Time Correction: The Market's Version of ‘Buffering’… ⏳

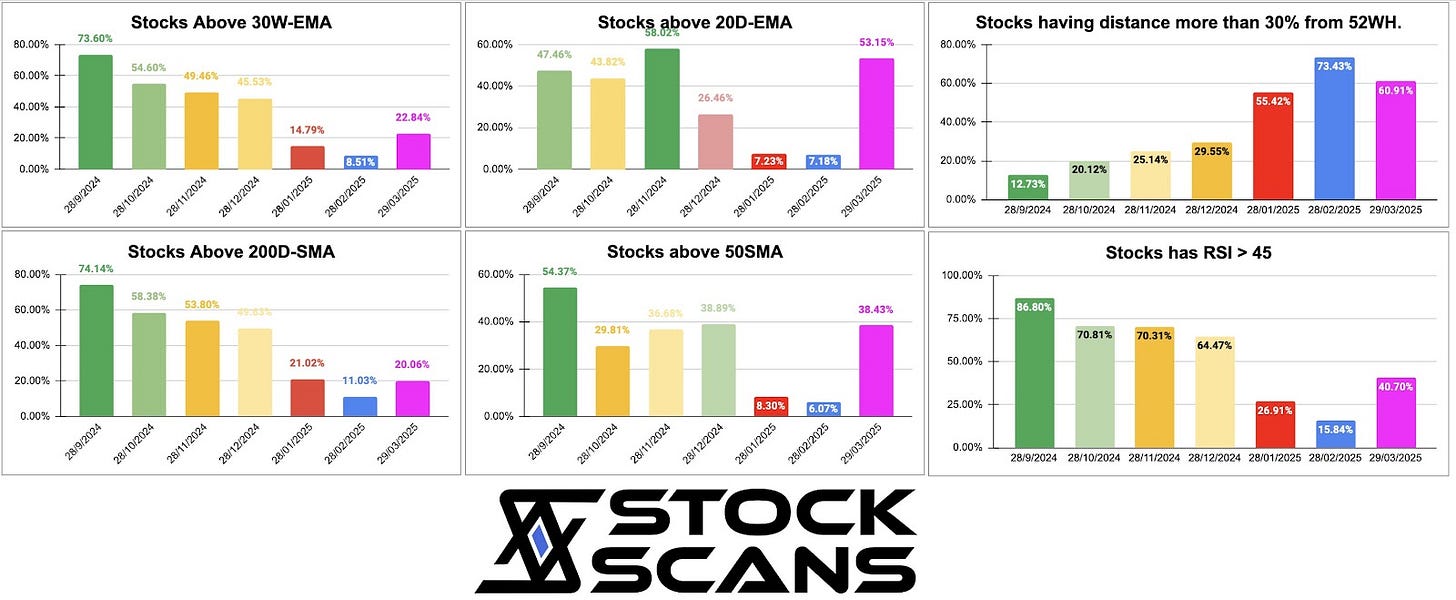

Market Breadth

Markets have broadly entered into time correction where the bulls and bears both are trying to fight with an equal strength and no one is able to overpower the other. Generally post the steep corrections that happen the market takes its sweet time to come back.

{ Coming on Monday! Video version of this week’s Insights with SOIC is exclusively available for SOIC Membership Tribe as well as a detailed session on Pre-Engineered Building Sector under the SOIC Membership. Join the membership now with the exclusive New Financial Year offer, limited for next 48 hours!

Coupon Code: SOICFY2026

Link to Join for 1 yr or 3 yrs: https://learn.soic.in/learn/fast-checkout/97666?priceId=36137 }

The average correction period has been 12 months in the past. Although this the correction in Nifty was not that brutal because of the strong support of DII flows but the correction in the mid and small cap space have been steep where many names are down more than 20-30%.

So based on this hindsight analysis that markets have a habit of going into a broad based time correction after the brutal price correction that happens.

The below breadth shows that the markets are signaling the signs of bottoming out and now the time comes for the time correction phase of the market.

Declining Trend (Till February 2025):

A steady decline is visible in the percentage of stocks above key moving averages (30W-EMA, 20D-EMA, 200D-SMA, 50SMA).

Fewer stocks were trading above their moving averages, indicating weakening momentum.

RSI>45 stocks also dropped sharply, suggesting that a majority of stocks were in bearish or neutral territory.

Signs of Recovery (March 2025):

A notable surge in stocks above the **20D-EMA** (53.15%) and **30W-EMA** (22.84%) indicates short-term buying interest.

The percentage of stocks **far from 52-week highs** (distance >30%) remains high, showing many stocks are still in a correction phase.

RSI>45 stocks rebounded (15.84% to 40.70%)**, hinting at improving momentum.

Relative Strength Check

Names like Private banks, Platform businesses, CDMO, etc had shown relative strength in the past week. As the market moves into more of the time correction relative strength will be a strong tool to find the winners of the next bull cycle that is about to come

Also, if we see on the indices front similar stories of new winners coming up can be seen where Metals, Capgoods, healthcare have seen good performance over the past month and even in the 3 month period.

Macro and Industry Check

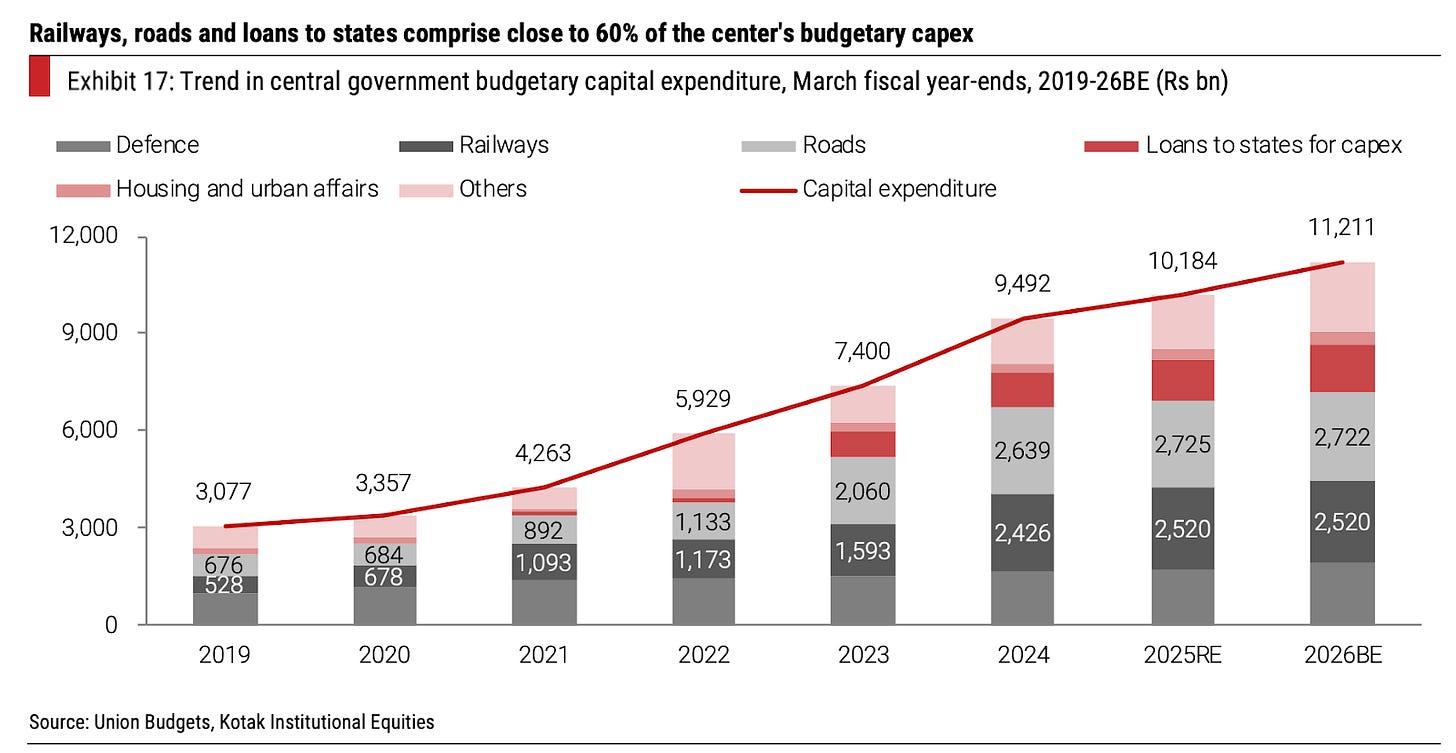

India and the Capex story

India is expected to see a deceleration in its overall investment rate. A lack of significant capital expenditure (capex) from state governments and central government constraints—except for potential boosts in railways—set the tone for a cautious environment.

Government capex is expected to moderate in the near term, with the central government projecting an 11% growth in FY2026 but facing challenges in meeting its targets. Railways, roads, and state-enabling investments remain the core focus, but spending here may plateau.

State governments, despite opportunities in city infrastructure, struggle with fiscal and institutional limitations, further dampening overall public sector capex momentum.

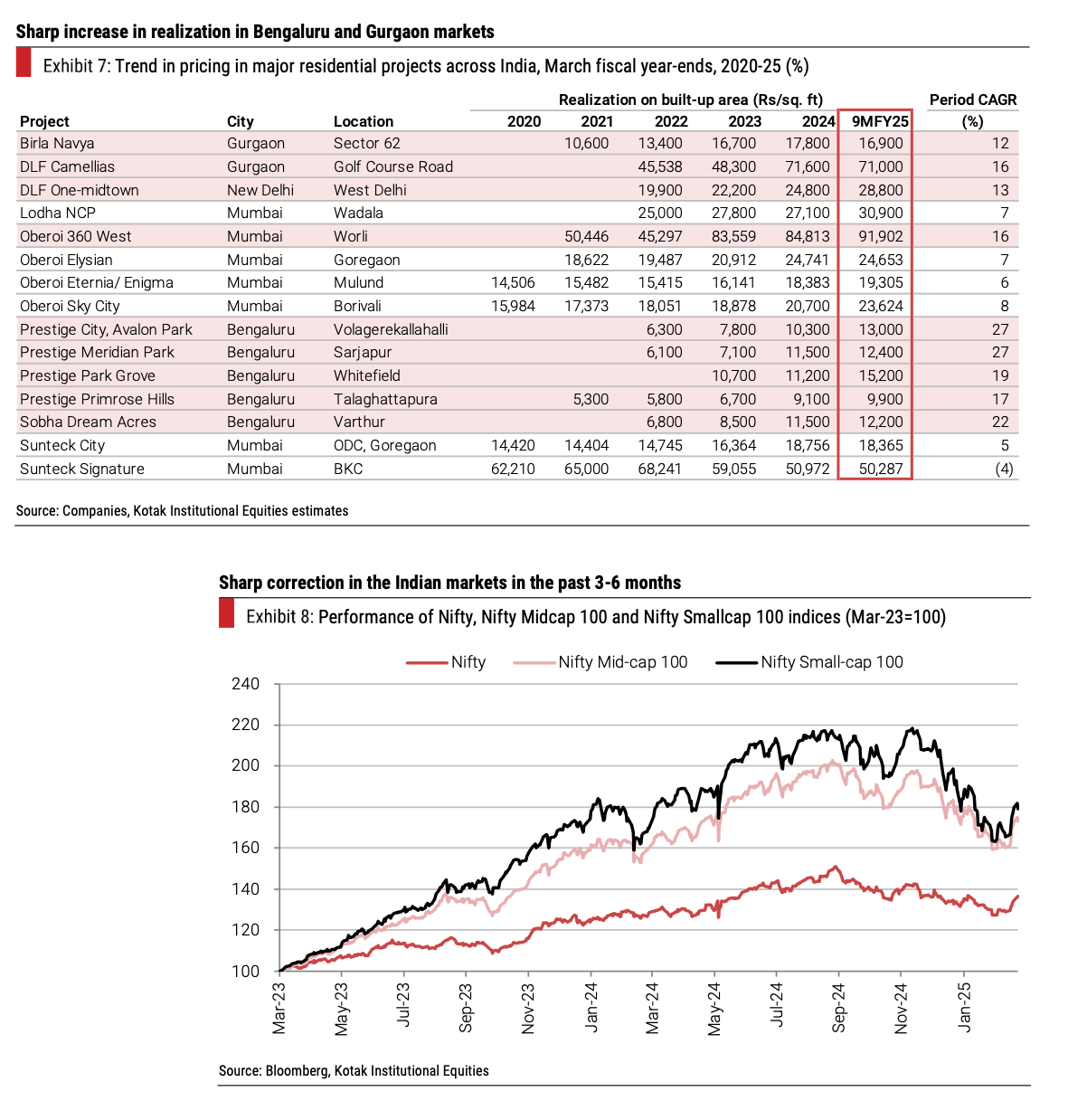

Strong housing demand, fuelled by income growth, urbanisation, and nuclearization of households, supports sustained household capex in the medium term. However, rising property prices, a stock market correction, and global uncertainties could cause a short-term blip. Despite this, household capex may outpace nominal GDP growth over time.

A meaningful pickup in private sector investment remains elusive, with FY2024 showing signs of weakness. Core infrastructure capex is mostly concentrated in electricity and metals & mining, while industrial manufacturing sees limited expansion.

Welfare schemes are hurting there fiscal deficits and hence impacting the growth in the capital expenditure required.

Growth Sectors:

Electricity: ₹7.5 tn capex in transmission & distribution (FY2025-30E).

Metals & Mining: ₹4.7 tn incremental steel capex.

Telecom: 5G capex moderating.

EMS & Semiconductors: ₹470 bn in EMS, large semiconductor potential.

However, high valuations in investment-heavy sectors indicate a cautious sentiment.

Management Meets Corner — SOIC Research

RACL Geartech

Company Overview and Key Customers:

RACL's major customers include BMW, KTM, and BRP, with BMW being the customer with the highest turnover, accounting for more than 20%. However, this figure combines BMW Motorrad and BMW car divisions, which are now separate entities.

KTM is considered a core customer, although there were some production volume issues which have now been resolved. Production for KTM restarted in mid-March.

Other significant customers mentioned include TVS, Aprilia, Mercedes, and MAN (trucks).

The company aims to maintain a balance between all its buyers, ensuring that no single customer exceeds 20% of the turnover. No single customer accounts for more than 20% of revenue.

RACL positions itself as a technological hub providing end-to-end solutions to its customers. For European buyers, RACL often acts as the sole supplier for a specific component for the entire lifespan of a vehicle model.

Products and Production Processes:

RACL manufactures a variety of products, with the smallest being one particular unnamed item and the largest being a high-value product. These are premium products with significant value addition (70% value add compared to 30% raw material cost).

The manufacturing process is batch production, not a continuous line production. Each product undergoes multiple processes.

Key in-house processes include forging (have 60% in-house), teeth cutting (hobbing) , coating, and various machining operations. 40% of forging is done by vendor partners. Rough turning is primarily outsourced to vendors in Faridabad.

Specialised, high-grade alloy steel is used, sourced from specialised suppliers, not from companies like Jindal or Tata. Pricing for these materials is generally passed on to the customer.

The plant features various advanced machinery, including CNC turning and milling machines, 3-axis and 5-axis machines, primarily from Taiwan, with some specific high-precision machines from Japan and Switzerland (e.g., Gleizon for hobbing, Junker for grinding). Racl also has in-house laser welding capabilities.

Quality is paramount, with 100% inspection at various stages, using specific control plans for each operation, accessible via a password-protected portal. DMC (Data Matrix Code) marking is used for part traceability throughout the supply chain, enabling recall of specific batches if issues arise in the field.

RACL has multiple plants (Chetak - the oldest, Ojas, Shakti, and others for specific customers or processes like heat treatment). Plant layouts are often customised based on customer requirements. Most plants operate on three shifts, 24 hours a day.

A new 1600-tonne forging press will be installed to increase the insourcing of forging

RACL has invested in a paint shop primarily for BRP, which is attracting interest from other customers.

Assembly is done on customer-specific tables (e.g., Motocut, BMW, TVS, KTM, Aprilia) with Poka-yoke (mistake-proofing) mechanisms.

Supply Chain and Inventory Management:

Raw material (special grade steel) is sourced from domestic suppliers, including those in Ludhiana and Faridabad. These suppliers are fixed and buyer-approved. RACL also works with exclusive job workers located near their facilities.

Steel suppliers are also subject to audits regarding the source and grade of steel.

RACL typically maintains 6 to 8 weeks of inventory in customer-bounded warehouses near the customers' locations to ensure continuous supply given the long shipment period from India (around 75 days). This inventory is often considered as receivables as invoices have already been cut.

RACL does not own these customer-bonded warehouses.

Internally, RACL aims to keep around 15 days of raw material.

A significant component of RACL's inventory is loose tools, which are consumed in the production process. The company's calculation of inventory days differs from that shown on platforms like Screener, which do not account for loose tool consumption in the cost of goods sold.

Financial Performance and Growth:

RACL achieved a turnover of approximately ₹423 crore last year and aimed for ₹550 crore or more this year. The company has a long-term goal of doubling its turnover in the next 3 to 4 years.

Historically, EBITDA margins were around 17-20% in 2019, jumping to 22-25% due to operational efficiencies, product mix, and technological advancements. However, H1 of the current year saw a drop to around 18%. The normalised margin target is 20-25%.

Return on Capital Employed (ROCE) is around 20%.

The company has undertaken significant capital expenditure (capex) in recent years, including ₹271 crore in FY22 and ₹49 crore in March. Capex in the current year is projected at ₹540 crore. These investments are often made 2-3 years in advance of expected demand from new projects.

KTM's production issues caused a significant impact on RACL's revenue and targets for the current year, with an estimated loss of ₹30-35 crore in revenue. Approximately 15% of the previous year's turnover came from KTM.

RACL has debt on its balance sheet, with a debt-to-equity ratio above 1.2. The company is focused on reducing its debt through repayments. Potential equity fundraising of up to ₹100 crore was being explored to further support growth and reduce reliance on debt, but there is no immediate compulsion.

RACL's business model is a heavy capex investment model focused on value addition and premium segments.

Future Strategy and Opportunities:

RACL is strategically shifting towards becoming a global system and sub-system integrator, moving beyond just component manufacturing.

The focus is on developing engine-agnostic products, such as park lock mechanisms and electric steering systems, to diversify across vehicle types.

New growth opportunities are being explored in sectors like aerospace and industrial gears, leveraging existing technological capabilities.

The relationship with ZF Rane presents significant growth potential in electric steering systems, aiming for a revenue of ₹1000 crore by 2029.

While involved in the EV scooter segment (supplying parts for BMW scooters C04 and C2), RACL is not currently involved in the direct drive systems for electric cars. The company observes a slowdown in the electric motorcycle market in Europe.

Research and Development (R&D) is process-oriented, supported by a significant team of around 60 engineers.

Human resources is identified as a key challenge, focusing on attracting and retaining skilled engineers. RACL prides itself on retaining its employees for long tenures.

Key Challenges and Risks:

While customer concentration has reduced, the automotive industry's cyclical nature and dependence on key accounts remain considerations.

Downturns in specific customer demand, as experienced with KTM, can significantly impact revenue and profitability in the short term.

Managing large-scale capital expenditure and ensuring timely revenue generation from these investments is crucial.

Volatility in the global economic and political landscape, although direct impacts from events like potential US tariffs on European goods are currently considered low.

The long gestation period for new projects means that investments may not yield returns for 2-3 years.

Points of Discussion/Clarification:

The calculation of inventory days presented by RACL includes loose tools, which may not be factored into external financial data sources, leading to discrepancies.

The significant capex in 2022 and ongoing investments are strategically aligned with expected demand from projects that will reach peak production around 2026-27, given the typical 2-3 year gestation period for new automotive programmes.

Continued capex despite current underutilisation in some areas is necessary to secure future growth from new customer nominations, as existing business cycles fluctuate.

Fixed costs, such as depreciation and employee expenses (due to a no-firing policy), impact profitability during sales downturns.

Potential equity fundraising is considered as a way to strengthen the balance sheet and support long-term growth without excessive reliance on debt, although the timing and necessity depend on market conditions and investment opportunities.

Future growth rates will depend on the successful execution of new projects, customer demand, and overall market conditions.

Key Corporate Announcements

Order Book Update

Engineers India: Middle East clients awarded contracts worth Rs. 730 Crores.

Godrej Properties: Godrej Properties sold homes worth over INR 1,000 crores in Hyderabad.

Nibe Ordance: Subsidiary Global Munition Limited receives Rs. 218.70 crores order.

Kalpatru projects: KPIL AWARDED NEW ORDERS OF RS. 2,366 CRORES

NBCC: Company wins an order worth Rs. 659 crores

Force motors: Force Motors Limited to supply over 2,900 Force Gurkha vehicles to the Indian Defence Forces

Dilip buildcon: we are pleased to inform you that DBL-STL Consortium has received the Advance Work Order (AWO) for “Design, Supply, Construction, Installation, Upgradation, Operation and Maintenance of middle mile network for BSNL Bharat Net Phase – III Broadband Connectivity Project, funded by USOF and the value of the project is Rs. 2631.14 cr.

Quadrant Future-Tek: Quadrant Future Tek Limited (“Quadrant”) has received a Letter of Acceptance (LOA) dated March 26, 2025, for receipt of a new work order worth Rupees One Hundred and Fifty-Five Crores Ninety-Three Lakhs Nine Thousand Only

NCC: Two contracts awarded by Bharat Sanchar Nigam Limited (BSNL) for the design, supply, construction, installation, upgradation, operation, and maintenance of middle mile networks under the BharatNet project in Uttarakhand (2647.12 Crores) and Madhya Pradesh (8157.44 Crores)

Godrej Properties: Godrej Properties sells homes worth over INR 1,000 Crores.

Newgen Software: Newgen Software Inc. secures USD 1.385 million agreement.

Bharat Heavy Electricals: Company wins large order worth Rs. 1,180 crores

HBL Power (Two Orders): Received an order for provision of Kavach systems in Viramgam Rajkot Okha Section of Rajkot Division of Western Railway worth Rs.244 crores and an order for provision of Kavach systems on Dholpur Bina Section of Jhansi Division of North central Railway worth Rs.255 crores.

BHEL: BHEL receives LOI for 2x660 MW power plant EPC package.

Railtel: CO WINS ORDER WORTH 1625 CR RUPEES

Zen Technologies: The Company has been awarded an order valued at approx INR 152 crores

Power Merch Projects: Company secures Rs. 4.25 bn order from Adani Power subsidiary

Zentec: Zen Technologies secures INR 152 crore order from Defence Ministry.

Solarium: Company has received an order for 3.6 crs from BSF Jammu.

Rites: Order received from Oil India Worth 157crs

Capex

IOLCP: Commencement of new Paracetamol unit and Clopidogrel expansion.

Indo Amines: Acquisition of industrial land for business expansion.

RKFORGE: Commencement of production capacity addition of 14,250 MT.

Ultratech: Commissioning of new cement capacities and terminals.

Asian Paints: Approval of Rs. 690 crores additional capex for manufacturing facility.

Ashok Leyland: Defence business secures multiple orders worth ₹700 crore.

Shakti pumps: Investment of Rs. 5 Crores in Shakti EV Mobility.

Ircon International: Letter of Award for Rs.872.69 Crores project.

Waaree Energies: Inauguration of 5.4 GW solar cell gigafactory in Gujarat.

Yatharth Hospitals: Company acquires hospital in New Delhi, operations to start soon.

Ramco cement: Increase in cement grinding capacity from 2 MTPA to 2.4 MTPA.

Lemon Tree hotels: Lemon Tree Hotels signs 50th hotel franchise agreement.

PDS: Investment of Rs.44 crores in NexStyle

Greenpanel Industries Limited: commenced commercial production at a new MDF plant in Andhra Pradesh, increasing their capacity by 2,31,000 CBM annually.

Management Change

IFCI: Appointment of Shri Rahul Bhave as MD & CEO.

United Spirits: Appointment of Mr. Praveen Someshwar as CEO.

Astec lifesciences: Appointment of Mr. Burjis Godrej as Managing Director for 5 years.

Stallion India: Resignation of CFO Ashish Mehta effective April 7, 2025.

Garware hi-tech: Re-appointment of Mrs. Sarita Garware Ramsay as Joint Managing Director.

Laurus Labs: Re-appointment of CEO and CFO for Laurus Labs.

Barbeque nation: Re-appointment of Mr. Kayum Razak Dhanani as Managing Director.

Allicon cast: Resignation of Company Secretary & Compliance Officer.

Allcargo: Re-appointment of Shashi Kiran Shetty as MD for 3 years.

Map My India: Rohan Verma resigns as CEO; new appointments made.

Alkem Laboratories: Alkem Laboratories acquires 100% stake in Adroit Biomed.

Others

Britannia: Operations at Jhagadia plant partially affected by strike.

ICICI Bank: ICICI Securities Limited delisted; now wholly owned by ICICI Bank.

Zinka logistics: Investment of ₹40 Crore in Blackbuck Finserve Private Limited.

KRN Heat Exchanger: Approved as vendor by Ministry of Railways.

Epack Durable: Company introduces new Air Fryer product.

Jubilant Food: Jubilant FoodWorks launches Elate, India's first Android-based POS system.

Thangamayil Jewellers: Promoters' shares completely released from bank pledges.

Ipca Labs: Sale of manufacturing facility and acquisition of Unichem Ireland.

Arvind Smartspaces: Arvind SmartSpaces sells 200 plots with a booking value of over ₹180 Crore at the launch of Arvind The Park, Devanahalli, Bengaluru

Allied Blenders: Received tax assessment orders totaling Rs. 352.31 Crores.

Tata Motors: Tata Motors sells 80% stake in Jaguar Land Rover Ventures.

Arman Financial: Approval for sale of ₹185.98 Crore stressed loan portfolio.

GAIL: company to get pipeline tariff boost, margins to rise by rupees 3,400 cr - et

Zaggle Prepaid: company has entered into an agreement with wonder home finance || Zaggle would provide wonder home finance, Zaggle Zoyer & Zaggle save propositions

Brigade Enterprises: Brigade Group signs JDA for prime land parcel for luxury residential project with senior living in Mysuru. Project with gross development value (GDV) of ₹300 crores to include 25% senior living spaces and 75% luxury apartments.

Venky’s: India reports eight outbreaks of highly pathogenic H5N1 bird flu in farms and backyard poultry - woah

Narayana Hrudayalaya: Agreement for operating hospital with medical college affiliation.

ABCAPITAL: Investment of Rs. 40 Crores in ABCDL.

ABCAPITAL: NCLT sanctions amalgamation of Aditya Birla Finance with parent company.

GMR Airports: AERA issued a tariff order increasing aeronautical tariffs by 148% at Delhi Airport for the period 2024-2029, significantly boosting projected revenues.

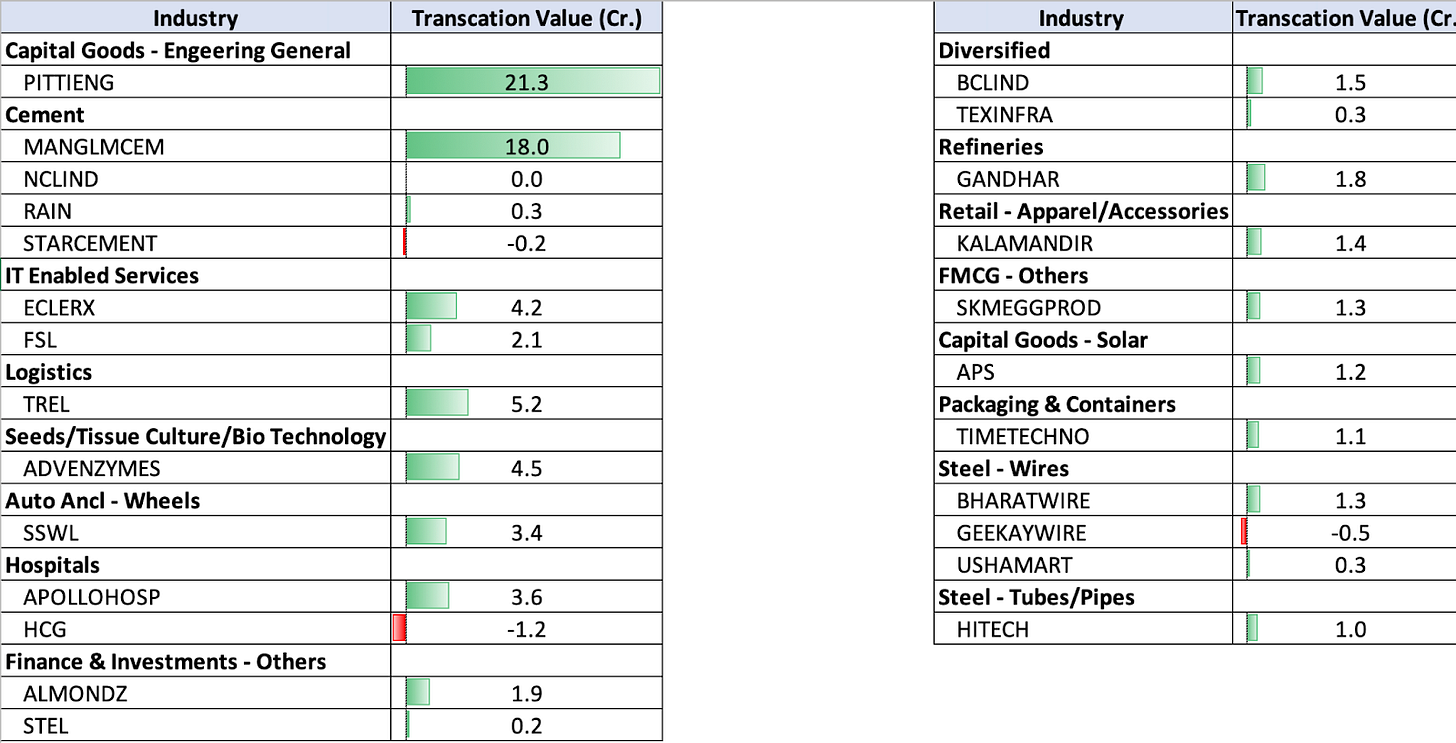

Insider Trades

Key Insider Transactions:

Pitti Engineering saw largest amount of buying.

Cement companies had also topped the charts this week in terms of insider buying.

Names like Timetechno, TDPowerSys, Ushamart, SteelStrips saw multiple buyings in the past week.

Fun Fact: In PGEL in early Sept 2022 Immediate relative was buying the stocks and the stock went up ~1000% in nearly 2 years time and currently the same relative has been selling the stock in the current week.

Peer to Peer Analysis

Pharma CDMO Peer to Peer Comparison

Indian Pharma CDMO vs Global CDMO companies: Indian CDMO companies are in a sense more in the CDO/CDMO side of the business. More importantly, Indian companies continue to invest more proactively in newer technologies, thereby narrowing the capability gap versus their global counterparts.

Here is the majority of CDMO businesses and their key revenue triggers.

The CDMO industry tailwinds commentary by the both the Indian and Global CDMO players.

Pre Engineered buildings Value chain

The Pre-engineered building is more of a cap goods style player giving end to end solutions to the customer rather than just acting as some steel fabricator. Here is the comprehensive view of how the value chain looks like for pre engineered buildings.

Most of the players in the Industry are present in all the verticals of the value chain except in the raw materials (steel and coatings).

Top Custom indices

Here are the top 3 custom indices that are looking interesting on the charts.

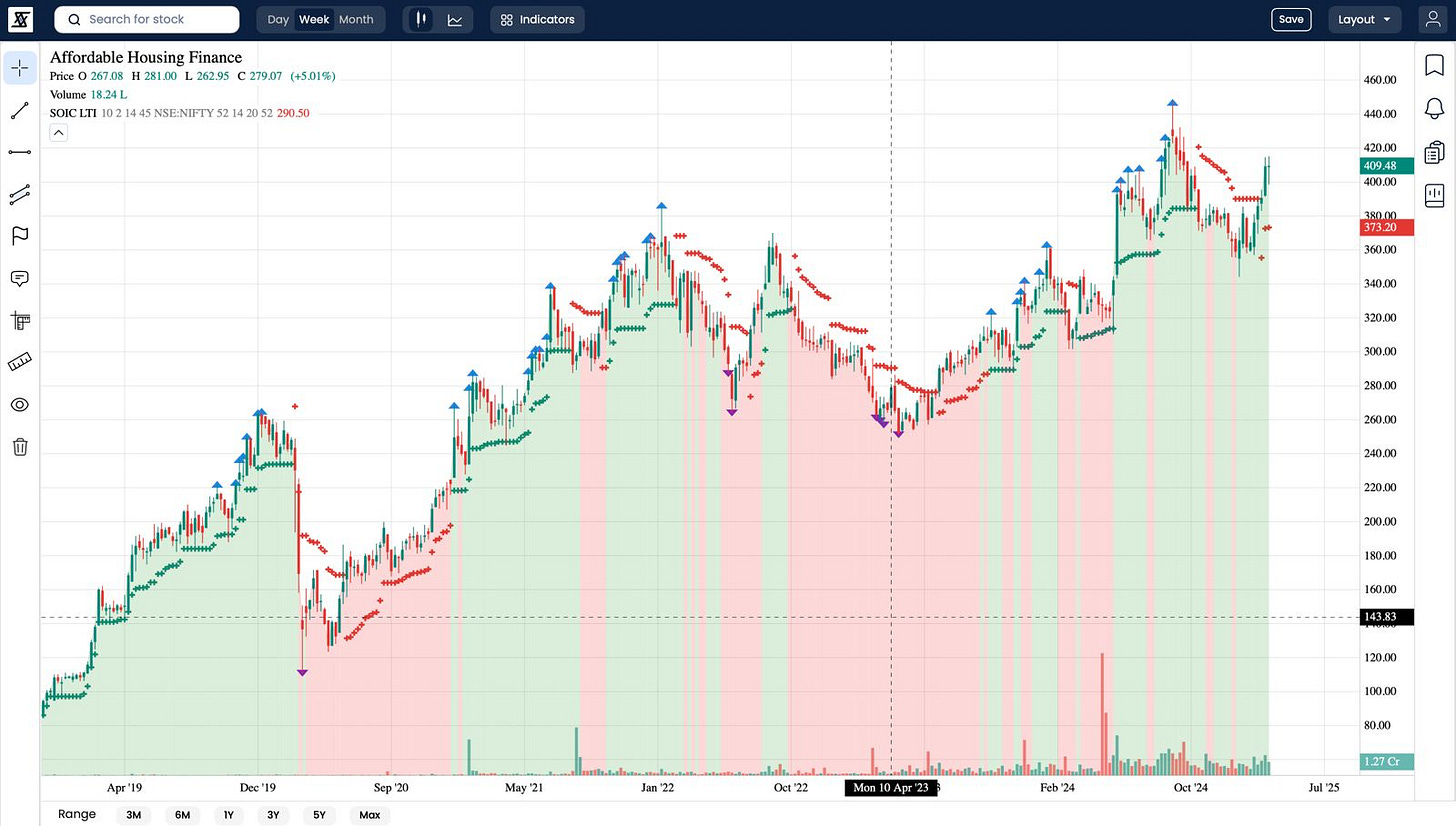

Affordable housing

Refrigerant Gases

Private large cap Banks

Key Mental Models and a Book Recommendation

Importance of reshuffling the Portfolio during market turns. This also reminds of an interesting quote by Paul Tudor Jones: “losers average losers.” Ayush Mittal sir’s example is beautiful from the past.

“Ayush recalls his experiences in 2017 when he was riding high on confidence as he had done exceptionally well in the small-cap space during the bull market of 2012–17. With this success, Ayush believed that these small, undervalued companies would continue to do well. He started investing in companies like Prakash Industries (despite corporate governance issues, the company was posting strong numbers and there was China + 1 theory), Suzlon (which had started showing strong numbers), and Reliance Capital (the company was growing at over 30 percent yet trading cheaply).

However, when the market fell, these stocks plummeted by 25 to 30 per cent in a short span. Confident, thanks to his recent success, Ayush started averaging these companies equally to try to bring down their costs. It was only when these stocks fell further by 50 per cent did he realize that he had made a mistake. His judgement froze, and he decided not to sell in the hope of a recovery. It wasn’t until these stocks had dropped by nearly 70 per cent that he finally sold, accepting his mistake.

Ayush acknowledges that this misstep was due to his overconfidence, FOMO, and adopting shortcuts during the bull market. He reflects that during bear or stable markets, we usually do a lot of work and scuttlebutt which we missed. Also in hanging on to the price of buying as an anchor rather than reality check on their worth.”

Watch our industry temperature check on the IT sector:

Bonus: SOIC Membership

As a bonus, SOIC Membership also gives you full access to our in-depth course on Fundamental Analysis—perfect for building strong investing foundations.

Both the video series and the fundamental analysis course are included as part of your SOIC Membership.

👉 Click here to register for the SOIC Membership

Do let us know about your thoughts in the comments below!

Disclaimer:

SOIC Intelligent Research LLP is a SEBI-registered research analyst with SEBI Registration No. INH000012582. Registration granted by SEBI and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors. Investment in the securities market is subject to market risks. Read all the related documents carefully before investing.

Just wanted to say Thanks a ton for all your work and efforts!

good article...