The Art of Selling Stocks

I wanted to write about this topic for a long time. A lot of literature is available on how to or when to buy a stock. I have hardly ever come across literature that gives a framework on how and when to sell. Buying is only half the job, monitoring and getting the selling part right is what helps an investor to survive and thrive in the long run.

Honestly, many investors I have interacted with, actually struggle with selling. I believe one of the primary reasons is that we lose objectivity when we are involved in a stock for a particular period of time (something that has given us disproportionate gains) or a lot of us are averse to selling something that is loss making as the business fundamentals have deteriorated.

Before I start this blog, one thing is clear. Everyone will have a different approach to selling as everyone has a different time horizon. My time horizon is typically between 2-3 years of holding a stock. I let the performance of the company be delivered to drive my decisions of buying, holding, or selling a particular stock. Those who have decadal views or monthly views might not derive value out of this. I generally think it's extremely difficult to take a view beyond the next 2-3 years in this ever changing world.

After giving this topic a lot of thought, I figured there are broadly 7 reasons for selling a stock:

1. The World Changed:

The more time you spend as an investor, the more you will realise that the world of business is ever changing. Let’s look at the financials of a company that grew at a brisk pace in a period between 2013-2018 and what happened in subsequent years as the world changed.

The name of the company is Music Broadcast, the owner of Radio City. Not long ago, radio used to be the preferred medium for advertising. What happened post 2017? Advertising revenues follow the attention of the users. Other forms of media like Youtube, Instagram, Tik-Tok and others have taken away advertising revenue growth from the traditional ones like radio and newspapers, as they have major market share in human attention span across the globe. This is something that reflects in business performance and eventual stock returns of all these companies. Whenever a business is on the path of structural degrowth the terminal value, where more than 70% of valuation of a business resides, is toast. No market participant while doing a DCF, for these companies, will give a terminal value growth rate due to which the single digit PE multiple often ends up deceiving investors.

Another recent example that comes to mind is that of the Lead Acid Battery Manufacturers. This is a duopolistic market consisting of Amaron and Exide Industries. Amara Raja was almost a 50 bagger between 2009-2015, as the company rightly targeted the replacement market vs Exide just sticking to OEMs and de-worsifying into insurance business. However, in the last 5 years. Both companies–business wise–have been flat and the going is to get even more difficult forward.

Guess why?

In Electric vehicles, the cost of battery is upto 50% of the total cost of the vehicle vs only a friction of cost for Lead Acid Batteries (the ones being used currently). As the EV theme keeps expanding major automakers will have a decision to make, that is, whether to manufacture these batteries in house or buy them from an outside vendor like Exide or Amara Raja. In fact, many are choosing to invest internally, as the battery is a key component for the automakers. This structurally changes the bargaining power for these players with OEMs, and with the technology for these batteries changing. The mammoth investments planned by both Exide and Amara Raja could be at risk and fast become obsolete. Such stocks, at least in my framework, are easy sell decisions as the business road is too uncertain in these cases.

Whenever the world changes, it is often better to leave what is disrupted.

2. Bent, Broken and Beyond Belief:

“You should know why you bought a stock, if it's a cyclical company that is doing awful, you wait till things are getting better, they are doing terrific and then you sell it. Whereas, if it is a growth stock like Walmart. You could have bought it 10 years after it went public. You could have bought the stock and made 500 times your money”—Peter Lynch

When it comes to when to sell, if we invert the entire action. Buying comes before selling. It's extremely important for an investor to understand the type of stock and story of the company they are buying. According to Mr. Peter Lynch, any stock can be classified into the following categories:

Use 4 B’s as given by Sanjoy Bhattarcharya in selling. Suppose if you own a stock and your reasons for buying are no longer valid. It’s often best to sell and move on. Often these stocks look: Bent, Broken, and Beyond Belief.

E.g. The reason for selling one of the Animal API companies was that the management which was a major part of the thesis, changed midway in the journey. For me it was Bent, Broken, and Beyond Belief. Even though only 2% of capital was lost. Secondly, Mr. Rajeev Thakkar from PPFAS in the AGM discussed how they went wrong on the Noida Toll Bridge company IL&FS.

I will highly encourage you to watch this video to recognize what Bent, Broken, and Beyond belief looks like:

3. Valuations bake in a lot of positives| A High Growth Company:

Trouble arises when high growth stocks at high valuation gradually enter the low growth trajectory. This is one of the nuggets of wisdom that can be derived from One upon wall street by Peter Lynch.

One of the most lethal cocktails in the world of investing is when Peak Margins and Peak Valuations combine together in a stock. One way to check this is to look at the historic margins and historic EV/EBITDA Multiples (PE ratios get distorted sometimes).

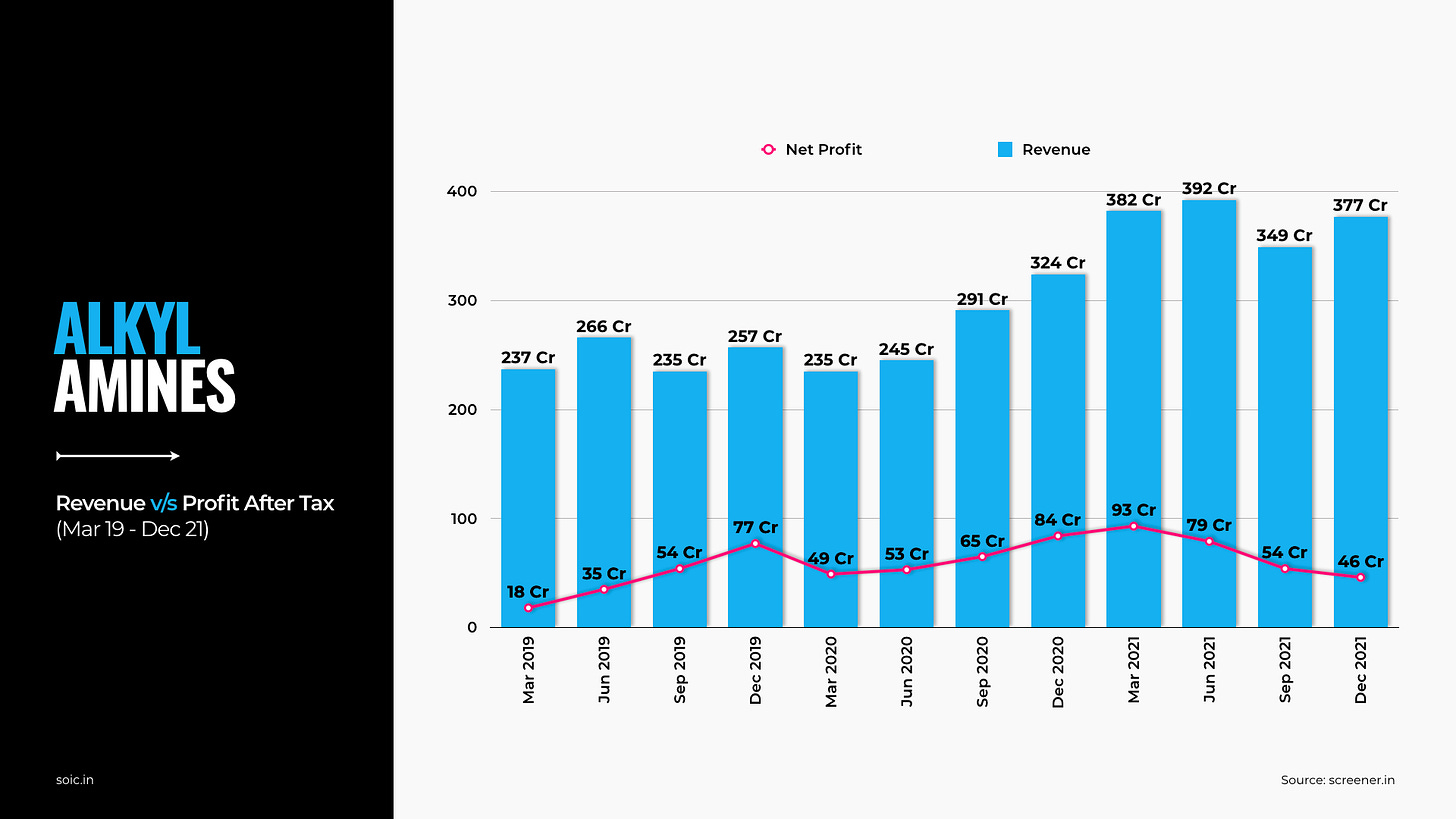

Let’s look at our reasons for selling Alkyl Amines, even though we were a bit early in the journey of selling the stock. But both the margin and multiple peaked and went way above the median margin+valuation the company used to get.

Another recent example of when we sold out because of relentless momentum and valuations is Indian Energy Exchange. As Indian Energy Exchange gained market share in the short term power trading market, the volume's growth took off. The stock quickly rerated from a multiple of less than 20 times to more than 80 times. Given the risk of regulations and relentless momentum with retail shareholding increasing disproportionately, I decided to take money off the table (it was a quick 2 bagger). Selling, at least to me, made sense as everything has to go perfectly for the company to make money from a multiple of more than 80 times.

Liquidating one’s portfolio mentally and then deciding whether I will buy this stock afresh or not can help you to identify the overheated stocks in your portfolio. Look at the most aggressive scenario, if you don’t see yourself making money even in the most aggressive scenario 3 years out. It’s better to sell and move to something else.

(Think about what Peter Lynch mentioned and see what has happened with Facebook/Meta’s stock ever since they announced that they have lost users).

4. Better Opportunities Available:

Imagine going to the office for 50 years+ and reading annual reports of a particular company for more than 50 years then finally deciding to buy the stock but the stock doesn’t move for 7 years and you end up selling.

This is the story of Warren Buffett and his investment in IBM. For 50 years, he read the annual report of IBM and then finally decided to buy the stock. For 7 years, the stock went into a time and a price consolidation.

But if you are a learning machine. What will you do?

You will keep looking for more and more opportunities. Mr. Buffett realised his mistake in IBM as the company had lost its competitive edge. Sold his IBM stake in 2017 and 2018 to buy Apple which was trading at ridiculously cheap valuation back then.

He sold something that was cheap but had no growth, to buy something that was cheap, dominant, and offered growth+sharebuybacks. This is what the eventual outcome has been:

Whenever you get a dud trap/Value Trap in your portfolio. Just remember there is always an opportunity cost of holding it compared to the next best alternative which you understand. Warren Buffett is perhaps the smartest investor of the last 70 years, realizing his mistake. He corrected it and made a killing in Apple in the last 5 years.

Opportunity costs matter, recognize mistakes and keep searching for new opportunities. If a 90 year old inspirational investor can do it, so can you with much less imperative and small capital base to be agile enough.

5. Factor Risk:

In order to survive over a long period of time. I have personally capped my sectoral or factor exposure to 30% of my Portfolio on a market price basis.

You will ask why? Simple answer is. Beyond a point it's very difficult to know what is happening inside a company or a sector. If a sector blows up due to headwinds, I prefer my factor or sectoral risks to be capped. Whenever, it goes to a level where it hurts my sleep at night. I prefer to sell and reduce my allocation.

6. Using Stop Loss for Long Term Investing:

Stop loss is a very interesting concept for risk management even when it comes to long term investing. I use it in two particular ways:

First way in which I use stop loss is via a Time Stop Loss Method. What this method essentially means is, suppose there is someone who has put on a lot of weight due to being lethargic. One of the ways to cut that weight is to monitor it closely and to put the person on a strict diet.

This is what I do with those businesses which I like, understand and yet the numbers aren’t meeting the narrative. I put them on a time stop loss, this time stop loss is generally between 4-8 quarters of closely monitoring the performance. In cases, if the performance doesn’t pick up I end up selling and moving on. The person has clearly failed to lose weight and execute the weight loss programme (business execution here).

Second way in which I use the stop loss mechanism, is to put a strict stop loss of 30% first. Suppose if a stock that I own and it randomly falls by 30% without the overall market correcting or sector correcting. Then it is highly likely that I need to reassess my thesis. This is the only way in which I can even take some guidance from bhaav bhagwaan che quote. I have held onto some stocks in the past which fell by 30% due to 1-2 soft quarters. Whereas, I have even sold some stocks where price indicated some anti thesis. When I dug deep, genuinely an antithesis in terms of business was playing out. You can only limit the damage of blow ups in mid cap space, you can never completely avoid one. When you want to compound capital at a very fast pace.

7. Law of Large Numbers:

When the base of the company increases to such an extent that I fail to foresee high rates of growth continuing. Whether its Page Industries, which became the market leader with 50%+ market share or Pi Industries, which is facing challenges to grow outside the Agrochemicals vertical. Base effect and law of large numbers is real. Just look at HDFC Ltd. which is by far the best listed Housing Financier but due to the base effect loan book, which used to grow at 20%+ at one point of time has tapered off to 10-12% per annum. (which is nonetheless commendable). Such businesses likely end up being what Mr. Peter Lynch calls, stalwarts. They grow at the GDP growth rate and because of their deep moats, they still keep compounding but given the base size. The rate of compounding keeps decreasing gradually, this is also reflected in the stock price of HDFC Ltd. in the last 7 years. This is one of the other reasons where selling makes sense if one has higher return expectations. Very few companies, especially in India, in the Business to Business space can keep scaling beyond a base. This is perhaps the reason why Amazon or Microsoft are still growing at 20-25%+; makes it even more commendable!

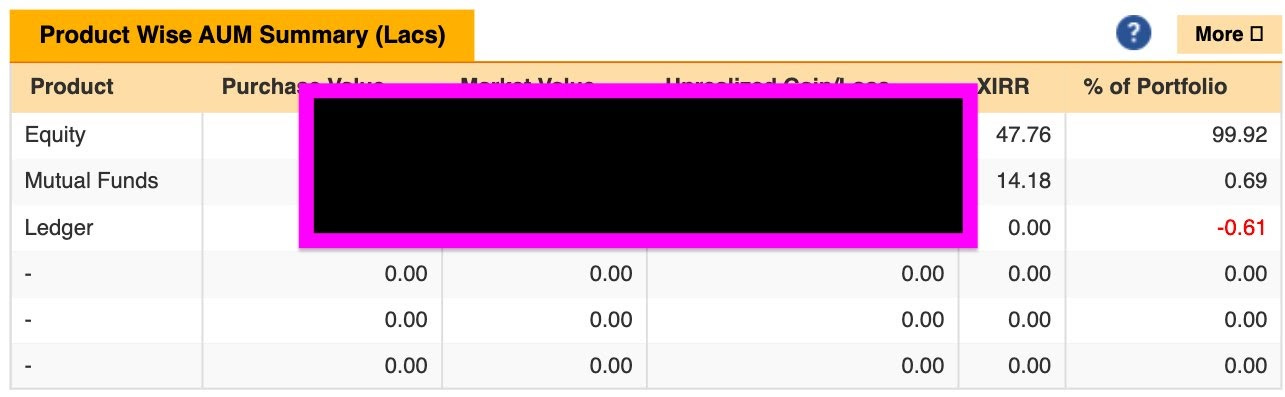

These were the 7 key reasons which I personally use to sell a stock. At the end the proof is in the pudding, I will credit my selling framework more than my buying framework for the XIRR ever since the beginning of my journey in investing. (I have invested in NIFTY to track the performance vs my PF since 2016.)

Let me know what you think in the comment section below.

This is my personal selling framework. If you found it helpful, I would love to read your comments! :)

Disclosure:Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author and SOIC do not hold the stocks in their portfolio at the date this post was published.