Trent: Elevating Your Style with Timeless and Trendy Apparel?

10 mins readPublishing Date : 2023-04-07

Industry Overview

India is one of the fastest-growing major economies and is expected to be one of the top three economic powers in the world over the next 10 to 15 years, backed by its robust democracy and strong partnerships. Estimates suggest that the Indian economy has rebounded sharply following the contraction in 2020 & 2021.

India’s apparel market is estimated at $59.3 billion in 2022 and the Indian fashion industry is slated to be the sixth largest market in the world. In recent years, private labels have emerged as the rising stars of retail and e-commerce. Private labels or in-house brands, typically offer shoppers value for money while earning higher margins for retailers with the potential to develop into self-sustaining brands.

There is also a growing emphasis on enriching customer experience. Window displays, in-store ambiance, coordinated product displays, lighting, music, and communication help build brand presence and awareness.

Company Overview

Trent primarily operates stores across four concepts– Westside, Zudio, Star and Landmark . Over the years the company continued to focus on robust and sustainable business models in each of its retail concepts. The company has consistently emphasized the importance of establishing the viability of a retail concept with a limited portfolio of stores before embarking on rapid expansion.

The approach to the expansion of the Zudio concept is a case in point. Trent also follows strong product/inventory disciplines across the value chain. This includes emphasis on own branded offering, ownership of product design & curation, focus on speed of “ concept to market ”, consistency of offer across platforms, and strong inventory management.

Zudio living up to the hype

Zudio’s store count has surged over 3x to 250 since March 2020. The value-fashion chain clocked Rs. 1,100 crore ($138 million) in sales in FY22–a quarter of Trent’s consolidated revenue. Even if it’s much smaller than Westside now, at this rate it could end up becoming Trent’s biggest brand.

However, its USP–selling everything under Rs. 1,000 ($12.5)--could also be a millstone around its neck. Westside makes way for a new star in Tata’s retail universe: Zudio

Westside–A well-known and well-appreciated brand.

Tata Group-owned Trent Ltd has been synonymous with its flagship apparel chain, Westside, for many years. Even so, the retailer’s center of gravity is shifting now. It is slowly, yet steadily moving towards six-year-old Zudio—a fast-fashion brand whose unique selling point or USP is to sell everything under Rs. 999.

This transition would have been unthinkable till recently. Westside was responsible for over 60% of Trent’s revenue in the year ended March 2022.

However, in the same period, Westside’s expansion paled in comparison to that of Zudio. Trent added just 26 Westside outlets even as it set up 100 Zudio stores. Trent remains a D2C brand and will continue to

1. Own the entire retail network,

2. Sell only its own brands,

3. Keep women at the center of product proposition, and

4. Offer value-for-money products.

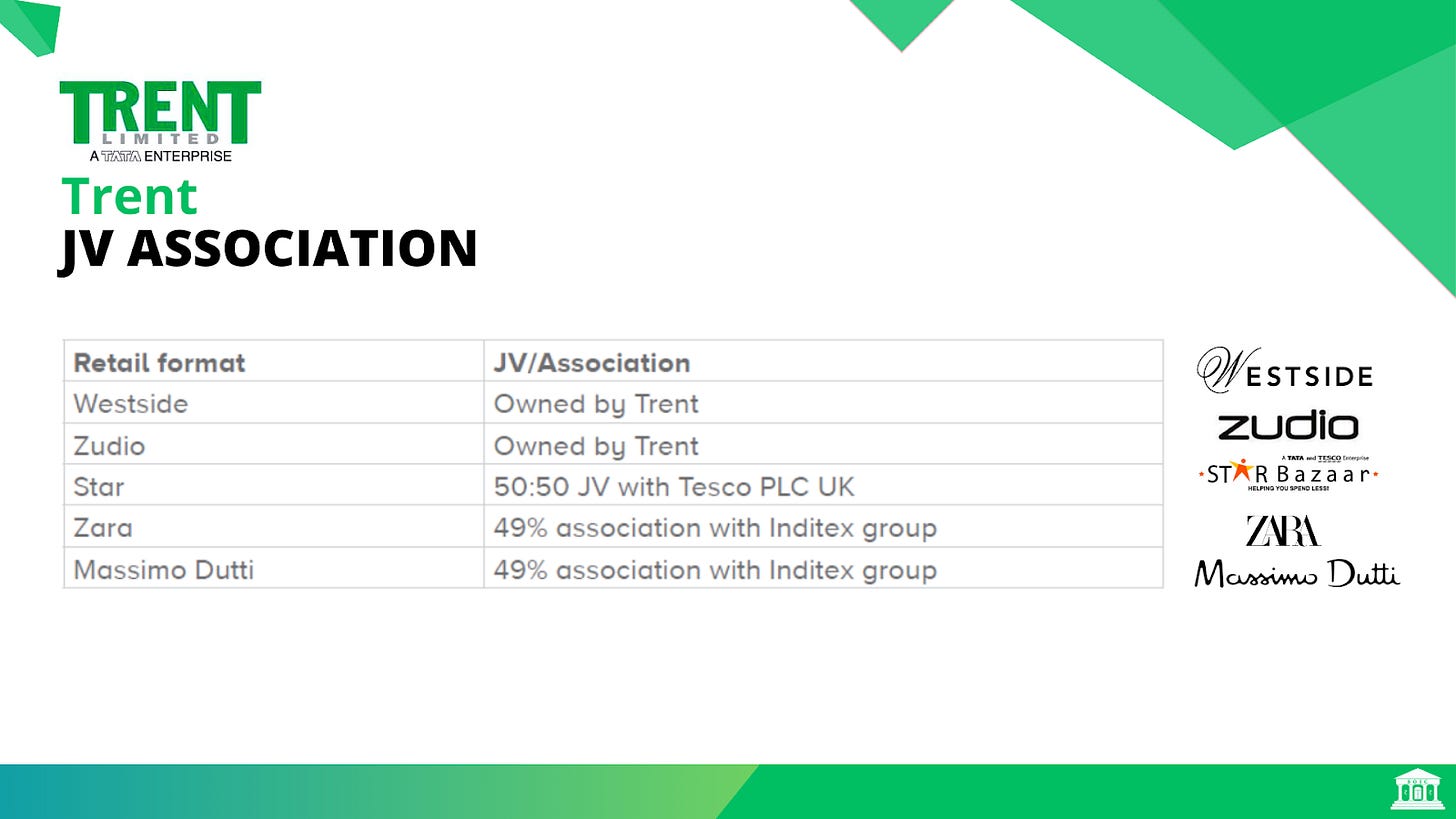

Trent’s JV/ Association

Trent is India’s leading retailer with a presence across various consumer categories (600+ stores). The inherent strength of brands (Westside, Zudio, Star, Zara, etc.) and accelerated store additions have led Trent to be among the fastest-growing companies in their retail coverage universe.

Westside (70% of revenues) has proven to be one of the most profitable business models as it primarily focuses on selling private label brands (EBITDA margin: 11%, consistent SSSG: 10%+).

Zudio (30% of sales), the value fashion brand, continues to be the next leg of growth for Trent (revenue CAGR: 72% FY19-22).

Trent will have an umbrella of 4-5 sizeable formats (Westside, Zudio, Star, Utsa, innerwear, etc.) that will be created through in-house expertise with a differentiated product pricing equation. The MAS tie-up and Star could be new growth engines. Zudio will keep growing at an accelerated pace along with Westside.

Westside makes way for a new star in Tata’s retail universe–Zudio

While both apparel chains are in roughly 90 cities, Westside’s likely geographical footprint may be capped at 150-200 cities, a limitation Zudio is free of, according to Nihal Jham , a retail analyst at brokerage Edelweiss Securities . The key reason is Zudio’s aggressive pricing strategy. Westside’s average selling price is just under 3x of Zudio’s.

As a result, Zudio may soon become Trent’s most visible retail brand in the coming years and maybe Tata Group’s as well. The steel-to-software conglomerate, through different companies, also runs electronics retailer Croma and jewelry chain Tanishq , among others.

However, value fashion is a cut-throat category. Zudio competes not just with Reliance Trends , Landmark Group’s Max Fashion , and V-Mart Retail . Its prices are in the same range as those charged by supermarket chain DMart , even if the latter has a minimal range in apparel.

Expanding The Reach To Cater To Demand

Westside

Westside is equally focusing on expansion, but the availability of good locations for a 20-25k sq ft size store is a challenge. But management is equally aggressive in Westside store additions. It targets family customers across age groups.

Zudio

The expansion of Zudio is relatively easy to execute given the lower format size of 7-8k sq ft. It will continue to grow at an accelerated pace. Trent prefers to open standalone stores instead of malls, which have lower store economics and are more relevant for brand enhancement.

The company has tried in the smaller/lesser populated towns but has not received a satisfactory response. So it is targeting larger tier 2-3 cities and the outskirts of top cities to open new stores. The relevant age is 15-35 years. However, it continues to focus on a family proposition.

Zara

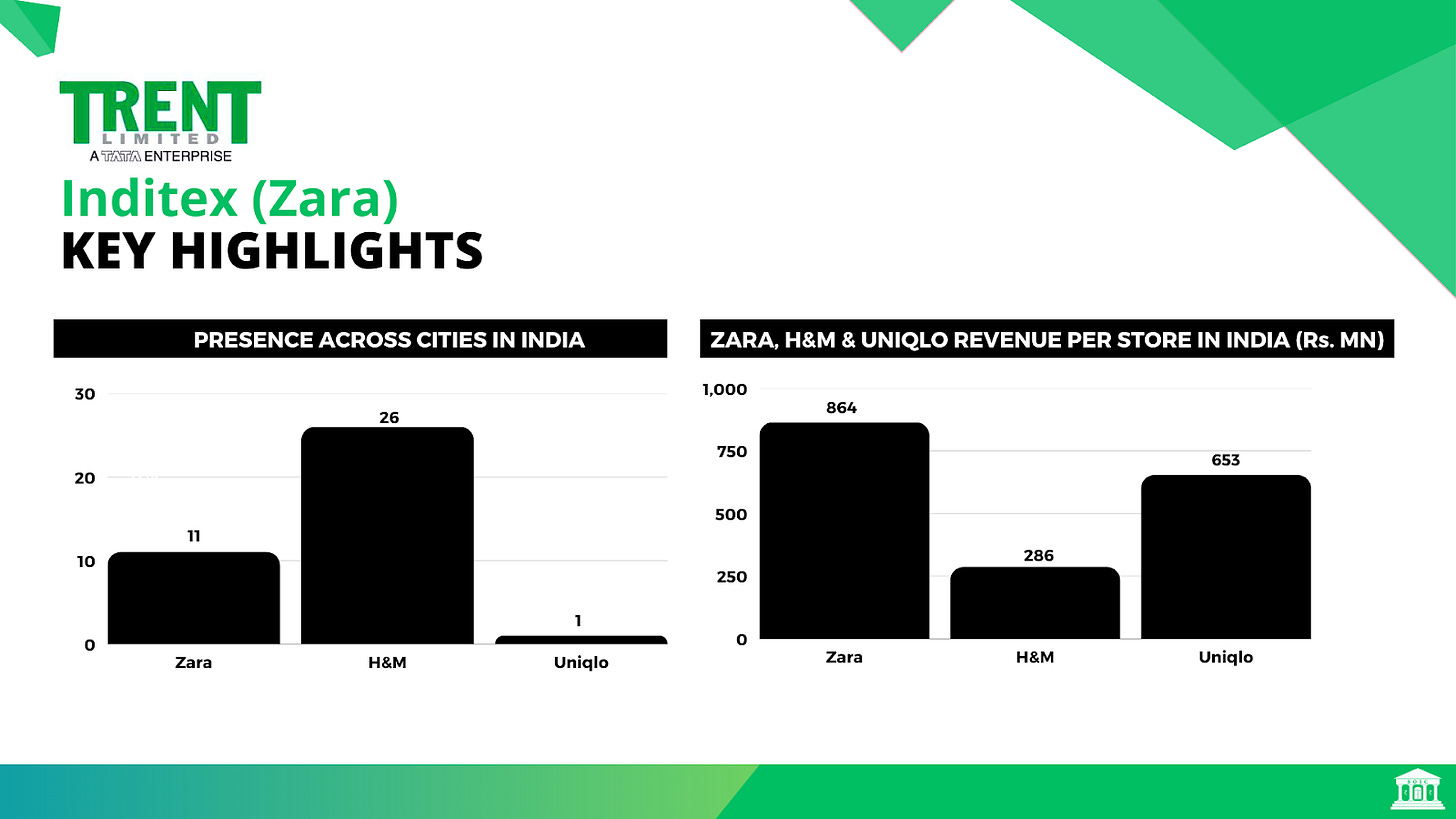

It’s interesting to note that Zara has been able to double its revenue over the last 5-6 years (FY16-22) with minimal retail expansion (added a net of only 3 stores in 6 years). Also, the company has been able to maintain an operating profit margin of 11%.

Inditex (Zara) revenue grew 2x during FY16-22. However, Zara’s retail expansion has remained stagnant over the past 5-6 years. Inditex could recover its EBIT margin back to pre-covid levels at 10-11%.

Zara’s store count in India is less than half compared to H&M . However, Zara’s revenue is 1.3x vs. H&M.

Zara’s revenue per store of Rs. 864 mn is 3x compared to H&M (Rs. 286 mn), and 1.3x compared to Uniqlo (Rs. 653 mn).

Data–FY21 Year ending 30th Nov

Star Bazar

Star Bazaar on a growth pathway–Star Bazaar posted its highest-ever quarterly revenue which grew 58% YoY. With small-footprint storefronts and a focus on fresh foods and own brands, the company saw increased consumer traction and sales densities. Trent sees the business as a significant growth driver due to better retail economics and a differentiated and scalable approach.

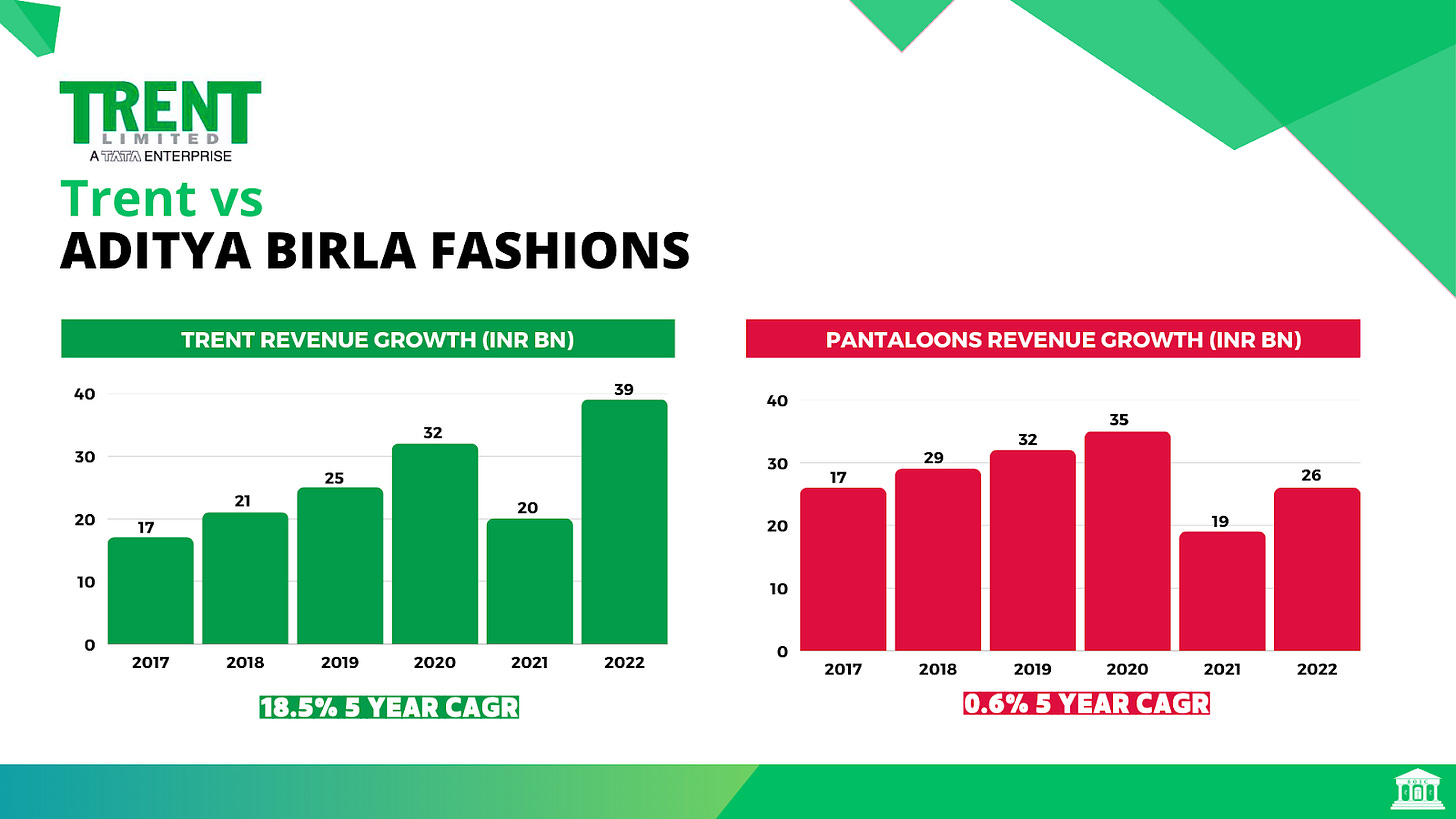

Trent vs ABFRL

Meanwhile, investors have sent Trent’s shares soaring nearly 5x in the past five years. In comparison, rival Aditya Birla Fashion Retail Ltd’s (ABFRL) shares have risen less than 2x. That’s partly because Westside has made up for its measured expansion with industry-leading gross margins of 60%. However, with its rapid store addition and rising contribution to Trent’s business, Zudio –whose margins are only 40%–will drag the company’s profitability down.

Source–IDBI Capital

Westside has outperformed competition like Pantaloons on several fronts

1. Trent Ltd compounded revenue at 18% CAGR over the last 5 years (FY17-22) while revenue from Pantaloons grew at 0.6% CAGR.

2. Average bill value of Westside has been consistently higher by 18-24% compared to Pantaloons over the last 5 years. Also, compared to pre-COVID levels, the average bill value of Westside grew 19% vs 16% for Pantaloons.

3. Store closure for Westside over the last 5 years stands at 21 stores compared to 40 stores for Pantaloons. In fact, many underperforming Westside stores were converted to Zudio. This is the strength of Trent’s business model which caters to both masses.

4. Compared to pre-COVID levels, the average bill value of Westside grew 19% (vs 16% for Pantaloons). Westside members spent 17% more compared to non-member customers. Members contribute 85% to Westside’s total revenue.

Key Metrics To Track Product And Customer Response

Full price sell-through rates of the portfolio—which shows if the product-pricing equation is working.

Store productivity—which helps to understand if the company is gaining at the retail store level.

Repeat purchase of products—which helps to understand if the product is accepted by customers.

Weekly/daily traction tracking through the rate of sales method.

Fast Fashion Concept To Drive The Growth

When a retailer’s identity is so closely tied to an easy-to-recall price ceiling, price hikes—even to counter inflation—can be hard to navigate. To top it all, value fashion, given its bargain-basement prices, is not as lucrative as the higher-end category in which Westside operates.

The consumer discretionary market has been witnessing a slowdown due to high inflation, but the impact has been different across brands. Brands that offer aspirational products at attractive value would be better insulated. Trent targets those customers. The slowdown’s impact on Trent customers was relatively less. Premiumization without a price increase is key as customers want good quality but do not want to pay a high price.

Trent is focusing on making the business model/business proposition relevant for customers, which works in every market cycle. Only a handful of retailers who stayed over the last 10 years.

Product Diversification Play

The company looks to balance the diversification of the portfolio, where having more than 5-7 brands/formats would be too much to manage and only 1-2 brands/formats would be too less. It will try to balance all the formats. There are many opportunities within the lifestyle segment.

Operating as a retailer with a recognized brand gives a company more chances to become successful instead of merely a retailer or a brand. Trent sees digital as a growth enabler rather than a growth driver.

Trent's key focus is to target the aspiration segment with the best quality products without increasing prices, as value-oriented customers are very price-conscious.

Product proposition, price point, and experience are the three key cornerstones that will help organized retailers gain a higher share.

During Q3FY23, Trent and the MAS Group of Sri Lanka formed a 50/50 Joint Venture to design, develop, and manufacture lingerie, activewear, and related apparel products. In Q3FY23, emerging markets including innerwear, footwear, and personal care products contributed 18%+ of total revenue. This JV will further uplift the category mix sales and improve growth.

Four Key Success Elements of Trent Ltd

Remain a D2C brand owning customers without using the middleman (distributor).

Focus on building and supplying own brands instead of third-party brands to create differentiation.

Offer less product repetition and limited discounts to keep fashion fresh and customers delighted with new variants at low pricing.

Target more women customers, as it increases chances of selling men's and children's wear through women's audiences. For example, Lululemon had a 100% women’s portfolio previously, which allowed it to expand into men’s and other categories. The kid’s category is not very exciting, but Trent will cater to the segment to complete the family portfolio.

MAS Tie-Up For Lingerie

MAS has solved the product problem for many top brands like Victoria's Secret , Lululemon , and Nike .

The key focus is to create a good quality product, which can be sold at 25-30% lower than the market without compromising on the quality.

There is a huge demand for good quality lingerie products. Trent may try to sell lingerie at a low ASP with a 40-45% margin and at good quality, as Indian customers are very price sensitive.

This is the first category where management has agreed to sell the product from outside its network, possibly due to the product’s pull (need not be combined with other fashion purchases).

Star–Is There A Growth Opportunity?

Management is extremely positive about the format as it believes Star is now gradually reaching a point where it feels confident about getting the business model right.

It has created a differentiation in product proposition for the business, which is seeing good traction. Management will leverage its own brands and focus on the limited SKUs and Fresh foods.

Trent plans to accelerate store additions as it is now on track to achieve healthy store economics. It expects to benefit from the closure of mom-and-pop stores in the long run.

The company is increasing its focus on accessories and beauty categories, which are seeing very good traction in existing formats.

Financials Snapshot

Financial Ratios

Return ratios were impacted by COVID in FY21. As a result, over the last five years, the average Pre-tax RoCE for Trent stood at 21% and RoE at 6%. Return on Invested Capital (ROIC) on average over FY18-22 stood at 4%.

Comparison with Peers

Revenue Trend among Peers

Segmental Breakup

Risk

Trent faces intense competition from other brick-and-mortar retailers like Lifestyle International , Aditya Birla Fashion , Shoppers Stop , etc. The company also faces competition from online retailers like Amazon , Flipkart , and Myntra .

Heightened competition from both brick-and-mortar and online players could impact the overall same-store sales growth of Trent. The company is competing with the crowded branded apparel segment and facing steep competition from unorganized players as the entry barrier is low.

Indian retail is subject to a high degree of competition. Though the Industry is predominantly unorganized, brands of other retail majors are also upping the ante.

Star remains in a restructuring phase as of now. Though losses are coming off steadily, reaching the break-even point may take some more time.

Higher promotional spending may not necessarily yield the desired degree of revenue traction. This is because the consumption sentiment pan-India remains muted as of now.

Trent's valuations are largely influenced by the same-store sales performance of its Westside outlets. If there is any performance miss at this end, it would cause some distress in the company.

At this moment valuation seems to be high in comparison with peers. It has to be closely observed if the Industry's leading performance and consistent revenue growth can support these premium valuations in the future.

Growth Forward

Trent shows continued growth potential in its top line in the coming quarters given the robust performance despite challenging times, focus on store expansion, rapid growth in emerging categories, and improvement signs in the Star Bazaar business witnessing strong revenue growth.

250 store additions between Westside and Zudio for FY23-24E Liquidity position remains strong with cash & investments worth 350+ crore that will enable it to tide over the current situation better than peers. Zudio continues to be the growth engine for Trent.

Trent’s industry-leading revenue growth is majorly driven by:

a. Strong SSSG and productivity,

b. Strong footprint additions and

c. Zudio’s strong value proposition.

It continues to outperform its peers and offers a huge runway for growth over the next three-to-five years. Trent has, over the years, consistently outperformed peers given the strong brand patronage ( Westside, Zudio, Star, Zara ) and proven business model ( Westside : 100% private label).

Share of the Zudio format in standalone revenues is expected to increase to 37% by FY24. Furthermore, a sharp increase in profits in the share of associates (Zara and Star Bazar) during 9MFY23 is a key positive and signals emphasis on cost-cutting measures and its journey towards improving the profitability of the ‘Star’ format.

Do mention in the comment section if you have ever tried any of the above brands. If yes, tell us how you feel about the brand.

Disclaimer: The information provided in this reference is for educational purposes only and should not be considered as investment advice or recommendation. As an educational organization, our objective is to provide general knowledge and understanding of investment concepts. We are not registered with SEBI (Securities and Exchange Board of India) and do not provide any buy/sell/hold investment advice, suggestions, or recommendations, nor do we provide any Portfolio Management Services.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and should not be borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.