Ways to Pick Businesses within the Banking Sector!

1) Check the Credit costs across cycles. Credit cost=Provisions/AUM. Some banks which are unsecured will have much higher Credit costs during the downturn. Think about Banks purely into Microfinance vs Secured ones. Compare credit costs of Bengal based Mfin bank vs HDFC or even an AU. Check the Credit costs of AU vs Ujjivan over a period of time. This will give you a rough sense of idea on which bank will do better in an upturn or which one will be worse off in a downturn:-

2. Check which segment they are catering to. If a bank which wants to build a retail asset book all of a sudden starts increasing its wholesale book. Then you know you are in for trouble as the bank has gone off its Strategy. This happened in RBL in the past. Wholesale loans in general are much riskier vs the Retail loans. Imagine giving 1-lakh to 100-borrowers. If two of them default, then the bank might have a Gross non performing asset of 2%. Compare this with a bank which is lending 1 crore to 1 borrower. What if that 1 borrower defaults?

Generally, Wholesale loans are considered riskier in nature, and retail loans like mortgages are considered to be the safest. A house is the last thing a person will default on.

3. Which Segment is the bank or the NBFC lending in?

This is one of the least appreciated mental models that comes while analysing or assessing banks. Investing for the future just doesn’t mean expanding the number of Branches, but it also means which Products are you getting into?

Broadly if you think about it. A bank or an NBFC can have multiple products. Which includes:-

A) Corporate Loans: Chunky or large ticket size loans given to AAA, AA, BB or B- corporates. Lower the grades, riskier the loans generally.

B)MSME Loans and Small business loans:- Loans given to MSME enterprises generally have an average ticket size of 30-50 Lakhs. This is the Bread and Butter for lenders like City Union Bank. 40%+ of their Loan Book consists of such loans. This is also a source of trouble for them as large banks with lower cost of funds entered this product category. City Union Bank unlike others didn’t invest beyond MSME loans or Gold loans at max. Which has led to their growth rates moderating to 12% and they have recently hired a consultant (never a good sign) to enter and build more product categories. Another challenge is that the bank has nearly 70%+ of its branches in one state. It never diversified geographically. This naturally caps the growth rate to the GDP of Tamil Nadu.

Second types of loans are loans given to Small Businesses. These are loans typically where Average ticket size is between Rs.3-6 Lakh. This type lending is much more Opex intensive, done in tier 3-tier 4 cities. Average Loan to value ratio is 45%. If Rs 100 of Collateral is kept, then only Rs45 of loan will be given. These are considered to be secured loans as they are backed by collateral (tough to sell the collateral though, social pressure works more).

Banks like AU and Equitas have perfected their lending to Small businesses. This is a highly profitable business segment for them as both make more than 4.5% ROA in this category.

NBFC’s like Five Star Finance, Aptus & others have also found a niche in lending to Small businesses with low Ticket sizes. As generally it is presumed that these types of loans are too opex heavy for large banks to do.

Insert infographic of their loan book growth: 5star, Equitas and AU Sfb in Small business loans.

C) Housing Loans and Affordable Housing Loans:

Housing loans are given against the house as a collateral and it is considered to be one of the safest types of Loans. As House is one of the last things an individual will default on.

There are Housing Financiers who specialise just in Home loans. These financiers have to ensure that more than 50% of their loan book consists of Home loans. Largest HFC was HDFC ltd with an average loan book of 7,23,000 crores!

Housing loans can also be categorised via ticket size and the cities in which one is lending in. Generally, competition for housing loans went up drastically post IL&FS. Large Private Banks with Low cost of funds like KOTAK Bank, ICICI, Axis & others started growing their loan book aggressively in the mortgages segment. This is also one of the reasons why the HDFC Ltd merger made sense. As these large private banks had lower cost of funds vs HDFC Ltd as a standalone entity. Generally the ticket size in these loans is between Rs. 35-50 lakhs for these loans.

On the other hand affordable housing loans are those which are done in Tier 4-5 cities and certain districts. Here the Average ticket size is less than Rs 10 Lakhs. Think of standalone Affordable housing financiers like AAVAS, or Gruh before it was merged. Even Small business banks have grown their Affordable housing books very aggressively.

D) Personal Loans:

Large banks have grown their credit card exposure very aggressively over the last few years. This is one of the most profitable segments, as it’s much easier to cross sell a credit card service to an existing customer of the bank. As the bank has tonnes of data on the transactions.

Just look at the standalone ROA for SBI Cards:-

There are other NBFCs like Bajaj Finance or Poonawala Finance which have specialised in Personal loans. Moreover, Bajaj has done phenomenally well over the last decade due to white space on Consumer Durable loans.

E) Auto Loans:

Loans given for new 2 wheeler or used 2 wheeler vehicles. Apart from 2 Wheeler, it also includes loans given for New 4 wheeler or Used 4 wheeler vehicles.

F) Commercial Vehicle Loans:

Commercial loans include loans for Light commercial vehicles, Medium-Heavy Commercial vehicles, and Heavy Commercial vehicles. This also includes Used and New Commercial vehicles.

There are banks like Indusind, AU & EQUITAS which specialise in CV Lending.

Then there are CV Financiers like Cholamandalam & Shriram which have built huge loan books in the CV Financing segment.

G) Gold Loans:

Gold loans are small ticket size loans below 1 lakh rupees which are taken by Farmers or small businessmen to meet working capital needs. Here the loan to value ratio on an average is 75%.

These are fully secured loans with Gold which is one the most Liquid assets as collateral. These loans used to be highly profitable, as some of the Standalone Gold financiers like Muthoot and Manapurram were generating 24-25% yields on such loans. However, Ants will come if there is sugar on the floor. Many regional and small banks like South Indian, City union, DCB Bank, Ujjivan, and even large banks like SBI & HDFC Bank became aggressive in this segment.

H) Microfinance segment:-

Finally the most loved and hated part of the loan book when it comes to banks and NBFCs. Microfinance is a deeply cyclical sector where Standalone MFI’s can make 30%+ ROE’s and 5% ROA. But due to deep cyclicality, most of them report 10%+ GNPA when the cycle turns for the worse.

Many macro events like DEMON, Covid, Farm loan waivers have disrupted the industry in the past.

Then there are small finance banks like ESAF, Ujjivan, Suryoday, Utkarsh and Jana etc. Where bulk of their current loan books (70%) can be attributed to Mirco-finance. Thus, in an upcycle these do very well. But in a downcycle their credit costs can go to as high as 6.9%+.

4) ROA Tree and why it matters!

Before coming to a lot of listed businesses. What really drive the Profitability of the banks?

If you understand this, most of the things will become easier in banking post this.

This is how the ROA tree looks like:-

A)Main source of revenue for Banks is Interest income i.e. the income that a bank or an NBFC earns on the loan that it has given.

B) Interest expended is the interest that the bank has given to folks from which it has taken money! Think of interest given out on FD’s, Bulk deposits, or Savings accounts.

C) The moment you subtract Interest income from Interest expensed you get to Net Interest Income.

D) Now, a bank also has other sources of income. This includes treasury profits and other income. Treasury profits or losses are the income generated from the Bonds that a bank holds.

Whereas, other income includes loan processing fees, prepayment of loans fee, Selling of third party products like insurance etc. This is one of the reasons why bank employees are made to hard sell insurance. It increases the Profitability at no cost!

E) Adding Net interest income and Other income you get to Total income for a Bank or an NBFC.

F) Now, to earn this income a bank will need to spend on setting up branches, hiring employees, power cost, IT cost and much more. All of this cost is termed as Opex or Operating Expenditure.

One of the key ratios to find out if a Bank has high or low Opex is to calculate the Cost to income and compare it with peers.

Cost to income= Opex/Total income that the bank has earned.

For a lot of Small finance banks, C/I is at 60%+ and they are sitting on operating leverage as their income ends up increasing in a good cycle.

G) Finally coming to PPOP= Pre Provisioning Operating Profits.

Once we know the Total income (Net interest income+Other income) and Opex. Once we simply subtract the two we get to Pre Provision Operating Profits. Which is also known as PPOP. PPOP will be lower in years where OPEX spends for a bank accelerate. Thus, tracking Cost to income ratio for a bank or an NBFC is extremely important!

H) Credit costs:

Remember the point number 1 I referred to in the blog. Credit costs are simply the cost of providing for bad loans (Gross Non Performing Assets). Credit costs= Provisions/AUM

Different banks will have different credit costs based on their loan profile. For example:- An IDFC First guides for 2% Credit cost due to Higher Retail loans.

Whereas, HDFC Bank due to secured loans will always talk about credit cost of less than 1%.

Banks with higher GNPAs will always have higher Credit costs. Just look at the credit costs of Yes Bank between 2018-2020!

I) PPOP-Credit Costs= This is what finally will give Profit Before Tax and subtracting tax will give us Profit After Tax.

J) Importance of Return on Asset and Return on Equity:-

A bank's credibility is seen in how well it can use its Balance sheet to generate profitability as inherently it is a leveraged entity which can lever beyond 10x.

Number 1 metric to check the Profitability of a bank is Return on asset=

Profit/Total Assets

An ROA of beyond 1.8% is what is preferred by investors. However, how can investors spot an improving ROA?

Simply by thinking about the following:-

1. If the Net interest margins expand (Gross margins) due to improving loan book or Newer Products. Then overall ROA’s will go up.

2. If Total income grows> than Opex. Then the Cost to income will fall and operating leverage will play out. Thereby, leading to an improving ROA or the Bank/NBFC spends on Efficiency to improve its productivity or aum per branch.

3. If credit costs fall due to improving asset quality then the ROA and Profitability will improve.

4. If Interest rates increase, and NIM’s go up whereas Cost of Funds go up with a lag. Even in this scenario in the short term the ROA ends up increasing.

Thus, we can conclude the ROA of a bank can improve due to:-

1. Improving Loan Mix or Higher Margin Products.

2. Falling credit costs

3. When Income grows faster than Opex=Operating Leverage

4. Improving efficiency with higher digital loans or productivity per branch.

Return on equity is nothing but ROA multiplied by Financial leverage that the bank is taking.

ROE across the landscape:-

5) Finally coming to a simple Strengths and Weakness analysis of Businesses across the landscape.

A) NBFC’s: Bajaj Finance, IIFL Finance, Poonawala, Five Star Finance.

Bajaj Finance:

Strengths

Best track record for an NBFC that has scaled across products and different segments. Moreover, it has maintained a Pristine asset quality while doing so.

Bullish argument is that in the entire lending landscape Bajaj finance has a 2% Market share. If the market keeps growing at 1.5x GDP, the market share of BAF expands to 5% over the next decade. Can Baj fin continue its 25%+ AUM Growth to justify the High Price to book?

Weakness

Many Bajaj Finance shareholders will rather ignore than ever think about Base rates. Thinking about risks is something that one should do without getting hurt ;)

Risks remain: how much can they grow when HDFC bank retail book is 6,00,000+ cr, Bajaj is approaching 2,70,000 crores and banks are prioritising retail growth given slowdown in corporate loans. Any AUM slowdown or fall in NIM’s as the Housing subsidiary is going at a very fast clip can be a risk at 39x PE and 8.4x PB.

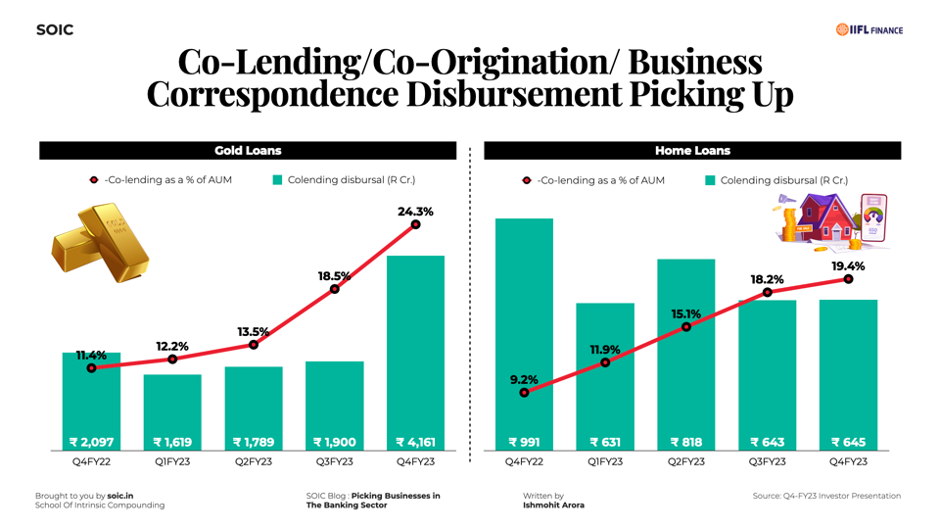

IIFL Finance

Strengths

One of the only Multi-Liner Gold Loan NBFCs with exposure in Housing loans, Microfinance, Business loans and Wholesale loans.

They have successfully cracked the Co-Lending model. AUM has scaled to 64,638 Crores.

In the last 2 years they have set up more than 1000 branches which led to their Cost to income and cost to assets ratio increasing. Thus, as income grows and opex falls. The NBFC is sitting on operating leverage.

Weakness

Cost of funds will increase in FY24. As a liability franchise it isn’t as strong. Average COF stands at 8.8% which can see further increase in FY24, thus NIMs might take a hit. Even though they have guided for falling cost to income and lower credit costs.

Another bit of weakness lies in numerous group entities which are listed and frequent news of violations of insider trading regulations (small amounts). It is important to see if they can control these issues from spilling over.

Poonawala Fincorp

Strength

Low cost of funds due to the business group that backs Poonawala Finance. COF for Poonawala stands at 7.9%, which is 50bps higher than Bajaj Finance at 7.4%.

Digital first NBFC which is guiding for lower Cost to income ratio and 40%+ growth rates in AUM, along with 35% growth in PAT. Moreover, the new loan book ex of Magma is barely doing 0.4% NPA. Base is small in size at around 16,000 crores AUM which they are guiding to take it up by 3x.

Weakness

Hasn’t seen a proper downcycle yet once the base size increases. Another weakness is that the growth rates at 40% might be too fast in an unsecured lending category. We have to keep assessing how the asset quality, and growth matrix pans out.

Five Star Finance

Strength:

Identified the niche of Lending to small businesses with Average Ticket Size of 3-3.5 Lakh Rupees, at the same time they have controlled their Gross Non Performing assets and have scaled their AUM nearly 50x in last 8 years. This is how the Historical Metrics of Five Star Finance Look like:-

Weakness:

Yields are too high for a secured loan product! Basically they are charging 2% Per month to the customer. Given its mostly a one product or segment NBFC it will be interesting to track how well it scales. As we have seen with multiple NBFCs in the past. That scalability becomes an issue after crossing a certain threshold.

Second key weakness is the high number of Borrowers missing their First and Second EMI’s. Stage 1 (31-60 days) and Stage 2 (61-90) days bucket remains at 9.15%+.

How well they scale by entering different districts is something that one needs to track carefully. As 3 states contribute to Bulk of the Assets Under Management.

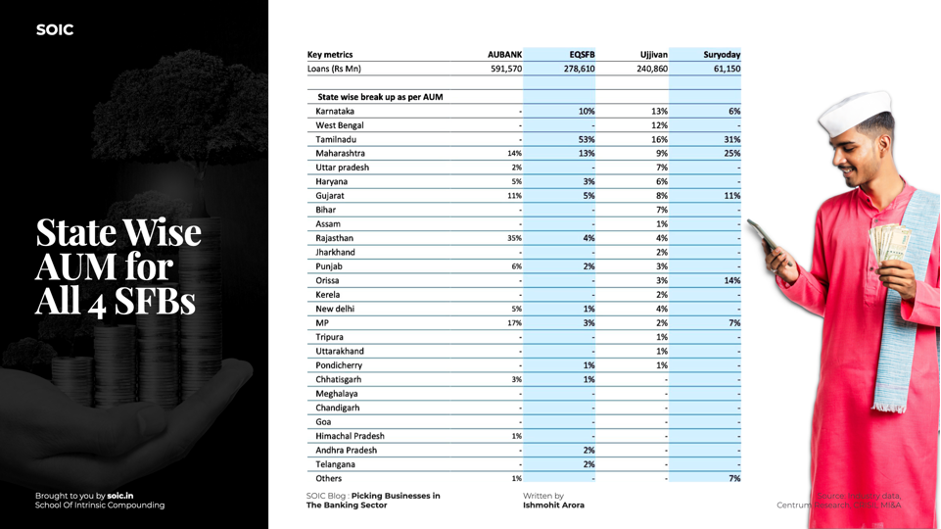

B) Small Finance Banks: There are 12 Small Finance Banks. With the top 3 controlling more than 50%+ of the gross advances of the SFB’s. SFB’s were born to deepen the penetration of credit in the country.

AU Small Finance Bank

Strengths:-

Highest mix of secured Assets amongst all the Small finance banks at 92%.

Lowest credit costs amongst all the Small Finance Banks due to higher share of secured assets.

Fastest SFB to scale to 50k+ crores AUM using its strength in its home state of Rajasthan. It is diversified across products including Small business loans, Wheels, Home Loans, Personal Loans, Commercial assets etc. An interesting fact is that AAVAS used to be the Housing finance arm of AU. They had to sell it due to regulations. However, AU itself has grown its Housing Finance Loan book at a CAGR of 180%+ in similar Geographies as Aavas.

Last bit of strengths are that AU has the most consistent Profitability numbers both in terms of ROE and ROA amongst the peers.

Weakness

Multiple resignations of KMP’s in 2021 has been one of the weaknesses. Both the Chief risk officer & Internal audit head resigned in 2021. This is something that an investor needs to track, if KMP’s stay in the bank for long terms or not.

However, recently Mr. Sanjay Aggarwal was given another 3 Year term by RBI to continue in his role as the MD.

Churn in KMP’s and continuity is something that needs to be observed as the Price to Book Multiple of the bank is at 4.5x +.

Equitas Small Finance Bank

Strengths

Equitas started diversifying its loan book away from Microfinance in 2015. As the Founder P.N Vasudevan saw multiple black swan events in the unsecured lending category.

Over the years, the secured portion of the loan book has been scaled to nearly 82% of the overall mix.

Bank has built a very granular Liabilities profile which is proven by the share of retail deposits which stands at 77%. This is highest amongst all the Small Finance Banks.

The small business loans vertical of the bank does 4.5%+ ROA and LTV is 45% in this business unit. Overall, the bank has finally come out of Covid and has started hitting 2% ROA in the last 2 Quarters. The key thing to observe will be, if they can maintain the consistency of their ROA profile.

Weakness

In Spite of doing secured loans, the bank suffered during the covid downturn with restructured book going as high as 10% of its Gross Advances.

Apart from this, the MD choosing to retire and then to come back and take another 3 year extension does ensure continuity. One still needs to track the composition of the board and the intent of the MD to continue. A Bank is only as good as the Banker that is heading it 🙂

Final bit of Weakness lies in the fact that more than 53% of the Loan book is from the state of Tamil Nadu. Even though the bank has been increasing its exposure to Gujarat and Karnataka (also seen in IPL sponsorship). One still needs to track how the Geographical mix moves over a period of time.

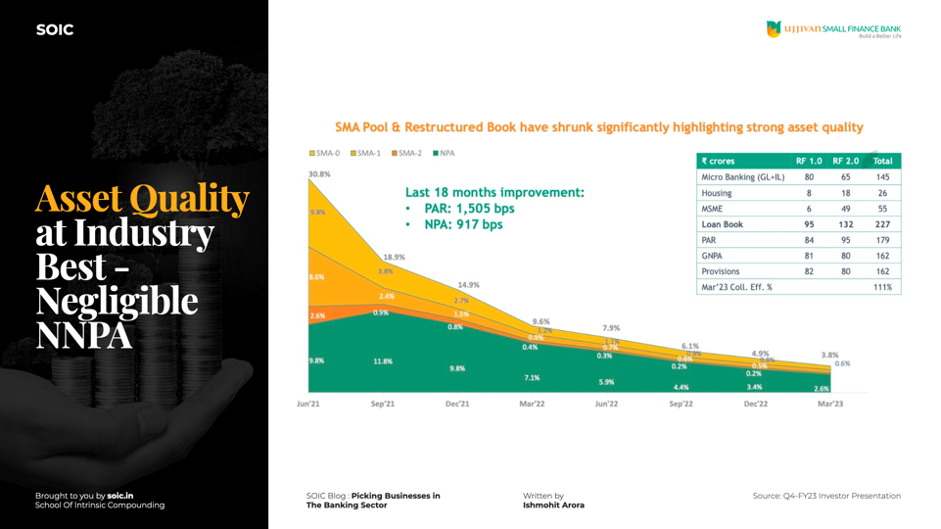

Ujjivan Small Finance Bank

Strengths

In the near to medium term bank may see a steep jump in its return ratios as the micro finance sector is under tailwinds. Its RoA in the upcycle can cross 4%. Also, the bank has cleaned up its NPA and currently its Net NPA is ~zero as their provision coverage ratio is almost 98%.

Ujjivan is the most diversified SFB geographically, it has presence in almost all states and UTs & no single state accounted for more than 16% of its AUM. The top three states together contribute around 41% of their AUM. In comparison with other peers like AU and Equitas their AUM is concentrated in a smaller number of states, ranging from 66% to 76% of their total AUM.

Weakness

The microfinance sector operates in a manner that is strongly influenced by economic cycles. In periods of economic decline or downturns, the industry experiences pronounced fluctuations. During these downcycles, gross NPA of these banks can rise significantly.

There have been multiple resignations of KMP in the past, during 2021 & 2022 its CFO, non-executive director, various independent directors, Managing Director and CEO and company secretary resigned from the bank. Currently the bank is headed by Mr. Ittira Das who is working as an interim MD & CEO of the bank for one year. Going forward the bank plans to have 40% of its loan mix from secured segments and 60% will still be microfinance. Thus, the business will have its own cycles of downturn and upturn.

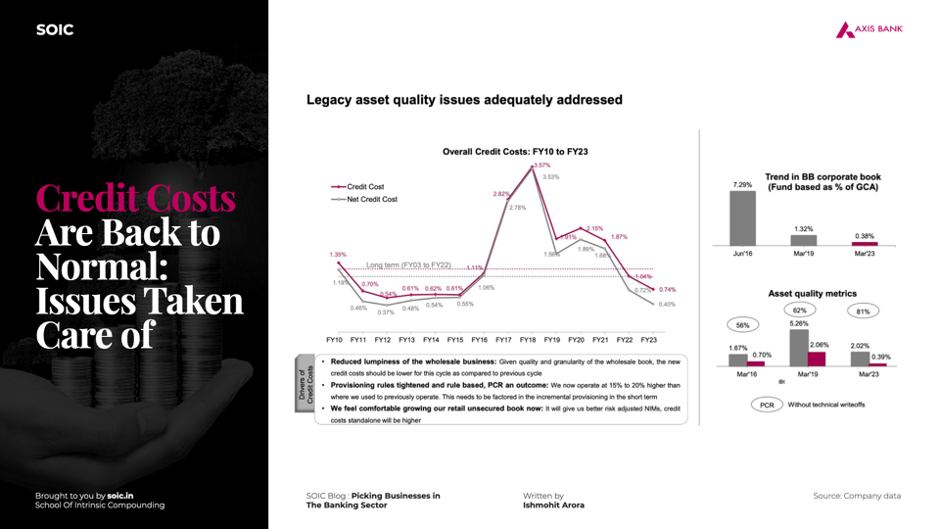

C) Large Banks: Axis Bank, ICICI Bank, Kotak Bank

Axis Bank

Strengths

Currently the bank is witnessing one of the best periods for the business as its RoA and ROE excluding Citi transaction looks really strong and management is guiding to continue the momentum in near future with advance growth of 12 to 13%. ROE is touching close to 19-20% which is one of the best for large private sector banks.

Bank has one of the lowest credit costs in the last 12 years with the highest provision coverage ratio because of the measures adequately taken by the management on reducing the wholesale business and taking care of legacy credit cost issues.

Weakness

Previously, the bank encountered significant challenges with its NPA previously as its credit cost escalated to a staggering 3.57% in the fiscal year 2018. However, subsequent to this period, there was a change in the managing director position, and Mr. Amitabh Chaudhary assumed control. As a result, the current credit costs have reduced significantly to 0.74%. NIM’s are something that the investors need to track and the movement of NIM’s over a period of time.

ICICI Bank

Strengths

In recent years, the bank has demonstrated strong performance across various indicators and achieved favourable return ratios under the guidance of Mr. Sandeep Bakshi. The bank's growth can be attributed to its management's emphasis on adopting a 'pull' approach for business development rather than a 'push' approach.

ICICI Bank has successfully established the most robust provision buffer among banks in India, which could help mitigate potential fluctuations in asset quality in the medium term.

Weakness

Allegations of significant lapses in internal control have surfaced under the leadership of former CEO and MD, Chanda Kochhar. These allegations point to failures in maintaining effective governance mechanisms and compliance within ICICI Bank. Investigations are ongoing to determine the validity of these allegations and their potential impact on the bank's overall operations and regulatory compliance.

One has to track how the asset quality does in the next downcycle. That will be the hallmark of changing leadership from HDFC to ICICI. If the latter does well in the downcycle too.

Kotak Mahindra Bank

Strengths

Kotak Mahindra Bank leads its peers with the highest CASA ratio of approximately 53%. In comparison, HDFC Bank, ICICI Bank, and Axis Bank have CASA ratios of 44%, 46%, and 47% respectively as of March 2023. This gives Kotak Mahindra Bank a notable competitive advantage, as the higher CASA ratio allows them to utilize their low-cost funds to engage in more aggressive lending and pursue opportunities to attract high-quality customers.

It is run by arguably one of the most conservative bankers that the Indian Banking industry has seen. Reading concalls of Kotak Bank will make one realise that how the Leadership at banks makes a real difference in the outcomes.

Weakness

The approaching completion of Mr. Uday Kotak's tenure as MD & CEO in December 2023 is viewed by the market as an overhang on the bank, resulting in a consolidation phase for its stock price over the past three years. The uncertainty surrounding the transition of leadership has created a cautious sentiment among investors, leading to a period of consolidation where the stock price has been relatively stable, as the market awaits clarity on the succession plan and the future direction of the bank under new leadership. This is one of the key points that an investor needs to track.

D) Old Banks: Bank of Baroda, South Indian Bank.

Bank of Baroda

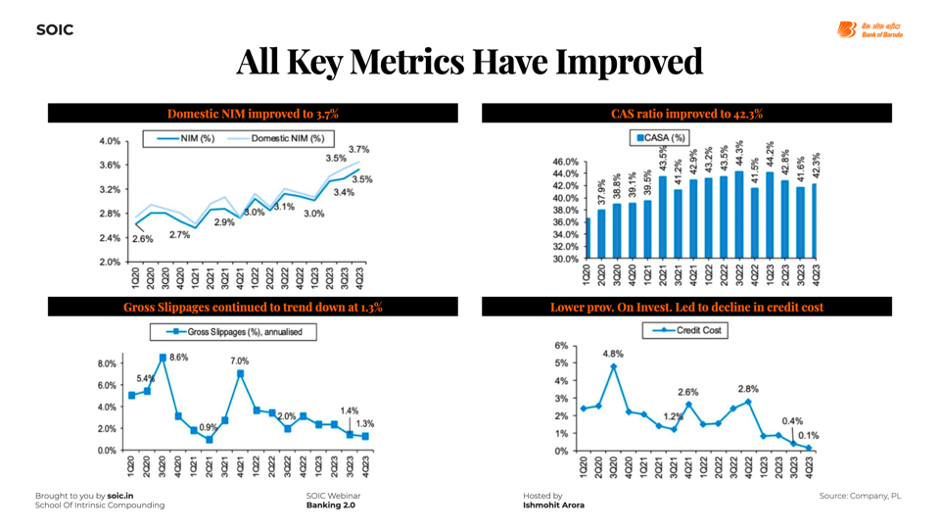

Strengths

Over the past few quarters, all key ratios for the bank have shown drastic improvements. Management is confident that this trend will continue in the near future.

The bank is currently experiencing extremely good asset quality and is projecting a credit cost of less than 1% in FY24. This trend is expected to continue in the medium term, as some write-backs are anticipated. Moreover, the Credit costs have fallen to below 0.5%. Like other PSU banks, the strength of a CASA franchise, diversified asset mix and a strong branch network exists.

In addition, management is guiding for a return on assets (RoA) of 1% and a return on equity (RoE) of 16-18% in the upcoming year.

Weakness

Public sector banks have been a major source of wealth destruction in the past due to a number of factors, including government interference in policy making, poor asset quality, corporate scandals, and lax lending practices. Any downcycle in the broader Banking system impacts PSU’s the most.

South Indian Bank

Strengths

In the past three years, Mr. Murali Ramakrishnan has successfully led a remarkable transformation at the bank. Under his leadership, the institution has shifted its focus from being a corporate bank to becoming more oriented towards retail banking. During his tenure, approximately 58% of the total loan portfolio has been reevaluated and revamped. As a result, the new loan book exhibits an impressively low Gross Non-Performing Asset (GNPA) ratio of just 0.09% in comparison to the 11.9% ratio observed in the previous loan book.

The bank is now retail focused where they are growing into gold loans, personal loans and corporate loans only for those whose credit rating is A and above.

The management always wants to beat the expectations so they under promise and over deliver, like previously they guided to reach to 1% RoA in FY2025 but they achieved it during Q4-FY2023 and will maintain the same for FY24. Also, for FY24 they guided to have loan growth of 12% but during Q1 their advance growth is ~14.5%.

Weakness

The bank is a regional bank and dependent majorly on Kerala so the regional banks growth will depend on the overall economic growth of these states.

The tenure of Mr. Murali Ramakrishnan who has turned around the bank is completing on 30-Sep-23 and he wants to retire so the bank has chosen the new MD and is currently awaiting for RBI confirmation on the same.

One needs to keep tracking how the asset quality moves under the new leadership. As SIB has been one of the stories which has disappointed many investors in the past.

E) Micro Financiers: Currently, the microfinance sector is experiencing favourable conditions, with the industry expanding at a rate of approximately 21%. It's important for investors to recognize that the microfinance industry is highly cyclical. During downturns, companies with weak underwriting practices tend to incur substantial losses.

Credit Access Grameen

Strengths

As of March 2023, Credit Access holds the position of being the largest MFI NBFC in India, boasting a market share of approximately 6%. With an extensive network of branches established in 14 states, the company has built a strong foundation. Furthermore, their loan book stands at 21,031 crore as of the same period.

In order to enhance its market presence in the states of Karnataka, Maharashtra, and Tamil Nadu, Credit Access acquired Madura MFI during FY20. Additionally, the company is venturing into new territories by establishing new branches, thereby expanding its geographical reach.

Weakness

Credit Access, presently the largest MFI NBFC in India with an asset under management (AUM) of 21,000 crore, may face challenges in sustaining the rapid growth rate it has achieved in the past.

Arman Financial Services

Strengths

Arman, a relatively small MFI NBFC, has been experiencing rapid growth primarily due to its low initial base. Its assets under management (AUM) have increased from 643 crore in March 2021 to 1943 crore in March 2023. In order to sustain this growth trajectory, the company conducted a fund raise in September 2022. Additionally, they plan to raise funds again once their AUM reaches 2500 crore.

Arman stands out in the MFI sector for having a highly conservative management approach. During times of crisis, such as the demonetization period or the COVID pandemic, they have been known to take swift action by halting disbursements. Their priority lies in maintaining the quality of their loan portfolio rather than aggressively pursuing the growth of their AUM. And when times are good, due to a favourable base. The company ends up growing faster than peers.

Weakness

Arman is presently being traded at a valuation that exceeds 4 times its price-to-book value (P/BV). At such a high valuation, the company's performance is expected to align with planned expectations, and any unexpected, significant events (also known as "black swan" events) have the potential to disrupt shareholder sentiment.

There have been multiple black swan events in the Microfinance sector like Demonetisation, IL&FS, Loan waivers, Andhra Pradesh Crisis & Covid Crisis. In deep cyclicals one needs to understand that the stock price cuts can be as deep as 60-70% once the cycle turns for the worse.

This is how we think about the Banking and the NBFC sector. Do let us know the next sector on which we should write a deep dive in the comment section below!!