Players in the Gold Loan Industry: From Anti-Fragile to Fragile?

In the previous blog post we analysed the gold loan industry and this time we'll be diving into the two dominant listed players of the industry: Manappuram Finance Ltd and Muthoot Finance Ltd.

Both companies operate in a niche industry that is a gold loan. Niche industry means that where there are two or three dominant organized players present and one must remember wherever there are concentrated profit pools the players are bound to make money. The organized sector is 35% whereas the unorganized players (Money lenders) still dominate the overall industry. We have covered this topic in detail in our recent video.

As these businesses are very similar, we will analyse them together in this post. But primarily the focus will be on Manappuram Finance due to its nature of being a deep value bet.

About the company

Manappuram Finance: The company was started by Shri V.C. Padmanabhan wanted to help the weaker section of the country to get access to loans. Therefore, he founded this NBFC. Now, the company is under the leadership of his son, V.P. Nandakumar, who took over the business in 1986.

Muthoot Finance: Founded by Shri M. George Muthoot in 1939. Received their NBFC license in 2001 and is now managed by his sons. But the group faced a misfortune as they recently lost their chairman M. George Muthoot who died in an accident.

Business Segments

They primarily deal in four business segments Gold Loans (Cash generating machine), Micro Finance Lending, Housing Finance, and Vehicle finance. Further, there is also Insurance broking but it is more in a captive capacity.

Gold Loan Business

As this business was already explained in our industry analysis, we will not touch the basics rather be company specific.

Muthoot is the market leader in this sector with around 19% market share and Manappuram at fourth place with 7.4% share as of FY19.

This segment is still growing and taking away market share even though banks offer lower interest rates and the average ticket size is also constantly on a rise.

This sector is less about interest rate and more about brand and reach. Muthoot and Manappuram have been doing it consistently well in both areas. Muthoot is ahead of Manappuram as they are the people who brought the cultural change of fighting the taboo of giving jewellery as collateral through extensive advertising.

With regards to reach, their no. of branches is much higher even when compared with some prominent private banks and focused towards rural areas where the actual demand lies.

In any other loan all you care about is a low interest rate whereas here you are going to keep your jewellery to which you are emotionally attached with the lender, so in case your lender goes bankrupt you will get worried. Hence, branding and reach are the key factors here.

Volatility of gold prices

As this segment requires gold as collateral the common question which everyone would get is how the gold price volatility affects the business. There is an inverse relation between the gold tonnage and the gold price in this business. When there is rise in the gold prices, customers require less gold as collateral to avail the amount of loan they want, which also creates a margin of safety for the lenders as the same amount of gold which was given as collateral has increased in its value, but the customer would take loan only for the requirement amount and not increase the LTV, but when the prices go down the opposite happens.

To further reduce the impact of the volatility Manappuram decided to shift their product mix to only 3-month products. As after every three months the loan is renewed on new terms according to the price in that month. This has helped Manappuram to limit its losses.

The auction process starts immediately after the expiry of the loan but there is still time for the customer to repay the amount because the process is bit lengthy as it requires sending notice to the customer, publishing it in newspaper, appointing auctioneers, etc. After the auction is done the company keeps only the amount which was due and the surplus is sent back to the customers. For valuable customers, branch managers especially call or visit the customer for repayment of the loan. All this is done within 90 days after the loan has become a NPA. Management believes that by making the customer pay every three months acts as a detergent and makes a customer discipline which leads to lower losses.

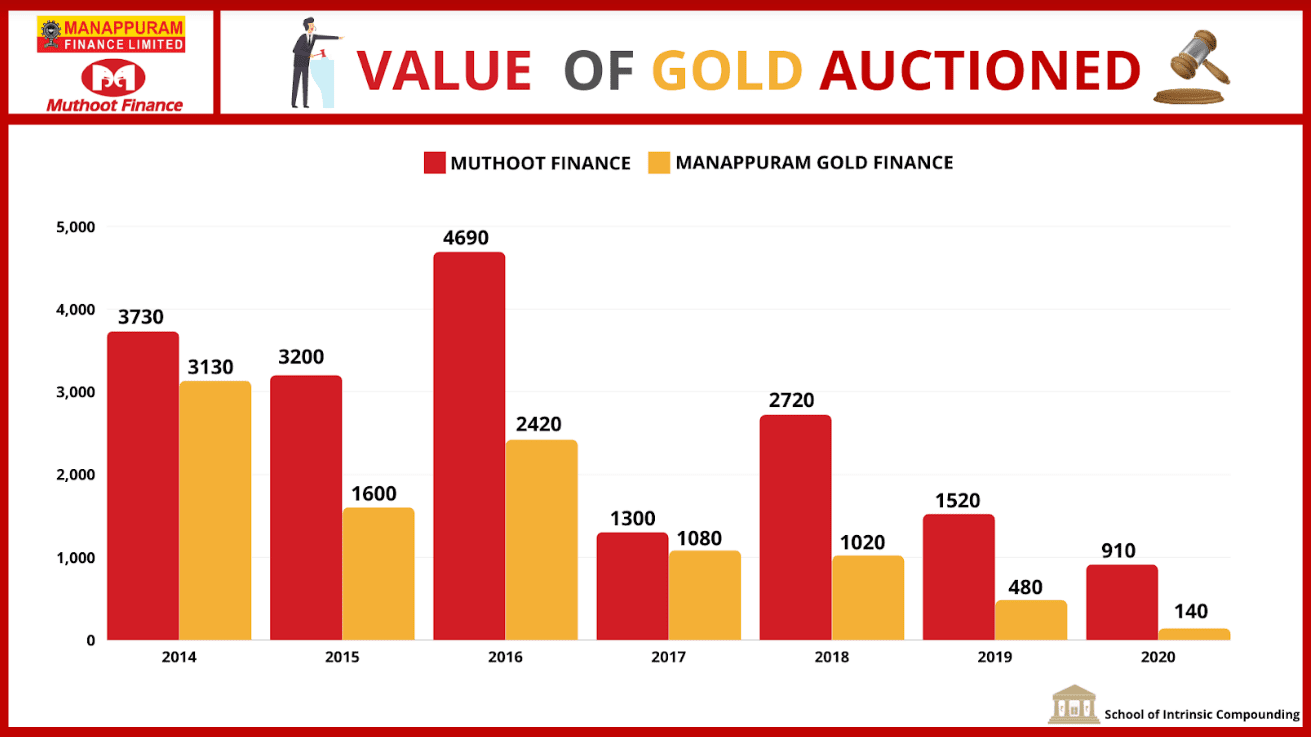

On the other hand, Muthoot still deals in one-year products but on average their loan repayment completion ranges from 3-6 months. Muthoot’s philosophy is that they want to keep customer’s convenience first and are ready to have NPAs on their balance sheet for that. The effectiveness of the shorter tenure can also be seen through numbers which show a declining trend in auctions for Manappuram.

Now, let’s do some simple calculations to understand the risk in a one year product. Suppose you take a 1 year loan product at 75% LTV of Rs 100 worth of gold. Now, for you to rationally (only in economic sense) default the loan would make sense if the price falls by 5-10% in a year (assuming you are paying the highest interest rate of 24%). Therefore, such product mix really exposes the company to risk of getting severely hit by a black swan event. In case of a 3-month product there must be around 15-20% fall in the gold prices that too just in 3 months. The likelihood of the latter is less probable.

This is not it, there is an Online Gold Loan facility which helps in hedging against the volatility because under this facility customers can store their gold with the nearest branch and can avail loans according to their demand. So, the demand might be only for 10% of the LTV but the company would be having 100% of the collateral with them. Customers use this as there are a lot of benefits. Free locker facility, free insurance, and 24x7 loan facility. This is definitely a better proposition than just keeping the gold at your house (Unless you use that ornament for your daily wear). As of Q3FY21 Manappuram has 59% of its gold AUM under Online Gold Loan scheme compared with Muthoot it stands at 20% of their gold loan customers.

So, connecting this with the tenure of the product we can understand that it is more beneficial for Manappuram to shift their clients to online mode compared with Muthoot because of their short tenure. With online gold loan customers would just renew their loans from the app/website and do not have to visit the branch every three months.

Therefore, we can understand that these companies have used few ways to hedge against the volatility but in case if we see a 20-25% fall in price of gold in one day then the LTV would increase, and they would be able to recover their principal amount just by selling the gold.

NPAs of a Gold Loan Businesses

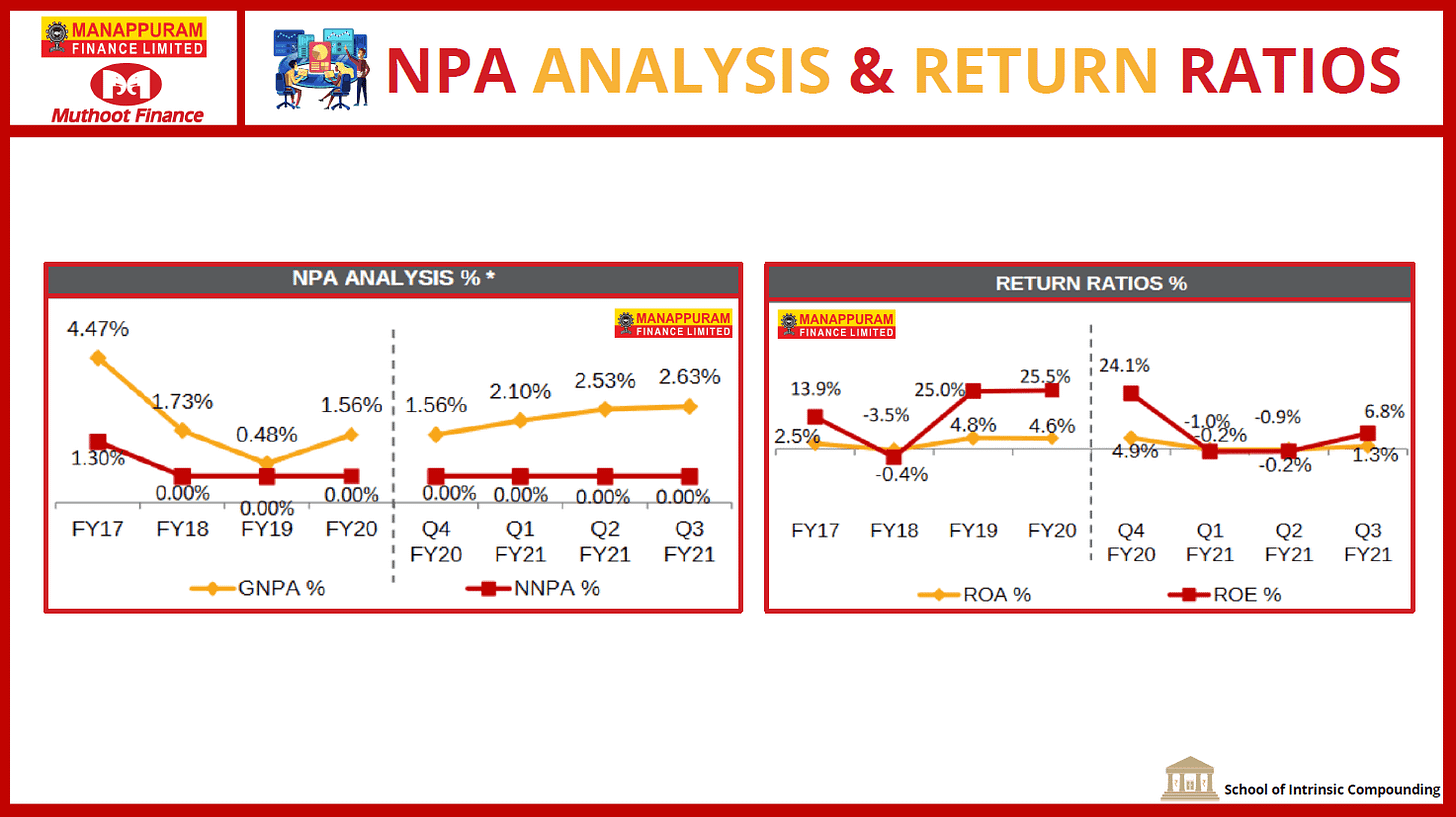

First of all, NPAs in a gold loan business rarely happen because the collateral is jewellery not a bullion or coin. Jewellery comes with emotional attachment so people do not want the company to auction their jewellery because they could not pay the loan.

Even when we look at their NPAs, they do not state the true earnings lost by the company. So, even after the default period customers do come back and repay the loan as there is sentimental value attached to it. Especially if someone is taking a loan from Muthoot Finance, they are ready to handle the pain of NPAs. Still, if the customer does not show up the resale value remains quite good to at least not make the company surfer any losses in most cases, unlike in vehicle finance where resale value is low.

What Happened During the Crisis?

Demonization and the IL&FS crisis had affected these businesses a lot. It did affect Manappuram’s net profits where they saw degrowth from Rs 755 cr to 676 cr and their gold AUM was intact but grew with slower growth rate from Rs.136 billion to Rs.157 billion . Similarly, Muthoot’s net profit moved from Rs. 1200 cr to Rs.1800 cr leading to slower growth and AUM from Rs. 274 billion to Rs. 295 billion. But after the IL&FS crisis the growth rate of their PAT fell from 51% to 11%.

During the time of liquidity crisis the credit rating for Manappuram was upgraded by CRISIL to - AA stable and Muthoot’s rating was reaffirmed as AA stable.

Further, it seems like these companies were not much affected by COVID (consolidated basis) as there was no degrowth and have witnessed a healthy growth rate, with Manappuram 16.6% YoY for Q3FY21 in PAT and Muthoot with 16.9%.

The Microfinance Segment

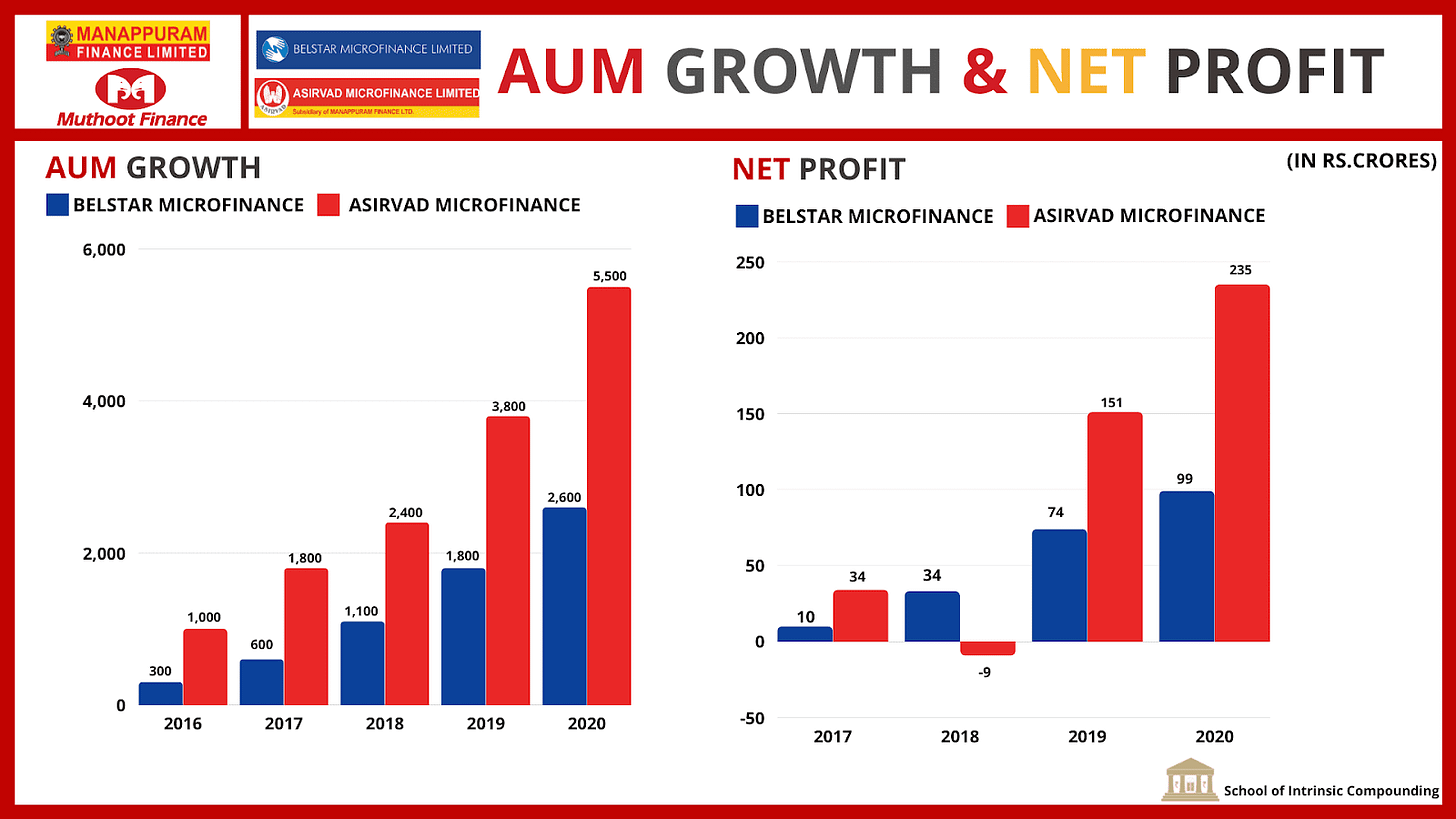

Asirvad is Manappuram Finance’s MFI subsidiary with 93.33% stake in it and Belstar is Muthoot Finance’s subsidiary where they hold 70% stake. It should be noted that Asirvad has the lowest operational expenses in the industry, has the highest credit rating in the MFI sector, and most diversified MFI with presences in 24 States with around 23 lakh customers. But currently Asirvad does not operate in their gold loan branches rather has its own standalone branches.

According to a KPMG report, the MFI sector’s Gross Loan Portfolio (GLP) from Rs 0.34 lakh crores to 2.31 lakh crores as of Sep 2020.

Further, here is what the Manappuram’s management has said about the size of opportunity:

To view this pic in large- https://drive.google.com/file/d/12cCWhMiY5oJV-JYIER0rtUyM4Ky9HU0s/view?usp=sharing

Even though unsecured lending sounds like this industry might be very risky but that is not true. The NPA are below 1% for the industry due to the aggressive RBI norms required for provisioning. The principal amount is just 3 basis points whereas provisioning is required for 100 basis points. But no doubt it's a risky business due to its cyclically because if the economy is not doing well how will the customer pay back.

Asirvad is built upon the Joint Liability Group (JLG) model where Belstar is mainly based on the Self Help Group (SHG) model and both provide loans to women only.

Comparison of JLG vs SHG:

Size: SHG provides loan to 10-20 members together whereas JLG its 5-10

Structure: SHG are more organized as they have positions like secretary, treasurer, etc. who represent the group, whereas in JLG each member interacts with the lender directly.

Amount: SHG group receives loan based on their saving whereas there is no such requirement in JLG model

Members: In SHG the loan is issued to SHG entities not to individuals and the members in it work together in the same activity whereas in JLG the members are different individuals who take an amount for different purposes. It is just that they are guarantors for each other.

Demonetization had taken the MFI sector for a toss and Asirvad and Belstar were among the players who got affected. Asirvad’s GNPA peaked at 4.5% in FY17 and in FY18 it reported loss for the first time.

To view the pic in large format- https://drive.google.com/file/d/1mXhCwKUnRIgAHfmW24e2DjxYNU-Pynq2/view?usp=sharing

What can kill this business?

We would like to use Amit Mantri’s tweet to explain it:

According to him three characteristics would kill an MFI business:

Large geographic concentration: Asirvad is present in 24 states and has maximum exposure of 10% of their portfolio to one state (Except Tamil Nadu at 22% and West Bengal at 12%). Belstar does not disclose their state wise data for now.

Ultra High Ticket Size: Asirvad starts their ticket size with 25k with the highest limit of 45k whereas Belstar’s ticket size is 20k.

Aggressive growth: Manappuram Finance fails the third test because they did their expansion very aggressively but Muthoot is playing it slowly where management says that their current focus is on gold loans and will expand only when things seem good but in future MFI is definitely a sector they want to be in. Andhra Crisis was one such example where many MFI customers started to commit suicide as they were not able to repay the loan.

Risk Management strategy of Asirvad:

Exposure: One of their risk management strategies is to restrict their exposure to a particular district to 1% which they are planning to bring down to 0.5% in next three years and at state level 10% but not exceeding their market share more than 5% in any state. If we look at their exposure it seems like it has been on a diversifying trend.

Ticket Size: The management has purposefully never increased the maximum ticket size above Rs. 45,000 from past 11 years. Their process involves the first lending amount to be around Rs. 25 to 35k and gradually increasing from there.

Data: Management states that they use analytics on data they have collected from bureaus.

Cap on loans: The company has also signed the code of responsible lending where a customer cannot be given a loan if already taken a loan from 2 MFIs + 1 bank.

Collection Teams: They have the same team for collection and disbursement both. They do not outsource it.

Vehicle Financing

Manappuram entered Vehicle Finance in FY16 where their focus area is commercial vehicles, passenger cars, and two-wheelers. They do not have a standalone branch but operate through the gold loan branches. The vehicle finance loan book consists 75% of commercial vehicles (among which 88% is reused vehicles) and rest two wheelers (100% in new vehicles).

60% of the customers of the subsidiary are new to credit i.e., they do not have any credit bureau records. So, to analyse the risk they take data of similar customers from the bureau and understand the risk by just talking to the customer on why they need the loan for what operation.

In their two-wheeler segment they get around 6,000 applications per month of which 20% are regularly rejected. In the commercial vehicle segment around 1,500 applications due to larger ticket size with a rejection rate of 25%.

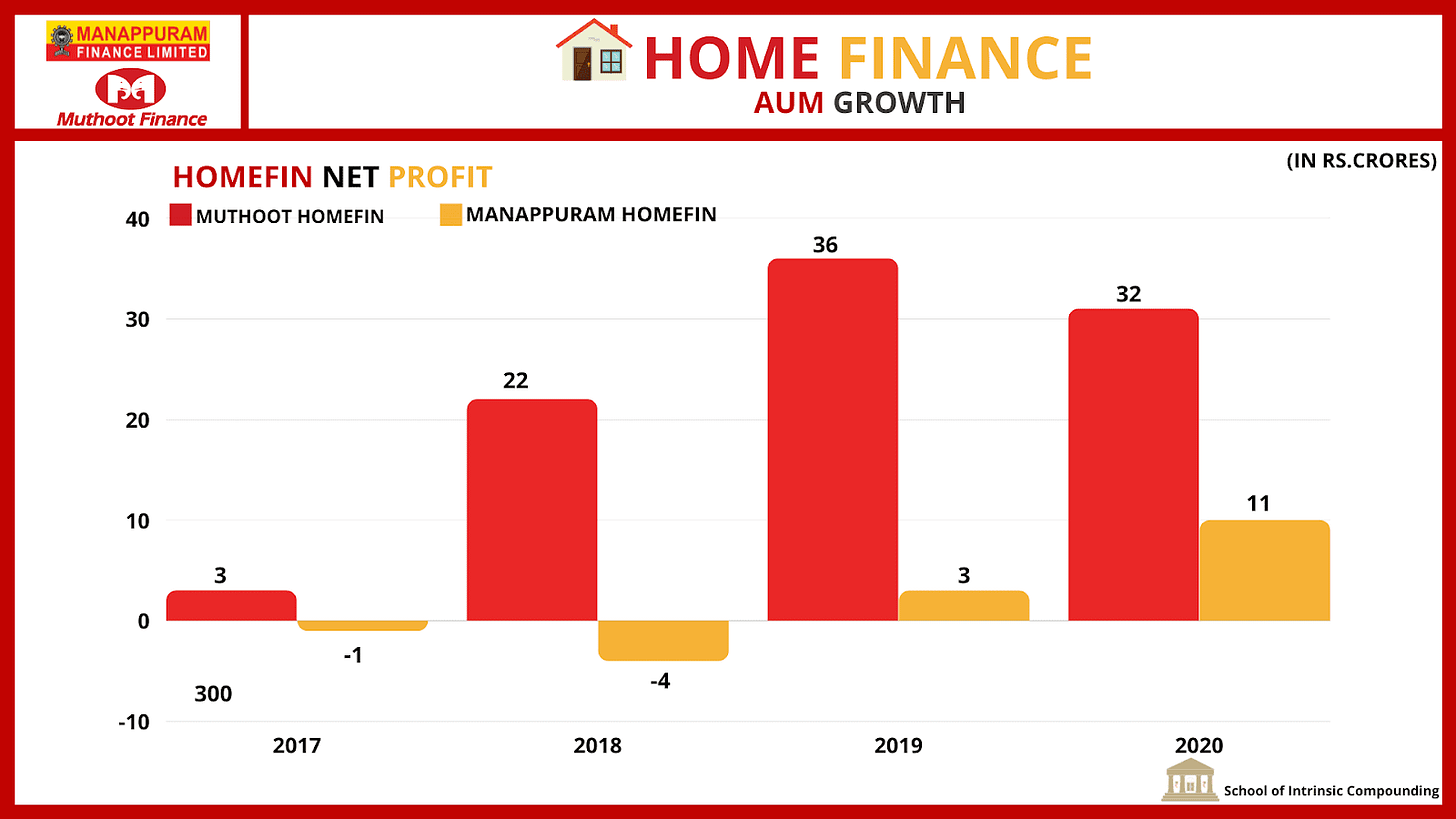

Housing Finance

This segment focuses on providing loans for affordable housing which means business of low-ticket size. Muthoot Homefin’s average size is around Rs. 9 lakhs with 12% yield whereas for Manappuram is around Rs 5-6 lakhs with 15% yield.

For Manappuram majority of their customers are people who have taken loans sometime in their life and around 20-25% are new to credit. But still, they have a requirement for having a minimum credit score. In case the customer does not have it then they use other mechanisms to evaluate. In this segment Manappuram receives around 600 applications per month with around 40 rejection rate but after accepting too they reject 20% of the application due to legal issues.

Muthoot’s management is currently fearful with this segment which can be seen as their business has witnesseing degrowth in their AUM since Q1FY21.

Why Did These Companies Diversify?

There seems to be two reasons for diversification. First, the gold business is a high ROE business which was generating a lot of free cash flow for the company so to put that cash flow into good use they decided to diversify. Second, they wanted to reduce the commodity risk. Third, gold loan business is a slow growth business compared to other NBFCs where one has to focus on their sales team and keep giving loans on the other hand in this sector the customer has to come to branch for taking the loan therefore, it's a slow process which is also visible by the tonnage growth these businesses see.

As we witnessed in the Phase 2 of the industry where gold prices saw a decline of 20-25% globally and their business got heavily affected. Manappuram got little aggressive in the diversification process and the non-gold portfolio today accounts for 33% of the loan book whereas Muthoot has taken a more safe and conservative approach by diversifying slowly leading their non-gold portfolio at 10%.

Another reason for diversifying is cross selling

The mental model of Adjacencies and Derivatives also plays a role here as management have stated that the reason for entering these businesses is also due to them being related products. Manappuram has around 26 lakhs gold loan customer base to which they plan and having been cross selling and similarly Muthoot too has a huge customer base of 50 lakhs to cross sell. For example, both the companies have also entered insurance broking as a captive business for supporting their main businesses.

Even though the management of these companies have not specifically thought about it, there is a change of an optionality that they could also enter into distribution of financial products. They have the reach, brand, and huge customer base with strong rural reach which makes them a perfect candidate for taking advantage of the finalization wave.

Liability/Cost Side

One should look at the borrowing side of NBFCs very carefully as they will protect the companies in the downturn. Focus on Bond market exposure, if the bond market exposure is good then it shows that the market trusts the company.

The expense ratio for both the companies have been falling consistently due to operating leverage kicking in as their productivity of branches increase and due to reduction in security expenses.

Manappuram finance has started to bring down its cost by implementation of technology with regard to their branch security. They have a tech subsidiary where they have employed 200 engineers who are working on Robotic Process Automation (RPA), use of Artificial Intelligence, etc. and they have also outsourced functions like infratustrute management to IBM.

The company is also planning on consolidating their branches which will further reduce their costs, we have already started seeing this in their Vehicle Finance business where branches have come down from 229 to 214. Plus as more customers shift to online gold loan facilities they would need less people at the branch.

On the other hand Muthoot’s current focus is not on increasing the branch's productivity rather to expand their reach. Looking at their Gross Non-Performing Loan, we see that for Muthoot’s GNPL ratio is on a higher side which is mainly due to their focus on 12-month tenure products and during 2018 their GNPL shot up as they were experimenting with a new 6-month tenure product but that didn’t work out.

Another issue which Muthoot faced was on the liability side which was that it had issued gold bonds at the rate of around 12% during the FY13-15. There were around 30% of the liability mix earlier from which they are at 1% today.

To view this pic in large, Click here- https://drive.google.com/file/d/1AZEfwIQGSkpcq_14vDeZR-eetImQFStz/view?usp=sharing

Muthoot has fought over its liability side issues and now has the lowest cost in the industry at 8.7% for FY20 but currently at 9.18% as of Q3FY21. It paid up the high-cost bonds it had issued earlier, managed to source low-cost funds via commercial papers and banks, and also raised foreign money i.e., External Commercial Borrowings (ECB).

This business is very fixed cost heavy which means that there is definitely room for operating leverage to kick in. As we could see that approximately 70% of cost for Muthoot is related to rental and employees related expenditure whereas similar is for Manappuram at 60%. As Muthoot has the highest gold loan per branch at Rs. 107mm whereas for Manappuram it's at Rs. 57mm as of Q3FY21 showing Muthoot having almost 2x benefit of operating leverage and all this is despite Muthoot having 30% larger branches in size.

Risks

Cannibalism by Microfinance business

On paper it seems that one would prefer MFI loan rather than giving collateral to the lender, but MFI loan has some requirements like:

They provide loans only to women and can take loans only from two MFI.

For rural areas your family income should be less than Rs. 125k and for urban areas it should be below Rs. 200k.

In the pyramid we shared in our previous post, MFI customers fall at the bottom whereas gold loan customers are above that.

Gold loan does not require many documents and the process gets completed within a few mins but in MFI the process of evaluation comes in and has a higher requirement of documents/analytics.

Rather Manappuram’s management believes that MFI will shift to gold loans as and when they get financially better because they will buy gold, open up businesses, and that will lead to demand for capital.

2) Commodity risk

This risk will always be there as both the company’s main business is related to gold which gets affected by the price volatility of it. As mentioned above they have taken few steps to mitigate this risk. Plus the LTV also acts as a buffer but still in case of a sudden fall of 25-30 fall their business would be affected severely.

3) Diversification/Diworsification risk

Gold loan business is a niche business where they have created advantages for themselves by staying in the game for so long. But now expanding into related streams could lead to a case of moving from anti-fragile to fragile business because the asset quality will decrease. Especially for Manappuram as the management is very aggressive and wants their non-gold portfolio to be at 50% which means a business where asset quality is lower than gold business will increase. Only time will tell whether the management has got into diversification or diworsification.

4) Regulatory risk

As we had seen in Phase 2, regulators got worried by the aggressive growth happening in the sector and decided to bring in stricter norms. The same could happen anytime at the will of RBI and the companies won’t be able to do anything.

5) The Taboo Risk

There is a possibility that even after so many benefits being provided by these lenders and changing the mindset through advertising, people would still think about gold loans as a distressed loan and avoid taking it for their public image.

6) Gold ETF

This does not seem like a serious threat but there is still a probability that the future generation may not be interested in buying actual jewelleries rather prefer buying gold ETFs. Therefore, as these companies only deal with jewellery and not bullion or biscuit it is possible that the rise of gold ETF could be a threat.

But both the management believe that such cultural change is not happening soon. Here is snippet from Manappuram Finance:

7) Risk of Theft

Both the companies have been a victim to robbery at some point in their lifetime and such could damage the brand image severely. Even though these gold ornaments are insurance, what really is a threat is the effect on the brand.

8) Competition from FinTechs

Startups are entering many industries these days and have started to disrupt the whole industry. Like we saw in our broking industry analysis. Similarly, FinTech is a serious threat which gold loan NBFCs are facing. One of which is Rupeek. It has tied up with ICICI Bank, Federal Bank, and Karur Vysya Bank for using their branches for locker facility. Their business model is very asset light, as they do not have to spend heavily on setting up branches. Their revenue went 5x from 2019-20 but they are yet to become profitable. Plus, they are also backed by Sequoia Capital and Binny Bansal (Co-Founder of Flipkart). That’s not it, their management team also consists of people who were ex-employes of Mckinsey, Ola, Amazon (Payments department), Manappuram Finance, Janalakshmi Financial Services, Varthana Financial Services, etc.

Here is a quick look at Rupeek’s financials:

Valuations

At SOIC we believe in getting the business analysis right and less about the precise valuation about the company. If the size of opportunity is huge, management seems capable, business has its competitive edge (which could be due to the structural nature of the industry), and valuation multiples seem convincing enough then making a bet would be a good option.

We recommend watching this video of Prof. Sanjay Bakshi explaining that when the competitive pressure is low or there are entry barriers in a business one can disregard the P/B ratio and focus on P/E if the earnings are durable for a financial company. Because when you look at the P/B ratio and think that the business is expensive you are implying that investing more money into assets would make the company cheaper without any earning growth. But that would also bring down the ROE of the business.

Both the companies seem to be trading at cheap valuation but we would want you guys to tell us in the comment section whether you think the market is right for giving them such valuation or this could be a contrarian bet. (Well, who said contrarian investing is easy…)

Disclosure: Nothing on this website should be construed as investment advice. Please consult your financial advisor. We are not SEBI registered Analysts/Advisors. We are not accountable for any loss or gains that might occur to you from this or any analysis on the website. The author holds both the stocks in his portfolio and stocks are not part of SOIC’s portfolio.

About the Author

Arjun Badola is a law student who has interest in analyzing businesses. He shares his thoughts on investing via his blog and twitter. In case you have anything to discuss related to investing, feel free to reach out to him.

Blog: arjunbadola.blog Twitter: @badola_arjun