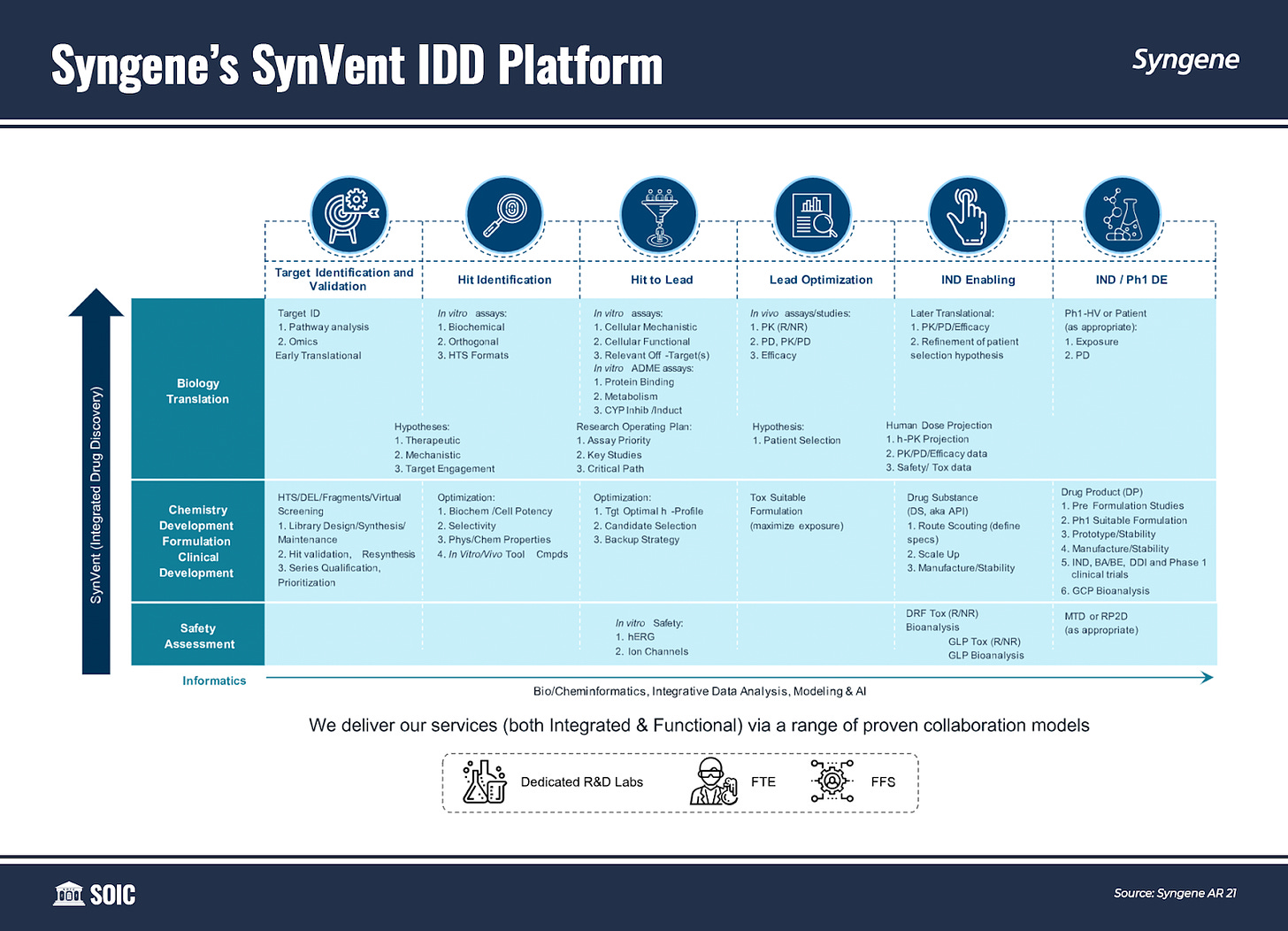

SynVent is Syngene’s proprietary platform for fully integrated therapeutic discovery and development across large and small molecules, as well as specialty modalities such as targeted protein degradation. SynVent Integrated Drug Discovery (IDD) services are designed to provide the most effective and efficient means to conduct target validation, translational interrogation, therapeutic discovery, and preclinical development for its clients. Executing End-to-End (E2E) discovery and development programs in collaboration with or on behalf of clients.

SynVent IDD delivers exponential value to its clients: seamless project management between Syngene discovery and development services teams; enhanced project visibility as the scope of client engagement is spread across multiple services; elimination of technology transfer and other logistical issues; and substantial potential to reduce project timelines and costs.

To grow its SynVent IDD platform, Syngene has restructured Discovery and Development Services by bringing each division under a single umbrella to drive internal alignment of its services and become the preferred partner for end-to-end projects.

One notable strategic collaboration Syngene has done under this platform is with Deerfield Discovery and Development (3DC), the drug discovery and development subsidiary of Deerfield Management Company is a healthcare investment firm, that backs innovative startups with outsized ambition, in healthcare, pharmaceuticals, and biotechnology space. Under this initial five-year contract, Syngene will execute a portfolio of fully integrated drug discovery programs. Many of these programs will represent novel biological targets with first-in-class opportunities. This partnership puts Syngene at the center of a network including some of the world’s most notable academic institutions and drug discovery innovators.

These divisions of Syngene are linear and somewhat resilient. Syngene needs to add scientists, almost on a one-to-one basis, to grow its revenue for these divisions—One scientist is one unit of growth. This hinders its ability to scale business non-linearly.

Syngene’s strategic decision in 2015 to “follow the molecule” to commercialization, has embedded an element of optionality and non-linearity to its business.

Nobody knows how well the molecules will do when they commercialize if they commercialize. This uncertainty is good. Financial returns higher than a market benchmark are most likely to be found in Unknown, Unknowable, and Unique situations. These returns are caused by the fact that investments in UUU environments are much more likely to be mispriced.

This uncertainty gives Syngene real option value—real options capture the value of uncertain growth opportunities. So, go beyond discounted cash flow!

“It is in these extremes that investing resides. Despite what the CFA foists on the young and innocent you cannot choose a level of risk and return along a classic bell-curve to suit your portfolio because that is neither accepting the deep uncertainty of the world nor acknowledging that the skew of returns is so extreme that it is the search for companies with the characteristics that might enable extreme and compounding success that is central to investing. But distraction through seeking minor opportunities in banal companies over short periods is the perennial temptation. It must be resisted. This requires conviction.”

— James Anderson

Optionality is the property of asymmetric upside with correspondingly limited downside. Most interesting options are free, or at the worst, cheap. In Syngene’s case, it’s almost negative as it gets paid for creating the optionality for itself—of molecule going to commercialization.

However, Syngene does have to put upfront investments in facilities and will probably not earn anything from it for the initial 4-6 years. But, this looks bad only on the “accounting statement”. In reality, it’s a feature not a bug as the nature of the business is such that costs are front-ended and returns are back-ended, making barriers to entry higher.

Moreover, demand for pharma CDMOs is outpacing supply by 16 to 24 months, and a gap remains for future capacity as the pipeline of therapies being developed continues to grow dramatically. Given the relationships and capabilities that Syngene has, I won’t be surprised if its customers pay to wait in production lines “years in advance.” Especially for Biologics Development & Manufacturing as well as for Viral Vector Development and Manufacturing plant which Syngene is building for Cell and Gene therapy.

Heads, I win… Tails, I win a lot!

Imagine a scenario where Syngene supports the innovator in progressing their Research and Development throughout Phase I, II, and III while ensuring the innovator’s IP which is of utmost importance. The scientific services they provide throughout are billed like IT services (cash-in). The low volume, high variety pilot-scale manufacturing of drug substances and the product it provides during the journey yields a very high operating margin to the company (cash in, again!)… Let’s say after X years, the research fails—It is irrelevant for Syngene as it has already got paid, unlike the innovator company who makes money only when the drug succeeds. The scientific talent will move on to the next project and life goes on.

Now, imagine another scenario where after X years of supporting the innovator in progressing their Research and Development, the novel molecule secures regulatory approval and a 15-20 year patent protection. Great news for the innovator but now, the innovator needs to protect IP as well as get the same performance and quality manufacturing by the company. As Syngene already has the knowledge—Syngene gets a multi-year commercial supplies contract which increases in volume/scale for 5-7 years before sales reach a plateau (usually from year 7 onwards) at a very good 25-30% operating margin.

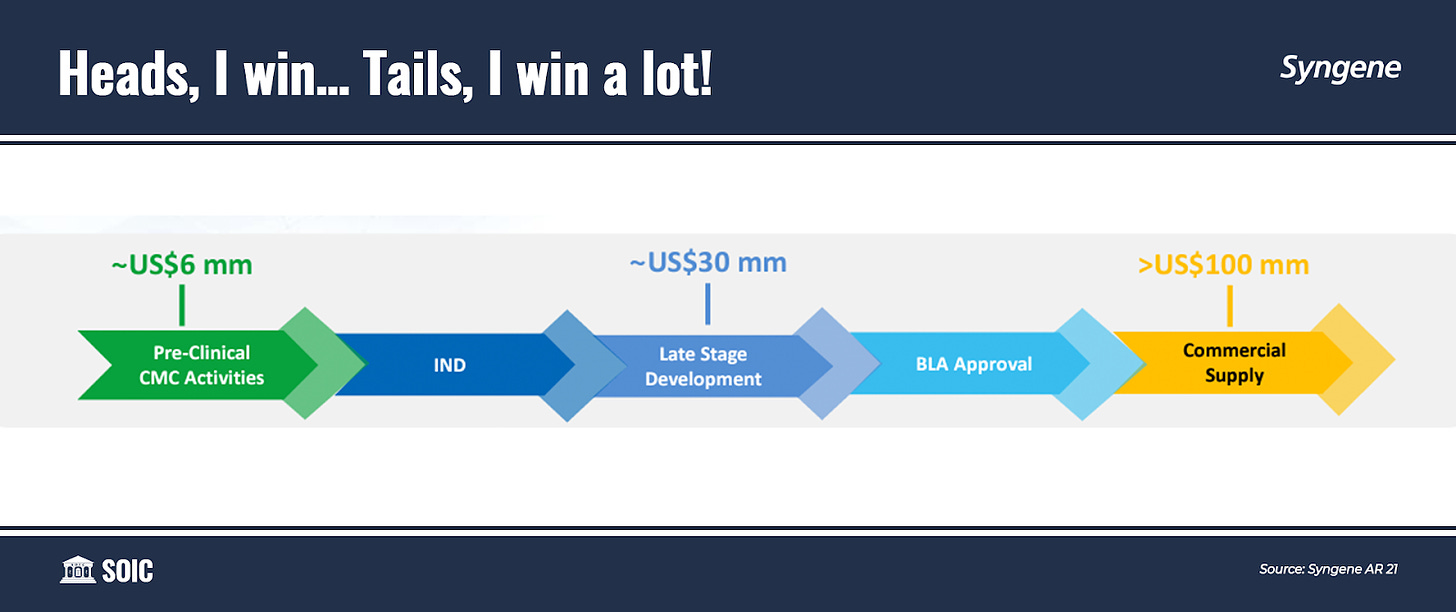

Either way, it’s a win-win for the company. And not just win-win, its win-win-a-lot as the business scales non-linearly when the drug goes commercial as average revenue from each project increases with its stages. From $6 million in discovery to $30 million in late-stage development to over $100 million when it goes commercial.

Return on Invested Capital and Competitive Strategy Analysis

Every investor places a different level of importance on the characteristics they feel are essential, but among all the traits, one of the most common characteristics of quality companies—companies with moats is, a high return on capital. If a business hasn't earned returns on capital substantially exceeding the opportunity cost of capital for 3-5 years, it doesn't have a moat.

The Rokda Test:

Velocity and margin are particularly important to a business because they are the two levers that most directly influence a company’s returns.

Syngene’s NOPAT margin over a business cycle has consistently been in a range of 28-32% with an invested capital turnover of around 1x. Giving it ROIC over a business cycle of 28%, which is comfortably more than the cost of capital.

“… The key thing isn’t margins, it's about value creation beyond the cost of capital and we do that on an enduring and sustainable basis…” — Jonathan Hunt

There are only two sources of competitive advantage: consumer advantage and production advantage. The key to each advantage is the creation of barriers to entry that fend off competition.

Since Syngene gets to a high ROIC through a high NOPAT margin, it indicates it has a consumer advantage. This consumer advantage is switching costs and customer lock-in.

It costs a lot of time, effort, and money for Syngene’s customers to switch.

Moreover, Syngene sells trust, which is hard to be bought and competed away. Innovator companies won’t trade their IP and trusted relationships just to save some dollars. Protection and Confidentiality of IP are indispensable in this industry along with quality standards. And for Syngene all I can ever say is, "so far so good".

“Inside our campus is the mindset is that we are a People’s Republic of the United States FDA (Food & Drug Administration). We operate in a highly regulated industry that has controls, checks, and balances apart from governance and rigor. We operate to a single standard of global science, driven by excellence and a high compliance regulatory mindset. Whether it’s the US FDA, European or Indian regulators, we meet and exceed their standards every day. It is one of the things that reassures our global clients.”

— Jonathan Hunt, CEO, Syngene

High switching costs lock in the customers and incentivize them to stay with Syngene throughout their life cycle. Once the customer is locked in, Syngene gains pricing power. It passes on almost all the wage and materials inflation to its customers.

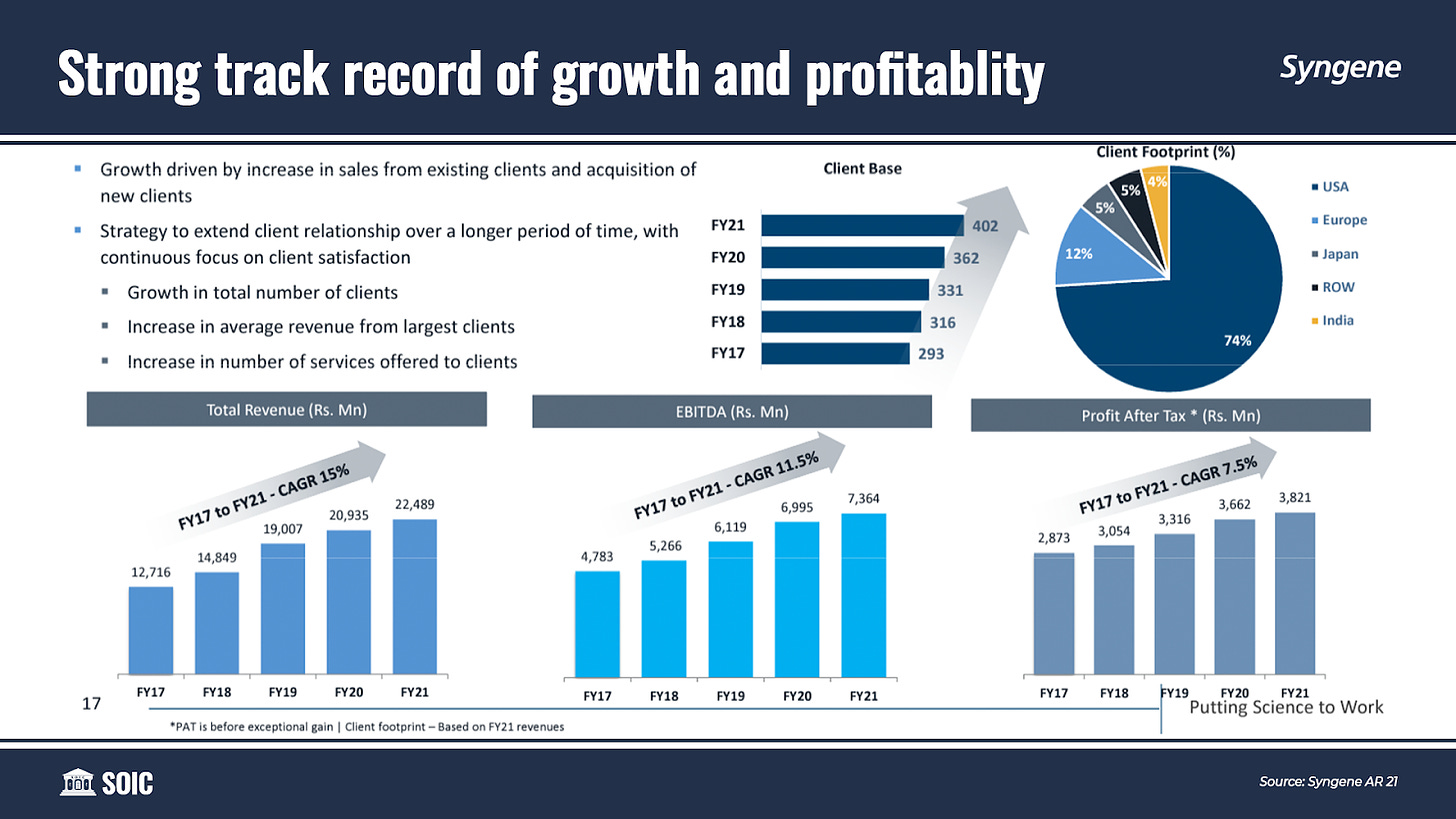

Syngene manages to roll forward 90-95% of the existing business into the next year. Every year, around two-thirds of new business comes from existing clients and the rest from new clients. This demonstrates the company's strong client relationship skills.

Syngene is not just an outsourcing partner but a “co-innovator”— a scientific equal and a source of good ideas and problem-solving solutions for its clients, this translates into stickier clients and longer contracts.

Jonathan Hunt, CEO of Syngene says “Our clients judge us by the company we keep, and the ‘company’ we keep of are world leaders in their field.” And they truly do—eight of the top 10 and 18 of the top 25 biopharma companies in the world are Syngene’s clients.

Syngene delivers science to a wide range of high-entry barrier industrial sectors, including pharmaceutical, biotechnology, nutrition, animal health, consumer goods, and specialty chemical companies.

If real estate is all about “location, location, and location.” Then Syngene’s business is all about “talent, talent, and talent”. Syngene has grown its revenue from just 400 crores in 2011 to 2500 crores in 2021. Moreover, the client base has grown to 400 which was just 100, 10 years back. This clearly shows that Syngene has the ability to acquire, train, and retain talent which adds value to its clients.

“…While we doubled our revenue over the four years, I do not know how you would measure it, but it feels as though we have more than doubled our capability and our competence, and our proven track record. It is a more sophisticated organization and that has continued to evolve in a positive way…” — Jonathan Hunt

Syngene’s business has reached a critical mass where the best talent gets attracted to serve the quality of clients Syngene has and that in turn attracts more high-quality clients. This feedback loop serves as a serious competitive advantage for Syngene.

Cash is king!

People with a limited understanding of business think that business is all about making profits. But those who understand business know that business is all about managing cash flows. Cash is King!

Syngene converts almost 95% of its operating profit into cash, which is extraordinary. Invested wisely, cash improves the company’s money making ability. There’s a psychological component to cash: when a company has its own cash rather than borrowed money, senior managers are more inclined to make bold investments that have greater potential rewards.

Companies with strong free cash flows are less interesting than companies whose free cash flows are held back by high-returning re-investment. Syngene re-invests almost all the cash flow it generates in expanding its capacities, future capabilities, and digitization & automation. All these investments are further entrenching Syngene’s moat.

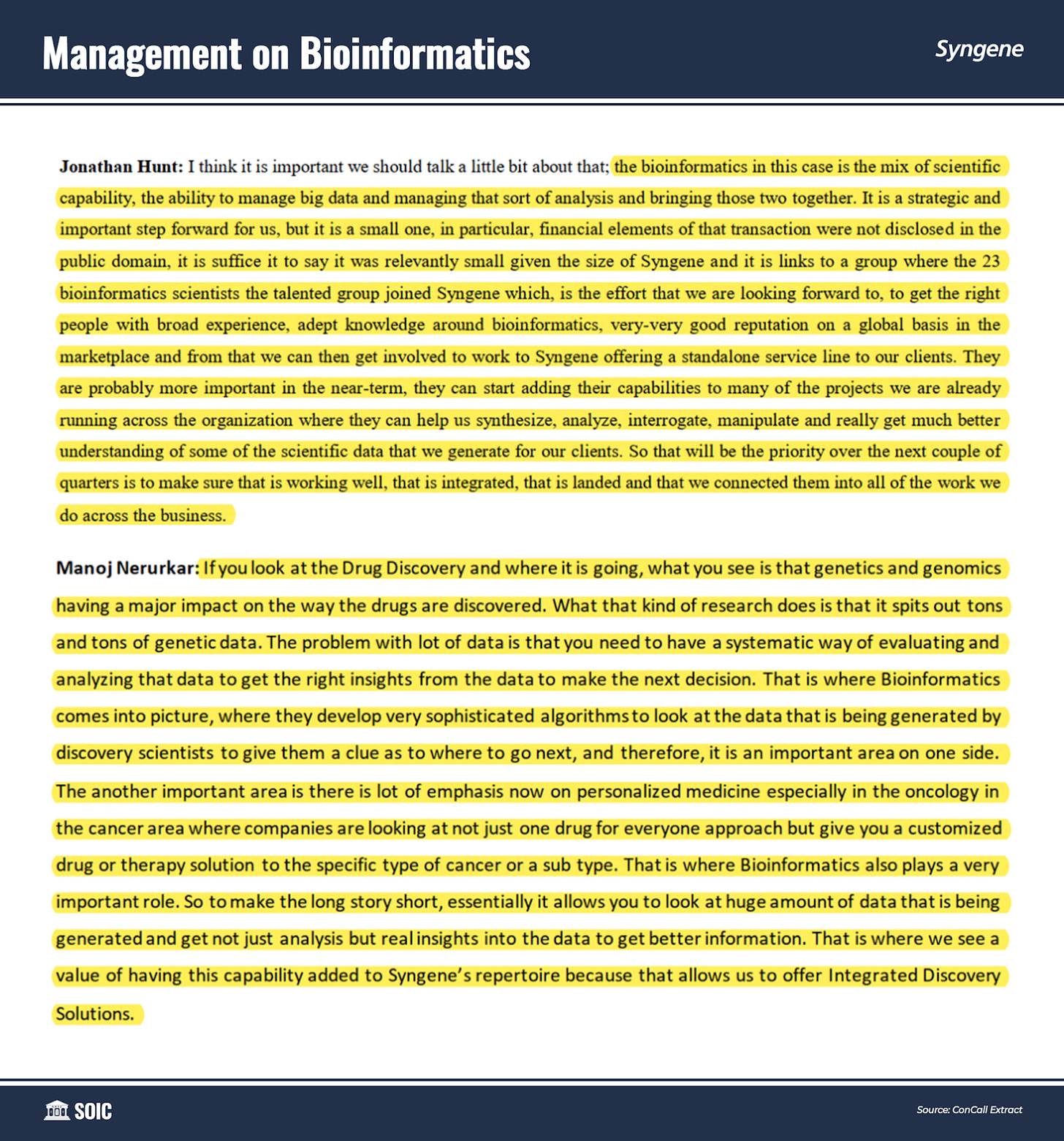

One such investment worth discussing is Syngene’s research informatics capabilities. Syngene has implemented a centralized data repository and has integrated research informatics capabilities across its operating units and enabling functions facilitating data flow to leverage the power of Data Science, Machine Learning, and Artificial Intelligence. The adoption of these transformational technologies is enabling strategic engagement, improved processes, and faster turnaround time. Moreover, Syngene has started offering its clients AI as a standalone service as well.

Operating Leverage & Valuation

Five years ago Syngene embarked on a significant greenfield CAPEX program to “follow the molecule” to commercialization and invested $100 million in a commercial-scale manufacturing facility in the Mangalore SEZ—Which will manufacture Active Pharmaceutical Ingredients and Intermediates for Novel Molecules.

All these years, Syngene has been incurring pre-production outlays which dampens its operating profit margins. In FY21, the facility got operational but still isn’t generating any revenues as it has to go through regulatory approvals which will take another two years, and that will be the inflection point. As Syngene increases its sales and fills its capacity, operating leverage will kick in—it will spread its preproduction costs over more units. The result will be a reduced average unit cost and higher operating profit margins.

Operating leverage will not expand the operating profit margin indefinitely. Rather, it will be a transitory phenomenon. Syngene will have to re-invest in its facilities as and when its existing facilities reach optimal utilization. Which is a great thing because given the industry structure and Syngene’s competitive position, the returns it will generate will be over the cost of capital.

Syngene has another operating leverage lever—If you look out five years beyond, as manufacturing will form a larger proportion of the business which is just 10% now, the growth in scientists will be far slower than the revenues, which are fully expensed on the income statement whereas fixed assets are depreciated over some time.

To value the business let’s look at the expectations that are embedded in the stock price today, (Source Tijori Finance)

Syngene today generates 400 crores of Free cash flow, assuming today all capex stops. Entire depreciation is maintenance capex and we subtract that out of the operating cash flow. This is a back of the envelope Reverse DCF that we do just to get an idea if the business is expensive or cheap today. To generate 12% Returns, The Reverse DCF and the terminal multiple implies a 15% growth in the cash flows for the next decade. Is it doable? That is the answer the investor should ask themselves. Size of opportunity is certainly there, and the stock has gone through a phase of time correction.

What can go wrong?

Well, like it’s the case with any business—Syngene has some risks associated with it.

Client Concentration: Around 60% of Syngene’s business is concentrated among its top 10 clients. Though, this percentage is heading downwards with each passing year, termination of contracts by any single one of them may lead to a rapid and large loss of revenue for Syngene.

IP Theft: There’s a Zero tolerance culture among the innovator companies relating to IP protection (rightly so…) Any breach of that will be a significant blow to Syngene’s reputation and it will not only be stripped of existing business but of future business as well.

Regulatory: Syngene operates in a highly-regulated industry. Any failure to comply with global regulatory authorities (such as USFDA, PMDA) will pose a serious risk.

Execution: Syngene is yet to prove its ability in manufacturing. So, there is a commercial risk associated with the failure of Syngene’s “following the molecule” strategy. And not just related to manufacturing but the "execution" is a key risk to the overall business—be its foray into biologics or IDD strategy or manufacturing.

Safety: Risk of safety is inherent to the business—hazards in operations due to fire due to chemical, biological nature of work performed. One such incident happened in one of the research facilities in 2017.

Human Resources: Syngene’s business is highly dependable on the high-skilled workforce. Every scientist is a salesperson. Syngene’s inability to attract and retain high-quality talent is a key risk.

These are just some of the risks—known risks. There can be more risks coming out of nowhere such as business model risk—CRO/CDMO is relatively a new business model, So how long this business model sustains is a risk in itself.

Is Syngene expensive or cheap?Let me know what do you think in the comment section below!

Thank you for reading, see you soon!

Neel Chhabra is a student at Delhi University, studying Philosophy and Economics. He did his schooling from Modern School, Barakhamba Road. He started investing at the age of 16. He is insatiably curious and is on a quest to understand how the world works. Furthermore, he is active on Twitter and has his own newsletter where he writes mainly at the intersection of investing, philosophy, and psychology. In case you have anything to discuss, feel free to reach out to him.

Twitter: @NeelChhabra