10 mins readPublishing Date : 2024-01-13

Unveiling the Glittering Dynamics of India's Gems and Jewellery Market: Trends, Challenges, and Growth Drivers

Introduction

India's gems and jewellery industry, deeply rooted in culture and tradition, has stood the test of time as a symbol of prosperity and adornment. In recent years, this glittering sector has witnessed a dynamic interplay of market forces, consumer preferences, and global economic factors. Let's embark on a detailed exploration of the key trends, market dynamics, and the promising future that unfolds within the gem and jewellery industry in India.

Market Overview

Annual Demand Surge

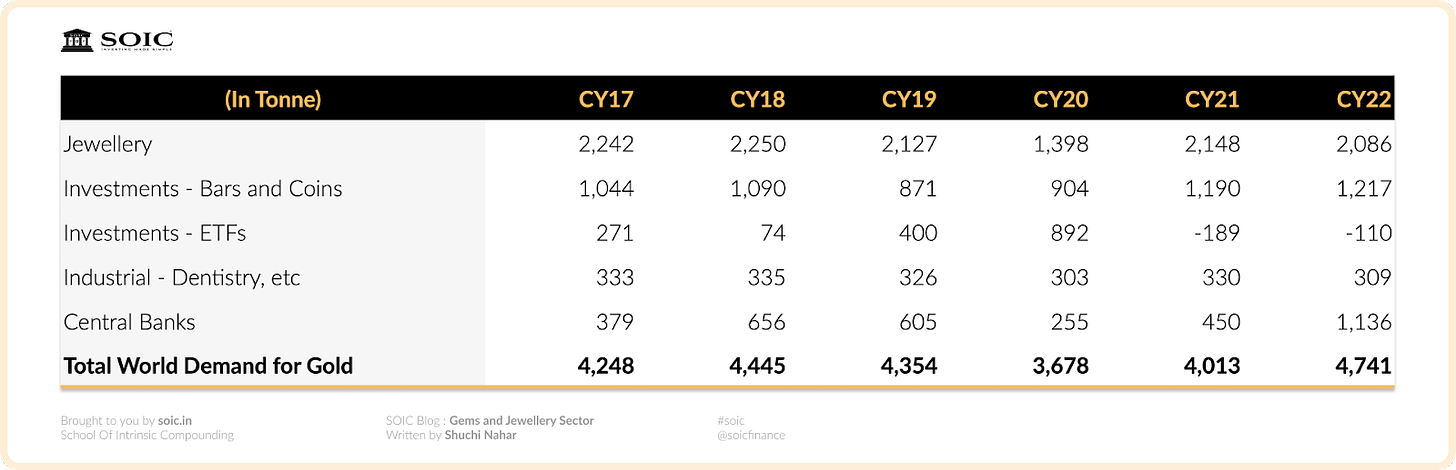

In 2022, the annual gold demand experienced a remarkable 18% surge, reaching a staggering 4,741 tonnes. Notably, robust investment demand played a pivotal role in this growth, with a 10% increase in investment demand (excluding OTC). Higher central bank holdings, particularly for two consecutive quarters, contributed significantly to the overall demand growth.

Sources: WGC Gold Demand Trends Full Year 2022, Senco DRHP

Jewellery Market Challenges

While investment demand thrived, the jewellery market faced challenges, resulting in a 3% decline in global demand to 2,086 tonnes. Factors such as higher gold prices, a slowdown in global economic growth, and a demand crunch in China, the largest consumer of gold, weighed on overall gold demand.

Domestic Market Valuation

In the fiscal year 2023, the domestic gems and jewellery market was estimated at approximately Rs. 4,700 billion. Gold jewellery dominated this market with a commanding 66% share. The industry, however, grappled with various headwinds, including demonetization, rising gold prices, the COVID-19 pandemic, and adverse regulatory changes.

Domestic Gems and Jewellery Market Split

Numerous headwinds led to a moderation in gold demand over fiscals 2016-23; organised players grew faster than the industry.

Source: WGC, industry, CRISIL MI&A Research, Senco DRHP

Gold Prices and Market Dynamics – Fiscal Year 2023 Impact

Gold prices in fiscal year 2023 were influenced by the US Federal Reserve's rate increase and a strengthening dollar. Despite a decline in prices, the market remained resilient, estimating a valuation of ~Rs. 4,700 billion.

Historical Price Trends

The gold market, experiencing fluctuations since 2013, peaked in fiscal 2016, recovered, and witnessed a 25% increase to $1,825/troy ounce in fiscal 2021. The expected rise in Fed rates in FY24 is anticipated to restrict further increases.

Gold jewellery demand in volume terms will likely improve over the medium term. A low base, pent-up demand, and more weddings are likely to boost jewellery demand in the near term. Over the long term, improving economic growth, rising urbanisation, and increasing disposable income levels are expected to aid growth.

Sources: WGC; CRISIL MI&A Research, Senco DRHP

Value Chain

Dominance of Gold and Diamonds:

The gems and jewellery sector in India revolves around gold and diamonds, forming the core of the product value chain. Gold, encompassing jewellery, bars, and coins, constitutes the major driver of domestic demand, while diamonds are primarily processed and exported.

Source: CRISIL MI&A Research, Senco DRHP

Jewellery

Gold and diamond studded jewellery and products made using other precious and semi precious stones and precious metals.

Manufacturing and Sales of Gold Jewellery

Source: Company reports, CRISIL MI&A Research, Senco DRHP

Manufacturing and Sales of Diamond Jewellery

The gems and jewellery sector is a significant contributor to India's foreign exchange earnings. In fiscal 2022, gems and jewellery constituted 9.4% of the country's exports (in value terms). India’s gems and jewellery exports comprise:

Cut and polished diamonds

Gold and diamonds

Studded jewellery

Bars, coins and medallions

Others include coloured gemstones, non-gold jewellery, pearls, synthetic stones, and rough diamonds.

Source: CRISIL MI&A Research, Senco DRHP

Foreign Exchange Earnings

The industry plays a crucial role in India's foreign exchange earnings, contributing 9.4% of the country's exports in fiscal 2022. The gems and jewellery exports include cut and polished diamonds, gold and diamond-studded jewellery, bars, coins, medallions, and other gemstones.

Market Share of the Players

The government has also taken steps to support and boost old gold recycling in India, primarily because it reduces the reliance on gold imports. The government introduced the Gold Monetization Scheme in 2015, where idle funds from households can be deposited with an RBI-designated bank and interest can be earned on the same.

In February 2021, the scheme was tweaked to transform banks and large jewellery retailers into BIS-certified gold collection and purity testing centres to encourage gold to enter the gold monetization scheme system. An organised segment to continue gaining share in the retail jewellery market.

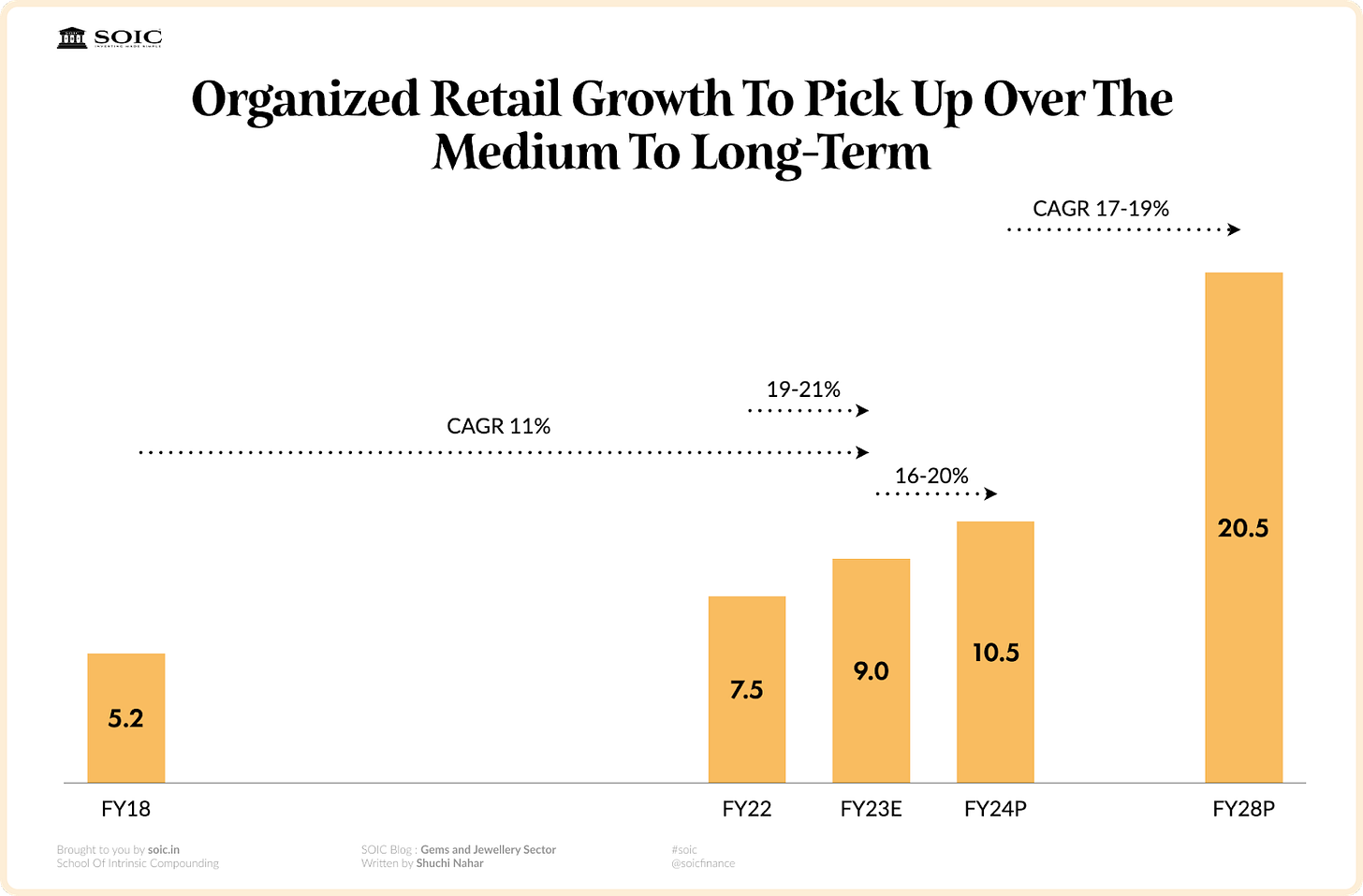

Organised Segment To Continue Gaining Share In The Retail Jewellery Market

Source: CRISIL MI&A Research, Senco DRHP

Emergence of Pan-India Retailing

Regional chains dominate the organised segment, which currently makes up 33–38% of the market as a whole. These jewellers have years of experience in the main areas, which has given them a thorough understanding of the preferences of local customers for particular designs and styles. They have also built a solid network in their region. However, in an attempt to grow, regional players are now venturing outside of their home region, which has caused this trait to start shifting recently.

In the 1990s, the Tata-owned Tanishq brand was introduced, signalling the beginning of the pan-Indian jewellery retailing industry. Prior to that, a number of areas had their own well-known brands, including Senco Gold and PC Chandra Jewellers in the east; Tribhovandas Bhimji Zaveri, Waman Hari Pethe Jewellers, and PN Gadgil in the west; and PC Jeweller in the north. In the south, there were Kalyan Jewellers, Malabar Gold, and Joyalukkas.

To leverage the shift in consumer preferences from unorganised to organised jewellers, numerous brands began to broaden their reach throughout the entirety of India. In addition to starting company-owned stores, a lot of them went the asset-light, franchise route to increase their market share. As a result, less capital was needed, allowing for quicker expansion.

Dynamics of Large and Small Format Stores in the Gold Retail Market

The gold jewellery market in India needs to be more cohesive and organised. Large retail chains dominate the jewellery retailing market in urban areas, but unlike the manufacturing of gold jewellery, the retailing segment has been gradually moving towards the organised sector.

Retail jewellery stores vary in size depending on their location and anticipated foot traffic. In South India, for example, stores tend to be larger than in other regions due to higher ticket sizes and the need to stock more inventory because customers there prefer heavier gold jewellery. The majority of family-owned single stores in semi-urban areas are smaller in size.

A retail jewellery store in an urban setting typically occupies 3,000–5,000 square feet. Numerous well-organised jewellery retailers have also opened large-format retail spaces that span more than 5,000 square feet in areas with significantly higher foot traffic and average ticket sizes.

Comparison of Key Parameters – Small Format vs Large Format Stores in Urban Areas

In India, the majority of jewellery retailers produce and market gold, silver, and diamond jewellery. Most jewellery retailers in India manufacture and sell gold, silver, and diamond jewellery.

List Of Players With Their Key Product Segments And Regional Presence

Source: Company website and annual reports, news articles, CRISIL MI&A Research

Seasonality In Jewellery Buying

Source: Company reports, CRISIL MI&A Research

Demand for jewellery rises in the months of the wedding season, such as May-June, September-November, and January. During the months of November and December, rural households invest their crop money in gold jewellery.

Gold demand in Tier II and Tier III towns is influenced by agricultural output and monsoons. During auspicious religious events like Diwali or Dhanteras in October and November and Akshaya Tritiya in April and May, demand for gold and silver jewellery increases.

Major Organised Jewellery Retailers – Domestic Store-Level Details In India

Source: Company website, annual reports and filings, CRISIL MI&A Research

Advantages Of Franchise And Company-Owned Models

Source: Senco DRHP

Financial Data Of Major Organised Jewellery Retailers (FY23)

Source: Company reports, CRISIL MI&A Research

^ For Titan, revenue and revenue growth data is for its jewellery division, while the remaining other data is for Titan Company Ltd.

Details Of Major Organised Jewellery Retailers In East India (Indicative List, Not Exhaustive)

Sources: CRISIL MI&A Research, Company reports

Organised Retail Growth To Pick Up Over The Medium To Long Term

Source: CRISIL MI&A Research

Demand Drivers And Consumer Trends

Influential Factors:

Several factors drive the demand for gems and jewellery in India. Seasonality remains a key influencer, with weddings, festivals, and harvests shaping the demand landscape. Rising income levels, a preference for branded jewellery, and urbanisation contribute significantly to the evolving dynamics of the market.

Shift Towards Organised Retail:

The demand for organised jewellery retail is fuelled by transparency in pricing, retail store experience, and exposure to gold-saving schemes. Branded jewellery has found a significant place in the competitive market, transforming the shopping experience with attentive attendants and well-displayed merchandise.

Financial Landscape And Success Factors

Success Elements:

Success in the gems and jewellery sector hinges on several factors. Designing capabilities, efficient raw material sourcing, managing foreign exchange volatility, scalability, hallmarking, and working capital management are identified as key success factors.

Hallmarking and Quality Assurance

Hallmarking, especially among organised players, provides a significant advantage by offering certificates of quality. This certification helps alleviate doubts regarding the purity of the products, establishing trust with consumers.

Some Of The Fine-Tuned Strategies Adopted By Industry Players

Competitive Gold Rates: Aligning gold rates with competitors for transparency and competitiveness.

100% Exchange Value Assurance: To foster trust, providing 100% exchange value on gold weighing 22 carats or more from any jeweller.

Benchmarked Making Charges: Determining making charges based on the best local competitors for craftsmanship that prioritises value.

Regionalised Store Inventory: Tailoring inventory to regional preferences for a personalised shopping experience.

Celebrity Endorsement: Partnering with a movie star as a brand ambassador for increased brand presence.

Thriving with Technology

WBQ Programme: Integrating cutting-edge technologies like CAD, 3D printing, and casting simulation for quality assurance.

Omni-Channel Experience: Providing store cards, 24-hour delivery, and an EZ process for a seamless shopping experience.

Winning Customer Trust

Competitive Gold Rate Matching: To ensure customer satisfaction, matching gold rates with rivals.

Absence of Deduction on Gold Exchange: In order to foster trust, gold exchange is exempt from deductions, irrespective of the source.

Standardised Making Charges: Using standardised making charges will result in clear and uniform pricing.

2x In-Store Inventory: Maintaining a 2x in-store inventory to offer a diverse selection for customers.

Additionally, various concepts with distinct purposes are implemented by the companies, which are as follows:

Golden Harvest Scheme:

Concept: A savings plan where customers make periodic payments, receiving a bonus or discount at the end.

Purpose: Encourages regular savings, fostering brand loyalty, and enables high-value jewellery purchases without a significant upfront payment.Studded Mix:

Concept: Combining precious metals with gemstones or diamonds to create diverse jewellery designs.

Purpose: Enhances product range, appeals to varied tastes, and attracts a broader customer base.Gold on Lease:

Concept: Customers lease gold jewellery for a period, with the option to buy or return at the end.

Purpose: Provides flexibility for special occasions, acts as a marketing tool, and caters to customers hesitant about outright purchases.Customisation and Personalisation:

Concept: Offering personalised options for designing jewellery with unique touches.

Purpose: Enhances the customer experience, reflects individual style, and sets the brand apart with exclusive, one-of-a-kind pieces.Digital Presence and E-Commerce:

Concept: Establishing a strong online presence with e-commerce, virtual try-ons, and digital marketing.

Purpose: Expands reach to a global audience, connects with tech-savvy customers, and provides seamless, engaging shopping experiences.Sustainability Initiatives:

Concept: Focus on eco-friendly practices and responsibly sourced materials.

Purpose: Appeals to environmentally conscious consumers and aligns with corporate social responsibility.Limited Edition Collections:

Concept: Release unique, and time-limited jewellery collections.

Purpose: Creates exclusivity, generates excitement, and attracts collectors.Digital Marketing and Social Media Engagement:

Concept: Utilise digital channels, social media, and influencer collaborations.

Purpose: Showcases products, engages customers, and builds a brand community.Innovative Design Collaborations:

Concept: Collaborate with designers, artists, or celebrities for trendsetting collections.

Purpose: Taps into new markets, creates buzz, and elevates brand image.Augmented Reality (AR) and Virtual Try-Ons:

Concept: Integrate AR for virtual jewellery try-ons.

Purpose: Enhances the online shopping experience and aligns with digital trends.Educational Content and Workshops:

Concept: Provide educational content on gemstones, metals, and craftsmanship.

Purpose: Builds trust, loyalty, and enhances perceived value.Seasonal Promotions and Events:

Concept: Run promotions tied to seasons, holidays, or special events.

Purpose: Creates urgency and capitalises on peak buying periods.Customer Loyalty Programs:

Concept: Reward repeat customers with discounts and exclusive perks.

Purpose: Fosters long-term customer loyalty and encourages brand preference.

Conclusion

Together, these strategies reflect the industry's adaptability to consumer preferences and market trends, contributing to sustained competitiveness in a dynamic landscape.

India's gems and jewellery market, though encountering challenges, remains a shining jewel in the nation's economic crown. As consumer preferences continue to evolve, organised players equipped with transparency, innovative designs, and efficient business models are poised to play a pivotal role in shaping the future of the industry. The journey of India's gems and jewellery market promises both challenges and opportunities, marking a captivating chapter in the nation's economic tapestry.

Disclaimer: The information provided in this reference is for educational purposes only and should not be considered investment advice or a recommendation. As an educational organisation, our objective is to provide general knowledge and understanding of investment concepts. We are SEBI-registered research analysts. This blog is only meant for educational purposes, and nothing in it constitutes investment advice.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and not borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.

😎🤘📚💯😇🙏

Very well explained thanks for Help