Varun Beverages: Standing on the Shoulders of Giants

About the Business

Varun Beverages Ltd is a RJ Corp group company who also owns Devyani International (franchise for Pizza Hut, KFC, and Costa Coffee). It is PepsiCo’s second largest franchisee outside the United States and they have been with PepsiCo for more than three decades since 1991. They operate in 6 countries that are India, Sri Lanka (contributes 1-1.5% of the total volume), Nepal, Morocco, Zambia and Zimbabwe. Currently they are also planning to enter Democratic Republic of the Congo with no additional capex rather than using the existing capacity in other countries and test the market. Earlier they were also in the Mozambique market but disinvested within a year as they did not find the scaling opportunity lucrative enough.

The Indian subcontinent contributes around 80% of the revenues and rest is from others, having 1.35 billion consumers around the globe which translates into 1/6th of the population. Within India they have franchise rights in over 27 states and 7 Union Territories. The only ones left are Jammu & Kashmir, Andhra Pradesh, and Ladakh. The business model of Varun Beverages is very simple. They are bottlers for the Pepsi Cola which many Indians like to drink and you might have also seen advertisements from Ranbir Kapoor to Salman Khan.

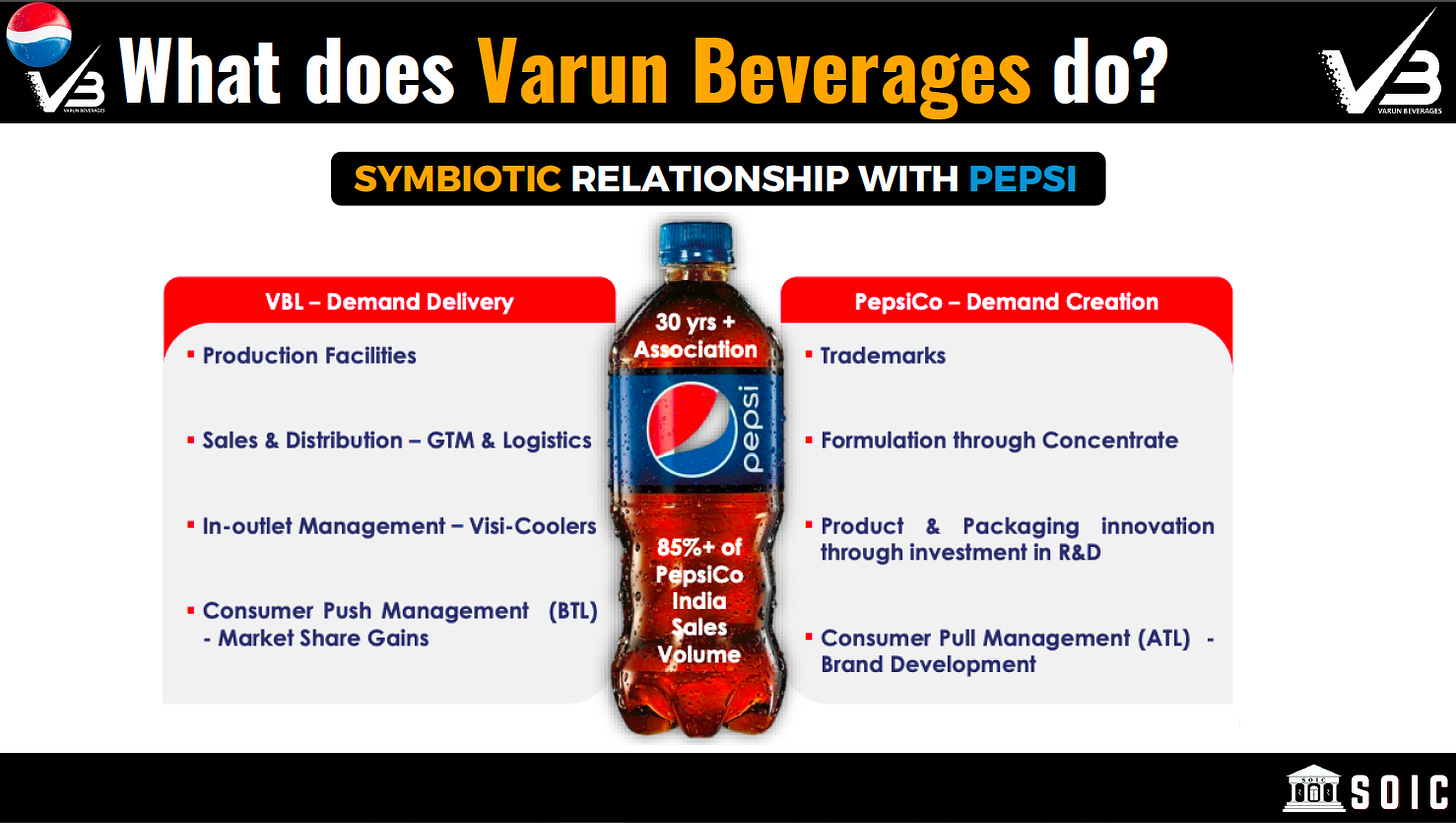

What does a bottler do? They get the concentrate from the brand owner, that is Pepsi in this case, and manufacture the carbonated soft drinks (CSDs) and distribute it themselves. The price of this concentrate is decided by PepsiCo which can also be a risk to the business as Varun Beverage do not have control over it. This concentrate forms 10-20% of the raw material cost for the company.

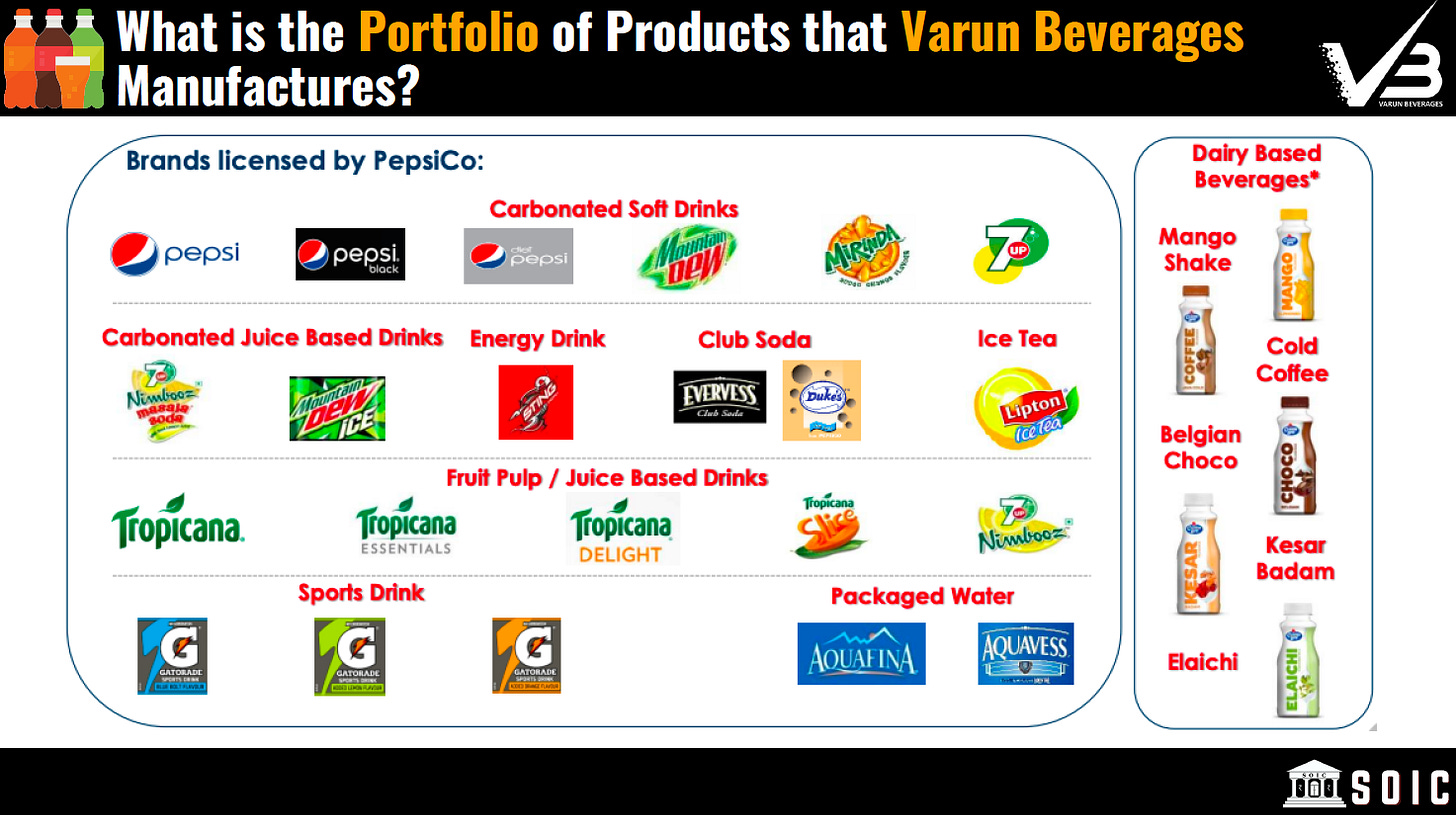

They have also extended to non-carbonated beverages (NCBs), where they charge 4-5% royalty, like Tropicana and Sting and packaged drinking water but NCBs do not contribute much to the revenues as of today.

Varun Beverages contributes around 85% of PepsiCo’s India beverage sales volume compared to 45% in CY16 which shows the trust of PepsiCo on their execution capabilities.

Industry Outlook

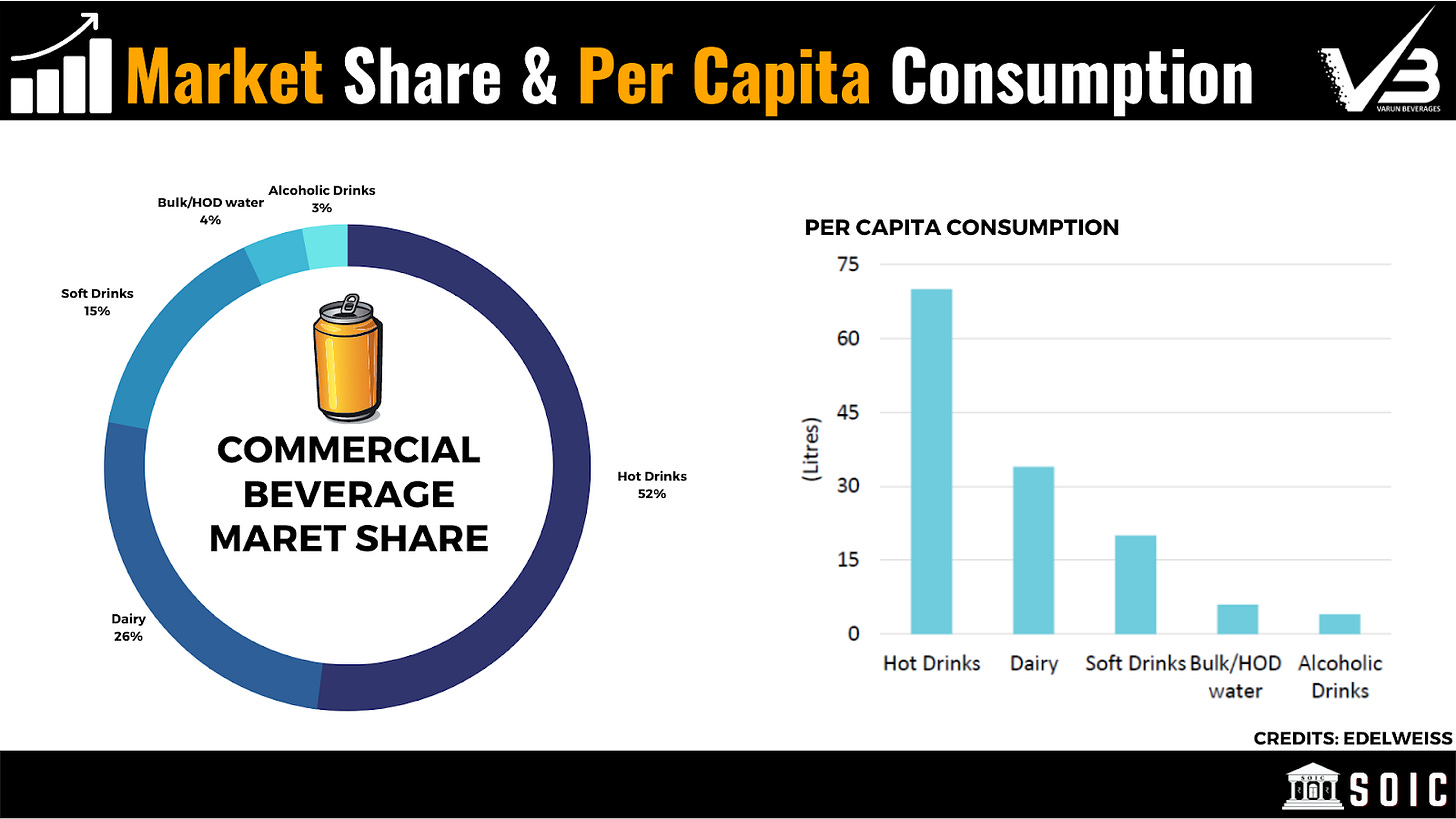

The Indian Carbonated Soft Drink industry is controlled by 2 major players that is Coca Cola with 60% market share and PepsiCo at 30%.

Indian non-alcoholic beverages market is expected to compound at 8.7% to reach ₹1.47 trillion by 2030. India’s per capita sales in 2018 was at 21.36 liters compared to the Philippines at 111.89 litres and Vietnam at 69.75 litres. Further, India’s revenue per person will be $8.89 in 2019 compared to $1,030 in the US and $67.05 in China.

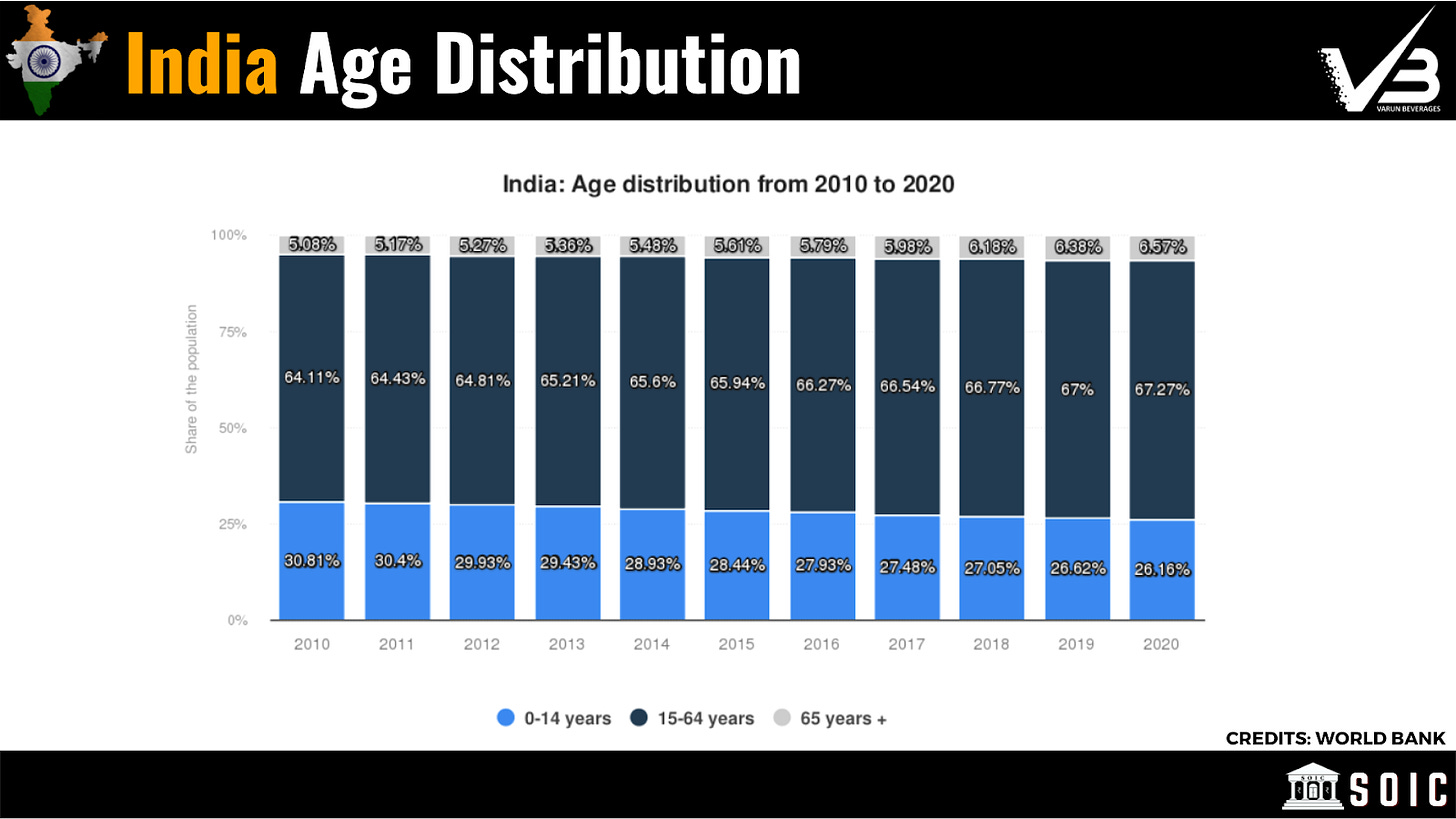

Even though the data would be few years old it shows us the huge opportunity size available. This is coupled with the favourable demographics of India where the majority of the population is in the age range of 15-64 years and 50% of India’s population falling under the working age category which can lead to increase in disposable income.

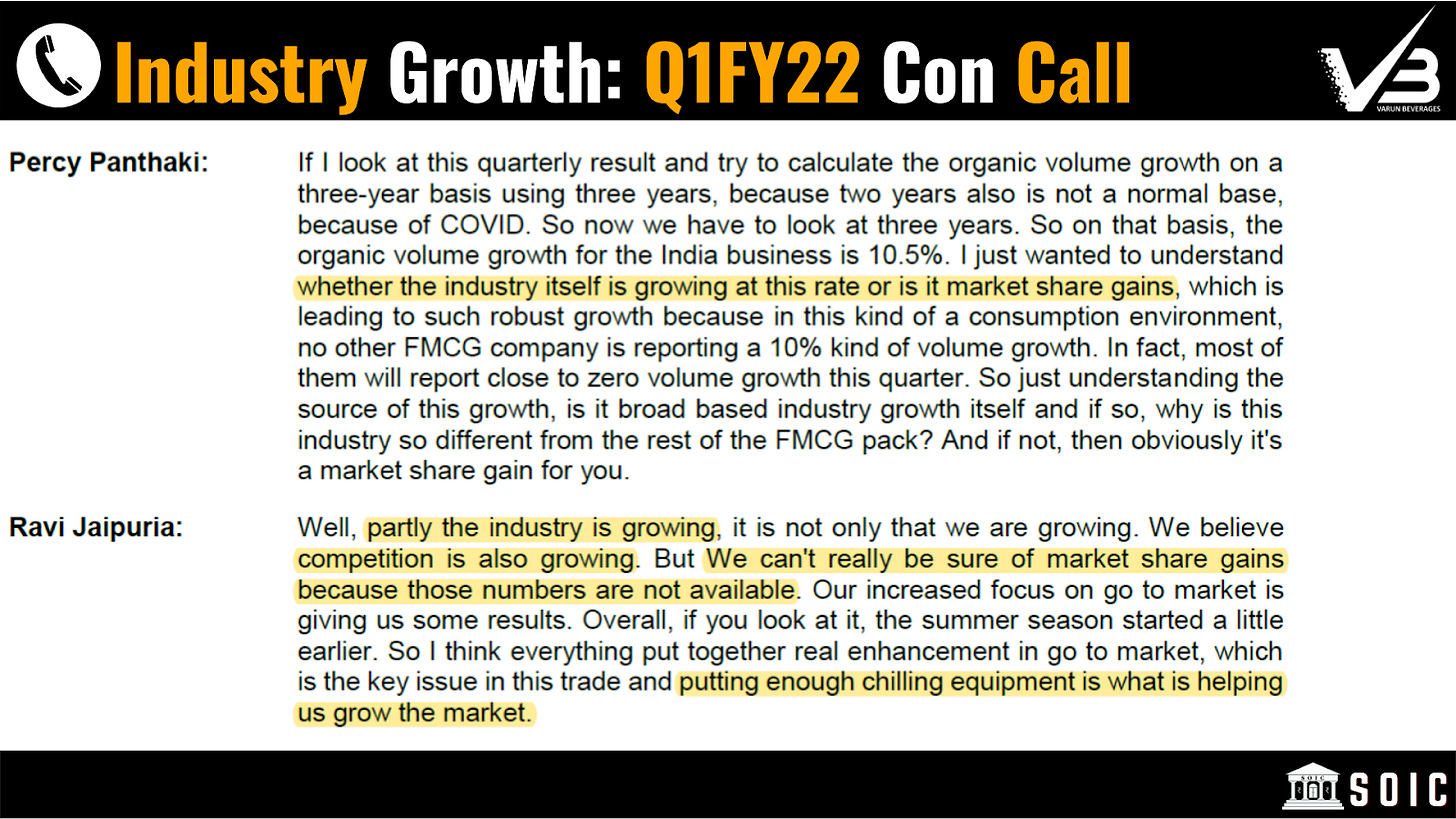

The industry itself is very lucrative and it could be growing in double digits as hinted in the concalls by the management:

Distribution Reach

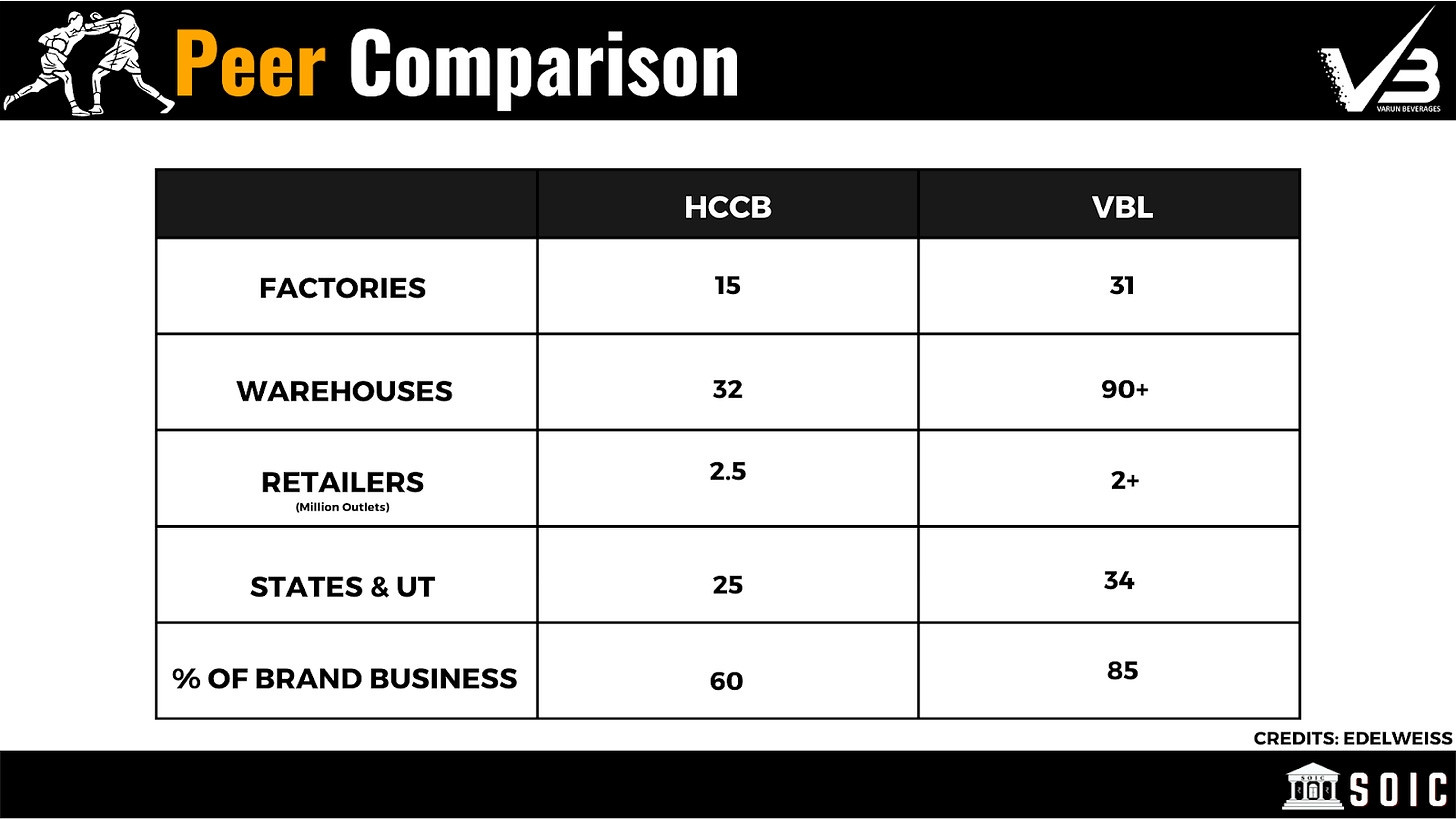

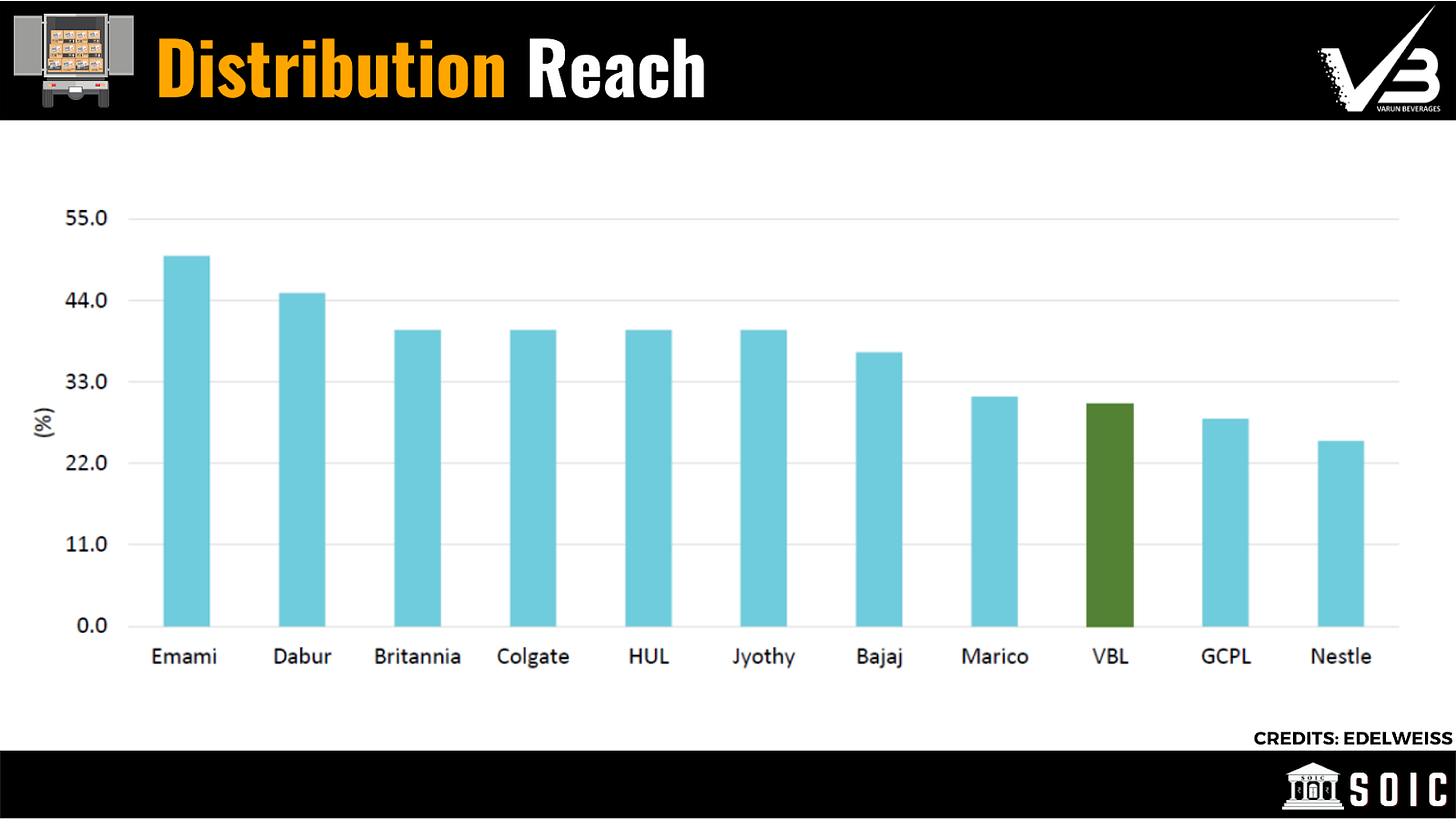

Currently the company has 37 production facilities (this used to be 16 in CY16), 100+ Depots, 2,500+ Owned Vehicles, 2,000+ Primary Distributors, Installed 8.40 Lakh+ Visi Coolers (which they plan to keep adding 40,000 every year) which used to be around 4,50,000+ in 2016, and retail outlet reach of 20 lakh whereas average FMCG company has of about 50 lakh.

Only 40% of their outlets have Visi Coolers in it because of non-availability of the infrastructure/electricity. One thing to keep note here is the cost of the Visi Cooler is taken by Varun Beverages therefore, expansion is not going to be difficult from the company side, it is the problem on the state side where development is required in rural areas.

This reach is spread 40% towards Urban and 30-30 towards Rural & Semi-Urban.

While comparing one has to remember it is harder to penetrate rural areas with a product which has to be served chilled compared to packaged products like other FMCG companies and still Varun Beverages reach is compared to FMCG peers.

Capital Expenditure

Currently there are two recent capex plans which management had incurred which have commenced production in Q1CY22, one is backward integration by manufacturing of plastic preforms and plastic closures at Jammu & Kashmir and second one is at Bihar where the plant will manufacture CSD, Non-CSD, and packaged drinking water.

The rationale behind J&K plant is that they want to make their business more reliant by having control over the raw material, for this they will be incurring Rs.190 cr.

The rationale for Bihar plant is the following:

“We never had a plant in Bihar which is a large territory with low penetration. We were servicing the territory from plants based out of UP. However, it is difficult to service the territory properly when you're bringing the products from other States, especially for a large State like Bihar. With our market share in Bihar being low we saw a large growth opportunity which would not be possible to service until and unless we put our own plant within the State. Being a 110 plus million population State we want to increase our focus. So, that is one of the key reasons why we are putting up a greenfield plant.” (Q3CY21)

The capex spent at the Bihar plant is Rs.285 cr and the expected revenue guidance by management is 2.5 times of the capex that is Rs.712 crs which takes few years to achieve but they feel it will be faster to achieve this revenue as Bihar is under-penetrated.

Going forward the capex will be mixed of Greenfield and Brownfield as even though at some plants there could have been debottlenecking, but many states have regulations with regards to limits on water usage by a plant hence that caps the number of line of productions to have for their business and requires them to buy new land.

Further, management has provided few guidelines incase they decide to go the inorganic way:

The consideration for the target territory / sub-territory shall be upto 1.0x of revenue (net of GST) ± 20%

The investment will be made such that the consolidated Debt/EBITDA ratio remains under 3x post acquisition.

Acquisition of any territory / sub territory shall be at an EV of under 6x EBITDA wherein EV shall be calculated as Volume X EBITDA X 6 and Volume is last one year proforma volumes of target territory / sub-territory and EBITDA is Varun Beverage’s last one year EBITDA per unit case

Any M&A related to PepsiCo franchise in the territory / sub territory shall be through VBL only

Entering into Other segments

Food Business: Kurkure Puffcorn

Varun Beverage has recently got into an agreement with PepsiCo India to become a co-packer for their “Kurkure Puffcorn” brand and the production will start in Q3CY22. There is not much information available on it but this can play as an optionality which unlock future growth opportunities for Varun Beverages.

Tropicana

If you ever buy a Tropicana juice just look at the name of the manufacturer behind and you will find Varun Beverages, there. This is a higher value product.

They are the first company to get the rights of Tropicana in the world and earlier it was getting co-packed by third parties. Before them getting the rights PepsiCo was struggling with Tropicana and losing market share.

Tropicana is running at full capacity and management plans to double its capacity next year. Further they have started to bring Tropicana juice into PET format and the equipment which they have is interchangeable between Tropicana and diary.

Sting (Energy Drink)

Sting energy drink which feels like a cheaper version of Red Bull is also a premium product which contributes 6-7% of the current revenues.

Other Products

Management has also brought in new products like Mountain Dew Ice, Dairy products under the name of Cream Bell. Further, management has no plans for launching new products as they are already busy with Mountain Dew Ice, which is a completely new category: it’s a juice-based lemon drink, Tropicana, Sting, and Diary drinks. As when launched they were hit with COVID so it was difficult to go full gears! But now they are ready to capture the market.

Even though management has spoken about not launching new products in the future but if you are a very long term investor then the optionality opportunity of the future product launches can be huge for Varun Beverages as PepsiCo owns Lays, Cheetos, Doritos, etc.

Debt repayment

As of Q1CY22, the company has net debt of Rs. 3,100 crore on which their interest payment has been around Rs.200crs. Currently they are more focused on using the cash flow to fund the capex and not raising further debt. But management had guided that once they are done with the capex for 2022 they will work towards reducing the debt by 40%, which should directly flow to the bottom line.

Their average borrowing cost is about 5-5.5% (which is down from 6.5%) but the marginal cost of borrowing for short term loans is at ~ 4.2%.

Recycling of Plastic & Water

Varun Beverages has got into an agreement with GEM Enviro Management Private Limited for recycling of their PET bottles via placing dustbins and vending machines. They specialize in collection and recycling of packaging waste. During calendar year 2021, 70% of the PET resin consumed by Varun Beverages was recycled, as compared to 66% during calendar year 2020.

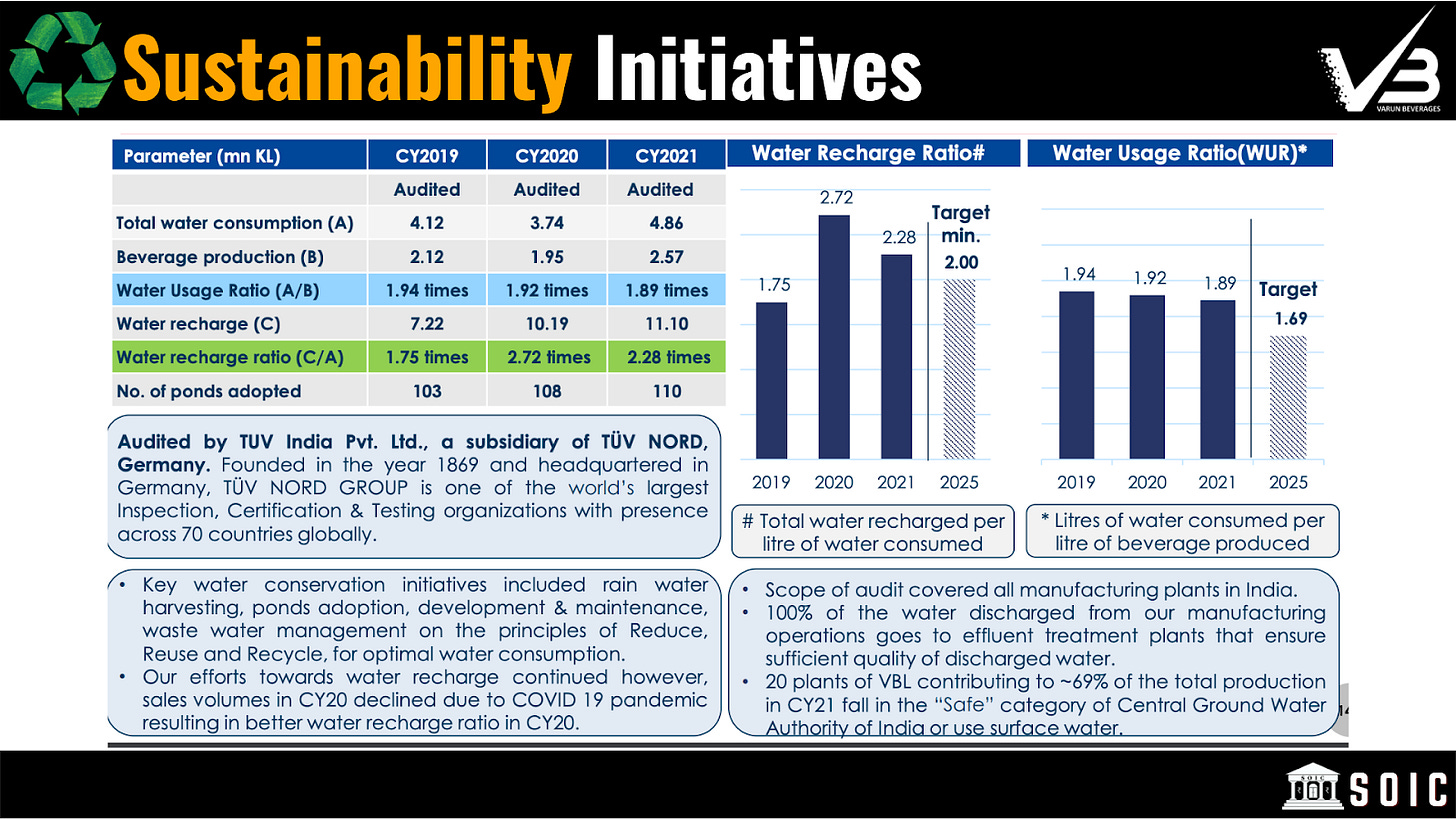

Initiatives regarding water recycling:

Key Risks

Business Agreement Risk: Varun beverage's huge business lies on one agreement with PepsiCo which allows them to sell, manufacture, and distribute products under their brand name. Any deviatiation or termination in the agreement could affect the business severely. But this risk is mitigated as the agreement is valid till April 30, 2039.

Health and Environment Risk: “The beverage value chains are also being reshaped as consumer tastes and preferences evolve towards a greater emphasis on health and sustainability. The industry is continuously focused on introducing new product innovations in sync with these market trends.” – Annual Report CY2021.

The use of water in their production process is a lot hence there is a limit on how many lines of production they can have in a plant in a state, this can lead to putting a cap on brownfield capacity and forcing them to go for greenfield.

Seasonality: There is an element of seasonality in their sales as more than 40% of their sales are done in the second quarter which is the peak season. If anything happens during that time like COVID happened, the demand is severely affected.

Valuation

Product mix is changing towards higher realization products like Sting, Tropicana, international sales, etc. In terms of EBITDA margin they guide for 21% range but one thing to keep in mind is they don’t need to take approvals for any price hikes and as raw material prices increased in the past few months they reduced the weight of PET bottles to cover for it.

In CY19 Varun Beverages acquired franchisee rights from PepsiCo of South & West India, where the average market share is lower than the market share Varun Beverages has in other territories.

There is the element of operating leverage which plays with the seasonality of demand. According to the calendar year Q1 & Q2 being the higher one and Q3 and Q4 on the lower side. Q2 is the peak of summer and Q4 is the peak of winter.

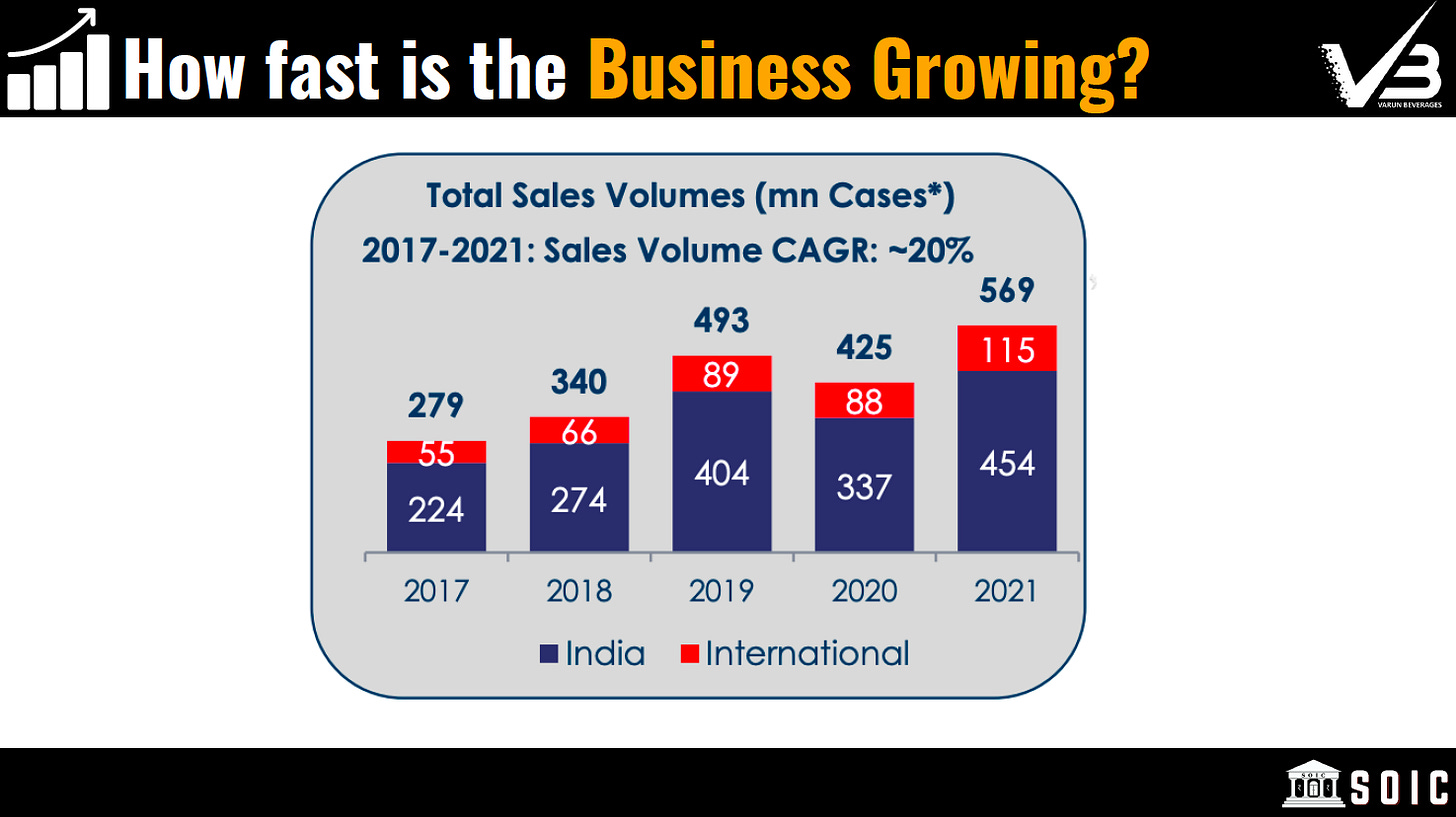

The guidance which management provides for volume growth is between 10-15% but has achieved above that most of the times excludly the COVID impact year.

By doing a quick reverse DCF analysis for the company we can see that the earnings growth expectation for them on the basis of their CY21 net profits comes at 20% with an assumption of a terminal multiple of 30 times for next 10 years and a discount rate of 12%. In the past the management has been able to grow its net profit higher than 20% except for a few down years like COVID.

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. SOIC DOES NOT own the stock in their portfolio at the date this post was published but the author has a tracking position.

About the Author

Arjun Badola is a law student who has interest in analyzing businesses. He shares his thoughts on investing via his blog and twitter. In case you have anything to discuss related to investing, feel free to reach out to him.

Blog: arjunbadola.blog Twitter: @badola_arjun