Windlas Biotech

Three Growth Engines in One Pharma Name

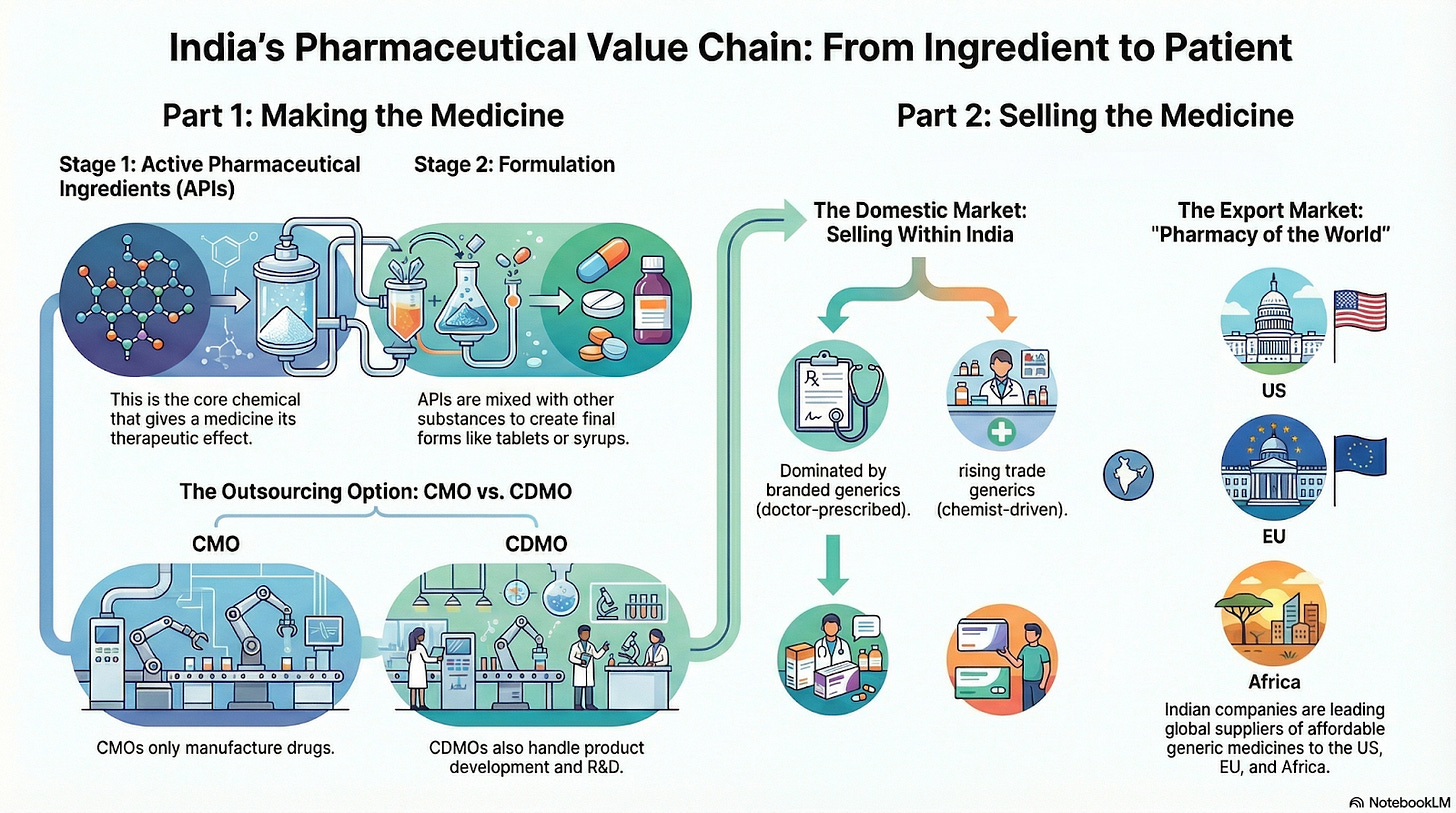

Let’s first start from understanding the pharma value chain!

The pharmaceutical value chain represents the journey of a medicine from its raw ingredients to the final product reaching patients. In simple terms, it starts with making the drug’s active ingredient, then formulating it into a consumable medicine, and finally distributing it to patients either in the domestic market or abroad. Different companies specialize in different links of this chain. Some focus only on producing raw drug ingredients, while others make finished tablets or capsules, and some help other pharma companies by contract manufacturing their products. Many big pharma firms in India cover multiple parts of the chain (they make ingredients, formulate the drug, and market it themselves), but others are niche specialists. Below, we break down each major segment of this value chain in easy language, with examples of major Indian listed companies in each category.

Active Pharmaceutical Ingredients (APIs): The Drug’s Core Components

Active Pharmaceutical Ingredients (APIs) are the core chemical substances in medicines that produce the intended therapeutic effect. In a pill, the API is the main medicine, while the rest (excipients) are just fillers or stabilizers. You can think of APIs as the flour in a bread recipe, the essential base without which the final product (the pill or syrup) wouldn’t work.

India is one of the world’s leading producers of generic APIs (the off patent drug ingredients). Historically, Indian API makers focused on high volume, “commodity” APIs, simple generic drug chemicals made cheaply and in bulk. In recent years, there’s been a strategic shift toward more complex and high value APIs (harder to make ingredients like specialty or high potency drugs) to improve profitability. Broadly, API manufacturers in India can be grouped into a few sub segments:

Commodity API Manufacturers: These companies produce large quantities of basic drug ingredients (often for painkillers, vitamins, simple antibiotics, etc.) at low cost. Their business is volume driven. Examples include IOL Chemicals & Pharmaceuticals and Solara Active Pharma Sciences, which have been known for bulk APIs like Ibuprofen or anti diabetic drug ingredients. These firms compete largely on cost efficiency, and face competition from other low cost producers globally.

Forward Integrated API Players: These are API companies that don’t just sell raw ingredients but also integrate forward into making finished dosage forms (the final tablets/capsules). By moving up the chain, they capture more value. Examples are Laurus Labs and Granules India. Laurus Labs, for instance, started in APIs (like anti retroviral drug ingredients) and then leveraged that strength to launch its own formulations (finished generic medicines) essentially forward integrating into the formulations business. Granules India similarly produces APIs (like Paracetamol and Ibuprofen in bulk) and also makes finished dose pills and sachets, often for export. This integrated model means these companies can use their own APIs as inputs for their formulations, improving cost control.

Complex API Specialists: These companies focus on difficult to make, high value APIs often in niche therapeutic areas or using specialized processes (such as fermentation or multi step synthetic processes). Because not many can make these, competition is lower and margins higher. Neuland Laboratories is a prime example: it specializes in complex APIs and custom manufacturing for global pharma, supplying niche molecules (for example, certain central nervous system or respiratory drug APIs) to top tier pharma companies. Concord Biotech is another, known for fermentation based APIs like immunosuppressants used in organ transplant medicines. Making these involves advanced biotech processes, so Concord has an edge in that niche. Such companies are moving India’s API industry “up the value chain” by focusing on low volume, high value products instead of just mass generics.

(Example to illustrate: Imagine a painkiller tablet like Ibuprofen. A commodity API maker like IOL Chemicals might manufacture tons of Ibuprofen raw material. A forward integrated player like Granules India could take that Ibuprofen API, press it into tablets, and package it. A complex API specialist like Neuland might instead be making a far more complex ingredient, say the API for an anti cancer drug in smaller quantities, which few other firms can supply.)

Formulators: From Chemicals to Finished Medicines

Once the API (drug substance) is ready, it needs to be converted into a finished formulation, the actual consumable medicine form (tablets, capsules, syrups, injections, creams, etc.). Companies in this segment are often called formulators or finished dosage manufacturers. They take the API and mix it with other necessary ingredients to make the final drug product that patients take. Think of this step as baking the cake using the flour: the API is the key ingredient, but the formulator blends it with excipients, forms the tablets or fills capsules, and packages them into the medicines you find at the pharmacy.

Many of India’s best known pharma companies are primarily formulators, they make and sell finished drug products (largely generics). Some formulators are integrated (they produce some APIs in house), while others buy most APIs from suppliers. India has a strong foothold here: it is a world leader in producing generic finished medicines. Major Indian formulator companies include Sun Pharma, Cipla, Dr. Reddy’s Laboratories, Lupin, Aurobindo Pharma, and Torrent Pharmaceuticals, among others. These companies take various APIs (either made themselves or procured) and manufacture a vast range of medicines from common pain relievers to complex oncology drugs often in huge volumes.

Some formulators focus on the domestic market (India) and sell branded generics (generic drugs given brand names for marketing). For example, Mankind Pharma is heavily focused on India, offering popular brands in chronic and acute therapies, and Alkem Laboratories derives a large share of revenue from its India formulations business. These companies have large sales teams that market to doctors and pharmacies in India.

Others are more export oriented formulators, making drugs for overseas markets (like the US, Europe, etc.) under generic names or under contract. For instance, Aurobindo Pharma and Dr. Reddy’s export a significant portion of their generic medicines to regulated markets worldwide. They must meet strict quality standards (USFDA, EU approvals) to do so, and India’s large number of USFDA approved plants attests to this capability

It’s common for big pharma players to straddle both segments: e.g., Sun Pharma not only sells branded generics in India (it has brands like Revital, a supplement, or various prescription brands), but also supplies generics to the US (it even owns Taro Pharmaceuticals in the US). Cipla is another well known in India for inhalers and HIV drugs (domestic and emerging markets), but also selling generic medicines in the US and EU. In summary, formulators are the ones turning chemical ingredients into actual pills and syrups. They are central in the value chain, as they create the form of the drug that patients ultimately use.

(Example: Take Paracetamol, one of the most commonly used medicines in India for fever and pain. An API manufacturer like IOL Chemicals produces the raw paracetamol powder. A formulator like Alkem or Cipla buys that API, blends it with other ingredients, and compresses it into tablets. These are then packaged and sold under brand names like “Calpol” or “Crocin.” The end product you buy at a pharmacy started as raw paracetamol API, turned into a finished tablet by the formulator.)

Contract Manufacturing Organizations (CMOs): Third Party Medicine Makers

Not every pharma company owns large factories to make their drugs, many outsource production to Contract Manufacturing Organizations (CMOs). A CMO is essentially a third party manufacturer that will produce drugs on behalf of pharma companies, usually under that company’s label. This is like a white label manufacturer: comparable to how some electronics brands might outsource their product assembly to a third party factory, in pharma a brand owner can contract a CMO to make its tablets or syrups. The formula and specifications are given by the hiring company, and the CMO just manufactures at scale efficiently.

CMOs are important in India’s pharma value chain because a lot of mid-sized and even large pharma companies choose to focus on R&D or marketing, and let contract manufacturers handle the actual production. India has a host of such contract manufacturers. Akums Drugs & Pharmaceuticals, for example, is a prominent CMO that produces a huge number of the drugs you find in Indian pharmacies for many different client companies. Companies like Marksans Pharma have in the past taken up contract manufacturing for overseas clients, and even some big Indian companies (like Dr. Reddy’s or Cadila Healthcare) have spare manufacturing capacity which they contract out to others. Essentially, any pharma company with strong plants can act as a CMO for another’s products if they choose.

The benefit for the hiring company is they don’t need to invest in additional factories, and they can be flexible with demand; the CMO benefits by keeping their factories running at high utilization. However, pure play CMO businesses usually operate on thin margins (since the product is not theirs and it’s a competitive service business). Scale and efficiency are crucial for them.

(Example: Suppose a pharma brand in India wants to launch a new cough syrup but doesn’t have a syrup manufacturing line. They might contract a CMO to produce, say, 1 million bottles of this cough syrup to their specifications. The CMO sources the ingredients, manufactures the bottles, and delivers them to the brand company, which then labels and sells them. The end consumer just sees the brand’s name; the manufacturing by a third party is behind the scenes.)

Contract Development & Manufacturing Organizations (CDMOs): From Lab to Factory as a Service

CDMOs are an evolution of the CMO concept. Contract Development & Manufacturing Organizations (CDMOs) not only manufacture drugs for other companies, but also help in developing the product (the formulation process, method, stability studies, regulatory filings, etc.). In simple terms, a CDMO offers an end to end service: they can take a client’s idea or research scale formula and develop it into a commercially viable product, and then manufacture it at scale. This is especially useful for companies that may not have in house expertise or infrastructure for formulation development or scaling up production.

In India, the CDMO sector has been growing as pharma outsourcing gains traction. One reason is that even Indian pharma companies (not just foreign multinationals) are increasingly outsourcing their manufacturing, focusing on core competencies like research or marketing and leaving the production to specialized players. Windlas Biotech is a great example of a pure play formulation CDMO. Windlas provides a comprehensive range of services in the value chain from product formulation development and testing to licensing and large scale manufacturing of generic formulations for its clients. Essentially, a domestic pharma company can approach Windlas with a concept for a new generic drug (or a request to develop a product similar to an existing drug), and Windlas will develop the formulation, conduct necessary trials/studies for stability, handle regulatory paperwork for approvals, and manufacture the final tablets or sachets.

Other notable CDMOs in India include Syngene International (which started as a research focused CRO but now offers development and manufacturing for pharma and biotech, especially in early stage and biologics), Divi’s Laboratories (a giant in custom API synthesis effectively a CDMO for bulk drug ingredients for global innovators), Piramal Pharma Solutions (the pharma services arm of Piramal, which does development and manufacturing for global clients, including injectable formulations), and Gland Pharma, which has a model of manufacturing injectable drugs, often in partnership with or on contract for global pharma companies. Suven Pharma is another example, focusing on custom research and manufacturing services for pharmaceutical companies worldwide (especially in the drug discovery and clinical stages).

The key difference between a CMO and a CDMO is the development part, CDMOs add more value by helping create the product and not just producing an existing formula. They often have strong R&D teams and formulation scientists. This typically gives CDMOs slightly better margins and stickier client relationships, since a client who lets a CDMO develop a drug with them is likely to continue with that CDMO for manufacturing.

(Example: Think of a small pharma company that has an idea for a novel combination drug for diabetes. They lack a formulation lab to turn that idea into a stable pill and don’t have a factory for large scale production. A CDMO can step in at the idea stage: formulate the tablet (choose the right excipients, do trial batches), test its shelf life, prepare documentation for regulators, and once approved, manufacture the tablets in bulk. The small company can then market this diabetes pill under its own brand, while all the backend work was handled by the CDMO.)

Domestic Pharma Companies

Domestic pharmaceutical companies in India primarily cater to the branded generics market, where off patent drugs are sold under company brand names and promoted to doctors. However, an increasingly important segment is trade generics, which operates differently and is reshaping drug distribution in India.

Branded Generics

Now, moving further down the chain, we reach the pharmaceutical companies that actually market and distribute medicines. In India, the end market is dominated by branded generics, medicines that are off patent (generic) but sold under brand names by companies to differentiate themselves in doctors’ prescriptions. Domestic Pharma companies typically focus on selling a portfolio of medicines within India. They often have large marketing and sales networks that reach doctors in every corner of the country. These companies may or may not manufacture all their products themselves, many have their own plants but also rely on CDMOs/CMOs for additional capacity or for certain products. Their strength lies in branding, regulatory approvals in India, and doctor relationships.

Examples of major Indian companies with a strong domestic market focus include Mankind Pharma, Alkem Laboratories, Cipla (significant India presence with respiratory and HIV drugs), Sun Pharma (market leader in India’s domestic market, with a huge portfolio), Torrent Pharma, Zydus Life, and specialty players like Eris Lifesciences (which concentrates purely on chronic diseases in India). Even multinational subsidiaries like Abbott India or Sanofi India operate in this branded generics model for the Indian market.

(Example: When you go to an Indian pharmacy with a prescription for fever or pain, you might get a brand like Crocin or Calpol. These are branded generic medicines made by domestic pharma companies. The actual active drug inside is paracetamol, which is a generic molecule, but the brand name and the company’s marketing make doctors and patients trust that particular version. The tablets or syrup might be manufactured in the company’s own plant or by a CMO, but the brand owner is the domestic pharma company that finally brings it to the market.)

Trade Generics

These are essentially the same generic medicines but not actively promoted to physicians. Instead, they are sold directly to stockists and pharmacists at much higher margins, incentivizing chemists to recommend them to customers. Trade generics might carry a less known brand or just the molecule name (for example, paracetamol instead of a popular brand like Crocin) and are often distributed in tier 3 cities, towns, and rural areas. With minimal marketing costs, companies price trade generics lower (often 15–25% cheaper than equivalent branded generics) while offering chemists significantly higher profit margins (sometimes 60–90%). This channel is chemist driven, the pharmacist’s recommendation or substitution drives the sale, rather than a doctor’s prescription.

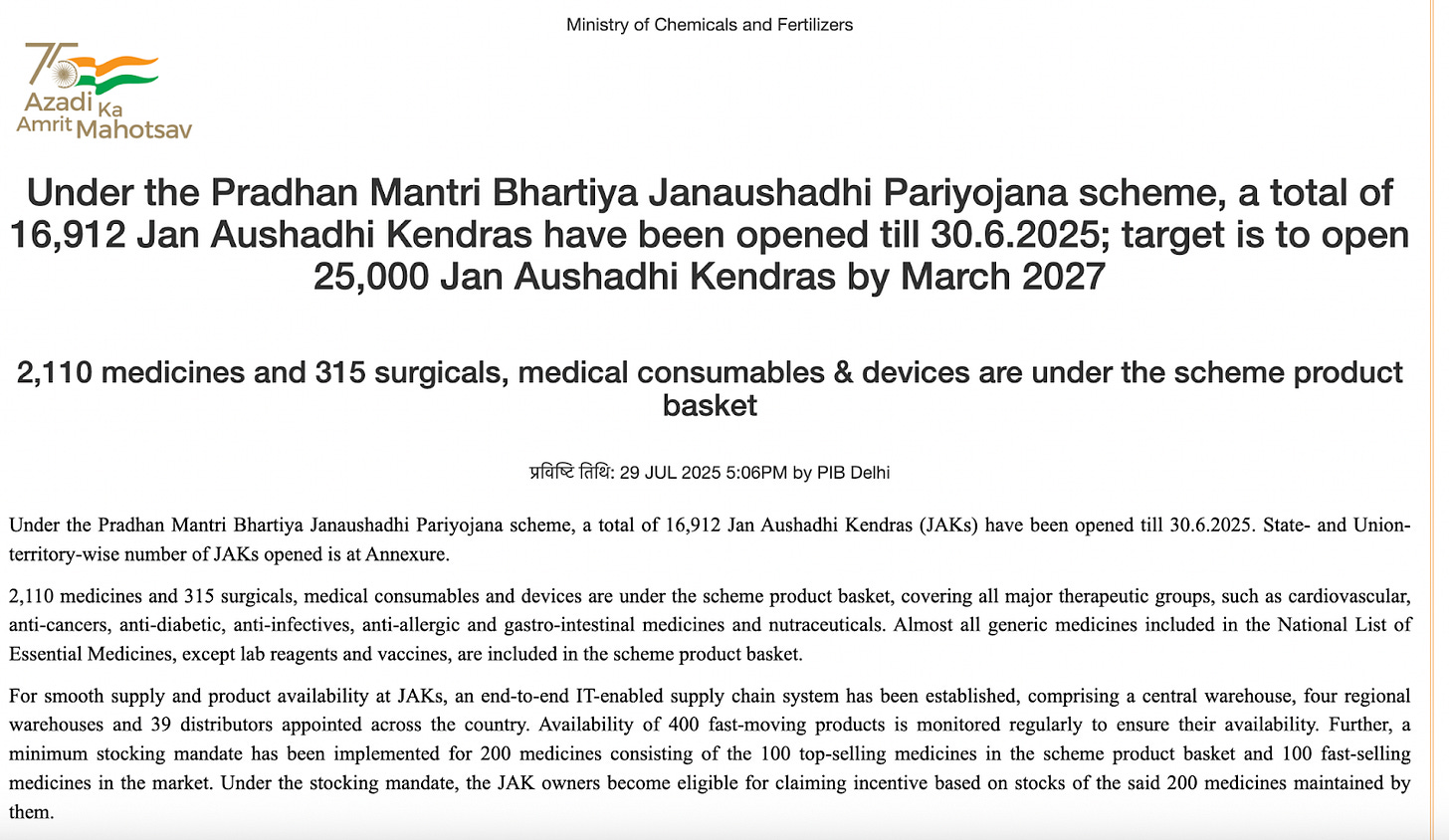

Why Trade Generics Matter in India: Trade generics currently form a relatively small share of the market by value (roughly 5–10% of sales), but they account for a much larger share by volume (nearly 20%). This reflects their low cost, high volume nature and huge potential for growth. Importantly, trade generics improve affordability and access to patients to get medicines at lower prices, which boosts adherence to treatments. Government initiatives like the Jan Aushadhi generic medicine stores (now over 24,000 outlets nationwide) further underscore the push towards unbranded and trade generic drugs to make healthcare more affordable. In rural and semi urban regions where doctors are fewer, trade generics ensure essential medicines reach patients through the retail network. As awareness and trust in generic quality grows, this segment is expanding at a faster pace than the traditional branded market, positioning it as a “dark horse” in India’s pharma value chain. Windlas Biotech, one of India’s leading pharmaceutical contract manufacturers has emerged as a key player in the trade generics space.

Generic Drug Companies: Export Focused Pharma

When we talk about “generic drugs,” we mean medications that are off patent and thus can be produced by multiple companies (not just the original inventor). India’s industry largely revolves around generics (unlike, say, the U.S. where big pharma focuses on new patented drugs). Generic drug companies are those that develop and produce generic versions of medicines and often sell them globally at lower prices than the original drugs. India has earned the nickname “pharmacy of the world” because it supplies affordable generics to so many countries.

Many of India’s top pharma companies have significant export focused generic businesses. They get their drugs approved by regulators like the US FDA or European EMA and sell in those markets once patents expire. Dr. Reddy’s Laboratories, for example, makes generic cancer drugs, anti allergy meds, etc., and sells them in the US, Europe, and other countries. Lupin exports a lot of cardiovascular and diabetes generics to the US. Aurobindo Pharma grew by being a major supplier of antibiotics and ARV (HIV) drugs to global markets (including large tenders for developing countries). Sun Pharma not only dominates in India but also has a huge US business (especially dermatology and specialty generics, partly via its Taro subsidiary). Cipla historically supplied a lot of inhalers and HIV drugs to Africa and other emerging markets and is now also in the US generic inhaler market. Torrent Pharma and Zydus have also been increasing their US generic portfolios.

Some companies focus on specific export niches. For instance, Gland Pharma specializes in generic injectables and largely exports or supplies them to partners overseas, injectables are a high growth niche where Gland acts as both a generic producer and a contract manufacturer for others. Ajanta Pharma built a strong business by focusing on emerging markets (Asia, Africa) with branded generics, adapting to local needs. Caplin Point Laboratories chose to excel in the Latin America market with a range of generics, even before attempting regulated markets. These strategies show that “export focus” can mean different geographies, not only the US/EU.

We are covering the company which is into Generic Formulations CDMO.

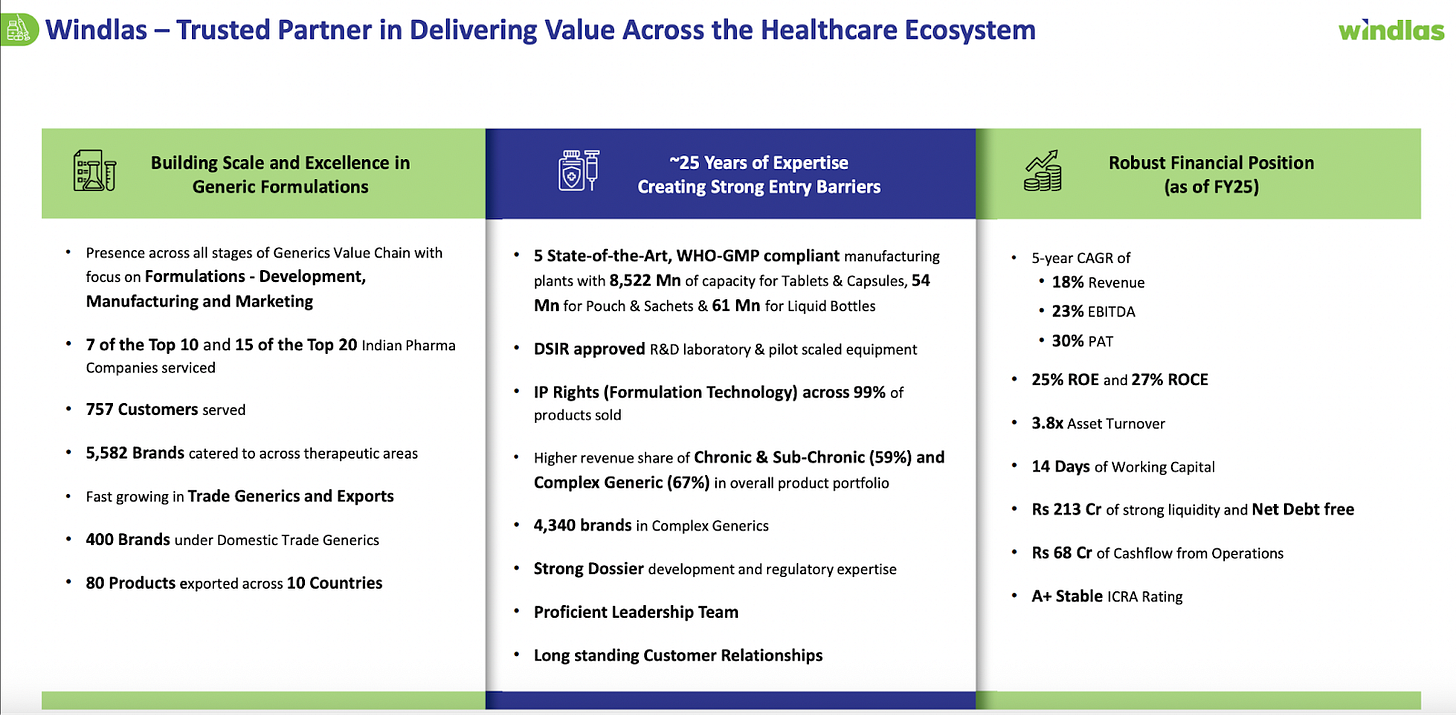

Windlas Biotech: Company Overview

Windlas Biotech Limited is an Indian pharmaceutical company founded in 2001, specializing in the development and manufacturing of generic drug formulations. Over two decades, Windlas has grown from a single plant into one of India’s top five formulation manufacturing partners (CDMOs) for pharma companies. Today, it operates five state of the art manufacturing facilities in Dehradun, Uttarakhand (up from just one in 2001). These facilities give Windlas a large production capacity able to produce over 8.5 billion tablets and capsules per year, plus additional capacity for sachets and liquid bottles. In late FY2024, the company also commissioned a new injectables manufacturing facility built to international cGMP standards, expanding into sterile drug production. This broad infrastructure allows Windlas to make a wide range of dosage forms while meeting strict quality requirements (it has over 177 staff in quality control alone).

Windlas Biotech’s business model spans contract development and manufacturing services for other pharma companies as well as marketing its own generic medicines. The company provides end to end CDMO solutions from product R&D and licensing to commercial scale production of medicines for its clients. It also sells generic formulations under its own brands in India, focused on affordable products for underserved markets, and exports some products overseas. More than 95% of Windlas’s revenue currently comes from India, with exports contributing less than 5%.

Business Segments Overview

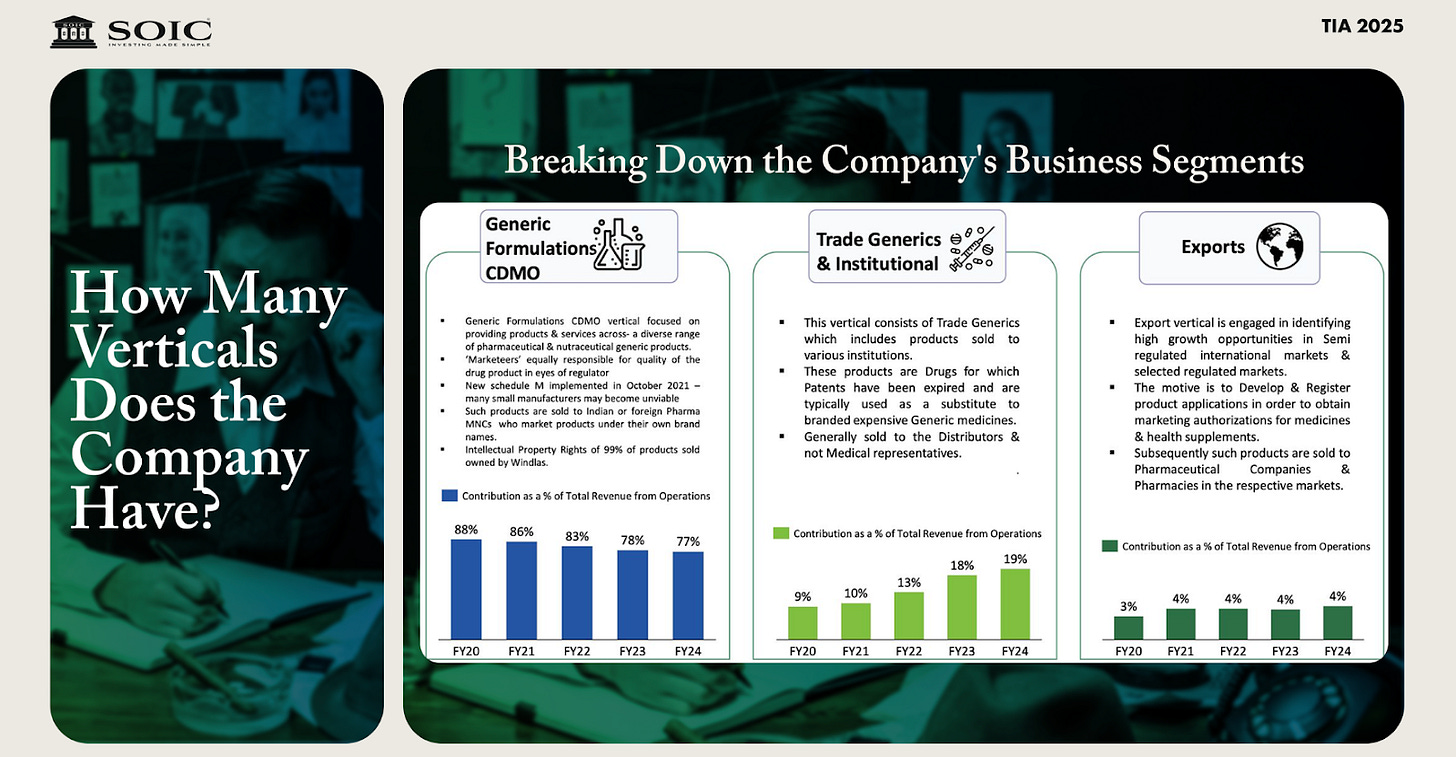

Windlas operates in three main business segments or verticals:

CDMO Services and Products (Contract Development & Manufacturing): developing and manufacturing formulations for other pharmaceutical companies.

Domestic Trade Generics and Institutional Sales: selling generic medicines under Windlas’s own brands in the domestic market (especially in smaller towns/rural areas) and supplying institutions.

Exports: exporting generic pharmaceutical products and health supplements to international markets (primarily emerging economies).

Each segment addresses a different market, and all three have been growing. As of H1FY6, about 74% of Windlas’s revenue came from the CDMO segment, 22% from trade generics, and 4% from exports. Below, we discuss each segment in detail, including Windlas’s activities and the industry landscape for that segment.

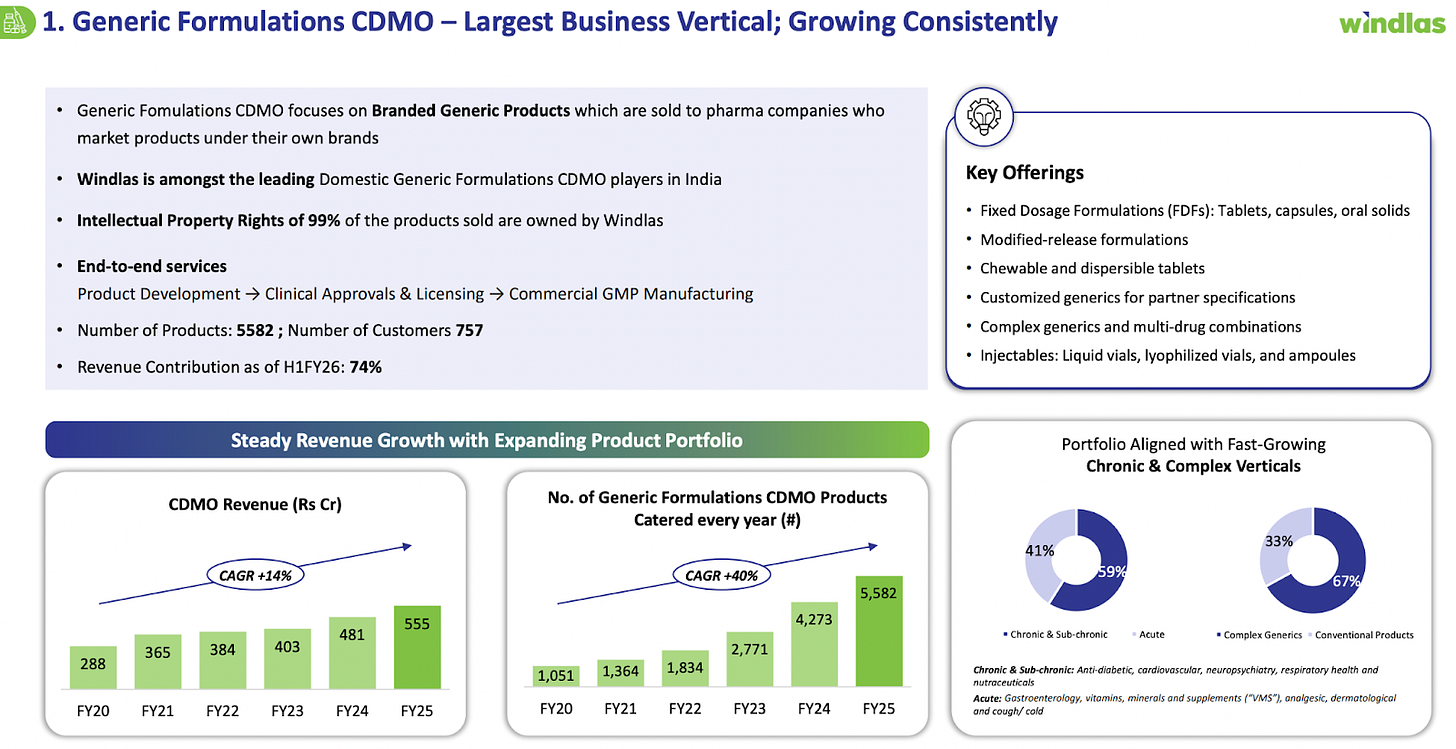

1. CDMO Services and Products (Generic Formulations CDMO)

The CDMO segment is Windlas Biotech’s largest business. Windlas acts as a third party manufacturer and developer for pharmaceutical companies that outsource their product formulation and production. In this vertical, Windlas provides a comprehensive range of services: it helps other pharma companies develop generic formulations, conducts product trials/registrations, and commercially manufactures the medicines at scale on their behalf. This allows client companies to avoid heavy capital investments in plants and utilize Windlas’s expertise and capacity.

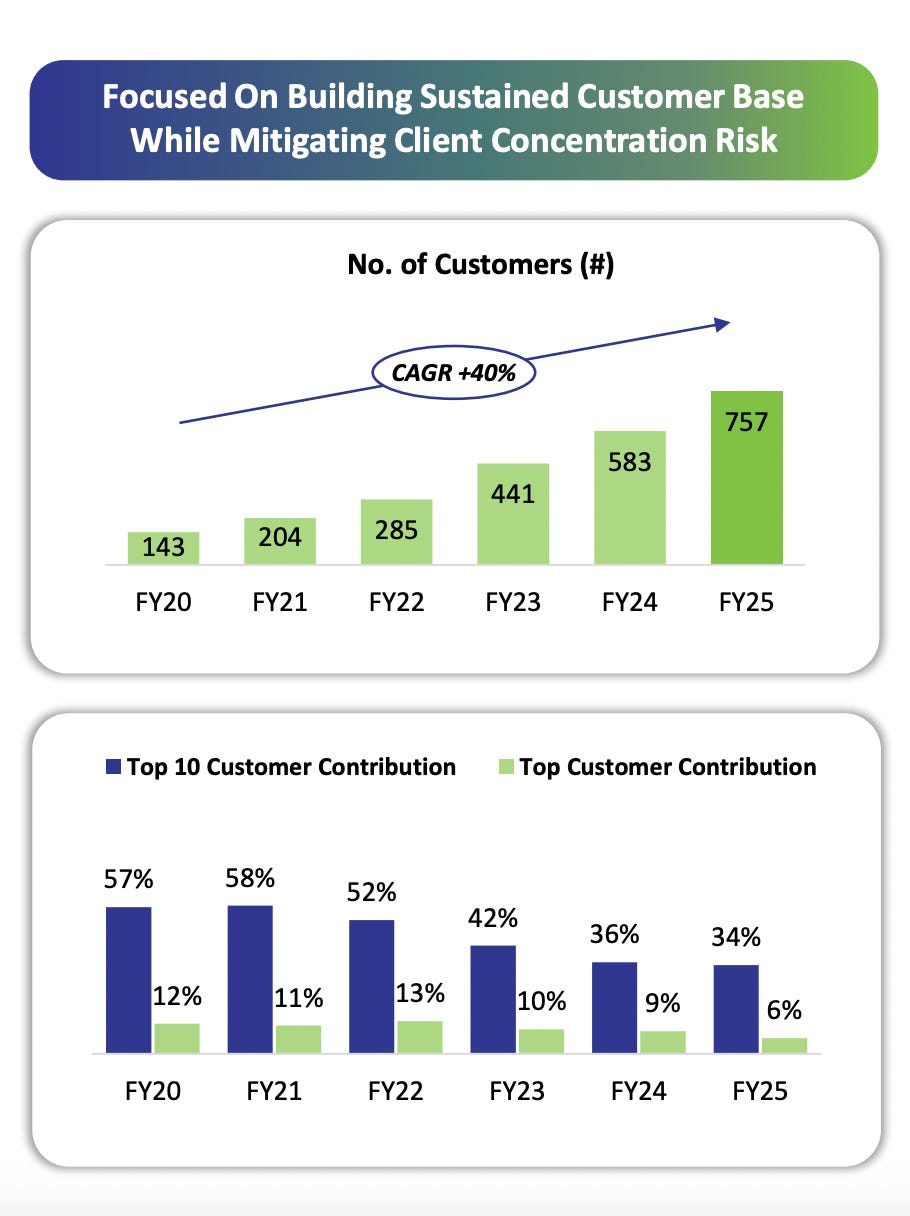

Windlas has built a strong reputation in this field, counting 15 of India’s top 20 pharmaceutical companies among its CDMO clients. In practice, many well known pharma brands rely on Windlas to produce some of their tablets, capsules, syrups, etc. Windlas’s four formulation plants in Dehradun and the new injectable plant enable it to handle large volumes and complex projects. Notably, about 67% of the products Windlas makes in its CDMO segment are “complex generics”, these are harder to manufacture medicines such as specialized formulations or novel dosage forms. Focusing on complex generics gives Windlas an edge, as it can offer niche and high value capabilities to clients (for example, modified release tablets, fixed dose combinations, or other technically challenging products). By H1FY26, the company’s CDMO customer base had grown to 757 clients (up from 143 in FY20), reflecting its broad reach in the market.

Segment Performance: The CDMO segment accounted for the majority of Windlas’s revenue roughly 74% and continues to grow steadily. In FY 25, revenues from CDMO services and products were around ₹555 crore, an increase of ~15% over the prior year. This growth has been driven by higher order volumes from existing customers as well as new client acquisitions. As the business scales up, fixed costs are better absorbed, which has helped improve Windlas’s profit margins over time. Management has indicated that the injectable facility, which began operations in Q4 FY24, will start contributing to CDMO revenues by making injectable drugs for clients going forward. Overall, the CDMO division provides Windlas with a stable core business that generates consistent cash flow.

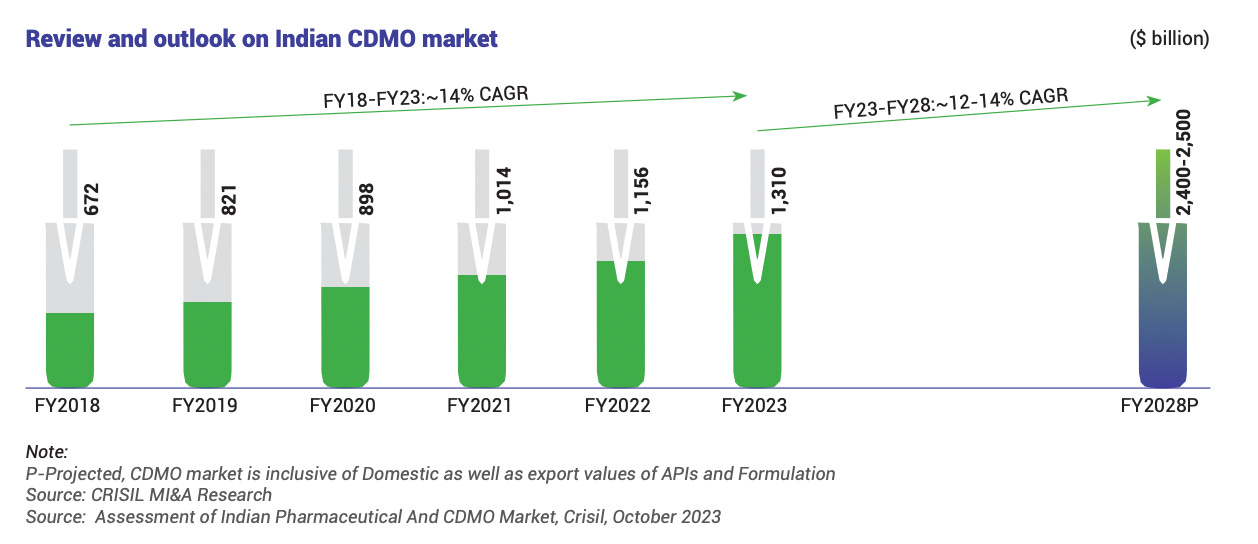

CDMO Industry Outlook: The outsourcing of drug manufacturing is a growing trend in the pharmaceutical industry. Many pharma companies (both in India and globally) are increasingly opting to use specialized manufacturers like Windlas to develop and produce their formulations, rather than investing in expanding their own factories. This allows them to save costs, increase speed to market, and tap external expertise. In India, the pharmaceutical contract manufacturing market has been expanding at a healthy pace it grew at roughly 14% CAGR from 2019 to 2024, and is projected to grow about 12–14% annually going forward, reaching an estimated ₹2,400–2,500 billion size by FY2027 28 (including both domestic and export demand).

One key indicator of this trend is the share of pharma production being outsourced. Around 35 40% of India’s pharmaceutical output was handled by CDMOs in FY2023, and this share is expected to rise to ~40 45% by FY2028. In other words, nearly half of all drug manufacturing in India could be done by contract manufacturers in the coming years, which signals plenty of business opportunities for players like Windlas. Globally as well, the CDMO model is gaining traction: the global formulation CDMO market grew from about $22 billion in 2017 to $31 billion by 2022, and is projected to reach $40–45 billion by 2027. Pharma companies worldwide are partnering more with low cost, high quality manufacturers in countries like India to handle production.

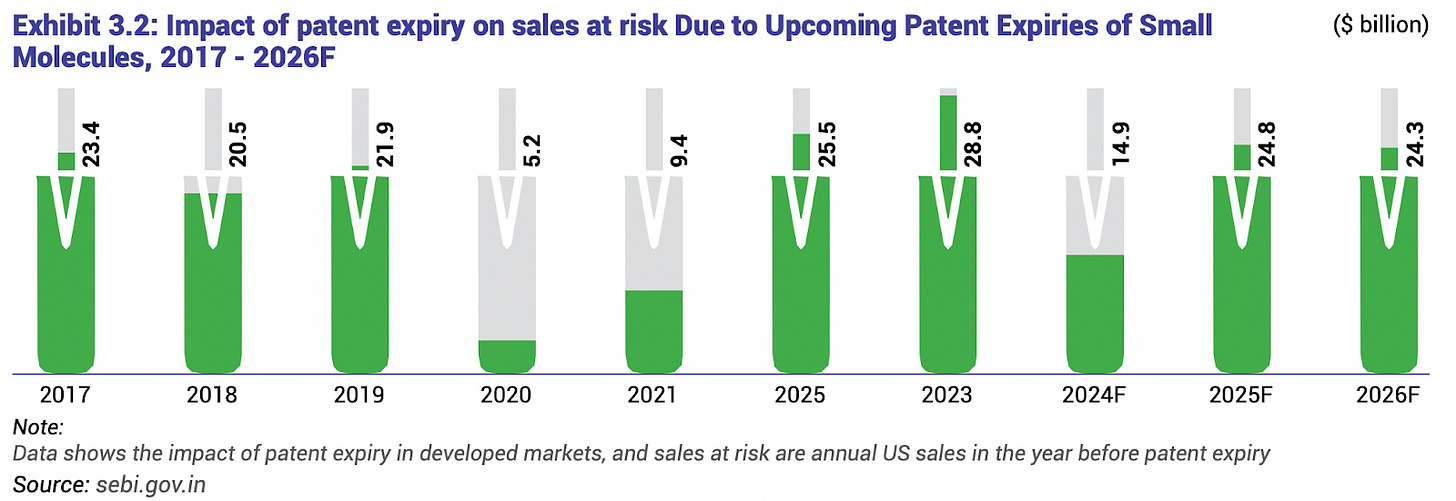

Another favorable factor is the wave of patent expiries of major drugs expected by 2028. As many blockbuster brand name medicines lose patent protection, there is an opportunity for generic versions to enter the market. CDMOs stand to benefit because pharmaceutical firms may outsource the development and production of these new generic formulations. Windlas’s management has explicitly pointed out upcoming patent expiries (for example, drugs like diabetes or cancer medicines going off patent) as a growth lever. Moreover, India’s strong position in generic drug exports (discussed later) and the global diversification away from China (“China Plus One” strategy) are further tailwinds supporting the CDMO industry in India. Overall, the industry outlook for contract manufacturing is positive, with steady growth ahead which bodes well for Windlas Biotech’s core CDMO segment.

2. Domestic Trade Generics and Institutional Business

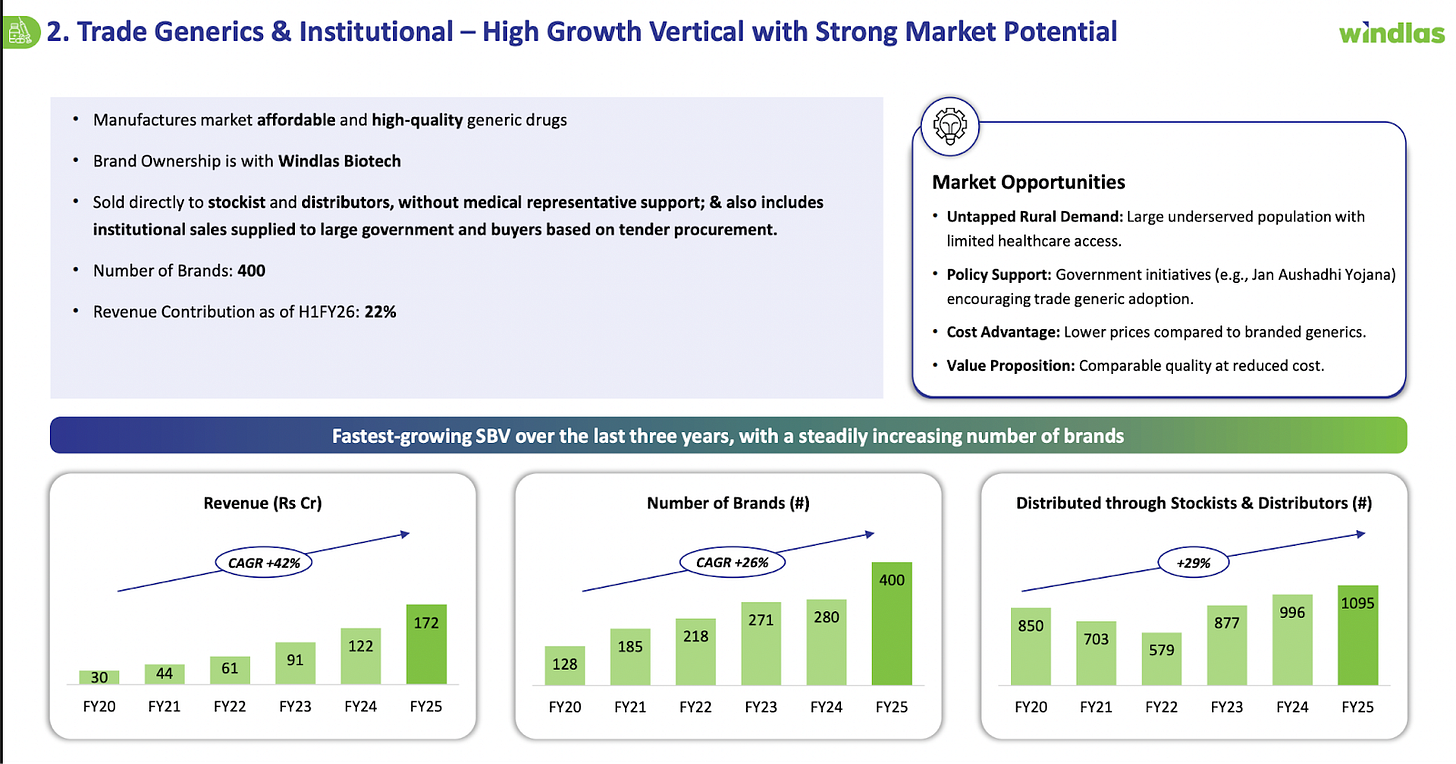

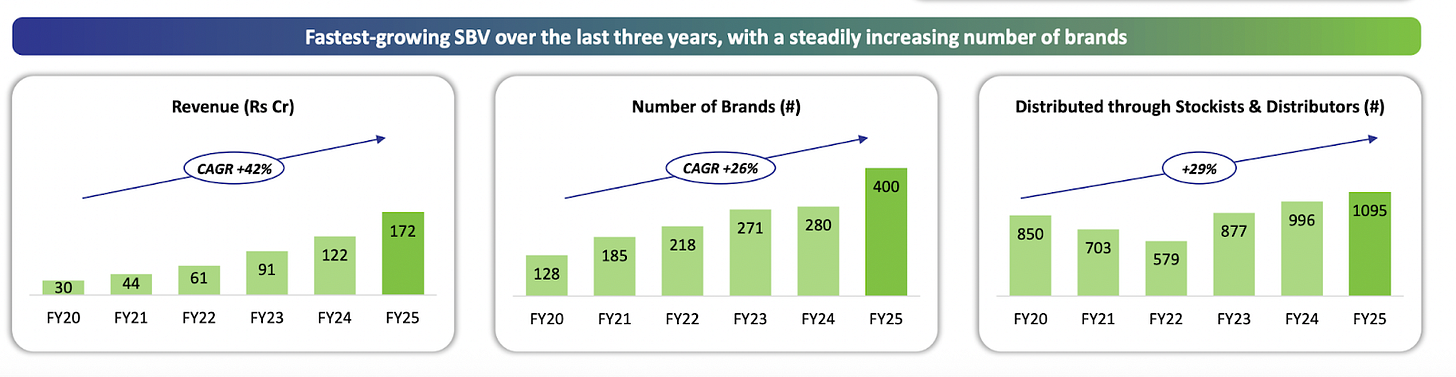

Windlas’s second segment is its Domestic Trade Generics and Institutional Sales division. In simpler terms, this is the business where Windlas sells generic medicines under its own brand names within India, rather than making them for other companies. The target market for these products is largely semi urban and rural areas across India, and the portfolio focuses on providing affordable, essential medicines to those regions. Windlas often refers to its approach here as the “AAA” strategy: Accessible, Affordable, and Authentic medicines for underserved communities. The company has built up a portfolio of around 400 products/brands in this vertical, which include common generic drugs, over the counter (OTC) health products, and nutraceutical supplements. These are sold through Windlas’s own marketing network. Importantly, Windlas has established a wide distribution network for its trade generics: as of FY25, it had coverage in 29 states of India via about 1,095 stockists and distributors. This network allows Windlas to reach smaller towns, villages, and pharmacies that serve a large population outside the big cities.

The “Institutional” part of this segment refers to sales to government agencies or institutional buyers. Windlas does participate in supplying medicines for public health programs or tenders for example, under schemes like Ayushman Bharat (the government’s health insurance scheme) and the Jan Aushadhi program (which sets up generic medicine outlets), there is growing demand for low cost generics in bulk. Windlas’s affordable product range positions it well to fulfill such institutional orders, complementing its retail distribution.

Segment Performance: The trade generics and institutional segment has become an important growth driver for Windlas. Although smaller than the CDMO division, it contributed about 22% of the company’s revenues in H1FY26 and has been growing faster than the core CDMO business in percentage terms. In FY25, Windlas’s revenue from trade generics/institutional sales was ₹172 crore, up from ₹122 crore the previous year, a 41% YoY growth. This is a sharp growth rate, reflecting both increasing volumes and an expanding product range. The company has been launching new products in this segment and aggressively widening its distribution reach, which is paying off in terms of higher sales. The management noted that this vertical achieved “robust growth” in FY25, outpacing many industry peers. Higher growth in this segment, which generally has better margins, also helped improve Windlas’s overall profitability. Going forward, Windlas seeks to continue this momentum by introducing more cost effective drugs (including in chronic therapeutic areas like diabetes, heart disease, etc.) and penetrating deeper into tier 2 and tier 3 markets. The fact that government healthcare spending in India is rising and more generic medicine outlets are being promoted is a supportive sign for this business line.

Trade Generics Industry Overview: In India’s pharmaceutical market, “trade generics” refer to generic drugs that are sold under a company’s brand name directly to retailers (pharmacies) without extensive marketing or doctor promotion. This is in contrast to “branded generics”, which are also off patent generic drugs but are branded and promoted by pharma companies through medical representatives to get doctors to prescribe them. Branded generics have traditionally dominated the Indian market (big companies selling affordable versions of drugs with their brand label). Trade generics, on the other hand, are usually sold in bulk to pharmacies or through wholesalers, and often the pharmacist may recommend them to patients as a cheaper alternative. As of FY2023, trade generics were a small but growing segment comprising roughly 5% of the overall generic medicines market in India, with the remaining 95% being branded generics. In terms of value, the Indian trade generics market was about ₹9,100 crore in FY23, having grown from around ₹6,300 crore in FY18 (around 7.4% CAGR over that period). This segment is expected to grow faster in the coming years projected at about 9.5–10.5% CAGR from FY2023 to FY2028, reaching an estimated ₹14,000 to 15,000 crore by FY28.

The growth drivers for trade generics include the rising demand for affordable medicines, especially in rural and semi urban areas where cost sensitivity is high. The Government of India has been actively encouraging the use of unbranded generics to make healthcare more affordable for instance, through the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), thousands of Jan Aushadhi stores have been opened that sell low cost generic drugs. This has increased awareness and acceptance of trade generics among the public. Also, private pharmacies and hospital chains are more open now to stocking trade generic brands as patients look to reduce out of pocket expenses. All these trends mean the trade generics segment is expanding its reach (from 2.5% market share a decade ago to around 5% now, and likely more in future), offering substantial room for companies like Windlas to grow. Being an early mover with an established distribution channel, Windlas is well positioned to capture a good share of this growth. The company’s focus on quality (to ensure “authentic” medicines) also builds trust, which is crucial for success in the generics market. In summary, the industry outlook for trade generics in India is positive, with double digit growth anticipated, and Windlas’s strategy aligns well with leveraging this opportunity by providing affordable medicines to the masses.

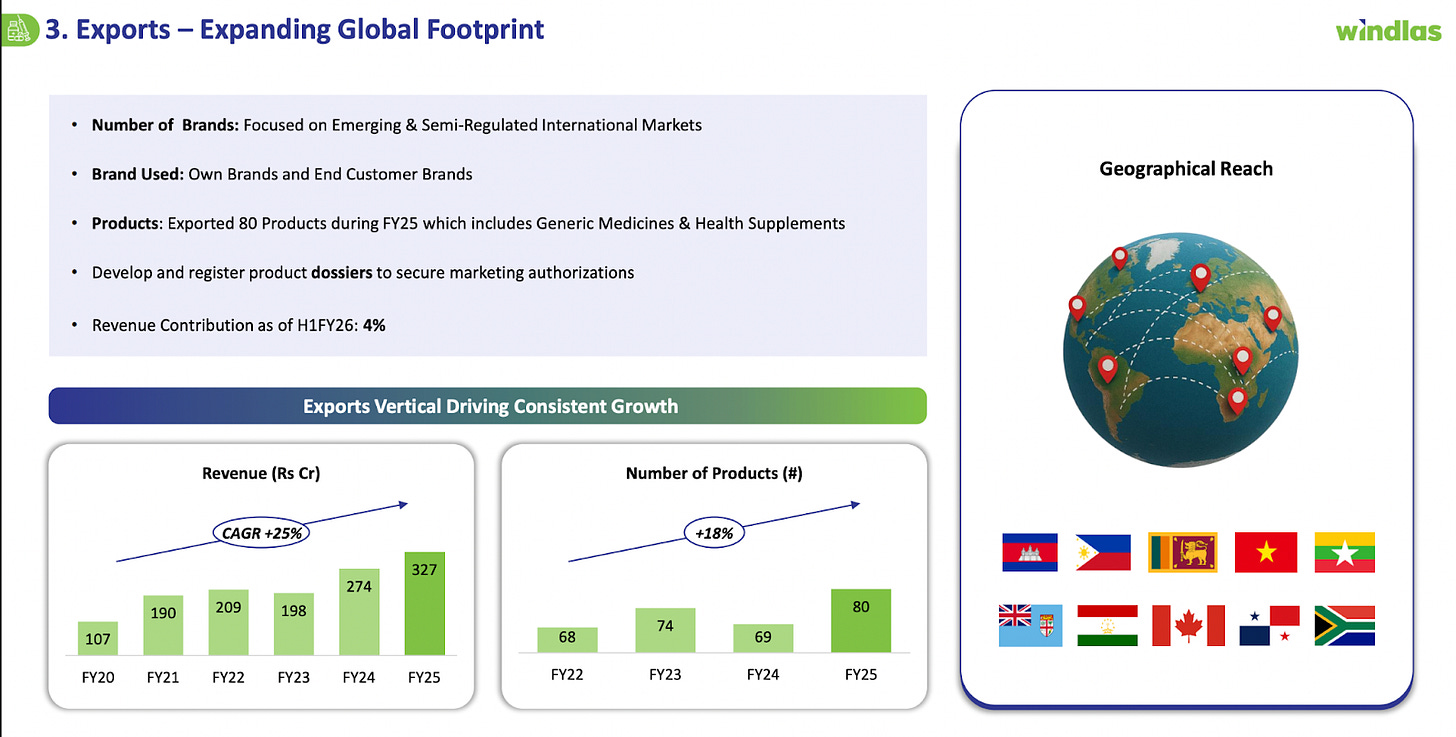

3. Exports Segment

The third segment of Windlas Biotech is its Exports business. This involves selling the company’s pharmaceutical products to international markets. Windlas’s export portfolio includes generic prescription drugs as well as nutraceutical and OTC health products. As of FY25 the company had around 80 products registered for export across different countries. Unlike many larger Indian pharma companies that focus on highly regulated Western markets, Windlas’s export strategy is targeted at “unregulated” or “semi regulated” markets essentially, developing countries in regions like Africa, Asia, Latin America, and the CIS. These are markets where the regulatory requirements are less stringent or the approval process for generics is faster (compared to, say, the US or EU). Windlas supplies these markets either under its own brand labels or via partnerships with local distributors/clients in those countries. For example, a partner in an African country might market Windlas made medicines under an agreement. This segment also includes institutional export orders (like aid agencies or NGOs procuring medicines for multiple countries).

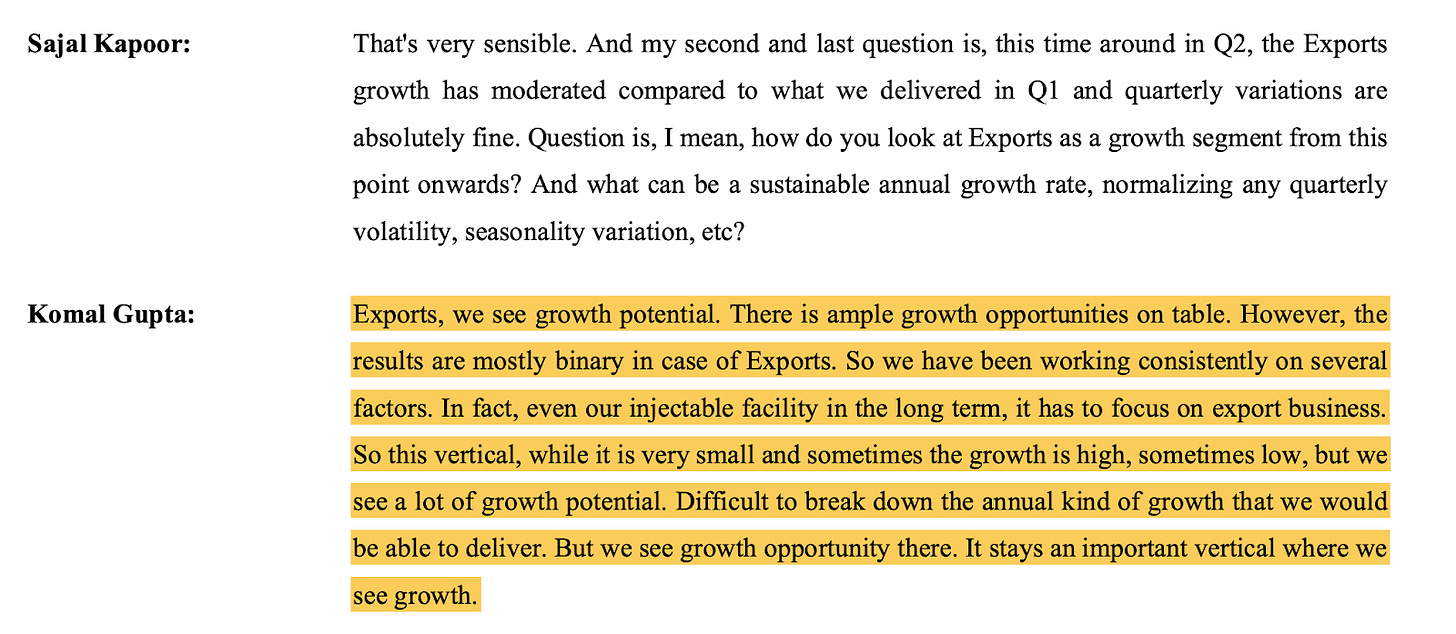

Segment Performance: Currently, exports are the smallest of Windlas’s three segments in revenue terms contributing only about 4% of total revenue in H1FY26. However, it is growing at a fast clip. In FY25, Windlas’s export revenue was marked a 20% growth over the prior year’s export revenue. While the absolute figure is modest, the high growth rate indicates that Windlas is gradually gaining traction internationally. The company’s efforts to widen its geographic reach are evident: it is filing dossiers (regulatory applications) to register more of its products in various countries, aiming to enter new markets in Asia, Africa, and Latin America. By broadening its presence, even in semi regulated regions, Windlas diversifies its revenue and can tap into additional demand.

Another development is the use of the new injectables facility for exports this plant, built to global standards, will enable Windlas to manufacture injectable drugs that could be supplied abroad (injectables are often in high demand, including in emerging markets for treatments like antibiotics, vaccines, etc.). If Windlas can get the necessary approvals, this could open up new export opportunities. It’s worth noting that Windlas has not yet entered the highly regulated markets like the United States or Europe, which require extensive clinical data and regulatory scrutiny (and often, separate inspections of facilities by USFDA or EMA). Those markets have longer term potential, but for now Windlas is content focusing on countries where it can leverage its cost advantage without heavy regulatory barriers. In those targeted countries, Windlas competes on the basis of affordability and reliable quality, which are key selling points for less regulated healthcare systems looking for budget friendly medicines.

Industry Context (Pharma Exports): India is known as the “pharmacy of the world” for its massive production of generic drugs. Indian pharmaceutical companies collectively supply medicines to more than 200 countries and territories worldwide. Broadly, India’s pharma exports can be divided into formulations (finished dosage medicines) and bulk drugs (active pharmaceutical ingredients). Formulation exports (which is what Windlas does) make up a significant portion of the total. In fact, the Indian domestic pharma market and export market are roughly equal in size. Roughly 50% of India’s pharma output by value is exported, and India accounts for about 3.5% of global drugs and medicines exports in value terms. Many countries, including highly regulated ones like the US, source a large number of generic drugs from India due to the cost competitiveness and high manufacturing capabilities here. For instance, Indian generics form a big chunk of the US generic market.

However, Windlas’s focus is on semi regulated markets, which have their own growth story. These markets (e.g. parts of Africa, South East Asia, Latin America) often have growing healthcare needs, rising incomes, and a push to improve access to medicines. They rely on imports of affordable generics because local production might be limited. As healthcare awareness increases and governments in those countries invest more in health, the demand for low cost generic medicines is rising. India, being a prime source of such generics, is well placed to fulfill that demand. Windlas’s strategy to serve these markets aligns with this trend. The company doesn’t have to compete directly with global giants in tightly regulated segments, yet it can still gain volume by catering to underserved international markets. Industry reports indicate that Indian formulation exports are expected to continue growing at around 6–8% annually over the next couple of years (slightly moderating from the high single digit growth seen in the previous five years). This sustained growth in exports is supported by factors like strong capabilities of Indian manufacturers, a trust in Indian generics (especially after India’s pharma industry proved crucial during COVID 19 vaccine/drug supply), and initiatives like trade agreements or India’s efforts to support African health programs, etc. Also, any global shifts such as diversification of supply chains away from China could benefit Indian exporters.

For Windlas, the export segment thus has a lot of room to grow from its small base. The company will still have to navigate regulatory requirements in each target country, ensure consistent quality, and build distribution relationships. But given the overall macro trends, where emerging markets are increasing their pharmaceutical consumption, Windlas’s export arm could see continued high growth. The management considers exports as an “optionality” or additional upside, while the domestic business remains the core. In sum, the export market provides Windlas a long term growth avenue: if even a few of its products gain traction in multiple countries, the volumes could scale up significantly. With 80 products already being sold abroad and more in the pipeline, Windlas is steadily laying the groundwork to make its mark internationally.

Key Growth Triggers

1. Expansion of CDMO Business & Client Diversification:

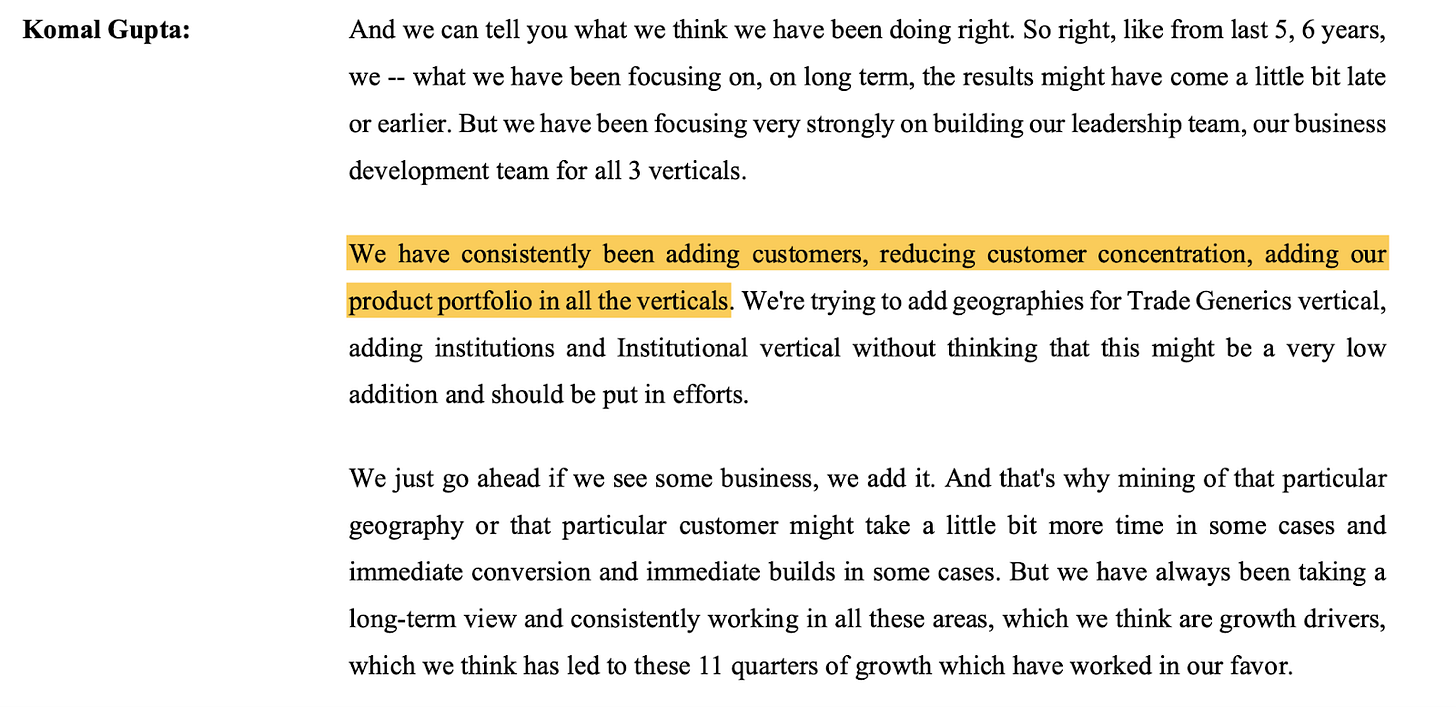

Windlas’s core CDMO segment (73% of FY25 revenue) is on a strong growth trajectory. The company has steadily added new clients and products, which has broadened its customer base and reduced dependence on a few big clients. Windlas now serves 757 customers (including 7 of India’s top 10 pharma firms) with over 5,500 brand formulations, and its top 10 customers account for only 34% of revenue (down from 57% levels in FY20). Management emphasizes that they have been “consistently adding customers, reducing customer concentration, adding our product portfolio in all verticals,” reflecting a deliberate strategy to diversify revenue streams.

(Concall Q2FY26)

This is especially timely as the generic pharma CMO industry is undergoing consolidation, stricter Schedule M GMP compliance regulations (enforced from Oct 2021) are forcing out many smaller, non compliant manufacturers. As a well established, compliant player, Windlas is benefiting from larger pharma companies increasingly outsourcing production to reliable partners. These trends provide a strong tailwind for Windlas’s CDMO business growth.

2. Rapid Growth in Trade Generics Segment:

Windlas has built a high growth Trade Generics business (unbranded generic medicines sold under its own brands) which contributed 22% of H1FY26 revenue. This segment has grown at over 40% CAGR in the past 5 years, driven by an expanding product portfolio and wider distribution reach. The company now markets around 400 generic brands across 29 states, distributed through 1,095+ stockists on a direct to stockist model. (Notably, sales in this channel are not dependent on a field force of medical representatives, which makes it an efficient, scalable model.) By continuously launching new affordable products and adding distributors, Windlas has significantly penetrated underserved rural and semi urban markets.

In H1FY26, the Trade Generics & Institutional segment grew ~25% YoY, reflecting this momentum. The company sees strong ongoing demand here, supported by rural healthcare needs, price conscious consumers, and its ability to offer quality drugs at lower cost. Management has indicated high visibility for growth in trade generics, given their focus on accessibility, affordability, and authenticity (a “AAA” strategy) to win trust in these markets.

3. Institutional Sales & Jan Aushadhi Tailwinds:

Windlas’s trade generics segment also includes institutional sales supplying medicines to government agencies and public health programs. A major growth driver is the Indian government’s push for affordable generics through initiatives like the Pradhan Mantri Jan Aushadhi Yojana (PMBJP), which has dramatically expanded the number of Jan Aushadhi generic pharmacies nationwide. These programs are creating robust demand for unbranded generic drugs at low prices. Windlas is well positioned to benefit, as it participates in tender based supply to large government buyers and Jan Aushadhi stores. In fact, policy support from the government (e.g. expanding Jan Aushadhi outlets) is explicitly encouraging the adoption of trade generics across the country. Being a compliant, mid sized manufacturer, Windlas meets the quality and scale criteria to service such institutional orders (smaller sub scale firms often cannot).

Management notes that the government programs are “taking larger and larger forms,” and Windlas is actively participating in these opportunities. The result is a win win: Windlas gains volume growth and a stable institutional customer base, while the government achieves its goal of reliable supply of inexpensive, quality medicines. (It’s worth noting that even large pharma companies who previously ignored trade generics are now entering this space, which validates the opportunity, though it may increase competition as well).

(Concall Q2FY26)

4. New Injectables Manufacturing Facility:

Windlas has recently expanded into injectable medicines, which opens a new growth leg for the company. In FY25, it commissioned its first injectables plant with a capex of about ₹75 crore to make vial and injectable formulations. This plant became operational in FY25 and has already started contributing, with initial revenue booked in H2FY25 and ramp up continuing through FY26. Management has said that the injectable facility is designed for around ₹100 crore of annual revenue at peak utilisation, so the current contribution is still at an early stage.

On the economics, management has indicated that for a domestic injectable CDMO plant, a gross asset turn of around 1.1 to 1.2 times is a reasonable assumption, compared with roughly 3 times on the oral solids side. At the same time, injectables are expected to have higher EBITDA margins, in the range of about 18 to 21 percent at steady state, once the plant reaches stable utilisation. Today, margins look lower because fixed operating costs like quality, air handling and compliance are already in place while volumes are still ramping up. As more CDMO and trade generic injectable products move from validation to commercial scale, utilisation should move up towards management’s targeted levels and the plant can deliver operating leverage, helping both growth and profitability for Windlas.

(Concall Q1FY26)

5. Capacity Utilization Upside & Operating Leverage:

Windlas has made substantial capacity investments in recent years (e.g. the Plant 2 extension and new Plant 6, discussed below), which means it currently has significant spare capacity ready to absorb new orders. For instance, the utilization of its oral solid dosage (tablets/capsules) capacity is only around ~65% at present, leaving ample headroom to increase production without major new capex. As the company fills this unused capacity, fixed costs (like manufacturing overhead and depreciation already incurred for the new facilities) will get better absorbed, resulting in operating leverage benefits.

This dynamic is already starting to reflect: in H1 FY26, gross margin improved ~70 bps YoY due to a favorable mix and scale effects, and EBITDA margin expanded despite higher expenses. Management expects overall margins to improve going forward as volumes grow. When asked about the impact of operating leverage over the next 2 3 years, management affirmed that “we expect overall margin improvement” for the company, though without giving a precise number.

(Concall Q1FY26)

In other words, Windlas’s recent capacity expansions have temporarily elevated costs, but they set the stage for faster profit growth than revenue growth in coming years as utilization rises. Importantly, the company’s operations are highly efficient in terms of working capital (only ~14 days net working capital), so increased sales should quickly translate into stronger cash flows. Indeed, management noted that operating cash flow will strengthen from FY26 onward as new capacities (especially injectables) ramp up and yield economies of scale.

6. Plant 6 Expansion to Fuel Future Growth:

To ensure it can meet rising demand, Windlas is in the process of adding a sixth manufacturing plant (Plant 6) focused on oral solid formulations. This expansion is on track and expected to be commissioned within FY26. Plant 6 will meaningfully boost production capacity management indicated it will increase Windlas’s annual oral dosage manufacturing capacity potential from roughly ₹800 Crore to ₹1,000 Crore in revenue terms (i.e. ~25% capacity addition).

Once operational, Plant 6 will allow Windlas to take on significantly more volumes in its CDMO and trade generic businesses without capacity bottlenecks. Essentially, the company is pre investing in capacity ahead of demand a strategic move that positions it to capture growth opportunities (for example, onboarding a large new CDMO client or scaling up a big tender supply) immediately when they arise. The new plant’s fixed costs will initially weigh on P&L, but as it ramps up, it provides further scope for operating leverage (as discussed above) and growth headroom for the next few years. Windlas’s proactive capacity expansion, funded by internal resources, reflects management’s confidence in future demand. It ensures that capacity will not be a constraint in achieving the next phase of revenue growth.

(Concall Q1FY26)

7. Near Term Margin Pressure & ESOP Investments (Positioning for Future Margins):

Windlas’s current EBITDA margins are modest (in the low teens) relative to its potential, but this is largely by design due to upfront investments in expansion and talent. Over FY24 FY25, the company’s operating expenses rose as it hired senior professionals (building out its leadership and business development teams across all three verticals) and incurred pre operating costs for new facilities. These strategic costs have temporarily kept margins around ~11–12% OPM.

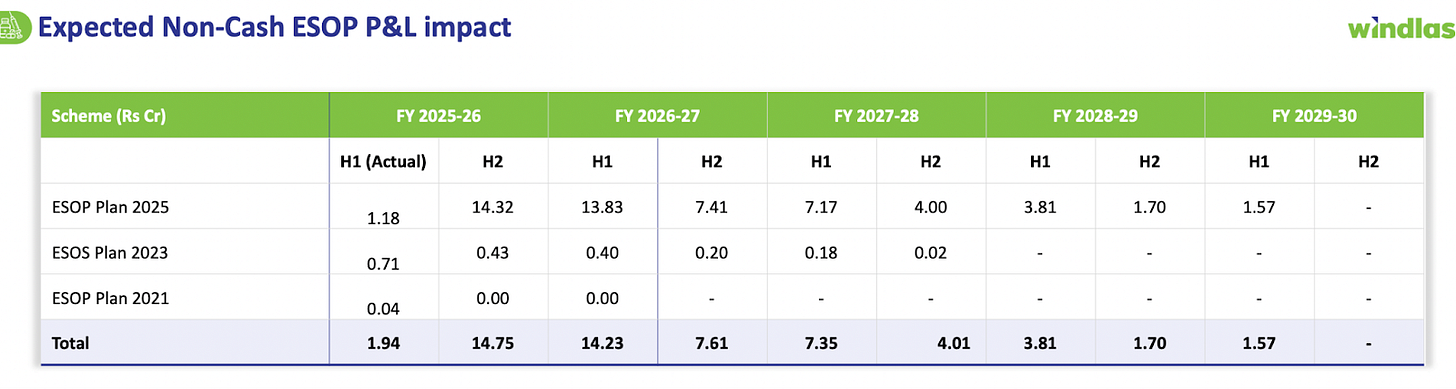

Additionally, Windlas introduced a new ESOP 2025 stock option plan to reward and retain ~100 key employees across various levels. The ESOP grants (awarded in Sep 2025) create a non cash P&L charge, about ₹1.2 Crore in Q2 FY26 was recorded as ESOP expense, and the total ESOP cost will be spread over the next 3 4 years. This has a short term impact on reported profitability. However, management views these steps as investments for future growth: the ESOP scheme is performance linked and meant to “align and empower” key talent for long term value creation, which should ultimately drive better results.

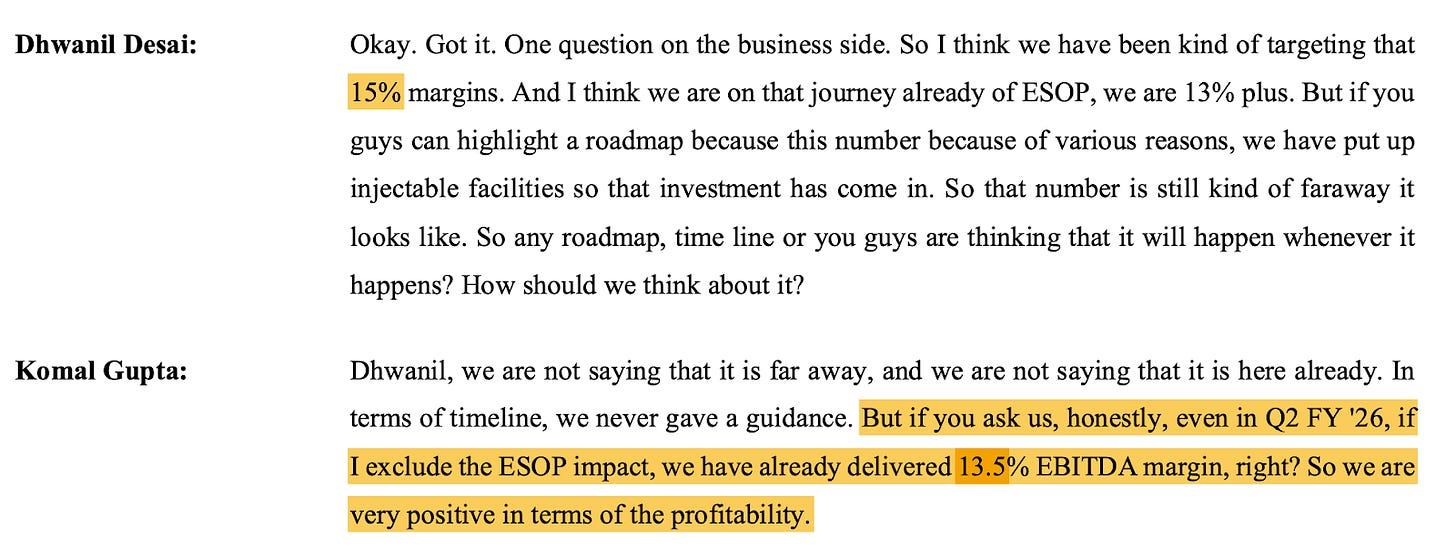

Notably, if one time ESOP expenses are adjusted out, Windlas’s underlying margins are already improving, for H1 FY26, the EBITDA margin was 13.5% (vs 12% a year ago) when excluding the ESOP cost.

(Concall Q2FY26)

Management has expressed confidence that as revenue scales and recent investments bear fruit, the company can achieve 15%+ EBITDA margins in the medium term. In short, current margins are slightly depressed due to deliberate higher opex (new capacity, team build out, employee incentives), but these moves set the stage for strong operating leverage and margin expansion going forward.

8. Export Market Optionality (Future Upside):

Exports represent a significant option value in Windlas’s growth story. Historically, the company has been predominantly domestic focused, with exports contributing only ~4% of revenue in FY25 (₹33 Crore). These exports have so far been to emerging/semi regulated markets, Windlas had over 80 products exported across 10 countries in FY25, including Asian and African markets. While the current export base is small, Windlas has been laying groundwork to scale it up. Management expects a more meaningful ramp up in export revenue from FY27 onward as approvals materialize and new markets open. In the meantime, export sales are growing from the small base e.g. export revenue grew ~19% in FY25 and 23% YoY in H1 FY26 and Windlas continues to add new products and geographies in the RoW (Rest of World) markets. Importantly, the recent foray into injectables is partly aimed at export opportunities (complex injectables for overseas clients) in the long term.

(Concall Q2FY26)

They are strengthening the export business development team and even exploring inorganic moves to accelerate this vertical. All said, exports remain an upside optionality not the core driver of near term forecasts, but a potential growth kicker in the medium term. If Windlas succeeds in cracking regulated markets or scaling up via acquisitions, the export segment could significantly boost the company’s overall growth beyond what the domestic market alone would deliver.

9. Robust Balance Sheet Enables Strategic Flexibility (Incl. Acquisition Opportunities):

Windlas’s financial position is very strong, giving it the firepower to support growth initiatives. The company is net debt free and cash generative as of H1 FY26 it had about ₹237 Crore in liquidity on the books (cash and equivalents), with negligible debt. This healthy cash pile continues to grow from operations (H1 FY26 saw ₹56 Cr cash from operations). Windlas has been funding its capex (such as the injectables plant and Plant 6 expansion) entirely through internal accruals, maintaining a debt free status despite an ₹80–100 Cr capex plan over FY25–FY27. A strong balance sheet not only de risks the company, but also provides optionality for strategic moves.

Management has stated that they are actively open to acquisitions if the right opportunity arises even if it means paying a premium for a high quality asset that fits synergistically. In particular, Windlas is scouting for targets that could expand its capabilities (for example, in new dosage forms or in certain export markets) without distracting from its core business. With ample cash and no debt overhang, the company can move quickly on a compelling acquisition or joint venture, which could further accelerate growth.

Key Risks in the Business

1. Dependence on a few large CDMO customers

Windlas has done a good job of adding many new CDMO clients and reducing the share of the top 10, but a meaningful part of revenue still comes from a limited set of big customers. If any of these large partners decide to move production in house, shift to another CDMO, or face their own demand issues, Windlas’s volumes and growth can be hit. In CDMO, customers also tend to negotiate hard on price once a product stabilises, which can put pressure on margins over time.

2. Regulatory and quality compliance risk

Pharma manufacturing is tightly regulated. Windlas must continuously comply with Indian rules like Schedule M, state FDA inspections, and various quality norms in export markets. Any quality failure, product recall, or adverse inspection report can lead to temporary plant shut downs, loss of contracts, or even long term damage to reputation. As the company scales up injectables and exports, the complexity of compliance will only increase and leaves less room for error.

3. Execution risk on new plants and injectables ramp up

A big part of the growth story rests on successful ramp up of the injectables facility and the new Plant 6. If customer onboarding, approvals or product validations take longer than planned, capacity can remain under utilised for some time. In that case, fixed costs like depreciation and staffing will keep margins under pressure. There is also the usual project risk around any capex plan: cost overruns, delays, or slower than expected demand can reduce the returns from these investments.

4. Competitive intensity and policy risk in generics and tenders

Both CDMO and trade generics are crowded spaces. Many regional manufacturers and larger pharma companies are now active in trade generics, institutional tenders, and Jan Aushadhi supplies. This can lead to price cuts, frequent re tendering and loss of share in some products. On top of that, the government can change rules on price caps, trade margins, or tender conditions at any time. For example, stricter control on trade margins or lower tender pricing can hurt profitability in the trade generics and institutional business even if volumes keep growing.

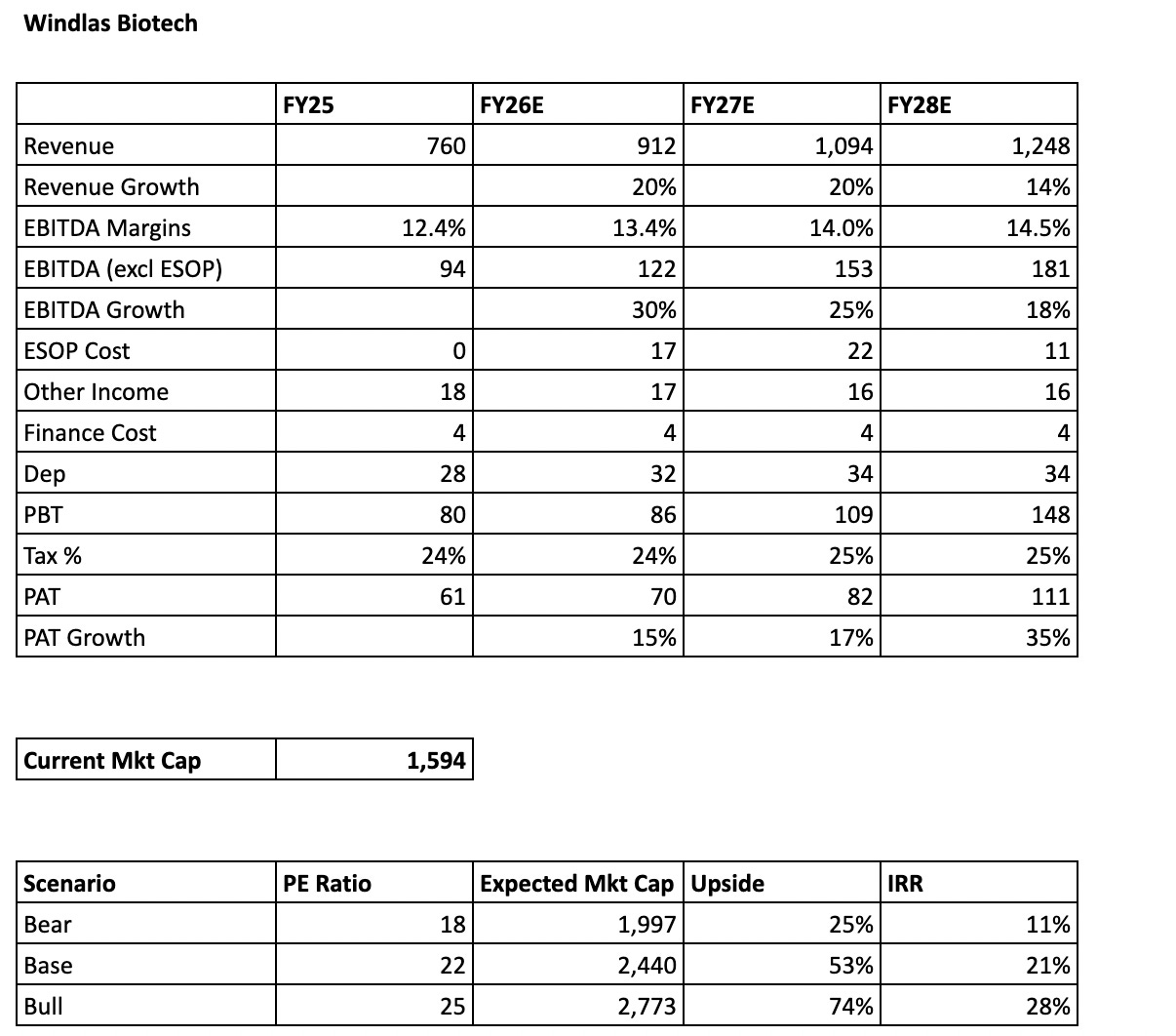

Valuations of the Company

On the revenue side, management has guided that at full utilisation of the existing capacities, Windlas can do around ₹1,100 crore of annual topline, and they have hinted at an upward revision to this number as the business scales and new lines stabilise. Based on our reading of the business, capacity additions and ramp up in injectables, we expect the company to reach near optimal utilisation by FY27. Beyond that, the planned acquisition by FY28 can provide the next leg of growth over and above this base.

On profitability, the company has guided to gradually move towards 15 percent EBITDA margins over time as operating leverage kicks in and the newer plants fill up. To stay conservative, we are working with 14.5 percent EBITDA margin by FY28, excluding ESOP costs. With this margin profile on a higher revenue base, and assuming other cost lines broadly stable as a percentage of sales, the model begins to show clear operating leverage.

Under these assumptions, as ESOP expenses normalise and taper down by FY28, and the fixed costs of the new capacities are spread over a larger topline, profit after tax can grow meaningfully faster than revenue. On our numbers, this combination of higher utilisation, slightly lower ESOP drag and modest margin expansion can support roughly 35 percent PAT growth by FY28, largely driven by operating leverage rather than aggressive margin assumptions.

Conclusion

To sum up, Windlas Biotech is essentially a “picks and shovels” play on the growth of Indian pharmaceuticals. It earns its bread and butter by making medicines for other pharma companies through the CDMO business, and adds growth layers through trade generics, institutional sales and a small but rising export franchise. The big picture is clear: capacity is already in place, the balance sheet is clean, and the company is consciously moving into higher value areas like complex generics and injectables. If management executes well, earnings can compound nicely as utilisation rises and operating leverage kicks in.

For investors, a few things are worth tracking closely over the next 2 to 3 years. On the CDMO side, watch how fast Windlas adds new clients and products, and whether the share of the top 10 customers continues to decline. In trade generics and institutional sales, monitor the growth in stockist count, the breadth of the product basket and how effectively the company taps government driven channels like Jan Aushadhi. For capex, the key checkpoints are the ramp up of the injectables plant, commissioning and scaling of Plant 6, and the overall capacity utilisation trend across all facilities. These will tell you whether the guided 1,100 crore topline on existing assets is realistically within reach by FY27.

Finally, keep an eye on profitability and capital allocation. It will be important to see EBITDA margins inching towards the guided zone as volumes rise, and ESOP related costs starting to taper by FY28. Any acquisition should be monitored for fit, price and integration, because that will likely set up the next leg of growth beyond the current capacity. Alongside this, staying alert to regulatory developments, quality track record and competitive intensity in both CDMO and trade generics will help you judge whether the thesis is on track. If the company delivers on these operational markers, the valuation story should take care of itself over time.

Author - Shubham Ajmera (Head Of Research - SOIC Research)

Disclaimer - We are SEBI registered research analyst and this deep dive is only for educational purposes and not a buy/sell recommendation.

This is amazing author has dedicated much of his time to research for SOIC tribe community I trust SOIC. During these days so many people’s , channels across social media makes only noise but no value whereas SOIC stands apart it’s difference between real diamond and lab grown diamond. SOIC is a real diamond thank you SOIC thank you all for your dedicated research

Thank you sir for this wonderful article…Could you give a breakdown of the margins business wise? Don’t you think traded generics would only pull down margins over the near term and supplying to govt would have an impact on WC going forward and have an impact on ROCE… wanted your views please